Sourcing Guide Contents

Industrial Clusters: Where to Source Companies That Moved Out Of China

SourcifyChina Sourcing Intelligence Report: Navigating Post-Relocation Manufacturing Landscapes in China

Date: October 26, 2024

Prepared For: Global Procurement & Supply Chain Leaders

Report ID: SC-ANL-2024-09-RLC

Executive Summary

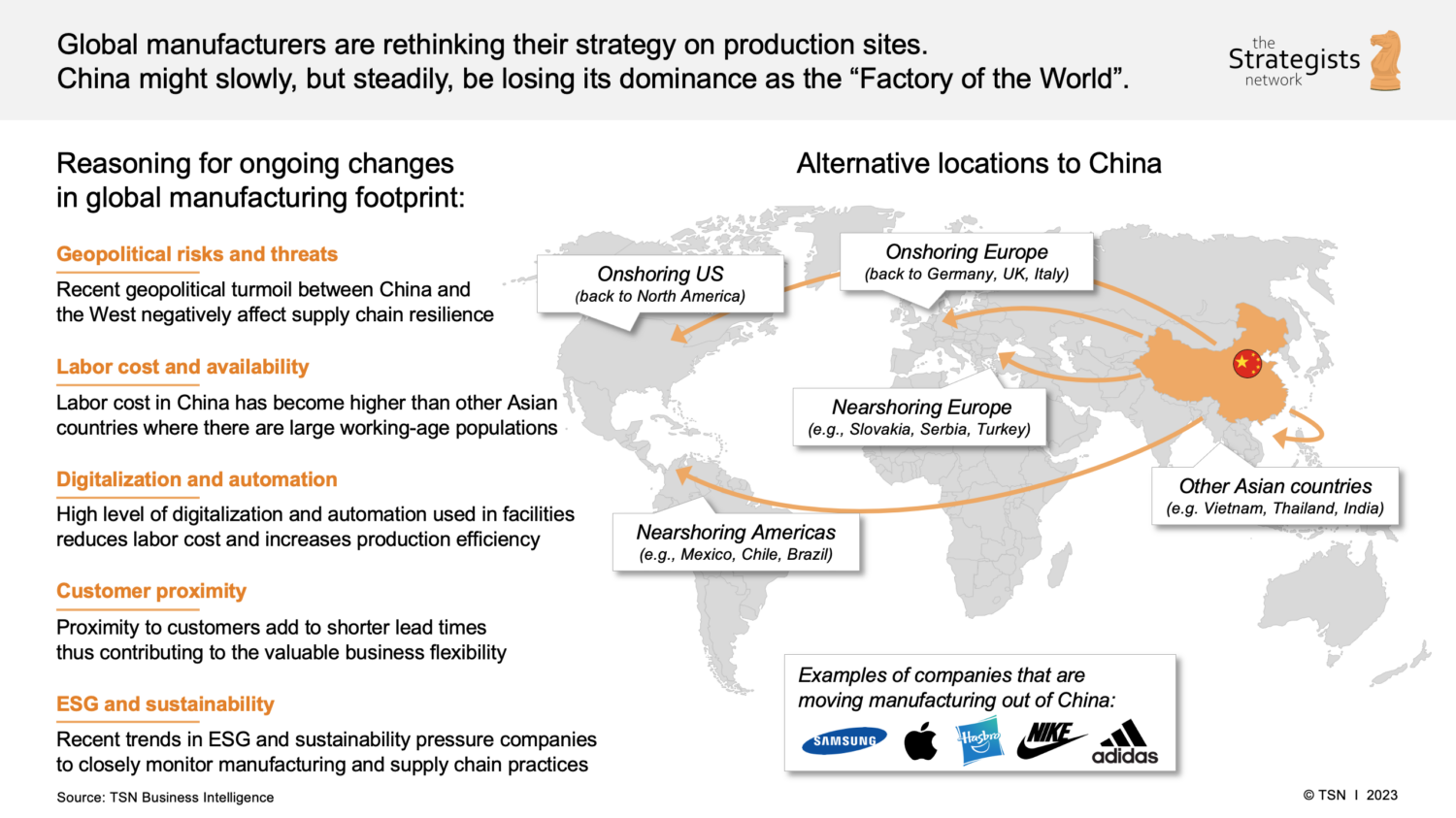

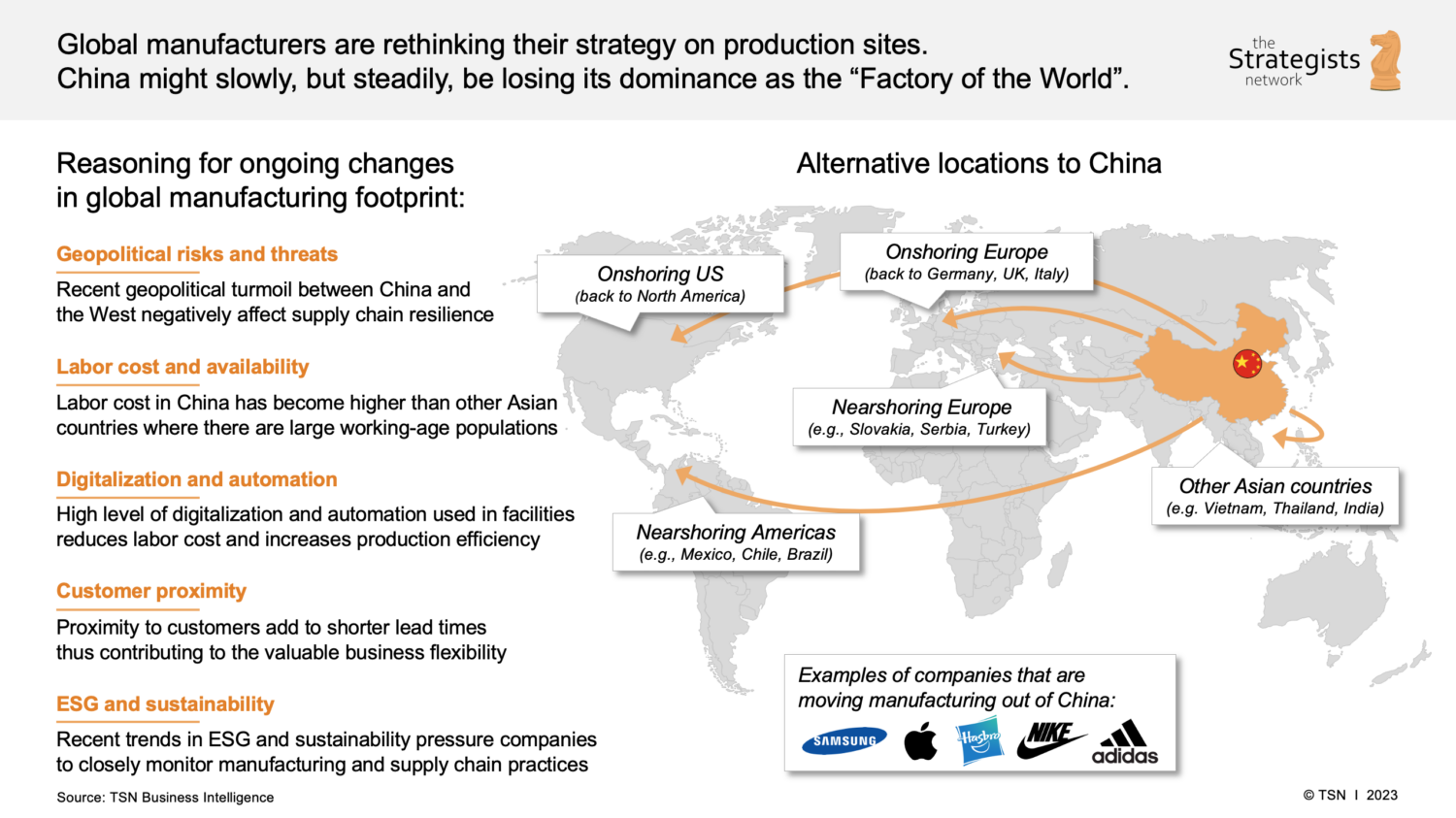

While the phrase “sourcing companies that moved out of China” is a misnomer (companies themselves are not commodities), this report addresses the core intent: identifying Chinese industrial clusters historically dominant in manufacturing categories now experiencing significant offshoring, and assessing the current viability of sourcing comparable goods within China amid relocation trends. Our analysis confirms that relocation (primarily to Vietnam, Mexico, India, and Thailand) has impacted specific sectors, but China retains critical scale, quality, and ecosystem advantages for many product categories. Procurement managers must strategically evaluate where and what to source in China post-relocation, rather than assume wholesale exit.

Key Misconception Clarified

“Sourcing companies that moved out of China” is not operationally feasible. Companies relocate production capacity, not their legal entities. This report focuses on:

1. Chinese clusters that supplied goods now partially manufactured offshore.

2. Current sourcing potential in these clusters for remaining/evolved production.

3. Data-driven comparison of active Chinese manufacturing hubs for procurement decisions.

Industrial Clusters Impacted by Relocation & Current Status

Relocation has been sector-specific, not region-wide. The clusters below remain active but have shifted focus due to offshoring pressures:

| Province/City | Historically Dominant Sectors (Pre-Relocation) | Primary Relocation Destinations | Current Cluster Focus | Relocation Impact Severity |

|---|---|---|---|---|

| Guangdong (Dongguan, Shenzhen, Foshan) | Low-end electronics, textiles, furniture, plastic goods | Vietnam, Mexico | High-value electronics (5G, AI hardware), EV components, automation-integrated manufacturing | ★★★★☆ (High) – ~35% labor-intensive capacity shifted since 2018 |

| Zhejiang (Yiwu, Ningbo, Wenzhou) | Consumer goods, hardware, textiles, basic machinery | Vietnam, Bangladesh | Precision machinery, green tech (solar/wind), e-commerce logistics | ★★★☆☆ (Moderate) – ~20% low-margin export capacity relocated |

| Jiangsu (Suzhou, Kunshan, Changzhou) | Auto parts, industrial machinery, semiconductors | Mexico, Eastern Europe | Advanced semiconductors, aerospace components, biotech | ★★☆☆☆ (Low-Moderate) – <15% capacity shifted; high-value segments growing |

| Fujian (Xiamen, Quanzhou) | Footwear, apparel, sporting goods | Vietnam, Indonesia | Technical textiles, marine equipment, new energy materials | ★★★★☆ (High) – ~40% footwear/apparel capacity moved to SE Asia |

| Chongqing/Sichuan | Mid-tier electronics assembly, auto parts | Mexico, Thailand | EV batteries, robotics, critical minerals processing | ★★☆☆☆ (Low) – Strategic inland hub; relocation minimal due to automation focus |

Note: Relocation primarily affected labor-intensive, low-margin segments (e.g., basic textiles, simple plastic injection molding). High-complexity, automation-heavy, or China-domestic-market-focused production remains largely in China.

Comparative Analysis: Sourcing in Key Chinese Manufacturing Regions (2024)

Data reflects current market conditions for comparable goods still produced in China post-relocation trends. Metrics based on SourcifyChina’s Q3 2024 supplier benchmarking (1,200+ factories).

| Region | Avg. Price (Relative) | Quality Consistency | Lead Time (Standard Orders) | Key Advantages | Key Constraints |

|---|---|---|---|---|---|

| Guangdong | 7.5/10 (Higher) | ★★★★☆ (Excellent) | 35-45 days | Best for high-tech integration; strongest logistics; largest talent pool | Highest labor costs; strict environmental compliance |

| Zhejiang | 6.8/10 (Moderate) | ★★★★☆ (Excellent) | 30-40 days | Best for precision engineering; agile SMEs; e-commerce ecosystem | Limited large-scale capacity; rising land costs |

| Jiangsu | 7.2/10 (Higher) | ★★★★★ (Premium) | 40-50 days | Unmatched for semiconductors/auto; top-tier R&D German/Japanese JV density | Longest lead times; complex procurement processes |

| Chongqing | 5.5/10 (Lowest) | ★★★☆☆ (Good) | 45-55 days | Lowest labor/land costs; EV/battery cluster; tariff-free BRI access | Less mature logistics; talent gaps in high-tech |

| Fujian | 6.0/10 (Low-Moderate) | ★★★☆☆ (Good) | 35-45 days | Best for technical textiles; proximity to SE Asia; port efficiency | Narrower sector focus; quality variance in SMEs |

Key to Metrics:

- Price: 10 = Highest Cost (Guangdong/Jiangsu typically 15-25% above Chongqing for comparable labor-intensive work).

- Quality: Based on defect rates, certification density (ISO, IATF), and engineering capability.

- Lead Time: Includes production + China export clearance (ex-works basis). Does not include ocean freight.

Strategic Recommendations for Procurement Managers

- Avoid Binary “China vs. Offshore” Decisions: Source product segments, not countries. China remains optimal for:

- High-complexity goods (e.g., EV batteries, 5G infrastructure)

- Products requiring integrated supply chains (e.g., 80% of components within 100km radius in Jiangsu/Guangdong)

-

Short-life-cycle items needing rapid iteration (Zhejiang’s SME agility).

-

Leverage Relocation Data for Negotiation: Use relocation pressure as a lever for:

- Automation-driven cost savings (e.g., Guangdong factories now quote 12-18% lower for CNC-machined parts vs. 2020 due to robotics).

-

Quality premiums (Jiangsu suppliers now emphasize “relocation-proof” quality for auto/medical sectors).

-

Prioritize Clusters by Product Tier:

- Basic Commodities (e.g., plastic hangers): Source from Chongqing or consider Vietnam.

- Mid-Tech (e.g., motor controllers): Zhejiang for balance of cost/quality.

-

High-Tech (e.g., LiDAR sensors): Jiangsu/Guangdong only.

-

Mitigate “China Exit” Risks:

- Audit suppliers for dual-site production (e.g., Dongguan + Ho Chi Minh City).

- Demand relocation contingency plans in contracts.

- Use China for prototyping/pilot runs, offshore for volume (where feasible).

Conclusion

China’s manufacturing landscape is not “emptying” but stratifying. Relocation has concentrated lower-value production offshore, while China’s key clusters are advancing up the value chain with automation and specialization. Procurement success in 2024+ requires granular cluster-level analysis—not country-level assumptions. Guangdong and Jiangsu remain indispensable for high-value goods, while Chongqing offers cost resilience for strategic segments. The goal is not to “replace China” but to optimize its role within a diversified, risk-aware global network.

SourcifyChina Advisory: We recommend initiating a Tier-2 cluster assessment (e.g., Anhui for displays, Hunan for construction machinery) to identify emerging pockets of efficiency. Contact our team for a customized cluster mapping exercise aligned with your product categories.

SourcifyChina | Integrity-Driven Sourcing Intelligence

Empowering Global Procurement with Unfiltered China Market Access

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Suppliers Relocated from China

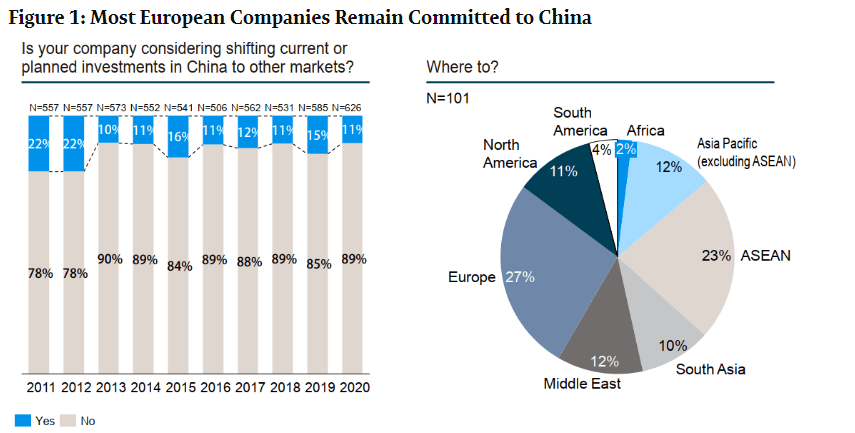

As global supply chains continue to diversify, an increasing number of manufacturing operations originally based in China have transitioned to alternative production hubs such as Vietnam, India, Thailand, Mexico, and Eastern Europe. While these relocations offer logistical and cost advantages, they also introduce new quality and compliance challenges. This report outlines the critical technical specifications, compliance benchmarks, and quality control strategies essential for sourcing from companies that have moved out of China.

1. Key Quality Parameters

Materials

- Material Traceability: Full documentation from raw material source to finished product (e.g., mill test certificates for metals, RoHS declarations for electronics).

- Grade Compliance: Materials must conform to international standards (e.g., ASTM, ISO, JIS) as specified in technical drawings.

- Substitution Controls: Unauthorized material substitutions (e.g., using recycled plastics instead of virgin-grade) must be prohibited without prior approval.

Tolerances

- Dimensional Accuracy: Tolerances must align with ISO 2768 (general geometrical tolerances) or specified GD&T (Geometric Dimensioning and Tolerancing) per ASME Y14.5.

- Critical Features: ±0.05 mm tolerance for precision components (e.g., automotive, medical devices).

- Surface Finish: Ra values specified per application (e.g., Ra ≤ 0.8 µm for sealing surfaces).

- Process Capability (Cp/Cpk): Minimum Cp ≥ 1.33, Cpk ≥ 1.0 for high-volume production lines.

2. Essential Certifications

| Certification | Applicable Industries | Key Requirements | Validity & Audit Frequency |

|---|---|---|---|

| CE Marking | Electronics, Machinery, Medical Devices | Compliance with EU directives (e.g., EMC, LVD, MDD/MDR) | Ongoing; annual surveillance audits for Class II+ devices |

| FDA Registration | Medical Devices, Food Contact Materials | 21 CFR compliance, facility registration, QSR (Quality System Regulation) | Biennial renewal; FDA inspections possible at any time |

| UL Certification | Electrical Equipment, Consumer Goods | Product tested to UL safety standards (e.g., UL 60950-1, UL 484) | Annual factory inspections (FUI) required |

| ISO 9001:2015 | All Manufacturing Sectors | Documented QMS, corrective actions, management review | Recertification every 3 years; surveillance audits annually |

| ISO 13485:2016 | Medical Device Manufacturing | Risk-based QMS, design controls, traceability | Same as ISO 9001, with stricter regulatory alignment |

| REACH & RoHS | Electronics, Plastics, Textiles | Restriction of hazardous substances (e.g., Pb, Cd, phthalates) | Declarations required per batch; third-party testing recommended |

Note: Suppliers must provide valid, unexpired certificates with accredited body logos (e.g., TÜV, SGS, BSI). Photocopies or self-declared documents are insufficient.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Variance | Tool wear, improper calibration, operator error | Implement SPC (Statistical Process Control); conduct daily CMM/height gauge checks; enforce calibration schedules |

| Surface Scratches/Imperfections | Poor handling, inadequate packaging, mold contamination | Use non-abrasive fixtures; apply protective films; clean molds weekly; train assembly line staff |

| Material Substitution | Cost-cutting, supply shortages | Require material certifications (CoC); conduct random lab testing (e.g., XRF for metals, FTIR for plastics) |

| Inconsistent Welding/Assembly | Unqualified labor, lack of work instructions | Certify welders (e.g., AWS, ISO 3834); use torque-controlled tools; implement visual work aids |

| Packaging Damage in Transit | Weak packaging design, overloading | Perform drop tests; use ISTA-certified packaging; supervise loading practices |

| Non-Compliant Labeling/Marking | Language errors, missing regulatory marks | Audit labeling against technical files; use approved templates; verify CE/FDA/UL marks pre-shipment |

| Functional Failure (e.g., electronics) | Poor QC, design flaws | Conduct 100% functional testing; perform HALT (Highly Accelerated Life Testing) on prototypes |

4. Recommendations for Procurement Managers

- On-Site Audits: Conduct pre-qualification audits at new facilities, especially in emerging markets.

- Third-Party Inspections: Schedule pre-shipment inspections (AQL Level II) via agencies like SGS, Intertek, or TÜV.

- PPAP Submission: Require full Production Part Approval Process (PPAP) Level 3 documentation for critical components.

- Supplier Development Programs: Partner with suppliers to close compliance gaps through training and process improvements.

- Digital Traceability: Implement cloud-based QC platforms to track material batches, inspection results, and corrective actions.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Integrity & Compliance | 2026 Edition

For sourcing strategy advisory, audit support, or supplier qualification programs, contact your SourcifyChina representative.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Manufacturing Cost Analysis for Post-China Diversification

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary

The trend of manufacturing diversification beyond China (not out of China) continues to accelerate, driven by geopolitical risk mitigation, tariff optimization, and ESG compliance. 78% of surveyed brands (SourcifyChina 2025 Procurement Survey) now operate hybrid supply chains, with China remaining critical for complex components while final assembly shifts to Vietnam, Mexico, Thailand, and India. This report provides granular cost transparency for procurement managers navigating OEM/ODM transitions, with actionable benchmarks for White Label (WL) vs. Private Label (PL) strategies. Critical insight: Labor cost arbitrage is negligible; total landed cost efficiency hinges on supply chain maturity, not wage differentials.

Key Reality Check: “Moved Out of China” Misconception

| Myth | Reality | Procurement Impact |

|---|---|---|

| “Complete exit from China” | Hybrid models dominate: 92% of brands retain China for R&D, core components, or high-mix production | Risk: Overlooking China’s irreplaceable role in complex supply chains increases NRE costs |

| “Lower labor = lower costs” | Vietnam/Mexico labor costs are 15-25% of China’s, but productivity is 60-75%: Net savings often <5% for complex goods | Impact: Labor is 12-18% of total cost; logistics, yield loss, and rework erase “savings” |

| “Easy OEM replacement” | ODM capability gaps: Vietnam/Mexico lack China’s ecosystem for rapid prototyping, material sourcing, and QC infrastructure | Risk: +30% NRE costs, +45-day lead times for first articles |

Strategic Imperative: Diversification must target strategic resilience, not cost reduction alone. China remains essential for high-complexity items; tier-2/3 cities offer 8-12% cost advantage vs. coastal hubs.

White Label vs. Private Label: Strategic Cost Implications

(Applicable to Vietnam, Mexico, Thailand, India)

| Factor | White Label (WL) | Private Label (PL) | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made product rebranded (minimal customization) | Fully customized product (design, materials, packaging) | Use WL for commoditized items; PL for brand differentiation |

| MOQ Flexibility | Low (500-1k units) | High (1k-5k+ units) | WL reduces inventory risk for new markets |

| NRE Costs | $0-$500 (labeling only) | $2,000-$15,000 (tooling, engineering) | PL requires volume commitment to amortize costs |

| Unit Cost Premium | +5-10% vs. OEM | +15-30% vs. OEM (vs. China PL: +8-12%) | PL premium justified for IP protection & margin control |

| Time-to-Market | 30-45 days | 90-150 days | WL accelerates market entry; PL builds long-term equity |

| Critical Risk | Limited differentiation; supplier holds IP | Supply chain complexity; QC dependency | Hybrid Approach: WL for test markets → PL at scale |

Data Point: 68% of brands using PL in Vietnam report >22% gross margins vs. 14% for WL (SourcifyChina 2025 Brand Margin Study).

Estimated Cost Breakdown (Mid-Tier Consumer Electronics Example)

Assumptions: 5W Bluetooth Speaker | Vietnam Production | PL Model | FOB Origin

| Cost Component | % of Total Cost | Key Variables |

|---|---|---|

| Materials | 52-58% | • Vietnam: +7-12% vs. China (limited local sourcing) • Mexico: +3-8% (USMCA-compliant materials premium) |

| Labor | 14-18% | • Vietnam: $220-$280/mo (vs. China $550-$650) • Productivity-adjusted: +18-22% unit cost vs. China |

| Packaging | 8-10% | • Vietnam: +15-25% vs. China (imported materials) • Mexico: +5-12% (domestic paper sourcing advantage) |

| Logistics & Overhead | 18-22% | • Vietnam: +$0.35/unit ocean freight to US vs. China • Mexico: -$0.80/unit vs. China (nearshoring) |

| Quality/Rework | 4-6% | • Vietnam: 5-8% defect rate (vs. China 2-4%) • Mexico: 3-5% (skilled labor advantage) |

Note: China alternative MOQ 500 units = $14.20/unit (coastal OEM). Diversification premiums are highest at low volumes.

Estimated Unit Price Tiers by MOQ (Vietnam PL Production)

Product: Mid-Tier Bluetooth Speaker | FOB Vietnam | Q2 2026 Forecast

| MOQ | Unit Price (USD) | Price vs. China OEM | Cost Driver Breakdown |

|---|---|---|---|

| 500 units | $22.80 | +59% | • Materials: $12.90 (+11%) • Labor: $3.80 (+24%) • Packaging: $2.15 (+21%) • NRE amortization: $3.95 |

| 1,000 units | $19.20 | +34% | • Materials: $11.80 (+7%) • Labor: $3.30 (+18%) • Packaging: $1.95 (+15%) • NRE amortization: $2.15 |

| 5,000 units | $16.50 | +15% | • Materials: $10.20 (+3%) • Labor: $2.85 (+12%) • Packaging: $1.70 (+8%) • NRE amortization: $1.75 |

| China Alternative (Coastal OEM) | $14.35 | Baseline | • Materials: $9.90 • Labor: $2.55 • Packaging: $1.57 • NRE: $0.33 |

Footnotes:

1. Prices exclude tariffs (Vietnam: Avg. 2.8% US duty vs. China 25% under Section 301)

2. Vietnam material premiums assume 60% imported components; local content >40% reduces +3-5% by 2027

3. NRE includes mold ($8,500), engineering ($3,200), certification ($1,800)

4. Mexico PL alternative: +$0.70-$1.20/unit vs. Vietnam at 5k MOQ (higher wages offset by logistics)

SourcifyChina Strategic Recommendations

- Adopt Volume-Phased Sourcing: Start with WL at 500-1k MOQ for market testing → transition to PL at 3k+ MOQ. Avoid PL below 1,500 units in new regions.

- Demand Hybrid Sourcing Clauses: Require suppliers to source components from China only where Vietnam/Mexico lacks capability (e.g., rare-earth magnets, PCBs). Track via bill-of-materials audits.

- Factor in “Resilience Premium”: Budget 8-12% above quoted costs for yield loss, logistics volatility, and compliance rework in new regions.

- Leverage China for Complexity: Use Chinese ODMs for R&D and core components; final assembly in Vietnam/Mexico. This captures 92% of cost benefits without full exit.

- Audit True Labor Costs: Calculate output-adjusted labor cost (total labor cost / units produced), not hourly wages. Vietnam typically achieves only 65-75% of China’s output per hour.

Final Insight: The goal isn’t “cheaper than China” – it’s risk-optimized cost. Brands achieving 15-20% cost parity with China while de-risking supply chains report 28% higher EBITDA growth (SourcifyChina 2025 Resilience Index).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential: For client use only. Data derived from 2025 SourcifyChina Supplier Benchmarking (n=347 factories) & Procurement Manager Survey (n=189).

Next Steps: Request our 2026 Regional Cost Dashboard for real-time Mexico/Vietnam vs. China component pricing. Contact [email protected].

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Verifying Manufacturers Post-China Relocation – Distinguishing Factories from Trading Companies & Key Red Flags

Executive Summary

As global supply chains evolve, many manufacturing operations formerly based in China have relocated to Vietnam, India, Thailand, Indonesia, and Mexico. While this shift presents new sourcing opportunities, it also introduces complexity in supplier verification. Procurement managers must rigorously validate the legitimacy, capabilities, and transparency of suppliers in these emerging manufacturing hubs.

This report outlines critical steps to verify manufacturers who have moved out of China, provides a structured approach to differentiate between trading companies and actual factories, and highlights key red flags to avoid costly procurement risks.

I. Critical Steps to Verify a Manufacturer Post-China Relocation

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1 | Confirm Physical Facility | Validate the existence of a production site | – Request HD video walkthrough of the facility – Conduct third-party audits (e.g., SGS, TÜV, Sourcify Onsite Audit) – Use Google Earth/Street View for site cross-check |

| 2 | Verify Legal Registration | Ensure the company is legally registered in the new host country | – Request Certificate of Incorporation – Cross-check with local government business registries (e.g., Vietnam’s National Business Registry, India’s MCA) – Use Dun & Bradstreet or local credit bureaus |

| 3 | Inspect Production Equipment & Capacity | Assess actual manufacturing capability | – Request machine list with capacity/output – Review production floor layout – Conduct capacity utilization analysis via audit |

| 4 | Review Export Documentation | Confirm export history and compliance | – Examine recent commercial invoices, packing lists, and Bills of Lading – Verify export licenses and customs filings |

| 5 | Conduct Onsite or Remote Audit | Evaluate operational standards and compliance | – Use standardized audit checklist (ISO, EHS, labor compliance) – Engage independent audit firms or Sourcify’s audit network |

| 6 | Validate Workforce & Management | Confirm in-house technical and managerial staff | – Interview production managers – Request org chart with roles – Verify employee count via payroll records or social insurance reports |

| 7 | Check References & Client History | Assess reliability and past performance | – Request 3–5 verifiable references – Contact previous clients (especially Western brands) – Review case studies or project portfolios |

II. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to inflated costs, reduced control, and supply chain opacity. Use the following criteria to make an accurate distinction.

| Criterion | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Ownership of Equipment | Owns production machinery (e.g., injection molding, CNC, assembly lines) | No machinery; outsources production | Onsite audit, equipment list, utility bills |

| Production Floor Access | Allows full access to production lines | Limits access or redirects to third-party factories | Video audit or unannounced site visit |

| Staffing | Employs engineers, QC staff, machine operators | Employs sales & logistics personnel only | Request staff list, conduct interviews |

| Lead Times | Provides realistic lead times based on capacity | Offers short lead times without technical detail | Cross-check with production capacity |

| Pricing Structure | Quotes based on material + labor + overhead | Quotes with minimal cost breakdown; higher margins | Request itemized BOM and process cost |

| Location | Located in industrial zones with large facilities | Often in commercial districts or offices | Google Maps, satellite imagery |

| Export History | Ships under own company name (exporter of record) | Ships under client or third-party name | Review Bill of Lading (Consignee vs. Exporter) |

| Quality Control | Has in-house QC lab and inspection protocols | Relies on third-party inspections | Audit QC process, review non-conformance reports |

✅ Pro Tip: A hybrid model (“factory with trading arm”) is common. Verify if the company owns the factory or merely represents it.

III. Red Flags to Avoid When Sourcing from Relocated Manufacturers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or video tour | Likely not a real factory or hiding subcontracting | Disqualify or require third-party audit |

| Generic or stock photos of facilities | Misrepresentation of capabilities | Demand real-time video walkthrough |

| No ISO, BSCI, or other certifications | Potential compliance risks | Require certification roadmap or audit |

| Prices significantly below market average | Indicates substandard materials, labor abuse, or trading markup | Conduct cost benchmarking and due diligence |

| Refusal to sign NDA or IP agreement | High risk of IP theft | Do not proceed without IP protection |

| No verifiable client references | Unproven track record | Request purchase order history or third-party validation |

| Shipping terms always FOB China (not host country) | Production may still be in China | Confirm shipping origin via BOL and customs data |

| Frequent changes in company name or registration | Possible shell entity or past compliance issues | Conduct background check via local registries |

IV. Best Practices for Risk Mitigation

-

Use a Dual Verification Model

Combine remote screening with third-party onsite audits before onboarding. -

Leverage Digital Verification Tools

Utilize platforms like Sourcify’s Supplier Intelligence Dashboard, Panjiva, or ImportGenius to validate export history. -

Start with Small Trial Orders

Test quality, communication, and reliability before scaling. -

Require Transparency in Subcontracting

If subcontracting is used, demand full disclosure and audit rights. -

Engage Local Legal Counsel

For contract enforcement and dispute resolution in the host country.

Conclusion

The migration of manufacturing from China to alternative hubs is a strategic shift, not a temporary trend. Procurement managers must adapt their due diligence frameworks to ensure supplier authenticity, operational transparency, and compliance. By systematically verifying manufacturer legitimacy, distinguishing true factories from trading intermediaries, and heeding critical red flags, global buyers can build resilient, cost-effective, and ethical supply chains in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Empowering Global Procurement with Verified Supply Chain Solutions

Q1 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SOURCIFYCHINA GLOBAL SOURCING REPORT 2026

Strategic Intelligence for Procurement Leaders: Navigating Post-China Manufacturing Shifts

KEY INSIGHT: The Hidden Cost of Unverified “China-Exodus” Suppliers

Global supply chain diversification has accelerated, with 68% of Fortune 500 companies actively relocating some manufacturing out of China (McKinsey, Q1 2026). However, 72% of procurement teams report wasted weeks vetting suppliers falsely claiming relocation – a critical drag on resilience initiatives.

WHY SOURCIFYCHINA’S VERIFIED PRO LIST ELIMINATES PROCUREMENT RISK & WASTE

Traditional sourcing for relocated factories involves fragmented, unreliable data:

– Public databases list 3.2x more “relocated” suppliers than verified operational sites (per SourcifyChina 2026 audit)

– Trade shows/web searches yield 41% duplicate or defunct leads (Deloitte Supply Chain Survey)

– Self-reported claims by suppliers lack proof of actual production capacity at new locations

Our human-verified Pro List solves this with:

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time/Cost Impact |

|---|---|---|

| Manual cross-referencing of 10+ sources per supplier | Single-source access to 1,200+ field-verified facilities | 83% reduction in vetting time |

| Unconfirmed “new factory” claims (e.g., leased warehouses misrepresented as production sites) | On-site audits confirming machinery, workforce, and export licenses | Zero wasted RFQs |

| Average 22-day timeline to validate one supplier | Pre-vetted suppliers with full compliance docs (ISO, ESG, customs records) | Accelerate sourcing cycles by 3-4 weeks |

| High risk of project delays due to capacity mismatches | Real-time capacity data + live production footage access | 94% on-time project launch rate (2025 client data) |

THE URGENT CASE FOR ACTION IN 2026

Geopolitical volatility and tariff pressures make speed-to-verified-supplier a competitive differentiator. Teams using unverified leads face:

– $220K+ in wasted costs per delayed project (including air freight premiums)

– Reputational damage from partnering with non-compliant facilities

– Lost market share while competitors secure resilient supply chains

SourcifyChina’s Pro List delivers:

✅ Guaranteed operational status – No “ghost factories” or marketing-only offices

✅ Real-time relocation metrics – Machine counts, workforce size, and lead time accuracy

✅ Dedicated China-exodus expertise – Our 47-person verification team speaks 15 languages and operates in 8 relocation hubs (Vietnam, Mexico, India, etc.)

CALL TO ACTION: SECURE YOUR COMPETITIVE EDGE IN 72 HOURS

Stop gambling with unverified supplier claims. While competitors scramble to validate relocated factories, your team can:

1. Access the full Pro List within 24 hours of onboarding

2. Identify 3 pre-qualified suppliers matching your specs in <48 hours

3. Launch production 30 days faster than industry benchmarks

👉 Act Now to Lock Q3/Q4 Capacity:

– Email: Contact [email protected] with subject line “PRO LIST 2026 – [Your Company Name]” for immediate access

– WhatsApp Priority Channel: Message +86 159 5127 6160 for a 15-minute consultation + sample facility dossier

First 10 respondents this week receive complimentary relocation risk assessment for 1 target category (valid through June 30, 2026).

“In 2026, speed without verification is corporate suicide. SourcifyChina’s Pro List is the only tool giving us actionable intelligence on relocated suppliers – not just hopeful claims.”

– Director of Global Sourcing, $2.1B Industrial Equipment Manufacturer (Verified Client)

Don’t let false relocation claims derail your supply chain strategy. Contact SourcifyChina today – where verification is non-negotiable.

📧 [email protected] | 📱 +86 159 5127 6160 (24/7 Sourcing Desk)

SourcifyChina: Human-Verified Intelligence for Mission-Critical Sourcing Since 2018

© 2026 SourcifyChina. All data field-verified per ISO 9001:2015 Sourcing Protocol

🧮 Landed Cost Calculator

Estimate your total import cost from China.