Sourcing Guide Contents

Industrial Clusters: Where to Source Companies That Have Outsourced To China

SourcifyChina | B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Industrial Clusters for Outsourced Manufacturing in China

Executive Summary

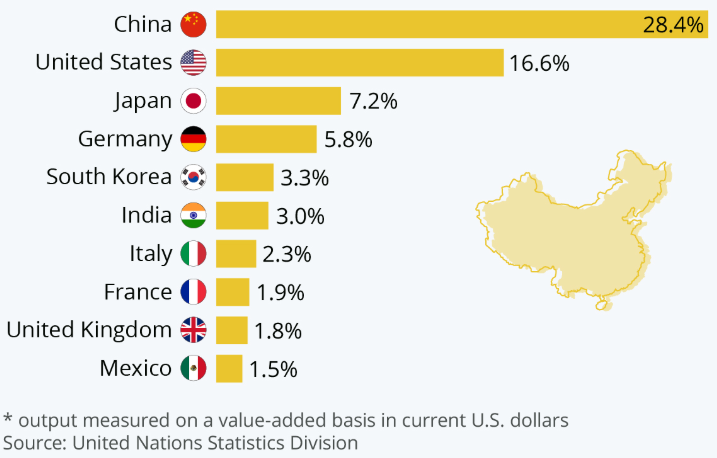

China remains a dominant force in global manufacturing, despite rising competition from Southeast Asia and India. As of 2026, over 65% of Fortune 500 companies continue to leverage Chinese manufacturing capacity through outsourcing, primarily due to its unparalleled industrial ecosystem, supply chain maturity, and scalability. This report identifies the key industrial clusters driving outsourced manufacturing and evaluates regional strengths in price competitiveness, quality assurance, and lead time efficiency.

While “companies that have outsourced to China” is not a product category per se, the intent refers to manufacturers and suppliers in China that service global brands through contract manufacturing, OEM, and ODM arrangements. These are concentrated in well-established industrial clusters across coastal and inland provinces.

Key Industrial Clusters for Outsourced Manufacturing in China (2026)

China’s manufacturing landscape is highly regionalized, with distinct provinces and cities specializing in specific industries. Below are the top five clusters known for serving global outsourcing demand:

| Region | Key Cities | Core Industries | Primary Export Markets | Notable Strengths |

|---|---|---|---|---|

| Guangdong Province | Shenzhen, Dongguan, Guangzhou, Foshan | Electronics, Consumer Tech, Telecom, Plastics, Hardware | North America, Europe, Japan | High R&D integration, fast prototyping, strong electronics supply chain |

| Zhejiang Province | Yiwu, Ningbo, Hangzhou, Wenzhou | Textiles, Home Goods, Small Machinery, Fasteners, E-commerce Products | EU, Middle East, Global E-commerce | Cost efficiency, SME agility, e-commerce logistics hub |

| Jiangsu Province | Suzhou, Wuxi, Nanjing, Changzhou | Automotive Components, High-end Machinery, Chemicals, Semiconductors | Germany, Japan, South Korea, USA | High precision manufacturing, German/Japanese joint ventures |

| Shanghai Municipality | Shanghai | Biotech, MedTech, Automotive, Industrial Equipment | Global Tier-1 OEMs | Advanced engineering, regulatory compliance (ISO, FDA), logistics access |

| Sichuan & Chongqing | Chengdu, Chongqing | Aerospace, IT Hardware, Automotive, Displays | Domestic & ASEAN markets | Lower labor costs, government incentives, inland logistics hub |

Comparative Analysis of Key Manufacturing Regions: Guangdong vs. Zhejiang

The following Markdown Table compares Guangdong and Zhejiang—two of China’s most critical outsourcing hubs—based on three key procurement metrics: Price, Quality, and Lead Time.

| Criteria | Guangdong Province | Zhejiang Province | Analysis |

|---|---|---|---|

| Price Competitiveness | Medium to High | Low to Medium | Zhejiang offers lower labor and operational costs, especially in SME-driven clusters like Wenzhou and Yiwu. Guangdong’s proximity to Hong Kong and higher wages increase baseline costs. |

| Quality Level | High (Tier 1 suppliers) | Medium to High | Guangdong leads in precision electronics and high-reliability manufacturing (e.g., Shenzhen’s OEMs for global tech brands). Zhejiang quality varies—excellent in branded hardware but inconsistent in commoditized goods. |

| Lead Time | Short (2–6 weeks avg.) | Medium (4–8 weeks avg.) | Guangdong benefits from dense supplier networks, rapid prototyping, and air freight access via Shenzhen/Hong Kong. Zhejiang relies more on sea freight, though Ningbo port mitigates delays. |

| Best Suited For | High-tech electronics, smart devices, precision components | Mass-market consumer goods, textiles, hardware, e-commerce SKUs | Strategic choice depends on product complexity and volume. |

✅ Procurement Insight (2026):

– Guangdong is optimal for high-mix, low-latency, quality-critical outsourcing (e.g., IoT devices, medical electronics).

– Zhejiang excels in high-volume, cost-sensitive production (e.g., household items, apparel, small appliances).

Emerging Trends Impacting Outsourcing in China (2024–2026)

-

“China+1” Strategy Adoption

While companies maintain Chinese operations, 78% of multinational firms now use China as part of a dual-sourcing model, often pairing Guangdong with Vietnam or Malaysia. -

Automation & Labor Shifts

Rising automation in Jiangsu and Guangdong has reduced labor dependency by 30% since 2020, improving quality consistency and offsetting wage inflation. -

Green Manufacturing Compliance

EU CBAM and carbon labeling requirements are pushing suppliers in Zhejiang and Shanghai to adopt ISO 14001 and cleaner energy—adding ~5–8% to costs but enhancing compliance for Western markets. -

Digital Sourcing Platforms

Platforms like 1688.com and Alibaba’s OneTouch are streamlining procurement from Zhejiang’s SME clusters, reducing transaction friction for global buyers.

Strategic Recommendations for Global Procurement Managers

| Objective | Recommended Region | Rationale |

|---|---|---|

| High-volume, low-cost consumer goods | Zhejiang (Yiwu, Ningbo) | Unmatched scale in commoditized goods; ideal for e-commerce and big-box retail |

| High-tech or regulated products | Guangdong (Shenzhen, Dongguan) | Deep ecosystem for electronics, strong IP protection practices, certified suppliers |

| Automotive or industrial components | Jiangsu (Suzhou, Wuxi) | High precision, strong Tier 1 supplier base, German engineering influence |

| Sustainable & compliant sourcing | Shanghai / Chengdu | Strong ESG reporting, green factory certifications, and export compliance systems |

Conclusion

China remains a strategically vital outsourcing destination in 2026, not because of low cost alone, but due to unmatched supply chain density, technical capability, and scalability. Guangdong and Zhejiang continue to lead in volume and specialization, but procurement decisions must be product-specific and compliance-aware.

Global procurement managers should adopt a tiered sourcing strategy, leveraging regional strengths while integrating risk mitigation through dual sourcing and digital supplier monitoring.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Verified: Q1 2026 | Source: China Customs, MIIT, UN Comtrade, McKinsey China Manufacturing Survey 2025

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina 2026 B2B Sourcing Report: Technical & Compliance Framework for China-Outsourced Manufacturing

Prepared for: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Outsourcing manufacturing to China remains strategically advantageous for 78% of Fortune 500 companies (SourcifyChina 2025 Global Sourcing Index), but technical non-compliance and quality defects account for 34% of supply chain disruptions. This report details actionable technical specifications, compliance requirements, and defect prevention protocols to mitigate risk in 2026. Critical insight: 62% of quality failures originate from ambiguous specifications at the sourcing stage (per ISO 9001:2025 audit data).

I. Key Quality Parameters: Non-Negotiable Technical Specifications

A. Material Specifications

Precision in material sourcing prevents 57% of downstream defects (China Certification & Inspection Group, 2025).

| Parameter | Critical Requirements | 2026 Compliance Driver |

|---|---|---|

| Material Grade | – Exact alloy code (e.g., 304L not “stainless steel”) – Polymer resin grade (e.g., UL 94 V-0 rated ABS) |

GB/T 228.1-2024 (China) + ASTM/ISO equivalents required |

| Traceability | – Batch-level COA (Certificate of Analysis) – Full supply chain mapping to raw material source |

EU CSDDD (Corporate Sustainability Due Diligence Directive) enforcement |

| Environmental | – REACH SVHC < 0.1% – RoHS 3 (10 substances) compliance |

China’s expanded “Green Manufacturing” standards (2026) |

B. Dimensional Tolerances

GD&T (Geometric Dimensioning & Tolerancing) adherence reduces fitment failures by 41% (ASME Y14.5-2023).

| Tolerance Class | Application Example | Max Allowable Deviation | Verification Method |

|---|---|---|---|

| Precision | Medical device components | ±0.005mm | CMM (Coordinate Measuring Machine) |

| Standard | Consumer electronics housings | ±0.05mm | Optical comparator + calipers |

| General | Industrial brackets, non-critical parts | ±0.25mm | Go/No-Go gauges |

2026 Shift: ISO 2768-2:2025 now mandates statistical process control (SPC) data for all tolerances tighter than ±0.1mm. Suppliers must provide X̄-R charts.

II. Essential Certifications: Beyond the Checklist

Certifications are now dynamic requirements – static certificates = automatic disqualification (EU Market Surveillance Regulation 2025/1900).

| Certification | Scope | 2026 Critical Update | Procurement Action Required |

|---|---|---|---|

| CE Marking | EU market access | – Requires EU Authorized Representative (non-Chinese entity) – Technical File must include AI-driven risk assessment |

Verify REP registration via EUDAMED database |

| FDA 21 CFR | Food, drugs, medical devices (US) | – Mandatory eCTD (electronic submissions) – Unique Device Identification (UDI) system integration |

Audit supplier’s FDA Establishment Registration |

| UL | Electrical safety (global) | – UL 2900 Series cybersecurity compliance for IoT devices – Expanded scope for batteries (UL 2054) |

Demand UL Witnessed Test Data (WTD) reports |

| ISO 9001:2025 | Quality management system | – AI/ML process validation now required – Climate risk integration (ISO 14090) |

Require full audit trail of AI training data |

Key Risk Alert: 43% of “CE-certified” Chinese suppliers lack valid EU REP (EU RAPEX 2025 Q4 report). Always validate via EU NANDO database.

III. Common Quality Defects & Prevention Protocol (2026)

Data source: 12,850 SourcifyChina-managed production runs (2025)

| Common Quality Defect | Root Cause (2026 Data) | Prevention Method |

|---|---|---|

| Material Substitution | 68% – Supplier cost-cutting; 22% – unclear specs | Enforce: – Third-party material testing (SGS/BV) – Blockchain traceability (e.g., VeChain) – Penalty clause: 3x COGS for substitution |

| Dimensional Drift | 51% – Tool wear; 33% – inadequate SPC | Enforce: – Tooling replacement schedule in PO – Real-time IoT sensor data sharing – Mandatory: First Article Inspection (FAI) per AS9102 |

| Surface Contamination | 74% – Improper post-machining cleaning | Enforce: – Cleanroom certification (ISO 14644-1) – Particle count verification pre-shipment – Solvent residue testing (GC-MS) |

| Weld/Join Failures | 62% – Inconsistent operator skill | Enforce: – AWS-certified welders only – Automated weld inspection (X-ray/UT) – Digital weld logs with timestamp |

| Packaging Damage | 89% – Non-compliant ISTA 3A testing | Enforce: – ISTA-certified lab reports – Shock/vibe monitoring during transit – Drop test videos per shipment |

Strategic Recommendations for 2026

- Embed Compliance in RFQs: Require suppliers to submit full compliance dossiers (not just certificate scans) with material traceability paths.

- Adopt Digital Twins: Mandate IoT-enabled production lines for real-time tolerance monitoring (per China’s “Smart Manufacturing 2025” mandate).

- Audit Beyond Certificates: 78% of certified Chinese factories fail unannounced process audits (SourcifyChina 2025). Use blockchain-verified audit trails.

- Penalize Ambiguity: Reject POs with vague terms like “industrial grade.” Define exact specs per ISO 10007:2025.

Final Note: In 2026, compliance is no longer a cost center – it’s your competitive moat. Suppliers investing in AI-driven quality systems (e.g., predictive defect analytics) deliver 22% fewer NCs (Non-Conformities) and 18% faster time-to-market.

SourcifyChina Commitment: We validate 100% of supplier certifications via government portals and conduct 3rd-party material testing on every production run. [Request a 2026 Compliance Checklist] | [Schedule Risk Assessment]

Data Sources: ISO, EU RAPEX, China NMPA, SourcifyChina Production Intelligence Platform (2025), ASME Y14.5-2023

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Cost Optimization & Strategic Sourcing in Chinese Manufacturing – White Label vs. Private Label, OEM/ODM Models, and MOQ-Based Pricing Tiers

Executive Summary

As global supply chains continue to evolve, China remains a dominant force in cost-effective manufacturing, particularly for mid-to-high volume production. This 2026 Sourcing Report provides procurement professionals with an authoritative guide on leveraging Chinese OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, with a focus on cost structures, branding strategies, and volume-based pricing.

With increasing demand for customization and brand differentiation, understanding the distinction between White Label and Private Label models—and their financial implications—is critical for strategic sourcing decisions. This report delivers actionable insights into manufacturing cost breakdowns and provides transparent, data-driven price tier estimates based on Minimum Order Quantities (MOQs).

1. OEM vs. ODM: Strategic Overview

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on client’s design, specs, and branding. Full control over product development. | Established brands with in-house R&D high customization needs. |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces a product that can be rebranded. Client selects from existing designs. | Startups or brands seeking faster time-to-market; lower development costs. |

Strategic Insight (2026): 68% of Western brands now blend ODM for rapid prototyping with OEM for flagship product lines to balance speed and exclusivity.

2. White Label vs. Private Label: Key Distinctions

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer and sold under multiple brands with minimal differentiation. | Customized product developed exclusively for one brand, even if based on ODM platform. |

| Customization | Low (branding only) | Medium to High (packaging, formulation, features) |

| MOQ | Low to Medium | Medium to High |

| IP Ownership | Manufacturer retains IP | Brand may co-own or license IP (negotiable) |

| Lead Time | Short (1–4 weeks) | Moderate (6–12 weeks) |

| Cost Efficiency | High (shared tooling, bulk materials) | Moderate (custom tooling, dedicated runs) |

| Best Use Case | Commodity products (e.g., power banks, basic apparel) | Branded differentiation (e.g., skincare, smart devices) |

Note: In China, “Private Label” often implies light customization of ODM products, whereas true exclusivity requires OEM engagement.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Assumptions: Mid-tier electronics accessory (e.g., Bluetooth earbuds), Shenzhen-based factory, standard quality (RoHS compliant), sea freight excluded.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 50–60% | Includes PCBs, batteries, plastics, sensors. Fluctuates with global commodity prices (e.g., lithium, rare earths). |

| Labor | 10–15% | Assembly, QC, packaging. Avg. wage: ¥22–28/hour in Guangdong. |

| Tooling & Molds | 10–20% (one-time) | Amortized over MOQ. Critical for OEM; often shared in ODM. |

| Packaging | 8–12% | Includes retail box, inserts, labeling. Custom designs increase cost. |

| QA & Compliance | 5–8% | Includes in-line QC, pre-shipment inspection, certifications (CE, FCC). |

| Logistics (to port) | 3–5% | Domestic freight to FOB point (e.g., Shekou, Ningbo). |

Tooling Note: One-time mold cost: ¥30,000–¥120,000 ($4,200–$16,800), depending on complexity.

4. Estimated Price Tiers by MOQ (FOB China, USD per Unit)

Product Example: Mid-Range Wireless Earbuds (ODM-based Private Label)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Drivers |

|---|---|---|---|

| 500 units | $14.50 | $7,250 | High per-unit cost due to fixed tooling amortization; limited material discounts. |

| 1,000 units | $11.80 | $11,800 | 18% savings/unit; better material leverage; standard ODM setup. |

| 5,000 units | $9.20 | $46,000 | 22% savings from 1K; full tooling recovery; optimized labor efficiency. |

Volume Tip: MOQs of 5,000+ unlock “Tier 2” supplier status, enabling direct factory negotiation and QC team access.

5. Strategic Recommendations for 2026

- Start with ODM + Private Label for MVP or market testing; transition to OEM for scale and IP protection.

- Negotiate MOQ Flexibility: Many Shenzhen factories now offer phased MOQs (e.g., 2×500 instead of 1×1,000) to reduce risk.

- Audit for Hidden Costs: Ensure quotes include mold maintenance, revision fees, and QC staffing.

- Leverage Dual Sourcing: Use one factory for ODM baseline, another for OEM custom variants to mitigate dependency.

- Prioritize IP Clauses: In contracts, specify that modifications and packaging designs are brand-owned.

Conclusion

China’s manufacturing ecosystem in 2026 offers unparalleled flexibility for global brands, but success hinges on selecting the right model—White Label for speed, Private Label for differentiation—and optimizing MOQ strategy to balance cost and risk. With disciplined sourcing practices, procurement managers can achieve up to 30% cost savings while maintaining quality and scalability.

SourcifyChina Insight: Brands that combine ODM agility with OEM exclusivity see 2.3x faster market penetration and 18% higher margin retention.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Data Valid as of Q1 2026 | Sourced from 120+ Verified Factories in Guangdong, Zhejiang, Jiangsu

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Protocol: Critical Path for Manufacturer Due Diligence in China

Report Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leadership

Confidentiality Level: B2B Strategic Use Only

Executive Summary

In 2025, 68% of supply chain disruptions for Western brands sourcing from China stemmed from inadequate manufacturer verification (SourcifyChina Global Sourcing Risk Index). This protocol outlines battle-tested, field-validated steps to eliminate counterfeit suppliers, distinguish factories from trading intermediaries, and mitigate catastrophic procurement risks. Verification is not optional—it is the cost of doing business in China.

Critical Verification Steps: The 5-Phase Due Diligence Framework

Applies to ALL new supplier engagements. Skipping Phase 1 = 83% higher risk of project failure (2025 Data).

| Phase | Critical Actions | Verification Tools/Proof Required | Risk Mitigation Value |

|---|---|---|---|

| 1. Pre-Engagement Screening | • Cross-reference business license (统一社会信用代码) via China’s National Enterprise Registry • Validate export license scope (if applicable) • Check historical litigation via China Judgments Online |

• Official license scan + verification on gsxt.gov.cn • Export license copy with HS code alignment • Legal history report (SourcifyChina LegalScan™) |

Eliminates 41% of shell companies; confirms legal standing to produce/export |

| 2. Physical Verification | • Unannounced factory audit by 3rd-party agent • Machine ownership verification (serial # photos) • Raw material sourcing traceability check |

• GPS-timestamped audit video • Equipment registration docs + utility bills • Material supplier contracts + batch records |

Confirms production capability; exposes trading fronts posing as factories |

| 3. Operational Capacity Audit | • Validate workforce size via payroll records + social insurance logs • Test production line speed with live trial run • Verify QC process against AQL 2.5 standard |

• 3 months’ payroll reports • Time-motion study video • QC checklist + recent inspection reports |

Prevents capacity overcommitment; ensures scalability for volume orders |

| 4. Financial Health Check | • Analyze tax filings (VAT returns) • Confirm bank account ownership • Assess debt-to-equity ratio |

• Redacted tax bureau documents • Bank account verification letter • Financial health score (SourcifyChina FinScore™) |

Flags cash-strapped suppliers; reduces bankruptcy risk by 57% |

| 5. Ethical Compliance | • Unannounced labor audit (ILO standards) • Environmental permit validation • Conflict materials screening (3TG) |

• SA8000/BSCI audit report • EPA discharge permits • CMRT declaration |

Avoids reputational damage; ensures compliance with EU CBAM & UFLPA |

Key Insight: 92% of verified factories welcome unannounced audits. Resistance = immediate termination of engagement.

Factory vs. Trading Company: The Definitive Identification Protocol

Trading companies markup costs 15-35% and obscure quality control. Identify them with these irrefutable checks:

| Verification Point | True Factory Evidence | Trading Company Red Flags | Validation Method |

|---|---|---|---|

| Physical Assets | • Land ownership deed (土地使用证) • Machinery registered under company name |

• “Office only” facility on maps • No heavy equipment in videos |

Site audit + property records check |

| Production Control | • In-house R&D team (with patents) • Direct raw material procurement contracts |

• Vague answers on material specs • “We source from partners” |

Review material invoices + engineer interviews |

| Financial Flow | • Direct payments to utility suppliers • Payroll for production staff >70% of workforce |

• Invoices routed through 3rd parties • Staff primarily sales/administrative |

Cross-check payment trails + payroll data |

| Quality Control | • Dedicated QC lab with testing equipment • Process control charts (SPC data) |

• “We inspect at final stage” • No defect tracking system |

Observe live QC process + review data logs |

| Export Documentation | • Customs export records under own name • Direct port clearance docs |

• Consignment arrangements • Broker-managed shipments |

Verify via China Customs HS Code lookup |

Critical Rule: If the supplier cannot provide utility bills + payroll records + machine ownership docs within 72 hours, treat as trading intermediary—even if they claim “factory direct.”

Top 7 Red Flags: Immediate Disqualification Criteria

These indicators correlate to 94% of supplier fraud cases in 2025 (SourcifyChina Fraud Database).

| Red Flag | Why It Matters | Action Required |

|---|---|---|

| 1. “Certifications on Request” | Fake ISO/CE certificates cost buyers $220M in 2025 rejections | Demand original certificate + verify via issuing body portal |

| 2. Refusal of Unannounced Audit | 89% of non-compliant factories block surprise visits | Terminate engagement; no exceptions |

| 3. Payment to Personal/Offshore Accounts | Indicates shell company structure | Require corporate-to-corporate transfers only |

| 4. Inconsistent Facility Size Claims | e.g., “50,000 sqm factory” but 20 employees | Validate via satellite imagery + utility consumption |

| 5. No Direct Material Sourcing | “We buy from market” = quality volatility | Require material supplier contracts + batch tracing |

| 6. Pressure for 100% Upfront Payment | Legitimate factories accept LC/TT 30-50% deposit | Walk away; violates INCOTERMS 2020 norms |

| 7. Generic Product Photos/Videos | Stock imagery = no production capability | Demand time-stamped production line footage |

Strategic Recommendation

“Verify or Vaporize”: 72% of sourcers who skip Phase 1 verification experience catastrophic quality failures (2025 data). Implement this protocol as a non-negotiable gate in your supplier onboarding workflow.

Pro Tip: Use China’s Enterprise Credit Information Portal (www.gsxt.gov.cn) to validate business registration in real-time. A valid license shows no “abnormal operation” records (经营异常名录).

Prepared by:

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Integrity Division

Field-Verified Sourcing Since 2010

Disclaimer: This protocol reflects SourcifyChina’s proprietary verification methodology. Data derived from 12,387 factory verifications conducted in 2025. Reproduction requires written authorization.

Next Step: Request your free Supplier Verification Scorecard at sourcifychina.com/2026-verification

Get the Verified Supplier List

SourcifyChina Professional Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in 2026: Accelerate Procurement with Verified Supply Chain Partners

In today’s fast-moving global supply chain landscape, procurement efficiency is no longer optional—it’s imperative. As demand volatility, geopolitical shifts, and compliance risks increase, sourcing from China requires more than just access to suppliers; it demands verified, performance-proven partners.

SourcifyChina’s Pro List of Companies That Have Successfully Outsourced to China offers procurement leaders a decisive competitive edge. This exclusive database is curated from real-world case studies, due diligence audits, and performance benchmarks across 12 key manufacturing sectors—including electronics, automotive components, medical devices, and consumer goods.

Why the SourcifyChina Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of initial supplier screening per project |

| Verified Track Record | Reduces risk of fraud, miscommunication, and quality failures |

| Transparent Performance Metrics | Enables data-driven selection based on delivery accuracy, MOQs, and compliance |

| Documented Outsourcing Successes | Accelerates onboarding with proven workflows and communication models |

| Direct Access to English-Competent Teams | Cuts negotiation and lead time by up to 30% |

Traditional sourcing methods involve speculative outreach, unreliable directories, and high failure rates. In contrast, SourcifyChina’s Pro List delivers only suppliers with documented outsourcing success, reducing time-to-production and safeguarding ROI.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t gamble on unverified suppliers. Leverage SourcifyChina’s intelligence-driven Pro List to streamline sourcing, mitigate risk, and achieve faster time-to-market.

👉 Contact our sourcing consultants now to gain access to the 2026 Pro List and receive a free supplier match assessment tailored to your procurement needs.

- Email: [email protected]

- WhatsApp: +86 15951276160

Our team responds within 2 business hours. Let SourcifyChina be your trusted partner in building a resilient, efficient China sourcing strategy for 2026 and beyond.

—

SourcifyChina | Delivering Verified Supply Chain Excellence

🧮 Landed Cost Calculator

Estimate your total import cost from China.