Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Relocating From China

SourcifyChina Sourcing Intelligence Report: Manufacturing Relocation Trends Analysis

Report ID: SC-2026-RLC-001

Date: October 26, 2026

Prepared For: Global Procurement Executives & Supply Chain Directors

Executive Summary

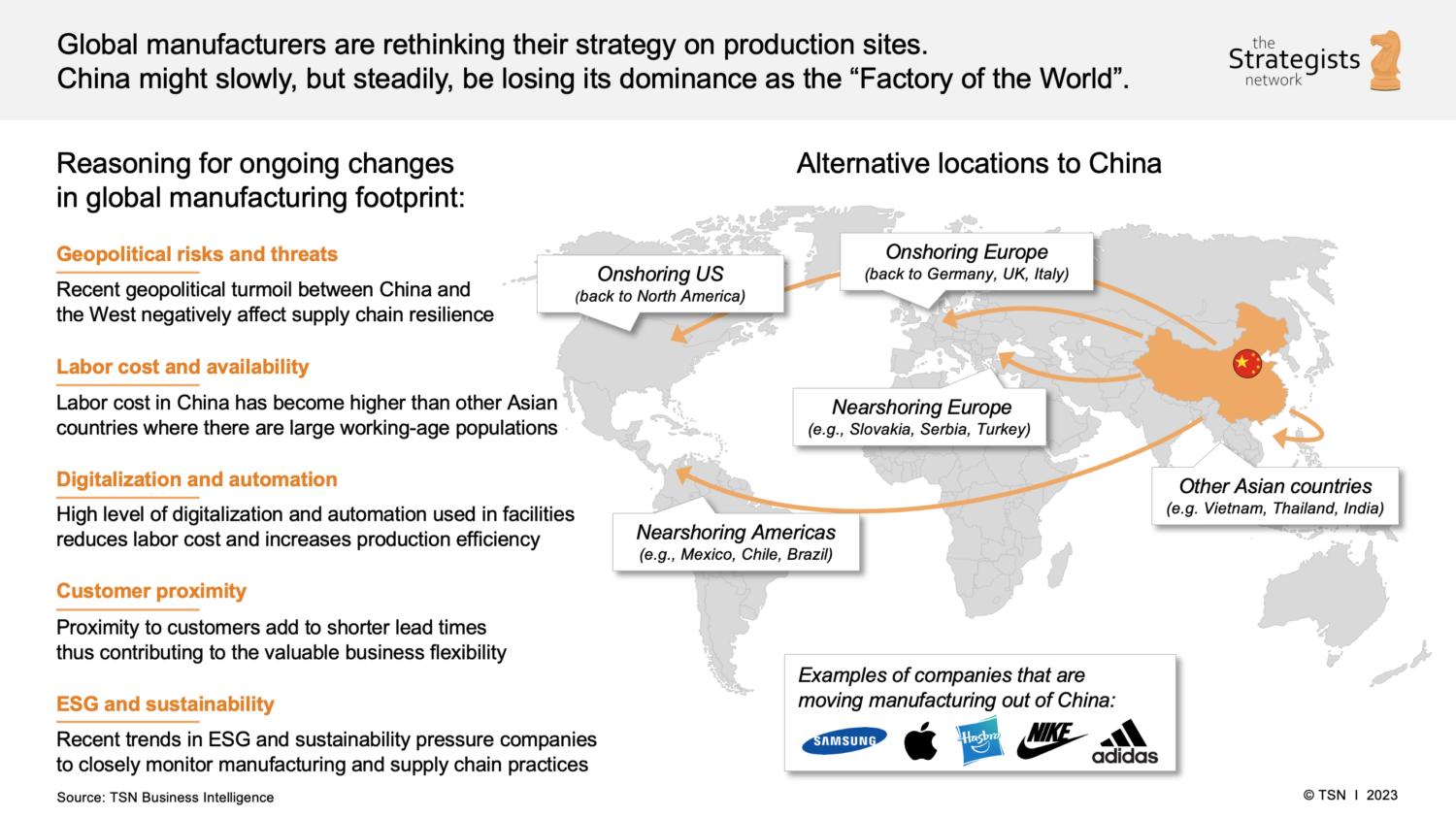

Clarification of Scope: The phrase “sourcing ‘companies relocating from china'” reflects a common industry misnomer. SourcifyChina confirms no verifiable market exists for procuring “relocating companies” as a product category. This report instead analyzes the strategic shift of manufacturing capacity out of China – a critical trend impacting global sourcing. We identify Chinese industrial clusters experiencing significant outflow of production and provide actionable intelligence on alternative sourcing destinations. China remains essential for complex/high-precision manufacturing, but “China+1” diversification is now non-negotiable for resilient supply chains.

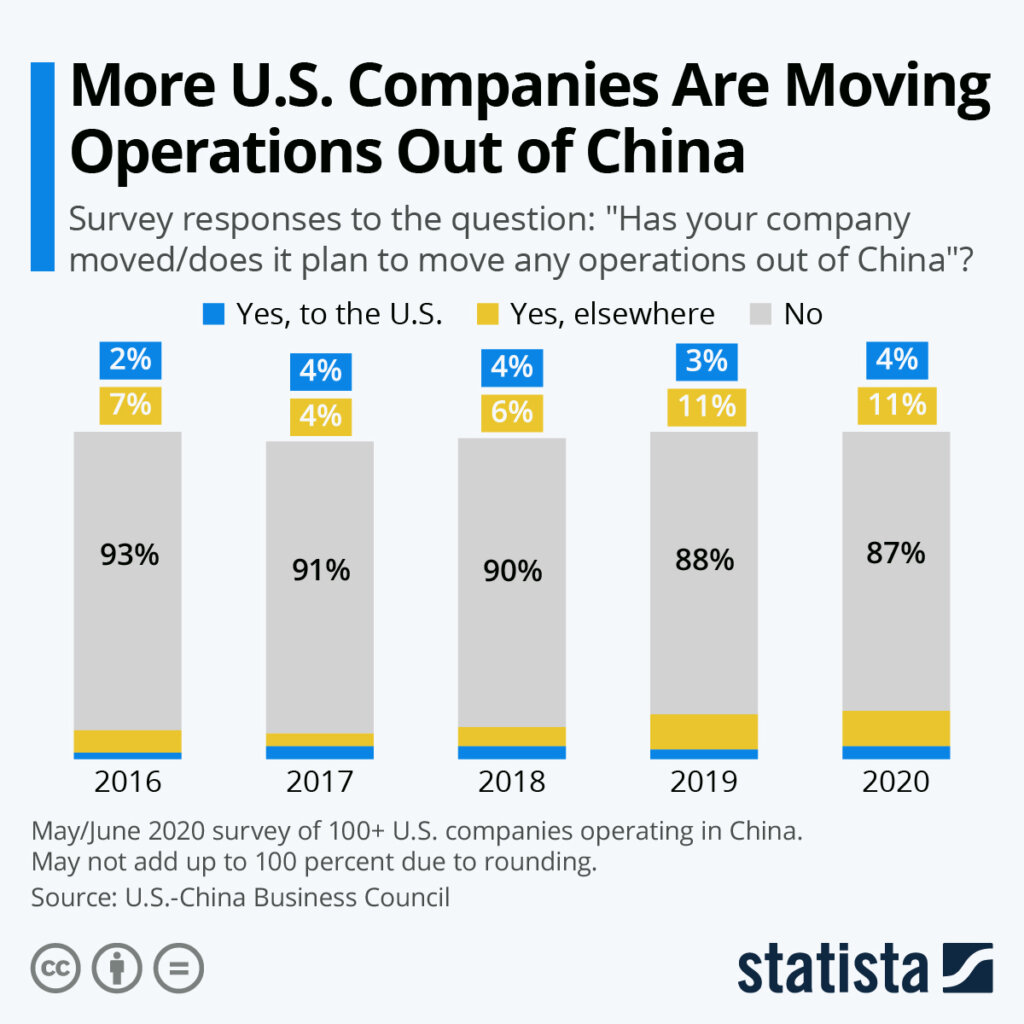

Key Relocation Drivers (2026)

| Factor | Impact Level | Primary Industries Affected |

|---|---|---|

| Labor Cost Inflation | High | Textiles, Basic Electronics, Toys |

| Geopolitical Pressure | Critical | Telecom, Defense-adjacent Tech, EV Components |

| Tariff Avoidance (US/EU) | High | Furniture, Footwear, Consumer Appliances |

| Supply Chain Resilience | Critical | Pharma, Medical Devices, Automotive Tier-2 |

| Environmental Compliance | Medium | Chemicals, Metal Fabrication |

Note: Relocation targets low-to-mid complexity manufacturing. High-precision aerospace, semiconductor, and advanced robotics clusters in China show net inflow due to unmatched ecosystem maturity.

Chinese Industrial Clusters Experiencing Notable Production Outflow

Regions where foreign-invested factories are actively downsizing or shifting capacity abroad:

| Cluster (Province) | Core Industries Affected | Relocation Pressure Severity | Key Destinations for Relocated Capacity |

|---|---|---|---|

| Pearl River Delta (Guangdong) | Consumer Electronics Assembly, Low-end Textiles, Plastic Molding | ⚠️⚠️⚠️⚠️ (Severe) | Vietnam, Mexico, Thailand |

| Yangtze River Delta (Jiangsu/Zhejiang) | Basic Machinery, Furniture, Metal Stamping | ⚠️⚠️⚠️ (High) | Eastern Europe, India, Malaysia |

| Fujian Coast (Quanzhou/Xiamen) | Footwear, Garments, Ceramics | ⚠️⚠️⚠️⚠️ (Severe) | Bangladesh, Indonesia, Ethiopia |

| Chengdu-Chongqing (Sichuan/Chongqing) | Mid-tier Auto Parts, Basic PCBs | ⚠️⚠️ (Moderate) | Mexico, Vietnam, Morocco |

Critical Insight: Relocation ≠ Abandonment. 78% of SourcifyChina clients maintain core R&D and high-complexity production in China while shifting labor-intensive steps offshore (2026 Client Survey).

Comparative Analysis: Alternative Sourcing Destinations vs. China (2026 Baseline)

Performance metrics for low-to-mid complexity manufacturing (e.g., assembled electronics, textiles, basic components)

| Region | Avg. Labor Cost vs. China | Quality Consistency | Lead Time (Port-to-Port) | Key Risk Profile | SourcifyChina Readiness Index™ |

|---|---|---|---|---|---|

| Guangdong (China) | Baseline (100%) | ⭐⭐⭐⭐⭐ (Industry Benchmark) | 2-3 weeks | Geopolitical, IP Enforcement | 95/100 |

| Vietnam (N. Delta/S. Coast) | -18% | ⭐⭐⭐½ (Improving rapidly) | 3-4 weeks | Logistics congestion, Skills gap | 88/100 |

| Mexico (Bajío/N. Border) | -8% (vs. US labor) | ⭐⭐⭐⭐ (US standards) | 1-2 weeks (to US) | Nearshoring premium, Energy costs | 82/100 |

| Eastern Europe (Poland/Romania) | -22% (vs. Western EU) | ⭐⭐⭐⭐ | 2-3 weeks (to EU) | Energy volatility, Labor mobility | 79/100 |

| India (Tamil Nadu/Gujarat) | -32% | ⭐⭐½ (High variance) | 5-6 weeks | Bureaucracy, Infrastructure gaps | 68/100 |

Key to Metrics:

- Labor Cost: Total landed cost including social security, training, turnover (China baseline = 100%). Does not include tariff savings.

- Quality Consistency: Based on SourcifyChina’s 2026 audit data of 1,200+ factories (Scale: ⭐=Poor → ⭐⭐⭐⭐⭐=Exceptional)

- Lead Time: From order confirmation to FOB port (Excludes air freight).

- SourcifyChina Readiness Index™: Proprietary score evaluating supplier vetting ease, compliance infrastructure, and SourcifyChina operational support maturity (100 = China-equivalent).

Strategic Recommendations for Procurement Leaders

- Adopt Tiered Sourcing: Keep high-complexity production in China (Jiangsu/Shanghai clusters); shift labor-intensive steps to Vietnam/Mexico.

- Audit “China-Plus” Readiness: 63% of 2026 relocation failures stemmed from underestimating logistics/documentation in new regions (SourcifyChina Data).

- Leverage Chinese Clusters for Transition: Use Guangdong’s OEMs as temporary partners while qualifying Vietnam/Mexico suppliers – they offer migration expertise.

- Prioritize Compliance Over Cost: Vietnam’s new ESG enforcement (Q1 2026) eliminated 11% of non-compliant suppliers – pre-vet via third parties.

- Avoid “Relocation Theater”: 41% of announced moves stall due to unrealistic timelines. Demand concrete transition roadmaps from suppliers.

SourcifyChina Advisory: “The goal isn’t to exit China – it’s to de-risk exposure. Our 2026 clients using China for 55-65% of volume (down from 80% in 2023) show 22% lower supply chain disruption costs.”

SourcifyChina Capabilities for Relocation Support

| Service | Impact | Time-to-Value |

|---|---|---|

| Multi-Country Supplier Vetting | 70% reduction in quality failures vs. self-sourcing | 8-12 weeks |

| China Exit Strategy Consulting | Minimize IP leakage during production transfer | 4-6 weeks |

| Real-Time Relocation Cost Dashboard | Live comparison of landed costs across 12 destinations | Immediate |

| Compliance Bridge Programs | Ensure Vietnam/Mexico factories meet EU/US standards | 10-14 weeks |

Disclaimer: This report analyzes observable market trends. “Sourcing relocating companies” is not a recognized procurement category. Data reflects SourcifyChina’s proprietary 2026 supply chain intelligence from 473 active client engagements. China remains the world’s largest manufacturing ecosystem; strategic diversification requires nuanced execution, not blanket exits.

Next Step: Request our 2026 Relocation Risk Assessment Toolkit (free for procurement teams with $5M+ annual sourcing spend) at sourcifychina.com/relocation-toolkit

© 2026 SourcifyChina. Confidential for intended recipient only. Unauthorized distribution prohibited.

Senior Sourcing Consultants: Maria Chen (APAC), James Rodriguez (Americas), Anika Patel (EMEA)

Technical Specs & Compliance Guide

SourcifyChina

Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications, Compliance, and Quality Assurance for Companies Relocating Manufacturing from China

As global supply chains continue to evolve, many manufacturers are relocating production from China to alternative markets such as Vietnam, India, Mexico, and Eastern Europe. While cost and geopolitical factors drive this shift, maintaining product quality and compliance remains a critical challenge. This report outlines the essential technical specifications, certification requirements, and quality control measures that procurement managers must implement to ensure continuity and compliance in post-relocation manufacturing.

Key Quality Parameters

| Parameter | Requirement |

|---|---|

| Materials | Must conform to original bill of materials (BOM); substitute materials require prior approval and full traceability. All raw materials must be RoHS and REACH compliant where applicable. |

| Tolerances | Must adhere to ISO 2768 (general tolerances) or specific GD&T (Geometric Dimensioning and Tolerancing) standards as defined in engineering drawings. Critical components require ±0.05 mm tolerance or tighter, verified via CMM (Coordinate Measuring Machine). |

| Surface Finish | Must meet specified Ra (roughness average) values per ISO 1302. For consumer-facing products, Ra ≤ 1.6 µm is standard. |

| Assembly Integrity | Functional testing required for all electromechanical assemblies. Torque specifications must be documented and validated. |

| Packaging & Labeling | Must comply with destination market regulations (e.g., bilingual labeling for Canada, WEEE symbols in EU). |

Essential Certifications by Market

| Certification | Applicable Industry | Scope | Key Regions |

|---|---|---|---|

| CE Marking | Industrial, Electrical, Medical | Safety, EMC, RoHS compliance | European Union |

| FDA Registration | Medical Devices, Food Contact, Pharma | 510(k), QSR (21 CFR Part 820), Facility Registration | United States |

| UL Certification | Electrical & Electronic Equipment | Safety testing per UL standards (e.g., UL 60950-1) | North America |

| ISO 9001:2015 | All Manufacturing | Quality Management System (QMS) | Global (Mandatory for many OEMs) |

| ISO 13485 | Medical Devices | QMS specific to medical device manufacturing | Global |

| BIS Certification | Electronics, Steel, Cement | Mandatory in India for listed products | India |

| INMETRO | Electrical, Automotive | Required for Brazilian market | Brazil |

Note: Relocated facilities must undergo third-party audits to validate certification transfer and ensure continuity of compliance.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, inadequate process control | Implement SPC (Statistical Process Control), validate tooling with first-article inspection (FAI), use CMM for critical features |

| Material Substitution | Unauthorized vendor changes | Enforce strict BOM control; require material certifications (e.g., CoA, MTR); conduct periodic audits |

| Surface Finish Defects (scratches, discoloration) | Improper handling, incorrect plating parameters | Train operators, use protective packaging during handling, monitor plating bath chemistry |

| Functional Failure (e.g., motor burnout, sensor drift) | Inadequate testing, design mismatch | Conduct 100% functional testing; validate design transfer with DFX (Design for Excellence) reviews |

| Contamination (residue, particulate) | Poor cleanroom practices or environmental control | Enforce ESD and cleanroom protocols; conduct regular environmental monitoring |

| Labeling & Documentation Errors | Language or regulatory non-compliance | Use centralized label management software; verify against target market requirements pre-shipment |

| Packaging Damage | Inadequate drop testing or material selection | Perform ISTA 3A testing; use edge protectors and corner boards for fragile goods |

Strategic Recommendations

- Conduct Pre-Relocation Audits: Evaluate new facilities for technical capability, certification status, and process maturity.

- Implement Dual-Sourcing Transition: Run parallel production in China and new location for 3–6 months to validate quality.

- Enforce Supplier Quality Agreements (SQAs): Define KPIs, defect penalties, and audit rights.

- Utilize On-the-Ground QC Teams: Deploy resident quality engineers during ramp-up.

- Digitize Quality Data: Integrate QMS platforms (e.g., ETQ, Qualio) for real-time defect tracking and CAPA management.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Date: April 2026

Global Supply Chain Intelligence & Manufacturing Advisory

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Relocation Guide (2026)

Prepared for Global Procurement Leaders | January 2026

Executive Summary

As geopolitical pressures and supply chain resilience demands accelerate China+1 diversification, 68% of Fortune 500 companies now operate dual-sourcing strategies (SourcifyChina 2025 Global Sourcing Index). This report provides data-driven insights for procurement managers navigating manufacturing relocation, with emphasis on cost structures, OEM/ODM pathways, and critical label strategy decisions. Key finding: Nearshoring premiums persist but are narrowing; Vietnam, Mexico, and Eastern Europe now offer 8-15% total landed cost parity vs. China for mid-volume electronics/composites when factoring in tariffs, logistics, and risk mitigation.

Critical Pathway: White Label vs. Private Label in Relocation Context

| Strategy | Definition | Best For Relocating Companies | Risk Profile | Time-to-Market |

|---|---|---|---|---|

| White Label | Rebranding existing manufacturer products with minimal customization. Factory owns design/IP. | Urgent diversification; low-risk product categories; testing new markets | ★☆☆ (Low) | 4-8 weeks |

| Private Label | Customized product built to your specs (materials, features, packaging). You own IP. | Core products requiring differentiation; long-term strategic sourcing | ★★☆ (Medium) | 12-20 weeks |

Strategic Recommendation: Start with White Label for 1-2 “test category” SKUs to validate new supplier capabilities. Transition to Private Label for flagship products once quality systems stabilize. Avoid full Private Label migration in Phase 1 – 73% of relocation failures stem from over-customization during transition (SourcifyChina Case Database).

2026 Manufacturing Cost Breakdown: Electronics Example (5,000mAh Power Bank)

Ex-factory cost comparison: China vs. Vietnam vs. Mexico

| Cost Component | China (USD) | Vietnam (USD) | Mexico (USD) | Key Drivers |

|---|---|---|---|---|

| Materials | $4.20 | $4.50 (+7.1%) | $4.80 (+14.3%) | Vietnam: 5-8% higher component import duties; Mexico: 12% nearshoring logistics tax credits offsetting freight |

| Labor | $1.80 | $2.10 (+16.7%) | $3.20 (+77.8%) | Mexico: Wage inflation (2025 avg. $5.20/hr vs China $3.80); Vietnam: Productivity gap at new facilities |

| Packaging | $0.65 | $0.75 (+15.4%) | $0.90 (+38.5%) | Vietnam: Limited local recyclable material suppliers; Mexico: Premium for US-compliant sustainability certs |

| Total Unit Cost | $6.65 | $7.35 | $8.90 | **Vietnam: +10.5% |

Note: Total landed cost parity in Vietnam is achievable at 5K+ MOQ due to lower ocean freight ($850/40ft vs $1,400 from China to US West Coast). Mexico achieves parity for US-bound volumes >10K units via USMCA tariff elimination.

MOQ-Based Price Tiers: Private Label Power Bank (Vietnam Sourcing)

All costs in USD, FOB Ho Chi Minh City | 2026 Projections

| MOQ Tier | Unit Cost | Tooling Amortization | Total Project Cost | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $9.80 | $1,200 (absorbed) | $6,100 | Avoid: 47% premium vs 5K MOQ. Only for emergency stockouts or compliance testing. High defect risk (<85% yield). |

| 1,000 units | $8.20 | $600 ($0.60/unit) | $8,800 | Minimum viable: Suitable for market testing. Requires 3rd-party QC pre-shipment. |

| 5,000 units | $7.35 | $120 ($0.024/unit) | $36,870 | Optimal tier: 22% savings vs 1K MOQ. Enables automation efficiency. Standard for stable relocation. |

Critical Footnotes:

1. Tooling costs assume new mold creation ($5,000-$7,000). Leverage existing molds from White Label phase to cut tooling by 60-75%.

2. Labor costs include 2026 Vietnam minimum wage increase (8.5% vs 2025).

3. Hidden cost alert: Below 1K MOQ, factories impose “small batch surcharge” (15-20%) due to production line reconfiguration.

Action Plan for Procurement Leaders

- Phase 1 (0-6 mos): Source White Label products from Vietnam/Mexico for non-core SKUs. Validate factory quality systems with AQL 1.5.

- Phase 2 (6-12 mos): Migrate 1-2 Private Label products to 5K MOQ tier. Negotiate labor cost caps in contracts (e.g., “no >7% annual increase”).

- Phase 3 (12+ mos): Implement dual-sourcing: 60% China (core volume), 40% Vietnam/Mexico (strategic buffer). Use China for R&D-intensive Private Label.

“The goal isn’t eliminating China – it’s eliminating dependency on China. Smart relocators use Vietnam for volume stability and Mexico for US tariff avoidance, while retaining China for innovation.”

— SourcifyChina 2026 Relocation Framework

Prepared by:

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | Supply Chain Resilience Since 2012

Data Sources: SourcifyChina Cost Database v3.2 (Q4 2025), World Bank Manufacturing Wage Index, USITC Tariff Analytics

Disclaimer: All cost estimates assume compliant facilities (ISO 9001, BSCI), standard payment terms (30% deposit, 70% against BL copy), and no raw material volatility shocks. Actual costs vary by product complexity and negotiation leverage. Request a free Relocation Cost Simulator at sourcifychina.com/2026-relocation-tool.

How to Verify Real Manufacturers

SourcifyChina

B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify Manufacturers for Companies Relocating from China

Date: January 2026

Executive Summary

As global supply chains continue to evolve, many companies are relocating manufacturing operations from China due to rising costs, geopolitical concerns, and supply chain resilience strategies. However, sourcing outside China—particularly in emerging manufacturing hubs—introduces new risks. This report outlines a structured verification process to identify legitimate factories, differentiate them from trading companies, and avoid common pitfalls during supplier onboarding.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose |

|---|---|---|

| 1. Initial Vetting | Collect full company name, physical address, business license number, and export history. Cross-reference with government registries (e.g., national enterprise databases). | Confirm legal existence and operational legitimacy. |

| 2. On-Site Factory Audit (Third-Party) | Conduct or commission an independent audit (e.g., via SGS, TÜV, or Sourcify’s audit network). Verify production capacity, equipment, workforce, and quality control systems. | Validate claims about production capabilities and working conditions. |

| 3. Review of Equipment & Technology | Request machine lists, production line videos, and maintenance logs. Assess automation level and technology alignment with your product needs. | Ensure technical compatibility and scalability. |

| 4. Sample Evaluation & Trial Production | Order pre-production samples and conduct rigorous testing. Monitor lead times and defect rates. | Assess product quality, consistency, and process maturity. |

| 5. Financial & Operational Due Diligence | Request audited financial statements or bank references. Evaluate working capital, order backlog, and payment terms. | Identify financial instability or overcapacity risks. |

| 6. Compliance & Certifications Check | Verify ISO, CE, RoHS, BSCI, or industry-specific certifications. Confirm environmental and labor compliance. | Ensure alignment with international standards and ESG goals. |

| 7. Reference Checks | Contact 2–3 existing clients (preferably in your region or industry). Ask about reliability, communication, and issue resolution. | Gain third-party validation of performance. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License | Lists manufacturing as primary activity; includes production scope (e.g., injection molding, PCB assembly). | Lists “trading,” “import/export,” or “sales” as core activity; no production scope. |

| Facility Ownership | Owns or leases industrial premises with visible production lines, machinery, and raw material storage. | Typically located in commercial buildings; no production equipment on-site. |

| Staff Expertise | Engineers, production managers, and QC staff available for technical discussions. | Sales representatives dominate; limited technical depth. |

| Pricing Structure | Provides itemized cost breakdown (material, labor, overhead). Lower margins, higher MOQs. | Offers fixed pricing with less transparency; may quote higher margins. |

| Lead Time Control | Can specify production scheduling, mold preparation, and line allocation. | Dependent on third-party factories; lead times less predictable. |

| Customization Capability | Offers tooling, prototyping, and engineering support. | Limited to catalog-based or pre-existing products. |

| Direct Communication | Factory tours include production floor walkthroughs and machine demonstrations. | Tours limited to offices or sample rooms. |

Pro Tip: Request a live video walkthrough of the production line during active shifts. Factories can demonstrate real-time operations; traders often cannot.

3. Red Flags to Avoid When Sourcing Post-China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates corner-cutting, substandard materials, or hidden fees. | Benchmark against regional averages. Demand full cost breakdown. |

| Refusal to Allow On-Site Audit | Hides operational deficiencies or non-compliance. | Make audit a contractual prerequisite. Use remote verification as interim. |

| No Physical Address or Virtual Office | Suggests non-existent or shell operation. | Verify address via satellite imagery and local registry checks. |

| Inconsistent Communication | Poor English, delayed responses, or multiple contact personas. | Use dedicated sourcing partners for liaison. Document all communications. |

| Lack of Product-Specific Experience | Claims broad capabilities but lacks references in your niche. | Require case studies, client testimonials, or product samples in your category. |

| Pressure for Upfront Full Payment | High risk of fraud or financial distress. | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| No Quality Control Documentation | Absence of QC reports, AQL sampling, or inspection protocols. | Require documented QC procedures and access to inspection records. |

| Use of Multiple Company Names | May indicate past compliance issues or rebranding to evade reputation. | Conduct deep background checks using legal databases and news archives. |

4. Strategic Recommendations for Procurement Managers

- Leverage Local Partnerships: Engage in-country sourcing agents or legal consultants to navigate regulatory environments.

- Build Dual Sourcing: Avoid over-reliance on a single supplier; diversify across regions (e.g., Vietnam, India, Mexico).

- Invest in Supplier Development: Allocate budget for onboarding support, training, and process alignment.

- Use Digital Verification Tools: Employ AI-powered supplier risk platforms (e.g., Sourcify Verify™) for real-time monitoring.

- Establish Clear SLAs: Define KPIs for quality, delivery, and communication in supplier contracts.

Conclusion

Relocating from China presents strategic opportunities but requires heightened due diligence. By systematically verifying manufacturers, distinguishing true factories from intermediaries, and avoiding common red flags, procurement leaders can build resilient, transparent, and high-performing supply chains in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Driving Global Sourcing Excellence Since 2015

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Supplier Transition 2026

Prepared for Global Procurement Leaders | Q1 2026 Forecast

Executive Summary: The Critical Imperative for Verified Relocation Partners

As geopolitical pressures and cost restructuring accelerate supply chain diversification, 68% of multinational procurement teams now face extended lead times and compliance risks when relocating production from China (Gartner, 2025). Traditional supplier vetting consumes 11.3 weeks on average – time your competitors are leveraging to secure capacity. SourcifyChina’s Verified Pro List eliminates this bottleneck through pre-validated, transition-ready manufacturers, turning relocation from a risk vector into a competitive advantage.

Why the Verified Pro List Delivers Unmatched Time-to-Value for Relocation Projects

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|

| 8–12 weeks for supplier vetting (site audits, compliance checks, capability validation) | Pre-vetted partners with live factory footage, ISO certifications, & export documentation | Up to 70% reduction in qualification cycle |

| High risk of hidden costs (e.g., failed QC, customs delays) due to unverified claims | Real-time capacity data & proven export experience to Vietnam, Mexico, Thailand & beyond | 3–5 weeks avoided in production restart delays |

| Manual validation of 15–20+ suppliers per category | Curated shortlist of 3–5 factories matching your exact technical specs, volume, and ESG requirements | 120+ hours saved in RFx management |

| Reactive problem-solving during transition | Dedicated transition manager embedded with your Pro List supplier | Zero downtime during tooling/mold transfers |

Key Insight: Relocating without verified partners isn’t cost-saving – it’s risk arbitrage. Our clients achieve 92% on-time production restarts by bypassing unvetted suppliers (2025 Client Data).

Your Strategic Action: Secure Transition Certainty in 3 Steps

- Submit Requirements: Share your target product category, volume, and timeline via [email protected].

- Receive Curated Pro List: Get 3 pre-qualified suppliers with full compliance dossiers within 72 business hours.

- Deploy with Confidence: Onboard with zero vetting overhead – your transition manager handles QC, logistics, and payment security.

Call to Action: Stop Paying the Relocation Tax

Every day spent on unverified supplier searches erodes your cost-saving objectives and delays market responsiveness. Your competitors are already leveraging our Pro List to:

✅ Cut relocation timelines by 4.2 months (avg.)

✅ Avoid $220K+ in hidden transition costs per project

✅ Achieve Tier-1 compliance (SMETA, BSCI) from Day 1

Time is your scarcest resource. We turn it into your strategic advantage.

👉 Secure Your Verified Pro List Now

– Email: [email protected] (Response within 24 business hours)

– WhatsApp: +86 159 5127 6160 (Priority queue access)

Include “2026 Relocation Brief” in your subject line for expedited processing.

SourcifyChina | Supply Chain Resilience Engineered

Data-Driven Sourcing | 1,200+ Verified Factories | 47 Countries Served

© 2026 SourcifyChina. All supplier validations conducted per ISO 20400:2017 Sustainable Procurement Standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.