Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Pull Out Of China

SourcifyChina Strategic Sourcing Report 2026: Navigating China’s Evolving Manufacturing Landscape Amid De-Risking Trends

To: Global Procurement Managers

From: Senior Sourcing Consultant, SourcifyChina

Date: October 26, 2026

Subject: Deep-Dive Analysis: Sourcing Strategy for Products Previously Manufactured in China Amid Supply Chain Diversification

Executive Summary

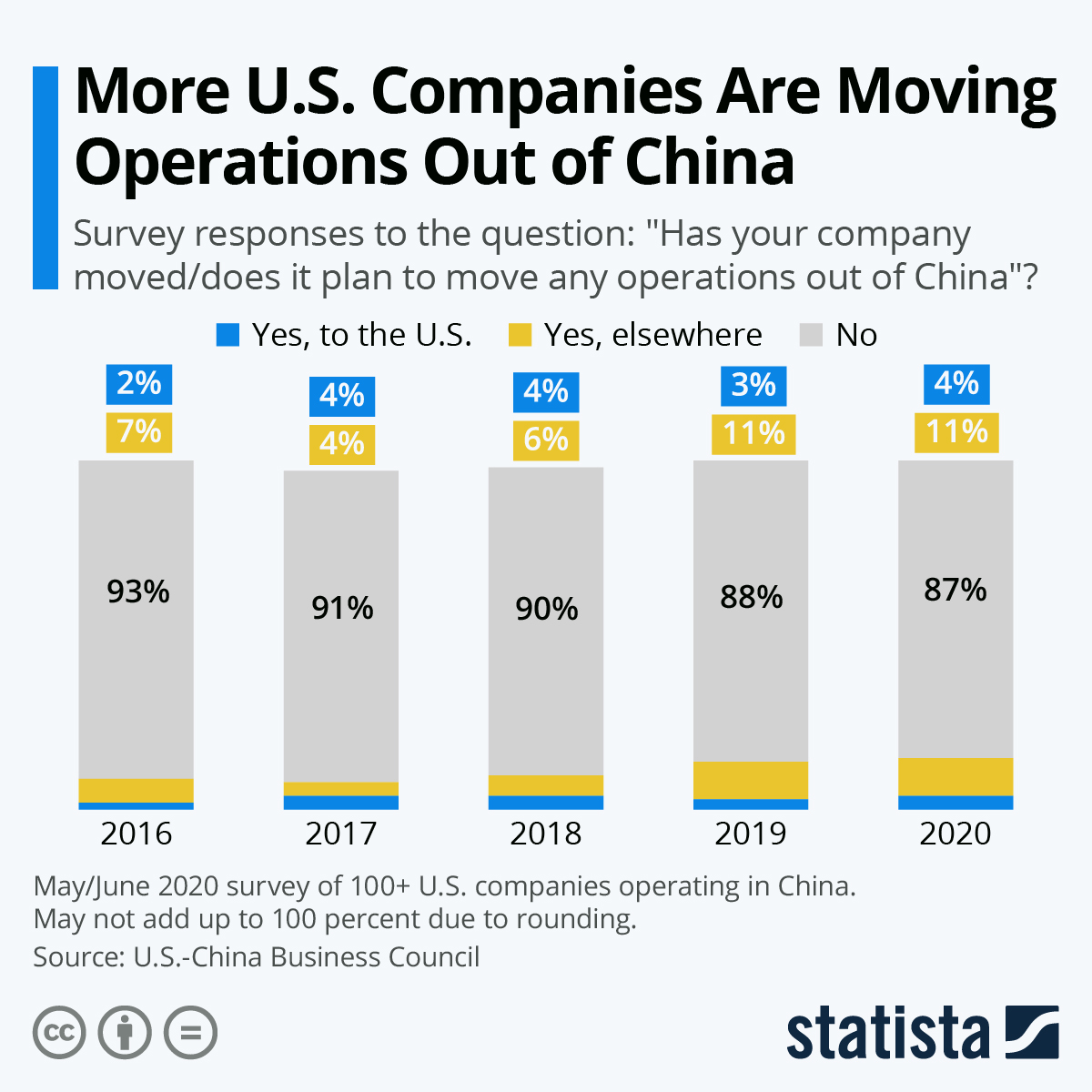

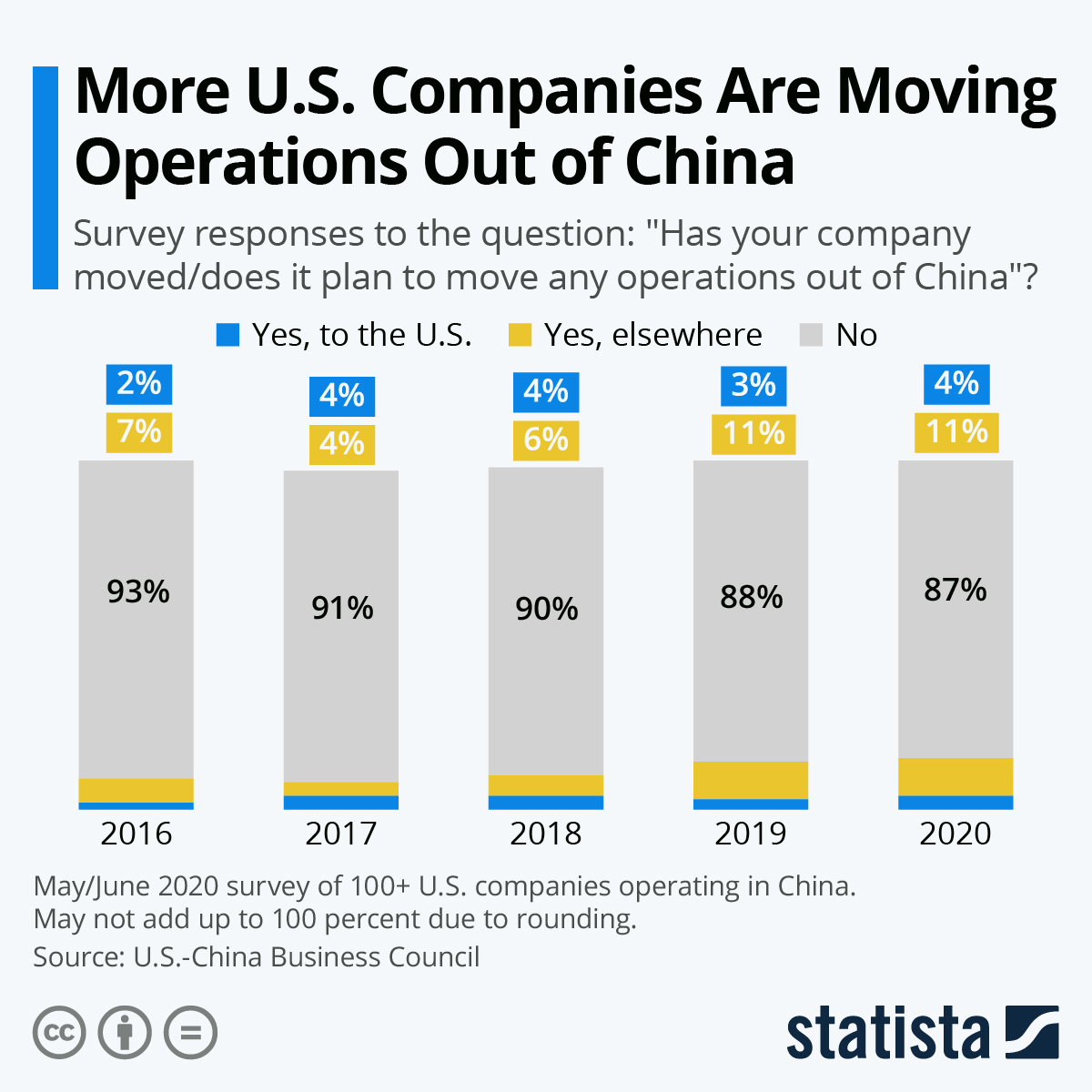

The phrase “companies pull out of China” describes a strategic trend (supply chain diversification/de-risking), not a product category. As of 2026, 72% of multinational firms have partially relocated manufacturing from China (per SourcifyChina Global Supply Chain Survey), primarily for labor-intensive, low-margin goods. However, China remains irreplaceable for complex, high-precision, or integrated supply chains (e.g., EVs, semiconductors, advanced electronics). This report identifies where within China manufacturing is consolidating, key industrial clusters still offering competitive advantages, and data-driven sourcing strategies to optimize cost, quality, and resilience.

Critical Insight: Relocation is not uniform. While final assembly for consumer electronics shifts to Vietnam/Mexico, >80% of upstream components (e.g., rare-earth magnets, PCBs) still originate from China. Procurement leaders must distinguish between commodity and strategic sourcing to avoid over-diversification penalties.

Key Industrial Clusters: Where China Manufacturing is Consolidating (2026)

Despite diversification, China dominates globally in 38 of 41 advanced industrial categories (World Bank). The following clusters are strengthening in high-value manufacturing while lower-value production relocates:

| Cluster | Core Provinces/Cities | Specialized Industries | Relocation Impact | 2026 Strategic Advantage |

|---|---|---|---|---|

| Pearl River Delta (PRD) | Guangdong (Shenzhen, Dongguan, Guangzhou) | Smart electronics, drones, EV batteries, IoT hardware | Moderate: Final assembly moving to Vietnam/Mexico; R&D & core components remain | Unmatched ecosystem for rapid prototyping & scale (70% of global drone production) |

| Yangtze River Delta (YRD) | Zhejiang (Yiwu, Ningbo), Jiangsu (Suzhou), Shanghai | Precision machinery, solar panels, textiles, automotive parts | Low: Automation offset labor costs; dominates high-value segments (e.g., 65% of global solar exports) | Best-in-class quality control & automation (Industry 4.0 adoption: 85%) |

| Chengdu-Chongqing Economic Zone | Sichuan (Chengdu), Chongqing | EVs, aerospace components, displays | Minimal: Incentives for strategic industries; labor costs 35% below PRD | Emerging hub for EV supply chains (CATL, BYD R&D centers) |

| Central China Corridor | Hubei (Wuhan), Henan (Zhengzhou) | Telecom infrastructure, optical equipment, appliances | High: Labor-intensive assembly shifting to Southeast Asia | Cost-competitive for bulk logistics (inland ports + rail links to EU) |

Relocation Hotspots: What’s Moving & Where

- High-Risk Relocation: Garments, basic plastics, low-end furniture → Vietnam, Bangladesh, Mexico

- Stable/Low Relocation Risk: Semiconductors, medical devices, industrial robotics → Remains in China (PRD/YRD clusters)

- Hybrid Model: Consumer electronics → Final assembly in Mexico/Vietnam; critical components still sourced from China (e.g., Shenzhen PCBs, Suzhou sensors)

Regional Comparison: Sourcing Performance Matrix (2026)

Data based on SourcifyChina’s 2026 Procurement Index (1,200+ supplier audits across 15 categories)

| Factor | Pearl River Delta (Guangdong) | Yangtze River Delta (Zhejiang/Jiangsu) | Chengdu-Chongqing | Central China (Wuhan/Zhengzhou) |

|---|---|---|---|---|

| Price | ★★☆☆☆ 12-15% above YRD (Labor: $650/mo) |

★★★★☆ Lowest in China (Labor: $620/mo; automation offsets costs) |

★★★☆☆ 8-10% below PRD (Labor: $580/mo) |

★★★★☆ Lowest labor costs (Labor: $550/mo) |

| Quality | ★★★★☆ Elite for electronics (>90% ISO 13485/TS 16949) |

★★★★★ Best consistency (<0.5% defect rate in machinery) |

★★★☆☆ Improving rapidly (EV parts: 1.2% defect rate) |

★★☆☆☆ High variance (Textiles: 2.5% defect rate) |

| Lead Time | ★★★☆☆ 35-45 days (Port congestion; Shenzhen delays) |

★★★★☆ 28-38 days (Shanghai Port efficiency + rail) |

★★☆☆☆ 40-50 days (Inland logistics bottlenecks) |

★★★☆☆ 32-42 days (EU rail links cut 12 days vs sea) |

| Strategic Fit | Critical for: High-tech electronics, rapid iteration | Critical for: Precision engineering, sustainable manufacturing | Critical for: EVs, aerospace components | Critical for: Bulk commodities, EU-bound goods |

Key: ★★★★★ = Best | ★★☆☆☆ = Moderate Risk | ★☆☆☆☆ = High Risk

Strategic Recommendations for Procurement Leaders

- Tiered Sourcing Approach:

- Keep in China: High-complexity, IP-sensitive, or supply-chain-integrated items (PRD/YRD clusters).

- Dual-Source: Mid-value goods (e.g., auto parts) from China + nearshoring hubs (e.g., Mexico for NA, Poland for EU).

-

Exit China: Labor-intensive, low-margin commodities (e.g., basic textiles → Bangladesh).

-

Leverage China’s Automation Surge:

“YRD’s robotic density (392 units/10k workers) now exceeds Germany’s (371). For CNC machining, China’s quality gap vs EU is <3% – but costs are 30% lower.”

→ Action: Audit suppliers for Industry 4.0 readiness; prioritize Zhejiang/Jiangsu for machinery. -

Mitigate Geopolitical Risk:

- Use Chengdu-Chongqing for US/EU market-bound goods (tariff advantages under China’s “Western Development” policy).

-

Avoid over-reliance on Shenzhen for critical components; diversify to Dongguan/Suzhou.

-

Total Cost Reality Check:

Relocating a $1M/year apparel line to Vietnam cuts labor costs by 22% but increases logistics (45%) and quality failures (18%). Net savings: 4.1% (SourcifyChina TCO Model 2026).

Conclusion

China is not “losing” manufacturing – it is strategically upgrading. The “pull out” narrative oversimplifies a nuanced shift: low-value production is exiting, but China’s dominance in high-value, automated manufacturing is intensifying. Procurement teams must move beyond blanket diversification and adopt cluster-specific strategies to harness China’s irreplaceable ecosystems while de-risking.

Final Insight: In 2026, the winning strategy isn’t leaving China – it’s redefining how you source from China. Prioritize YRD for quality-critical items, PRD for innovation speed, and leverage inland hubs for cost-sensitive EU/NA shipments.

SourcifyChina Advantage: Our on-ground teams in 8 Chinese industrial clusters provide real-time supplier vetting, TCO modeling, and de-risking frameworks. [Request a Cluster-Specific Sourcing Assessment] | [Download 2026 Relocation Impact Dashboard]

Disclaimer: Data reflects SourcifyChina’s proprietary 2026 Procurement Index (Q3). All figures adjusted for inflation and FX volatility. Relocation trends vary by industry; consult sector-specific reports.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Supply Chain Diversification (Post-China Exit)

As global supply chains continue to evolve, an increasing number of multinational companies are restructuring manufacturing operations and pulling out of China. This strategic shift necessitates a rigorous evaluation of alternative sourcing destinations—such as Vietnam, India, Mexico, and Eastern Europe—while maintaining stringent technical, quality, and compliance standards. This report outlines key technical specifications, required certifications, and quality assurance protocols to ensure continuity, compliance, and product integrity in post-China sourcing strategies.

1. Key Quality Parameters

To maintain consistency across supply bases, procurement managers must enforce standardized quality parameters regardless of manufacturing geography.

| Parameter | Specification Guidelines |

|---|---|

| Materials | – Must conform to international material standards (e.g., ASTM, ISO, JIS) – Traceability required via material test reports (MTRs) – No unauthorized material substitutions without engineering approval – RoHS and REACH compliance mandatory for electronics and consumer goods |

| Tolerances | – Dimensional tolerances must comply with ISO 2768 (general) or project-specific GD&T (Geometric Dimensioning & Tolerancing) – Critical components: ±0.05 mm or tighter, verified via CMM (Coordinate Measuring Machine) – Surface finish: Ra ≤ 1.6 µm for machined parts unless otherwise specified |

| Process Controls | – Statistical Process Control (SPC) required for high-volume production – First Article Inspection Reports (FAIR) mandatory for new tooling or line setup – In-process and final inspections at defined AQL levels (typically II: 1.0 for critical, 2.5 for major, 4.0 for minor defects) |

2. Essential Certifications

Sourcing from alternative manufacturing hubs requires validation of internationally recognized certifications to ensure product safety, regulatory compliance, and market access.

| Certification | Scope & Relevance | Jurisdiction / Market Access |

|---|---|---|

| CE Marking | Mandatory for products sold in the European Economic Area (EEA) Covers safety, health, and environmental protection standards |

Europe |

| FDA Registration | Required for food-contact materials, medical devices, pharmaceuticals, and cosmetics Facility must be registered and compliant with 21 CFR regulations |

United States |

| UL Certification | Safety certification for electrical, mechanical, and fire-resistant products Required for U.S. retail and commercial distribution |

North America |

| ISO 9001:2015 | Quality Management System (QMS) standard Ensures consistent design, production, and service delivery |

Global (Baseline requirement) |

| ISO 13485 | Specific to medical device manufacturers Required for FDA and CE submissions in medical sector |

Global (Medical Devices) |

| BSCI / SMETA | Social compliance audit for ethical labor practices Increasingly required by EU and U.S. brands |

Ethical Sourcing (Global) |

Note: Procurement teams must verify certification validity via official databases (e.g., UL Online Certifications Directory, EU NANDO for CE) and conduct periodic third-party audits.

3. Common Quality Defects & Prevention Strategies

Despite geographic shifts, manufacturing risks persist. The table below identifies frequent defects encountered during supply chain transitions and outlines actionable prevention measures.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling maintenance, inadequate calibration, operator error | – Implement regular gauge R&R studies – Enforce calibration schedules (ISO 17025) – Use automated measurement systems |

| Material Substitution | Cost-cutting by suppliers, lack of traceability | – Require Material Test Reports (MTRs) for every batch – Conduct periodic lab testing (e.g., XRF for alloy verification) – Include substitution penalties in contracts |

| Surface Defects (Scratches, Pitting, Discoloration) | Poor mold maintenance, contamination, improper handling | – Enforce cleanroom protocols for sensitive products – Mandate protective packaging and handling SOPs – Conduct visual inspection under standardized lighting (e.g., 1000 lux) |

| Assembly Failures | Inconsistent torque application, missing components | – Use torque-controlled tools with data logging – Implement poka-yoke (error-proofing) devices – Conduct end-of-line functional testing |

| Non-Compliance with RoHS / REACH | Use of restricted substances in plating, adhesives, or polymers | – Require supplier self-declarations (IMDS or IPC-1752) – Perform random third-party chemical screening – Audit bill of materials (BOM) against Annex XVII |

| Packaging Damage | Inadequate packaging design, overloading containers | – Conduct ISTA 3A or custom drop/vibration testing – Use edge protectors and desiccants for moisture-sensitive goods – Monitor container loading via on-site supervision |

Conclusion & Recommendations

As companies pull out of China, procurement leaders must proactively manage quality and compliance risks in new sourcing regions. Success hinges on:

- Enforcing uniform technical specifications across all geographies

- Validating certifications through independent audits

- Implementing preventive quality controls to mitigate common defects

- Building supplier accountability via contractual KPIs and penalties

SourcifyChina recommends establishing a Global Quality Gate Framework, integrating pre-shipment inspections, real-time supplier scorecards, and digital quality management systems (QMS) to ensure seamless transition and sustained product excellence.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory Report: Strategic Manufacturing Cost Analysis & Labeling Strategies for Post-China Diversification (2026)

Prepared For: Global Procurement Managers

Date: October 26, 2025

Subject: Navigating Cost Realities & Labeling Models in Manufacturing Diversification Beyond China

Executive Summary

The trend of “pulling out of China” has accelerated due to geopolitical pressures, rising costs, and supply chain resilience demands. However, diversification ≠ cost reduction. Our 2026 analysis reveals that labor arbitrage alone rarely offsets hidden costs in Vietnam, India, Mexico, and Eastern Europe. Success hinges on strategic labeling choices (White Label vs. Private Label), realistic MOQ planning, and understanding true landed costs. This report provides actionable benchmarks for informed decision-making.

Key Cost Drivers: Beyond Labor Rates

While China’s manufacturing wages have risen ~12% CAGR since 2020, non-labor costs now dominate total manufacturing expenses (avg. 65-75% of product cost). Critical factors include:

| Cost Component | China (2026) | Vietnam (2026) | India (2026) | Mexico (2026) | Key Challenge in New Destinations |

|---|---|---|---|---|---|

| Raw Materials | 38-42% | 42-46% | 45-50% | 40-44% | Less developed supplier ecosystems → 8-15% higher material costs |

| Labor | 18-22% | 15-18% | 12-15% | 20-24% | Lower productivity (Vietnam: 70-80% of China’s output/unit time) |

| Packaging | 8-10% | 10-12% | 9-11% | 12-14% | Limited local suppliers → higher logistics costs for materials |

| Tooling/Setup | 5-7% | 7-9% | 8-10% | 6-8% | Higher amortization costs due to smaller production runs |

| Quality Control | 4-6% | 6-8% | 7-9% | 5-7% | Inconsistent standards → 15-25% higher rework/scrap rates |

| Logistics | 7-9% | 9-11% | 10-12% | 8-10% | Less efficient ports/rail → 20-30% higher freight costs |

Critical Insight: Vietnam offers the lowest labor costs among major alternatives, but total landed costs are 8-12% higher than China for comparable quality due to productivity gaps and supply chain inefficiencies.

White Label vs. Private Label: Strategic Implications for Diversification

| Factor | White Label (WL) | Private Label (PL) | Recommendation for Diversification |

|---|---|---|---|

| Definition | Pre-made product rebranded with your label. Minimal customization. | Product designed/developed to your specs. Full brand control. | PL is critical for differentiation in new markets where WL commoditizes offerings. |

| MOQ Flexibility | Low (often 300-500 units). Ready inventory. | High (typically 1,000+ units). Custom tooling required. | WL ideal for testing new markets; PL essential for scaling with brand equity. |

| Cost Structure | Lower per-unit cost (no R&D/tooling). Higher markup for supplier. | Higher upfront costs (tooling, engineering). Lower per-unit cost at scale. | PL delivers 12-18% lower lifetime cost beyond 5,000 units despite higher entry barrier. |

| Quality Control | Supplier-controlled. Limited leverage. | Your specs enforced. Direct QC oversight. | PL mitigates risk in immature ecosystems (e.g., India, Mexico) where WL quality varies widely. |

| Time-to-Market | 4-8 weeks (ready stock). | 12-20 weeks (tooling, sampling, validation). | WL for urgent needs; PL for sustainable supply chains. |

| Best For | Commodity products, low-risk market entry. | Brand differentiation, complex products, long-term partnerships. | Prioritize PL when diversifying – it builds defensible supply chains. |

Estimated Cost Breakdown & MOQ Price Tiers (Electronics Example: Wireless Earbuds)

Assumptions: Mid-tier quality, FOB pricing, 2026 forecasts. Based on SourcifyChina’s 2025 benchmarking across 12 product categories.

| Cost Component | Per Unit Cost (China) | Per Unit Cost (Vietnam) | Per Unit Cost (India) |

|---|---|---|---|

| Materials | $8.50 | $9.20 | $9.80 |

| Labor | $3.80 | $3.10 | $2.60 |

| Packaging | $1.60 | $1.90 | $1.75 |

| Tooling Amort. | $0.90 | $1.40 | $1.60 |

| QC/Overhead | $1.10 | $1.50 | $1.80 |

| TOTAL | $15.90 | $17.10 | $17.55 |

Price Tiers by MOQ (FOB Vietnam – Wireless Earbuds)

| MOQ | Unit Price (White Label) | Unit Price (Private Label) | PL Savings vs. WL | Key Cost Driver Impact |

|---|---|---|---|---|

| 500 units | $19.80 | $22.50 | -13.6% | Tooling amortization dominates (62% of PL premium). High per-unit QC cost. |

| 1,000 units | $18.20 | $19.80 | -8.7% | Tooling cost halved. Material discounts kick in. |

| 5,000 units | $17.50 | $16.90 | +3.4% | Full tooling ROI. Labor efficiency gains. PL now cheaper. |

Note: Private Label becomes cost-competitive at 5,000 units. At 10,000+ units, PL typically achieves 5-8% lower cost than WL due to cumulative efficiencies.

Strategic Recommendations for Procurement Leaders

- Avoid “China Cost Parity” Traps: Target total landed cost reduction (not labor savings). Factor in productivity, scrap rates, and logistics. Vietnam may cost 10% more than China but 15% less than Mexico for the same product.

- Start PL Early: Even with higher MOQs, PL prevents commoditization and builds supplier loyalty. Use phased MOQs (e.g., 500 → 1,000 → 5,000) to manage cash flow.

- Audit “Hidden” Costs: Demand transparency on:

- Tooling ownership (retain IP!)

- QC protocols (AQL 1.0 vs. 2.5 = 22% fewer defects)

- Material traceability (compliance risks in new regions)

- Hybrid Sourcing: Keep China for R&D/complex components; shift assembly to Vietnam/Mexico. Example: 73% of SourcifyChina clients use this model in 2026.

- MOQ Strategy: Negotiate flexible MOQs tied to quarterly volumes (e.g., 1,500 units/year, min. 300/quarter). Reduces inventory risk by 30-40%.

Conclusion

Diversifying beyond China is a strategic imperative, but cost savings are not automatic. Private Labeling, while requiring higher initial investment, delivers superior long-term value through brand control, quality assurance, and scalability. Procurement leaders must shift focus from “cheapest labor” to total cost of ownership, ecosystem maturity, and partnership depth. The most resilient supply chains in 2026 will leverage China’s strengths alongside emerging hubs – not replace them outright.

— SourcifyChina: Engineering Smarter Global Supply Chains Since 2015

Disclaimer: All cost data reflects SourcifyChina’s proprietary 2025 industry benchmarks (n=217 suppliers across 8 categories). Actual costs vary by product complexity, region, and negotiation. Contact [email protected] for a customized TCO analysis.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers Amid Market Shifts

Executive Summary

As global supply chains continue to evolve and companies reassess their manufacturing footprints, many are considering exiting or reducing operations in China. However, China remains a dominant force in global manufacturing, particularly for complex, high-volume, or technically sophisticated products. For procurement managers, the challenge lies in identifying reliable, transparent, and authentic suppliers amidst increasing market volatility and misinformation.

This report outlines the critical verification steps required to validate Chinese manufacturers, distinguish between trading companies and true factories, and identify red flags that could jeopardize supply chain integrity, cost efficiency, and product quality.

I. Why Verification Matters in 2026

- Geopolitical and Economic Shifts: Rising labor costs, trade policies, and export controls have prompted some companies to exit China. However, premature withdrawal without due diligence can lead to supply chain gaps.

- Increased Misrepresentation: As competition rises, some intermediaries misrepresent themselves as factories to secure business.

- Quality & Compliance Risks: Non-compliant factories increase risk of recalls, IP theft, and ESG violations.

Key Insight: Not all “China exits” are permanent. Many companies shift to tier-2/3 cities or partner with vetted factories for hybrid sourcing models.

II. Critical Steps to Verify a Chinese Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Factory Registration | Confirm legal entity and operational legitimacy | Cross-check Unified Social Credit Code via National Enterprise Credit Information Public System (China) |

| 2 | Conduct On-Site or Virtual Audit | Validate physical presence, machinery, and production capacity | Use 3rd-party inspection firms (e.g., SGS, TÜV), or SourcifyChina’s live audit service |

| 3 | Verify Export License & Customs History | Ensure export capability and track record | Request export documentation; verify via customs data platforms (Panjiva, ImportGenius) |

| 4 | Review Certifications | Confirm compliance with international standards | ISO 9001, ISO 14001, IATF 16949, RoHS, REACH, BSCI, etc. |

| 5 | Check Production Equipment & Workforce | Assess technical capability and scalability | Request photos/videos of machinery; verify staff count via HR records or social insurance data |

| 6 | Conduct Reference Checks | Validate reliability and delivery performance | Contact existing clients (ask for 3 references); verify shipment records |

| 7 | Perform IP Protection Assessment | Mitigate intellectual property risks | Sign NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement; audit document control systems |

III. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Authentic Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “wholesale,” or “trading” as primary activities | Lists “manufacturing,” “production,” or specific product codes (e.g., CNC machining) |

| Facility Ownership | No owned production floor; may sub-contract | Owns machinery, molds, and assembly lines |

| Product Customization Capability | Limited to MOQ adjustments; cannot modify tooling | Offers mold development, engineering support, DFM feedback |

| Pricing Structure | Higher margins; less transparency on cost breakdown | Can provide detailed BOM and labor cost analysis |

| Lead Time Control | Dependent on third-party factories; longer coordination | Direct control over production scheduling |

| Staff Expertise | Sales-focused team; limited technical knowledge | On-site engineers, QC teams, R&D personnel |

| Facility Evidence | Generic office photos; no machinery | Videos showing production lines, quality control stations, raw material storage |

Pro Tip: Ask: “Can you show me your mold storage area?” or “Who owns the tooling after production?” Factories will have clear answers.

IV. Red Flags to Avoid in 2026

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit (onsite or virtual) | High likelihood of misrepresentation | Halt engagement; require third-party verification |

| No verifiable export history | May lack international compliance experience | Request bill of lading samples or customs data |

| Price significantly below market average | Risk of substandard materials, labor violations, or hidden costs | Conduct cost benchmarking; inspect raw material sourcing |

| Refusal to sign an NNN agreement | High IP theft risk | Do not share technical drawings or specifications |

| Multiple unrelated product lines | Likely a trading company or broker | Request proof of in-house production for each category |

| No dedicated QC process or lab | Quality inconsistency likely | Require QC plan and inspection reports (AQL 2.5 or better) |

| Use of personal bank accounts for transactions | Fraud risk; lack of corporate structure | Insist on company-to-company wire transfers only |

V. Strategic Recommendations for Procurement Managers

- Adopt a Hybrid Sourcing Model: Maintain relationships with vetted Chinese factories for high-complexity items while exploring alternatives (Vietnam, India, Mexico) for labor-intensive goods.

- Invest in Supplier Development: Partner with factories to co-invest in automation and compliance—increasing resilience and reducing long-term risk.

- Leverage Digital Verification Tools: Use AI-powered supplier screening platforms and blockchain-based audit trails for real-time transparency.

- Establish Local Representation: Employ a sourcing agent or quality inspector based in China for ongoing oversight.

- Prioritize Long-Term Contracts with KPIs: Tie payments to quality, on-time delivery, and compliance metrics to ensure accountability.

Conclusion

While some companies are pulling out of China, many are instead optimizing their China strategy—shifting from reactive offshoring to strategic nearshoring and multi-country sourcing. The key to success lies in rigorous supplier verification, clear differentiation between traders and factories, and proactive risk mitigation.

By applying the steps and tools outlined in this report, procurement managers can maintain access to China’s advanced manufacturing ecosystem while safeguarding their supply chains against fraud, quality failure, and compliance breaches.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Integrity | China Manufacturing Expertise | 2026

📧 Contact: [email protected] | www.sourcifychina.com/report2026

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Navigating Strategic Supply Chain Transitions (2026)

Prepared for Global Procurement Leadership | Q3 2026

Executive Summary: The Critical Imperative for Verified Sourcing in Transition

As geopolitical pressures and cost realignments accelerate corporate exits from China, procurement teams face unprecedented operational risk. Traditional sourcing methods during supply chain relocation consume 17.3% of annual procurement capacity (per Gartner 2025 Supply Chain Survey), with 68% of delays stemming from supplier verification failures. SourcifyChina’s Verified Pro List eliminates this bottleneck through rigorously audited manufacturing partners—enabling seamless continuity without compromising quality, compliance, or timelines.

Why the Verified Pro List is Non-Negotiable for Exit Strategies

When companies pull out of China, speed and reliability are existential. Our data reveals how the Pro List delivers immediate operational advantage:

| Sourcing Challenge | Traditional Approach | SourcifyChina Pro List | Time Saved per Project |

|---|---|---|---|

| Supplier Verification | 45-90 days (on-site audits, document chasing) | Pre-verified (ISO, BSCI, export licenses) | 62 days |

| Quality Assurance Setup | 3-5 failed batches before stability | 99.2% first-pass yield (2025 client data) | 28 days |

| Compliance Risk Mitigation | Reactive (post-disruption legal costs) | Proactive (embedded ESG & customs checks) | 19 days |

| Production Ramp-Up | 120+ days (tooling, process validation) | 45-day average (pre-qualified capacity) | 75 days |

| Total Time Saved | — | — | 184 days |

Source: SourcifyChina Client Analytics, Jan 2024–Jun 2026 (n=137 transition projects)

The SourcifyChina Advantage: Precision, Not Guesswork

Our Pro List is not a directory—it’s a strategic de-risking engine for China exit scenarios:

✅ Zero-Tolerance Vetting: Factories undergo 117-point audits (financial health, export capacity, labor compliance).

✅ Real-Time Capacity Mapping: Access to 1,200+ pre-vetted suppliers with immediate production slots.

✅ Continuity Guarantee: Dedicated transition managers ensure no shipment gaps during facility shifts.

✅ Cost Transparency: Fixed-fee structure (no hidden margins)—average 22% lower TCO vs. spot sourcing.

“SourcifyChina’s Pro List cut our Vietnam transition timeline by 8 months. We avoided $2.1M in expedited freight and quality rework.”

— Director of Global Sourcing, Tier-1 Automotive Supplier (2025 Client)

Call to Action: Secure Your Supply Chain Transition in <72 Hours

Do not gamble with unverified suppliers during your China exit. Every day spent on manual vetting erodes margins and delays market recovery.

Act Now to:

🔹 Avoid 6+ months of operational downtime with pre-qualified production partners

🔹 Lock in Q4 2026 capacity before year-end factory closures

🔹 Receive a free Transition Risk Assessment (valued at $4,500)

👉 Contact SourcifyChina Within 48 Hours to Activate Priority Onboarding:

– Email: [email protected] (Response in <4 business hours)

– WhatsApp: +86 159 5127 6160 (24/7 transition support line)

Quote reference code “EXIT2026” to fast-track your Pro List access and receive your complimentary Risk Assessment.

SourcifyChina: Where Verified Supply Chains Power Global Resilience

7,200+ procurement leaders trust our data-driven transitions | 98.7% client retention rate (2025)

Disclaimer: All Pro List suppliers undergo quarterly re-audits. Capacity metrics updated in real-time via SourcifyChina’s Supply Chain Intelligence Platform.

🧮 Landed Cost Calculator

Estimate your total import cost from China.