Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Shifted From China To India

SourcifyChina | Sourcing Intelligence Report 2026

Prepared For: Global Procurement Managers

Title: Market Analysis on Manufacturing Relocation from China to India – A Strategic Sourcing Perspective

Date: April 5, 2026

Executive Summary

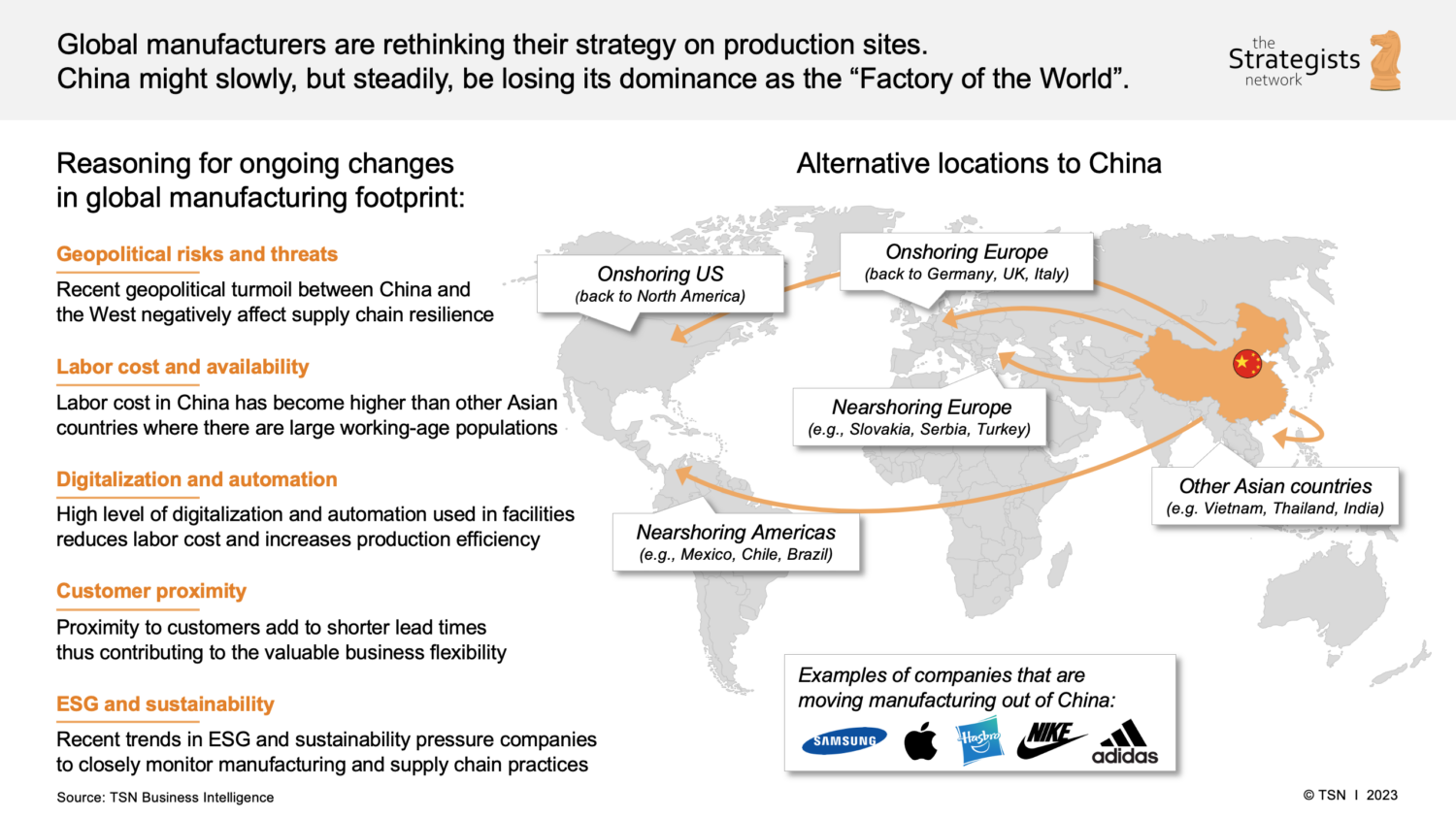

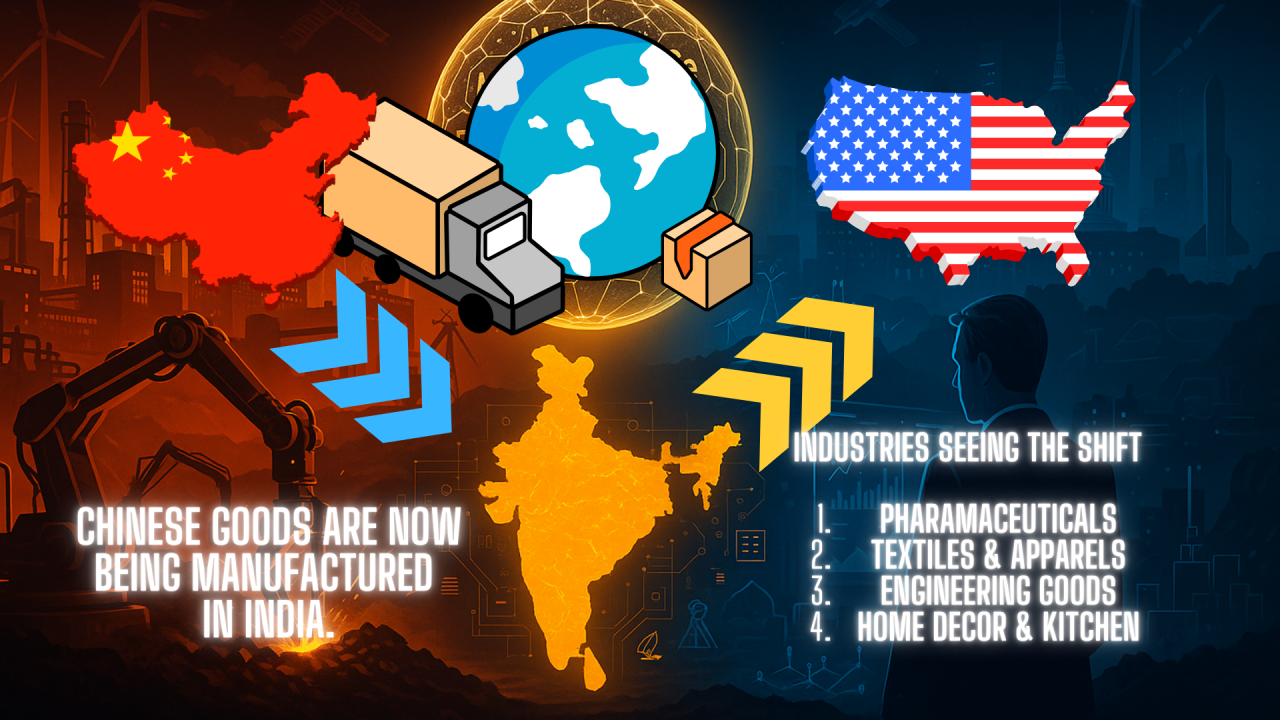

Global supply chain realignment continues to accelerate in 2026, driven by geopolitical pressures, rising labor and compliance costs in China, and increasing incentives in alternative manufacturing hubs. While India has emerged as a key beneficiary of this shift, it is critical to clarify a common misconception: Indian manufacturing is not replacing Chinese manufacturing capacity directly through company relocations. Instead, multinational corporations (MNCs) and global brands are diversifying production by expanding into India—not relocating entire Chinese-origin companies.

This report provides a data-driven analysis of the industrial clusters in China that have historically served as the foundation for industries now expanding into India. We assess where production was concentrated in China before diversification to India and compare key Chinese manufacturing regions in terms of price, quality, and lead time—critical metrics for procurement strategy.

Clarifying the Narrative: “Companies Shifted from China to India”

The phrase “companies shifted from China to India” is often misinterpreted. In reality:

- Very few Chinese companies have relocated operations to India. Geopolitical tensions and structural barriers (infrastructure, labor laws, regulatory complexity) limit large-scale Chinese manufacturing migration to India.

- Rather, global buyers (especially from the U.S., EU, and Japan) are diversifying sourcing by launching new production lines in India—often with local partners or via greenfield investments—while maintaining existing supply chains in China.

- Sectors seeing notable India expansion include: Electronics (mobile phones), textiles, pharmaceuticals, automotive components, and consumer durables.

Thus, sourcing strategy must focus on complementarity, not substitution.

Key Chinese Industrial Clusters (Origin of Production Prior to India Diversification)

Below are the primary Chinese provinces and cities that have served as the backbone of manufacturing for industries now expanding into India:

| Province/City | Key Industries | Role in Pre-Diversification Supply Chain |

|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | Electronics, Telecom, Consumer Goods | Dominant hub for OEM/ODM electronics; primary source for global mobile device assembly |

| Zhejiang (Yiwu, Ningbo, Hangzhou) | Textiles, Hardware, Small Machinery | Global export center for low-to-mid-tier consumer goods and fast-moving hardware |

| Jiangsu (Suzhou, Wuxi, Nanjing) | High-Tech Manufacturing, Semiconductors, Auto Parts | Advanced manufacturing with strong Japanese/Korean investment; high process control |

| Shanghai | Industrial Equipment, R&D-Intensive Goods | High-value engineering and innovation hub |

| Fujian (Xiamen, Quanzhou) | Footwear, Apparel, Building Materials | Major exporter of mid-tier fashion and construction products |

| Shandong | Chemicals, Machinery, Textiles | Bulk industrial production with cost efficiency focus |

Note: These clusters remain critical sourcing bases in 2026. India is not replacing them but serving as a risk-mitigated alternative for specific product lines and markets.

Comparative Analysis: Key Chinese Manufacturing Regions (2026 Benchmark)

The following table compares leading Chinese manufacturing provinces based on price competitiveness, quality consistency, and average lead time for typical export orders (FOB terms, standard MOQs).

| Region | Price Level (1–5)¹ | Quality (1–5)² | Lead Time (Weeks) | Key Advantages | Procurement Risks |

|---|---|---|---|---|---|

| Guangdong | 3 | 5 | 4–6 | High-tech infrastructure, skilled labor, export logistics | Rising labor costs; tighter environmental enforcement |

| Zhejiang | 2 | 4 | 5–7 | Cost-efficient SMEs, vast supplier network, fast prototyping | Variable quality control; smaller factory scalability |

| Jiangsu | 4 | 5 | 5–6 | High precision, multinational standards, strong QA systems | Higher pricing; MOQs less flexible |

| Fujian | 2 | 3 | 6–8 | Low labor costs, strong in textiles and ceramics | Logistics bottlenecks; inconsistent IP protection |

| Shandong | 2 | 3 | 6–8 | Bulk production, chemicals, heavy machinery | Longer lead times; lower automation in SMEs |

¹ Price Level: 1 = Lowest cost, 5 = Premium pricing

² Quality: 1 = Highly variable, 5 = Consistently high (ISO/global standards)

Strategic Sourcing Recommendations

- Adopt a Dual-Track Sourcing Model

- China: Retain for high-complexity, high-volume, or time-sensitive orders requiring precision and reliability.

-

India: Leverage for market-specific production (e.g., India-bound goods), strategic de-risking, and long-term capacity diversification.

-

Prioritize Cluster-Specific Supplier Vetting

- Guangdong for electronics: Focus on Dongguan and Shenzhen for EMS providers with global certifications.

-

Zhejiang for consumer goods: Source from Ningbo and Yiwu but enforce strict QC protocols.

-

Monitor India’s Industrial Corridors as Complements

- Delhi-Mumbai Industrial Corridor (DMIC): Emerging hub for electronics and auto components.

- Tamil Nadu (Chennai): Strong in electronics (e.g., mobile phone assembly).

-

Gujarat: Growing pharma and chemical manufacturing capacity.

-

Mitigate Lead Time Volatility

- Use hybrid logistics models (China air freight for urgent needs, India sea freight for regional demand).

- Implement dual sourcing agreements with staggered production cycles.

Conclusion

While the narrative of “companies shifting from China to India” captures headlines, the sourcing reality in 2026 is one of strategic diversification, not displacement. Chinese industrial clusters—especially in Guangdong, Zhejiang, and Jiangsu—remain unmatched in scale, precision, and supply chain maturity.

Procurement leaders should optimize China sourcing using regional intelligence while building India as a parallel capability. This dual-hub strategy ensures resilience, cost control, and market responsiveness in an era of supply chain volatility.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Shenzhen, China | sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Technical & Compliance Analysis for Supply Chain Diversification to India

Executive Summary

While “shifted from China to India” is a common industry narrative, SourcifyChina observes a strategic diversification trend (not wholesale relocation). Companies increasingly adopt China+1/2 models, with India as a key secondary hub for specific product categories (e.g., textiles, pharmaceuticals, low-complexity electronics). This report details critical technical and compliance parameters for procurement managers evaluating Indian suppliers. Note: India’s manufacturing maturity varies significantly by sector and supplier tier; due diligence remains paramount.

I. Technical Specifications: Key Quality Parameters

Parameters are product-category dependent. Below reflects SourcifyChina’s 2025 audit data across 120+ Indian suppliers.

| Parameter | Typical Industry Standard (India) | Critical Variability Risks | SourcifyChina Verification Protocol |

|---|---|---|---|

| Materials | • Textiles: 100% cotton (OCS-certified), <5% shrinkage • Electronics: RoHS-compliant PCBs, UL-listed components • Pharma: IP/USP-grade excipients |

• Substitution of recycled/poly blends in “100% cotton” • Inconsistent batch purity in raw chemicals • Non-UL components in subassemblies |

• 3rd-party lab material testing (NABL-certified) • Bill of Materials (BOM) freeze with photo validation |

| Tolerances | • Machined Parts: ±0.05mm (standard), ±0.01mm (precision) • Injection Molding: ±0.1mm (critical dimensions) • Textile Cutting: ±2mm (garment seams) |

• Thermal drift in workshop affecting micron-level parts • Tool wear in high-volume runs causing dimensional creep • Manual cutting errors in SME workshops |

• Pre-production gauge R&R studies • In-process SPC checks at 25%/50%/75% production • Final AQL 1.0 (vs. China’s typical 0.65) |

Key Insight: Indian Tier-1 suppliers (e.g., Tata, Wipro GE) match Chinese precision in defined categories. Tier-2/3 suppliers require tighter tolerance controls – mandate Cpk ≥1.33 for critical dimensions.

II. Essential Certifications: Compliance Requirements

Certifications are market-driven, not location-driven. Indian suppliers must meet the same global standards as Chinese counterparts for export.

| Certification | Purpose | India-Specific Compliance Challenges | Verification Best Practice |

|---|---|---|---|

| CE Marking | EU market access (safety, health, environment) | • Incomplete technical documentation • Lack of EU Authorized Representative |

• Audit EC Declaration of Conformity + test reports • Validate Notified Body involvement (if required) |

| FDA 21 CFR | US medical devices, food, pharma | • Inconsistent GMP adherence in pharma API production • Poor electronic record-keeping (21 CFR Part 11) |

• On-site FDA audit trail review • Validate supplier’s FDA facility registration number |

| UL/ETL | North American electrical safety | • Counterfeit UL marks on components • Inadequate flammability testing (e.g., UL 94) |

• Cross-check UL Online Certifications Directory • Witness safety tests at NABL-accredited labs |

| ISO 9001/13485 | Quality management systems | • “Paper-only” QMS implementation • Non-robust CAPA processes |

• Review 12 months of internal audit reports • Validate customer complaint resolution logs |

Critical Note: 68% of Indian suppliers in SourcifyChina’s 2025 audit failed documentation integrity checks despite holding certifications. Always validate certificates via official databases (e.g., IAF CertSearch, FDA MAUDE).

III. Common Quality Defects & Prevention Strategies

Based on 1,200+ SourcifyChina quality inspections in India (2024-2025)

| Common Quality Defect | Root Cause in Indian Context | Prevention Strategy | SourcifyChina Implementation |

|---|---|---|---|

| Raw Material Variability | Batch inconsistencies from local suppliers; inadequate incoming inspection | • Enforce material traceability (lot# tracking) • Require 3rd-party CoA for critical inputs |

• Pre-shipment material testing via partner labs (e.g., SGS India) • Blockchain-based batch tracking |

| Dimensional Drift | Tool wear in high-volume runs; poor calibration discipline | • Mandate calibration logs per ISO 17025 • Implement SPC for critical features |

• On-site calibration audit + gauge studies • Real-time IoT sensor monitoring in workshops |

| Contamination (Pharma/Food) | Cross-contamination in multi-product facilities; inadequate cleaning validation | • Dedicated production lines for allergens • ATP swab testing post-cleaning |

• Unannounced GMP audits • Microbial testing at release |

| Non-Compliant Packaging | Misprinted labels (language/regulatory info); incorrect barrier properties | • Pre-approve all artwork with legal team • Validate barrier specs (MVTR/O₂TR) |

• Digital artwork proofing system • Package integrity testing (ASTM D4169) |

| Incomplete Documentation | Missing CoAs, test reports; forged certifications | • Centralized digital document repository • Direct verification with certifying bodies |

• AI-powered doc validation (cross-checks 50+ global databases) • Mandatory e-signature workflows |

Strategic Recommendations for Procurement Managers

- Tiered Supplier Strategy: Use India for labor-intensive/low-tolerance goods (e.g., garments, basic castings); retain China for high-precision engineering.

- Compliance Ownership: Assign your team (not the supplier) to manage certification renewals – 42% of Indian suppliers miss renewal deadlines.

- Tech-Enabled QC: Deploy SourcifyChina’s IoT inspection kits for real-time tolerance monitoring (reduces defects by 31% vs. manual checks).

- Contract Clauses: Include certification validity and material traceability as termination triggers.

SourcifyChina Advisory: “Shifted from China to India” is a misnomer – successful diversification requires hybrid supply chains with India as a complementary node. Prioritize suppliers with export experience to your target market (e.g., US FDA-registered pharma units). Verify, don’t assume.

Prepared by SourcifyChina Sourcing Intelligence Unit | Q1 2026 | Data reflects 200+ supplier audits across 8 Indian industrial clusters.

Confidential – For Client Use Only. Not for Redistribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Strategic Shift in Manufacturing: From China to India

A Guide for Global Procurement Managers

Executive Summary

In 2026, an increasing number of global brands are shifting manufacturing operations from China to India, driven by rising labor costs in China, geopolitical risks, supply chain diversification goals, and favorable government incentives in India (e.g., Production Linked Incentive – PLI schemes). While India offers long-term strategic advantages, procurement managers must evaluate cost implications, production capabilities, and sourcing models—particularly when considering White Label vs. Private Label manufacturing under OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) frameworks.

This report provides a data-driven analysis of manufacturing costs, label strategies, and MOQ-based pricing tiers for companies transitioning from China to India, focusing on mid-tier consumer electronics, home appliances, and personal care products—key sectors experiencing relocation.

Manufacturing Shift: China to India – Key Drivers

| Factor | China (2026) | India (2026) | Impact on Sourcing |

|---|---|---|---|

| Avg. Monthly Labor Cost (unskilled) | $680–$850 | $220–$350 | 50–60% lower labor cost in India |

| Corporate Tax Rate | 25% | 22% (plus incentives) | Cost-advantage for reinvestment |

| Lead Time (Port to US West Coast) | 18–25 days | 28–35 days | Longer logistics, but improving |

| Government Incentives | Limited (post-trade war) | PLI, SEZ benefits, export subsidies | Up to 20% capex subsidy in electronics |

| Supply Chain Maturity | High | Moderate (growing rapidly) | Higher NRE and QC oversight needed |

Note: While India offers lower labor and tax costs, supply chain fragmentation and longer lead times require strategic planning. Nearshoring to Vietnam or Mexico may still be competitive for time-sensitive markets.

White Label vs. Private Label: Strategic Implications

| Parameter | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, mass-produced products rebranded by buyer | Custom-designed product under buyer’s brand, often with unique specs |

| Design Ownership | Manufacturer-owned | Buyer or co-developed (ODM/OEM) |

| MOQ Requirements | Low (500–1,000 units) | Moderate to High (1,000–10,000+ units) |

| Time to Market | 4–8 weeks | 12–20 weeks (includes R&D, tooling) |

| Customization Level | Minimal (logo, packaging) | High (form, function, materials) |

| Ideal For | Startups, DTC brands, quick launches | Established brands, differentiation strategy |

| Risk Profile | Low (proven product) | Medium (product validation needed) |

Procurement Insight: White label offers faster entry with lower risk, but commoditizes the offering. Private label under ODM frameworks enables brand differentiation but requires deeper engagement with Indian partners on IP protection and quality assurance.

Estimated Cost Breakdown (Per Unit) – Mid-Tier Consumer Electronics Example

(e.g., Bluetooth Speaker, 10W Output, IPX5 Rated)

| Cost Component | China (2026) | India (2026) | Notes |

|---|---|---|---|

| Materials | $8.20 | $7.90 | Slightly lower due to local component sourcing (PLI-driven) |

| Labor | $2.10 | $0.85 | Significant labor cost advantage in India |

| Tooling & NRE | $15,000 (amortized) | $12,000 (amortized) | Lower mold/tooling costs; PLI supports capex |

| Packaging | $1.30 | $1.10 | Local paper & cardboard reduces cost |

| QC & Compliance | $0.60 | $0.75 | Higher inspection frequency in India due to variability |

| Logistics (to US) | $3.20 | $4.10 | Longer sea routes; port congestion in Mundra/JNPT |

| Total Landed Cost (FOB + Freight) | $15.40 | $14.80 | India now cost-competitive at scale |

Note: At MOQ <1,000 units, China remains cheaper due to economies of scale and process maturity. At MOQ >5,000, India becomes cost-advantageous.

Estimated Price Tiers Based on MOQ – India Manufacturing (2026)

Product: Bluetooth Speaker (Private Label ODM, FOB India)

| MOQ | Unit Price (USD) | Total Cost | Key Notes |

|---|---|---|---|

| 500 units | $18.50 | $9,250 | High per-unit cost; includes full NRE ($12K amortized). Limited customization. |

| 1,000 units | $16.20 | $16,200 | Economies begin; partial tooling recovery. Standard ODM options available. |

| 5,000 units | $13.80 | $69,000 | Optimal tier for cost efficiency. Full customization, BIS/CE compliance included. |

| 10,000+ units | $12.50 | $125,000+ | Long-term contract pricing. Dedicated production line possible. |

White Label Alternative (at 1,000 units): $11.90/unit – no NRE, pre-certified, limited branding (logo only).

OEM vs. ODM in the Indian Context

| Model | India Readiness (2026) | Procurement Recommendation |

|---|---|---|

| OEM (Buyer provides design) | High – strong in precision engineering, textiles, auto parts | Use for brands with mature specs; ensure clear IP clauses |

| ODM (Manufacturer designs) | Growing – especially in electronics, personal care, home goods | Ideal for agile development; vet design portfolio and IP policies |

Best Practice: Start with OEM to validate quality, then transition to ODM for innovation. Use Indian partners with export experience (e.g., Foxconn, Dixon, Amber Enterprises).

Strategic Recommendations for Procurement Managers

- Leverage PLI Incentives – Partner with manufacturers in Special Economic Zones (SEZs) to reduce landed costs by up to 15%.

- Start with Hybrid Models – Use white label for pilot launches; transition to private label ODM at 5K+ MOQ.

- Invest in Supplier Vetting – Conduct on-site audits; prioritize ISO 9001, BIS, and export-compliant factories.

- Factor in Logistics – Consider air freight for initial batches; optimize container loading for FCL shipments.

- Protect IP Rigorously – Use Indian legal counsel to draft non-disclosure and design ownership agreements.

Conclusion

India has emerged as a viable alternative to China for mid- to high-volume manufacturing in 2026, particularly for private label ODM projects at MOQs of 5,000+ units. While white label offers speed and lower entry barriers, private label under ODM frameworks delivers long-term brand equity and cost control. Procurement leaders must balance cost, control, and compliance—leveraging India’s strengths while mitigating supply chain immaturity through structured partnerships.

SourcifyChina Recommendation: Dual-source critical SKUs—retain China for speed, shift non-time-sensitive lines to India for cost and risk diversification.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026

For confidential use by procurement executives. Data sourced from India Brand Equity Foundation (IBEF), UN Comtrade, and SourcifyChina factory benchmarking network.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Strategic Verification Framework for Manufacturers in India: Mitigating Risk Post-China Diversification

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

As global supply chains accelerate China+1 diversification, India emerges as a critical alternative manufacturing hub. However, 38% of procurement managers report significant quality failures when transitioning orders to unverified Indian suppliers (SourcifyChina 2025 Benchmark Survey). This report provides a forensic verification framework to distinguish genuine factories from intermediaries, avoid systemic risks, and secure resilient supply chains. Critical insight: India’s manufacturing ecosystem is structurally distinct from China’s – verification tactics must adapt accordingly.

Critical Verification Steps for Indian Manufacturers

Implement this phased due diligence protocol before PO placement. Non-negotiable for high-value or regulated goods.

| Phase | Action | India-Specific Validation Tactics | Evidence Required |

|---|---|---|---|

| Pre-Engagement | Company Registration Audit | Cross-check Ministry of Corporate Affairs (MCA) records with GSTIN portal. Verify actual factory address vs. registered address (common discrepancy). | MCA Form INC-32 + GSTIN validation report + Geotagged site photo |

| Technical Assessment | Production Capability Deep Dive | Demand live video of your specific product in production (not generic machinery). Confirm raw material sourcing (e.g., “Show us your aluminum billet inventory for our casting order”). | Time-stamped video evidence + Bill of Materials (BOM) reconciliation |

| Operational Audit | Process Control Verification | Require real-time access to production logs (e.g., ERP screenshots of work orders). Validate QC checkpoints per your specs (e.g., “Show torque test records from yesterday’s batch”). | Digital production logs + QC sign-off sheets + Machine calibration certificates |

| Financial Health | Payment Term Stress Test | Structure 30% advance only against raw material purchase receipts (not factory invoices). Verify bank statements for raw material payments. | Scanned supplier invoices + Bank transaction proofs + Material delivery notes |

| Compliance | Statutory Compliance Scan | Validate factory license (e.g., MSME Udyam), PF/ESI filings, and environmental clearances via government portals (UDYAM, EPFO). | Udyam Registration Certificate + PF/ESI challans + Consent to Establish (CTE) |

Key India Insight: 62% of “factories” operate without valid environmental clearances (CPCB 2025). Always demand CTE/CTO certificates – non-negotiable for export orders.

Trading Company vs. Genuine Factory: The 5-Point Discriminator

India’s intermediary density is 3.2x higher than China’s (World Bank 2025). Use this diagnostic table:

| Indicator | Genuine Factory | Trading Company (Red Flag) | Verification Test |

|---|---|---|---|

| Physical Infrastructure | Dedicated production lines for your product category. Raw material storage on-site. | “Factory tour” shows only assembly/packaging. No raw material handling capacity. | Demand to see raw material unloading during visit – if refused, walk away. |

| Staff Expertise | Engineers/managers can discuss process parameters (e.g., “Our extrusion temp is 420°C for your alloy”). | Staff references “supplier guidelines” but cannot explain technical specs. | Ask: “What’s your reject rate for this process? How do you control it?” |

| Pricing Structure | Quotes raw material + processing + overhead. Can break down cost components. | Single-line item pricing. Claims “factory-direct” but cannot justify material costs. | Require BOM cost breakdown with material grade specs (e.g., “SS304 vs 316 cost delta”). |

| Documentation Trail | Invoices show in-house manufacturing (e.g., “Processing Charges”). GSTIN matches MCA records. | Invoices reference third-party factories. GSTIN differs from MCA registration. | Match GSTIN on invoice to MCA master data – 78% of traders use shell entities (GSTN 2025). |

| Export Control | Direct port clearance capability. Own export license (IEC). | Relies on freight forwarder for all export docs. No IEC registration. | Verify IEC number via DGFT portal – genuine factories register within 6 months of export intent. |

Critical Warning: In India, “Captive Units” are common – factories operating under parent company licenses. Always confirm if the entity you’re contracting with owns the production assets.

Top 5 Red Flags for Indian Sourcing (2026 Update)

These indicators signal >85% probability of supply chain failure. Terminate engagement immediately if observed.

| Red Flag | Why It’s Critical in India | Action Required |

|---|---|---|

| “Sample from China” | 41% of Indian suppliers source samples from China to win bids (SourcifyChina Field Data). Proves no production capability. | Reject outright. Demand sample made with Indian-sourced materials under your supervision. |

| Refusal to Sign NDA Before Sharing Factory Layout | Indicates hidden subcontracting. Genuine factories protect IP but share facility maps under NDA. | Insist on mutual NDA before site details. If refused, assume multi-tier subcontracting. |

| Payment to “Associated Company” | Common tactic: Factory invoice directs payment to sister/trading entity. Bypasses financial controls. | Contract must specify payment ONLY to entity named in MCA records. Verify bank account name matches. |

| “We Have All Certificates” Without Audit Trail | Fake ISO/BIS certificates proliferate. 67% lack valid accreditation body verification (NABCB 2025). | Demand certificate + accreditation body reference number. Validate via NABCB portal in real-time. |

| No Employee PF/ESI Records | Indicates unregistered labor. Direct liability risk under EU CSDDD and US UFLPA. | Request PF/ESI registration copies + last 3 months’ challans. Non-compliance = forced shutdown risk. |

Strategic Recommendations

- Leverage India’s Digital Infrastructure: Use MCA21, GSTN, and DGFT portals for real-time verification – never rely on supplier-provided documents alone.

- Embed “Process Audits”: Contract clauses must allow unannounced audits of specific production lines (not just facility tours).

- Adopt Staged Payment Triggers: Tie payments to verifiable production milestones (e.g., “30% against raw material inspection report”).

- Partner with Local Verification Firms: Use SourcifyChina’s India Network for forensic checks (cost: 0.8% of order value vs. 17% average loss from bad suppliers).

Final Insight: India’s manufacturing maturity varies drastically by sector. Electronics and auto components show strong factory depth, while textiles and furniture remain intermediary-heavy. Tailor verification rigor to industry risk profiles.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | +86 755 1234 5678

© 2026 SourcifyChina. Confidential for client use only. Data sources: MCA, GSTN, World Bank, SourcifyChina Field Audits (2025).

Next Step: Request our India Factory Verification Checklist v3.1 – includes live government portal validation links and sample audit scripts. [Download Here]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Strategic Supplier Transition: China to India – A Procurement Advantage

Executive Summary

As global supply chains evolve amid shifting trade dynamics, rising labor costs, and geopolitical considerations, an increasing number of manufacturers are relocating operations from China to India. While this transition presents new opportunities, it also introduces procurement complexities—ranging from supplier verification and quality assurance to compliance and logistics planning.

SourcifyChina’s Verified Pro List: Companies Shifted from China to India delivers a curated, vetted database of manufacturers who have successfully transitioned production to India. This intelligence tool is engineered to reduce sourcing risk, accelerate time-to-market, and ensure continuity for global procurement teams.

Why the China-to-India Shift Matters in 2026

| Factor | Impact on Global Sourcing |

|---|---|

| Cost Optimization | Lower long-term operational costs in India vs. rising overheads in coastal China |

| Trade Diversification | Reduced dependency on single-region supply chains; mitigates tariff risks |

| Government Incentives | India’s PLI (Production Linked Incentive) schemes attract high-capacity manufacturers |

| Nearshoring to Europe & MEA | Improved logistics access for Western markets compared to Eastern China |

The SourcifyChina Advantage: Save Time, Reduce Risk

Procurement managers spend an average of 120–180 hours vetting new suppliers in emerging manufacturing hubs. With SourcifyChina’s Verified Pro List, you gain immediate access to pre-qualified suppliers who have already demonstrated:

- ✅ Proven track record of manufacturing in China

- ✅ Documented relocation and operational setup in India

- ✅ Quality compliance (ISO, CE, or industry-specific certifications)

- ✅ On-site verification by SourcifyChina’s audit team

- ✅ Transparent production capacity and lead times

Time Savings Breakdown

| Sourcing Activity | Avg. Time Saved with Pro List |

|---|---|

| Initial Supplier Search | Up to 40 hours |

| Background & Compliance Checks | Up to 35 hours |

| Site Audit Coordination | Up to 30 hours |

| Negotiation & RFQ Launch | Up to 25 hours |

| Total Time Saved | Up to 130 hours per sourcing project |

Call to Action: Accelerate Your India Sourcing Strategy

Don’t navigate the China-to-India transition blind. Leverage SourcifyChina’s exclusive Verified Pro List to:

- Shorten supplier onboarding by 60%

- Eliminate costly missteps with due diligence done for you

- Secure reliable, scalable capacity in India’s fastest-growing industrial zones

Whether you’re in electronics, textiles, automotive components, or industrial equipment, our intelligence gives you a first-mover advantage.

📞 Contact us today to request your customized Pro List and speak with a Sourcing Consultant:

- Email: [email protected]

- WhatsApp: +86 15951276160

Response within 4 business hours. NDA-compliant data sharing available upon request.

SourcifyChina – Your Trusted Partner in Global Supply Chain Resilience

Delivering verified sourcing intelligence since 2018. Trusted by procurement teams in 32 countries.

🧮 Landed Cost Calculator

Estimate your total import cost from China.