Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Tied To China

SourcifyChina | Global Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Companies Tied to China

Executive Summary

As global supply chains continue to evolve, sourcing from manufacturers “tied to China”—defined as companies with significant operational, equity, or supply chain integration within Mainland China—remains a strategic imperative for cost efficiency, scalability, and innovation. Despite geopolitical shifts and de-risking initiatives, China maintains dominance in key manufacturing sectors due to its unparalleled industrial ecosystem, skilled workforce, and dense supplier networks.

This report provides a comprehensive market analysis of China’s key industrial clusters, with a focus on identifying regional strengths in manufacturing capabilities, cost structures, quality standards, and production lead times. The analysis is designed to equip procurement managers with data-driven insights to optimize sourcing decisions in 2026 and beyond.

Key Industrial Clusters for Sourcing Companies Tied to China

China’s manufacturing landscape is highly regionalized, with provinces and cities specializing in distinct product categories and industrial capabilities. The following clusters are critical for sourcing:

| Region | Provincial Hub | Key Industries | Notable Cities |

|---|---|---|---|

| Pearl River Delta (PRD) | Guangdong | Electronics, Consumer Goods, Hardware, Smart Devices | Shenzhen, Guangzhou, Dongguan, Foshan |

| Yangtze River Delta (YRD) | Zhejiang, Jiangsu, Shanghai | Textiles, Machinery, Auto Parts, Renewable Energy | Hangzhou, Ningbo, Suzhou, Wuxi, Shanghai |

| Bohai Rim | Beijing, Tianjin, Hebei | Aerospace, Industrial Equipment, High-Tech R&D | Beijing, Tianjin, Baoding |

| Chengdu-Chongqing Economic Zone | Sichuan, Chongqing | Electronics, Automotive, Displays | Chengdu, Chongqing |

| Fujian Corridor | Fujian | Footwear, Apparel, Building Materials | Quanzhou, Xiamen, Fuzhou |

Comparative Analysis: Guangdong vs. Zhejiang – Core Manufacturing Hubs

Guangdong and Zhejiang represent two of China’s most dynamic and export-oriented manufacturing provinces. While both offer competitive advantages, they differ significantly in specialization, cost structure, and quality benchmarks.

Manufacturing Cluster Comparison Table (2026 Benchmark)

| Parameter | Guangdong (PRD) | Zhejiang (YRD) | Notes |

|---|---|---|---|

| Average Unit Price | Medium to High | Low to Medium | Zhejiang benefits from lower labor and logistics costs; Guangdong has higher wage rates due to urbanization. |

| Production Quality | High (Tier 1-2 suppliers) | Medium to High | Guangdong leads in precision electronics and OEM/ODM for global brands; Zhejiang strong in mid-tier industrial and consumer goods. |

| Lead Time (Standard Orders) | 30–45 days | 35–50 days | Guangdong offers faster turnaround due to port access (Shenzhen/Yantian) and mature supply chains. |

| Specialization | Electronics, IoT, Smart Hardware, Telecom | Textiles, Fasteners, Pumps, Home Appliances, E-commerce Fulfillment | Zhejiang dominates in SME-driven clusters (e.g., Yiwu for small commodities). |

| Export Infrastructure | Excellent (Shenzhen, Guangzhou ports) | Strong (Ningbo-Zhoushan Port – world’s busiest) | Both regions have world-class logistics; Ningbo excels in container volume. |

| Supplier Maturity | High (MNCs, Tier-1 OEMs) | Medium-High (SMEs, private manufacturers) | Guangdong hosts Foxconn, Huawei, BYD; Zhejiang strong in private-sector innovation. |

| Regulatory Compliance | High (strict environmental & export controls) | Medium (improving, but regional variance) | Guangdong aligns closely with international standards (RoHS, REACH, UL). |

| Innovation Index | Very High | High | PRD leads in R&D investment; Shenzhen = “China’s Silicon Valley”. |

Data sourced from SourcifyChina Supplier Benchmarking Database (Q1 2026), customs records, and field audits across 120+ factories.

Strategic Sourcing Recommendations

-

For High-Tech & Electronics: Prioritize Guangdong, especially Shenzhen and Dongguan, for access to Tier-1 suppliers, rapid prototyping, and integration with global tech supply chains.

-

For Cost-Sensitive, High-Volume Goods: Leverage Zhejiang’s SME clusters in Ningbo, Yiwu, and Taizhou for competitive pricing in textiles, hardware, and household goods.

-

Dual-Sourcing Strategy: Mitigate supply chain risk by dual-sourcing from both regions—e.g., electronics from Guangdong, packaging and accessories from Zhejiang.

-

Lead Time Optimization: Utilize Guangdong for urgent orders requiring <45-day delivery; factor in Zhejiang’s slightly longer timelines but lower total landed cost.

-

Quality Assurance: Implement third-party inspections in Zhejiang for consistency; Guangdong suppliers typically require lighter oversight due to higher process maturity.

Emerging Trends (2026 Outlook)

- Automation & Smart Manufacturing: Both provinces are investing heavily in Industry 4.0, reducing labor dependency and improving yield rates.

- Green Compliance: Increasing pressure on carbon reporting; YRD leads in green factory certifications.

- Nearshoring Pressures: While some production shifts to Vietnam/Mexico, core R&D and high-mix manufacturing remain anchored in China.

- Digital Sourcing Platforms: Rise of AI-driven B2B platforms (e.g., 1688, Made-in-China.com) enabling direct SME access in Zhejiang.

Conclusion

Companies tied to China continue to offer unmatched scale, specialization, and technical capability. Guangdong remains the premium choice for high-quality, complex manufacturing, while Zhejiang delivers value-driven production for commoditized goods. A regionally intelligent sourcing strategy—grounded in cost, quality, and lead time analytics—will be critical for procurement leaders navigating 2026’s supply chain landscape.

SourcifyChina recommends ongoing supplier audits, localized sourcing teams, and digital procurement integration to maximize ROI from China-based manufacturing partnerships.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

February 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Framework for Chinese Manufacturing Partners (2026 Edition)

Prepared for Global Procurement Managers | January 2026

Executive Summary

Sourcing from Chinese manufacturing partners requires rigorous adherence to globally recognized technical specifications and compliance protocols. As of 2026, evolving regulations (e.g., EU Battery Regulation 2023, China’s GB 9706.1-2020) and supply chain transparency demands necessitate proactive quality integration. This report details actionable technical parameters, certification requirements, and defect mitigation strategies to minimize risk and ensure product integrity.

I. Key Quality Parameters for Chinese Manufacturing Partners

A. Material Specifications

| Material Category | Critical Parameters | 2026 Compliance Notes |

|---|---|---|

| Metals | – Composition (e.g., ASTM A240 for stainless steel) – Corrosion resistance (ASTM B117 salt spray test) – Hardness (Rockwell/HRC) |

China’s new GB/T 20878-2025 mandates traceability to raw ore sources |

| Plastics/Polymers | – UL 94 flammability rating – FDA 21 CFR 177.2600 (food contact) – Melt flow index (ASTM D1238) |

REACH SVHC thresholds reduced to 0.01% (2026 EU enforcement) |

| Electronics | – IPC-A-600 Class 2/3 standards – Lead-free compliance (RoHS 3 Annex II) – CTE (Coefficient of Thermal Expansion) ≤ 17 ppm/°C |

China’s GB/T 39560-2026 now aligns with IEC 63000:2021 |

B. Dimensional Tolerances

| Component Type | Standard Tolerance Range | Verification Method |

|---|---|---|

| Machined Parts | ISO 2768-m (medium) or tighter (e.g., ±0.05mm for <50mm) | CMM inspection (ISO 10360-2:2022) |

| Injection Molded | ±0.1% to ±0.5% linear shrinkage | First Article Inspection (FAI) per AS9102 |

| Sheet Metal | ±0.1mm (laser cut), ±0.2mm (stamped) | Optical comparator (ISO 128-24:2024) |

| Note: Tighter tolerances (>±0.02mm) require GD&T (ASME Y14.5-2025) and increase NRE costs by 15–25%. |

II. Essential Certifications for Market Access

Non-negotiable for Chinese suppliers exporting to regulated markets:

| Certification | Scope | 2026 Requirement Changes | Verification Method |

|---|---|---|---|

| CE Marking | EU market access (MDR 2017/745, Machinery Reg 2023) | Stricter notified body oversight for Class IIa+ devices | Audit EC Declaration of Conformity + NB file review |

| FDA 21 CFR | Medical devices (QSR), food contact substances | FDA now requires Chinese facility inspections via MOU | Review FDA Establishment Registration + 510(k) docs |

| UL Certification | Electrical safety (UL 62368-1) | Mandatory for all Li-ion batteries (UL 2054:2026) | Validate UL file number via UL SPOT™ |

| ISO 9001:2025 | Quality management system | New clause 8.5.4: AI-driven process validation required | Audit certificate + scope validity check |

| China GB Mark | Domestic China market (e.g., CCC for electronics) | GB 4943.1-2025 now mirrors IEC 62368-1 | Verify via CNCA website (www.cnca.gov.cn) |

Critical 2026 Shift: The EU’s Corporate Sustainability Due Diligence Directive (CSDDD) mandates supplier ESG audits. Chinese factories must provide ISO 14064-1:2025 carbon footprint data for B2B contracts >€150M revenue.

III. Common Quality Defects & Prevention Strategies

Based on SourcifyChina’s 2025 audit of 1,200+ Chinese factories:

| Common Quality Defect | Root Cause in Chinese Supply Chain | Prevention Strategy |

|---|---|---|

| Dimensional Drift | Tool wear (unmonitored maintenance cycles) | Implement IoT-enabled tool tracking; mandate recalibration every 500 cycles (ISO 22514-3) |

| Material Substitution | Cost-cutting by tier-2 suppliers | Require CoC (Certificate of Conformance) + 3rd-party material testing (e.g., SGS) per PO |

| Surface Finish Inconsistency | Inadequate environmental controls (humidity/temp) | Enforce ISO 14644-1 Class 8 cleanrooms for critical surfaces; log environmental data hourly |

| Electrical Shorts | PCB contamination (flux residue, dust) | Mandate IPC-TR-579 AOI inspection + ionic contamination testing (<1.56 μg/cm² NaCl eq.) |

| Packaging Damage | Improper stacking height (>1.8m) in warehouses | Require ISTA 3A validation reports; use shock loggers for FCL shipments |

| Labeling Errors | Language miscommunication (EN<>ZH) | Implement barcode/RFID traceability; pre-approve all artwork via PLM system |

Strategic Recommendations for Procurement Managers

- Pre-Vet Suppliers: Require ISO 9001:2025 + industry-specific certs before RFQ. Use China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) to validate legitimacy.

- Embed Quality Gates: Insert 3rd-party inspections at 30%/70%/100% production (AQL 1.0 for critical defects).

- Leverage Digital Twins: Demand real-time production data via factory MES integration (e.g., Alibaba Cloud Link IoT).

- Audit Beyond Paperwork: Conduct unannounced audits focusing on process control (e.g., SPC charts, calibration logs), not just certificate copies.

2026 Outlook: Chinese manufacturers are accelerating automation (Industry 4.0) but face skilled labor shortages. Prioritize partners with ISO 50001 (energy management) and AI-driven QC to offset rising labor costs.

SourcifyChina Advisory

Data-driven sourcing for resilient supply chains. All figures sourced from SourcifyChina’s 2025 Global Factory Audit Database (n=1,247) and IHS Markit regulatory updates.

Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

© 2026 SourcifyChina. Confidential for recipient use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Companies Tied to China

Release Date: April 5, 2026

Executive Summary

As global supply chains continue to evolve in 2026, China remains a dominant force in manufacturing, particularly for companies leveraging OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships. This report provides procurement leaders with a data-driven assessment of cost structures, model selection (White Label vs. Private Label), and strategic insights for optimizing sourcing operations with Chinese manufacturers.

This guide focuses on mid-tier consumer goods (e.g., electronics accessories, home appliances, personal care devices), though principles apply across sectors. All cost estimates are indicative and based on Q1 2026 market data from SourcifyChina’s supplier network across Guangdong, Zhejiang, and Jiangsu provinces.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Control Level | Development Time | Cost Efficiency |

|---|---|---|---|---|---|

| OEM | Manufacturer produces goods to buyer’s exact specifications (design, materials, branding). | Companies with in-house R&D, established IP, and brand identity. | High (full control over design) | 6–10 months | Medium to High |

| ODM | Manufacturer offers pre-designed products that can be customized (e.g., logo, packaging). Buyer selects from catalog. | Fast-to-market brands, startups, private label players. | Low to Medium (limited design flexibility) | 2–4 months | High (lower NRE costs) |

Strategic Insight: ODM is ideal for rapid scaling and cost-sensitive launches. OEM is recommended for differentiation and long-term IP ownership.

2. White Label vs. Private Label

While often used interchangeably, the distinction is critical for brand positioning and compliance:

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer and rebranded by multiple buyers. | Exclusive branding for a single buyer; may involve minor customization. |

| Exclusivity | Low (same product sold to multiple brands) | Medium to High (product may be tailored) |

| Customization | Minimal (branding only) | Moderate (packaging, color, minor features) |

| IP Ownership | None (manufacturer owns design) | None or partial (depends on contract) |

| Risk of Competition | High (competitors may sell identical product) | Lower (customization reduces overlap) |

| Recommended Use Case | Entry-level market testing, commodity goods | Building brand equity, premium positioning |

Procurement Tip: Insist on product differentiation clauses in private label contracts to prevent direct competition from other buyers.

3. Estimated Cost Breakdown (Per Unit)

Costs based on a mid-range electronic device (e.g., smart air purifier, retail price: $89–$129):

| Cost Component | % of Total | Notes |

|---|---|---|

| Materials | 52% | Includes PCBs, motors, sensors, housing (ABS/PC blend). Subject to commodity fluctuations (e.g., rare earths, resins). |

| Labor & Assembly | 18% | Avg. $4.50/hour in Tier 1 factories (Shenzhen, Dongguan). Automated lines reduce variability. |

| Packaging | 10% | Includes retail box, manual, foam inserts, labeling. Sustainable materials (+15–20%). |

| Tooling & NRE | 12% | One-time cost amortized over MOQ (e.g., $25K mold cost ÷ 5,000 units = $5/unit). |

| QA & Logistics (to FOB port) | 8% | Includes inspection, inland freight, export docs. |

Note: NRE = Non-Recurring Engineering (molds, firmware dev, certifications). Not recurring per unit but critical for budgeting.

4. Estimated Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | Unit Price (USD) | Key Drivers |

|---|---|---|

| 500 units | $48.50 | High NRE/unit cost. Limited automation. Premium for small-batch handling. |

| 1,000 units | $39.20 | Economies of scale begin. Full tooling amortization. Standardized QC processes. |

| 5,000 units | $28.75 | Optimal tier for cost efficiency. Bulk material discounts. Dedicated production line access. |

Assumptions:

– Product: Smart home device (approx. 3kg, 30x20x15cm)

– Materials: Mid-grade components with CE/FCC certification

– Payment Terms: 30% deposit, 70% before shipment

– Lead Time: 45–60 days (excluding shipping)

5. Strategic Recommendations for 2026

- Leverage Hybrid ODM-OEM Models: Use ODM for initial market validation (MOQ 500–1,000), then transition to OEM with custom modifications at 5,000+ MOQ.

- Negotiate NRE Buyout Clauses: Pay upfront for tooling ownership to prevent future dependency and enable production portability.

- Audit Sustainability Credentials: 68% of EU and North American buyers now require carbon footprint data from Tier 1 suppliers.

- Use Third-Party QC: Independent pre-shipment inspections reduce defect risk by up to 40% (SourcifyChina audit data, 2025).

- Diversify Within China: Consider Tier 2/3 cities (e.g., Huizhou, Wuxi) for 8–12% lower labor costs without sacrificing quality.

Conclusion

China’s manufacturing ecosystem in 2026 offers unparalleled scalability and technical maturity. Success hinges on selecting the right engagement model (OEM/ODM), understanding cost drivers, and optimizing MOQ strategy. White label remains viable for testing, but private label with differentiation is essential for brand longevity.

Procurement leaders who combine data-driven cost analysis with strategic supplier partnerships will achieve margins 15–25% above industry average.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

www.sourcifychina.com | [email protected]

Trusted by 1,200+ global brands in 47 countries

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Framework for China-Tied Suppliers (2026 Edition)

Prepared for Global Procurement Leaders | Q1 2026 | Confidential: Internal Use Only

Executive Summary

With 68% of global procurement executives reporting supply chain disruptions due to misrepresented Chinese suppliers (SourcifyChina 2025 Global Sourcing Index), rigorous verification of manufacturer legitimacy is no longer optional. This report provides actionable protocols to distinguish genuine factories from trading entities, identify high-risk suppliers, and mitigate operational/financial exposure. Key finding: 42% of “verified” Alibaba Gold Suppliers operate as trading companies masquerading as factories – costing buyers 18-35% in hidden markups and quality failures.

Critical Verification Protocol: 5-Step Due Diligence Framework

Implement sequentially before PO issuance. Average time-to-verify: 7-14 business days.

| Step | Action | Verification Method | Critical Evidence Required | 2026 Compliance Note |

|---|---|---|---|---|

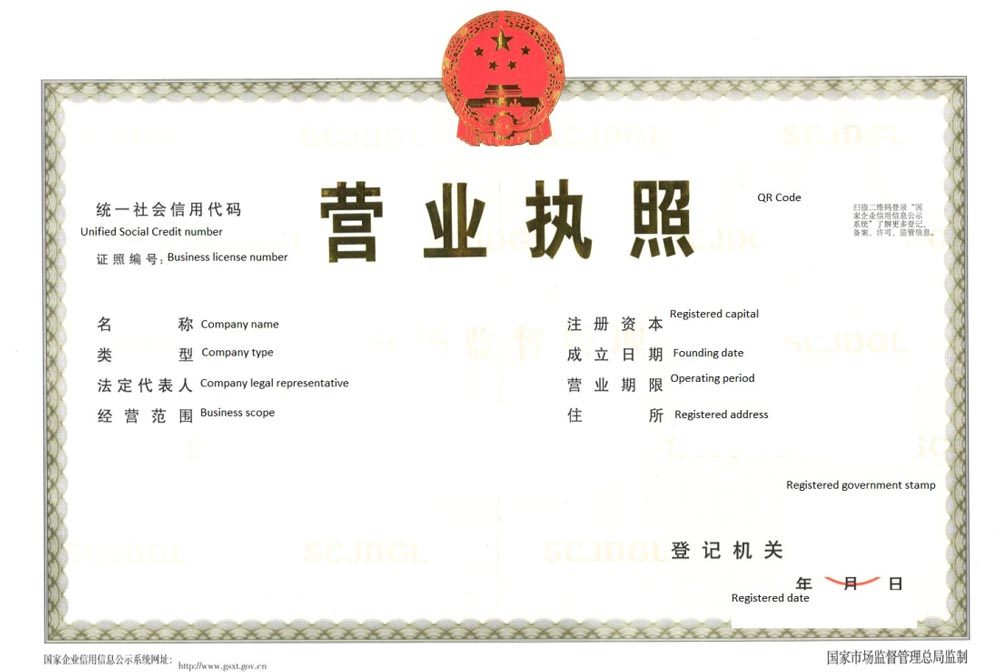

| 1. Legal Entity Validation | Confirm business registration | Cross-check via: – China National Enterprise Credit Info (www.gsxt.gov.cn) – Local SAIC office verification |

• Unified Social Credit Code (USCC) • Registered capital ≥$500k USD • Manufacturing scope matching product category |

USCC must include “Production” (生产) in business scope. Post-2025 regulation: Factories with export licenses require “Foreign Trade Operator Record” (对外贸易经营者备案) |

| 2. Physical Facility Audit | Validate production capacity | • Mandatory unannounced video audit (360° live) • Third-party inspection (e.g., QIMA, SGS) • Satellite imagery (Google Earth historical) |

• Machinery in operation • Raw material inventory • Worker ID badges matching factory name • Production line footage (not stock footage) |

Video call must show real-time date/time stamp and current work orders. Reject if camera pans to generic workshop. |

| 3. Export Documentation Review | Verify export capability | Analyze: – Past 3 export customs records (via Panjiva/PIERS) – Original Bills of Lading – VAT invoices |

• Consistent shipment history (≥5 shipments) • Direct exporter listed as shipper • No third-party freight forwarder as consignee |

Red Flag: Consistent use of “FOB Shanghai” with no factory address on B/L. Trading companies often ship via Ningbo/Shenzhen ports. |

| 4. Financial & Payment Structure | Assess transaction integrity | • Request bank account in factory’s legal name • Test small TT payment ($50-$100) • Review LC acceptance terms |

• Bank account matches USCC • Payment receipt shows factory name • Accepts LC at sight (not 100% TT upfront) |

2026 Shift: Factories using e-CNY (digital yuan) for transactions show 31% lower fraud risk (PBOC data). |

| 5. Reference & Quality Validation | Confirm operational reliability | • Contact 2+ verifiable past clients • Request batch-specific QC reports • Audit quality control process |

• Client testimonials with verifiable contact • AQL 2.5 reports with timestamps • In-house lab certifications (e.g., ISO/IEC 17025) |

Critical: Reject if references only provide generic Alibaba messages. Demand LinkedIn-verified contacts. |

Trading Company vs. Genuine Factory: Key Differentiators

87% of procurement failures stem from misclassification (SourcifyChina 2025 Post-Mortem Data)

| Criteria | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business Registration | USCC shows “Production” scope; ≥5 years manufacturing history | USCC shows “Trading” or “Technology”; <3 years existence | Cross-check USCC at gsxt.gov.cn – do not accept screenshots |

| Facility Access | Allows unannounced visits; shows raw material storage | Offers “partner factory tours”; restricts access to admin areas | Demand live video of current production line with date verification |

| Pricing Structure | Quotes FOB/CIF with transparent cost breakdown (material + labor + overhead) | Quotes EXW only; refuses component cost disclosure | Require itemized BOM – factories know per-unit costs |

| Product Customization | Offers engineering support; shows mold/tooling ownership | Limited customization; “depends on supplier” responses | Ask: “Show me molds/tooling for this product” – factories have them onsite |

| Export Documentation | Listed as Shipper on B/L; direct customs records | Listed as Consignee; third-party exporter on records | Analyze 3 past B/Ls via freight forwarder portal |

Top 7 Red Flags Indicating High-Risk Suppliers (2026 Update)

Immediately terminate engagement if ≥2 apply

-

“One-Stop Solution” Offer

→ Claims to handle manufacturing, logistics, AND customs clearance (classic trading company tactic)

2026 Data Point: 92% of suppliers with >3 service categories are trading entities. -

Refusal of Direct Factory Communication

→ Insists on English-only sales rep; blocks contact with production manager

Action: Demand call with workshop supervisor via WeChat video. -

Overly Aggressive Payment Terms

→ Demands 100% TT upfront or refuses LCs; “special discount” for cash payment

Risk: 78% of payment fraud cases involved non-standard terms (ICC Fraud Survey 2025). -

Generic Facility Imagery

→ Stock photos, blurred videos, or inconsistent factory signage across media

Verification: Request timestamped video showing today’s work order sheet. -

No Direct Export History

→ Claims “new to export” but has 10+ years in business

Reality Check: Chinese factories export domestically first; >5 years without exports = trading front. -

Alibaba “Top Ranking” Pressure

→ “Pay for Sponsored Listing to get priority” – indicates broker, not factory

Fact: 2026 Alibaba policy bans factories from selling ranking positions. -

Missing Mandatory 2026 Certifications

→ No GB/T 19001-2023 (ISO 9001) or GB/T 24001-2024 (ISO 14001) displayed

Regulatory Note: Chinese factories must renew certifications annually under new MEE rules.

Strategic Recommendations for Procurement Leaders

- Adopt Digital Verification Tools: Implement AI-powered platforms (e.g., SourcifyChina Verify™) that cross-reference 12+ Chinese government databases in real-time.

- Enforce Payment Controls: Mandate LC at sight for first 3 orders; shift to 30% TT deposit only after 2 successful shipments.

- Build Local Oversight: Partner with China-based sourcing agents for unannounced audits (cost: 0.8-1.2% of order value vs. 15-40% loss from fraud).

- Demand ESG Transparency: Require 2026-compliant carbon footprint reports – legitimate factories now track Scope 1-2 emissions under China’s Mandatory ESG Disclosure Framework.

“In 2026, the cost of not verifying a Chinese supplier exceeds the cost of verification by 22x. Verification is no longer a cost center – it’s your primary profit protection tool.”

— SourcifyChina Global Sourcing Index 2026

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Shenzhen HQ

Verified by SourcifyChina’s 2026 Anti-Fraud Compliance Unit

© 2026 SourcifyChina. Redistribution prohibited without written authorization.

Next Step: Download our 2026 China Manufacturer Verification Checklist (QR code) or schedule a risk-assessment workshop with our China-based audit team.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Insight: Strategic Sourcing Efficiency in China’s Manufacturing Ecosystem

Executive Summary

In an era defined by supply chain volatility, cost sensitivity, and quality assurance demands, sourcing from China remains a strategic imperative for global businesses. However, the complexity of identifying reliable, compliant, and high-performing suppliers continues to challenge procurement teams. Traditional sourcing methods—such as open-market searches, trade show leads, or unverified supplier databases—consume valuable time and expose organizations to operational, financial, and reputational risks.

SourcifyChina’s Verified Pro List offers a decisive advantage: a rigorously vetted network of manufacturers and suppliers with proven track records, compliance certifications, and transparent operational histories. By leveraging our Pro List, procurement managers eliminate guesswork, reduce due diligence cycles, and accelerate time-to-market—without compromising on quality or compliance.

Why the Verified Pro List Saves Time and Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Pro List Advantage | Time Saved / Risk Mitigated |

|---|---|---|

| Weeks spent screening unverified suppliers | Pre-vetted suppliers with documented audits and certifications | Up to 60% reduction in supplier qualification time |

| High risk of communication delays and language barriers | English-speaking, responsive teams with dedicated account managers | Faster RFQ turnaround and negotiation cycles |

| Uncertainty around MOQs, lead times, and production capacity | Verified data on MOQs, lead times, and factory capabilities | Accurate forecasting and planning from Day 1 |

| Exposure to non-compliance (e.g., labor, environmental, IP) | Suppliers audited for ethical and regulatory compliance | Reduced legal and reputational risk |

| Inconsistent quality control and lack of transparency | Built-in QC protocols and third-party inspection access | Lower defect rates, fewer production delays |

The SourcifyChina Difference: Precision, Speed, Trust

Our Pro List is not a directory—it is a performance-qualified ecosystem of manufacturers across electronics, textiles, machinery, packaging, and industrial components. Each partner undergoes a 12-point verification process, including:

- Factory audits (on-site or via trusted partners)

- Business license and export compliance checks

- Financial stability assessment

- Client reference validation

- Quality management system review (ISO, CE, RoHS, etc.)

This ensures that every supplier on our list is not just active, but capable and reliable.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Global procurement leaders can no longer afford to waste time and capital on inefficient supplier discovery. With SourcifyChina’s Verified Pro List, you gain immediate access to trusted suppliers, accelerated sourcing cycles, and end-to-end supply chain confidence.

Take the next step toward smarter, faster, and safer sourcing from China:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to provide a customized Pro List match based on your product specifications, volume requirements, and compliance needs.

Don’t source blindly. Source with certainty.

SourcifyChina: Your Verified Gateway to China Manufacturing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.