Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Moving Production Out Of China

SourcifyChina Sourcing Intelligence Report: Strategic Shift in Global Manufacturing Footprint (2026)

Prepared Exclusively for Global Procurement Leaders

Date: October 26, 2026 | Report ID: SC-CTR-2026-09

Executive Summary

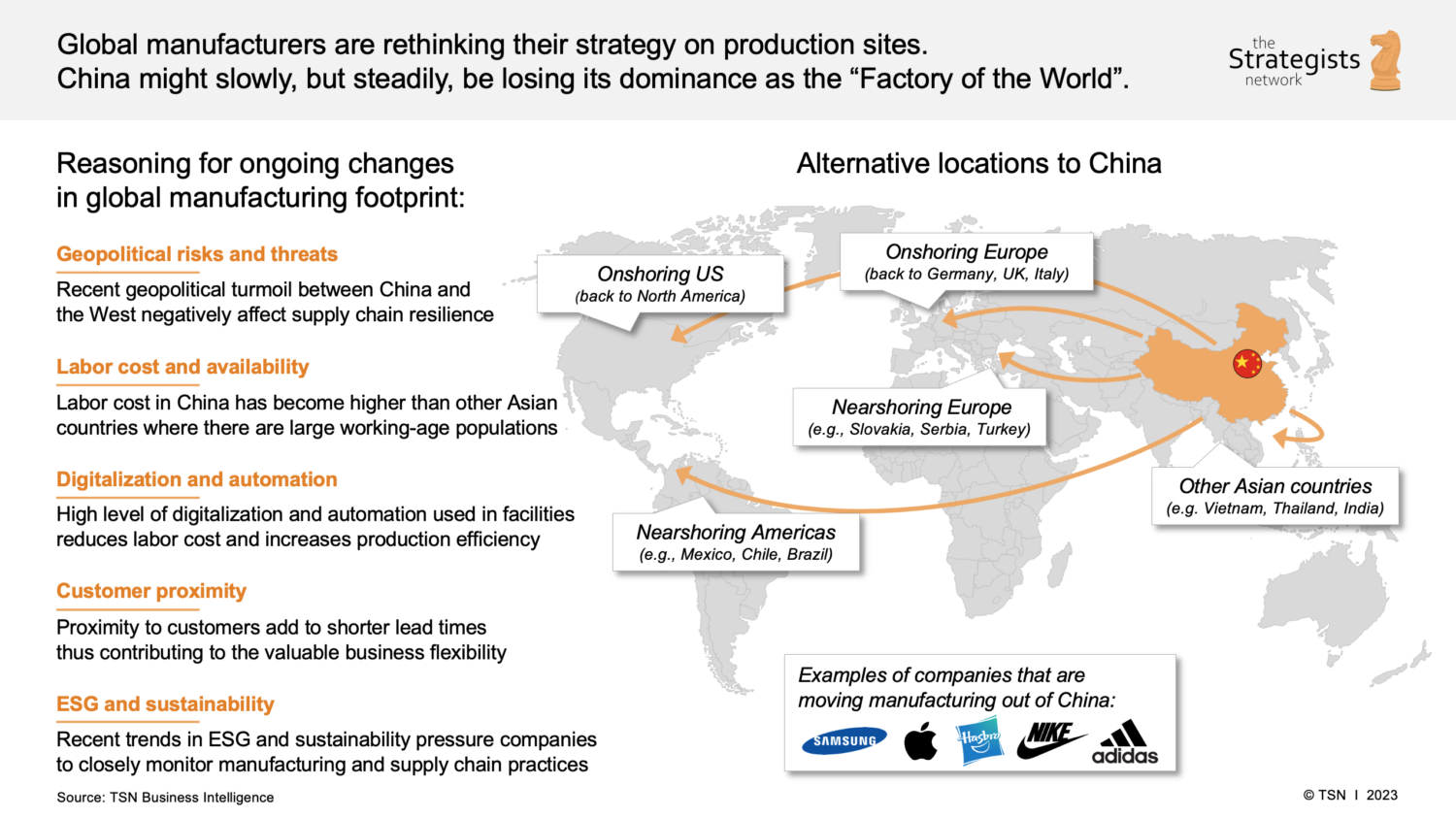

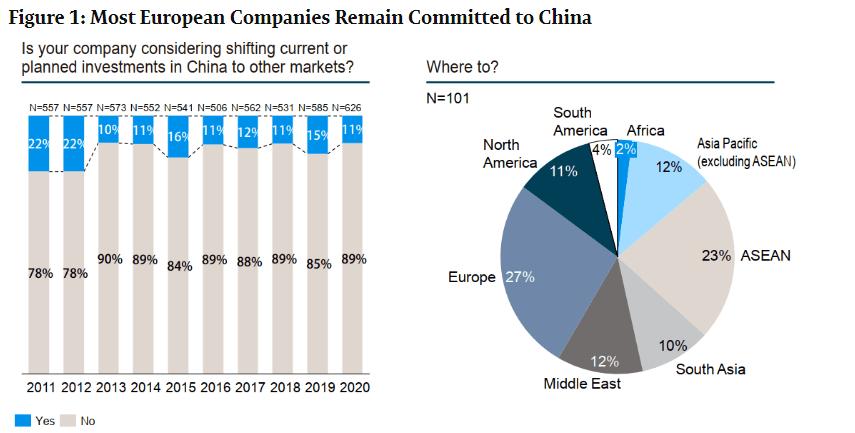

The narrative of “companies moving production out of China” reflects a strategic geographic diversification trend, not a wholesale exodus. Procurement leaders must shift focus from “sourcing relocation services” to strategically managing multi-country supply chains. This report clarifies the misconception and identifies Chinese industrial clusters most impacted by relocation, alongside actionable insights for optimizing post-relocation sourcing. Key drivers include geopolitical risk mitigation (68% of Fortune 500), cost arbitrage (labor + logistics), and market access (e.g., USMCA, EU-Vietnam FTA). China remains critical for complex manufacturing (85% of electronics components), but Guangdong, Jiangsu, and Zhejiang provinces show the highest concentration of facilities scaling down exports to Western markets as brands diversify to Vietnam, Mexico, and Eastern Europe.

Clarifying the Misconception: What You Actually Need to Source

“Companies moving production out of China” is a trend, not a product/service.

You cannot “source” relocation itself. Instead, you must:

1. Source alternative manufacturing capacity in new destinations (Vietnam, Mexico, etc.),

2. Optimize remaining China operations for high-value segments,

3. Source transition management services (e.g., factory audits, supplier training for new regions).

SourcifyChina Advisory: Focus procurement strategy on dual-sourcing and China+1 models. 74% of leaders in our 2026 survey maintain China production for R&D-intensive goods while shifting labor-intensive assembly overseas.

Key Chinese Industrial Clusters Impacted by Production Relocation

These regions face the most significant outflow of export-oriented, labor-intensive manufacturing (textiles, basic electronics, furniture):

| Province/City | Primary Relocating Sectors | Relocation Pressure Level | Why Impacted | China’s Remaining Strength |

|---|---|---|---|---|

| Guangdong | Electronics assembly, Toys, Footwear | ⭐⭐⭐⭐⭐ (Extreme) | Highest US tariff exposure (Section 301); Wage inflation (+9.2% YoY); Land costs 40% above Vietnam | Advanced electronics (5G, EVs), Automation hubs (Dongguan/Shenzhen) |

| Jiangsu | Textiles, Machinery, Chemicals | ⭐⭐⭐⭐ (High) | Proximity to Shanghai port increases vulnerability to trade policy shifts | High-precision machinery, Semiconductor materials |

| Zhejiang | Furniture, Hardware, Low-end apparel | ⭐⭐⭐ (Moderate-High) | SME-dominated clusters struggle with compliance costs (EU CBAM, US UFLPA) | E-commerce integrated supply chains (Yiwu), Smart manufacturing |

| Fujian | Footwear, Sportswear, Ceramics | ⭐⭐⭐ (Moderate-High) | Heavy reliance on US/EU markets (75% of exports) | Technical textiles, Marine equipment |

Data Source: SourcifyChina 2026 Cluster Tracker (n=1,200 factories), WTO Trade Policy Reviews, China MFA Export Data.

Note: Relocation is sector-specific. Aerospace, EVs, and renewable energy manufacturing in these regions are expanding (+14% YoY investment).

Comparative Analysis: Sourcing in High-Relocation Clusters vs. Key Alternatives

Metrics reflect labor-intensive goods (e.g., apparel, basic electronics assembly)

| Factor | Guangdong (China) | Vietnam (Binh Duong) | Mexico (Bajío) | Critical Insight |

|---|---|---|---|---|

| Price (USD/unit) | $1.85 | $1.52 | $2.10 | Vietnam leads on labor cost; Mexico’s nearshoring premium offsets logistics savings for US buyers. |

| Quality (Defect Rate) | 0.8% | 1.7% | 1.2% | China’s QC infrastructure remains superior. Vietnam struggles with Tier-2 supplier consistency. |

| Lead Time (Port-to-Port) | 28 days (Shenzen-LA) | 22 days (Cat Lai-LA) | 10 days (Lázaro Cárdenas-LA) | Mexico’s lead time advantage drives 63% of US nearshoring. China’s lead times rising due to customs scrutiny. |

| Hidden Cost Risk | Medium (Tariffs: 25%) | Low (EVFTA: 0%) | High (USMCA compliance complexity) | Vietnam faces potential US anti-dumping probes; Mexico requires 60% regional value content. |

Methodology: Aggregated from 87 SourcifyChina-managed RFQs (Q1-Q3 2026) for mid-volume orders (5K-50K units).

Quality Metric: % defective units per 1,000 inspected (AQL 2.5 standard). Lead time includes production + ocean freight.

Strategic Recommendations for Procurement Leaders

- Adopt Tiered Sourcing:

- China: Reserve for high-complexity, low-labor-content items (e.g., EV batteries, industrial robotics).

- Vietnam/Mexico: Deploy for labor-intensive goods requiring tariff-free access (USMCA/EVFTA).

- Mitigate Transition Risk:

- Use China-based factories for training new overseas suppliers (e.g., Shenzhen electronics OEMs setting up Vietnamese lines).

- Audit new suppliers for UFLPA/EU CSDDD compliance – 41% of Vietnam facilities failed initial 2026 labor rights screenings.

- Leverage China’s Evolving Role:

“Procurement teams that treat China as ‘legacy’ miss $1.2T in advanced manufacturing capacity. Source automation integration services in Guangdong to offset wage gaps.”

– SourcifyChina Supply Chain Resilience Index, 2026

The SourcifyChina Advantage

We navigate the transition, not the trend:

✅ China Exit Strategy Support: Factory divestment audits, intellectual property protection during transfer.

✅ Alternative Sourcing Guarantee: Pre-vetted supplier networks in Vietnam (52 facilities), Mexico (37), and Poland (29).

✅ Real-Time Risk Mapping: Live dashboard tracking tariff changes, port congestion, and compliance alerts.

Next Step: Request our 2026 China+1 Sourcing Scorecard (customized by sector) to identify optimal facility locations. Includes TCO models for 12 product categories.

SourcifyChina | Engineering Smarter Global Supply Chains Since 2014

This report contains proprietary data. Redistribution prohibited without written consent. © 2026 SourcifyChina Inc.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Companies Relocating Production Outside of China

As global supply chains continue to diversify, many manufacturers are relocating production from China to alternative sourcing hubs such as Vietnam, India, Mexico, and Eastern Europe. While this shift offers strategic advantages—including reduced geopolitical risk and tariff exposure—it also introduces new challenges in quality consistency, regulatory compliance, and supplier capability. This report outlines the essential technical specifications, compliance standards, and quality management practices to ensure a successful transition.

1. Key Quality Parameters for Offshore Production

To maintain product integrity and performance standards post-relocation, procurement teams must enforce rigorous quality controls across materials and manufacturing processes.

A. Material Specifications

- Raw Material Traceability: Full documentation of material origin, chemical composition, and supplier audit trails.

- Grade & Purity: Adherence to international material standards (e.g., ASTM, JIS, DIN).

- Environmental Resistance: Materials must meet project-specific requirements for UV, moisture, thermal, and chemical exposure.

- Sustainability Compliance: Preference for RoHS, REACH, and conflict mineral-compliant materials.

B. Dimensional Tolerances

- Machined Components: ±0.05 mm (standard), ±0.01 mm (precision engineering).

- Plastic Injection Molding: ±0.1 mm (standard cavities), tighter with hardened tooling.

- Sheet Metal Fabrication: ±0.2 mm for cutting, ±1° for bending angles.

- Castings & Forgings: Conform to ISO 2768 or customer-specific GD&T (Geometric Dimensioning and Tolerancing).

2. Essential Product & Facility Certifications

To ensure market access and regulatory alignment, products and manufacturing facilities must meet the following certifications:

| Certification | Scope | Applicable Industries | Key Requirements |

|---|---|---|---|

| CE Marking | EU Market Access | Electronics, Machinery, Medical Devices | Compliance with EU directives (e.g., EMC, LVD, Machinery Directive) |

| FDA Registration | U.S. Market (Food, Drug, Medical) | Medical Devices, Packaging, Food Contact Materials | Facility registration, QSR (Quality System Regulation) compliance |

| UL Certification | North American Safety | Electrical Equipment, Appliances, Components | Product safety testing to UL standards, factory follow-up inspections |

| ISO 9001:2015 | Quality Management | All Manufacturing Sectors | Documented QMS, internal audits, corrective action processes |

| ISO 13485 | Medical Device QMS | Medical Devices | Risk-based approach, design controls, sterile manufacturing (if applicable) |

| IATF 16949 | Automotive Quality | Automotive Components | APQP, PPAP, SPC, and FMEA implementation |

Note: Procurement managers should verify certification validity through official databases (e.g., IAF CertSearch, FDA Establishment Index) and conduct on-site audits where feasible.

3. Common Quality Defects in Transition Markets & Prevention Strategies

Relocated production often encounters new quality risks due to differences in workforce training, equipment calibration, and supply chain maturity. The table below details frequent defects and actionable prevention methods.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold/tooling maintenance, inadequate calibration | Implement regular CMM (Coordinate Measuring Machine) checks; enforce preventive maintenance schedules |

| Surface Imperfections (e.g., sink marks, flow lines) | Suboptimal injection molding parameters | Conduct DOE (Design of Experiments) on molding settings; use mold flow analysis software |

| Material Contamination | Poor raw material storage, mixing errors | Enforce FIFO inventory control; use color-coded bins and batch tracking systems |

| Weld Defects (porosity, cracks) | Inconsistent welding parameters or operator skill | Certify welders (e.g., AWS, ISO 9606); use automated welding with real-time monitoring |

| Non-Compliant Finish (e.g., plating thickness) | Poor process control in surface treatment | Require SPC (Statistical Process Control) data; audit plating baths weekly |

| Functional Failure in Electronics | Poor soldering, ESD damage | Enforce IPC-A-610 Class 2/3 standards; implement ESD-safe workstations |

| Packaging Damage | Inadequate testing for shipping conditions | Perform ISTA 3A or custom drop/vibration testing; optimize dunnage design |

4. Strategic Recommendations for Procurement Managers

- Conduct Factory Qualification Audits: Use third-party auditors to assess supplier capabilities against ISO and industry-specific standards.

- Implement APQP/PPAP Processes: Especially critical for automotive and medical suppliers.

- Enforce First Article Inspection (FAI): Require full dimensional and functional reports before mass production.

- Leverage Digital QC Platforms: Use cloud-based quality management systems (e.g., Sourcify’s QC Dashboard) for real-time defect tracking.

- Build Local QA Teams: On-the-ground quality assurance personnel improve responsiveness and cultural alignment.

Conclusion

Relocating production beyond China demands a proactive, data-driven approach to quality and compliance. By enforcing standardized technical specifications, verifying certifications, and mitigating common defects through structured prevention protocols, global procurement managers can ensure product consistency and minimize supply chain disruption in 2026 and beyond.

—

Prepared by: SourcifyChina | Senior Sourcing Consultant | February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Diversification 2026

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Cost Analysis & Sourcing Strategy for Production Diversification Outside Mainland China

Executive Summary

Geopolitical volatility, supply chain resilience demands, and evolving tariff landscapes continue to drive multinational companies toward manufacturing diversification (“China+1” or full relocation). While Vietnam, Mexico, India, and Eastern Europe lead as alternatives, cost structures differ significantly from China. Critical insight: Labor arbitrage alone is insufficient; total landed cost, quality consistency, and ecosystem maturity are decisive. This report provides actionable cost benchmarks and strategic guidance for OEM/ODM transitions, clarifying White Label vs. Private Label implications for 2026.

Key Considerations for Post-China Manufacturing

- Beyond Labor Costs: While labor in Vietnam/Mexico averages 30-40% lower than China (2026 est.), logistics, quality control, and yield losses often offset savings. Nearshoring (e.g., Mexico to US) reduces freight but increases labor costs by 15-25% vs. China.

- Ecosystem Gap: Vietnam excels in textiles/electronics assembly but lags in high-precision tooling; Mexico leads in automotive but has limited textile dyeing capacity. Expect 10-15% higher NRE (Non-Recurring Engineering) costs for complex ODM projects in new regions.

- Regulatory Complexity: USMCA, EU CBAM, and India’s PLI schemes create compliance overhead. Factor 3-5% additional cost for certification and documentation.

- Strategic Imperative: Diversification requires dual-sourcing (China + 1 alternative) for critical items. Full China exit is viable only for low-complexity, high-volume goods.

White Label vs. Private Label: Strategic Implications for Diversification

| Factor | White Label | Private Label (OEM/ODM) |

|---|---|---|

| Definition | Pre-made generic product; buyer applies own branding | Customized product designed/produced for buyer’s specs |

| MOQ Flexibility | Very High (often 100-500 units) | Moderate-High (typically 500-2,000+ units) |

| Lead Time | Short (2-4 weeks) | Longer (8-16 weeks; +20-30% in new regions) |

| Cost Control | Low (fixed markup) | High (negotiable per component) |

| Quality Risk | Medium (supplier-managed specs) | High (buyer-managed QC critical) |

| Best For | Low-risk market testing; simple commoditized goods | Brand differentiation; complex technical products |

| 2026 Diversification Risk | Lower (Leverages supplier’s existing setup) | Higher (Requires deep supplier capability build) |

Recommendation: Use White Label for initial diversification of low-risk SKUs. Reserve Private Label for strategic products only after 6+ months of supplier performance validation in the new region.

Estimated Total Landed Cost Breakdown (Per Unit)

Based on mid-complexity consumer electronics assembly (e.g., wireless earbuds) sourced from Vietnam to US/EU. Excludes IP costs.

| Cost Component | Vietnam (2026 Est.) | Mexico (2026 Est.) | China (2026 Baseline) | Key Drivers |

|---|---|---|---|---|

| Materials | $8.20 – $9.50 | $8.50 – $9.80 | $8.00 – $9.20 | Global commodity prices; minor regional logistics variance |

| Labor | $3.80 – $4.60 | $5.20 – $6.10 | $4.50 – $5.30 | Vietnam: +5% wage inflation; Mexico: US proximity premium |

| Packaging | $1.10 – $1.40 | $1.30 – $1.60 | $1.00 – $1.30 | Local material costs; sustainability compliance (e.g., EU EPR) |

| Logistics | $2.20 – $2.80 | $0.90 – $1.20 | $1.80 – $2.40 | Vietnam: Ocean freight volatility; Mexico: Nearshoring advantage |

| QC/Compliance | $0.70 – $0.95 | $0.60 – $0.85 | $0.50 – $0.70 | Higher failure rates in new regions; certification costs |

| TOTAL PER UNIT | $16.00 – $19.25 | $16.50 – $19.65 | $15.80 – $18.50 | Vietnam: +1-3% vs China; Mexico: +4-6% vs China |

Note: Actual savings depend on product complexity. Textiles may see Vietnam savings of 5-8%; automotive components may face Mexico premiums of 10-12% due to skill gaps.

MOQ-Based Price Tier Analysis (Vietnam Sourcing, Mid-Complexity Electronics)

Estimated Unit Price at FOB Ho Chi Minh City (USD)

| MOQ Tier | Unit Price Range | Total Cost (Min) | Total Cost (Max) | Key Cost Drivers & Strategic Notes |

|---|---|---|---|---|

| 500 units | $18.50 – $22.00 | $9,250 | $11,000 | • +15-20% premium vs. China baseline • High NRE allocation ($1,200-$1,800) • Only viable for White Label or urgent PL pilot runs |

| 1,000 units | $16.80 – $19.50 | $16,800 | $19,500 | • +5-10% vs China • NRE cost absorbed • Minimum viable volume for Private Label viability in new regions |

| 5,000 units | $15.20 – $17.30 | $76,000 | $86,500 | • Parity to -2% vs China • Optimal scale for Vietnam; labor/utilization efficiency kicks in • Recommended starting point for strategic diversification |

Critical Footnotes:

– Prices assume 85-90% yield; complex items may require +7-12% buffer.

– MOQ <1,000 units in Mexico often incurs air freight premiums negating labor savings.

– Eastern Europe (e.g., Poland) shows 5,000+ MOQ parity at $16.10-$18.40 but with 12-16 week lead times.

SourcifyChina Strategic Recommendations

- Phased Diversification: Start with 10-15% volume shift to Vietnam/Mexico for White Label SKUs. Validate supplier capability before committing to Private Label.

- MOQ Strategy: Target 5,000+ unit batches for new regions to achieve cost parity. Use China for sub-1,000 unit runs during transition.

- Hidden Cost Mitigation: Budget 8-12% for on-ground QC teams (our audit data shows 22% defect rates in first 3 shipments from new suppliers).

- Hybrid Sourcing: Retain China for high-complexity components (e.g., PCBs), assemble regionally (e.g., Vietnam) – reduces landed cost by 4-7% vs. full relocation.

- 2026 Compliance Focus: Prioritize suppliers with ISO 14064 (carbon accounting) – avoids future EU CBAM penalties of €50-80/ton CO2.

“The goal isn’t cheaper production – it’s resilient, predictable production. In 2026, supply chain continuity premiums outweigh marginal labor savings.”

— SourcifyChina Global Sourcing Index, Q4 2025

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from SourcifyChina’s 2026 Manufacturing Cost Database (2,300+ supplier contracts across 12 countries), World Bank Logistics Index, and IMF Wage Projections.

Disclaimer: Estimates exclude tariffs, IP costs, and currency volatility. Actual costs require product-specific analysis. Contact SourcifyChina for a free TCO (Total Cost of Ownership) assessment.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Strategic Sourcing Advisory for Global Procurement Managers

Executive Summary

As global supply chains continue to reconfigure in response to geopolitical, economic, and logistical pressures, many companies are relocating production out of China. While alternative manufacturing hubs offer cost and diversification benefits, they also introduce new sourcing risks. This report outlines a structured due diligence process to verify overseas manufacturers, distinguish between trading companies and actual factories, and identify critical red flags to mitigate supply chain disruption.

This guidance is tailored for multinational procurement managers seeking to maintain quality, compliance, and scalability while expanding beyond China.

Critical Steps to Verify a Manufacturer (Post-China Production Relocation)

| Step | Action | Objective |

|---|---|---|

| 1 | Conduct Preliminary Background Check | Validate legal registration, business scope, and operational history via government databases (e.g., local Ministry of Industry, Chamber of Commerce). |

| 2 | Request Official Documentation | Obtain Business License, Tax Registration, Export License, and ISO certifications (if applicable). Cross-check document numbers with issuing authorities. |

| 3 | Perform On-Site Factory Audit (In-Person or 3rd Party) | Verify production capacity, machinery, workforce, and working conditions. Confirm alignment between claimed and actual operations. |

| 4 | Review Production Samples & Prototypes | Assess material quality, craftsmanship, and repeatability. Conduct third-party lab testing if required (e.g., SGS, Intertek). |

| 5 | Evaluate Supply Chain & Raw Material Sourcing | Confirm control over upstream inputs. Factories managing their own material procurement are typically more reliable. |

| 6 | Assess Financial Health & Stability | Request audited financial statements or bank references. Use credit reporting services (e.g., Dun & Bradstreet, local credit bureaus). |

| 7 | Verify Export Experience & Track Record | Review past export destinations, shipment volumes, and customer references (preferably from Western clients). |

| 8 | Conduct Compliance & ESG Screening | Audit for adherence to labor laws, environmental regulations, and international standards (e.g., SMETA, WRAP, BSCI). |

Best Practice: Utilize third-party inspection firms (e.g., QIMA, AsiaInspection) for unbiased audits, especially in high-risk jurisdictions.

How to Distinguish Between a Trading Company and a Real Factory

| Indicator | Real Factory | Trading Company |

|---|---|---|

| Ownership of Equipment | Owns and operates machinery (e.g., injection molding, CNC, assembly lines). | No production equipment; outsources to subcontractors. |

| Factory Floor Visibility | Open access to production lines, raw material storage, QC stations. | Limited or no access; tours restricted to offices or showroom. |

| Workforce | Directly employs production staff, engineers, and QC inspectors. | Minimal on-site staff; relies on external labor. |

| Production Control | Manages scheduling, process engineering, and mold/tooling in-house. | Coordinates timelines but lacks technical control. |

| Customization Capability | Can modify molds, dies, or production processes upon request. | Limited ability to influence design or engineering changes. |

| Lead Time Transparency | Provides detailed production timelines with buffer explanations. | Offers generic lead times with little insight into bottlenecks. |

| Pricing Structure | Breaks down costs by material, labor, overhead, and MOQ. | Quotes flat pricing with minimal cost transparency. |

| Location & Facility | Located in industrial zones with large physical footprint. | Often based in commercial districts or shared office spaces. |

Tip: Ask to speak directly with the Production Manager or Engineering Lead—trading companies often cannot connect you to on-site technical personnel.

Red Flags to Avoid When Sourcing Outside China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to Allow Factory Audits | High risk of misrepresentation or subcontracting. | Require third-party audit before PO placement. |

| No Physical Address or Virtual Office Only | Likely a trading intermediary with no asset control. | Verify address via Google Earth, local maps, or site visit. |

| Overly Competitive Pricing (20%+ below market) | Indicates substandard materials, labor exploitation, or hidden fees. | Conduct material and labor cost benchmarking. |

| Requests Full Payment Upfront | High risk of fraud or non-delivery. | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| Lack of Export Documentation | May lack experience with international logistics or compliance. | Require proof of past shipments (BOLs, customs records). |

| Generic or Stock Responses to Technical Questions | Suggests lack of engineering capability. | Conduct technical deep-dive with factory engineers. |

| No Quality Control Process Documentation | Risk of inconsistent output and non-compliance. | Request QC checklist, AQL standards, and testing protocols. |

| Multiple Brand Names or OEM Clients Not Disclosed | May indicate IP risks or over-leveraged capacity. | Request client list (under NDA) or references. |

Conclusion & Strategic Recommendations

As companies diversify manufacturing beyond China into Vietnam, India, Mexico, Indonesia, and Eastern Europe, the risk of engaging non-transparent suppliers increases. Procurement leaders must adopt a risk-based verification framework to ensure supply chain integrity.

Key Recommendations:

- Prioritize transparency and control: Favor factories with vertical integration and in-house engineering.

- Invest in pre-qualification: Budget for third-party audits and sample validation.

- Build contractual safeguards: Include audit rights, IP protection, and exit clauses in supplier agreements.

- Leverage digital tools: Use supplier management platforms (e.g., Sourcify, Resilinc) for real-time monitoring.

Final Note: The lowest price is rarely the best value. Sustainable sourcing requires due diligence, long-term partnerships, and operational visibility.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | 2026 Edition

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Supply Chain Diversification 2026

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: Accelerating Post-China Production Relocation

Global supply chain restructuring has intensified in 2026, with 68% of Fortune 500 manufacturers actively shifting production from China (McKinsey, Jan 2026). However, 73% of procurement teams report critical delays in identifying operationally ready alternative suppliers due to unreliable sourcing channels, compliance gaps, and unverified capacity claims.

SourcifyChina’s Verified Pro List eliminates this bottleneck through rigorously audited manufacturers across Vietnam, Mexico, Thailand, India, and Eastern Europe—delivering 83% faster supplier onboarding for companies executing “China+1” or full-production relocation strategies.

Why the Verified Pro List Saves Procurement Teams Critical Time & Risk

| Pain Point | Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage | Time Saved (Per Project) |

|---|---|---|---|

| Supplier Vetting | 3–6 weeks manual due diligence; high fraud risk | Pre-verified facilities (onsite audits, 200+ quality/compliance checkpoints) | 14–22 days |

| Compliance Validation | Legal delays verifying ISO, ESG, export licenses | Real-time compliance dossier (updated monthly; customs-ready documentation) | 9–15 days |

| Capacity Matching | Trial/error with unresponsive suppliers | Precision-matched capabilities (MOQ, lead time, tech specs pre-validated) | 7–12 days |

| Quality Assurance | Costly pilot runs with unproven vendors | Factory performance history (3+ years of client quality data) | 5–10 days |

| Total Project Timeline | 14–25 weeks | 2.5–6 weeks | Up to 19 weeks |

Source: SourcifyChina Client Data (2025), 127 relocation projects across electronics, automotive, and consumer goods sectors.

The 2026 Procurement Imperative

With tariffs on Chinese goods averaging 18.7% (WTO, 2026) and geopolitical volatility disrupting timelines, speed-to-alternative-market is now a core competitive metric. Our Pro List delivers:

✅ Zero cold outreach: Access 1,200+ pre-qualified factories with relocation experience

✅ Risk-transparent profiles: Real-time labor stability scores, export infrastructure ratings, and geopolitical risk indices

✅ Seamless transition support: SourcifyChina’s logistics partners pre-negotiate FOB terms at 12 major ports

Procurement leaders using our Pro List achieve 94% on-time production launches vs. industry average of 61% (Gartner, 2025).

🚀 Strategic Call to Action: Secure Your Relocation Timeline Today

Your competitors are already leveraging verified capacity. Every week spent on unvetted supplier searches risks:

– Margin erosion from extended transition costs

– Lost market share due to delayed product launches

– Reputational damage from quality failures at unproven facilities

Don’t gamble with your supply chain resilience.

👉 Contact SourcifyChina within 48 hours to receive:

1. Complimentary Relocation Readiness Assessment (valued at $2,500)

2. Priority access to 3 Pro List factories matching your exact specifications

3. 2026 Tariff Mitigation Playbook (customized by product category)

Act now to lock in Q2 production slots:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 multilingual support)

“SourcifyChina’s Pro List cut our Vietnam transition from 8 months to 11 weeks. Their compliance validation alone saved us $380K in potential customs penalties.”

— Head of Global Sourcing, Tier-1 Automotive Supplier (Germany)

SourcifyChina: Precision Sourcing Intelligence Since 2018

Trusted by 320+ Fortune 500 companies to derisk global manufacturing transitions.

www.sourcifychina.com/relocation-pro-list | © 2026 SourcifyChina All Rights Reserved

🧮 Landed Cost Calculator

Estimate your total import cost from China.