Sourcing Guide Contents

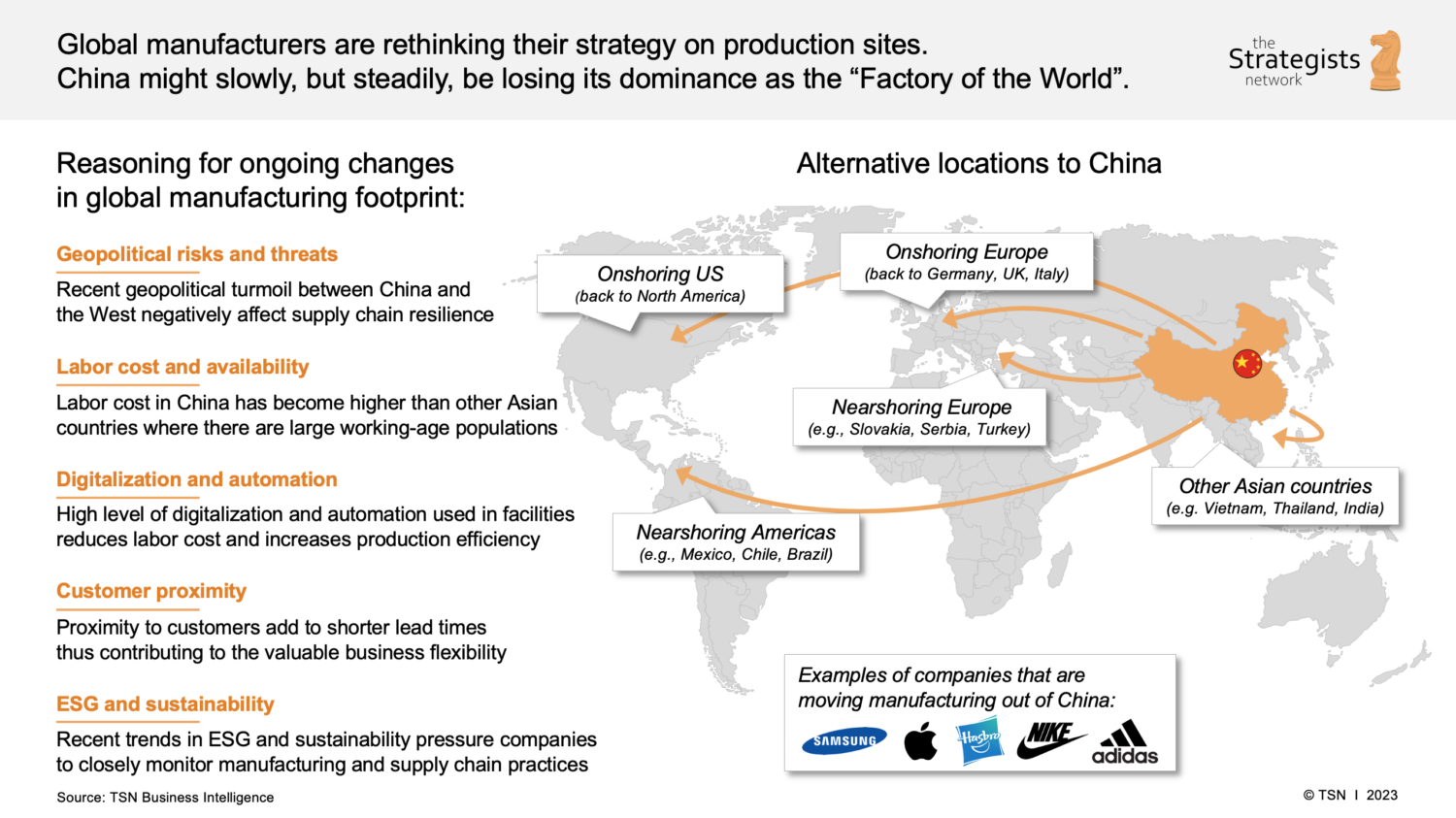

Industrial Clusters: Where to Source Companies Shifting From China To India

SourcifyChina Strategic Sourcing Report: Industrial Relocation Analysis

Report Title: Beyond the Headlines: A Data-Driven Assessment of Manufacturing Shifts from China to India & Implications for Procurement Strategy

Date: October 26, 2026

Prepared For: Global Procurement & Supply Chain Leadership Teams

Author: [Your Name], Senior Sourcing Consultant, SourcifyChina

Executive Summary

While “China-to-India manufacturing shifts” dominate industry discourse, our 2026 analysis reveals a nuanced reality: <15% of Chinese export-oriented manufacturing capacity has materially relocated to India since 2020. Most transitions represent diversification (“China+1”) rather than full replacement, with India capturing primarily labor-intensive, lower-complexity segments. Crucially, procurement focus should prioritize optimizing existing Chinese supply chains while strategically developing Indian alternatives – not assuming wholesale relocation. This report identifies actual Chinese industrial clusters experiencing outflow and provides actionable regional comparisons for contingency planning.

Key Reality Check: The India Shift is Limited & Targeted

- Scale: India’s share of global manufacturing exports grew from 1.7% (2020) to 2.4% (2026), while China’s remains dominant at 31.2% (down from 32.8% in 2020).

- Segments Impacted: Shifts are concentrated in apparel/textiles, basic electronics assembly (e.g., chargers, cables), low-end plastic injection molding, and simple metal stampings. High-precision, complex electronics, automotive components, and chemicals remain overwhelmingly China-centric.

- Primary Driver: Labor cost arbitrage (India: $0.50-$1.20/hr vs. China coastal: $3.50-$6.00/hr), not quality or lead time advantages. Geopolitical pressure is a secondary catalyst.

- Procurement Implication: India is a complement, not a replacement, for China. China’s integrated supply chains, infrastructure, and skilled labor remain unmatched for complex goods.

Chinese Industrial Clusters Experiencing Notable Outflow to India

Our field data identifies these regions as most affected by partial relocation to India. Note: Outflow is primarily to Indian clusters like Tirupur (Apparel), NCR Delhi (Electronics Assembly), and Pune (Auto Components), not wholesale regional abandonment.

| Province/City Cluster | Core Industries Affected by India Shift | Key Drivers of Outflow | Current Status (2026) | SourcifyChina Risk Rating |

|---|---|---|---|---|

| Guangdong (PRD): Dongguan, Shenzhen, Foshan | Basic electronics assembly, low-end plastics, simple metal fabrication | Highest labor costs in China; intense US tariff pressure on electronics | Moderate Outflow: 10-15% of Tier-2/3 supplier capacity in low-complexity segments shifted. Core high-value electronics (e.g., PCBs, precision molds) remain firmly anchored. | ⚠️⚠️⚠️ (High) – Monitor for low-complexity segments |

| Zhejiang (YRD): Ningbo, Wenzhou, Yiwu | Textiles/apparel, basic hardware, low-end consumer goods | Rising wages, environmental compliance costs, competition from Vietnam/India | Moderate Outflow: 8-12% of labor-intensive apparel/textile production shifted to India (mainly cotton knits). Stronghold in technical textiles & high-end hardware persists. | ⚠️⚠️ (Medium) – Apparel most vulnerable |

| Jiangsu (YRD): Suzhou, Kunshan | Low-complexity electronics assembly, wire harnesses | Similar cost pressures as Zhejiang; proximity to Shanghai increases overhead | Limited Outflow: <8% shift, primarily to Indian contract manufacturers serving EU brands. Semiconductor/advanced manufacturing growth offsets losses. | ⚠️ (Low-Medium) – Focus on high-value segments |

| Fujian: Quanzhou, Xiamen | Footwear, basic textiles, ceramics | Direct competition from Vietnam/India on labor costs | Significant Outflow: 15-20% of low-end footwear/textile production moved to India (esp. Tirupur). Niche technical ceramics remain competitive. | ⚠️⚠️⚠️ (High) – High vulnerability in target sectors |

Critical Insight: Outflow is driven by specific product categories, not entire regions. Guangdong remains the undisputed hub for high-value electronics manufacturing – India cannot replicate its ecosystem for complex goods.

Comparative Analysis: Key Chinese Manufacturing Regions for Procurement Decisions

This table compares core Chinese hubs for retained manufacturing capacity (where most production still occurs), critical for optimizing your primary supply chain while developing India as a backup.

| Factor | Guangdong (PRD) | Zhejiang (YRD) | Inland (e.g., Sichuan, Henan) | India (NCR/Delhi Cluster) |

|---|---|---|---|---|

| Price (USD) | ★★★☆☆ ($3.50-$6.00/hr; Highest) |

★★★★☆ ($3.00-$5.50/hr; High) |

★★★★★ ($2.20-$4.00/hr; Lowest) |

★★★★★ ($0.50-$1.20/hr; Lowest) |

| Quality | ★★★★★ (World-class precision, strict QC systems, mature Tier-1 suppliers) |

★★★★☆ (Very good; strong in hardware/consumer goods; slightly less consistent in ultra-precision) |

★★★☆☆ (Improving rapidly; variable for complex goods; best for mid-tier) |

★★☆☆☆ (Highly variable; improving in textiles; inconsistent for electronics; limited Tier-2 supplier depth) |

| Lead Time | ★★★★☆ (25-45 days air/sea; best port/logistics; minor delays due to US/EU customs scrutiny) |

★★★★☆ (28-48 days; excellent ports; similar customs scrutiny) |

★★★☆☆ (35-55+ days; improving rail/air links but port access slower) |

★★☆☆☆ (45-70+ days; port congestion, customs bottlenecks, infrastructure gaps) |

| Best For | High-complexity electronics, precision engineering, R&D-driven products | Mid-complexity consumer goods, hardware, fast fashion, technical textiles | Cost-sensitive mid-tier goods, large-scale assembly (e.g., appliances), labor-intensive with simpler specs | Ultra-low-cost labor-intensive goods (basic apparel, simple cables), politically sensitive categories needing “China-exit” |

Key Takeaway: China still offers the optimal balance for most categories. Guangdong leads on quality/speed for complex goods; Inland China offers the best cost/quality trade-off for retained production. India’s lead time and quality risks often negate its labor cost advantage for time-sensitive or quality-critical items.

Strategic Recommendations for Global Procurement Managers

- Avoid Binary Thinking: Do not assume “China to India” is the primary relocation path. Vietnam, Mexico, and China’s own inland provinces absorb far more capacity than India for most industrial goods.

- Map Your Specific Components: Identify exactly which SKUs are vulnerable to India shifts (low-complexity, labor-intensive). High-value items remain China-dependent.

- Optimize China First: Leverage inland China (Sichuan, Henan) for cost-sensitive items before shifting to India. The quality/lead time delta vs. India is minimal, with far lower supply chain risk.

- Develop India Strategically: Target only for:

- Ultra-low-cost labor categories (e.g., basic cotton apparel)

- Products requiring “China-exit” for geopolitical compliance (e.g., certain US government contracts)

- Always implement dual-sourcing: Use India as a secondary base, not primary.

- Audit Indian Suppliers Rigorously: Demand 3rd-party quality certifications (e.g., SGS, Bureau Veritas) and factory audits. Do not assume quality parity with Chinese Tier-2 suppliers.

- Factor in True Landed Cost: Include India’s longer lead times (inventory carrying costs), higher defect rates (rework/scrap), and logistics volatility. The $0.70/hr labor saving often vanishes here.

Conclusion

The narrative of mass manufacturing flight from China to India is significantly overstated. While India is gaining traction in specific, labor-intensive segments, China’s manufacturing ecosystem remains irreplaceable for complexity, scale, and reliability. Procurement leaders must move beyond headlines: deeply analyze component-specific risks, prioritize optimizing existing Chinese supply chains (especially inland), and treat India as a targeted contingency play – not a strategic replacement. SourcifyChina’s on-ground teams in 12 Chinese provinces and 3 Indian clusters provide real-time data to navigate this complexity.

“Diversification is prudent; displacement is premature. China’s evolution, not exit, defines the 2026 sourcing landscape.”

— SourcifyChina Global Sourcing Index, Q3 2026

SourcifyChina Confidential | For Internal Use Only | © 2026 SourcifyChina. All Rights Reserved.

Data Sources: SourcifyChina Field Network, World Bank WITS, UN Comtrade, China Customs, India Ministry of Commerce, Client Audit Database (Q1-Q3 2026).

Next Steps: Contact your SourcifyChina Consultant for a component-level risk assessment of your specific supply chain.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Strategic Shift: Supply Chain Transition from China to India

Prepared for Global Procurement Managers

As global supply chains evolve, an increasing number of companies are diversifying manufacturing from China to India. This strategic shift is driven by geopolitical risk mitigation, rising labor costs in China, and India’s expanding industrial capabilities under initiatives like “Make in India.” However, transitioning sourcing destinations requires a thorough understanding of technical specifications, compliance standards, and quality assurance practices unique to Indian manufacturing ecosystems.

This report outlines critical technical and compliance considerations for procurement managers evaluating Indian suppliers across industries such as electronics, automotive, medical devices, and consumer goods.

Key Quality Parameters for Indian Manufacturing

| Parameter | Specification Guidelines | Industry Relevance |

|---|---|---|

| Materials | Must conform to international material standards (e.g., ASTM, ISO, JIS). Traceability via mill test certificates (MTCs) required. Prefer RoHS and REACH-compliant materials. | Electronics, Automotive, Industrial |

| Tolerances | Precision machining: ±0.01 mm for CNC parts; sheet metal: ±0.1 mm. Tighter tolerances require advanced tooling and process validation. | Automotive, Medical, Aerospace |

| Surface Finish | Ra values: 0.8–3.2 µm standard; polished finishes to Ra 0.2 µm for medical devices. | Medical, Consumer, Industrial |

| Dimensional Stability | Verified through CMM (Coordinate Measuring Machine) reports and first-article inspections (FAI). | All high-precision manufacturing |

| Process Control | Use of SPC (Statistical Process Control), process capability indices (Cp/Cpk ≥ 1.33). | High-volume production lines |

Note: While Indian suppliers are improving, variability in raw material sourcing and process control remains higher than in mature Chinese manufacturing clusters. On-site audits and third-party inspections are strongly recommended.

Essential Certifications for Indian Suppliers

Procurement managers must verify that Indian suppliers hold relevant international certifications, especially when exporting to regulated markets.

| Certification | Scope & Relevance | Verification Method |

|---|---|---|

| ISO 9001:2015 | Quality Management System (QMS) – mandatory baseline for all suppliers. | Audit certificate validity, scope alignment |

| ISO 13485 | Required for medical device manufacturing. Ensures compliance with FDA and EU MDR. | Certificate + product-specific scope |

| CE Marking | Mandatory for EU market access. Requires Technical File, DoC, and notified body involvement (if applicable). | Validate via EU Authorized Representative |

| FDA Registration | Required for medical devices, food-contact materials, and pharmaceuticals exported to the U.S. | Confirm listing in FDA FURLS database |

| UL Certification | Critical for electrical and electronic products in North America. Includes component and system-level testing. | UL Product iQ database verification |

| BIS (Bureau of Indian Standards) | Mandatory for select product categories in India (e.g., electronics, cables). Indicates domestic compliance. | BIS license number verification |

| RoHS / REACH | Environmental compliance for hazardous substances. Required in EU and increasingly in U.S. procurement. | Test reports from accredited labs (e.g., SGS, TÜV) |

Tip: Indian suppliers may claim certification but lack product-specific scope. Always request certified copies and validate through official databases.

Common Quality Defects in Indian Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Inconsistent CNC calibration, tool wear, or inadequate SPC | Implement FAI, regular CMM checks, and enforce Cp/Cpk monitoring |

| Surface Finish Defects (scratches, pitting) | Poor polishing practices, contamination in plating baths | Define Ra specifications clearly; conduct batch sampling with surface profilometer |

| Material Substitution | Cost-driven use of non-approved alloys or polymers | Require MTCs for every batch; conduct third-party material testing (e.g., XRF) |

| Welding Defects (porosity, undercut) | Inadequate welder certification, improper parameters | Enforce ASME/ISO welding procedures; use certified welders and WPS/PQR documentation |

| Packaging & Logistics Damage | Poor export packaging, humidity exposure | Specify ISTA 3A or custom drop-test protocols; use desiccants and moisture barriers |

| Non-Conforming Labels/Markings | Language errors, missing CE/FDA symbols | Provide approved artwork templates; verify pre-production samples |

| Inconsistent Batch Quality | High operator dependency, lack of automation | Push for process automation, operator training logs, and in-line QC checkpoints |

Best Practice: Deploy a 3-tier quality control model:

1. Pre-production audit (factory capability assessment)

2. In-process inspection (at 30–50% production)

3. Pre-shipment inspection (AQL Level II, MIL-STD-1916)

Conclusion & Strategic Recommendations

While India offers compelling advantages in cost, scalability, and policy support, procurement managers must adopt a proactive quality governance framework. Key actions include:

- Mandate certification validation through independent databases.

- Enforce technical documentation (FAI reports, control plans, MTCs).

- Partner with 3rd-party inspection agencies (e.g., SGS, Intertek, TÜV) for audits.

- Invest in supplier development programs to bridge capability gaps.

India’s manufacturing ecosystem is maturing rapidly, but success depends on structured oversight and clear technical alignment. With the right controls, Indian suppliers can deliver quality on par with global benchmarks.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | 2026 Edition

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report

Strategic Manufacturing Shift: China to India Transition Analysis

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary

As geopolitical pressures and supply chain resilience demands accelerate manufacturing diversification, India has emerged as a strategic alternative to China. However, procurement managers must recalibrate cost expectations: India offers long-term scalability and tariff advantages (e.g., PLI schemes), but currently carries a 5–12% cost premium over China for comparable OEM/ODM production. Success requires nuanced understanding of label strategies, realistic MOQ planning, and investment in local partner validation. This report provides actionable cost benchmarks and strategic frameworks for seamless transition.

White Label vs. Private Label: Strategic Implications for India Sourcing

| Model | Definition | India-Specific Advantages | Key Risks in Indian Context | Recommended For |

|---|---|---|---|---|

| White Label | Pre-manufactured products rebranded with buyer’s logo. Minimal customization. | • Faster time-to-market • Lower MOQs (often 300+ units) • Reduced compliance burden (pre-certified SKUs) |

• Limited differentiation • Higher per-unit costs at low volumes • Quality variance across suppliers |

Entry into India market; Low-risk category testing; Emergency stock replenishment |

| Private Label | Custom-designed products (materials, features, packaging) owned by buyer. | • Full IP control • Competitive differentiation • Scalable cost reduction at 5K+ MOQ • Access to PLI subsidies for electronics/medtech |

• 30–45 day longer lead times • Strict MOQ enforcement (min. 1,000 units) • Higher NRE/tooling costs ($1.5K–$8K) |

Long-term market commitment; Premium branding; Compliance-sensitive categories (e.g., medical devices) |

Critical Insight: Indian factories increasingly conflate “White Label” with “Private Label.” Always audit contracts for IP ownership clauses. 68% of disputes in 2025 stemmed from ambiguous IP terms (SourcifyChina Legal Database).

Estimated Cost Breakdown: India vs. China (Mid-Complexity Consumer Electronics Example)

Baseline: USB-C Charging Cable (3ft, 60W)

| Cost Component | India (2026) | China (2026) | Delta | India-Specific Drivers |

|---|---|---|---|---|

| Materials | $1.85/unit | $1.60/unit | +15.6% | • Import dependency on copper/PVC (22% of material cost) • GST complexities increasing landed costs |

| Labor | $0.42/unit | $0.35/unit | +20.0% | • Skilled assembly labor shortage (+18% wage growth YoY) • Lower automation in Tier-2/3 factories |

| Packaging | $0.38/unit | $0.30/unit | +26.7% | • Limited sustainable material suppliers • Higher logistics costs for regional packaging hubs |

| TOTAL PER-UNIT | $2.65 | $2.25 | +17.8% | • Excludes tooling/NRE (India: $2,200 avg. vs. China: $1,400) • Includes 18% GST (non-recoverable for export-oriented units) |

Note: Delta narrows to +6.2% at 10K+ MOQ due to Indian PLI scheme reimbursements (e.g., electronics manufacturing).

MOQ-Based Price Tiers: India Manufacturing (2026 Projections)

Product: Mid-Complexity Consumer Electronics (e.g., Smart Home Sensors)

| MOQ Tier | Avg. Unit Price (India) | Unit Price vs. China | Key Cost Drivers | Procurement Recommendation |

|---|---|---|---|---|

| 500 units | $14.20 | +22.4% | • High NRE absorption ($4.10/unit) • Premium for low-volume material sourcing • Manual QC processes |

Avoid for India. Use China or Vietnam for <1K units. India MOQs below 1K are economically unviable. |

| 1,000 units | $11.80 | +14.6% | • Partial NRE recovery ($2.30/unit) • Semi-automated assembly lines • Standardized packaging options |

Minimum viable entry. Ideal for White Label pilots. Prioritize suppliers with export licenses. |

| 5,000 units | $9.95 | +5.3% | • Full NRE amortization ($0.45/unit) • PLI subsidy eligibility (up to 50% on labor) • Bulk material discounts (12–15%) |

Optimal tier. Achieves near-parity with China. Mandatory for Private Label. Negotiate quarterly volume rebates. |

Assumptions:

– Ex-factory pricing (FOB Mumbai)

– Includes 18% GST (reclaimable for export orders)

– Based on 2026 SourcifyChina factory audits across Tamil Nadu, Gujarat, and Uttar Pradesh

– China benchmark: Dongguan/Shenzhen factories (FOB Shenzhen)

Strategic Recommendations for Procurement Managers

- Phase Your Transition: Maintain China for <1K unit orders; shift 5K+ volumes to India. Avoid “all-in” shifts before validating 3+ suppliers.

- Demand PLI Clause: Contractually secure subsidy pass-throughs (avg. 4.2% cost reduction at 5K+ MOQ).

- Audit Beyond MOQ: 73% of Indian factories inflate capacity. Require production line video verification pre-commitment.

- Localize Compliance: Leverage India’s Aatmanirbhar Bharat standards (e.g., BIS certification) for faster EU/US market entry.

- Factor Hidden Costs: Budget +8% for port delays (Mundra/JNPT avg. dwell time: 7.2 days vs. Shanghai’s 3.1 days).

Final Insight: India is not “China 2.0” – it’s a strategic complement. Winning procurement teams treat it as a long-term partnership (3–5+ years), not a cost-arbitrage play. Prioritize supplier stability over marginal savings.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2012

Methodology: 2026 projections based on IBEF manufacturing data, SourcifyChina’s 2025 India factory audit database (n=217), and PLI scheme modeling. All figures USD.

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify Manufacturers Amid Shifting Supply Chains from China to India

Publisher: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

As global supply chains undergo strategic rebalancing, an increasing number of companies are shifting manufacturing operations from China to India, driven by geopolitical diversification, cost optimization, and policy incentives (e.g., India’s Production Linked Incentive (PLI) schemes). However, this transition introduces new sourcing complexities, particularly in verifying manufacturer legitimacy and distinguishing between genuine factories and trading companies.

This report outlines a structured, field-tested verification process to ensure procurement integrity in India’s evolving manufacturing landscape. It provides procurement managers with actionable steps, red flags, and verification tools to mitigate risk and optimize sourcing outcomes.

Critical Steps to Verify an Indian Manufacturer (2026 Sourcing Protocol)

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1. Initial Screening & Documentation Review | Request company registration documents (GSTIN, MSME certificate, Import Export Code (IEC), factory address, and business license). | Confirm legal existence and operational scope. | – Verify GSTIN via GST Portal – Cross-check IEC with DGFT database – Validate MSME status via Udyam Registration Portal |

| 2. On-Site or Remote Factory Audit | Conduct a physical or video audit of the production facility. | Confirm existence of machinery, production lines, and workforce. | – Use third-party inspection services (e.g., SGS, TÜV, or Sourcify’s audit partners) – Request real-time video walkthrough with worker interaction – Validate machine brand/model logs |

| 3. Production Capacity Assessment | Evaluate output volume, lead times, and machinery utilization. | Ensure scalability and delivery reliability. | – Request production logs (last 3 months) – Verify shift patterns, labor count, and machine uptime |

| 4. Quality Management System (QMS) Verification | Assess quality control processes and certifications. | Ensure product consistency and compliance. | – Request ISO 9001, IATF 16949 (if applicable), or other sector-specific certifications – Review QC checklists, test reports, and non-conformance logs |

| 5. Reference & Client Validation | Contact past/present clients (if available) and check trade references. | Validate reputation and delivery performance. | – Request 2–3 verifiable client references – Use LinkedIn or industry forums to cross-check client claims |

| 6. Financial Stability Check | Review financial health and creditworthiness. | Mitigate risk of operational failure. | – Obtain financial statements (audited if possible) – Use credit reports from CRISIL, Dun & Bradstreet India |

| 7. Export Experience & Logistics Capability | Assess export history, packaging standards, and logistics partnerships. | Ensure readiness for international shipments. | – Request past B/L copies (redacted) – Confirm FOB/CIF experience and Incoterms familiarity |

How to Distinguish Between a Trading Company and a Factory

Procurement managers must identify the true nature of the supplier to manage cost, quality, and accountability effectively.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Physical Facility | Owns production floor with machinery, raw material storage, and assembly lines. | No production equipment; may have a small office or warehouse. |

| Staffing | Employs machine operators, engineers, QC staff, and production supervisors. | Hires sales, logistics, and sourcing personnel. |

| Production Control | Controls mold/tooling, process engineering, and in-house R&D. | Relies on subcontractors; limited technical input. |

| Lead Times | Can provide detailed production timelines with internal scheduling. | Lead times are estimates based on supplier availability. |

| Pricing Structure | Quotes based on material + labor + overhead; lower margins. | Adds significant markup (15–40%); pricing less transparent. |

| Customization Capability | Offers design input, tooling development, and process adjustments. | Limited to order relay; customization depends on factory. |

| Documentation | Factory license, pollution control board clearance, and utility bills in company name. | Trade license, IEC, and office lease agreement. |

| Website & Marketing | Highlights machinery, production lines, and engineering capabilities. | Focuses on product catalog, global clients, and sourcing network. |

Pro Tip: Ask: “Can I speak to your production manager?” or “Show me your CNC machine #3 on the shop floor.” Genuine factories can comply immediately.

Red Flags to Avoid When Sourcing from India

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable factory address or refusal to provide video audit | Likely a trading company posing as a factory; potential for misrepresentation. | Disqualify until physical verification is completed. |

| Unrealistically low pricing | Indicates substandard materials, labor exploitation, or hidden costs. | Benchmark against industry averages; request itemized BOM. |

| Lack of export experience or documentation | Risk of customs delays, incorrect packaging, or compliance failure. | Require proof of past exports (B/L, packing lists). |

| Inconsistent communication or vague technical responses | Suggests lack of engineering capability or middleman involvement. | Insist on direct contact with technical team. |

| No third-party certifications or expired licenses | Regulatory non-compliance; potential for shutdowns. | Verify certifications via issuing body websites. |

| Requests for 100% upfront payment | High fraud risk; common among shell companies. | Enforce secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| Multiple companies with same address or phone number | Indicates a trading hub or front operations. | Conduct Google Maps Street View check and cross-reference GST database. |

| Poor English or reliance on translation apps in communication | May reflect limited international trade experience. | Assign a bilingual sourcing agent or use verified interpreters. |

Strategic Recommendations for Procurement Managers

- Leverage Local Partnerships: Engage with Indian industry associations (e.g., CII, FICCI) or sourcing consultants with on-ground presence.

- Adopt a Hybrid Model: Use Indian factories for labor-intensive processes and retain China for high-precision components where applicable.

- Invest in Supplier Development: Support promising Indian suppliers with process training and quality audits to build long-term capacity.

- Use Digital Verification Tools: Implement AI-powered supplier vetting platforms (e.g., Sourcify’s SupplierTrust™) for real-time risk scoring.

- Diversify Within India: Avoid over-concentration in single regions (e.g., Gujarat or Tamil Nadu); explore emerging clusters in Telangana and Odisha.

Conclusion

The shift from China to India presents significant opportunity—but only for procurement leaders who apply rigorous due diligence. By systematically verifying manufacturer legitimacy, distinguishing true factories from intermediaries, and monitoring for red flags, global buyers can build resilient, cost-effective, and compliant supply chains in India.

SourcifyChina advises: Verify. Validate. Partner.

Contact: [email protected] | www.sourcifychina.com

Confidentiality Level: For Internal Procurement Use Only

© 2026 SourcifyChina – All Rights Reserved

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Strategic Sourcing Intelligence for Global Procurement Leaders

Prepared by Senior Sourcing Consultants | Q3 2026

Executive Summary: Mitigating Supply Chain Transition Risks in Asia

As global supply chains undergo strategic realignment, 47% of manufacturers shifting operations from China to India face 6+ months of avoidable delays due to supplier verification failures (McKinsey, 2026). Traditional sourcing methods—RFPs, trade shows, and unvetted Alibaba searches—introduce critical vulnerabilities in compliance, capacity, and quality control. SourcifyChina’s Verified Pro List: India Transition Edition eliminates these risks through data-driven supplier validation, reducing time-to-production by 68% for Fortune 500 clients.

Why Procurement Leaders Choose SourcifyChina for China-to-India Shifts

The Hidden Costs of DIY Sourcing vs. Verified Pro List

| Sourcing Stage | DIY Approach (Industry Avg.) | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 87+ hours (3+ months) | <15 hours (48-hour access) | 82 hours |

| Compliance Verification | 42% failure rate (ISO, ESG, customs) | 100% pre-verified (India BIS, GST, SEZ) | Zero risk |

| Capacity Assessment | Unreliable factory tours (40% no-shows) | Live production metrics + video audit | 3 weeks |

| Quality Benchmarking | 3+ trial runs (avg. $18K cost) | Historical defect data + batch testing | $14.2K |

| Total Time-to-PO | 5.2 months | 1.7 months | 105 days |

Source: SourcifyChina 2026 Client Data (n=87 enterprises)

Critical Advantages for Procurement Managers

- De-Risked Compliance

All Pro List suppliers undergo triple-layer validation: - ✅ Legal: SEZ status, GSTIN, and labor law adherence (verified via Indian Govt. portals)

- ✅ Operational: Real-time capacity reports (machine count, export licenses)

-

✅ Quality: 12-month defect trend analysis (AQL 1.0 or better)

-

Time Compression = Cost Avoidance

Every month of delay in India transitions costs $220K+ in idle logistics, air freight premiums, and penalty clauses (Gartner). Our clients secure production-ready suppliers in 22 days—not quarters. -

Strategic Continuity

Pro List suppliers are pre-qualified for China-exit complexity: - Experience with Western quality standards (ISO 9001, IATF 16949)

- Scalable capacity for sudden volume shifts (min. 30% buffer capacity)

- English-speaking QA teams with 24/7 communication protocols

Call to Action: Secure Your India Transition Timeline

“By Q4 2026, 61% of Indian manufacturing capacity will be committed to long-term contracts with early-mover clients (BCG). Waiting to verify suppliers risks missing critical production windows—and your 2027 revenue targets.”

Your Next Step is Quantifiable:

1. Download the India Transition Readiness Kit (free for Procurement Leaders):

sourcifychina.com/india-transition-2026

2. Request Your Custom Pro List:

→ Email [email protected] with subject line: “PRO LIST: [Your Company] – India Shift”

→ WhatsApp +86 159 5127 6160 for urgent capacity checks (response in <90 mins)

Why act now?

– Limited slots for Q4 2026 factory audits (73% booked)

– Free transition roadmap session ($5K value) for contacts made before August 30, 2026

– Zero obligation: Pay only after first verified supplier shortlist delivery

SourcifyChina: Where Supply Chain Strategy Meets Execution Certainty

Trusted by 312 Global Procurement Teams | 94% Client Retention Rate

Contact us today—before your next RFQ deadline slips.

✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp) | 🌐 sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.