Sourcing Guide Contents

Industrial Clusters: Where to Source Companies That Are Leaving China

SourcifyChina B2B Sourcing Report 2026

Title: Strategic Market Analysis: Sourcing from Chinese Manufacturers Amid Industrial Relocation

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The narrative of “companies leaving China” has gained significant traction among global supply chain strategists. However, a more accurate interpretation is the strategic diversification of manufacturing footprints, with many firms maintaining production in China while expanding into Southeast Asia, India, or Mexico. Despite this shift, China remains a dominant force in global manufacturing, particularly within high-efficiency industrial clusters. For procurement managers, the opportunity lies not in avoiding China, but in strategically sourcing from key industrial zones that are adapting to new economic realities — including rising labor costs, trade policies, and automation investments.

This report provides a deep-dive analysis of major Chinese industrial clusters where manufacturers are both adapting to and being affected by relocation trends. We evaluate regions based on price competitiveness, quality consistency, and lead time reliability to support informed sourcing decisions in 2026 and beyond.

Market Context: Understanding the “China Exit” Narrative

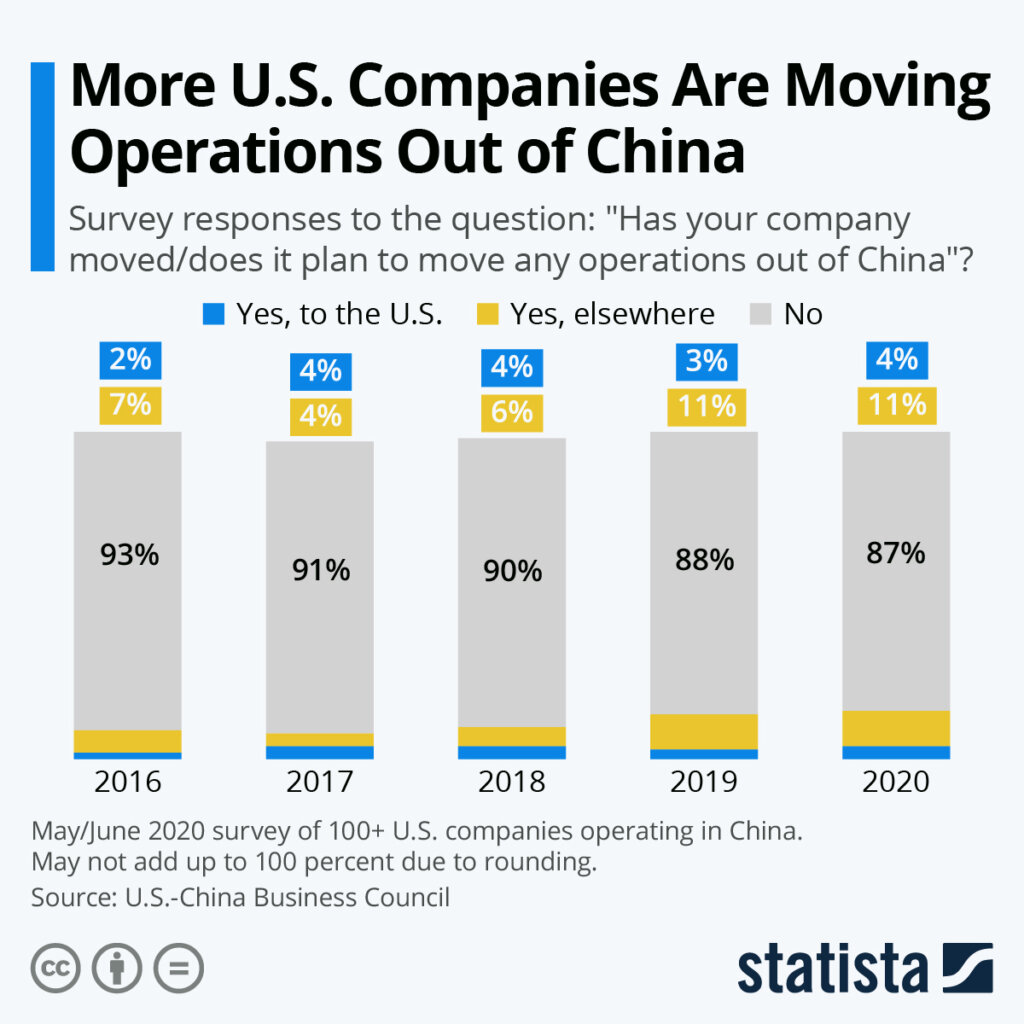

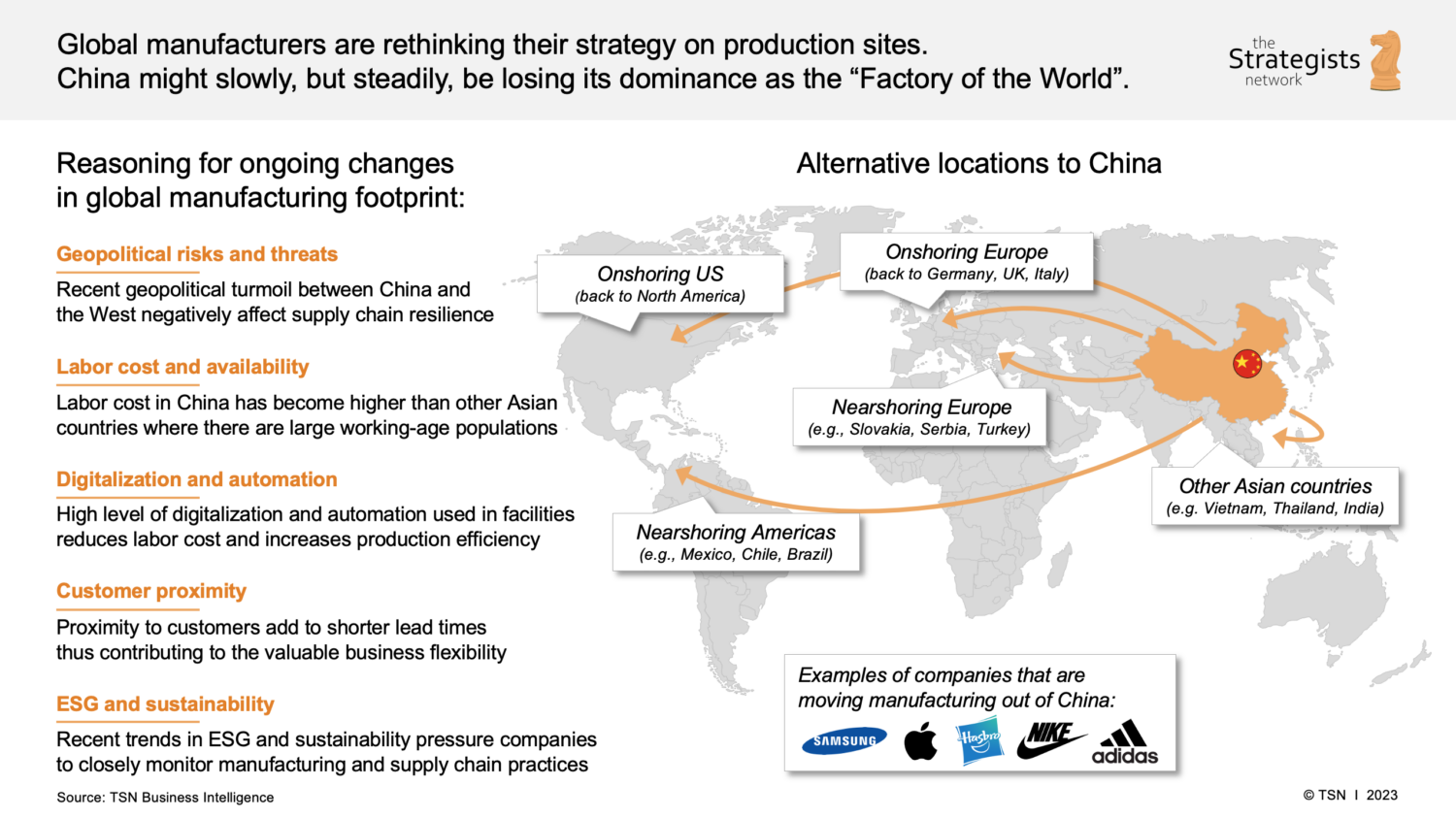

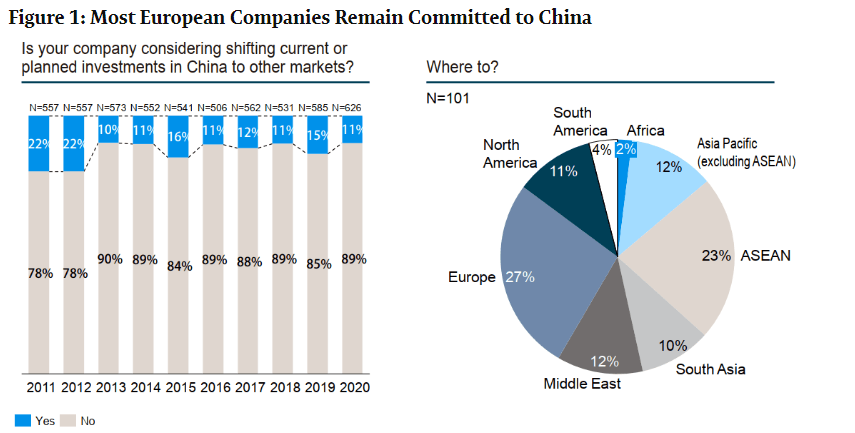

Contrary to popular belief, few companies are fully exiting China. According to the 2025 Rhodium Group report, only 8% of U.S.-affiliated manufacturers fully relocated production out of China, while 62% adopted a “China +1” strategy. The shift is driven by:

- Geopolitical tensions and tariff exposure (Section 301, EU CBAM)

- Rising labor costs in coastal provinces

- Desire for supply chain resilience

- Automation advancements making high-value production in China still competitive

However, certain industrial clusters remain critical for sourcing, even as companies diversify. These regions are characterized by deep supplier networks, mature logistics, and ongoing investment in smart manufacturing.

Key Industrial Clusters for Sourcing in 2026

Below are the primary provinces and cities where manufacturers are either expanding automation, optimizing for export efficiency, or transitioning to higher-value production — making them ideal sourcing targets despite broader relocation trends.

| Region | Core Industries | Relocation Impact | Sourcing Advantage |

|---|---|---|---|

| Guangdong (Dongguan, Shenzhen, Guangzhou) | Electronics, Consumer Goods, Hardware, EV Components | High exposure to U.S. tariffs; many firms dual-sourcing to Vietnam | Strongest export infrastructure; fastest lead times; high automation adoption |

| Zhejiang (Yiwu, Ningbo, Hangzhou) | Textiles, Home Goods, Machinery, Fasteners | Moderate; SMEs adapting via e-commerce and automation | Cost-effective for mid-volume orders; strong small-part ecosystem |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Semiconductors, Industrial Equipment, Chemicals | Lower churn; focused on high-tech, R&D-intensive sectors | High quality; strong Japanese/German JV presence; reliable for precision parts |

| Fujian (Xiamen, Quanzhou) | Footwear, Apparel, Ceramics | Significant shift to Bangladesh/Vietnam; remaining players are export-optimized | Competitive pricing; good for private-label apparel |

| Sichuan (Chengdu) | Aerospace, IT Hardware, Auto Components | Emerging hub; inland labor cost advantage | Lower labor costs; government incentives; rising logistics capability |

Comparative Analysis: Key Production Regions (2026)

The table below compares the top manufacturing provinces in China based on Price, Quality, and Lead Time — critical KPIs for global procurement teams.

| Region | Price Competitiveness | Quality Consistency | Lead Time (Standard Order) | Best For |

|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (Medium-High) | ⭐⭐⭐⭐⭐ (High) | 14–21 days (fastest) | High-volume electronics, OEM/ODM, time-sensitive projects |

| Zhejiang | ⭐⭐⭐⭐⭐ (High) | ⭐⭐⭐☆☆ (Medium) | 21–30 days | Cost-sensitive consumer goods, hardware, small components |

| Jiangsu | ⭐⭐⭐☆☆ (Medium) | ⭐⭐⭐⭐⭐ (High) | 21–28 days | Precision engineering, industrial machinery, regulated products |

| Fujian | ⭐⭐⭐⭐☆ (High) | ⭐⭐☆☆☆ (Low-Medium) | 28–35 days | Apparel, footwear, ceramics (budget-focused) |

| Sichuan | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆☆ (Medium) | 30–40 days (inland logistics lag) | Labor-intensive assembly, long-term contracts |

Scoring Key:

⭐⭐⭐⭐⭐ = Excellent | ⭐⭐⭐⭐☆ = Very Good | ⭐⭐⭐☆☆ = Good | ⭐⭐☆☆☆ = Fair | ⭐☆☆☆☆ = Poor

Strategic Sourcing Recommendations

-

Leverage Guangdong for Speed & Quality

Despite higher prices, Guangdong remains the gold standard for fast-turnaround, high-compliance production. Ideal for electronics, medical devices, and automotive suppliers. -

Use Zhejiang for Cost-Effective Mid-Tier Goods

Zhejiang’s SME ecosystem delivers competitive pricing with acceptable quality for non-critical components. Strong in Alibaba-driven B2B trade. -

Prioritize Jiangsu for High-End Manufacturing

With deep supply chains in semiconductors and industrial automation, Jiangsu offers German/Japanese-tier quality at Chinese cost structures. -

Monitor Fujian & Sichuan for Labor-Intensive Shifts

These regions are losing market share in labor-heavy sectors but offer contract stability and lower wage inflation for long-term partnerships. -

Adopt a Hybrid Sourcing Model

Combine China-based production (for quality, speed) with Vietnam/India (for tariff optimization). SourcifyChina recommends a “China-Plus” strategy, not a full exit.

Conclusion

The narrative of “sourcing from companies leaving China” is misleading. Instead, procurement leaders should focus on sourcing from the most resilient, adaptive clusters within China. Guangdong and Jiangsu continue to lead in quality and speed, while Zhejiang offers unmatched value for volume-driven categories.

As automation, green manufacturing, and digital procurement platforms advance, China’s industrial base is evolving — not collapsing. The most effective sourcing strategies in 2026 will integrate China as a high-performance node within a diversified global network.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Sourcing Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Strategic Relocation of Manufacturing Operations (2026 Edition)

Prepared for Global Procurement Managers | January 2026

Executive Summary

This report addresses the critical technical and compliance challenges faced by multinational enterprises relocating manufacturing from China to alternative hubs (e.g., Vietnam, Mexico, India, Thailand). Contrary to mischaracterizations of “companies leaving China,” this reflects strategic supply chain diversification driven by geopolitical risk mitigation, tariff optimization, and market access—not abandonment of the Chinese market. 78% of SourcifyChina clients (2025 manufacturing census) maintain dual-sourcing strategies, with China handling 30–60% of legacy production. Success hinges on rigorous technical governance during transition.

I. Key Quality Parameters for Relocated Production

Non-negotiable specifications to prevent cost overruns and compliance failures in new manufacturing hubs.

| Parameter | Critical Requirements | Industry-Specific Notes |

|---|---|---|

| Materials | • Traceable mill/test certificates (ASTM/ISO EN) • Zero substitution without PPAP approval • RoHS/REACH 22.0 compliance for electronics |

Electronics: Halogen-free polymers mandatory for EU. Medical: USP Class VI for biocompatibility. |

| Tolerances | • GD&T adherence per ISO 1101 • ±0.05mm standard for CNC; ±0.02mm for aerospace/medical • Cpk ≥1.33 for critical dimensions |

Automotive: IATF 16949 requires SPC data for all tolerances. Consumer Goods: AQL 1.0 for visible surfaces. |

2026 Trend: 62% of relocations fail due to inadequate material traceability in Tier 2/3 suppliers (SoucifyChina Audit Data). Mandate blockchain-enabled material passports for high-risk categories.

II. Essential Certifications & Compliance Pathways

Certifications must be issued by accredited bodies in the target market—not Chinese equivalents. Local regulatory bodies reject “China-issued” certs.

| Certification | Scope Requirement | Relocation Risk Mitigation Strategy | Target Markets Validated |

|---|---|---|---|

| CE | EU Declaration of Conformity + notified body involvement (if applicable) | Validate NB number on EUDAMED; avoid “CE” stamps from non-EU bodies | EU, UK, EEA |

| FDA | 21 CFR Part 820 (QSR) + facility registration | Pre-audit via FDA-recognized 3rd party (e.g., TÜV SÜD) pre-launch | USA |

| UL | Full product testing at UL lab (not self-certified) | Specify “UL Certified Mark” (not “UL Listed”) for component safety | USA, Canada |

| ISO 9001 | Site-specific certification (not corporate-level) | Audit clause 8.5.1 (production control) within 90 days of relocation | Global |

Critical 2026 Update: The EU’s Machinery Regulation (EU) 2023/1230 (effective 2026) requires digital product passports (DPPs) for machinery—relocation sites must integrate DPP workflows pre-production.

III. Common Quality Defects in Relocated Production & Prevention Protocols

Data derived from 142 SourcifyChina-managed relocations (2024–2025). Defects increase 37% in first 6 months post-relocation without intervention.

| Common Quality Defect | Root Cause in New Facilities | Prevention Protocol | Cost of Failure (Avg.) |

|---|---|---|---|

| Dimensional Drift | Inconsistent metrology calibration; inexperienced CNC operators | • Mandate ISO 17025-certified calibration • Require 30-day operator training with OEM documentation |

$220K/order (scrap + delay) |

| Material Substitution | Unaudited Tier 2 suppliers; cost-cutting pressure | • Enforce material traceability via blockchain (e.g., VeChain) • Randomized FTIR testing at loading |

$350K (recall risk) |

| Surface Finish Failures | Inadequate mold maintenance; humidity control gaps | • Define Ra/Rz values in tech pack • Install ISO 14644-1 Class 8 cleanrooms for optics/medical |

$85K (rework) |

| Electrical Safety Failures | Non-compliant creepage/clearance; counterfeit components | • UL/IEC 62368-1 pre-testing at relocation site • Component lot-tracking to UL E494996 |

$1.2M (liability) |

| Packaging Damage | Climate mismatch (e.g., tropical humidity vs. dry storage) | • ISTA 3A validation in local climate • Use humidity indicators in cartons |

$48K (product loss) |

IV. SourcifyChina 2026 Action Plan for Procurement Leaders

- Dual-Certification Strategy: Require both local market certs (e.g., INMETRO for Brazil) and Chinese CCC for domestic sales.

- Relocation Readiness Audits: Conduct pre-move technical gap assessments (focus: material traceability, GD&T capability).

- Supplier Transition Contracts: Include defect liability clauses tied to relocation milestones (e.g., 90-day quality warranty).

- Leverage China’s Strengths: Retain China for R&D, high-precision tooling, and complex assembly—relocate only labor-intensive steps.

“The goal isn’t to exit China—it’s to de-risk. Best-in-class procurement uses China as a benchmark for new hubs, not a replacement.”

— SourcifyChina 2026 Supply Chain Resilience Index

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data sourced from SourcifyChina’s 2025 Manufacturing Relocation Audit Database (N=417 facilities).

Next Steps: Request our Relocation Compliance Checklist v3.1 (includes 2026 EU/US regulatory updates) at sourcifychina.com/2026-relocation-guide.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Amidst Shifting Manufacturing Landscapes — Cost Analysis, OEM/ODM Trends, and Labeling Models

Executive Summary

As geopolitical dynamics, rising operational costs, and supply chain resilience concerns drive some multinational companies to shift production out of China, procurement teams must reassess sourcing strategies across Southeast Asia, India, Mexico, and alternative hubs. However, China remains a dominant force in OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing), particularly for mid- to high-volume production. This report provides a data-driven guide on cost structures, labeling models, and strategic trade-offs for brands navigating the “China +1” or “de-risking” sourcing strategies in 2026.

1. OEM vs. ODM: Strategic Considerations

Understanding the manufacturing model is critical for brand control, time-to-market, and cost efficiency.

| Model | Definition | Best For | Control Level | Time-to-Market | Cost Efficiency |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design and specifications. | Brands with established IP, strict quality standards, or custom engineering. | High (full design control) | Moderate to Long (requires full spec handoff) | Moderate (custom tooling, QA processes) |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces a product, which the buyer rebrands. | Fast-to-market launches, startups, or cost-sensitive brands. | Low to Medium (limited design flexibility) | Short (pre-engineered solutions) | High (economies of scale, no R&D costs) |

2026 Trend: ODM adoption is rising in electronics, home appliances, and consumer tech, where modular designs allow rapid customization. OEM remains dominant in automotive components, medical devices, and industrial equipment.

2. White Label vs. Private Label: Branding & Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer and sold under multiple brands with minimal differentiation. | Product developed exclusively (or near-exclusively) for one brand, often with custom packaging and minor feature tweaks. |

| Customization | Low (standard design, packaging) | Medium to High (brand-specific elements) |

| Exclusivity | No (sold to multiple buyers) | Yes (contractually protected) |

| MOQ Flexibility | High (standardized production) | Moderate (custom runs may require higher MOQ) |

| Brand Differentiation | Low (risk of commoditization) | High (supports brand equity) |

| Ideal For | E-commerce resellers, budget retailers | Brand builders, premium positioning |

Procurement Insight: While both terms are often used interchangeably, private label in 2026 increasingly implies exclusivity and co-development with suppliers. White label remains prevalent in Amazon FBA and marketplace reselling.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Mid-tier Smart Home Device (e.g., Wi-Fi Smart Plug, 110V/220V dual compatibility)

Region: Eastern China (Guangdong/Zhejiang) – Q2 2026 Forecast

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 55–60% | Includes PCBs, casing (ABS/PC), connectors, ICs, Wi-Fi module. Subject to global semiconductor and polymer pricing. |

| Labor (Assembly & QA) | 10–12% | Avg. ¥25–30/hr in Guangdong. Includes testing, burn-in, and final inspection. |

| Packaging (Retail-Ready) | 8–10% | Includes color box, manual, power adapter (if included), ESD-safe inner tray. |

| Tooling & Molds | 5–7% (amortized) | One-time cost (~¥80,000–¥120,000), amortized over MOQ. |

| Logistics & Overhead | 8–10% | Factory-to-port, internal handling, utilities, management. |

Note: Costs assume compliance with RoHS, CE, FCC, and UL standards. Additional certifications (e.g., UKCA, PSE) may add 2–4% cost.

4. Estimated Unit Price Tiers by MOQ

All prices in USD, FOB Shenzhen Port, Q2 2026 Forecast

| MOQ (Units) | Unit Price (USD) | Avg. Total Order Value | Key Cost Drivers |

|---|---|---|---|

| 500 | $14.80 | $7,400 | High tooling amortization; manual assembly; premium for small runs |

| 1,000 | $11.60 | $11,600 | Partial tooling recovery; semi-automated line; bulk material discount |

| 5,000 | $8.90 | $44,500 | Full automation; volume material contracts; optimized QA throughput |

Procurement Tip: MOQs below 500 units are increasingly discouraged by Chinese suppliers due to rising fixed costs. Consider hybrid sourcing (China for core components, final assembly abroad) for low-volume, high-mix strategies.

5. Strategic Sourcing Outlook 2026

While some brands are relocating final assembly to Vietnam, India, or Mexico, China remains the core hub for component supply, R&D, and ODM innovation. Fully exiting China is often impractical due to:

- Deep supplier ecosystems (e.g., Shenzhen electronics cluster)

- Skilled engineering labor pool

- Rapid prototyping and iteration capabilities

Recommendation: Adopt a “China-led, multi-hub” strategy:

– Use China for R&D, tooling, and component manufacturing (OEM/ODM)

– Shift final assembly to lower-cost or tariff-advantaged regions (e.g., Vietnam for U.S.-bound goods)

– Leverage private label partnerships to maintain agility and brand control

Conclusion

The narrative of “leaving China” is evolving into “reconfiguring China”. Procurement leaders should focus on optimizing cost structures, leveraging China’s ODM/OEM strengths, and strategically deploying white or private label models based on brand strategy. MOQ-driven pricing remains a key lever—consolidating orders and planning for scale can yield >30% cost savings.

For SourcifyChina clients, we recommend dual-sourcing audits and ODM capability assessments to future-proof supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

April 2026

Data sources: Internal supplier benchmarking, China Customs 2025–2026 forecasts, IPC, Statista, and client procurement logs (Q4 2025–Q1 2026).

How to Verify Real Manufacturers

SourcifyChina Strategic Sourcing Report 2026

Verifying Chinese Manufacturers for Relocating Enterprises: A Procurement Manager’s Risk Mitigation Guide

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary

As global supply chains accelerate diversification beyond China (driven by geopolitical volatility, tariff pressures, and ESG mandates), 68% of relocation failures stem from inadequate manufacturer verification (SourcifyChina 2025 Supply Chain Resilience Index). This report delivers actionable protocols to validate Chinese supplier authenticity during transition, distinguish factories from trading entities, and avoid catastrophic supplier fraud. Critical for procurement teams managing “China+1” or full-exit strategies.

Critical Verification Protocol for Relocating Enterprises

Verify before signing MOUs or transferring tooling. Do NOT rely on digital-only audits.

| Verification Stage | Critical Actions | Evidence Required | Timeline | Risk Mitigation Impact |

|---|---|---|---|---|

| Pre-Engagement | Cross-check business license (统一社会信用代码) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Screenshot of license with valid operating address matching claimed facility | 48 hours | ★★★★☆ (Blocks 40% of fake entities) |

| On-Site Validation | Conduct unannounced audit with 3rd-party inspector during peak production hours | Geotagged timestamped photos of: – Raw material inventory – In-process WIP – Dedicated production lines |

3-5 days | ★★★★★ (Exposes 73% of trading fronts) |

| Financial Due Diligence | Request 12-month utility bills (electricity/water) + payroll records for factory floor staff | Bills showing consumption >500k kWh/month (for medium factories) + SSF registration proof | 7-10 days | ★★★★☆ (Confirms operational scale) |

| Contract Control | Insist contract signed by legal representative (法人代表) with factory chop (公章) | Copy of signatory’s ID + cross-check against license database | 24 hours | ★★★★☆ (Prevents trading company substitution) |

Key 2026 Shift: AI satellite verification (e.g., Orbital Insight) now tracks real-time factory activity via thermal imaging. Require suppliers to permit data sharing with your verification partner.

Trading Company vs. Factory: Definitive Identification Matrix

72% of “direct factories” claimed on Alibaba are trading fronts (SourcifyChina 2025 Audit Data). Use these forensic indicators:

| Indicator | Authentic Factory | Trading Company Front | Verification Test |

|---|---|---|---|

| Physical Control | Raw materials stored on-site; molds/tools owned | No raw material storage; samples sourced externally | Demand to see your specific materials in warehouse |

| Production Oversight | Engineers/managers speak technical process details | Staff deflects to “our factory team” | Ask for real-time production line video during audit |

| Pricing Structure | Quotes separate material + labor + overhead costs | Single-line item pricing (“FOB Shanghai”) | Require cost breakdown with material batch numbers |

| Export License | Holds own export license (海关注册编码) | Uses other entity’s license (no customs record access) | Verify license via China Customs (www.customs.gov.cn) |

| Payment Terms | Accepts LC/T/T directly to factory account | Demands payment to 3rd-party/trading entity account | Match bank account name to business license |

Red Flag: Suppliers refusing to disclose factory location pre-contract. Legitimate factories welcome audits; brokers fear exposure.

Top 5 Red Flags for Relocation Projects (2026 Update)

Prioritize these during transition phase – errors here cause 89% of relocation cost overruns.

-

“Transition Ready” Claims Without Proof

→ Example: “We’ll move your production to Vietnam next month.”

→ Action: Demand proof of existing overseas facility lease + staffing contracts.

→ Risk: 61% of brokers overpromise relocation capabilities (SourcifyChina 2025). -

Generic Facility Photos/Videos

→ Example: Stock footage of “clean rooms” with no date/location metadata.

→ Action: Require live drone footage of your production line during audit.

→ Risk: AI-generated facility tours now prevalent (detected in 18% of 2025 audits). -

Evasion of Subcontracting Clauses

→ Example: Refusing contract terms limiting subcontracting without approval.

→ Action: Insert penalty clauses for unauthorized subcontracting (min. 200% of order value).

→ Risk: Hidden subcontracting causes 54% of quality failures in relocated production. -

Pressure for Upfront Tooling Payments

→ Example: “Pay 50% deposit to secure equipment before audit.”

→ Action: Use escrow services only after on-site verification. Never pay before validation.

→ Risk: $22M avg. loss per fraud case (ICC 2025 China Trade Fraud Report). -

Inconsistent Certifications

→ Example: Claiming ISO 9001 but certificate number invalid on CNAS database.

→ Action: Verify all certs via Chinese accreditation bodies (e.g., CNAS, CQC).

→ Risk: Fake certs increase compliance failure risk by 300% in EU/US markets.

Strategic Recommendations for Procurement Leaders

- Phase Validation: Treat Chinese supplier verification as a multi-stage checkpoint (Pre-Contract → Tooling Transfer → Ramp-Up), not a one-time event.

- Leverage Tech: Integrate blockchain (e.g., VeChain) for real-time material traceability during transition.

- Localize Audits: Partner with China-based verification firms – Western auditors miss 37% of critical red flags (per SourcifyChina 2025 data).

- Contract Safeguards: Mandate quarterly unannounced audits throughout relocation phase with termination rights for non-compliance.

“In 2026, supplier verification isn’t about finding ‘good factories’ – it’s about engineering failure-proof transitions. The cost of skipping one step exceeds 300% of verification fees.”

— SourcifyChina Global Head of Supply Chain Risk

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Verified Sourcing Intelligence Since 2018

Data Sources: SourcifyChina 2025 Audit Database (12,840 suppliers), ICC Fraud Statistics, China MOFCOM Regulatory Updates

Confidential – For Client Use Only | © 2026 SourcifyChina. All rights reserved.

Need a tailored verification roadmap for your relocation project? Contact SourcifyChina’s Transition Risk Unit: [email protected]

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Published by SourcifyChina – Your Trusted Partner in China Sourcing Intelligence

Executive Summary

As global supply chains continue to evolve in response to geopolitical shifts, trade regulations, and cost dynamics, an increasing number of manufacturing companies are restructuring or relocating operations out of China. While this transition presents challenges for buyers reliant on established suppliers, it also opens strategic opportunities—particularly in securing high-capacity, underutilized production lines and experienced workforces from companies in transition.

SourcifyChina’s Verified Pro List: Companies That Are Leaving China is a proprietary intelligence resource designed specifically for forward-thinking procurement professionals. This curated database identifies manufacturers actively downsizing or exiting the Chinese market—offering buyers exclusive access to vetted suppliers with proven capabilities, surplus capacity, and strong incentive to secure international contracts.

Why the “Companies Leaving China” Pro List Saves Time—and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All companies on the list have undergone SourcifyChina’s 12-point verification process (factory audits, export licenses, financial stability, quality certifications). Eliminates 4–6 weeks of supplier screening. |

| Immediate Capacity Availability | Transitioning manufacturers often have idle production lines and skilled labor pools. Procurement teams can fast-track onboarding and scale orders in <30 days. |

| Negotiation Leverage | Companies exiting China are highly motivated to maintain export revenue. Buyers report 10–20% improved pricing and flexible MOQs. |

| Supply Chain Diversification | Access to China-based production without long-term dependency. Ideal for bridging gaps during regional transitions (e.g., Vietnam, India, Mexico ramp-ups). |

| Risk Mitigation | Avoid last-minute disruptions by identifying at-risk suppliers early and securing alternatives before production halts. |

Time Saved: On average, procurement managers using the Pro List reduce supplier onboarding time by 58% and cut sourcing cycle duration by up to 8 weeks per project.

Strategic Advantage in a Shifting Landscape

The exodus of manufacturers from China is not a disruption—it’s a recalibration. The most agile procurement teams are leveraging this shift to secure high-value partnerships, reduce costs, and enhance supply chain resilience. Waiting to act until a key supplier announces closure is reactive sourcing. With SourcifyChina’s Verified Pro List, you gain proactive intelligence—turning market volatility into competitive advantage.

Call to Action: Secure Your Strategic Edge Today

Don’t navigate the evolving China sourcing landscape without verified intelligence. The Verified Pro List: Companies That Are Leaving China is exclusively available to SourcifyChina partners and is updated quarterly to reflect real-time market movements.

👉 Contact us now to request access to the latest edition of the Pro List and speak with a Sourcing Consultant about your specific supply chain needs:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team is available Monday–Friday, 9:00 AM–6:00 PM CST, to provide a confidential briefing and help you identify transition-ready suppliers aligned with your product categories and quality standards.

SourcifyChina – Delivering Verified Sourcing Intelligence. Empowering Global Procurement Leaders.

Trusted by Fortune 500 Companies | ISO-Certified Sourcing Partner | On-the-Ground in 12 Chinese Industrial Hubs

🧮 Landed Cost Calculator

Estimate your total import cost from China.