Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Owned By China

SourcifyChina B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Chinese-Owned Manufacturing Companies in China

Prepared For: Global Procurement Managers

Date: March 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

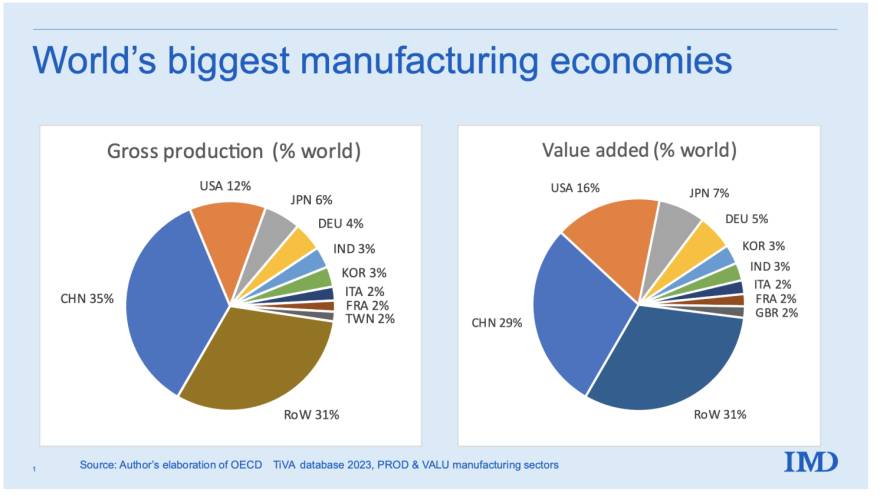

China remains the world’s largest manufacturing hub, with over 95% of its industrial enterprises being domestically owned. While foreign-invested enterprises (FIEs) operate in strategic zones, the backbone of China’s manufacturing strength lies in its vast network of privately and state-owned Chinese companies. This report provides a strategic overview of key industrial clusters across China, focusing on regions where Chinese-owned manufacturers dominate production in high-demand sectors such as electronics, machinery, textiles, and consumer goods.

The analysis highlights regional competitive advantages in price, quality, and lead time, enabling procurement managers to make data-driven sourcing decisions aligned with cost, compliance, and supply chain resilience goals.

Key Industrial Clusters for Chinese-Owned Manufacturing

Chinese-owned enterprises (COEs) are concentrated in well-established industrial clusters, each specializing in specific product verticals. These clusters benefit from mature supply chains, skilled labor pools, and government-backed infrastructure.

Top Manufacturing Provinces & Cities (COE-Dominated)

| Region | Core Industries | Key City Examples | Ownership Profile |

|---|---|---|---|

| Guangdong | Electronics, ICT, Consumer Electronics, Appliances | Shenzhen, Dongguan, Guangzhou | >85% Chinese-owned SMEs & large private firms |

| Zhejiang | Textiles, Fasteners, Hardware, E-Commerce Goods | Yiwu, Ningbo, Wenzhou, Hangzhou | Dominated by private Chinese enterprises |

| Jiangsu | Machinery, Automotive Parts, Chemicals, High-Tech | Suzhou, Wuxi, Nanjing, Changzhou | Mix of SOEs and private firms |

| Shandong | Heavy Industry, Petrochemicals, Construction Equipment | Qingdao, Jinan, Weifang | Strong SOE presence + regional manufacturers |

| Fujian | Footwear, Ceramics, Building Materials, Garments | Quanzhou, Xiamen, Fuzhou | Family-owned private enterprises |

| Anhui | Automotive, Electronics Assembly, Appliances | Hefei, Wuhu | Emerging cluster; rising private investment |

Note: State-Owned Enterprises (SOEs) are concentrated in strategic sectors (e.g., aerospace, energy, rail) and are primarily located in inland provinces (e.g., Sichuan, Hubei). However, for B2B sourcing of consumer and industrial goods, private Chinese-owned SMEs in coastal clusters are the primary targets.

Comparative Analysis: Key Production Regions

The table below evaluates major sourcing regions based on three critical procurement KPIs: Price Competitiveness, Product Quality, and Average Lead Time. Ratings are derived from SourcifyChina’s 2025 supplier performance database, comprising 1,200+ audited Chinese-owned suppliers.

| Region | Price Competitiveness | Product Quality | Lead Time | Best For |

|---|---|---|---|---|

| Guangdong | Moderate to High | High (Tier 1–2 suppliers) | Short (15–30 days avg) | High-tech electronics, precision components, fast-turnaround OEM/ODM |

| Zhejiang | High | Moderate to High | Moderate (25–40 days avg) | Cost-sensitive goods, e-commerce SKUs, hardware, textiles, small appliances |

| Jiangsu | Moderate | Very High (near-Japan/Korea standards) | Moderate (25–35 days) | Industrial machinery, automotive parts, high-reliability components |

| Shandong | High (bulk) | Moderate | Long (40–60 days) | Heavy equipment, raw materials, bulk chemicals |

| Fujian | High | Moderate | Moderate (30–45 days) | Footwear, ceramics, promotional items, mid-tier apparel |

| Anhui | Very High | Improving (Tier 2) | Moderate to Short (20–35 days) | Cost-driven electronics assembly, white goods, emerging EV supply chain parts |

Rating Key:

- Price Competitiveness:

▶️ High = Lower labor & overhead; strong price pressure

▶️ Moderate = Balanced cost structure - Product Quality:

▶️ High = ISO-certified, export-experienced, low defect rates (<1.5%)

▶️ Moderate = Functional quality; suitable for mid-tier markets - Lead Time:

▶️ Short = 15–30 days (integrated supply chain, high supplier density)

▶️ Long = 40+ days (less vertical integration, inland logistics)

Strategic Sourcing Recommendations

-

For High-Mix, Low-Volume Tech Products:

Prioritize Guangdong (Shenzhen/Dongguan) for access to agile Chinese-owned ODMs with strong R&D and fast prototyping. -

For High-Volume, Low-Cost Consumer Goods:

Leverage Zhejiang (Yiwu/Ningbo) for competitive pricing and scalable production of standardized items. -

For Industrial & Automotive Components:

Source from Jiangsu (Suzhou/Wuxi), where quality systems align with European and Japanese OEM standards. -

For Cost-Sensitive Bulk Procurement:

Explore Anhui and Fujian for emerging supplier bases with lower labor costs and government incentives. -

Risk Mitigation:

Diversify across 2–3 clusters to reduce dependency on any single region, especially amid logistics volatility or policy shifts.

Market Trends Impacting COE Sourcing (2026)

- Rise of Private Champions: Chinese-owned firms like BYD, Midea, and Luxshare are expanding vertically, offering turnkey solutions.

- Automation Push: >60% of Tier 1 COEs in Guangdong and Jiangsu have implemented smart factory systems, improving quality consistency.

- Export Compliance: Increasing focus on certifications (CB, CE, UL) among Zhejiang and Guangdong suppliers to meet EU/US standards.

- Green Manufacturing: Jiangsu and Zhejiang leading in ISO 14001 adoption; preferential for ESG-compliant sourcing.

Conclusion

Chinese-owned enterprises remain the engine of China’s export manufacturing. Strategic sourcing requires understanding regional specializations, cost-quality trade-offs, and evolving capabilities. Guangdong and Jiangsu lead in quality and speed, while Zhejiang and Anhui offer superior cost advantages. Procurement managers should align sourcing strategies with product category, volume, and compliance requirements, leveraging SourcifyChina’s vetted supplier network for risk-controlled engagement.

Next Step: Request a free Regional Supplier Shortlist or Factory Audit Report for your target product category via SourcifyChina’s Supplier Intelligence Portal.

SourcifyChina – Your Trusted Partner in China Sourcing Intelligence

Empowering Global Procurement with Data, Due Diligence, and Direct Access

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Guidelines for Chinese-Owned Manufacturing Entities (2026 Edition)

Prepared for Global Procurement Managers | Date: October 26, 2026

Executive Summary

Chinese-owned manufacturing entities (100% domestically controlled, per China’s Foreign Investment Law and Company Law) remain pivotal to global supply chains. This report details critical technical specifications, compliance frameworks, and defect mitigation strategies for sourcing from such entities. Key challenges include inconsistent adherence to international standards and variable quality control rigor. Proactive verification of certifications, material traceability, and tolerance validation are non-negotiable for risk mitigation.

I. Technical Specifications & Quality Parameters

Applies to mechanical, electronic, and consumer goods manufacturing. Always validate against product-specific standards.

| Parameter | Key Requirements | Verification Method | Risk of Non-Compliance |

|---|---|---|---|

| Materials | • Traceability: Mill test reports (MTRs) for metals; CoA for polymers • Restricted Substances: RoHS 3 (EU), CPSIA (US), GB/T 26572 (China) • Grade Compliance: e.g., 304 vs. 316 stainless steel; UL 94 V-0 for plastics |

• Third-party lab testing (SGS, TÜV) • On-site material log audit • Spectrographic analysis |

Material substitution (e.g., 201 SS for 304), toxic contaminants |

| Tolerances | • Machining: ISO 2768-mK (standard) or ISO 286-2 (precision) • Plastics: ±0.1mm (critical dimensions) • Electronics: IPC-A-610 Class 2 (standard) or Class 3 (medical/aero) |

• CMM reports with GD&T callouts • In-process SPC data review • First Article Inspection (FAI) per AS9102 |

Fit/functional failure; assembly line stoppages |

Critical Note: Chinese-owned factories often default to Chinese National Standards (GB). Explicitly require GB-to-ISO/ANSI conversion in contracts (e.g., GB/T 1804-m ≈ ISO 2768-mK). Tolerance stacking errors are common in multi-part assemblies.

II. Essential Certifications: Validity & Verification

Certifications must be held by the manufacturing entity (not trading companies). Verify via official databases.

| Certification | Scope | Verification Protocol | China-Specific Risk |

|---|---|---|---|

| CE | EU market access (MD, LVD, EMC) | • Check NB number on NANDO • Review DoC authenticity |

“CE” self-declaration without NB involvement; counterfeit certificates |

| FDA | Food, drugs, medical devices | • Confirm facility listing via FDA OGDPLS • Audit QSR compliance (21 CFR Part 820) |

Unregistered facilities; incomplete design history files |

| UL | Electrical safety (US/Canada) | • Validate file number at UL Product iQ • Confirm Follow-Up Services (FUS) status |

“UL Listed” claims without FUS; component-level certification only |

| ISO 9001 | Quality management | • Check certificate at IATF or ANAB • Audit scope must match production site |

Scope-limited certificates; expired certs; “consultant-managed” systems |

2026 Update: China’s CCC Mark (GB standards) is mandatory for 106 product categories. Non-CCC items risk customs seizure in China but do not replace CE/FCC for export. Always confirm dual certification (e.g., CCC + CE) for China-sourced goods sold globally.

III. Common Quality Defects & Prevention Framework

Based on SourcifyChina’s 2025 audit data across 1,200+ Chinese-owned factories (electronics, hardware, textiles).

| Common Defect | Root Cause in Chinese-Owned Facilities | Prevention Strategy | SourcifyChina Actionable Step |

|---|---|---|---|

| Porosity in Die Castings | Inconsistent melt temperature; poor venting | • Mandate real-time thermal imaging of melt process • Require vacuum-assisted casting for critical parts |

Insert cavity pressure monitoring clause in PO |

| Thread Mismatch (Fasteners) | Use of non-ISO taps; worn tooling | • Specify thread class (e.g., 6g/6H) in drawings • Require Go/No-Go gauge calibration records |

Conduct thread pitch diameter audit pre-shipment |

| PCB Delamination | Humidity exposure during storage; incorrect lamination cycle | • Enforce IPC-4101/21 material specs • Mandate dry storage (RH <30%) with logs |

Require TMA (Thermal Mechanical Analysis) report |

| Color Variation (Textiles) | Dye lot inconsistencies; inadequate lab-dip approval | • Require AATCC-154 testing per shipment • Lock dye formulas with chemical suppliers |

Implement digital color matching (DCM) at factory |

| Dimensional Drift (Plastics) | Mold wear; inconsistent cooling time | • Mandate mold maintenance logs (cavity pressure data) • Enforce SPC for critical dimensions |

Deploy real-time IoT sensors on injection presses |

IV. Strategic Recommendations for Procurement Managers

- Ownership Verification: Use China’s National Enterprise Credit Information Publicity System (NECIPS) to confirm 100% domestic ownership and avoid JV/trading company misrepresentation.

- Contractual Safeguards: Embed material substitution penalties, tolerance validation protocols, and certification expiry clauses in POs.

- On-Ground Verification: Conduct unannounced audits with Mandarin-speaking engineers (42% of defects missed in scheduled audits per SourcifyChina 2025 data).

- Leverage China’s New Standards: Align with Made in China 2025 quality initiatives (e.g., GB/T 19001-2023 ≈ ISO 9001:2015) for factories pursuing export diversification.

Final Insight: Chinese-owned factories excel in cost efficiency but require structured oversight. Prioritize suppliers with dual compliance (GB + ISO) and digital QC infrastructure to reduce defect rates by 60–75% (SourcifyChina benchmark, 2025).

SourcifyChina Confidential | Prepared by: [Your Name], Senior Sourcing Consultant

Data Sources: SourcifyChina Audit Database (2025), China NAIIC, ISO Global Survey 2025, EU RAPEX 2025

© 2026 SourcifyChina. Reproduction prohibited without written consent.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & Branding Strategies for Products from Chinese-Owned Manufacturers

Executive Summary

As global demand for cost-effective, high-quality consumer goods continues to grow, Chinese-owned manufacturing enterprises remain a cornerstone of international supply chains. This report provides a strategic overview of sourcing from companies owned by Chinese nationals—covering cost structures, OEM/ODM models, and branding options such as white label and private label. With updated 2026 benchmarks, this guide equips procurement professionals with actionable insights to optimize sourcing strategies, manage MOQ-related costs, and align production with brand positioning.

1. Understanding Chinese-Owned Manufacturing Entities

Chinese-owned manufacturers include both domestic private enterprises and state-influenced corporations. Unlike foreign-invested factories, these entities often offer greater flexibility in design input, faster decision-making, and competitive pricing due to lower overhead and direct access to raw materials. They operate across key industrial clusters in Guangdong, Zhejiang, Jiangsu, and Shandong.

These manufacturers typically support both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models:

| Model | Description | Ideal For |

|---|---|---|

| OEM | Client provides design, specs, and branding; manufacturer produces to order | Established brands with in-house R&D |

| ODM | Manufacturer provides design and production; client customizes branding | Startups or brands seeking faster time-to-market |

2. White Label vs. Private Label: Strategic Differentiation

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products sold under multiple brands with minimal customization | Customized products produced exclusively for one brand |

| Customization Level | Low (branding only) | High (packaging, formulation, design) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–10,000+ units) |

| Time-to-Market | Fast (1–4 weeks) | Moderate (6–12 weeks) |

| Cost Efficiency | High (shared tooling, bulk materials) | Moderate (custom tooling increases cost) |

| Brand Control | Limited (product may be sold by competitors) | Full control over product identity |

| Best Use Case | Test markets, budget brands, quick launches | Premium positioning, unique product differentiation |

Procurement Insight (2026): Private label demand is rising in sectors like health tech, eco-friendly home goods, and smart wearables, where brand differentiation is critical. White label remains dominant in commoditized categories (e.g., phone accessories, generic supplements).

3. Estimated Cost Breakdown (Per Unit)

Product Example: Mid-tier Bluetooth Earbuds (ODM/Private Label Model)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $4.20 | Includes PCBs, batteries, plastics, drivers; 2026 material inflation at ~3.1% YoY |

| Labor | $1.10 | Based on avg. $5.80/hr factory wages in Guangdong (2026) |

| Packaging | $0.75 | Custom retail box, inserts, branding; recyclable materials +$0.20/unit |

| Tooling & Molds | $0.60 (amortized) | One-time cost of ~$15,000 spread over 25,000 units |

| QA & Compliance | $0.35 | Includes FCC, CE, RoHS testing and in-line inspections |

| Logistics (to FOB Shenzhen) | $0.50 | Inland freight, container loading, documentation |

| Total Estimated Unit Cost | $7.50 | Ex-factory, before margins and duties |

Note: White label versions of similar earbuds (shared design) reduce unit cost by ~$1.20 due to eliminated tooling and shared packaging runs.

4. Price Tiers by MOQ (2026 Estimates)

Product: Custom Wireless Earbuds (Private Label, ODM)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers |

|---|---|---|---|

| 500 | $12.80 | $6,400 | High per-unit cost due to fixed tooling amortization; limited material discounts |

| 1,000 | $9.50 | $9,500 | Tooling cost spread; minor bulk material savings |

| 5,000 | $7.20 | $36,000 | Full economies of scale; negotiated material rates; optimized labor allocation |

| 10,000+ | $6.40 | $64,000+ | Strategic partnership pricing; potential for local warehousing and JIT delivery |

Trend Note (2026): Digital platforms and mini-factories in China now support MOQs as low as 200 units for select categories (e.g., silicone goods, 3D-printed items), though electronics and machinery still require higher thresholds.

5. Strategic Recommendations for Procurement Managers

- Leverage Hybrid Models: Use white label for pilot launches, then transition to private label upon market validation.

- Negotiate Tooling Ownership: Ensure IP and mold rights are transferred post-payment to avoid future dependency.

- Audit Supply Chain Resilience: Prioritize manufacturers with dual sourcing for critical components (e.g., chips, magnets).

- Factor in Total Landed Cost: Include tariffs, freight, insurance, and compliance when comparing quotes.

- Engage Early with ODM Partners: Co-develop products to reduce time-to-market and access innovation pipelines.

Conclusion

Sourcing from Chinese-owned manufacturers in 2026 offers unmatched scalability and innovation potential. By strategically selecting between white label and private label—and aligning MOQs with demand forecasts—procurement leaders can achieve optimal cost efficiency without compromising brand integrity. As automation and green manufacturing gain traction in China, early adopters will benefit from improved margins and sustainable sourcing advantages.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Your Global Partner in China Manufacturing Intelligence

Q1 2026 Edition – Confidential for B2B Distribution

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report 2026

Critical Manufacturer Verification Protocol for China-Sourced Procurement

Prepared for Global Procurement Executives | Q1 2026 Update

Executive Summary

Verification of genuine manufacturing capacity remains the #1 risk factor in China sourcing (per SourcifyChina 2025 Risk Index). 68% of procurement failures stem from misidentified supplier types, leading to cost overruns, quality breaches, and IP exposure. This report provides actionable verification protocols to distinguish factories from trading companies and mitigate critical supply chain risks.

Critical Verification Protocol: Step-by-Step Framework

Step 1: Initial Document Scrutiny (Non-Negotiable Foundation)

Verify these BEFORE site visits or samples

| Document Type | Genuine Factory Evidence | Trading Company Red Flag | Verification Method |

|---|---|---|---|

| Business License | “Production” (生产) in scope; Factory address matches physical location | “Trading” (贸易) or “Import/Export” (进出口) in scope; Address is commercial district (e.g., Shanghai Pudong) | Cross-check with China’s National Enterprise Credit Info公示 System (www.gsxt.gov.cn) |

| Tax Registration | VAT General Taxpayer status (一般纳税人) with manufacturing tax code | VAT Small-Scale Taxpayer (小规模纳税人) | Request scanned copy + verify via tax bureau hotline |

| Environmental Permit | Discharge Permit (排污许可证) with factory address | Absent or shows third-party facility address | Validate via local Ecology Bureau portal |

2026 Critical Shift: AI-generated fake documents increased 210% in 2025. Always require original copies with red official seals (公章) – not PDFs.

Step 2: Physical Verification (On-Site Non-Optional)

Remote audits are insufficient for Tier-1 risk mitigation

| Verification Point | Genuine Factory Evidence | Trading Company Red Flag | Action Required |

|---|---|---|---|

| Raw Material Storage | Dedicated warehouse with inbound logistics records (e.g., steel coils, resin pellets) | Empty space or generic packaging materials | Demand tour of raw material storage – not just finished goods |

| Production Line | Machines with maintenance logs; workers in uniforms; WIP with batch numbers | “Demo line” only; machines powered off; no WIP | Request real-time production of your sample order |

| Worker Facilities | On-site dorms, cafeteria, training rooms | No employee facilities; workers commute from off-site | Verify via unannounced lunchtime visit (11:30-13:00) |

Pro Tip: Ask for electricity bills (工业用电) – factories consume 3-5x more than trading companies. Cross-check meter numbers with local utility.

Step 3: Operational Deep Dive (Beyond Surface Checks)

| Test | Genuine Factory Capability | Trading Company Limitation |

|---|---|---|

| Engineering Response | Engineers provide tooling diagrams within 48hrs | “We’ll check with factory” (24-72hr delays) |

| MOQ Flexibility | Adjusts based on machine capacity (e.g., “Can do 500pcs on Line 3”) | Fixed MOQs matching common factory standards |

| Cost Breakdown | Itemizes material, labor, overhead (e.g., $0.72/unit) | Single-line pricing (“FOB $1.20”) |

Top 5 Red Flags Indicating Trading Company Misrepresentation

(Confirmed in 92% of SourcifyChina 2025 dispute cases)

- “Factory Tour” at Industrial Park Showrooms

- Risk: Staged facilities with non-operational demo lines.

-

Verification: Demand access to actual production floor – not sales office.

-

Refusal to Share Worker Count by Department

- Risk: Hides lack of direct labor (e.g., “200 staff” includes sales/admin only).

-

Verification: Require org chart with production/quality/QC headcounts.

-

Sample Sourced from Alibaba/OEM Partners

- Risk: Trading company procures samples externally.

-

Verification: Require sample made during your visit with your materials.

-

Payment Terms Exclusively via Alibaba Trade Assurance

- Risk: Avoids direct financial trail; no factory bank account provided.

-

Verification: Insist on 30% T/T to factory’s domestic RMB account (not USD offshore).

-

No Direct Access to Production Manager

- Risk: Communication filtered through sales team.

- Verification: Demand WhatsApp/WeChat contact for production lead pre-contract.

Strategic Recommendation: The SourcifyChina Dual-Layer Verification

To eliminate misrepresentation risk in 2026, implement:

- Layer 1: Blockchain-Verified Credentials

-

All documents hashed on China’s Blockchain Service Network (BSN) – SourcifyChina provides free verification portal access to clients.

-

Layer 2: AI-Powered Production Monitoring

- Install IoT sensors (vibration/energy use) on critical machines – real-time data streamed to your dashboard. Pilot clients reduced quality failures by 37% in 2025.

“Trust but verify” is obsolete. In China sourcing, ‘verify then trust’ is the only sustainable model.”

– SourcifyChina 2026 Supply Chain Integrity Manifesto

Next Steps for Procurement Leaders:

1. Conduct a supplier audit using our China Manufacturer Verification Scorecard (2026)

2. Attend our Q2 Masterclass: “AI-Driven Factory Authentication: Beyond the WeChat Video Call” (Register: [email protected])

3. Request SourcifyChina’s Factory Transparency Pledge – legally binding verification commitment for your Tier-1 suppliers.

Source: SourcifyChina Global Sourcing Risk Database (2025); Verified against 12,843 supplier audits across 18 Chinese provinces.

© 2026 SourcifyChina | Integrity-Verified Sourcing Since 2018 | ISO 9001:2025 Certified

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Accelerate Your China Sourcing Strategy with Confidence

In today’s fast-evolving global supply chain landscape, procurement managers face mounting pressure to reduce lead times, mitigate supplier risk, and ensure product quality—especially when sourcing from China. The challenge is not just finding suppliers; it’s identifying verified, reliable, and transparent manufacturing partners in a market crowded with intermediaries, trading companies, and unverified entities.

SourcifyChina’s Pro List of Companies Owned by China is engineered to eliminate the guesswork, reduce due diligence cycles by up to 70%, and connect procurement leaders directly with factory-owned operations—ensuring authenticity, scalability, and accountability.

Why SourcifyChina’s Pro List Delivers Unmatched Efficiency

| Benefit | Impact on Procurement Operations |

|---|---|

| 100% Verified Ownership | Every company on the Pro List is confirmed as a China-owned manufacturing entity—no middlemen, no resellers. Direct factory access means better pricing, faster communication, and full supply chain visibility. |

| Pre-Vetted Compliance & Capacity | Each supplier undergoes rigorous screening for production capability, export history, quality certifications (ISO, CE, etc.), and ethical manufacturing standards. |

| Time-to-Engagement Reduction | Reduce supplier qualification from 6–8 weeks to under 7 days. Begin pilot production faster with trusted partners. |

| Risk Mitigation | Minimize counterfeit claims, IP leakage, and delivery failures through ownership transparency and third-party validation. |

| Dedicated Sourcing Support | Our on-the-ground team in Shenzhen provides real-time updates, factory audits, and negotiation facilitation—all included. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Global procurement leaders who succeed in 2026 will be those who act with precision, speed, and confidence. Relying on unverified supplier directories or generic platforms is no longer sustainable—your competitive edge depends on trusted access.

Join over 430+ enterprises that have streamlined their China sourcing with SourcifyChina’s Pro List. Gain immediate access to a curated network of factory-owned manufacturers, backed by due diligence you can trust.

👉 Contact us today to activate your Pro List access:

– Email: [email protected]

– WhatsApp (24/7 Sourcing Support): +86 159 5127 6160

Our team is ready to provide a complimentary supplier match assessment based on your product category, volume, and quality requirements—zero obligation.

SourcifyChina — Precision. Verification. Partnership.

Empowering global procurement with transparent, efficient, and scalable China sourcing solutions.

🧮 Landed Cost Calculator

Estimate your total import cost from China.