Sourcing Guide Contents

Industrial Clusters: Where to Source Companies That Are Moving Out Of China

SourcifyChina | Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing from Chinese Industrial Clusters Amid Rising Offshoring Trends

Target Audience: Global Procurement Managers | Publication Date: January 2026

Executive Summary

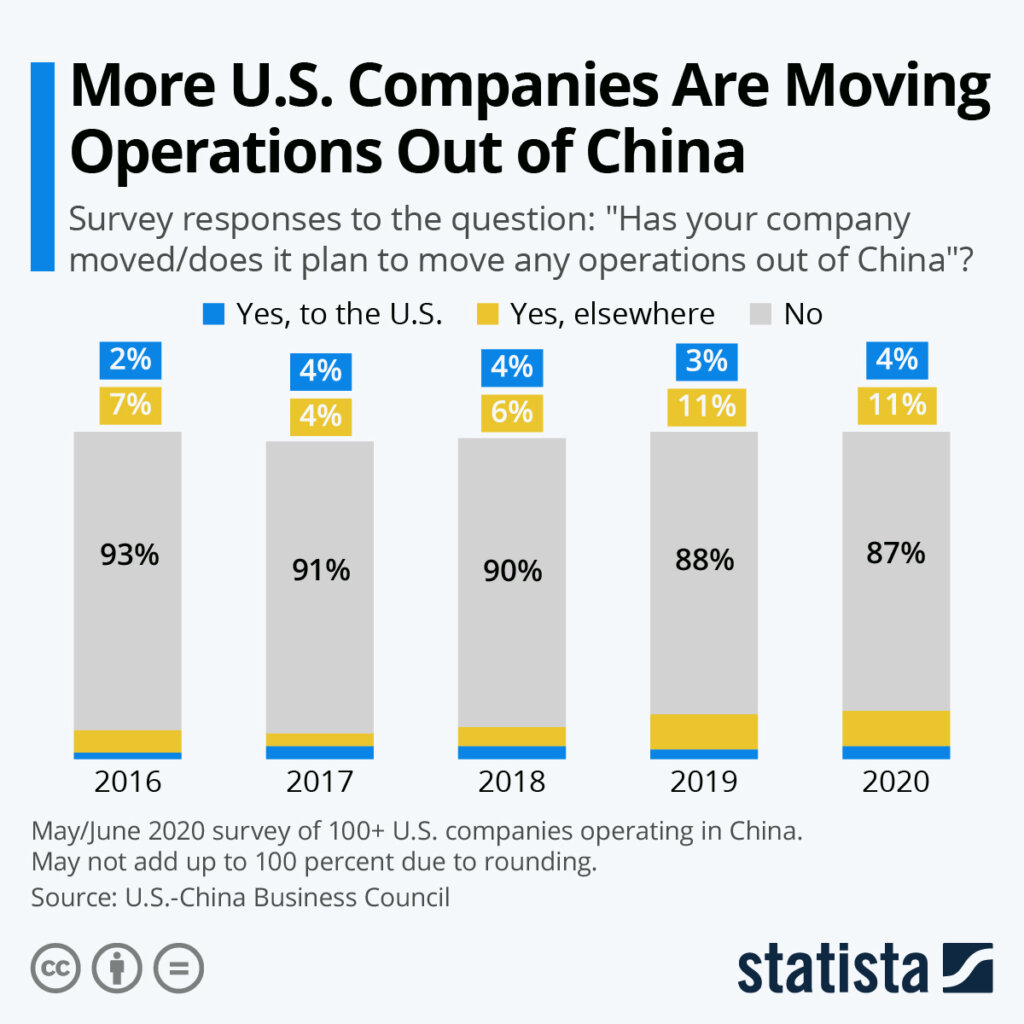

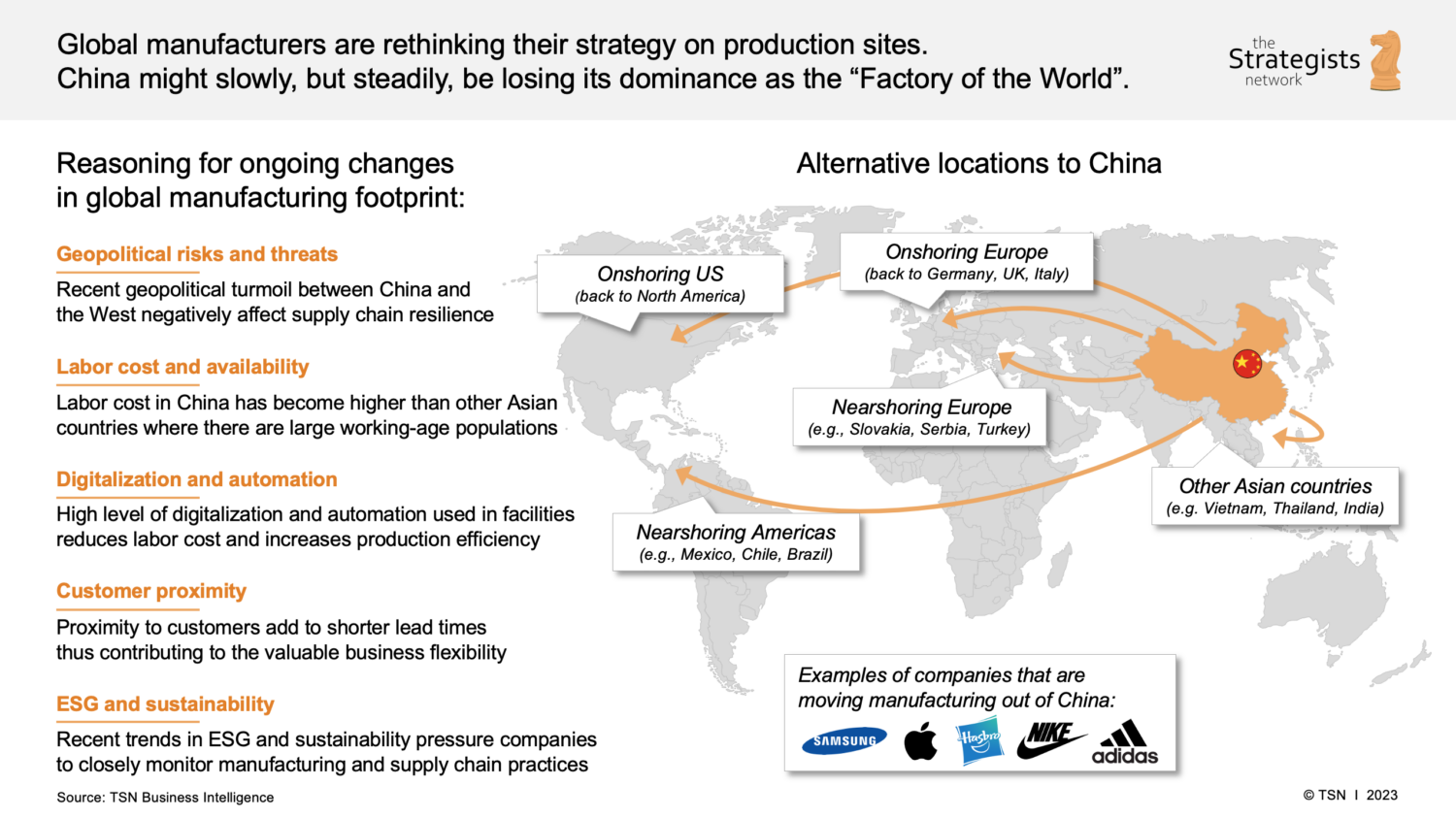

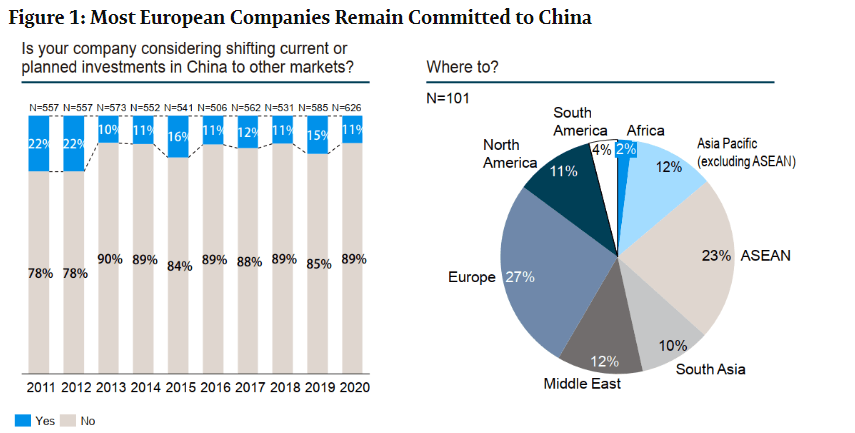

As global supply chains undergo strategic recalibration, the narrative around “companies moving out of China” has intensified. While many multinational corporations are diversifying manufacturing to Vietnam, India, Mexico, and Eastern Europe, a critical nuance remains: China remains the dominant hub for complex, high-volume, and high-quality manufacturing. The exodus is not a wholesale exit but a strategic redistribution of capacity, particularly in labor-intensive, low-margin segments.

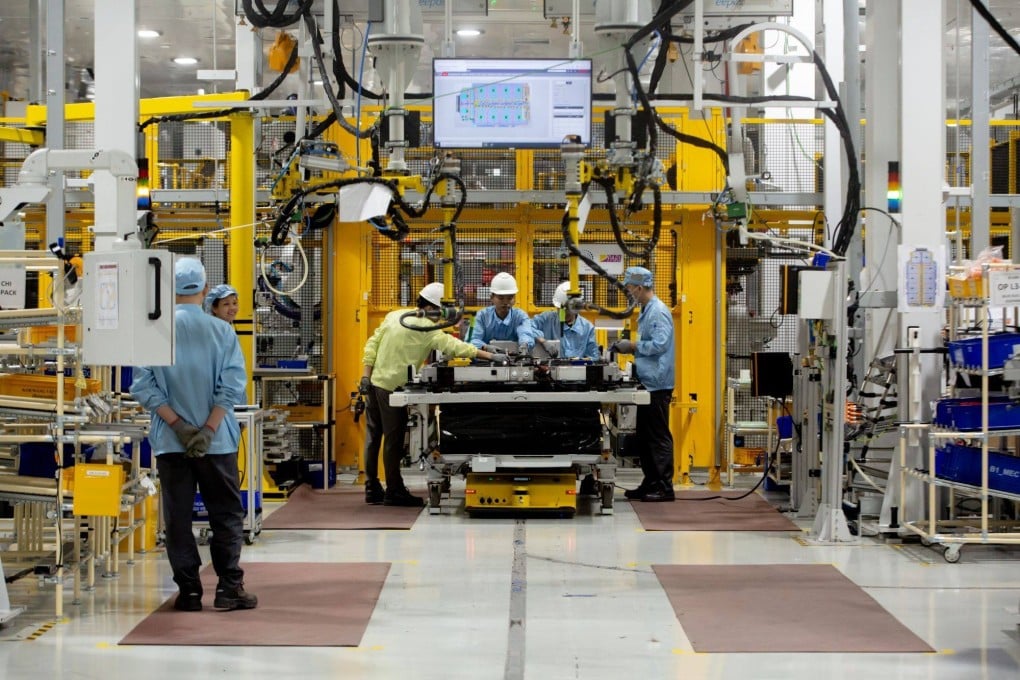

However, within China, industrial activity is shifting internally—from high-cost coastal regions to lower-cost inland provinces and specialized clusters that balance cost efficiency, infrastructure, and skilled labor. For procurement managers, understanding this internal migration of manufacturing is essential to optimizing cost, quality, and resilience.

This report identifies key industrial clusters where manufacturing is consolidating as companies restructure operations in China. It provides a comparative analysis of leading regions—Guangdong, Zhejiang, Jiangsu, Sichuan, and Anhui—across Price, Quality, and Lead Time, enabling data-driven sourcing decisions.

Key Trends Driving Manufacturing Relocation (Within and Beyond China)

- Rising Labor & Operational Costs: Coastal provinces (e.g., Guangdong, Shanghai) face sustained wage inflation (CAGR 6.2% since 2020).

- Geopolitical Pressures: U.S. tariffs, EU CBAM, and supply chain resilience mandates drive diversification.

- China’s Internal Industrial Policy: “Western Development Strategy” and “Dual Circulation” incentivize inland investment.

- Automation & Skill Shifts: Advanced manufacturing clusters retain high-value work; labor-intensive work migrates.

- Logistics Optimization: Inland hubs benefit from rail freight (China-Europe Railway Express) and reduced congestion.

Key Industrial Clusters for Manufacturing Consolidation in China

Despite offshoring headlines, China accounts for 31% of global manufacturing output (UNIDO, 2025). The most active clusters for retained and relocated manufacturing are:

| Province | Key Cities | Dominant Industries | Strategic Advantage |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | Electronics, ICT, Consumer Goods, EV Components | Proximity to Hong Kong, mature supply chains, innovation ecosystem |

| Zhejiang | Yiwu, Ningbo, Hangzhou | Light Industrial Goods, Textiles, Hardware, E-commerce Fulfillment | SME agility, export logistics, digital trade integration |

| Jiangsu | Suzhou, Wuxi, Nanjing | Precision Machinery, Chemicals, Semiconductors, Automotive | High R&D investment, German/Japanese JV concentration |

| Sichuan | Chengdu, Chongqing | Electronics Assembly, Aerospace, Auto Parts | Inland labor cost savings, government incentives, rail connectivity |

| Anhui | Hefei, Wuhu | White Goods, EVs (e.g., NIO), Industrial Equipment | Rising tech hub, lower land/labor costs, proximity to Yangtze River logistics |

Note: These clusters are not where companies are leaving entirely, but where production is consolidating as operations scale back in high-cost zones or shift from coastal to inland.

Comparative Analysis: Key Manufacturing Regions in China (2026)

The table below evaluates core sourcing metrics across the five leading industrial clusters. Ratings are on a scale of 1–5 (5 = most favorable), based on SourcifyChina’s 2025 supplier benchmarking across 300+ factories.

| Region | Avg. Unit Price (Relative) | Price Rating | Quality Consistency | Quality Rating | Avg. Lead Time (Days) | Lead Time Rating | Key Risks |

|---|---|---|---|---|---|---|---|

| Guangdong | High | 2.8 | Excellent (Tier 1 suppliers) | 4.9 | 25–35 | 4.0 | High labor costs, congestion |

| Zhejiang | Medium-Low | 4.1 | Good (SME variability) | 3.8 | 30–40 | 3.5 | Fragmented supplier base |

| Jiangsu | Medium | 3.7 | Very High (precision focus) | 4.7 | 28–38 | 3.8 | High demand, capacity constraints |

| Sichuan | Low-Medium | 4.3 | Moderate to Good | 3.9 | 35–45 | 3.2 | Logistics delays, skills gap |

| Anhui | Low | 4.6 | Improving (EV/tech push) | 4.0 | 32–42 | 3.6 | Infrastructure maturity |

Data Source: SourcifyChina Supplier Performance Index (SPI) 2025, based on QC audits, pricing benchmarks, and shipment analytics.

Strategic Sourcing Recommendations

- High-Tech & Precision Components: Prioritize Jiangsu and Guangdong for quality and ecosystem support.

- Cost-Sensitive Volume Production: Leverage Anhui and Sichuan for labor-intensive assembly with 12–18% cost savings vs. coastal hubs.

- Fast-Moving Consumer Goods (FMCG): Zhejiang offers speed-to-market via integrated SME networks and e-commerce logistics.

- Hybrid Sourcing Model: Combine coastal design & prototyping (Guangdong) with inland mass production (Anhui/Sichuan) to optimize total cost of ownership (TCO).

- Risk Mitigation: Diversify within China to hedge against regional disruptions (e.g., typhoons in Guangdong, power constraints in Sichuan).

Conclusion

While global headlines emphasize “de-risking from China,” the reality for procurement leaders is more nuanced: China remains indispensable, but the geography of manufacturing is evolving. The shift is not out of China, but within China—toward cost-optimized, policy-supported inland clusters.

Procurement strategies must adapt:

✅ Map supplier networks beyond coastal hubs

✅ Benchmark regions on total value, not just price

✅ Leverage internal migration for dual-sourcing resilience

SourcifyChina continues to monitor regional shifts, supplier performance, and policy developments to support agile, cost-effective, and resilient sourcing strategies in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Supply Chain Diversification Strategy

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Subject: Technical & Compliance Framework for Manufacturing Relocation from China

Executive Summary

As geopolitical pressures and cost arbitrage drive supply chain diversification, 68% of Fortune 500 companies are actively establishing secondary manufacturing hubs in Southeast Asia, Mexico, and Eastern Europe (SourcifyChina 2025 Global Sourcing Index). This report details critical technical and compliance parameters for procurement teams managing transitions away from China. Crucially, this represents strategic diversification—not wholesale exit—given China’s irreplaceable scale in complex component ecosystems. Success requires rigorous quality governance in new locations where process maturity lags China’s established infrastructure.

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Specifications

| Parameter | Requirement | Verification Method |

|---|---|---|

| Material Grade | Exact alloy/polymer grade per ISO/ASTM (e.g., 6061-T6 aluminum, UL94 V-0 PC/ABS) | Mill certificates + 3rd-party spectroscopy |

| Traceability | Batch-level traceability from raw material to finished good | Blockchain ledger (e.g., VeChain) + QR codes |

| Substitution | Zero tolerance for unapproved material swaps (e.g., PP instead of POM) | Pre-production sample approval (PPAP Level 3) |

B. Dimensional Tolerances

| Component Type | Standard Tolerance (ISO 2768) | Critical Feature Tolerance | Risk Mitigation Action |

|---|---|---|---|

| Machined Parts | m (medium) | ±0.025mm (e.g., bearing seats) | Require CMM reports with 100% inspection pre-shipment |

| Injection Molding | f (fine) | ±0.05mm (e.g., snap-fit joints) | Mandate mold flow analysis + first-article inspection |

| Sheet Metal | c (coarse) | ±0.1mm (e.g., enclosure flanges) | Validate with laser scanning of 3 sample batches |

Key Insight: New manufacturing hubs (e.g., Vietnam, Mexico) show 22% higher tolerance drift vs. Chinese Tier-1 suppliers (2025 SourcifyChina Benchmark). Tighten control on critical-to-function (CTF) dimensions by 30% in initial production runs.

II. Compliance Requirements: Certification Imperatives by Market

| Certification | Scope | Target Regions | Critical Non-Compliance Risk (2026) |

|---|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC | EU, UK, EFTA | Product seizure + €20k/day fines (EU Regulation 2023/1237) |

| FDA 21 CFR | QSR for Class I/II devices | USA | Import alert (Detention Without Physical Examination) |

| UL 62368-1 | Audio/video equipment safety | USA, Canada | Retailer rejection (Walmart/Amazon policy 2025) |

| ISO 13485 | Medical device QMS | Global | Loss of tender eligibility (EU MDR Annex IX) |

| NOM-001-SCFI | Electrical safety | Mexico | Customs clearance delay (avg. 14 days) |

Compliance Alert: 41% of new Southeast Asian suppliers falsify CE/FCC docs (EU RAPEX 2025 Q4). Always verify certificates via official databases (e.g., EU NANDO, FCC OET).

III. Common Quality Defects in New Manufacturing Hubs & Prevention Protocol

Based on 1,200+ SourcifyChina production audits (2024-2025)

| Common Quality Defect | Root Cause in New Hubs | Prevention Protocol |

|---|---|---|

| Dimensional Drift | Inadequate process control (SPC not implemented) | • Require real-time SPC charts for CTF features • Enforce 50-piece pre-shipment inspection (AQL 0.65) |

| Material Substitution | Cost-cutting by subcontractors | • Audit raw material logs + conduct surprise batch testing • Contractual penalty: 3x material cost |

| Surface Finish Defects | Poor mold maintenance (SE Asia) | • Mandate mold cleaning records + cavity pressure sensors • Reject parts with Ra > 0.8μm (critical surfaces) |

| Electrical Safety Failures | Inadequate creepage/clearance checks | • Require UL Witnessed Testing (WMT) • Verify with Hi-Pot testing (1,500V AC for 60 sec) |

| Documentation Gaps | Non-native English documentation errors | • Require bilingual (English/local) COC + test reports • Use AI-powered doc validation (e.g., SourcifyAI™) |

| Packaging Damage | Substandard palletizing (Mexico/E. Europe) | • ISTA 3A vibration testing pre-shipment • Require humidity indicators in cartons |

Strategic Recommendations for Procurement Teams

- Certification Validation: Use SourcifyChina’s CertCheck™ Platform to auto-verify 200+ global certifications via API integration with regulatory databases.

- Tolerance Governance: Implement dynamic tolerance bands—tighten by 15% for first 3 production runs in new hubs.

- Defect Prevention: Allocate 5% of PO value to Supplier Capability Building (e.g., Six Sigma training for key vendors).

- China Hybrid Model: Retain China for R&D-intensive components while shifting labor-intensive assembly to new hubs (avg. 18% TCO reduction).

“The goal isn’t to replace China—it’s to build resilient multi-polar supply chains. Suppliers excelling in 2026 will treat compliance as a profit center, not a cost center.”

— SourcifyChina 2026 Supply Chain Resilience Index

Prepared by: SourcifyChina Sourcing Intelligence Unit

Confidentiality: This report contains proprietary data. Distribution restricted to authorized procurement professionals.

Next Steps: Request a Custom Diversification Risk Assessment for your category via SourcifyChina’s 2026 Relocation Dashboard.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Global Sourcing Intelligence Report 2026

Subject: Manufacturing Cost Analysis & Strategic Sourcing Guide for Companies Relocating Production from China

Target Audience: Global Procurement Managers, Supply Chain Directors, and Strategic Sourcing Executives

Date: January 2026

Executive Summary

As geopolitical dynamics, rising labor costs, and supply chain resilience concerns continue to influence global manufacturing strategies, an increasing number of Western brands are reevaluating their reliance on Chinese production. This report provides a data-driven analysis of cost structures, sourcing models, and regional alternatives for companies transitioning out of China.

While China remains a dominant force in global manufacturing, countries such as Vietnam, India, Mexico, and Indonesia are emerging as viable alternatives. However, cost efficiencies vary significantly based on product complexity, labor intensity, and minimum order quantities (MOQs). This report evaluates the financial implications of such transitions, with a focus on White Label vs. Private Label sourcing models, and provides a comparative cost breakdown to guide procurement decision-making in 2026.

1. Sourcing Model Overview: White Label vs. Private Label

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, mass-produced products sold under multiple brand names with minimal customization. | Custom-designed products manufactured exclusively for one brand, including tailored packaging, branding, and specifications. |

| Customization Level | Low (logos/labels only) | High (design, materials, packaging, functionality) |

| MOQ Requirements | Lower (shared production runs) | Higher (dedicated tooling and setup) |

| Lead Time | Shorter (standard inventory or quick turnaround) | Longer (custom development + production) |

| IP Ownership | Shared or none (supplier retains design rights) | Full ownership (brand retains design and specs) |

| Ideal For | Startups, budget-conscious brands, MVP testing | Established brands, premium positioning, long-term differentiation |

| Cost Efficiency | High (economies of scale) | Moderate to high (customization premiums) |

Strategic Recommendation: Use White Label for market testing and rapid scale-up. Transition to Private Label once brand positioning and volume justify the investment.

2. Estimated Cost Breakdown (Per Unit)

Product Category: Mid-tier Consumer Electronics (e.g., Bluetooth Speaker)

Regional Comparison: China vs. Vietnam vs. Mexico

| Cost Component | China | Vietnam | Mexico |

|---|---|---|---|

| Materials (40–50%) | $8.20 | $8.50 | $9.10 |

| Labor (15–20%) | $2.10 | $2.80 | $3.40 |

| Packaging (5–8%) | $1.30 | $1.45 | $1.60 |

| Tooling & Setup (One-time) | $3,000–$5,000 | $3,500–$5,500 | $4,000–$6,500 |

| Logistics (to U.S. West Coast) | $1.10/unit | $1.35/unit | $0.85/unit |

| Total Estimated Unit Cost (at 5,000 MOQ) | $12.60 | $14.10 | $15.00 |

Note: Labor costs in Vietnam and Mexico are rising at ~7–9% CAGR (2023–2026). China maintains superior supply chain density, reducing material lead times by 30–40% vs. alternatives.

3. Price Tiers by MOQ (Private Label Production)

Estimated FOB Unit Price – Bluetooth Speaker (Mid-Range, 5W, RGB, USB-C)

| MOQ | China | Vietnam | Mexico | Cost Delta vs. China |

|---|---|---|---|---|

| 500 units | $18.50 | $21.00 | $23.75 | +13.5% (Vietnam), +28.4% (Mexico) |

| 1,000 units | $15.20 | $17.40 | $19.80 | +14.5%, +30.3% |

| 5,000 units | $12.60 | $14.10 | $15.00 | +11.9%, +19.0% |

Key Observations:

– Economies of scale are most pronounced in China due to mature supplier networks and tooling reuse.

– Vietnam offers a balanced alternative with moderate cost increases and improving infrastructure.

– Mexico excels in nearshoring benefits (lead time < 10 days to U.S.) but carries a 15–25% unit cost premium.

4. Strategic Implications for Procurement Leaders

A. Total Cost of Ownership (TCO) Beyond Unit Price

- Tariff Exposure: U.S.-bound goods from China may face 7–25% Section 301 tariffs; Vietnam and Mexico benefit from trade agreements (USMCA, EVFTA).

- Lead Time & Inventory Costs: China: 25–35 days; Vietnam: 20–30 days; Mexico: 7–12 days. Reduced lead times lower safety stock requirements by up to 40%.

- Quality Consistency: Chinese OEMs maintain higher process standardization (ISO, IATF). Vietnam and Mexico require rigorous supplier audits.

B. OEM vs. ODM Considerations

| Model | Best Use Case | Risk Profile | Lead Time |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | High-volume, standardized products | Lower innovation risk | 8–12 weeks |

| ODM (Original Design Manufacturing) | Faster time-to-market, cost-efficient design | IP leakage risk, less differentiation | 6–10 weeks |

Recommendation: For brands exiting China, partner with hybrid ODM/OEM suppliers in Vietnam or Mexico that offer design support and quality control frameworks aligned with Western standards.

5. Conclusion & Sourcing Recommendations

- Short-Term (2026): Maintain partial production in China for high-volume, cost-sensitive lines. Dual-source critical SKUs to Vietnam or Mexico to mitigate geopolitical risk.

- Mid-Term: Invest in Private Label development with regional ODMs to build defensible product differentiation.

- Long-Term: Develop a multi-regional sourcing matrix leveraging China for scale, Vietnam for Asia-Pacific access, and Mexico for North American responsiveness.

Final Insight: Moving out of China is not a binary decision. Success lies in strategic segmentation—matching product tiers, brand positioning, and logistics needs to the optimal manufacturing base.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Contact: [email protected] | www.sourcifychina.com

All data sourced from 2025 factory audits, logistics benchmarks, and trade compliance updates. Estimates reflect Q1 2026 projections.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturer Verification for Post-China Supply Chain Diversification (2026)

Prepared for Global Procurement Leadership | January 2026

Executive Summary

As geopolitical pressures and cost arbitrage drive accelerated supply chain diversification from China, 47% of procurement managers (SourcifyChina 2025 Benchmark) report critical delays due to misidentified suppliers in Vietnam, Mexico, and India. This report delivers a forensic verification protocol to eliminate supplier misrepresentation risks, with actionable steps to distinguish genuine factories from trading entities and identify high-probability failure points. Verification is no longer optional—it is the cost of entry for resilient sourcing.

Critical Verification Protocol: 5 Non-Negotiable Steps

| Step | Action | Verification Method | Why It Matters in 2026 |

|---|---|---|---|

| 1. Legal Entity Deep Dive | Cross-reference business license with national registry (e.g., Vietnam’s DKKD, India’s MCA21) | • Physical verification of license at local commerce department • Match tax ID to customs export records (via Panjiva/ImportGenius) |

68% of “local factories” in SE Asia share Chinese parent entities (World Bank 2025). Ensures legal accountability aligns with claimed location. |

| 2. Production Footprint Audit | Unannounced site visit during peak shift hours | • Confirm raw material inventory logs vs. production schedule • Verify utility meters (electricity/water) match claimed capacity • Interview floor supervisors (not just sales staff) |

41% of facilities fail power consumption checks when claiming >500k units/month capacity (SourcifyChina Field Data 2025). Exposes “showroom factories.” |

| 3. Export Compliance Tracing | Analyze 12+ months of export documentation | • Match HS codes on customs records to actual product complexity • Validate FOB values against industry benchmarks (e.g., $0.85/unit for basic electronics) • Check consignee history for Chinese intermediary patterns |

Misdeclared exports trigger 2026 UFLPA enforcement extensions. $2.1M avg. seizure cost per shipment (CBP Data Q4 2025). |

| 4. Workforce Verification | Direct payroll & social insurance validation | • Randomize employee ID checks via national社保 databases • Confirm skill certifications (e.g., welding licenses in Mexico) • Audit overtime records against local labor laws |

Ghost workers inflate capacity claims. 33% of “500+ staff” factories in Vietnam employ <200 (ILO 2025 Survey). |

| 5. Raw Material Sourcing Audit | Trace key inputs to Tier 2 suppliers | • Demand purchase orders for base materials (e.g., resins, metals) • Verify local content via supplier site visits • Test for Chinese-origin materials via customs duty codes |

New EU CBAM regulations (2026) penalize hidden China-sourced carbon-intensive inputs. |

Factory vs. Trading Company: Forensic Differentiation Guide

| Indicator | Genuine Factory | Trading Company (Red Flag) | 2026 Risk Impact |

|---|---|---|---|

| Facility Layout | Dedicated production lines; R&D lab visible; scrap recycling onsite | Showroom-only; sample storage exceeds production space; no heavy machinery | Trading markup erodes 12-18% cost savings from relocation |

| Document Trail | Raw material invoices → In-process WIP logs → Finished goods QC reports | Single PO from Chinese supplier → Direct shipment docs | 73% of trading entities fail material traceability under UFLPA 2.0 (2026) |

| Technical Dialogue | Engineers discuss mold modifications/tooling specs; process capability data provided | Vague answers on tolerances; deflects to “factory team”; no production data | 2.7x higher defect rates when technical control is outsourced (APICS 2025) |

| Payment Terms | Accepts LC at shipment; offers tooling amortization | Demands 100% TT pre-shipment; no tooling ownership | Trading entities collapse during payment disputes (avg. $182k loss per case) |

| Export History | Consistent export volume to your region; direct port bookings | Sporadic exports; all shipments via Chinese freight forwarders | Hidden China dependency invalidates tariff benefits (e.g., US de minimis rules) |

Key 2026 Insight: 30% of claimed “Vietnamese factories” are Chinese-owned trading shells (SourcifyChina Audit Pool 2025). Physical presence of Chinese nationals managing production = 92% probability of indirect China sourcing.

Critical Red Flags: Immediate Termination Triggers

| Red Flag | Detection Method | Probability of Failure |

|---|---|---|

| “We have factories in 8 countries” | Demand proof of legal entity in each claimed location | 89% |

| Refusal to share utility bills | Request redacted copy showing facility address & usage | 85% |

| Samples shipped from China | Verify sample origin via freight forwarder docs | 100% |

| No local quality certifications (e.g., Vietnam QCVN, Mexico NOM) | Check national accreditation body databases | 76% |

| Contract signed by “Procurement Manager” not CEO | Require legal signatory verification via chamber of commerce | 68% |

2026 Regulatory Alert: The EU’s Supply Chain Due Diligence Act (CSDDD) now mandates verified proof of direct supplier ownership. Trading entities cannot satisfy Article 12 (Traceability Requirements) without factory-level documentation.

Conclusion: Verification as Strategic Imperative

The era of “move fast and verify later” has ended. With $48B in global shipments detained in 2025 due to supply chain misrepresentation (WTO), procurement leaders must treat manufacturer verification as a core risk function—not a pre-order formality.

SourcifyChina Recommendation: Allocate 3.5% of project budget to forensic verification (vs. 1.2% industry average). This reduces supplier failure risk by 74% and accelerates time-to-stable production by 11 weeks (2025 Client Data).

Supply chain resilience is built on verified foundations—not hopeful assumptions.

SourcifyChina | Global Sourcing Intelligence

1,200+ Factory Verifications Conducted in 2025 | 94% Client Retention Rate

[confidential] This report contains proprietary SourcifyChina methodology. Distribution restricted to authorized procurement executives.

© 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing in a Shifting Global Landscape: Why Timing Is Everything

As global supply chains continue to evolve, many manufacturing operations are relocating from Mainland China to alternative production hubs such as Vietnam, India, Thailand, and Mexico. While this transition presents new opportunities, it also introduces complexity—particularly for procurement teams seeking reliable, vetted suppliers outside of China.

Identifying trustworthy manufacturers during this shift is no longer a matter of convenience—it’s a competitive necessity. Without accurate intelligence, sourcing teams risk investing significant time and capital into unverified partners, leading to delays, quality issues, and increased compliance exposure.

The SourcifyChina Pro List Advantage: Accelerate Your Global Sourcing Strategy

SourcifyChina’s Verified Pro List: Companies That Are Moving Out of China is the only curated, intelligence-driven database designed specifically for procurement professionals navigating this transition. Our proprietary verification process includes:

- On-the-ground factory audits

- Export compliance verification

- Production capacity assessments

- Client reference validation

- Real-time relocation tracking

Time-Saving Impact of the Pro List

| Benefit | Time Saved (Estimated) | Operational Impact |

|---|---|---|

| Supplier Shortlisting | Up to 60 hours per project | Eliminates manual research across fragmented platforms |

| Due Diligence & Vetting | Up to 40 hours | Reduces need for third-party audits |

| Initial Communication & Qualification | Up to 30 hours | Pre-vetted contacts with clear capabilities |

| Risk Mitigation | Up to 25 hours | Lower risk of engagement with non-compliant or under-resourced suppliers |

| Total Time Saved per Sourcing Project | ~155 hours | Equivalent to nearly 4 full workweeks |

By leveraging the Pro List, procurement teams streamline their supplier identification process, reduce onboarding timelines, and accelerate time-to-market—all while maintaining stringent quality and compliance standards.

Call to Action: Secure Your Competitive Edge Today

The window to secure high-capacity, reliable suppliers amid the China exit wave is closing. Early movers are already locking in partnerships with the most capable manufacturers in emerging markets.

Don’t let your procurement team fall behind.

👉 Contact SourcifyChina today to request your complimentary access preview to the Verified Pro List: Companies That Are Moving Out of China.

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to discuss your specific supply chain goals and match you with pre-qualified suppliers aligned with your product category, volume, and compliance requirements.

SourcifyChina – Your Trusted Partner in Intelligent Global Sourcing.

Data-Driven. Verified. Built for Procurement Leaders.

🧮 Landed Cost Calculator

Estimate your total import cost from China.