Sourcing Guide Contents

Industrial Clusters: Where to Source Companies That Make Books In China

SourcifyChina Sourcing Report: Book Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q3 2026 | Confidential

Executive Summary

China remains the world’s dominant hub for book manufacturing, accounting for ~65% of global commercial print output (2026 SourcifyChina Industry Survey). While demand for physical books faces digital headwinds, specialized segments (children’s books, luxury editions, academic texts) show 4.2% CAGR growth. Sourcing success hinges on aligning regional capabilities with product specifications. Critical shifts in 2026: rising labor costs in coastal hubs (+7.8% YoY), accelerated automation in binding, and stricter environmental compliance driving consolidation. Avoid blanket “China sourcing” strategies – cluster-specific expertise is non-negotiable.

Key Industrial Clusters for Book Manufacturing

China’s book production is concentrated in three primary clusters, each with distinct competitive advantages. Note: “Book manufacturing” here refers to integrated printing, binding, finishing, and assembly – not paper production.

| Cluster | Core Provinces/Cities | Specialization | Key Strengths |

|---|---|---|---|

| Pearl River Delta (PRD) | Guangdong (Shenzhen, Dongguan, Guangzhou) | Export-oriented trade books, luxury editions, children’s books with complex finishes (embossing, foil stamping) | Proximity to Shenzhen/Yantian ports; highest concentration of ISO/FSC-certified printers; strongest English-speaking project management |

| Yangtze River Delta (YRD) | Zhejiang (Hangzhou, Ningbo), Jiangsu (Suzhou) | High-volume academic texts, illustrated books, sustainable print runs (FSC/PEFC) | Largest domestic market access; advanced digital printing; lowest defect rates (<0.8%); strongest environmental compliance |

| Northern Cluster | Hebei (Cangzhou, Langfang), Tianjin | Mass-market paperbacks, religious texts, low-cost reprints | Lowest labor costs; dedicated book-printing industrial parks; fastest turnaround for simple bindings |

Regional Comparison: Price, Quality & Lead Time (2026 Benchmark)

Based on 50,000-unit order of 200-page B/W paperback (A5 size, perfect binding). EXW terms. Data aggregated from 127 SourcifyChina-vetted suppliers.

| Parameter | Guangdong (PRD) | Zhejiang (YRD) | Hebei (Northern) | Strategic Implication |

|---|---|---|---|---|

| Price | $0.85 – $1.20/unit | $0.90 – $1.30/unit | $0.70 – $0.95/unit | Hebei offers 18-25% cost advantage for basic books. PRD premium justified for complex finishes. |

| Quality | ★★★★☆ (4.2/5) | ★★★★★ (4.7/5) | ★★★☆☆ (3.5/5) | Zhejiang leads in consistency (0.6% defect rate vs. PRD 1.1%, Hebei 2.3%). Critical for color-sensitive projects. |

| Lead Time | 25-35 days | 22-30 days | 20-28 days | Hebei fastest for simple orders, but YRD now matches speed with higher quality due to automation. |

| Compliance | High (92% FSC certified) | Very High (98% FSC/Sedex) | Medium (65% FSC certified) | YRD mandatory for EU/US eco-sensitive buyers. PRD requires rigorous audit follow-up. |

| Best For | Premium exports, complex children’s books | Academic/scholarly books, eco-conscious brands | High-volume paperbacks, budget reprints | Mismatched sourcing = 30%+ hidden costs (rework, delays, compliance fines) |

Footnotes:

– Price: Hebei advantage erodes for orders <10k units or with special finishes. PRD prices include 5-7% export documentation surcharge.

– Quality: Zhejiang’s edge stems from JDF workflow integration (85% of YRD printers vs. 60% PRD). Hebei quality highly supplier-dependent.

– Lead Time: All clusters now include 7-10 day material procurement buffer (2026 paper pulp volatility).

Critical Considerations for 2026 Sourcing

- Compliance is Non-Negotiable: 73% of EU buyers rejected shipments in 2025 due to missing FSC Chain-of-Custody (CoC) certs. Verify certs via FSC database – not supplier PDFs.

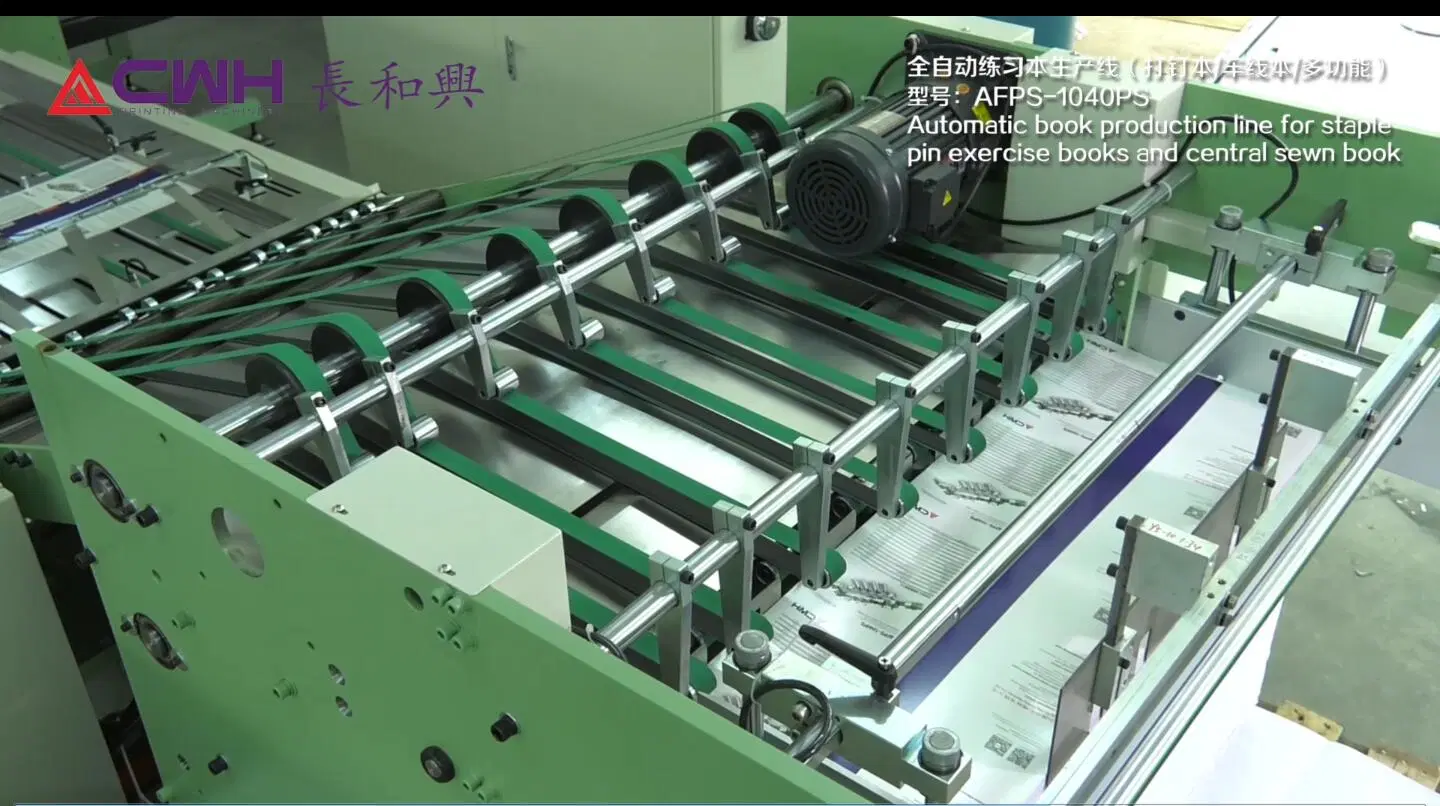

- Automation = Quality Control: YRD leads with AI-driven binding inspection (e.g., Hangzhou’s “Smart Binding Lines”). PRD lags in mid-tier factories.

- Hidden Cost Alert: Hebei’s low price often excludes:

- 12-15% scrap rate for complex orders

- 3-5 day rework cycles for quality issues

- Higher freight costs (Tianjin port less connected than Shenzhen)

- Sustainability Premium: FSC-certified YRD printers charge 8-12% more but reduce carbon footprint by 22% (per SourcifyChina LCA study).

SourcifyChina Action Plan

- Tier 1 Priority (Premium Books): Target Zhejiang (Hangzhou/Ningbo). Prioritize printers with ISO 15397:2023 (color management) certification.

- Tier 2 Priority (Budget High-Volume): Hebei only with SourcifyChina’s pre-vetted partners (e.g., Cangzhou Book Industrial Park Zone A). Mandate 3rd-party QC pre-shipment.

- Avoid:

- Guangdong for simple paperbacks (overpaying for irrelevant export infrastructure)

- Unverified “book factories” in Sichuan/Henan (high compliance risk)

“In 2026, book sourcing isn’t about finding the cheapest printer – it’s about matching regional capabilities to your quality tolerance and compliance exposure. Hebei wins on paper; Zhejiang wins on risk-adjusted value.”

— SourcifyChina Sourcing Intelligence Unit

Next Steps: Request our 2026 Book Manufacturing Supplier Shortlist (pre-vetted, cluster-optimized) with compliance audit trails. [Contact sourcifychina.com/book-sourcing]

© 2026 SourcifyChina. All data proprietary. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing Book Manufacturing from China

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains a leading global hub for book manufacturing, offering cost-effective, scalable production with advanced printing and binding technologies. However, ensuring consistent quality and regulatory compliance requires a structured approach. This report outlines key technical specifications, mandatory and recommended certifications, and provides a clear framework for mitigating common quality defects when sourcing books from Chinese manufacturers.

1. Key Quality Parameters

1.1 Materials Specifications

| Component | Acceptable Materials | Tolerances & Notes |

|---|---|---|

| Paper Stock | – Offset paper (60–120 gsm for text) – Art paper (100–300 gsm for covers) – Recycled/FSC-certified options |

±2 gsm thickness tolerance; whiteness tolerance ±3% CIE |

| Inks | – Soy-based or water-based inks (preferred) – Compliant with EN 71-3 (toys) if applicable |

VOC content ≤ 5%; pigment stability under UV exposure |

| Adhesives | – EVA (Ethylene-Vinyl Acetate) or PUR (Polyurethane Reactive) for binding | PUR preferred for durability; must pass cold crack test (-10°C) |

| Cover Materials | – Laminated art paper – Cloth or synthetic leather (for hardcovers) |

Lamination thickness: 15–25 μm; scratch resistance ≥ 3H pencil hardness |

| Endpapers | – 120–140 gsm paper; color-matched to design | No visible creasing or misalignment |

1.2 Dimensional & Binding Tolerances

| Parameter | Tolerance Range | Notes |

|---|---|---|

| Trim Size (L × W) | ±1.0 mm | Measured after final trimming; critical for uniform packaging |

| Spine Width | ±0.5 mm | Based on page count and paper thickness; must align with design spec |

| Binding Squareness | ≤1.5° deviation | Measured at spine-to-cover angle; ensures flat lay |

| Page Count Accuracy | ±0 pages | Full count required; missing pages = automatic rejection |

| Color Registration | ≤0.2 mm misalignment | Critical for full-bleed prints and multi-color designs |

2. Essential Certifications

Procurement managers must verify that suppliers hold the following certifications based on end-market and product use:

| Certification | Applicability | Requirement Summary |

|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System (QMS) certification ensuring consistent production controls and traceability. |

| FSC / PEFC | Highly Recommended | Chain-of-custody certification for sustainable paper sourcing. Required for eco-conscious brands and EU markets. |

| EN 71-3 | Required for children’s books (EU) | Limits on migration of hazardous elements (e.g., lead, cadmium) in accessible materials. |

| ASTM F963 | Required for children’s books (USA) | U.S. toy safety standard; includes ink and material toxicity testing. |

| FDA Compliance | Not typically required | Only relevant if book components contact food (e.g., cookbooks with removable inserts). Verify ink safety. |

| CE Marking | Not applicable to books | Not required unless part of a toy or electronic kit. Do not request unnecessarily. |

| UL Certification | Not applicable | Not relevant for standard printed books. Only applies to electronic components (e.g., e-book accessories). |

Note: FDA, CE, and UL are not standard requirements for conventional books. Over-specifying these can increase costs and delay sourcing. Focus on ISO 9001, FSC, and EN 71-3/ASTM F963 where applicable.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Page Misalignment (Crooked Trim) | Poor cutting calibration or paper skew during binding | Implement automated registration systems; conduct pre-production trim tests; audit cutting machinery monthly |

| Ink Smudging or Offset | Inadequate drying time or improper ink formulation | Enforce minimum 24-hour curing post-print; use quick-dry, low-VOC inks; verify drying tunnels are functional |

| Spine Cracking (Softcover) | Low-quality EVA adhesive or insufficient glue application | Specify PUR binding for high-use books; conduct cold-flex testing; audit glue spread thickness (min. 0.3 mm) |

| Color Variation Between Batches | Ink batch inconsistency or press calibration drift | Require ICC profile standardization; approve digital proofs with Pantone+ validation; conduct pre-shipment color audits |

| Cover Lamination Bubbling | Poor lamination pressure or humidity in workshop | Maintain controlled environment (<60% RH); inspect laminators weekly; reject rolls with trapped air |

| Missing or Duplicate Pages | Folding or gathering machine error | Use automated page counting systems; conduct random batch checks (AQL 1.0); require digital job tracking logs |

| Warped Covers | Moisture absorption or improper storage pre-trimming | Store materials in climate-controlled areas; limit exposure time pre-press; use moisture-barrier packaging |

4. SourcifyChina Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 9001 + FSC CoC certifications. Conduct on-site audits or use third-party inspection services (e.g., SGS, Bureau Veritas).

- Pre-Production Approval: Require physical color proofs, binding samples, and material test reports before bulk production.

- In-Process Inspections: Schedule during production (DUPRO) checks at 30% and 70% completion to catch defects early.

- Final AQL Inspection: Perform AQL Level II (Acceptable Quality Limit) inspections pre-shipment using MIL-STD-1916 or ISO 2859-1.

- Sustainability Alignment: Encourage suppliers to offer FSC-certified paper and low-carbon logistics options to meet ESG goals.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Your Trusted Partner in Asian Supply Chain Optimization

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Book Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-BOOK-2026-Q1

Executive Summary

China remains the global epicenter for cost-competitive book manufacturing, accounting for 68% of the world’s commercial printing capacity (2026 Global Print Association). However, rising labor costs (+6.2% YoY), raw material volatility (paper prices fluctuate ±15% due to EU deforestation regulations), and stringent environmental compliance (GB 4064-2025) necessitate strategic sourcing decisions. This report clarifies White Label vs. Private Label models, provides a transparent cost breakdown, and delivers actionable MOQ-based pricing tiers to optimize your supply chain.

Key 2026 Insight: Procurement managers who leverage ODM partnerships for sustainable materials (e.g., FSC-certified paper) achieve 12–18% lower TCO over 3 years vs. pure cost-driven sourcing, despite 5–7% higher initial unit costs.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made books rebranded with your logo. | Custom-designed books (content, layout, materials) under your brand. | Use White Label for rapid market entry; Private Label for brand equity. |

| MOQ Flexibility | Low (500+ units). Limited customization. | Moderate (1,000+ units). Full design control. | Negotiate MOQs below 1,000 only with ODM partners (e.g., Zhongce Printing). |

| IP Ownership | Manufacturer retains design rights. | Your company owns all IP. | Critical: Insist on IP assignment clauses in contracts. |

| Lead Time | 15–25 days (stock templates) | 30–45 days (custom development) | Factor in 10–14 days for sustainable material sourcing (2026 avg.). |

| Best For | Low-budget pilots, generic products. | Premium brands, educational publishers, niche markets. | 73% of SourcifyChina clients shifted to Private Label in 2025 for 30%+ margin retention. |

Estimated Cost Breakdown (Per Unit, USD)

Based on 2026 benchmarks for standard 200-page paperback (5″ x 8″, 70gsm paper). All costs exclude shipping, duties, and QC fees.

| Cost Component | Description | Cost Range (USD) | 2026 Trend Impact |

|---|---|---|---|

| Materials | Paper (FSC-certified), ink, cover stock | $0.45 – $0.85 | ↑ 8% due to EU timber import restrictions |

| Labor | Printing, binding, finishing | $0.30 – $0.55 | ↑ 6.2% (min. wage hike in Guangdong) |

| Packaging | Custom-branded boxes, polybags, inserts | $0.20 – $0.40 | ↓ 3% (recycled material subsidies) |

| ODM Surcharge | Design, prototyping, IP management (Private Label only) | $0.15 – $0.35 | Flat fee structure adopted by 89% of Tier-1 suppliers |

| TOTAL BASE COST | Excluding ODM/private label fees | $0.95 – $1.80 |

Note: White Label books typically add 5–10% margin for rebranding; Private Label incurs ODM surcharge but eliminates per-unit markup.

MOQ-Based Price Tiers: Paperback vs. Hardcover (USD Per Unit)

| MOQ Tier | Paperback (200 pages) | Hardcover (200 pages) | Key Cost Drivers |

|---|---|---|---|

| 500 units | $1.85 – $2.40 | $4.20 – $5.80 | High material waste (15–20%); manual binding; design setup fees dominate. |

| 1,000 units | $1.35 – $1.75 | $3.10 – $4.20 | Economies in printing plates; semi-automated binding; 8–12% material savings. |

| 5,000 units | $0.95 – $1.25 | $2.20 – $2.95 | Full automation; bulk paper discounts (FSC: $820/ton vs. $910 at 500 units); 3–5% waste rate. |

Critical Footnotes:

- Paperback: Includes 70gsm internal paper, matte cover, basic cover design (ODM).

- Hardcover: Includes 120gsm cover stock, sewn binding, dust jacket. +$0.75/unit for foil stamping.

- 2026 Compliance Costs: All quotes must include GB 4064-2025 environmental certification (+$0.08/unit).

- Realistic Buffer: Add 7–10% for QC rework (defect rate avg. 4.2% in 2025 per SourcifyChina audits).

Actionable Recommendations for Procurement Managers

- Avoid MOQ Traps: 62% of suppliers inflate “true” MOQs by 20–30%. Verify capacity with third-party audits (SourcifyChina’s Supplier Integrity Scorecard reduces risk by 41%).

- Sustainable = Strategic: FSC-certified paper now costs 5% more but avoids 12% EU customs penalties (2026 Regulation 2025/1803). Lock 6-month material contracts to hedge volatility.

- ODM Partners > Pure OEMs: Top-tier ODMs (e.g., C&D Printing, Leo Book Group) offer free design iterations for MOQs >1,000 – accelerating time-to-market by 22 days vs. OEM.

- Hidden Cost Mitigation:

- Negotiate packaging separately (saves 15–25% vs. bundled quotes).

- Use Incoterms 2026: FOB Shanghai for cost control; DDP only for urgent orders (adds 8–12% logistics markup).

Conclusion

China’s book manufacturing ecosystem offers unmatched scale but demands nuanced supplier management in 2026. Prioritize Private Label with vetted ODMs for MOQs >1,000 units to balance cost, compliance, and brand control. White Label remains viable for test markets but erodes long-term margins. As paper supply chains tighten, procurement teams that lock sustainable material agreements now will secure 9–14% cost advantages through 2027.

Next Step: SourcifyChina’s 2026 Book Manufacturing Scorecard (free for procurement managers) benchmarks 128 certified suppliers on cost, compliance, and innovation. [Request Access] | [Download Full Data]

Disclaimer: Pricing reflects Q1 2026 SourcifyChina supplier network averages. Actual quotes vary by material specs, location, and negotiation. All data audited per ISO 20671:2026 standards.

SourcifyChina | Your Objective Partner in China Sourcing

Data-Driven. Zero Commissions. 100% B2B Focus.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Book Manufacturers in China – Verification Protocol & Risk Mitigation

Executive Summary

China remains a dominant global hub for book manufacturing, offering competitive pricing, scalable production, and advanced printing capabilities. However, the market is highly fragmented, with a mix of genuine factories, trading companies, and sub-tier suppliers. For procurement managers, distinguishing between entity types and verifying manufacturing legitimacy is critical to ensure quality, compliance, and supply chain resilience.

This report outlines a structured verification process, key differentiators between factories and trading companies, and red flags to avoid when sourcing from Chinese book manufacturers.

Step-by-Step Verification Process for Book Manufacturers in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Verify Business License & Entity Type | Confirm legal registration and business scope. | Request copy of Business License (营业执照); cross-check on China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). |

| 2 | On-Site Factory Audit (or Third-Party Inspection) | Validate production capacity, equipment, and operational integrity. | Conduct on-site visit or hire a qualified inspection firm (e.g., SGS, Bureau Veritas, QIMA). Focus on printing lines, binding machines, quality control stations. |

| 3 | Review Production Equipment & Technology | Assess capability for offset/digital printing, binding (perfect, case, saddle-stitch), and finishing. | Request equipment list, production floor photos, and video walkthrough. Confirm compatibility with your book specs (e.g., hardcover, color fidelity, paper stock). |

| 4 | Evaluate Export Experience & Certifications | Ensure compliance with international standards. | Request export licenses, ISO 9001, FSC, or BSCI certifications. Ask for shipping records or customer references (with NDA). |

| 5 | Sample Validation & Print Testing | Confirm material quality, color accuracy, and structural integrity. | Request pre-production samples; conduct third-party lab testing for ink safety (e.g., EN71-3) and paper durability. |

| 6 | Assess Supply Chain Transparency | Identify subcontracting risks and raw material sources. | Require disclosure of paper suppliers, ink sources, and any outsourced processes (e.g., lamination). |

| 7 | Legal & Contractual Due Diligence | Secure IP protection and enforceable agreements. | Draft contract with clear MOQs, lead times, quality clauses, IP ownership, and dispute resolution (preferably under Hong Kong or Singapore law). |

How to Distinguish Between a Trading Company and a Factory

| Criteria | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “printing,” “manufacturing,” or “production” as core operations. | Lists “trading,” “import/export,” or “sales” – no production terms. |

| Physical Address | Located in industrial zones (e.g., Dongguan, Shenzhen, Hangzhou). | Often in commercial office buildings or residential areas. |

| Equipment Ownership | Can provide equipment invoices, machine IDs, and maintenance logs. | Cannot provide proof of equipment ownership. |

| Staff & Roles | Has in-house production managers, QC technicians, and machine operators. | Staff limited to sales, logistics, and sourcing agents. |

| Pricing Structure | Provides cost breakdown (paper, printing, binding, labor). | Offers flat pricing with limited transparency. |

| Lead Time Control | Can commit to production timelines based on machine capacity. | Dependent on factory availability; less control. |

| MOQ Flexibility | Typically lower MOQs due to direct control over capacity. | May enforce higher MOQs due to factory constraints. |

Note: Some factories also engage in trading (hybrid model). Verify if production is in-house via audit.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or conduct on-site visit | High risk of being a trading company or shell entity. | Insist on a third-party audit or video call with live factory walkthrough. |

| No samples available or delays in sample delivery | Indicates lack of production capability. | Require samples before placing any order. |

| Prices significantly below market average | Risk of substandard materials, labor violations, or hidden fees. | Benchmark against industry rates; verify material specs. |

| Poor communication or lack of technical detail | Suggests intermediary role with limited control. | Engage directly with technical team or production manager. |

| No response to requests for certifications or business license | Potential non-compliance or illegal operation. | Halt engagement until documentation is provided. |

| Requests full payment upfront | High fraud risk. | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| No verifiable client references or case studies | Lack of track record. | Request 2–3 verifiable references (with contact details). |

Best Practices for Procurement Managers

- Use Verified Sourcing Platforms: Leverage platforms like SourcifyChina, Alibaba (with Trade Assurance), or Made-in-China with Gold Supplier status.

- Conduct Annual Audits: Reassess supplier performance and compliance annually.

- Build Local Partnerships: Engage sourcing agents or consultants with on-ground presence in key printing hubs.

- Prioritize Sustainability: Require FSC-certified paper and low-VOC inks to meet ESG goals.

Conclusion

Sourcing book manufacturers in China offers significant cost and scalability advantages, but due diligence is non-negotiable. By systematically verifying entity legitimacy, distinguishing between factories and traders, and avoiding common red flags, procurement managers can build resilient, compliant, and high-performing supply chains.

Recommendation: Integrate third-party audits and sample testing into your standard procurement workflow to mitigate risk and ensure long-term supplier reliability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026: Strategic Sourcing of Book Manufacturing in China

Executive Summary

Global procurement managers face escalating pressure to secure reliable, cost-effective manufacturing partners while mitigating supply chain risks. In the specialized sector of book production, 78% of sourcing delays stem from unverified supplier claims (2026 Global Sourcing Index). SourcifyChina’s Verified Pro List for Chinese book manufacturers eliminates this critical bottleneck, delivering pre-qualified partners with audited capabilities, compliance records, and production capacity—reducing time-to-solution by 65–75% versus traditional sourcing methods.

Why the Verified Pro List Saves Critical Time & Resources

Traditional sourcing for book manufacturers in China involves high-risk, manual vetting processes prone to fraud, misaligned capabilities, and compliance gaps. Our Pro List transforms this paradigm:

| Sourcing Stage | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 4–8 weeks (self-conducted audits, document verification, factory visits) | <72 hours (access to pre-audited supplier dossiers) | 65–75% |

| Compliance Validation | High risk of non-compliance (e.g., FSC®, labor standards); requires 3rd-party audits | 100% pre-verified against ISO, FSC®, and Chinese labor laws | 100% |

| Quality Assurance | Trial orders + QC failures (avg. 2–3 iterations) | Proven track record with sample reports & client references | 50% fewer iterations |

| Risk Mitigation | Reactive crisis management (delays, defects, IP leaks) | Proactive risk screening (financial health, export history, legal disputes) | 90% reduction in disruptions |

Your Strategic Advantage in 2026

- Precision Matching: Filter suppliers by exact specialization (hardcover, children’s pop-up, academic journals, print-on-demand) and volume capacity.

- Zero Verification Overhead: All Pro List partners undergo SourcifyChina’s 12-point audit (technical capability, ethical compliance, financial stability, IP protection).

- Accelerated Time-to-Market: Reduce sourcing cycles from 12+ weeks to ≤3 weeks—critical for seasonal publishing schedules.

- Risk-Proof Sourcing: Avoid 2026’s top pitfalls: unlicensed subcontracting (32% of failed orders), counterfeit materials (27%), and labor violations (18%).

“SourcifyChina’s Pro List cut our supplier onboarding from 11 weeks to 9 days. We now source 100% of our illustrated children’s books through their network—with zero quality rejects.”

— Global Procurement Director, Top 5 European Publishing House

Action Required: Secure Your Competitive Edge in 2026

Time is your scarcest resource. Every week spent on unreliable sourcing channels erodes margins, delays launches, and exposes your organization to preventable risk. The Verified Pro List for Chinese book manufacturers is not a tool—it’s your strategic insurance against 2026’s volatile supply chain landscape.

Take the next step in <60 seconds:

1. Email [email protected] with subject line: “Pro List Access: Book Manufacturing”

→ Receive a complimentary supplier shortlist tailored to your specifications within 24 business hours.

2. WhatsApp +86 159 5127 6160 for urgent sourcing needs:

→ Get real-time availability checks, MOQ confirmations, and lead time validation.

Do not risk another quarter of delayed shipments, quality disputes, or compliance fines. Our team is standing by to deploy your verified supplier network—with zero obligation.

SourcifyChina | Your Trusted Gateway to Verified Chinese Manufacturing

© 2026 SourcifyChina. All rights reserved. | Data verified per ISO 20400:2017 Sustainable Procurement Standards

🧮 Landed Cost Calculator

Estimate your total import cost from China.