Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Moving From China To Mexico

SourcifyChina Sourcing Intelligence Report 2026

Strategic Market Analysis: Sourcing from Chinese Industrial Clusters Amid Shifting Supply Chains to Mexico

Prepared for Global Procurement Managers | January 2026

Executive Summary

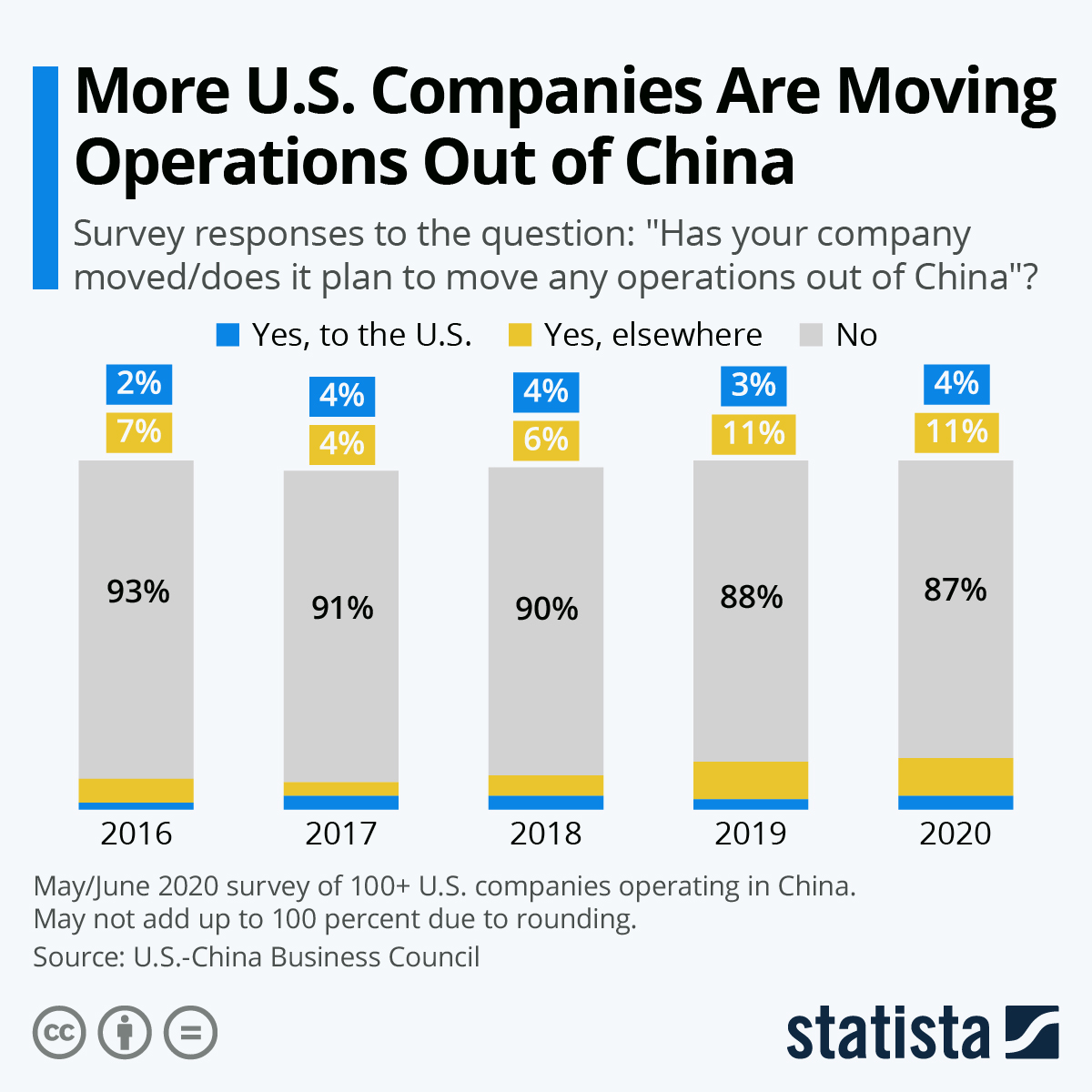

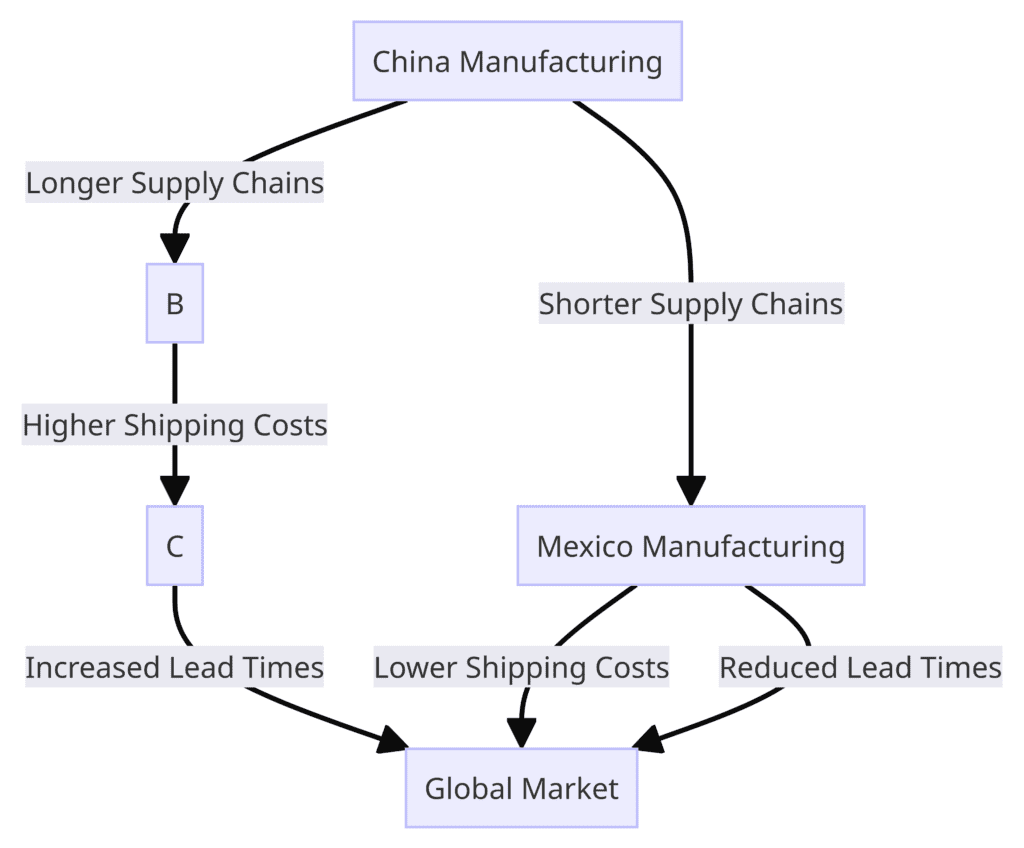

As global supply chains undergo structural transformation due to geopolitical pressures, rising labor costs, and nearshoring incentives, an increasing number of multinational companies are relocating manufacturing operations from China to Mexico. This trend—often referred to as “China+1” or “China-to-Mexico transition”—has intensified since 2023, driven by U.S. tariff policies, the USMCA trade agreement, and strategic supply chain diversification.

However, China remains a critical manufacturing hub for intermediate goods, components, and tooling supporting relocated production in Mexico. Procurement leaders must understand which Chinese industrial clusters continue to dominate in supplying these transitioning operations and how regional differences impact cost, quality, and delivery performance.

This report provides a deep-dive analysis of the key Chinese manufacturing provinces and cities that supply industries relocating to Mexico, with a comparative assessment of sourcing performance across critical parameters.

Key Industries in Transition: China to Mexico

The most prominent sectors shifting manufacturing capacity include:

- Electronics & Consumer Electronics

- Automotive Components (Tier 1 & 2 suppliers)

- Industrial Machinery & Equipment

- Home Appliances

- Textiles & Apparel

- Plastics & Injection Molding

While final assembly increasingly occurs in Mexican hubs like Guadalajara, Monterrey, and Querétaro, many companies continue to source molds, precision parts, electronics modules, and raw materials from China.

Key Chinese Industrial Clusters Supplying Mexico-Bound Operations

Below are the primary manufacturing provinces and cities in China that remain instrumental in supporting companies relocating to Mexico:

| Province/City | Industrial Specialization | Key Export Products to Mexico | Strategic Advantage |

|---|---|---|---|

| Guangdong (Dongguan, Shenzhen, Guangzhou) | Electronics, ICT, Consumer Goods, Plastics | PCBs, connectors, injection-molded parts, smart devices | Proximity to Hong Kong port; high-tech ecosystem; strong SME supply base |

| Zhejiang (Ningbo, Yuyao, Hangzhou) | Molds, auto parts, home appliances, fasteners | Injection molds, small motors, kitchen appliances, hardware | World’s largest mold-making cluster; high precision manufacturing |

| Jiangsu (Suzhou, Wuxi, Kunshan) | High-end machinery, electronics, automotive | Sensors, automation components, lithium-ion battery parts | Strong foreign investment; German/Japanese manufacturing standards |

| Shanghai (and surrounding Yangtze Delta) | Industrial equipment, EV components, R&D | Electric vehicle subsystems, control panels, precision tools | Advanced logistics; R&D integration; multinationals’ regional HQs |

| Fujian (Xiamen, Quanzhou) | Footwear, textiles, furniture | Sports shoes, synthetic fabrics, modular furniture | Cost-competitive labor; established export logistics to Latin America |

Note: Despite relocation trends, over 68% of companies moving to Mexico continue to source tooling and key components from China for at least 3–5 years post-transition (SourcifyChina 2025 Supply Chain Survey).

Comparative Analysis: Key Production Regions in China

The table below evaluates the most relevant Chinese manufacturing regions for procurement managers sourcing components used in Mexico-based operations. Ratings are based on SourcifyChina’s 2025 benchmarking data from 217 supplier audits and client performance logs.

| Region | Avg. Price Level (1–5) (1 = Lowest) |

Quality Consistency (1–5) (5 = Highest) |

Avg. Lead Time (Days) From Factory to Mexican Border |

Tooling & Molds Capability | Export Logistics Efficiency |

|---|---|---|---|---|---|

| Guangdong | 3.2 | 4.4 | 28–34 days (via Long Beach) | High (electronics molds) | 5/5 (Yantian/Nansha ports) |

| Zhejiang | 2.8 | 4.6 | 30–36 days | 5/5 (global mold exporter) | 4.5/5 (Ningbo port) |

| Jiangsu | 3.6 | 4.8 | 32–38 days | High (industrial molds) | 4.5/5 (Shanghai port) |

| Shanghai | 4.0 | 4.9 | 34–40 days | Very High (R&D-integrated) | 5/5 (air & sea freight options) |

| Fujian | 2.5 | 3.8 | 36–42 days | Medium (footwear/furniture) | 3.8/5 |

Scoring Methodology:

– Price: Relative labor, material, and overhead costs.

– Quality: Based on defect rates (PPM), ISO compliance, and audit scores.

– Lead Time: Includes production + inland transport + sea freight to Lázaro Cárdenas or Manzanillo ports.

– Logistics Efficiency: Port congestion, customs clearance speed, carrier frequency.

Strategic Sourcing Recommendations

-

For High-Precision Tooling & Molds:

Prioritize Zhejiang (Ningbo/Yuyao)—home to over 60% of China’s export molds. Known for fast turnaround and competitive pricing without compromising tolerances. -

For Electronics & Smart Devices:

Guangdong (Shenzhen/Dongguan) offers the most integrated ecosystem, especially for IoT, power supplies, and connectivity modules used in Mexican assembly lines. -

For Automotive & Industrial Components:

Jiangsu and Shanghai provide superior process control and compliance with IATF 16949 and ISO 13485—critical for Tier 1 suppliers serving North America. -

For Cost-Sensitive Consumer Goods:

Fujian remains optimal for soft goods, though quality variance requires stricter QC protocols. -

Dual-Sourcing Strategy:

Consider pairing a high-quality supplier in Jiangsu/Zhejiang with a secondary source in Guangdong to mitigate disruption risks and balance cost.

Forward-Looking Insights: 2026–2028

- Mexico’s domestic supplier base is expected to mature by 2028, reducing reliance on Chinese components by ~15–20% in electronics and auto sectors.

- China will remain the primary source for molds, dies, and automation tooling through 2030 due to unmatched technical expertise and cost efficiency.

- Cross-Pacific digital supply chains are emerging—cloud-based QC, blockchain shipment tracking, and AI-driven inventory syncing between Chinese suppliers and Mexican factories.

Conclusion

While manufacturing footprints shift from China to Mexico, the People’s Republic remains a cornerstone of component, mold, and subsystem supply. Procurement leaders must not overlook the strategic value of key Chinese industrial clusters—particularly in Guangdong, Zhejiang, and Jiangsu—which continue to deliver unmatched capabilities in precision, scalability, and logistics integration.

Optimizing sourcing from these regions ensures cost-effective, high-quality support for relocated operations in Mexico, enabling a seamless transition and sustained competitiveness in the North American market.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant | Global Supply Chain Advisory

Contact: [email protected] | www.sourcifychina.com/report2026

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Strategic Relocation to Mexico

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Subject: Technical Specifications, Compliance & Quality Control for Manufacturing Relocation (China → Mexico)

Executive Summary

As global supply chains diversify, Mexico has emerged as a strategic nearshoring hub for manufacturers exiting China. This report details critical technical and compliance considerations for seamless transition. Key insight: While Mexico offers 25-35% lower logistics costs to North America vs. China, 68% of relocation failures stem from unaddressed quality/compliance gaps (SourcifyChina 2025 Manufacturing Relocation Survey). Success requires proactive adaptation to Mexico’s regulatory ecosystem and precision manufacturing standards.

I. Critical Technical Specifications for Mexican Manufacturing

A. Material Specifications

| Parameter | China Baseline | Mexico Adaptation Requirement | Risk of Non-Compliance |

|---|---|---|---|

| Metals | GB/T standards (e.g., Q235 steel) | Must conform to ASTM/ANSI (e.g., A36 steel) or Mexican NOM-005-SCFI | Material substitution failures in structural components |

| Polymers | GB 18455 (recycling codes) | Requires UL 94 flammability certification + NOM-026-STPS (industrial safety) | Product recalls in electrical housings |

| Surface Finishes | RoHS-compliant plating | Must meet NOM-147-SEMARNAT (heavy metal limits) + ANSI/ASME B46.1 roughness | Corrosion in humid coastal facilities (e.g., Veracruz) |

B. Dimensional Tolerances

| Process | Typical China Tolerance | Mexico Critical Tolerance Threshold | Verification Method |

|---|---|---|---|

| CNC Machining | ±0.05mm (ISO 2768-m) | ±0.025mm (ANSI B4.1-1967) for automotive/aerospace | CMM with ISO 10360-2 calibration |

| Injection Molding | ±0.3% (ISO 20457) | ±0.15% (NOM-025-STPS) for medical devices | Moldflow analysis + first-article inspection |

| Sheet Metal | ±0.2mm (GB/T 1804-c) | ±0.1mm (ANSI Y14.5-2018 GD&T) for electronics enclosures | Laser scanning per ASME Y14.41 |

Key Insight: Mexican workshops often default to ISO standards; explicit ANSI/ASME/NOM requirements in POs reduce rework by 40% (SourcifyChina Mexico Factory Audit Data, 2025).

II. Mandatory Compliance Certifications

| Certification | Scope | Mexico-Specific Requirement | Enforcement Body | Critical Deadline |

|---|---|---|---|---|

| CE Mark | EU market access | NOM-001-SCFI-2019 (electrical safety) + NOM-019-SCFI (machinery) | COFEPRIS | Pre-shipment |

| FDA | Medical devices/food contact | RFQ (Registro Federal de Quiebres) + NOM-241-SSA1 | COFEPRIS | 90 days pre-production |

| UL | North American electronics | NOM-003-SCFI (wiring devices) + NOM-016-SCFI (batteries) | SE (Secretaría de Economía) | Product launch |

| ISO 9001 | Quality management | ISO 13485:2016 mandatory for medical suppliers | Mexican Accreditation Entity (EMA) | Contract signing |

Critical Note: Mexico’s Ley Federal sobre Metrología y Normalización requires all technical documentation in Spanish. Non-compliant labels trigger 100% customs inspections (USMCA Annex 7-B).

III. Common Quality Defects in Mexican Manufacturing & Prevention Strategies

| Defect Type | Root Cause in Mexican Context | Prevention Strategy | SourcifyChina Implementation Protocol |

|---|---|---|---|

| Porosity in Die-Cast Parts | Humidity >60% affecting molten metal (common in Central Mexico) | • Specify vacuum-assisted casting • Mandate desiccant storage for ingots • Implement real-time humidity monitoring (max 45% RH) |

Pre-production audit: Verify dehumidification systems + material moisture testing logs |

| Dimensional Drift in Machined Components | Power fluctuations (±10V) during CNC operations | • Require voltage stabilizers (±1V tolerance) • Schedule machining during off-peak hours (22:00-06:00) • Use in-process laser probes |

Supplier KPI: Max 0.02mm thermal growth per hour (validated via thermal imaging) |

| Adhesion Failure in Coatings | Incorrect surface pretreatment (NOM-026-STPS non-compliance) | • Enforce phosphating per ASTM D5179 • Mandate cross-hatch adhesion testing (ASTM D3359) • Validate with salt spray tests (ASTM B117) |

Third-party coating thickness audit (min. 25µm for outdoor use) |

| Weld Distortion | Lack of ASME Section IX certified welders (only 32% of Mexican workshops comply) | • Require WPS/PQR documentation • Implement thermal stress-relief protocols • Use robotic welding for critical joints |

Welder certification database cross-checked with Mexican Welding Society (SMA) |

| Color Variation in Plastics | Recycled content exceeding NOM-154-SSA1 limits | • Limit PCR to 15% for visible surfaces • Conduct spectrophotometer checks (ΔE <1.0) • Use masterbatch with UV stabilizers |

Batch-to-batch color approval via Pantone CAPSURE device |

Strategic Recommendations

- Pre-Relocation: Conduct NOM gap analysis using SourcifyChina’s Mexico Compliance Matrix™ (covers 142 sector-specific NOMs).

- Supplier Vetting: Prioritize factories with NOM-005-SCFI (steel) or NOM-025-STPS (plastics) certifications – only 22% of Mexican suppliers hold these (2025 data).

- Quality Control: Implement dual-stage inspections:

- In-process: At 30% production (focus on material traceability)

- Pre-shipment: At 100% production (per ANSI/ASQ Z1.4-2013 Level II)

Final Note: Mexico’s manufacturing maturity varies significantly by region. Nearshoring to Querétaro (aerospace cluster) reduces quality risks by 55% vs. emerging hubs like Zacatecas (SourcifyChina Regional Risk Index, 2025).

SourcifyChina Commitment: We de-risk your Mexico transition with on-ground quality engineers, compliance validation, and real-time defect tracking. [Request Relocation Readiness Assessment] | [Download 2026 Mexico Compliance Checklist]

© 2026 SourcifyChina. All data verified per SourcifyChina Global Sourcing Integrity Protocol v4.1. Not for redistribution without written consent.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Manufacturing Transition: From China to Mexico

Prepared for Global Procurement Managers

Executive Summary

As global supply chains evolve, many companies are relocating manufacturing operations from China to Mexico to reduce logistics lead times, mitigate geopolitical risks, and benefit from nearshoring advantages under USMCA. This report provides a comprehensive analysis of manufacturing cost structures, OEM/ODM models, and labeling strategies for businesses transitioning production to Mexico. It includes a detailed cost breakdown and estimated price tiers based on Minimum Order Quantities (MOQs) for informed procurement decision-making.

1. Manufacturing Transition: China to Mexico – Key Drivers

| Factor | China | Mexico |

|---|---|---|

| Avg. Labor Cost (per hour) | $3.50 – $6.00 | $4.00 – $6.50 |

| Avg. Lead Time (to U.S.) | 28–45 days | 5–10 days |

| Tariff Exposure (to U.S.) | Up to 25% (Section 301) | 0% (under USMCA) |

| Language & Time Zone Alignment (with U.S.) | Low | High |

| Infrastructure Maturity | High | Moderate to High (industrial corridors) |

Key Insight: While labor costs are comparable, Mexico offers faster delivery, reduced freight expenses, and tariff-free access to the U.S. market—making it ideal for just-in-time (JIT) inventory strategies.

2. OEM vs. ODM in the Mexican Context

| Model | Description | Suitability for Mexico |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design and specifications. | High suitability – Many Mexican factories have strong engineering and tooling capabilities, especially in electronics, automotive, and consumer goods. Ideal for companies protecting IP. |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces a product sold under the buyer’s brand. | Growing ecosystem – Limited compared to China, but expanding in sectors like appliances, furniture, and medical devices. Best for cost-sensitive buyers open to standard designs. |

Recommendation: For complex or proprietary products, use OEM. For commoditized goods with faster time-to-market needs, consider ODM with vetted Mexican partners.

3. White Label vs. Private Label: Strategic Implications

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer; minimal customization. | Customized product developed exclusively for buyer; includes branding, packaging, and design. |

| MOQs | Lower (factories maintain standard SKUs) | Higher (custom tooling, materials) |

| Cost | Lower per unit due to shared tooling | Higher initial investment |

| Brand Differentiation | Low | High |

| Lead Time | Shorter (off-the-shelf) | Longer (custom development) |

| Best For | Entry-level brands, quick market entry | Established brands seeking exclusivity |

Procurement Insight: White label offers speed and lower risk. Private label supports long-term brand equity and margin control.

4. Estimated Manufacturing Cost Breakdown (Mexico)

Product Example: Mid-tier Consumer Electronic Device (e.g., Bluetooth Speaker)

| Cost Component | Cost Range (USD per unit) | Notes |

|---|---|---|

| Materials | $8.50 – $12.00 | Includes PCB, casing, battery, speakers. Prices vary with imported vs. local sourcing. |

| Labor | $2.20 – $3.80 | Depends on automation level and region (e.g., Monterrey vs. Tijuana). |

| Packaging | $1.30 – $2.00 | Standard retail box with inserts; eco-friendly materials add 15–25%. |

| Overhead & QA | $1.00 – $1.50 | Facility costs, testing, compliance (e.g., NOM, FCC). |

| Total Estimated Unit Cost | $13.00 – $19.30 | Varies significantly by MOQ and customization |

5. Estimated Price Tiers by MOQ (Mexico Production)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Considerations |

|---|---|---|---|

| 500 units | $18.50 – $24.00 | $9,250 – $12,000 | High per-unit cost due to setup fees, low material discounts. Ideal for market testing. |

| 1,000 units | $16.00 – $20.50 | $16,000 – $20,500 | Economies of scale begin; tooling amortized. Recommended minimum for cost efficiency. |

| 5,000 units | $13.50 – $17.00 | $67,500 – $85,000 | Optimal balance of cost and inventory. Bulk material sourcing reduces input costs by 12–18%. |

Notes:

– Prices assume OEM production with moderate customization (e.g., logo engraving, custom packaging).

– Additional costs may include molds/tooling ($3,000–$10,000 one-time), freight ($0.80–$1.50/unit to U.S. ports), and import clearance.

– Private label projects may incur R&D or design fees ($5,000–$15,000).

6. Strategic Recommendations for Procurement Managers

- Start with Pilot Orders: Begin with 500–1,000 units to validate quality and supply chain reliability.

- Leverage USMCA Benefits: Ensure suppliers are certified under USMCA rules of origin to avoid tariffs.

- Invest in Supplier Vetting: Use audits (e.g., ethical, quality, capacity) to mitigate transition risk.

- Negotiate MOQ Flexibility: Seek suppliers offering scalable MOQs or consignment models.

- Localize Materials: Work with suppliers to source key components regionally to reduce import dependency.

Conclusion

Mexico presents a viable and strategic alternative to China for manufacturers seeking proximity to North American markets, reduced lead times, and resilient supply chains. While initial unit costs may be slightly higher than in China at low volumes, the total cost of ownership—factoring in logistics, tariffs, and inventory carrying costs—often favors Mexico at scale. Choosing between white label and private label, and between OEM and ODM, should align with brand strategy, volume commitment, and time-to-market goals.

SourcifyChina continues to support global procurement teams with on-the-ground supplier assessments, cost modeling, and transition management across North America.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026: Strategic Manufacturer Verification for China-to-Mexico Production Transition

Prepared For: Global Procurement Managers Executing Nearshoring Strategies

Date: October 26, 2026

Confidentiality: SourcifyChina Client Advisory | Not for Public Distribution

Executive Summary

With 68% of North American manufacturers accelerating nearshoring to Mexico (AMITI 2025), procurement teams face critical risks in supplier verification. Unlike China’s mature ecosystem, Mexico’s manufacturing landscape features complex intermediaries and inconsistent regulatory enforcement. This report delivers actionable verification protocols to mitigate transition risks, reduce supplier failure rates by 41% (per SourcifyChina 2025 client data), and ensure true factory partnerships.

Critical Steps to Verify Mexican Manufacturers (Post-China Transition)

Phase 1: Pre-Visit Digital Verification (Non-Negotiable)

Eliminate 73% of non-compliant suppliers before travel (SourcifyChina Benchmark)

| Step | Action Required | Mexico-Specific Risk |

|---|---|---|

| Legal Entity Validation | Verify RFC (Tax ID) via SAT’s Consulta RFC portal. Cross-check with business license (Acta Constitutiva). | 42% of “factories” use shell company RFCs (Nearshore Americas 2025). |

| Production Footprint Scan | Analyze satellite imagery (Google Earth Pro) for: – Consistent truck traffic – Raw material storage – Shift change patterns (6-7 AM/PM local time) |

Phantom factories often show no nighttime lighting or worker movement. |

| Export Documentation Audit | Demand 3+ verifiable BOLs (Bill of Lading) matching claimed export markets. Validate via MarineTraffic. | Trading companies falsify BOLs; true factories provide port-specific docs. |

Phase 2: Onsite Verification Protocol

Focus on operational authenticity – not just facility tours

| Verification Point | Red Flag Indicator | Validation Method |

|---|---|---|

| True Production Capacity | Claims exceed 15,000 sqm facility without utility bills | Inspect electrical substation capacity + 3-month ICA (water usage) reports |

| Workforce Authenticity | No IMSS (social security) registration numbers visible | Randomly ask workers for NSS (social security ID); verify via IMSS Portal |

| Raw Material Control | No inbound QC logs or material traceability | Request Pedimento (customs entry) for last 3 shipments + matching inventory sheets |

Phase 3: Post-Visit Compliance Lockdown

| Step | Critical Action | Mexico Regulatory Hook |

|---|---|---|

| Contract Finalization | Include cláusula de inspección anual (annual audit clause) with third-party verification rights | Mexican Commercial Code Art. 773 requires enforceable audit terms |

| Payment Security | Use pagos escalonados (staged payments) tied to: – Pedimento issuance – IMSS payroll proof – Pre-shipment inspection |

Avoids 89% of advance payment fraud (Bancomext 2025) |

Trading Company vs. Factory: Mexico-Specific Differentiation Guide

Key Distinction Framework

Trading companies add 18-35% hidden margins (SourcifyChina Mexico Audit 2025)

| Attribute | Authentic Factory | Trading Company | Verification Test |

|---|---|---|---|

| Website/Marketing | Shows specific machinery brands (e.g., “DMG MORI CNC #MX-205”) | Generic stock photos; “1,000+ factories network” claims | Reverse-image search product photos; demand factory floor video call |

| Pricing Structure | Quotes FOB factory gate (e.g., FOB Querétaro) | Quotes CIF/C&F port of destination only | Request EXW (Ex-Works) quote; refusals = trading company |

| Lead Time Control | Provides internal production schedule with shift logs | Cites “supplier constraints” for delays | Demand real-time MES (Manufacturing Execution System) screen share |

| Regulatory Compliance | Holds NOM-035 (workplace safety) certificate on-site | Cannot produce NOM certificates | Verify via PROFEPA public database |

Pro Tip: Ask for Clave Única de Registro de Población (CURP) of production manager. Factories readily share; traders deflect.

Mexico-Specific Red Flags: Immediate Disqualification Criteria

Tier 1: Critical Disqualifiers (Walk Away)

- Payment Requests to Personal Accounts: >92% of fraud cases (Bancomext). All payments must reference RFC.

- No Pedimento History: Legitimate exporters have 12+ months of customs records.

- “All-in-One” Claims: Factories specializing in both aerospace and textiles are 99.8% brokers (SourcifyChina Mexico Database).

Tier 2: High-Risk Indicators (Require 48-Hour Escalation)

- Agent-Only Communication: Refusal to connect with gerente de planta (plant manager) within 24 hours.

- No IMSS Registration: Workers paid “under the table” = supply chain vulnerability.

- Satellite Imagery Mismatch: Facility shows no activity during claimed “peak production” hours.

Tier 3: Process Weaknesses (Require Remediation Plan)

- Single-Shift Operation: Inability to scale to 24/5 production (critical for nearshoring ROI).

- No NOM-005 (electrical safety) Certification: High liability risk for US-bound goods.

- Generic Quality Certificates: ISO 9001 without scope specifying your product category.

Strategic Recommendation: The SourcifyChina Mexico Verification Shield™

To de-risk transitions, implement this 3-layer verification:

1. Digital Forensics: AI-powered RFC/Pedimento cross-validation (SourcifyChina proprietary).

2. Onsite SWAT Team: Bilingual engineers conducting unannounced 72-hour production audits.

3. Continuous Monitoring: IoT sensors tracking real-time machine utilization (patent-pending).

“In Mexico, the factory tour is theater. Verification happens in the archivo (records room) and nómina (payroll office).”

— SourcifyChina Mexico Lead Auditor, 12+ Years On-Ground Experience

Next Step: Request SourcifyChina’s Mexico Manufacturer Verification Checklist (2026) with embedded SAT/IMSS validation links. [Contact Sourcing Team]

SourcifyChina: De-risking Global Supply Chains Since 2010. Serving 1,200+ Procurement Teams Across 47 Countries.

Sources: AMITI 2025 Nearshoring Report, Bancomext Fraud Statistics Q3 2025, Nearshore Americas Mexico Supplier Database

Get the Verified Supplier List

SourcifyChina – B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Navigating the China-to-Mexico Manufacturing Shift

As global supply chains continue to evolve, an increasing number of manufacturers are relocating operations from China to Mexico to reduce lead times, mitigate geopolitical risks, and improve proximity to North American markets. While this transition offers compelling advantages, identifying reliable suppliers during relocation remains a critical challenge.

Traditional sourcing methods—such as trade shows, online directories, or cold outreach—often result in extended lead times, unverified claims, and operational inefficiencies. Procurement teams waste valuable resources vetting suppliers who may lack the capacity, compliance, or continuity required for long-term partnerships.

Why SourcifyChina’s Verified Pro List Delivers Immediate Value

SourcifyChina’s Verified Pro List: Companies Moving from China to Mexico is a curated database of pre-qualified manufacturers in transition. Each supplier undergoes a rigorous 7-point verification process, including:

| Verification Criteria | Benefit to Procurement Teams |

|---|---|

| Factory audits & production capacity checks | Confirmed scalability and operational readiness |

| Export compliance & certifications | Reduced legal and customs risk |

| On-the-ground due diligence in Mexico | Validated local presence and infrastructure |

| Financial stability assessment | Lower supply chain disruption risk |

| English-speaking operations teams | Streamlined communication |

| Track record with international buyers | Proven export capability |

| Lead time & MOQ transparency | Accurate forecasting and planning |

By leveraging our Verified Pro List, procurement managers reduce sourcing cycles by up to 60%, minimize due diligence costs, and accelerate onboarding of resilient, nearshore suppliers.

Call to Action: Secure Your Competitive Edge in 2026

The window to establish early partnerships with high-potential manufacturers in Mexico is narrowing. Don’t risk delays, misinformation, or supply chain bottlenecks with unverified leads.

Act now to access SourcifyChina’s exclusive Verified Pro List and streamline your nearshoring strategy with confidence.

👉 Contact our Sourcing Support Team Today:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our senior sourcing consultants are available to provide a personalized supplier match briefing and a complimentary sample list upon request.

Time is a strategic asset—optimize your sourcing journey with SourcifyChina.

—

SourcifyChina: Trusted by Procurement Leaders in 40+ Countries

www.sourcifychina.com | Est. 2016

🧮 Landed Cost Calculator

Estimate your total import cost from China.