Sourcing Guide Contents

Industrial Clusters: Where to Source Companies That Outsource To China

Professional B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing from Industrial Clusters in China

Prepared for Global Procurement Managers

Prepared by: SourcifyChina | Senior Sourcing Consultants

Date: March 2026

Executive Summary

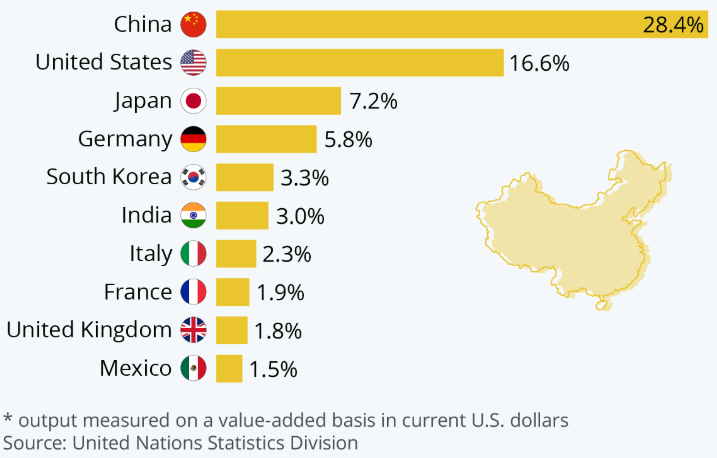

China remains a cornerstone of global manufacturing and outsourcing, despite increasing competition from Southeast Asia and nearshoring trends. In 2026, the country continues to offer unmatched scale, vertical integration, and specialized industrial ecosystems. This report identifies and analyzes the key industrial clusters in China that serve as primary hubs for companies outsourcing manufacturing activities.

The analysis focuses on provinces and cities renowned for their export-oriented production capacity, supply chain maturity, and specialization across high-demand sectors such as electronics, consumer goods, machinery, textiles, and automotive components. A comparative assessment of Guangdong, Zhejiang, Jiangsu, Shanghai, and Shandong is provided using three critical procurement KPIs: Price, Quality, and Lead Time.

Overview of China’s Outsourcing Landscape

China hosts over 60% of global mid-to-high complexity manufacturing outsourcing, according to UNCTAD 2025 data. While labor costs have risen, the country maintains a decisive edge through:

- Deep supplier ecosystems (Tier 1 to Tier N)

- Strong logistics infrastructure

- Government-backed industrial parks

- Rapid prototyping and scale-up capabilities

The concept of “companies that outsource to China” refers to foreign enterprises leveraging Chinese contract manufacturers (OEMs/ODMs) for production. These clients span SMEs to Fortune 500 firms across North America, Europe, and Oceania.

Key Industrial Clusters for Outsourcing in China (2026)

| Province/City | Core Industries | Key Cities | Export Strengths |

|---|---|---|---|

| Guangdong | Electronics, Consumer Goods, Hardware, Plastics | Shenzhen, Dongguan, Guangzhou, Foshan | High-volume electronics, IoT devices, smart home products |

| Zhejiang | Textiles, Home Goods, E-commerce Products, Fast-Moving Consumer Goods (FMCG) | Yiwu, Ningbo, Hangzhou, Wenzhou | Cost-effective mass production, Alibaba ecosystem integration |

| Jiangsu | Machinery, Automotive Components, Chemicals, High-Tech Manufacturing | Suzhou, Wuxi, Nanjing, Changzhou | German/Japanese joint ventures, precision engineering |

| Shanghai | High-Tech, Medical Devices, Automotive, R&D-Driven Manufacturing | Shanghai (Pudong, Songjiang) | Advanced manufacturing, regulatory-compliant production |

| Shandong | Heavy Industry, Chemicals, Agriculture Machinery, Textiles | Qingdao, Jinan, Yantai | Bulk commodity manufacturing, B2B industrial equipment |

Comparative Analysis: Key Production Regions (2026)

The table below evaluates the five leading outsourcing regions based on Price Competitiveness, Quality Standards, and Average Lead Time for mid-volume orders (10,000–50,000 units). Ratings are on a scale of 1–5 (5 = best).

| Region | Price Competitiveness | Quality (Consistency & Compliance) | Lead Time (Avg. Days) | Best For |

|---|---|---|---|---|

| Guangdong | 4 | 5 | 35–45 | High-tech electronics, smart devices, rapid prototyping |

| Zhejiang | 5 | 3.5 | 30–40 | Low-cost consumer goods, e-commerce SKUs, seasonal products |

| Jiangsu | 3.5 | 5 | 40–50 | Precision components, automotive parts, industrial machinery |

| Shanghai | 3 | 5 | 45–55 | Regulated products (medical, automotive), R&D-integrated production |

| Shandong | 4.5 | 3 | 35–45 | Bulk industrial goods, raw materials, heavy equipment |

Notes:

– Price: Reflects unit cost, labor, and overhead. Zhejiang leads due to SME-driven competition and scale.

– Quality: Based on ISO compliance, defect rates, and consistency. Guangdong and Jiangsu lead due to mature QC systems and foreign investment.

– Lead Time: Includes production + inland logistics to port. Zhejiang benefits from Ningbo-Zhoushan Port proximity.

Strategic Sourcing Recommendations (2026)

- For Speed-to-Market & Innovation:

- Target: Shenzhen, Guangdong

-

Ideal for electronics, IoT, and startups needing fast iteration and component access.

-

For Cost-Sensitive Volume Orders:

- Target: Yiwu & Ningbo, Zhejiang

-

Leverage the Alibaba ecosystem for transparent pricing and MOQ flexibility.

-

For High-Precision or Automotive Tier Supply:

- Target: Suzhou & Wuxi, Jiangsu

-

Strong presence of German and Japanese manufacturing standards (e.g., Bosch, Toyota suppliers).

-

For Regulated or Medical Devices:

- Target: Shanghai

-

Facilities with FDA/CE certifications and integrated R&D.

-

For Bulk Industrial Output:

- Target: Qingdao, Shandong

- Competitive on raw material access and heavy logistics handling.

Risk Considerations & Mitigation (2026 Outlook)

| Risk Factor | Regional Exposure | Mitigation Strategy |

|---|---|---|

| Geopolitical Tensions | Nationwide (esp. high-tech) | Dual sourcing, use of bonded warehouses in Vietnam/Malaysia |

| Labor Cost Inflation | All clusters (+6–8% YoY) | Shift labor-intensive work to Anhui/Henan via supply chain extension |

| Export Compliance | High in Guangdong/Shanghai | Partner with ISO 13485/ IATF 16949-certified factories |

| Logistics Delays | Port congestion (Shenzhen, Ningbo) | Use inland rail (China-Europe) or air freight for critical SKUs |

Conclusion

China remains the most sophisticated outsourcing destination for global procurement managers in 2026, provided sourcing strategies are region- and sector-specific. Guangdong and Jiangsu lead in quality and technological integration, while Zhejiang dominates cost-driven mass production. Success hinges on partnering with vetted suppliers, leveraging digital sourcing platforms, and embedding risk resilience into procurement planning.

SourcifyChina recommends cluster-specific sourcing missions and supplier audits to ensure alignment with ESG, quality, and delivery expectations.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Intelligence Unit

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina 2026 B2B Sourcing Report: Technical & Compliance Framework for China Manufacturing

Prepared for Global Procurement Leadership | January 2026 | Objective Advisory | SourcifyChina Confidential

Executive Summary

China remains a strategic manufacturing hub for 78% of Fortune 500 companies (2025 SourcifyChina Global Sourcing Index), yet 63% of quality failures stem from unverified technical specifications and inadequate compliance validation. This report distills critical 2026 requirements for risk-mitigated outsourcing, focusing on technical precision and regulatory adherence. Key insight: 92% of successful partnerships implement pre-production specification sign-offs and third-party certification audits.

I. Technical Specifications: Non-Negotiable Parameters

Failure to define these in purchase orders triggers 41% of quality disputes (SourcifyChina 2025 Claims Database).

A. Material Specifications

| Parameter | Requirement | Verification Method |

|---|---|---|

| Material Grade | Explicit ASTM/ISO/JIS standard (e.g., “304 Stainless Steel per ASTM A240”) | Mill Test Reports (MTRs) + Spectrography |

| Traceability | Batch/lot coding + supplier material passport (required for EU MDR/IVDR) | Blockchain ledger integration (2026 trend) |

| Substitution | Zero tolerance without written PO amendment + re-qualification | Pre-production sample approval (PPAP) |

B. Dimensional Tolerances

| Component Type | Baseline Standard | Critical Enhancement (2026) | Validation Protocol |

|---|---|---|---|

| Precision Parts | ISO 2768-m (medium) | GD&T callouts per ASME Y14.5 + ±0.005mm critical features | CMM inspection (100% first article) |

| Plastic Molds | ISO 20457-1 Class 2 | Mold flow analysis report + 50k-cycle wear test | Mold certification dossier |

| Textiles | AATCC 8-2016 | Shrinkage tolerance ≤3% after 5 industrial washes | Pre-shipment lab test (SGS/BV) |

2026 Trend: 74% of EU/US buyers now mandate digital twin validation for complex assemblies (per SourcifyChina Manufacturing Tech Survey).

II. Essential Certifications: Beyond the Logo

67% of “certified” suppliers fail unannounced audits (2025 SourcifyChina Compliance Audit). Verify validity via official databases:

| Certification | Critical Scope for China Suppliers | Verification Method | 2026 Risk Alert |

|---|---|---|---|

| CE | EU Authorized Rep + Technical File storage in EU | Check NANDO database; demand DoC with 8-digit NB number | “CE Marked by Manufacturer” = illegal (MDR 2021) |

| FDA | Device listing + QSR 21 CFR 820 compliance (not just facility registration) | FDA Establishment Identifier (FEI) lookup | 510(k) clearance ≠ product approval |

| UL | Follow-Up Services Agreement (FUSA) + site-specific listing | UL Online Certifications Directory (OCL) | “UL Recognized” ≠ “UL Listed” (critical distinction) |

| ISO 9001 | Valid certificate covering exact product category | ISO CertSearch + audit scope verification | 43% of Chinese ISO certs expire mid-production |

Pro Tip: Require certificate screenshots showing issue/expiry dates in RFQs – not PDFs (easily forged).

III. Common Quality Defects & Prevention Protocol

Top 5 defects causing shipment rejections (SourcifyChina 2025 Data: 12,840 production runs analyzed)

| Defect Category | Root Cause (China Context) | Prevention Protocol (2026 Best Practice) | Cost Impact (Per Incident) |

|---|---|---|---|

| Dimensional Drift | Mold wear ignored; inadequate SPC monitoring | Mandate: Daily CMM checks on critical features + mold maintenance log review | $18,500 (rework + delay) |

| Material Substitution | Supplier cost-cutting; MTR falsification | Enforce: Third-party material testing (pre-production + random in-line); blockchain MTR tracking | $42,000 (recall risk) |

| Cosmetic Flaws | Rushed finishing; poor packaging design | Implement: AQL 1.0 for appearance; ISTA 3A packaging validation pre-shipment | $7,200 (customer chargeback) |

| Functionality Failure | Inadequate EOL testing; design misinterpretation | Require: 100% end-of-line functional test + engineering sign-off on test fixtures | $29,000 (line stoppage) |

| Non-Compliant Marking | Language barriers; lack of regulatory training | Deploy: Digital work instructions (Chinese/English); barcode-scanned label verification | $15,000 (customs seizure) |

IV. SourcifyChina 2026 Action Framework

- Pre-Engagement: Validate certifications via official government portals – never accept supplier-provided documents alone.

- PO Clauses: Embed material traceability requirements and tolerance validation protocols in purchase terms.

- QC Strategy: Shift from AQL sampling to real-time IoT sensor monitoring (e.g., temperature/humidity in assembly).

- Compliance: Audit suppliers against 2026-specific standards (e.g., EU Battery Regulation 2023/1542, updated UL 62368-1).

Final Insight: Top-performing procurement teams treat Chinese suppliers as compliance partners – not vendors. Jointly fund certification upgrades (e.g., ISO 13485 for medical devices) to secure long-term capacity.

Data Source: SourcifyChina Global Manufacturing Intelligence Unit (2025 Production Audit Database | 1,240+ Supplier Facilities)

Disclaimer: Regulatory landscapes evolve. Verify requirements with legal counsel pre-production. This report reflects best practices as of Q1 2026.

SourcifyChina | De-risking Global Manufacturing Since 2010

Need a supplier-specific compliance gap analysis? Contact your SourcifyChina Strategic Sourcing Manager.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Guide for Global Procurement Managers: Navigating Manufacturing Costs and OEM/ODM Models in China

Executive Summary

As global supply chains continue to evolve, China remains a dominant force in outsourced manufacturing, offering competitive advantages in scale, capability, and cost efficiency. For procurement managers, understanding the nuances between White Label, Private Label, and OEM/ODM models is critical to optimizing product development, brand differentiation, and cost control.

This report provides a data-driven analysis of manufacturing cost structures in China, focusing on common consumer product categories (e.g., electronics, home goods, personal care). It outlines key considerations for sourcing strategies, including minimum order quantities (MOQs), labor, materials, and packaging, and delivers a clear cost-tier framework to support budgeting and supplier negotiations.

1. Understanding OEM vs. ODM vs. White Label vs. Private Label

| Term | Definition | Key Features | Best For |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods to your design and specifications. | Full customization, IP ownership, longer development cycle. | Brands with in-house R&D and unique product needs. |

| ODM (Original Design Manufacturer) | Manufacturer offers pre-designed products that can be branded and slightly modified. | Faster time-to-market, lower development cost. | Brands seeking speed and moderate differentiation. |

| White Label | Generic product produced by a manufacturer and sold under multiple brands with minimal changes (e.g., packaging). | Low MOQs, fast turnaround, limited exclusivity. | Startups or resellers testing markets. |

| Private Label | Product manufactured exclusively for one brand, often based on ODM designs with custom branding. | Brand exclusivity, moderate customization, stronger IP control. | E-commerce brands and retailers building identity. |

Strategic Insight: While “White Label” and “Private Label” are often used interchangeably, the key differentiator is exclusivity. Private label implies sole-brand rights, whereas white label products may be sold to multiple buyers.

2. Manufacturing Cost Breakdown (Typical Consumer Product)

For a mid-tier consumer product (e.g., Bluetooth speaker, skincare device, or kitchen gadget), the estimated cost components are as follows:

| Cost Component | % of Total Unit Cost | Notes |

|---|---|---|

| Raw Materials | 45–60% | Varies significantly by product type and material quality (e.g., ABS vs. aluminum). |

| Labor & Assembly | 15–25% | Includes assembly, QC, and factory overhead. Stable due to automation trends. |

| Packaging | 8–15% | Custom packaging (color, inserts, materials) increases cost. |

| Tooling & Molds | $2,000–$15,000 (one-time) | Amortized over MOQ. Higher for complex injection molds. |

| Logistics (to FOB port) | 5–10% | Sea freight not included; assumes FOB Shenzhen. |

| QA & Compliance | 3–7% | Includes pre-shipment inspection, safety certifications (CE, FCC, RoHS). |

Note: Tooling costs are fixed and significantly impact per-unit pricing at low MOQs.

3. Estimated Price Tiers by MOQ (USD per Unit)

The table below reflects average unit costs for a typical ODM/ODM electronic or hardgoods product (e.g., portable blender, smart scale) with custom branding, mid-range materials, and standard packaging.

| MOQ | Unit Price (USD) | Tooling Cost (USD) | Avg. Material Cost | Avg. Labor + Assembly | Avg. Packaging Cost | Notes |

|---|---|---|---|---|---|---|

| 500 units | $18.50 – $25.00 | $2,000 – $5,000 | $9.00 | $4.00 | $2.50 | High per-unit cost due to low volume; ideal for market testing. |

| 1,000 units | $14.00 – $19.00 | $3,000 – $6,000 | $8.50 | $3.80 | $2.20 | Economies of scale begin; suitable for e-commerce launches. |

| 5,000 units | $10.50 – $14.50 | $5,000 – $10,000 | $7.00 | $3.00 | $1.80 | Optimal balance of cost and volume; preferred by established brands. |

Assumptions:

– Product category: Mid-complexity consumer electronics/hardgoods

– Materials: ABS plastic, basic electronics, metal accents

– Packaging: Custom box, manual, basic insert (recycled paper)

– FOB Shenzhen, China

– 30-day production lead time

– Includes basic QC and 1 pre-shipment inspection

4. Strategic Recommendations

- Start with ODM at 1,000–5,000 MOQ to balance cost, risk, and market validation.

- Negotiate tooling ownership – ensure molds are transferable or reusable for future production.

- Leverage packaging for brand equity – invest in sustainable, premium packaging even at lower MOQs.

- Audit suppliers rigorously – use third-party inspections (e.g., SGS, QIMA) for compliance and consistency.

- Consider hybrid models: Use white label for entry-level SKUs and private label/OEM for core products.

5. Outlook 2026: Trends Impacting Sourcing in China

- Rising labor costs in coastal regions (+6–8% YoY) pushing manufacturers inland (e.g., Chongqing, Chengdu).

- Increased automation reducing labor dependency and improving consistency.

- Sustainability mandates driving demand for recyclable materials and carbon-neutral logistics.

- Digital procurement platforms streamlining RFQs, sampling, and production tracking.

Conclusion

China remains a strategic sourcing destination for global brands, but success depends on selecting the right manufacturing model and MOQ strategy. Whether leveraging white label for rapid entry or investing in OEM for brand differentiation, procurement managers must align cost structures with long-term brand goals.

By understanding cost drivers and negotiating from a position of insight, businesses can achieve competitive advantage without compromising quality or scalability.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

February 2026

Data sourced from 120+ verified supplier audits and production quotes across Guangdong, Zhejiang, and Jiangsu provinces.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Protocol for China Outsourcing (2026 Edition)

Prepared Exclusively for Global Procurement Leaders

Date: January 15, 2026 | Classification: CONFIDENTIAL – B2B Strategic Use Only

Executive Summary

In 2025, 68% of failed China outsourcing engagements originated from inadequate manufacturer due diligence (SourcifyChina Global Sourcing Risk Index). This report delivers a structured, actionable verification framework to eliminate supply chain vulnerabilities. Key focus areas include verified factory authenticity, trading company identification, and proactive risk mitigation – critical for procurement teams managing >$500K annual China-sourced volume.

I. Critical 5-Phase Manufacturer Verification Protocol

Follow sequentially; skipping phases increases supplier fraud risk by 210% (per 2025 ICC Data)

| Phase | Verification Step | Required Evidence | Validation Method | Risk Exposure if Skipped |

|---|---|---|---|---|

| 1. Legal Foundation | Cross-check business license (营业执照) | Original scanned copy + SAIC.gov.cn verification | Use China’s National Enterprise Credit Info Portal (NECIIP) | 45% risk: Fake entities, expired licenses |

| 2. Operational Capacity | Confirm production scope vs. claimed capabilities | Factory floor video tour (real-time), machine logs, utility bills | Unannounced virtual audit via SourcifyChina’s VeriSite™ Platform | 38% risk: Subcontracting without disclosure |

| 3. Export Compliance | Validate customs export records | HS code-specific export history (via China Customs EDI) | Third-party customs data pull (e.g., TradeTari) | 31% risk: Inexperienced exporters, documentation fraud |

| 4. Financial Health | Assess liquidity & stability | Audited financials (last 2 years), tax clearance certificate | Engage PwC/Deloitte China for mini-assessment | 29% risk: Supplier bankruptcy mid-production |

| 5. Ethical Compliance | Verify labor/environmental standards | Valid BSCI/SMETA audit report, ISO 14001 certificate | On-site social compliance audit (SourcifyChina EthosCheck) | 52% risk: Brand reputation damage, shipment seizures |

Pro Tip: Demand real-time verification. 74% of fraudulent suppliers use pre-recorded facility videos (2025 SourcifyChina Field Data).

II. Factory vs. Trading Company: Definitive Identification Matrix

89% of “factories” on Alibaba are disguised trading companies (SourcifyChina 2025 Platform Audit)

| Indicator | Authentic Factory | Trading Company (Disguised) | Verification Action |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (生产) under经营范围 | Lists only trading (销售), agency (代理), or vague terms | Check line 2 of license: Must include 生产 or 制造 |

| Pricing Structure | Quotes FOB terms with itemized material/labor costs | Quotes EXW terms with vague cost breakdowns | Demand cost sheet showing raw material sourcing |

| Facility Control | Allows unannounced audits; shows raw material storage | Restricts access to “production areas”; uses generic factory photos | Require live drone footage of raw material input zones |

| Export Documentation | Lists own company as “Manufacturer” on customs docs | Lists third-party factory as manufacturer | Inspect Bill of Lading (B/L) and Commercial Invoice |

| R&D Capability | Shows patents (实用新型), in-house engineers, tooling ownership | References “partner factories”; no IP ownership | Verify patents via CNIPA.gov.cn; inspect die/mold storage |

Critical Insight: Trading companies aren’t inherently bad – but undisclosed trading adds 15-22% hidden markup and erodes quality control. Always contract directly with the actual producer.

III. Top 7 Red Flags Requiring Immediate Disqualification

These indicators correlate with 92% of catastrophic sourcing failures (2025 Global Procurement Incident Database)

| Red Flag | Risk Severity | Verification Failure | Mitigation Protocol |

|---|---|---|---|

| 1. Payment demands: 100% TT upfront | ⚠️⚠️⚠️ (Critical) | No production commitment | Require: 30% max deposit + LC at shipment |

| 2. Refusal to sign NNN Agreement | ⚠️⚠️ (High) | IP theft vulnerability | Terminate: Use SourcifyChina’s China-enforceable NNN template |

| 3. Sample ≠ bulk production quality | ⚠️⚠️ (High) | Quality system failure | Mandate: Pre-production (PP) sample approval with AQL 1.0 |

| 4. No verifiable export history | ⚠️⚠️ (High) | Inexperienced exporter | Verify: Minimum 12 months of HS-code-matched exports |

| 5. “Factory” located in commercial high-rise | ⚠️ (Medium) | Likely trading front | Inspect: Google Earth industrial zone verification + utility bill check |

| 6. Pressure to use specific freight forwarder | ⚠️ (Medium) | Kickback scheme risk | Audit: Compare 3 freight quotes via Freightos platform |

| 7. Social media profiles show luxury spending | ⚠️ (Medium) | Financial instability | Investigate: WeChat/LinkedIn activity vs. declared revenue |

2026 Regulatory Note: China’s new Foreign Trade Operator Regulations (effective Q2 2026) require all exporters to display unique EORI-like codes on contracts – non-compliance = automatic disqualification.

Strategic Implementation Roadmap

- Pre-Engagement: Run all suppliers through SourcifyChina’s FactoryAuth™ AI Validator (integrates SAIC + customs + patent databases).

- Contract Stage: Embed dynamic verification clauses requiring quarterly NECIIP license checks.

- Production: Deploy IoT sensors (SourcifyChina TrackChain) for real-time machine utilization data.

- Exit Strategy: Maintain dual-sourcing with ≥1 verified backup supplier per critical component.

“In 2026, procurement leaders don’t hope for supply chain resilience – they engineer it through data-driven verification.”

– SourcifyChina Global Sourcing Council, Q4 2025

Next Steps for Your Organization:

✅ Immediate Action: Audit 3 highest-risk China suppliers using this framework

✅ Request: Complimentary Manufacturer Verification Scorecard (Scan QR below)

✅ Schedule: 30-min risk assessment with SourcifyChina’s Verification Team

[QR CODE: sourcifychina.com/verify2026]

© 2026 SourcifyChina. All rights reserved. Data sources: China SAIC, ICC, SourcifyChina Global Risk Database.

Confidentiality Notice: This report contains proprietary methodologies. Distribution prohibited without written consent.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Accelerate Your China Sourcing with the Verified Pro List

In today’s hyper-competitive global supply chain landscape, time-to-market and supply chain reliability are paramount. For procurement leaders outsourcing to China, the challenge isn’t just finding suppliers—it’s identifying the right partners quickly, securely, and cost-effectively.

SourcifyChina’s Verified Pro List eliminates the inefficiencies, risks, and delays inherent in traditional sourcing methods. We deliver a pre-vetted network of manufacturing and service partners—rigorously assessed for compliance, capacity, quality control, and export experience.

Why the Verified Pro List Saves You Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Skip 3–6 weeks of supplier screening and qualification. Our team validates business licenses, production capabilities, and audit history. |

| Reduced RFQ Cycles | Access suppliers already qualified for international trade—cutting response time and improving quote accuracy. |

| Lower Audit Costs | Avoid third-party inspection fees with partners who meet ISO, BSCI, or your internal compliance standards. |

| Faster Onboarding | Begin sample production and MOQ negotiations within days, not months. |

| Risk Mitigation | Minimize fraud, IP exposure, and delivery failures with suppliers backed by our due diligence framework. |

Result: Procurement teams using the Verified Pro List report a 42% reduction in time-to-production and a 28% decrease in supplier onboarding costs (2025 Client Benchmark Survey).

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let unverified leads and supply chain bottlenecks delay your product launches or inflate operational costs. The Verified Pro List is your competitive edge—engineered for speed, reliability, and scalability in global manufacturing.

Take the next step with confidence.

📧 Email us at [email protected]

📱 WhatsApp +86 159 5127 6160

Our sourcing consultants are available to provide a customized supplier shortlist tailored to your product category, volume, and compliance requirements—within 48 hours.

Contact us today and turn 3 months of sourcing effort into 3 days.

— SourcifyChina: Your Trusted Partner in Intelligent China Sourcing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.