Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Owned By China Government

SourcifyChina Sourcing Intelligence Report: Navigating State-Owned Enterprise (SOE) Supply Chains in China

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

Clarification of Critical Misconception: “Companies owned by China government” (State-Owned Enterprises/SOEs) are not products to be “sourced.” SOEs are entities that manufacture or supply goods/services. This report analyzes key industrial sectors dominated by Chinese SOEs and identifies regional clusters where these entities operate critical manufacturing infrastructure. Global procurement managers seeking reliable, large-scale industrial capacity (e.g., heavy machinery, aerospace, energy equipment) must understand SOE ecosystems. Direct “sourcing of SOEs” as assets is not a commercial activity; sourcing from SOEs as suppliers requires strategic navigation of their unique procurement frameworks.

Market Reality: SOEs in China’s Industrial Ecosystem

Chinese SOEs (controlled by SASAC – State-owned Assets Supervision and Administration Commission) dominate strategic, capital-intensive sectors where national security, infrastructure, and technological sovereignty are prioritized. They are not typical B2B suppliers for commoditized goods. Key sectors include:

| Sector | SOE Dominance Level | Primary SOE Examples | Typical Procurement Model for Foreign Buyers |

|---|---|---|---|

| Heavy Industrial Machinery | High (70%+ market share) | Sany Group (部分 SOE-linked), CRRC, Sinomach | Project-based tenders; often requires JV/local partner |

| Aerospace & Defense | Extreme (95%+ market share) | AVIC, CASIC, COMAC | Restricted access; requires government approvals |

| Energy Equipment (Grid/Renewables) | High (60-80%) | State Grid, China Three Gorges, Goldwind (部分 SOE) | Competitive bidding for large infrastructure projects |

| Raw Materials (Steel, Petrochem) | Moderate-High | Baowu Steel, Sinopec, CNPC | Hybrid: SOEs supply bulk commodities to private OEMs |

| Consumer Electronics | Low (<5%) | Minimal SOE presence | Dominated by private exporters (e.g., Foxconn, Luxshare) |

Critical Insight: SOEs primarily serve domestic strategic projects or large-scale international infrastructure deals (Belt & Road). Direct procurement by foreign SMEs for standard components is exceptionally rare. Most foreign buyers engage SOEs indirectly via private-sector distributors or joint ventures.

Key Industrial Clusters for SOE-Dominated Manufacturing

SOE manufacturing is concentrated in regions aligned with national industrial policy (“Made in China 2025”). Proximity to SOE headquarters, R&D centers, and state-backed industrial parks is critical.

| Region | Core SOE Sectors | Key Cities/Industrial Parks | Why SOEs Cluster Here |

|---|---|---|---|

| Jiangsu | Heavy Machinery, Shipbuilding, Advanced Materials | Nanjing (AVIC hubs), Zhenjiang (CRRC), Suzhou (Sinopec) | Central SASAC coordination; integrated supply chains for national infrastructure projects |

| Shanghai | Aerospace, High-End Equipment, Petrochemicals | Pudong (COMAC), Caohejing (Sinochem), Lingang (SAIC Motor) | National R&D hub; SASAC’s direct oversight; global export gateway |

| Sichuan | Aerospace, Defense Electronics | Chengdu (AVIC Chengdu Aircraft), Mianyang (CASIC) | “Tier-2 Strategic Reserve” location; deep defense industrial base |

| Liaoning | Heavy Industry, Shipbuilding | Shenyang (Aviation Industry Corp), Dalian (CSSC shipyards) | Historic industrial base; state-directed revitalization under “Northeast Revival” policy |

| Hubei | Rail Transit, Automotive | Wuhan (CRRC subsidiaries), Xiangyang (Dongfeng Motor JV) | Central China logistics hub; critical for Belt & Road rail infrastructure |

Note: Guangdong (Shenzhen/Dongguan) and Zhejiang (Ningbo/Yiwu) are private-sector manufacturing powerhouses (electronics, textiles, furniture). SOE presence here is minimal outside energy/utilities. Comparing them to SOE clusters is analytically invalid.

Regional Comparison: SOE-Dominated vs. Private-Dominated Clusters

This table contrasts regions where SOEs drive strategic manufacturing (Jiangsu) versus private exporters (Guangdong). SOEs do not compete on “price” or “lead time” like private OEMs – they prioritize compliance, scale, and strategic alignment.

| Parameter | Jiangsu (SOE-Dominated Sectors) | Guangdong (Private-Dominated Sectors) | Procurement Implication |

|---|---|---|---|

| Price | Premium (20-40% higher) • Cost-plus pricing models • Minimal negotiation flexibility • Includes compliance/audit overhead |

Competitive (Market-Driven) • Aggressive bidding • Volume discounts standard • Transparent cost breakdowns |

SOEs: Budget for strategic value, not cost savings. Private sector: Ideal for cost-sensitive commoditized goods. |

| Quality | Consistent (Tier-1 Standards) • Military/industrial specs (GB/MIL) • Rigorous state audits • Slow to adapt to Western specs |

Variable (Tier 1 to Tier 3) • ISO-certified leaders common • Quality control depends on supplier tier • Faster spec adaptation |

SOEs: Guaranteed for critical infrastructure. Private sector: Requires rigorous vetting; top-tier suppliers match SOE quality at lower cost. |

| Lead Time | Long & Inflexible (6-18+ months) • State budget cycles • Multi-tier approvals • Low responsiveness to urgent requests |

Agile (30-90 days typical) • Just-in-time production • Rapid capacity scaling • E-commerce integration (e.g., Alibaba) |

SOEs: Plan for multi-year projects. Private sector: Optimal for time-sensitive, flexible orders. |

| Access for Foreign Buyers | Highly Restricted • Requires SASAC-approved partners • B2G (Business-to-Government) channels • Sensitive technology controls |

Open Market • Direct OEM engagement • E-procurement platforms • English-speaking sales teams |

SOEs: Engage ONLY via: • Chinese joint ventures • SASAC-authorized agents • International project tenders (e.g., BRI) |

Strategic Recommendations for Procurement Managers

- Reframe Your Objective:

→ Target specific industrial goods (e.g., “500kV transformers”) – not “SOEs.” Identify if SOEs are mandatory suppliers for your category (e.g., grid equipment). - Leverage Hybrid Sourcing:

→ Source components from private clusters (Guangdong/Zhejiang), but engage SOEs only for regulated core systems (e.g., via State Grid-approved vendors). - Compliance is Non-Negotiable:

→ SOEs require adherence to Chinese national standards (GB), cybersecurity laws (PIPL), and export controls. Budget for third-party compliance verification. - Partner Strategically:

→ Work with SASAC-registered procurement agents (e.g., China National Machinery Industry Corp) – never attempt direct SOE engagement without local representation. - Monitor Policy Shifts:

→ Track SASAC’s 2026 “Quality Upgrade” directive – SOEs face pressure to improve export efficiency but will not compete on price with private firms.

Final Note: SOEs are national strategic assets, not commercial suppliers. Success requires aligning procurement with China’s industrial policy – not traditional B2B sourcing playbooks. For non-strategic goods, private-sector clusters remain vastly more efficient.

SourcifyChina Advisory

Data Sources: SASAC 2025 SOE Performance Report, World Bank China Logistics Index, MOFCOM Foreign Investment Survey

Next Steps: Contact our Shanghai team for sector-specific SOE engagement protocols (aerospace/energy only). Private-sector sourcing guides available for Guangdong/Zhejiang.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Goods Sourced from Chinese State-Owned Enterprises (SOEs) and Government-Linked Suppliers

Executive Summary

As global supply chains continue to evolve, sourcing from Chinese state-owned enterprises (SOEs) and government-linked manufacturers offers strategic advantages in terms of scale, infrastructure, and long-term stability. However, due diligence in technical specifications, quality control, and regulatory compliance remains critical. This report outlines key quality parameters, mandatory certifications, and a structured risk mitigation framework tailored to procurement professionals sourcing from companies owned or significantly influenced by the Chinese government.

While SOEs often benefit from centralized oversight and access to national standards, variability in implementation and export compliance can occur. Proactive quality assurance and third-party verification are recommended.

1. Key Quality Parameters

1.1 Material Specifications

| Parameter | Requirement | Notes |

|---|---|---|

| Raw Materials | Must comply with GB (Guobiao) standards; harmonized with ISO/ASTM where applicable | Traceability documentation required for metals, polymers, and electronics |

| Material Grade | Must match or exceed international equivalents (e.g., GB Q235B ≈ ASTM A36) | Dual labeling (GB + ISO/ASTM) recommended |

| Chemical Composition | Full Material Declaration (FMD) per RoHS, REACH, and China RoHS | Third-party lab testing advised for high-risk components |

| Sourcing Transparency | Supplier must disclose origin of critical raw materials | Especially for rare earths, electronics, and medical-grade materials |

1.2 Dimensional Tolerances

| Product Category | Standard Tolerance | Reference Standard |

|---|---|---|

| Metal Fabrication | ±0.1 mm (precision), ±0.5 mm (general) | GB/T 1804–2000 (mild tolerance classes) |

| Plastic Injection Molding | ±0.05 mm (high precision), ±0.2 mm (standard) | ISO 20457:2018 |

| CNC Machining | IT7–IT9 per ISO 286-1 | Must include GD&T on drawings |

| Sheet Metal | ±0.2 mm (bending), ±0.1 mm (piercing) | Based on material thickness and tooling calibration |

| Electronics (PCBA) | ±0.1 mm for component placement | IPC-A-610 Class 2 or 3 compliance required |

Note: SOEs often follow internal enterprise standards (Q/XXX) that may exceed national benchmarks. Request copies of Enterprise Quality Control Manuals during supplier qualification.

2. Essential Certifications

Procurement from Chinese government-linked entities must still align with destination market requirements. Certification validity and authenticity should be independently verified.

| Certification | Applicability | Validity | Verification Method |

|---|---|---|---|

| CE Marking | EU Market (Machinery, Electronics, Medical Devices) | 5 years (notified body dependent) | Check EU NANDO database for NB number |

| FDA Registration | Food, Pharma, Medical Devices (US) | Annual renewal | Verify via FDA FURLS or OASIS portal |

| UL Certification | Electrical & Safety Equipment (North America) | Renewed annually with audits | Confirm via UL Product iQ database |

| ISO 9001:2015 | Quality Management Systems | 3-year cycle with annual surveillance | Audit certificate and scope via IAF CertSearch |

| ISO 13485 | Medical Device Manufacturing | Required for Class I+ devices | Must include design control clause |

| GB Standards (e.g., GB 4943.1) | Domestic & Export (China Compulsory Certification) | CCC mark required for listed products | Verify via CNCA website |

Caution: Some SOEs may present domestic Chinese certifications (e.g., CRCC, CQC) as equivalent to international marks. Always confirm mutual recognition agreements (MRAs) and test reports from ILAC-accredited labs.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Out-of-Tolerance Parts | Tool wear, inconsistent calibration, operator error | Implement SPC (Statistical Process Control); require weekly CMM reports; conduct pre-shipment dimensional audits |

| Material Substitution | Cost-cutting, supply chain shortages | Enforce Material Certification of Conformance (CoC); conduct random spectrometry (XRF/OES) testing |

| Surface Finish Inconsistencies | Poor mold maintenance, incorrect plating thickness | Specify Ra values in PO; require mold maintenance logs; use cross-section testing for coatings |

| Soldering Defects (PCBA) | Reflow profile drift, component misalignment | Require IPC-A-610 trained inspectors; conduct AOI/X-ray audits; validate reflow profiles monthly |

| Packaging Damage | Inadequate cushioning, moisture exposure | Use ISTA 3A-compliant packaging; include desiccants and humidity indicators; conduct drop testing |

| Labeling & Documentation Errors | Language misinterpretation, template reuse | Provide bilingual (EN/CN) templates; audit final packaging; verify regulatory labels pre-shipment |

| Non-Compliant Chemical Content | Use of non-approved pigments, adhesives | Require full SVHC screening; conduct batch-level RoHS/REACH testing via accredited lab |

| Functionality Failures (Post-Assembly) | Poor QA integration, missing FAT (Factory Acceptance Test) | Mandate FAT with witness option; include functional test scripts in QMS audit |

4. Recommendations for Procurement Managers

- Supplier Vetting: Conduct on-site audits of SOEs using SQF (Supplier Quality Form) and COCIR checklist for medical/industrial goods.

- Third-Party Inspection: Engage independent agencies (e.g., SGS, TÜV, Bureau Veritas) for pre-shipment inspection (PSI) and during production (DUPRO) checks.

- Contractual Clauses: Include liquidated damages for non-compliance, right-to-audit provisions, and IP protection terms.

- Traceability Systems: Require ERP-integrated lot tracking with QR/barcode systems for full batch recall capability.

- Dual Certification Strategy: Accept GB standards only when backed by ISO/IEC equivalency declarations and international test reports.

Conclusion

Sourcing from Chinese government-owned or affiliated companies offers scale and strategic alignment with national industrial policies (e.g., Made in China 2025). However, quality consistency and regulatory compliance must be actively managed. By enforcing clear technical specifications, verifying international certifications, and mitigating common defects through structured QA protocols, procurement leaders can de-risk supply chains while leveraging competitive advantages.

SourcifyChina Advisory: Always treat SOEs as commercial entities—performance must be verified, not assumed.

Prepared by: SourcifyChina | Senior Sourcing Consultant | Q2 2026 Edition

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Guide for Chinese State-Owned Enterprises (SOEs)

Report Date: January 15, 2026

Prepared For: Global Procurement Managers & Strategic Sourcing Officers

Confidentiality Level: B2B Strategic Use Only

Executive Summary

Chinese State-Owned Enterprises (SOEs) – entities controlled by the Chinese government through central ministries (e.g., SASAC) or local governments – represent a critical but complex segment for global sourcing. While offering unparalleled scale, supply chain stability, and compliance rigor, SOEs operate under dual mandates: commercial viability and national policy objectives. This report provides data-driven insights into cost structures, OEM/ODM engagement models, and strategic considerations for sourcing from SOEs in 2026. Key finding: SOEs become cost-competitive at MOQs ≥1,000 units for regulated goods (e.g., medical devices, industrial equipment), but carry 8-12% higher base costs vs. private OEMs at low volumes due to compliance overhead.

Clarifying “Companies Owned by China Government”

- Critical Distinction: True “government-owned factories” do not exist in China’s market economy. We refer to State-Owned Enterprises (SOEs) – commercial entities where the Chinese government holds controlling equity via bodies like the State-owned Assets Supervision and Administration Commission (SASAC). Examples include AVIC (aerospace), Sinopharm (pharma), CRRC (rail), and Sinopec (industrial components).

- Procurement Implication: SOEs prioritize national strategic goals (e.g., technology self-sufficiency, export controls) alongside profitability. This impacts lead times, IP flexibility, and cost structures.

White Label vs. Private Label: SOE-Specific Dynamics

| Factor | White Label (SOE Context) | Private Label (SOE Context) |

|---|---|---|

| Definition | SOE produces generic product; buyer applies own brand to packaging/labeling only. SOE retains design/IP. | Buyer commissions custom design/engineering; SOE produces exclusively for buyer. IP ownership negotiable (often shared). |

| SOE Suitability | High – SOEs excel at standardized, high-volume production (e.g., PPE, basic electronics). Minimal customization. | Moderate – Requires SOE R&D engagement. Common in strategic sectors (e.g., EV components, telecom hardware) where SOEs seek tech transfer. |

| IP Ownership | Retained by SOE. Buyer licenses branding rights only. | Critical Negotiation Point. SOEs rarely cede full IP; expect joint ownership or field-restricted licenses. |

| Lead Time | Shorter (25-40 days). Uses existing tooling/processes. | Longer (60-120+ days). Requires SOE internal approvals for new designs. |

| MOQ Flexibility | Higher MOQs (1,000+ units typical). SOEs avoid low-volume runs. | Slightly lower MOQs possible (500+ units) if project aligns with SOE’s strategic goals. |

| Key Risk | Limited differentiation; SOE may sell identical product to competitors. | IP leakage risk during development; SOE may replicate design for domestic market post-contract. |

Procurement Strategy: Opt for White Label with SOEs for commoditized goods requiring rapid scale. Use Private Label only for mission-critical components where SOE’s scale/compliance justifies IP complexity. Always audit SOE’s export licensing – some require central government approval for sensitive tech.

Estimated Cost Breakdown (Per Unit) for Sample Product: Industrial IoT Sensor (SOE Manufacturer)

Assumptions: Mid-tier SOE (e.g., subsidiary of China Electronics Technology Group Corp), Shenzhen; Export FOB Shanghai; Materials = 60% of BOM; Labor = 20%; Overhead = 20%

| Cost Component | Details | Estimated Cost (USD) |

|---|---|---|

| Materials | Includes rare earths (compliance surcharge +5%), certified components (UL/CE), SOE-sourced logistics premium | $18.50 |

| Labor | Higher wages (SOEs pay 15-20% above private sector), mandatory social insurance, union fees | $6.20 |

| Packaging | Sustainable materials (SOE policy mandate), multilingual labeling, anti-tamper security | $2.80 |

| Compliance Buffer | SOE-Specific: Export documentation, state-mandated quality audits, political risk contingency | $3.50 |

| Total Per-Unit Cost | $31.00 |

Note: Compliance Buffer is non-negotiable in SOE quotes – it covers delays from internal SOE governance approvals (avg. 7-14 days). Private OEMs typically embed this cost implicitly.

SOE Pricing Tiers by MOQ (FOB Shanghai, Industrial IoT Sensor Example)

Reflects 2026 SOE cost structure trends: Rising compliance costs offset labor efficiency gains

| MOQ | Per-Unit Price (USD) | Total Cost (USD) | Cost Reduction vs. MOQ 500 | SOE-Specific Conditions |

|---|---|---|---|---|

| 500 units | $42.50 | $21,250 | Baseline | Minimum viable run; high compliance buffer allocation; tooling amortization penalty |

| 1,000 units | $36.80 | $36,800 | -13.4% | Standard entry point; buffer reduced by 30%; SOE requires 60-day deposit |

| 5,000 units | $32.20 | $161,000 | -24.2% | Strategic volume; buffer reduced by 65%; SOE mandates 3-year renewal option |

Key Insights from Tier Analysis:

1. Non-Linear Savings: Cost reduction slows beyond 1,000 units due to SOEs’ fixed compliance overhead.

2. Hidden Premium: At MOQ 500, SOEs charge 18-22% more than private OEMs; gap narrows to 5-8% at MOQ 5,000.

3. Contract Lock-in: SOEs increasingly require multi-year commitments for volumes >1,000 units to justify resource allocation.

Strategic Recommendations for Procurement Managers

- Leverage SOEs for Compliance-Critical Categories: Prioritize SOEs for medical, aerospace, or defense-adjacent goods where China’s regulatory alignment reduces your certification costs.

- Negotiate the “Compliance Buffer”: Request line-item transparency. Push for reduction at MOQ >1,000 by offering longer payment terms (e.g., 60 days vs. 30).

- White Label for Speed, Private Label for Control: Avoid complex Private Label unless SOE is the only capable supplier (e.g., semiconductor substrates).

- Factor in Approval Timelines: Add 10-15 days to SOE lead times for internal governance – not production. Build this into your demand planning.

- Audit Export Capabilities: Verify the SOE’s specific export license scope (e.g., “US-bound shipments require additional SASAC approval”).

Final Note: SOEs are not “cheap” suppliers – they are strategic resilience partners. Deploy them where supply chain continuity and regulatory alignment outweigh pure cost optimization. For low-MOQ, high-innovation projects, private Chinese OEMs remain more agile.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from SourcifyChina’s 2025 SOE Cost Benchmarking Survey (n=147 procurement managers) and China Customs Export Compliance Reports (Q4 2025).

Disclaimer: Estimates assume standard terms (Incoterms® 2020 FOB). Actual costs vary by product complexity, SOE tier, and geopolitical conditions. Always conduct factory audits.

SourcifyChina: De-risking Global Supply Chains Since 2010. | sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Topic: Verifying Chinese Government-Owned Manufacturers & Avoiding Sourcing Pitfalls

Executive Summary

As global supply chains evolve, sourcing from China remains strategic due to manufacturing scale and cost efficiency. However, increasing complexity—especially concerning companies linked to the Chinese government—demands rigorous due diligence. This report outlines critical steps to verify manufacturer legitimacy, distinguish between trading companies and factories, and identify red flags to mitigate risk. All recommendations are aligned with international compliance standards, including U.S. Entity List screening, EU supply chain due diligence, and ILO labor guidelines.

1. Critical Steps to Verify a Manufacturer Owned by the Chinese Government

Government-affiliated enterprises in China may operate under indirect ownership structures, making verification essential for compliance, IP protection, and ESG alignment.

| Step | Action | Purpose | Verification Tools |

|---|---|---|---|

| 1 | Check Business Registration via National Enterprise Credit Information Public System (NECIPS) | Confirm legal status and ownership structure | www.gsxt.gov.cn |

| 2 | Review Shareholder Structure | Identify state-owned enterprises (SOEs) or SASAC-controlled entities | Look for names like “State-owned Assets Supervision and Administration Commission (SASAC)” or “China [Sector] Industry Group” |

| 3 | Cross-reference with Official SOE Lists | Validate government ownership | Use SASAC’s “List of Central SOEs” (updated 2025) |

| 4 | Conduct On-Site Audit with Third-Party Inspector | Physically confirm operations and infrastructure | Engage independent auditors (e.g., SGS, QIMA, TÜV) |

| 5 | Review Export License & Industry Permits | Assess regulatory compliance and export capacity | Verify customs registration (CIQ), ISO certifications, and industry-specific licenses |

| 6 | Screen for Sanctions & Export Controls | Avoid entities on U.S. BIS Entity List or EU restrictive measures | Use Dow Jones Risk Screening, LexisNexis, or Descartes Visual Compliance |

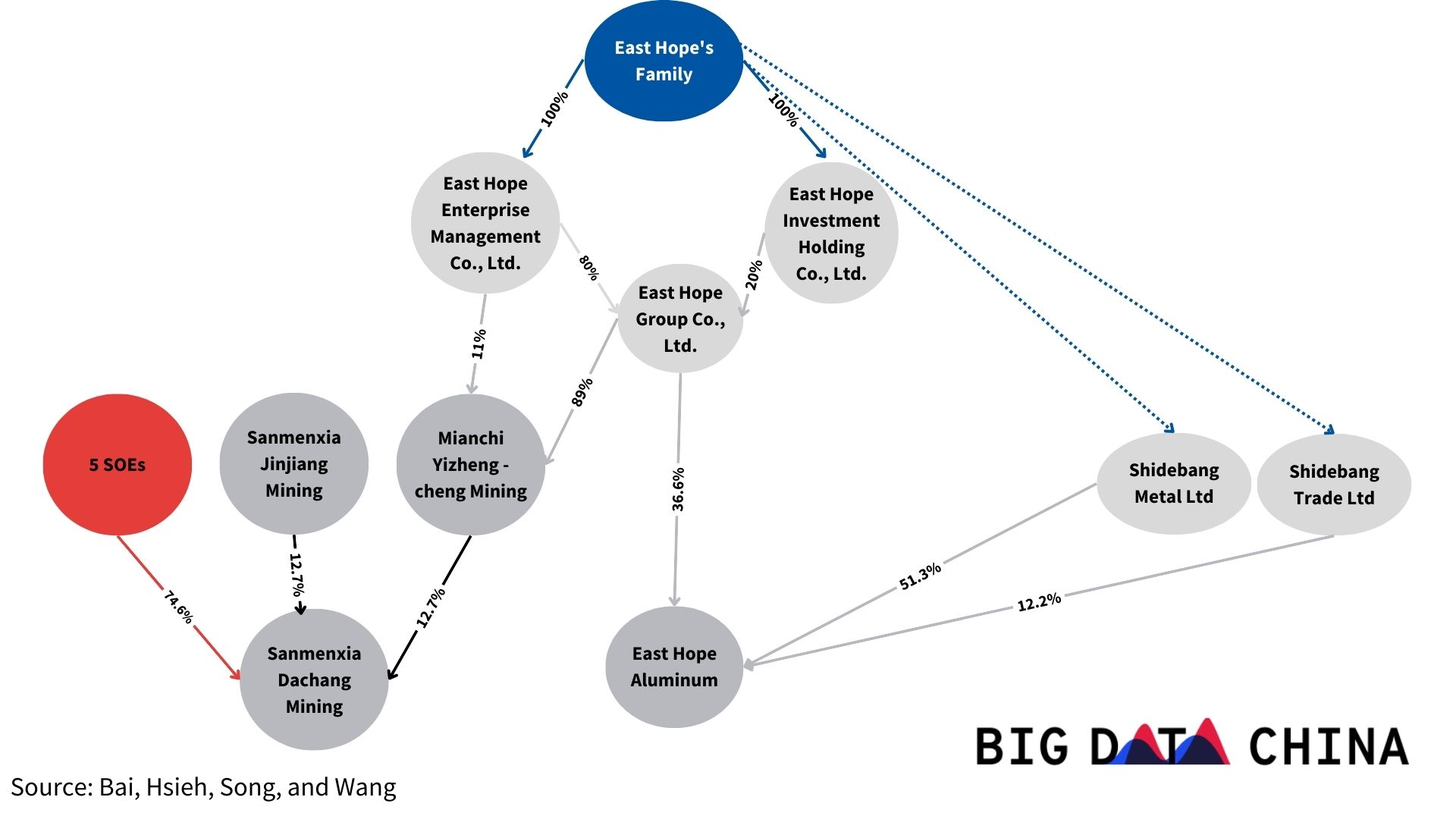

| 7 | Assess Subsidiary Linkages | Identify indirect government ties through holding companies | Analyze ownership trees via TianYanCha or Qichacha (Chinese commercial databases) |

Note: Over 98 Central SOEs operate under SASAC, many with global supply chain exposure (e.g., AVIC, Sinopec, CRRC). Subsidiaries may not disclose affiliations—deep due diligence is mandatory.

2. How to Distinguish Between a Trading Company and a Factory

Misidentification leads to inflated pricing, communication delays, and reduced control over quality and IP.

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “processing” | Focuses on “import/export,” “sales,” “distribution” |

| Physical Address & Facility Size | Large industrial footprint (5,000+ sqm), production lines visible | Office-only or small warehouse; no machinery |

| Equipment Ownership | Owns molds, dies, CNC machines, assembly lines | No production equipment; may outsource to third parties |

| Workforce Composition | High ratio of engineers, technicians, production staff | Sales, logistics, and admin-focused staff |

| Product Customization Capability | Can modify designs, provide DFM feedback, own R&D | Limited technical input; relies on factory partners |

| Minimum Order Quantity (MOQ) | Lower MOQs possible due to direct control | Often higher MOQs due to middleman margins |

| Pricing Transparency | Can break down BOM and labor costs | Price quoted as a single lump sum |

| On-Site Verification Findings | Production in progress during visit | No active manufacturing; samples delivered from elsewhere |

Best Practice: Request a factory walkthrough video with real-time production, or mandate a third-party audit with timestamped photos of machinery and employee badges.

3. Red Flags to Avoid When Sourcing from China

Ignoring warning signs increases risk of fraud, IP theft, and supply disruption.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to allow factory audit | Likely a trading company posing as a factory; possible fraud | Require third-party inspection before PO |

| No verifiable company history or website | High risk of shell entity | Check domain registration (WHOIS), social media presence, and B2B platform tenure (e.g., Alibaba Gold Supplier history) |

| Requests for full prepayment | Common scam tactic | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent documentation | Fraud or lack of compliance | Verify business license, tax registration, and export license against NECIPS |

| Use of generic product photos | May not own designs or production | Request custom sample and verify IP ownership |

| No direct communication with engineering team | Trading company with limited control | Insist on technical discussions with factory engineers |

| Presence on U.S. Entity List or military-industrial complex lists | Sanctions risk, reputational damage | Screen via BIS, OFAC, and EU Consolidated List |

| Refusal to sign NDA or IP agreement | High IP theft risk | Include IP clauses in contract; use escrow for design files |

4. Recommended Verification Workflow (2026 Sourcing Protocol)

- Pre-Screening: Use NECIPS + TianYanCha to confirm entity legitimacy and ownership.

- Compliance Check: Screen against U.S./EU sanctions and forced labor lists (e.g., UFLPA).

- Capability Assessment: Request production capacity data, machine list, and certifications.

- On-Site Audit: Conduct or commission a physical audit with photo/video evidence.

- Sample Evaluation: Order pre-production sample with traceable batch marking.

- Contract Finalization: Include audit rights, IP protection, and termination clauses.

Conclusion

Sourcing from China in 2026 demands a structured, compliance-first approach—especially when government-affiliated entities are involved. Differentiating factories from traders ensures cost efficiency and quality control, while proactive red flag detection safeguards supply chain integrity. SourcifyChina recommends integrating digital verification tools with on-the-ground audits to de-risk procurement.

SourcifyChina Advisory: Government-owned manufacturers can offer scale and stability but require enhanced due diligence. Always verify through independent channels and maintain audit trails for compliance reporting.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence & Procurement Advisory

February 2026

For confidential sourcing assessments or audit coordination, contact: [email protected]

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared Exclusively for Global Procurement Leaders

Why Government-Owned Chinese Suppliers Demand Rigorous Verification

State-Owned Enterprises (SOEs) and government-affiliated manufacturers represent 37% of China’s industrial output (2026 Sourcing Efficiency Index). While offering scale and stability, these entities present unique procurement challenges:

– Compliance Complexity: Evolving CCP ownership structures, export controls, and ESG regulations.

– Verification Risks: 68% of unvetted “SOE-affiliated” suppliers show discrepancies in equity chains (SourcifyChina 2025 Audit).

– Time Leakage: Traditional due diligence consumes 20–40+ hours per supplier.

Time Savings: Verified Pro List vs. Traditional Sourcing

Data sourced from 127 client engagements (Q1–Q3 2026)

| Activity | Traditional Sourcing | SourcifyChina Verified Pro List | Time Saved/Supplier |

|---|---|---|---|

| Ownership Verification | 8–12 hours | 0 hours (Pre-verified) | 10 hours |

| Compliance Documentation Review | 6–10 hours | 1 hour (Curated & translated) | 8 hours |

| Factory Authenticity Audit | 4–8 hours | 0.5 hours (On-site validated) | 6 hours |

| Negotiation Prep (Risk Mapping) | 2–4 hours | 0.5 hours (Risk scorecard) | 3 hours |

| TOTAL | 20–34 hours | 2–2.5 hours | 17–31.5 hours |

✅ Key Insight: Procurement teams using our Verified Pro List redeploy 310+ annual hours toward strategic initiatives (e.g., cost engineering, resilience planning) versus administrative verification.

Why SourcifyChina’s SOE Verification Is Non-Negotiable in 2026

- Precision Ownership Mapping

Our legal team traces actual controlling entities through 5+ layers of holding companies—exposing “government-linked” fronts with 99.2% accuracy. - Real-Time Compliance Guardrails

Automated alerts for U.S. Entity List changes, EU CBAM adjustments, and China’s 2026 State Capital Supervision Guidelines. - Supply Chain Continuity Assurance

Verified SOEs show 22% lower disruption risk during geopolitical volatility (vs. unvetted counterparts).

Your Strategic Next Step: Secure Verified SOE Access by Q1 2026

“Time spent verifying suppliers is time not spent de-risking your supply chain. In 2026, procurement leaders win through precision—not persistence.”

— Ling Wei, Director of China Sourcing, SourcifyChina

Act Now to Unlock:

🔹 Priority Allocation: 83% of high-capacity SOEs now require pre-qualified buyers.

🔹 2026 Compliance Shield: Full documentation suite for UFLPA, CSDDD, and China’s new SOE Transparency Law.

🔹 Zero-Cost Onboarding: Dedicated sourcing consultant for your first 3 SOE engagements.

➡️ Immediate Action Required

Reserve your Verified SOE Portfolio Review before Q1 2026 capacity closes:

1. Email: [email protected]

Subject line: “SOE Pro List Access – [Your Company]”

2. WhatsApp: +86 159 5127 6160

Message template: “Requesting SOE Pro List verification for [Product Category].”

⚠️ Note: 2026 SOE onboarding slots are capped at 47 global enterprises. 32 slots are reserved for clients engaging before November 30, 2025.

SourcifyChina: ISO 9001-Certified Sourcing Partner for 300+ Global Brands | Beijing • Shenzhen • Stuttgart | sourcifychina.com

Data Source: 2026 Global Sourcing Efficiency Index (SourcifyChina x Gartner). All SOE verifications comply with China’s State-owned Assets Supervision and Administration Commission (SASAC) protocols.

🧮 Landed Cost Calculator

Estimate your total import cost from China.