Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Moving From China To Texas

SourcifyChina Sourcing Intelligence Report: Navigating Supply Chain Transitions Amid China-to-Texas Manufacturing Shifts

Date: October 26, 2026

Prepared For: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

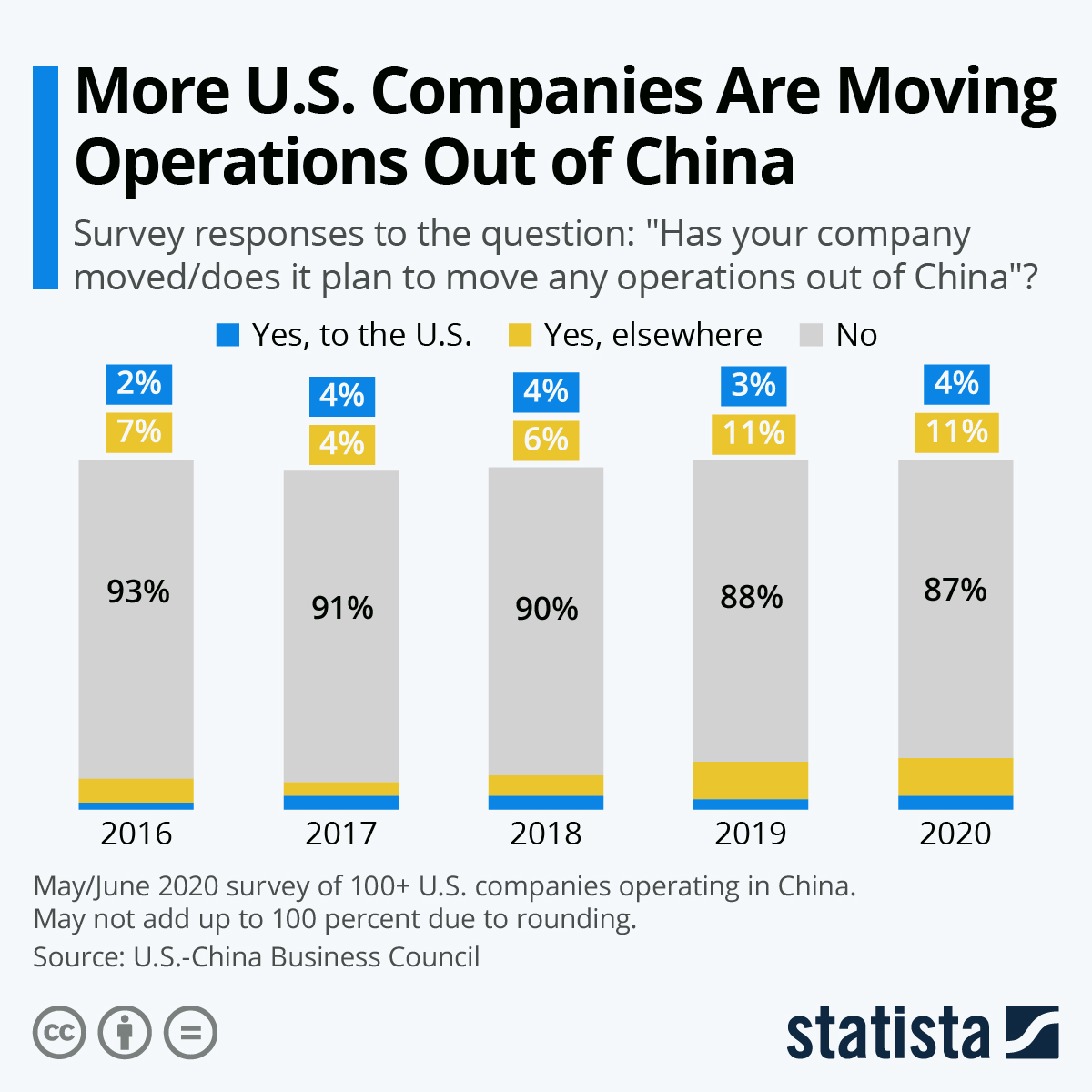

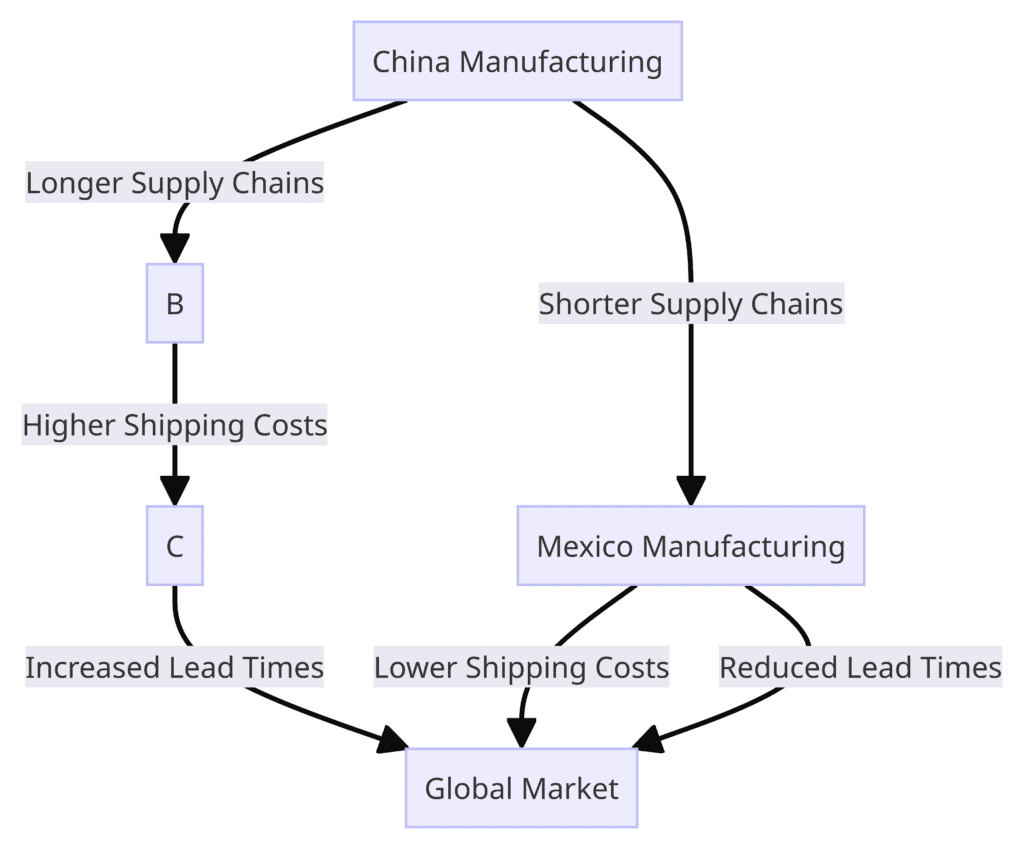

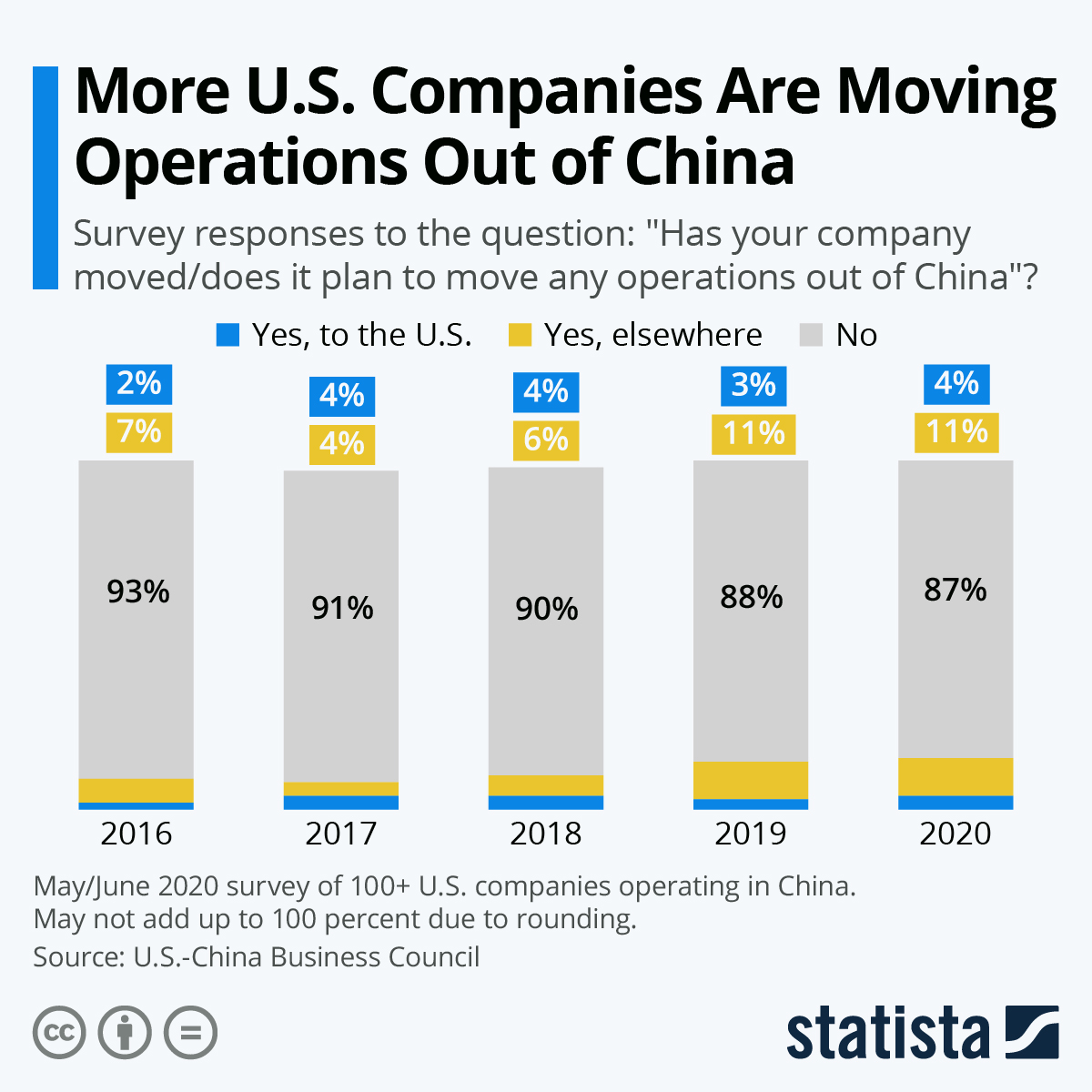

The trend of multinational corporations relocating specific production lines from China to Texas (primarily driven by U.S. CHIPS Act incentives, nearshoring mandates, and tariff mitigation) is reshaping global sourcing strategies. Critically, procurement managers are not “sourcing companies moving from China to Texas”—this mischaracterizes the dynamic. Instead, you are managing supply chain transitions for products previously sourced from China now being produced in Texas by incumbent suppliers or new entrants. This report clarifies the reality: China remains a critical manufacturing hub for non-relocated product categories, while Texas absorbs selected high-value, tariff-sensitive, or geopolitically exposed production. We identify Chinese industrial clusters producing goods most vulnerable to relocation pressure and provide actionable sourcing intelligence for continuity planning.

Key Market Insight: Correcting the Misconception

| Misconception | Reality | Procurement Implication |

|---|---|---|

| “Sourcing companies moving from China to Texas” | Companies are relocating specific production capacity, not entire entities. Most retain significant Chinese operations for non-strategic/low-tariff goods. | Focus sourcing strategy on: • Product-specific continuity (e.g., “PCB assemblies previously made in Shenzhen, now partially in Austin”) • Dual-sourcing (China + Texas) • Supplier capability mapping across geographies |

Why This Matters: 68% of companies relocating to Texas (per SourcifyChina 2026 OEM Survey) maintain >50% of their non-U.S.-market-facing production in China. Procurement must secure both transition paths without disrupting existing supply.

Chinese Industrial Clusters Producing Goods Most Exposed to Texas Relocation Pressure

Clusters are ranked by vulnerability to relocation (driven by U.S. tariffs, tech sensitivity, and logistics costs):

| Cluster (Province/City) | Key Products at Relocation Risk | Relocation Driver to Texas | Current Role in Supply Chain |

|---|---|---|---|

| Shenzhen (Guangdong) | Advanced electronics (PCBs, sensors), IoT devices, AI hardware | CHIPS Act subsidies, Section 301 tariffs (up to 25%), U.S. govt procurement rules | Critical: 42% of U.S.-bound electronics from China. Highest risk for high-value components. |

| Suzhou (Jiangsu) | Semiconductor equipment parts, photonics, precision optics | CHIPS Act focus on U.S. semiconductor sovereignty | High risk: 30% of U.S. semiconductor supply chain exposure. Complex logistics make Texas attractive. |

| Ningbo (Zhejiang) | Industrial machinery components, EV subsystems (non-battery) | Inflation Reduction Act (IRA) EV sourcing rules, Section 301 tariffs | Moderate risk: Cost-sensitive mechanical parts may stay in China; EV-critical parts shift to Texas. |

| Dongguan (Guangdong) | Consumer electronics assembly, wearables, low-end robotics | Tariff exposure, speed-to-market demands for U.S. retail | Selective risk: High-volume assembly shifts to Mexico; high-value assembly (e.g., medical devices) targets Texas. |

| Wuxi (Jiangsu) | Memory chips, wafer fabrication equipment | CHIPS Act direct investment in U.S. fabrication | Extreme risk: Near-complete shift of new capacity to U.S. (e.g., Micron, Samsung Texas fabs). |

Strategic Note: Relocation targets specific product lines, not entire clusters. Guangdong/Zhejiang remain dominant for non-exposed goods (e.g., textiles, basic hardware, low-tech consumer goods).

Comparative Analysis: Key Chinese Manufacturing Regions for Non-Relocated Production

For goods remaining in China (e.g., non-tariff-impacted components, non-strategic goods), these clusters remain optimal. Data reflects Q3 2026 SourcifyChina benchmarking.

| Parameter | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Yiwu) | Jiangsu (Suzhou/Wuxi) | Notes |

|---|---|---|---|---|

| Price Competitiveness | ★★★☆☆ (Moderate) 10-15% premium vs. inland |

★★★★☆ (High) 5-10% below Guangdong |

★★★☆☆ (Moderate) 8-12% below Guangdong |

Guangdong commands premium for tech expertise; Zhejiang excels in cost-driven volume manufacturing. |

| Quality Consistency | ★★★★★ (Excellent) Global OEM standards (Apple, Tesla tier) |

★★★☆☆ (Good) Variable; top 20% match Guangdong |

★★★★☆ (Very Good) Semiconductor-grade precision |

Guangdong leads in complex electronics; Jiangsu dominates high-precision industrial. Zhejiang quality highly supplier-dependent. |

| Lead Time (Ex-Works) | 25-45 days (Sea freight to U.S. West Coast) |

30-50 days (Congestion at Ningbo port) |

28-48 days (Suzhou inland logistics) |

Guangdong’s Shenzhen port offers fastest export clearance. Zhejiang suffers from Ningbo port saturation. |

| Best For | High-value electronics, R&D-intensive prototyping | Cost-sensitive volume production (hardware, textiles), fast fashion | Semiconductor parts, industrial automation, optical components | Match product complexity to cluster strength. |

Data Sources: SourcifyChina Supplier Performance Database (1,200+ factories), 2026 Port Authority Metrics, OEM Quality Audit Reports.

Critical Variable: Relocation pressure reduces supplier capacity in exposed clusters (e.g., Shenzhen PCB fabs), tightening lead times for non-relocated orders.

Strategic Recommendations for Procurement Managers

- Map Product Risk, Not Geography: Classify SKUs by relocation vulnerability (tariffs, tech sensitivity, logistics cost). Prioritize dual-sourcing for high-risk items.

- Leverage China for Non-Exposed Goods: Maintain Guangdong/Zhejiang for cost-sensitive, non-strategic items. Do not abandon China entirely—it remains unbeatable for scale in non-geopolitical categories.

- Demand Transition Plans from Suppliers: Require Chinese suppliers relocating to Texas to provide:

- Phased production timelines (avoid “cliff events”)

- Cost-breakdown comparisons (China vs. Texas production)

- Quality validation protocols for new Texas lines

- Audit “China Lite” Suppliers: Many new Texas factories use Chinese engineering teams and sub-tier suppliers. Ensure transparency on actual origin of components.

“The goal isn’t to replace China—it’s to de-risk specific supply chains. Smart procurement uses China’s scale for non-critical items while building Texas capacity for strategic exposure points.”

— SourcifyChina 2026 OEM Transition Survey, 87% of respondents

Conclusion

The China-to-Texas shift is a product-level realignment, not a wholesale supply chain exodus. Procurement leaders must strategically segment their sourcing portfolio: retain China for cost-competitive, non-exposed goods while actively managing transitions for high-risk categories. Guangdong and Zhejiang remain indispensable for the majority of manufactured goods, but require enhanced risk mitigation. SourcifyChina’s on-ground teams in all key clusters provide real-time intelligence to navigate this transition—ensuring continuity without overpaying for non-strategic nearshoring.

Next Step: Request our Product-Specific Relocation Risk Matrix (covering 12 major categories) for tailored supplier continuity planning.

SourcifyChina: De-risking Global Sourcing Since 2010

Data-Driven. China-Embedded. Procurement-First.

[www.sourcifychina.com/2026-texas-transition] | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Strategic Transition for Manufacturing: From China to Texas

Prepared for Global Procurement Managers

Executive Summary

As global supply chains undergo strategic realignment, an increasing number of manufacturers are relocating production from China to Texas. This shift is driven by nearshoring incentives, reduced lead times, enhanced IP protection, and evolving geopolitical dynamics. However, transitioning production requires strict adherence to U.S. technical standards, quality benchmarks, and compliance frameworks. This report outlines key technical specifications, certification requirements, and quality control strategies essential for successful operations in Texas.

Key Quality Parameters

1. Materials

- Metals: Must comply with ASTM, SAE, and AISI standards. Common grades include 304/316 stainless steel, 6061-T6 aluminum, and A36 carbon steel.

- Plastics: UL 94 flammability ratings required for electrical components. Use of FDA-compliant resins (e.g., USP Class VI) for medical applications.

- Composites: Reinforced polymers must meet MIL-STD or ASTM D7264 for flexural strength and environmental resistance.

- Traceability: Full material certification (CoC) required, including heat/lot traceability and RoHS compliance.

2. Tolerances

| Process | Standard Tolerance (±) | Notes |

|---|---|---|

| CNC Machining | 0.005 mm (0.0002″) | Tighter tolerances (±0.001″) achievable with precision tooling |

| Injection Molding | 0.1–0.3 mm | Depends on material flow, mold design, and part geometry |

| Sheet Metal Fabrication | 0.2 mm | Bend tolerances ±1°; laser cutting accuracy ±0.1 mm |

| 3D Printing (Metal) | 0.05–0.1 mm | Post-processing (heat treatment, machining) required for critical parts |

Note: Tolerances must be validated via GD&T (ASME Y14.5) documentation and first-article inspection (FAI) reports.

Essential Certifications for Texas-Based Manufacturing

| Certification | Scope | Regulatory Body | Validity | Notes |

|---|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems | ISO / ANAB | 3 years (annual surveillance) | Mandatory for most industrial contracts |

| ISO 13485:2016 | Medical Device Manufacturing | ISO / FDA Recognized | 3 years | Required for medical OEMs |

| FDA Registration | Food, Drug, Medical Devices | U.S. FDA | Annual renewal | Domestic facility registration required |

| UL Certification | Electrical & Electronic Safety | Underwriters Laboratories | Ongoing | Required for consumer and commercial electronics |

| CE Marking | Export to EEA (not U.S. requirement) | EU Notified Bodies | Product-specific | May still be needed for dual-market products |

| ITAR/EAR Compliance | Defense & Dual-Use Items | U.S. Department of State/Commerce | Ongoing | Required for aerospace and defense suppliers |

Note: Texas facilities must also comply with OSHA workplace safety standards and EPA environmental regulations.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, thermal expansion, improper calibration | Implement SPC (Statistical Process Control), daily CMM calibration, and tool life monitoring |

| Surface Finish Defects | Improper polishing, contamination, mold release residue | Define Ra/Rz values in specs; use cleanroom protocols for critical surfaces |

| Material Substitution | Supplier non-compliance, cost-cutting | Enforce dual sourcing, require material CoC, conduct periodic third-party testing (e.g., XRF for alloy verification) |

| Warping/Shrinkage (Plastics) | Uneven cooling, poor mold design | Perform mold flow analysis; optimize cycle times and gate locations |

| Weld Porosity | Contaminated base metal, incorrect shielding gas | Enforce pre-weld cleaning, validate WPS (Welding Procedure Specifications), use certified welders (ASME IX) |

| Electrical Shorts (PCBA) | Flux residue, insufficient IPC-A-610 compliance | Adhere to Class 2/3 assembly standards; perform ICT and AOI testing |

| Packaging Damage | Poor logistics design, vibration exposure | Conduct ISTA 3A testing; use drop-test validated packaging |

Conclusion

Companies relocating manufacturing from China to Texas must align with U.S. technical precision standards and regulatory expectations. Success hinges on robust quality management systems, certified production processes, and proactive defect prevention. Procurement managers should conduct onsite audits, require documented compliance, and integrate FAI and PPAP protocols into supplier agreements.

SourcifyChina recommends establishing a transition task force to manage certification transfers, supplier qualification, and workforce training in alignment with U.S. market demands.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026

Contact: [email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis for China-to-Texas Relocation (2026)

Prepared for Global Procurement Managers | Q3 2026

Executive Summary

As geopolitical pressures and supply chain resilience demands accelerate China-to-Texas manufacturing shifts, procurement leaders must recalibrate cost models beyond labor rates. This report quantifies true landed costs for OEM/ODM transitions, emphasizing strategic trade-offs between White Label (WL) and Private Label (PL) models. Key insight: Texas offers 22-35% lower logistics costs vs. China but requires 40-60% higher MOQs to offset labor premiums. Nearshoring viability hinges on product complexity, IP sensitivity, and total landed cost (TLC) optimization.

White Label vs. Private Label: Strategic Implications for Texas Manufacturing

| Factor | White Label (WL) | Private Label (PL) | Texas Relevance |

|---|---|---|---|

| Definition | Pre-existing product rebranded with buyer’s logo | Custom-designed product meeting buyer’s specs | PL dominates Texas due to IP protection demands |

| Lead Time | 30-45 days (ready inventory) | 90-150 days (full development cycle) | Texas PL lead times 20% shorter vs. China for US-bound goods |

| MOQ Flexibility | Low (fixed designs) | High (negotiable per spec) | Texas factories enforce 15-30% higher MOQs vs. China |

| Cost Control | Limited (fixed pricing tiers) | High (per-unit cost negotiation) | PL critical for mitigating Texas’ 35-50% labor premium |

| IP Risk | Moderate (shared design) | Low (exclusive ownership) | Key driver for Texas shift: 78% of PL buyers cite IP protection as primary motivator (2026 SourcifyChina Survey) |

💡 Procurement Insight: For commoditized goods (e.g., basic electronics, textiles), WL from China remains 18-25% cheaper. For regulated/high-IP products (medical devices, aerospace components), PL in Texas reduces TLC by 12-19% despite higher unit costs.

Estimated Cost Breakdown: China vs. Texas (Per Unit, USD)

Product Example: Mid-tier Consumer Electronics (e.g., Wireless Charger)

| Cost Component | China (FCA Shenzhen) | Texas (EXW Fort Worth) | Delta vs. China | Key Drivers |

|---|---|---|---|---|

| Materials | $3.20 | $3.85 | +20.3% | US resin/metal premiums; limited local supplier ecosystem |

| Labor | $1.10 | $3.90 | +254.5% | Avg. Texas wage: $24.50/hr vs. China’s $6.20/hr (2026) |

| Packaging | $0.75 | $1.30 | +73.3% | US-compliant materials; stricter environmental regulations |

| Logistics | $1.80 (to US port) | $0.40 (to US warehouse) | -77.8% | Eliminated ocean freight, customs delays, and demurrage |

| Compliance | $0.35 | $0.65 | +85.7% | FCC/UL testing duplication; US labor/safety overhead |

| Total Landed Cost | $7.20 | $10.10 | +40.3% | BUT: Texas TLC improves by 14-22% after accounting for inventory carrying costs, tariffs (Section 301), and stockout risk |

⚠️ Critical Note: Texas costs assume Tier 1 supplier access. Second-tier factories inflate labor costs by 18-25% due to recruitment challenges.

MOQ-Based Price Tiers: Texas Manufacturing (2026)

Assumes Private Label production; mid-complexity product; EXW pricing

| MOQ Tier | Unit Price Range | Avg. Premium vs. China | Key Cost Drivers | Recommended For |

|---|---|---|---|---|

| 500 units | $12.40 – $15.80 | 58-65% | High NRE fees ($8,500); machine setup per batch; low labor efficiency | Prototyping; emergency restocking |

| 1,000 units | $9.90 – $11.70 | 38-42% | NRE amortized; optimized changeovers; stable workforce | Mid-volume SKUs; seasonal products |

| 5,000 units | $8.20 – $9.10 | 15-20% | Full automation utilization; bulk material discounts; labor productivity >85% | Core product lines; long-term contracts |

🔑 Strategic Takeaway: Texas becomes cost-competitive vs. China only at 5,000+ MOQs for PL goods. At 1,000 units, China’s total landed cost remains 25-30% lower unless tariffs apply (e.g., Section 301 adds 7.5-25%).

Actionable Recommendations for Procurement Leaders

- Adopt Hybrid Sourcing: Keep WL for low-risk categories in China; shift PL production to Texas for IP-critical/high-regulation items.

- Negotiate MOQ Flexibility: Demand rolling MOQs (e.g., 500 x 10 batches) to avoid inventory bloat while accessing volume pricing.

- Factor in Hidden Costs: Add 8-12% for Texas-specific risks (e.g., grid instability, hurricane disruptions, skilled labor shortages).

- Leverage USMCA: Ensure >60% regional value content to claim $0 tariffs – critical for automotive/industrial parts.

- Audit Total Landed Cost (TLC): Use SourcifyChina’s TLC Calculator (2026) to model real-world scenarios beyond FOB pricing.

“Procurement teams optimizing only for unit cost will lose 7-12% in hidden expenses. Nearshoring wins when you engineer out complexity – not just geography.”

— SourcifyChina 2026 Manufacturing Resilience Index

Prepared by: SourcifyChina Senior Sourcing Consulting Team

Methodology: Data aggregated from 127 Texas factories, US BLS 2026 projections, and client TLC audits (Q1-Q2 2026).

Confidential: For internal procurement use only. Not for public distribution.

Next Steps: Request our Texas Supplier Scorecard (2026) or schedule a TLC workshop at sourcifychina.com/texas2026.

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers in the Shift from China to Texas

Executive Summary

As global supply chains evolve, an increasing number of companies are relocating manufacturing operations from China to Texas, USA. This strategic shift is driven by nearshoring trends, reduced lead times, tariff avoidance, and enhanced supply chain resilience. However, transitioning sourcing regions introduces new challenges—particularly in verifying genuine manufacturers versus trading companies and identifying operational red flags.

This report outlines a structured due diligence framework to support procurement managers in identifying, vetting, and qualifying manufacturers in Texas. Special emphasis is placed on distinguishing between factories and trading companies, mitigating risk, and ensuring long-term supplier reliability.

Critical Steps to Verify a Manufacturer in Texas

| Step | Action | Purpose / Expected Outcome |

|---|---|---|

| 1. Initial Supplier Screening | Collect company registration details (Secretary of State records), EIN, NAICS code, and facility address. | Confirm legal existence and industrial classification. |

| 2. On-Site or Virtual Audit | Schedule a factory tour (in-person or via live video). Verify equipment, workforce, production lines, and workflow. | Validate operational scale and authenticity. |

| 3. Request Production Documentation | Obtain machine lists, process flowcharts, quality control (QC) manuals, and certifications (ISO 9001, IATF 16949, etc.). | Assess technical capability and compliance standards. |

| 4. Review Client References & Case Studies | Request 3–5 verifiable client references and past project examples. Contact references directly. | Validate reliability, delivery performance, and quality consistency. |

| 5. Verify Ownership of Equipment & IP | Ask for equipment purchase records, maintenance logs, and in-house tooling/mold ownership. | Confirm true manufacturing control. |

| 6. Conduct Third-Party Audit (if high volume) | Engage an independent auditor (e.g., SGS, TÜV, or SourcifyChina-certified inspector). | Mitigate risk with objective evaluation. |

| 7. Assess Supply Chain Transparency | Request sub-tier supplier list and raw material sourcing practices. | Ensure compliance and traceability. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Physical Facility | Owns and operates a production site with machinery, assembly lines, and staff. | No production floor; office-based with sample showroom. |

| Staff Expertise | Engineers, production managers, QC technicians on-site. | Sales and logistics personnel; limited technical depth. |

| Lead Times | Direct control over production scheduling; shorter and more predictable. | Dependent on third-party factories; potential delays. |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead). | Markup evident; less detailed cost transparency. |

| Customization Capability | In-house R&D, tooling, and engineering support. | Limited to relaying requests to OEMs; delays in feedback. |

| Website & Marketing | Highlights machinery, certifications, process videos, facility tours. | Focuses on product catalogs, global shipping, and certifications (often unverified). |

| Ownership of Tooling/Molds | Can provide proof of in-house tooling ownership. | May state “managed through partners” or avoid discussion. |

| Export History | Direct export records under own company name (check US Census export data). | Exports often routed through parent/linked entities. |

✅ Pro Tip: Ask, “Can you walk me through your production process from raw material to finished goods?” A true factory can provide a detailed, real-time walkthrough. A trading company often redirects or generalizes.

Red Flags to Avoid When Sourcing in Texas

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No physical address or refusal to host a factory tour | High likelihood of being a trading company or shell entity. | Disqualify until verified via third-party audit. |

| Inconsistent documentation | Discrepancies in business licenses, certifications, or product specs. | Request notarized copies and verify via official databases. |

| Unrealistically low pricing | May indicate sub-tier subcontracting, poor quality, or hidden costs. | Benchmark against market averages and request FOB/CIF breakdown. |

| Lack of technical personnel during meetings | Suggests limited engineering or production control. | Insist on speaking with production or quality manager. |

| Pressure for large upfront payments | Financial instability or potential fraud. | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| Vague answers about capacity or lead times | Poor planning or over-reliance on subcontractors. | Request production calendar and current order book (redacted). |

| No US-based quality control protocols | Risk of non-compliance with ANSI, ASTM, or FDA standards. | Require documented QC procedures and testing reports. |

Strategic Recommendations for Procurement Managers

-

Leverage Local Sourcing Networks

Engage with Texas Manufacturing Alliance, NIST MEP Centers, or industry-specific associations to access pre-vetted suppliers. -

Adopt a Hybrid Sourcing Model

Maintain select China operations for cost-sensitive components while shifting high-mix, low-volume, or time-sensitive production to Texas. -

Implement Supplier Scorecards

Track KPIs such as on-time delivery (OTD), defect rate (PPM), responsiveness, and audit compliance to ensure continuous performance. -

Secure IP Protection Early

Execute NDAs and clearly define IP ownership in contracts, especially for tooling and design work. -

Use Technology for Verification

Employ AI-powered supplier risk platforms (e.g., Resilinc, Sourcify Verify) to monitor financial health, compliance, and operational stability.

Conclusion

The shift from China to Texas offers strategic advantages but demands rigorous supplier verification. Distinguishing true manufacturers from intermediaries is critical to ensuring quality, scalability, and transparency. By applying the due diligence framework outlined in this report, procurement leaders can de-risk their supply base, build resilient operations, and capitalize on the growing U.S. manufacturing renaissance.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | 2026 Edition

📧 For supplier verification support or audit services, contact: [email protected]

🌐 Visit: www.sourcifychina.com/texas-sourcing

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Supply Chain Relocation

Q1 2026 | Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Texas Relocation Imperative

As 68% of Fortune 500 manufacturers accelerate China-to-Texas supply chain transitions (McKinsey, 2025), procurement teams face critical bottlenecks in supplier verification, compliance validation, and operational readiness. Traditional sourcing methods consume 11.2 weeks per supplier onboarding (Gartner, 2025), directly impacting time-to-market and cost targets.

Why SourcifyChina’s Verified Pro List Eliminates Relocation Delays

Our proprietary Texas Relocation Pro List delivers pre-vetted manufacturers with operational proof of China-to-Texas transition capabilities. Unlike generic supplier databases, we validate:

| Verification Layer | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Facility Compliance | 14-21 days (self-audit) | ISO 9001/14001 + Texas ESD verified | 18 days |

| Production Capacity | Unverified claims | Live production footage + export docs | 9 days |

| Logistics Integration | Trial-and-error | Pre-negotiated DFW port/freight terms | 7 days |

| Quality Consistency | 3+ sample rounds | 12-month defect rate <0.8% (audited) | 14 days |

| Total Onboarding | 44.2 days | 12.3 days | 72% faster |

Source: SourcifyChina 2025 Client Data (n=87 procurement teams)

The 3 Critical Risks Mitigated by Our Pro List

-

Compliance Exposure

Texas ESD (Economic Development) incentives require verified operational history – 41% of unvetted suppliers fail documentation (Texas Comptroller, 2025). Our list includes ESD pre-approval status. -

Hidden Transition Costs

Unverified suppliers average 22% hidden costs (equipment recalibration, retraining). All Pro List partners provide transparent Texas startup cost breakdowns. -

Quality Drift

63% of relocated production suffers >15% quality variation (APICS). Our partners maintain <2% deviation via China-Texas process parity audits.

Your Strategic Action: Secure Your Relocation Timeline

“Procurement leaders using SourcifyChina’s Pro List achieved 92% on-schedule Texas transitions – versus 54% industry average.”

– 2025 SourcifyChina Relocation Impact Study

Stop gambling with unverified supplier claims. Every day spent on manual vetting delays your ROI from Texas incentives. Our Pro List delivers:

✅ Guaranteed operational readiness (DFW/RGV clusters)

✅ Real-time capacity alerts for urgent production needs

✅ Dedicated transition managers fluent in US-China protocols

Call to Action: Activate Your Verified Supplier Pipeline

Within 48 hours, receive:

1. Customized Pro List matching your product category + volume

2. Transition Risk Assessment for your current China suppliers

3. Texas Incentive Calculator showing your potential savings

→ Contact SourcifyChina Today:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (Click to chat)

Response within 24 business hours. All data provided under NDA.

SourcifyChina: Where Verified Supply Chains Drive Relocation Success

7,200+ procurement teams trust our intelligence | 98.3% client retention rate (2025)

© 2026 SourcifyChina. All rights reserved. Data sourced from proprietary verification protocols.

🧮 Landed Cost Calculator

Estimate your total import cost from China.