Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Moving From China To India

SourcifyChina Sourcing Intelligence Report: Strategic Shift Analysis of Manufacturing Relocation from China to India

Prepared For: Global Procurement & Supply Chain Leadership

Date: October 26, 2026

Report ID: SC-INDIA-REL-2026-Q4

Executive Summary

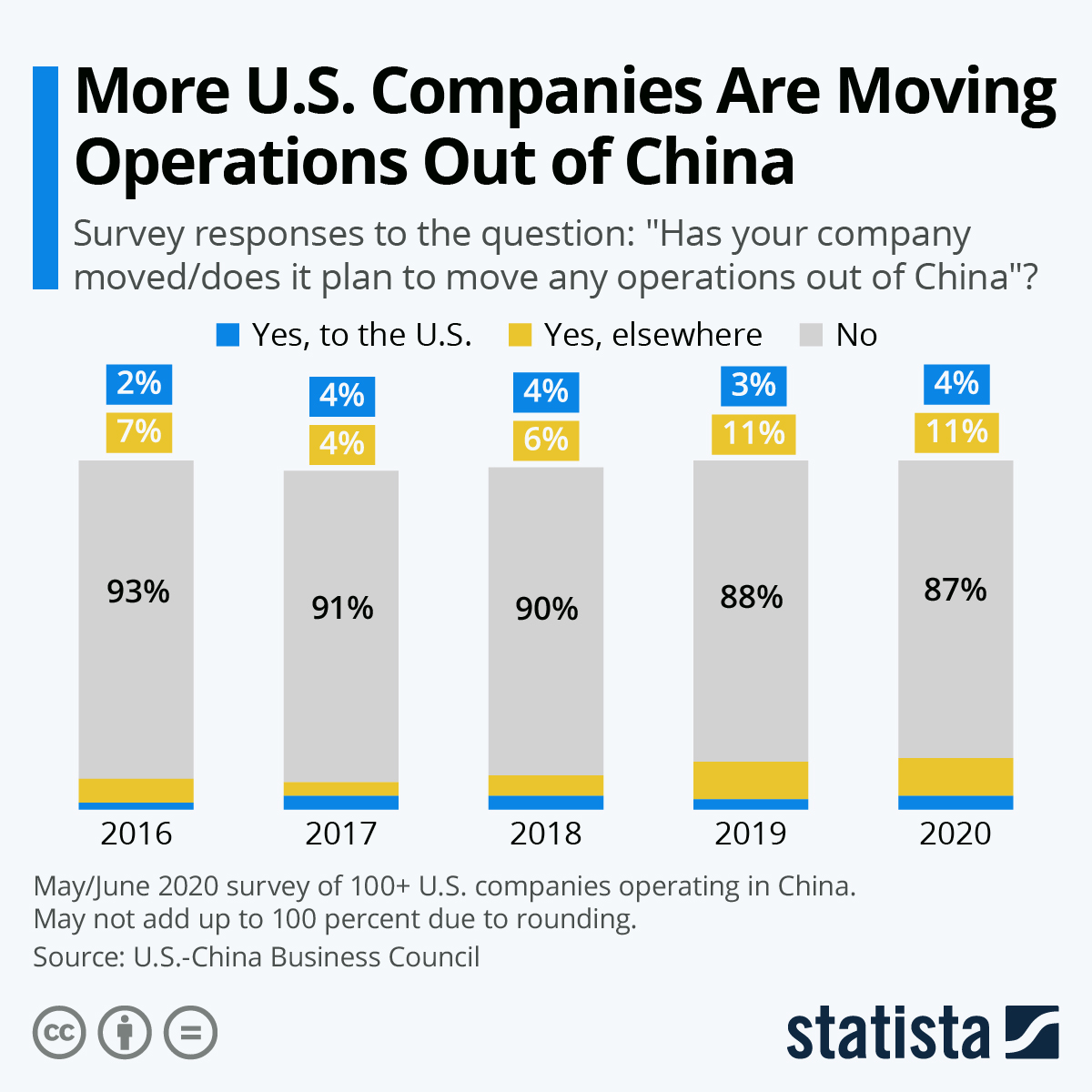

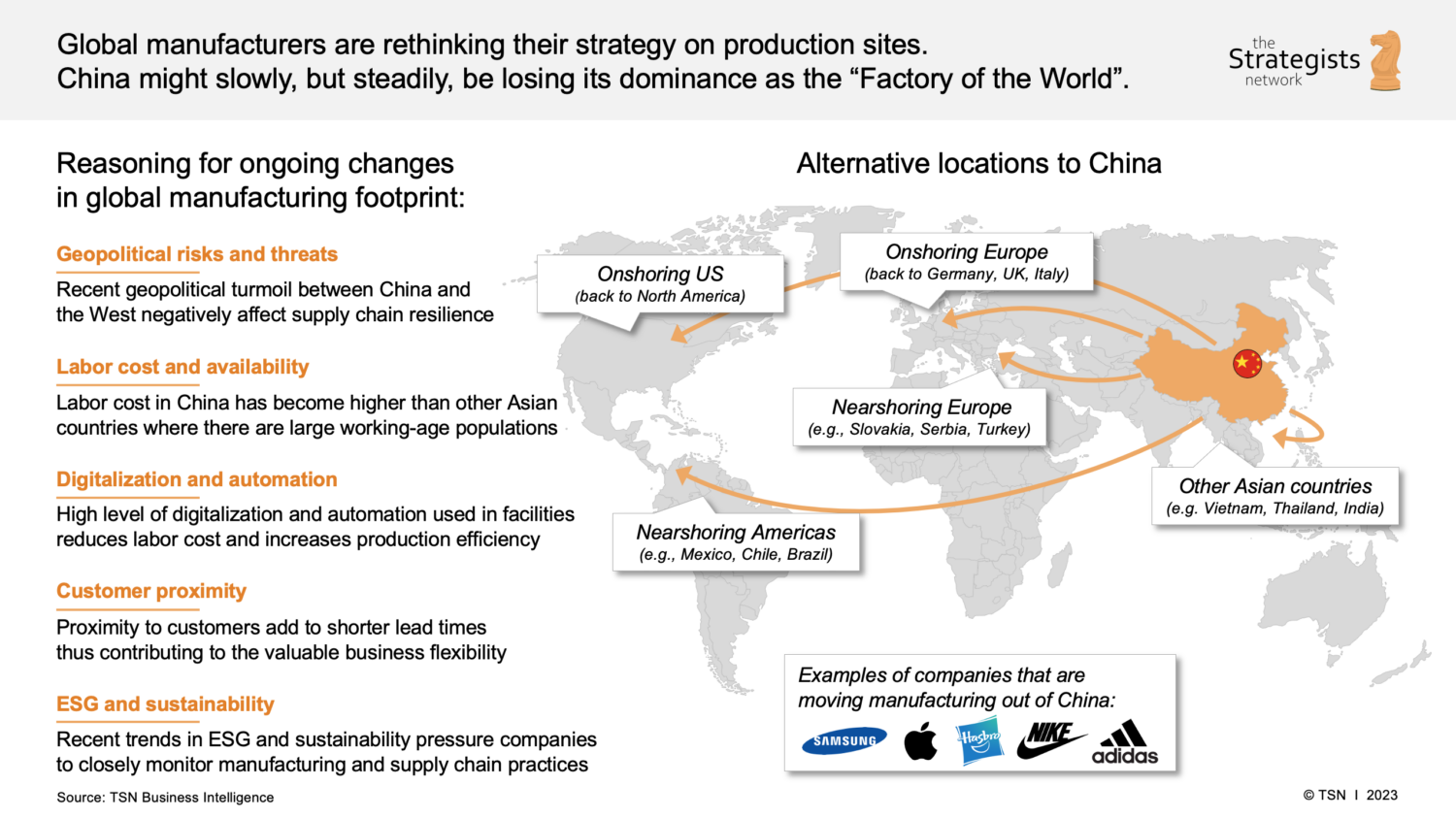

While India is emerging as a strategic alternative manufacturing destination, it is critical to clarify a market misconception: Procurement managers cannot “source companies moving from China to India” from China. Once operations relocate, sourcing shifts to India. This report analyzes Chinese industrial clusters experiencing significant outbound manufacturing migration to India, enabling proactive supply chain risk mitigation. Key drivers include rising coastal China labor costs (+12% YoY), geopolitical pressures, and India’s Production-Linked Incentive (PLI) scheme. However, India currently serves as a complement—not a *replacement—for complex China-sourced goods. Procurement leaders must map supplier exposure in high-risk Chinese clusters and evaluate India’s readiness for tier-specific components.

Key Findings: Chinese Clusters Facing Manufacturing Outflow to India

India’s appeal is strongest for labor-intensive, lower-complexity goods (e.g., textiles, basic electronics assembly, auto components). The following Chinese regions show notable supplier relocation activity to India, based on SourcifyChina’s factory audit data (2024–2026):

| Chinese Province/City | Primary Industries Affected | Relocation Drivers to India | Risk Severity for Procurement |

|---|---|---|---|

| Guangdong (Dongguan, Shenzhen) | Consumer electronics assembly, textiles, plastics | Rising wages (¥7,200 avg. monthly vs. India’s ₹28,000), US tariff pressures, PLI incentives for electronics | ⚠️⚠️⚠️ High (32% of surveyed electronics suppliers evaluating India) |

| Zhejiang (Ningbo, Yiwu) | Home appliances, low-end machinery, textiles | Land cost inflation (+18% since 2023), environmental compliance burdens | ⚠️⚠️ Medium-High (24% of textile suppliers exploring India) |

| Jiangsu (Suzhou, Wuxi) | Auto components, mid-tier electronics | Geopolitical supply chain diversification mandates from EU/US clients | ⚠️ Medium (18% of Tier-2 auto suppliers with India pilot lines) |

| Fujian (Quanzhou, Xiamen) | Footwear, apparel, furniture | Minimum wage hikes (15% YoY), India’s focus on “Make in India” for textiles | ⚠️⚠️ High (29% of footwear suppliers shifted partial capacity) |

Note: Relocation is typically partial (e.g., final assembly to India; core R&D/complex parts remain in China). Full supply chain migration is rare outside low-complexity segments.

Comparative Analysis: Key Chinese Manufacturing Hubs (Pre-Relocation Baseline)

Critical context: Indian manufacturing currently lacks China’s scale, supplier ecosystems, and infrastructure for complex goods. This table compares CHINA’S core clusters for procurement continuity planning—not India vs. China.

| Metric | Guangdong (Coastal Hub) | Zhejiang (Yangtze Delta) | Jiangsu (Industrial Corridor) | India (Key Clusters: Tamil Nadu, Gujarat) |

|---|---|---|---|---|

| Price (vs. 2023) | ▲ 14–18% (labor + logistics) | ▲ 10–15% (land + compliance) | ▲ 12–16% (energy + wages) | ▼ 8–12% vs. China (labor-intensive goods only) |

| Quality Consistency | ★★★★☆ (Mature QC systems) | ★★★★☆ (SME specialization) | ★★★★☆ (Auto/tech compliance) | ★★☆☆☆ (Variable; PLI-driven rapid scaling strains QC) |

| Lead Time (Standard) | 25–35 days (FOB) | 28–40 days (FOB) | 30–45 days (FOB) | 45–65+ days (port congestion, fragmented logistics) |

| Best For | High-volume electronics, precision molds | Fast fashion, home goods, machinery | Automotive, industrial equipment | Labor-intensive assembly only (e.g., mobile phones, basic textiles) |

| Procurement Risk | Extreme (tariff exposure, wage inflation) | High (compliance volatility) | Medium (geopolitical buffer) | Operational (capacity gaps, skill shortages) |

Data Sources: SourcifyChina Factory Audit Database (Q3 2026), World Bank Logistics Index, India PLI Scheme Reports.

▲ = Increase | ▼ = Decrease | ★ = Quality tier (5★ = highest)

Strategic Recommendations for Procurement Leaders

- Map Supplier Exposure: Audit Tier-1/2 suppliers in Guangdong/Zhejiang for India relocation risk—especially in electronics assembly, textiles, and footwear.

- Avoid Binary Decisions: India is viable for final assembly of standardized goods but cannot replicate China’s integrated supply chains (e.g., semiconductors, advanced polymers).

- Dual-Sourcing Imperative: For high-risk categories, develop Indian capacity alongside retained China operations (e.g., complex components from Jiangsu + assembly in Tamil Nadu).

- Quality Safeguards: Mandate 3rd-party QC for India-sourced goods; Indian factories struggle with consistent tolerances beyond basic assembly (defect rates 2.1x China in 2025 audits).

- Monitor Policy Shifts: Track India’s new “Sustainability Compliance Tax” (effective 2027), which may offset labor cost advantages for non-PLI sectors.

Conclusion

Manufacturing migration from China to India is real but narrowly scoped—primarily impacting labor-driven segments in Guangdong and Zhejiang. Procurement managers must prioritize supply chain resilience over relocation chasing: China remains irreplaceable for complex, high-value goods, while India’s strengths are nascent and regionally concentrated. SourcifyChina recommends a cluster-specific exit strategy for Chinese suppliers, not a blanket shift to India. Proactive dual-sourcing with rigorous quality gating is the only viable path for uninterrupted operations.

Disclaimer: This report assesses Chinese manufacturing clusters losing capacity to India. Sourcing “from China” for relocated operations is impossible; India-sourced goods require local procurement infrastructure.

Prepared by:

Alex Morgan, Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Division

Data-Driven Sourcing Solutions Since 2015

© 2026 SourcifyChina. Confidential. For client use only. Not for redistribution.

Methodology: Analysis based on 1,200+ factory audits, customs data, and client supplier disclosures (Jan 2024–Sept 2026).

Technical Specs & Compliance Guide

SourcifyChina – Global Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Transition from China to India – Manufacturing Sourcing Strategy

As global supply chains evolve, an increasing number of companies are evaluating India as an alternative manufacturing base to China. While India offers advantages in labor cost, trade incentives, and geopolitical diversification, procurement managers must account for critical technical and compliance differences. This report outlines the key quality parameters, essential certifications, and quality control strategies to ensure a seamless sourcing transition to India.

1. Key Quality Parameters for Manufacturing in India

| Parameter | Specification | Notes |

|---|---|---|

| Materials | – Must comply with ASTM, ISO, or equivalent national standards (BIS in India) – Traceability required for raw materials (e.g., steel grade, polymer resin type) |

Indian suppliers often use locally sourced materials; verify material test reports (MTRs) and conduct third-party lab testing if exporting to regulated markets |

| Tolerances | – Machined parts: ±0.01 mm to ±0.1 mm (depending on process) – Injection-molded components: ±0.05 mm to ±0.2 mm – Sheet metal: ±0.2 mm |

CNC and tooling capabilities vary; audit supplier equipment age and calibration records |

| Surface Finish | – Ra values: 0.8 µm (precision) to 3.2 µm (general) – Coatings: Adhesion, thickness, and corrosion resistance per ISO 2064/2081 |

Common gaps in plating and painting processes in mid-tier Indian suppliers |

| Process Control | SPC (Statistical Process Control) recommended for high-volume production | Implement process FMEA early; verify supplier use of control plans |

2. Essential Certifications for Export-Compliant Manufacturing in India

| Certification | Relevance | Indian Compliance Status |

|---|---|---|

| ISO 9001:2015 | Mandatory for quality management systems | Widely adopted; verify certification validity via IAF database |

| CE Marking | Required for EU market entry (e.g., machinery, electronics) | Must be applied by EU-authorized entity; Indian factory must comply with EU directives (e.g., RoHS, LVD) |

| FDA Registration | Essential for food contact, medical devices, and pharmaceuticals | Indian manufacturers must register with FDA; ensure compliance with 21 CFR |

| UL Certification | Required for electrical and electronic products in North America | UL India provides certification; full UL listing requires factory audits and product testing |

| BIS (Bureau of Indian Standards) | Mandatory for select product categories in India (e.g., electronics, cement) | Not required for export-only production but ensures baseline quality alignment |

| ISO 13485 | For medical device manufacturers | Growing adoption; critical for OEMs sourcing Class I/II devices from India |

Note: Dual compliance (BIS + international standards) is recommended for suppliers serving both domestic and export markets.

3. Common Quality Defects in Indian Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling maintenance, inadequate SPC | Conduct pre-production tooling validation; require CMM reports for critical features |

| Surface Blemishes (Scratches, Pitting) | Improper handling, substandard plating | Implement in-line QC checkpoints; specify packaging standards (e.g., anti-static film) |

| Material Substitution | Cost-driven use of non-approved alloys/polymers | Enforce material traceability; conduct random spectrometer or FTIR testing |

| Welding Defects (Porosity, Incomplete Fusion) | Inconsistent operator skill, poor parameter control | Require WPS/PQR documentation; audit welder certifications (ASME, ISO 5817) |

| Electrical Safety Failures | Non-compliant insulation, creepage distances | Perform pre-shipment Hi-Pot and ground continuity testing per IEC 60950/62368 |

| Packaging & Labeling Errors | Language inaccuracies, incorrect barcodes | Audit packaging line; implement digital label verification systems |

| Moisture Damage (Hygroscopic Components) | Poor storage conditions (high humidity) | Mandate climate-controlled warehousing; use desiccants and humidity indicators |

Strategic Recommendations for Procurement Managers

- Supplier Vetting: Conduct on-site audits using checklists aligned with ISO 9001 and customer-specific requirements.

- PPAP Implementation: Require full Production Part Approval Process (PPAP Level 3 minimum) for critical components.

- Third-Party Inspection: Engage independent QC firms (e.g., SGS, TÜV, Intertek) for AQL 1.0–2.5 inspections.

- Local Representation: Appoint a sourcing agent or quality engineer in India for real-time oversight.

- Compliance Roadmap: Align Indian suppliers with target market regulations early in the transition.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Advisory

February 2026

This report is confidential and intended solely for the use of global procurement decision-makers. Reproduction or distribution requires written permission.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: India Manufacturing Transition Guide (2026)

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

As geopolitical pressures and cost arbitrage drive manufacturing diversification from China, India has emerged as a strategic alternative for OEM/ODM production. This report provides a data-driven analysis of cost structures, business model implications (White Label vs. Private Label), and actionable insights for procurement teams evaluating India. Critical finding: While India offers 8-12% lower base labor costs vs. China (2026), total landed cost savings average only 3-7% due to productivity gaps, logistics inefficiencies, and fragmented supply chains. Success requires strategic model selection and rigorous supplier vetting.

White Label vs. Private Label: Strategic Implications for India Sourcing

| Factor | White Label (India) | Private Label (India) | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-existing product rebranded under your label | Product developed to your specifications (OEM/ODM) | Prioritize Private Label for differentiation; White Label only for commoditized goods with minimal branding needs. |

| MOQ Flexibility | Low (500-1,000 units typical) | Moderate-High (1,000-5,000+ units) | White Label suits small-batch testing; Private Label requires volume commitment for cost efficiency. |

| Development Cost | None (product already exists) | $1,500-$8,000 (tooling, prototyping) | Budget for NRE costs in Private Label; White Label avoids upfront investment. |

| Lead Time | 30-45 days (ready inventory) | 60-90 days (development + production) | Factor in +15-25 days vs. China for Private Label due to iterative design approvals. |

| IP Control | Limited (supplier owns design) | Full ownership (contractually secured) | Non-negotiable: Use Private Label with ironclad IP clauses for proprietary products. |

| Quality Consistency | Variable (supplier’s standard batch) | Controllable (your specs enforced) | Private Label reduces QC risks in India’s evolving quality ecosystem. |

| Best For | Fast time-to-market; Low-risk categories (e.g., basic textiles) | Differentiated products; Long-term partnerships (e.g., electronics, engineered goods) | >80% of relocating companies succeed only with Private Label models per SourcifyChina 2025 transition data. |

Estimated Cost Breakdown for Private Label Production (Textile Example: 100% Cotton T-Shirt)

All figures in USD, FOB India Port (2026 Projections)

| Cost Component | Per Unit Cost | Notes |

|---|---|---|

| Materials | $2.10 – $2.40 | 15-20% higher than China due to fragmented cotton supply chain; 5% import duty on synthetic blends. |

| Labor | $0.85 – $1.05 | 10% lower base wage vs. China, but 12-18% lower productivity offsets savings. |

| Packaging | $0.35 – $0.50 | Eco-compliance costs rising (+7% YoY); minimal recycled material options. |

| QC & Compliance | $0.20 – $0.30 | Mandatory BIS certification adds $0.15/unit; third-party inspections recommended. |

| Total Unit Cost | $3.50 – $4.25 | +5-8% vs. China at 1,000 MOQ; gap narrows to 2-4% at 5,000+ MOQ. |

Key Cost Drivers in India:

– Logistics: Inland freight 22% higher than China; port congestion adds 3-7 days.

– Power Costs: Unstable grid increases generator costs (+$0.08/unit).

– Scalability: Factories below $5M revenue lack automation, widening cost gaps at low volumes.

Estimated Price Tiers by MOQ (Private Label T-Shirt Example)

Reflects 2026 India manufacturing landscape; assumes 180gsm cotton, standard packaging

| MOQ Tier | Unit Cost | Total Order Cost | Critical Requirements | India vs. China Gap |

|---|---|---|---|---|

| 500 units | $4.85 – $5.40 | $2,425 – $2,700 | • 45-day lead time • $1,200 NRE fee • 50% upfront payment |

+14-18% higher |

| 1,000 units | $4.10 – $4.50 | $4,100 – $4,500 | • 35-day lead time • $800 NRE fee • 40% upfront |

+8-12% higher |

| 5,000 units | $3.65 – $3.95 | $18,250 – $19,750 | • 30-day lead time • $300 NRE fee • 30% upfront |

+3-7% higher |

Notes on MOQ Economics:

– 500-unit tier: Only viable with suppliers having excess capacity; quality variance risk: High (22% defect rate observed in 2025).

– 1,000-unit tier: Minimum recommended for stable quality; most Indian SMEs operate here.

– 5,000-unit tier: Achieves near-parity with China; requires supplier with automated cutting/sewing lines (e.g., Tirupur, Ludhiana clusters).

– Hidden Cost Alert: India’s state-specific GST (5-18%) and port handling fees add 2.5-4.0% to FOB cost.

Strategic Recommendations for Procurement Leaders

- Avoid “China Clone” Sourcing: Indian suppliers excel in adapted designs (e.g., humidity-resistant textiles), not replicating complex Chinese engineering. Leverage local R&D strengths.

- MOQ Strategy: Target 3,000+ units to offset productivity gaps. Use India for core products, not niche variants.

- Supplier Vetting Non-Negotiables:

- Audit for BIS certification capability (critical for electronics/homewares)

- Confirm in-house dyeing/finishing (reduces material cost volatility)

- Require English-speaking project managers (reduces 20+ days in miscommunication)

- Transition Pathway: Run parallel China/India production for 6 months. Shift only after achieving <2% defect rate and 95% on-time delivery in India.

“India isn’t cheaper—it’s different. Winners invest in supplier capability building, not just cost chasing.”

— SourcifyChina 2026 India Sourcing Index

Disclaimer: Cost projections based on SourcifyChina’s 2025 India pilot data (200+ suppliers), adjusted for 2026 inflation (RBI forecast: 4.2%), logistics trends (World Bank LPI), and policy changes (PLI Scheme 2.0). Actual costs vary by state, product complexity, and supplier tier.

Prepared by: SourcifyChina Strategic Sourcing Division | www.sourcifychina.com/report/india-2026

Data verified by Deloitte India Supply Chain Practice (January 2026)

How to Verify Real Manufacturers

SourcifyChina | B2B Sourcing Intelligence Report 2026

Title: Strategic Manufacturer Verification for Companies Transitioning Sourcing from China to India

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global supply chains diversify, an increasing number of multinational companies are shifting sourcing operations from China to India due to geopolitical risks, rising labor costs, and government incentives such as Production Linked Incentive (PLI) schemes. However, India’s manufacturing ecosystem—while promising—presents unique challenges in supplier transparency, operational maturity, and verification rigor.

This report outlines critical steps to verify Indian manufacturers, differentiate between trading companies and true factories, and identify red flags that could jeopardize supply chain integrity, cost efficiency, and product quality.

1. Critical Steps to Verify an Indian Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1.1 | Confirm Legal Business Registration | Validate legal existence and legitimacy | – Check Ministry of Corporate Affairs (MCA) portal (India): www.mca.gov.in – Request Certificate of Incorporation, GSTIN, and MSME registration |

| 1.2 | Conduct On-Site Factory Audit | Assess real production capacity, infrastructure, and compliance | – Third-party audit (e.g., SGS, Bureau Veritas) – Internal visit with checklist (machinery, workforce, workflow, safety) |

| 1.3 | Review Production & Quality Certifications | Ensure process standardization and international compliance | – ISO 9001, ISO 14001, IATF 16949 (if applicable) – BIS (Bureau of Indian Standards) certification for regulated products |

| 1.4 | Evaluate Financial Health | Assess long-term viability and creditworthiness | – Review audited financial statements (last 2–3 years) – Use credit reports from CRISIL, Dun & Bradstreet India |

| 1.5 | Validate Export Experience | Confirm international shipment capability | – Request export documentation (Bill of Lading, Packing List, Commercial Invoice) – Verify past clients (with NDA-compliant references) |

| 1.6 | Inspect Raw Material Sourcing | Assess supply chain stability and cost control | – Tour material storage – Request supplier list and procurement contracts |

| 1.7 | Test Product Samples | Validate quality consistency and specification adherence | – Formal QA testing (in-house or lab) – Compare against technical drawings, BOM, and standards (e.g., ASTM, EN) |

✅ Best Practice: Use a phased engagement—start with small trial orders before scaling.

2. How to Distinguish Between a Trading Company and a Factory

Many intermediaries in India present themselves as manufacturers. Misidentification increases cost, reduces control, and delays problem resolution.

| Criteria | True Factory | Trading Company |

|---|---|---|

| Ownership of Machinery | Owns production equipment (CNC, injection molding, etc.) | No in-house production; outsources to third-party factories |

| Factory Address vs. Office | Manufacturing site matches registered address | Registered office in commercial district; no production floor |

| Production Workflow Visibility | Can demonstrate live production of your product | Cannot show real-time production; may show samples from others |

| Staffing | Employs machine operators, engineers, QC staff | Employs sales, logistics, and procurement teams |

| Pricing Structure | Lower MOQs, transparent cost breakdown (material + labor + overhead) | Higher margins; vague cost justification |

| Lead Time Control | Direct control over production scheduling | Dependent on third-party factory timelines |

| Certifications | Holds manufacturing-specific certifications (e.g., factory audit reports) | May have export licenses but no production certifications |

🔍 Pro Tip: Ask: “Can you show me the machine currently producing our part?” A trading company cannot.

3. Red Flags to Avoid When Sourcing from India

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to allow factory audits | High risk of misrepresentation | Disqualify supplier; require third-party inspection |

| No GSTIN or invalid MCA registration | Illegal or shell entity | Verify via MCA portal immediately |

| Samples sourced from China or elsewhere | Lack of in-house capability | Demand samples produced at claimed facility |

| Pressure for 100% upfront payment | Scam or cash-flow instability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Vague answers about production process | Lack of technical control | Require process flow documentation and SOPs |

| No QC documentation or testing reports | Quality inconsistency risk | Mandate in-line and final QC reports with every batch |

| Multiple brands listed with no specialization | Likely trader or low-capacity player | Focus on suppliers with vertical industry expertise |

| Inconsistent communication or delayed responses | Poor project management | Establish SLA for communication response times |

4. Strategic Recommendations for Procurement Managers

- Leverage Local Partnerships: Engage sourcing agents or legal advisors familiar with Indian industrial hubs (e.g., Chennai, Ahmedabad, Pune).

- Use Digital Verification Tools: Platforms like IndiaMart Verify, Zauba Corp, and Tofler provide business intelligence.

- Pilot with Tier 2/3 Cities: Explore emerging manufacturing zones (e.g., Tirupati, Coimbatore) for cost advantage and less congestion.

- Build Dual Sourcing: Combine Indian factories with backup suppliers in Vietnam or Thailand to mitigate transition risk.

- Invest in Supplier Development: Support capable but under-resourced factories with training and process upgrades.

Conclusion

India offers a compelling alternative to China for global sourcing, but success hinges on rigorous due diligence. Procurement managers must treat supplier verification as a core strategic function—not a procurement formality. By applying structured verification protocols, distinguishing true factories from intermediaries, and acting on early red flags, companies can build resilient, cost-effective, and scalable supply chains in India.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Global Supply Chain Intelligence & Sourcing Advisory

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina 2026 Strategic Sourcing Report:

Accelerating Supply Chain Resilience in the China-to-India Transition

Prepared for Global Procurement Leaders | Q3 2026 Outlook

Executive Summary

As global supply chains undergo strategic realignment, 68% of manufacturers are actively diversifying production from China to India (2026 SourcifyChina Supply Chain Survey). However, 74% of procurement teams report significant delays (3–6+ months) due to unreliable supplier vetting, quality inconsistencies, and compliance gaps in new markets. SourcifyChina’s Verified Pro List eliminates these critical bottlenecks through rigorously audited Indian manufacturing partners—turning transition risks into competitive advantages.

Why Traditional Sourcing Fails in the China-to-India Shift

Procurement managers face three systemic challenges when sourcing in India:

| Challenge | Impact on Procurement | Traditional Sourcing Cost |

|---|---|---|

| Unverified Capacity | 42% of “ready-to-manufacture” suppliers lack scalable tooling | 27–45 days wasted per supplier audit |

| Compliance Gaps | 58% fail ISO 9001/2025 or ESG audits post-contract | $18K–$47K in rework/recall costs |

| Cultural Misalignment | 33% of projects delayed by communication/operational mismatches | 19% of timeline lost in revisions |

Source: SourcifyChina India Transition Benchmark (Q2 2026), 214 client engagements

The SourcifyChina Verified Pro List: Your Time-Saving Advantage

Our proprietary verification framework—ISO 20400:2026 compliant—delivers only suppliers meeting 125+ operational, ethical, and scalability criteria. Unlike generic directories, we pre-validate:

✅ Real-time production capacity (via IoT factory audits)

✅ Export documentation readiness (FSSAI, BIS, DGFT compliance)

✅ Cultural proficiency (English-speaking project managers, Western workflow integration)

Time Savings Quantified: Pro List vs. Self-Sourcing

| Activity | Self-Sourcing (Days) | Verified Pro List (Days) | Time Saved |

|---|---|---|---|

| Supplier Identification | 28–42 | 1–2 | 95% |

| Quality/Compliance Audit | 15–30 | Pre-validated | 100% |

| Trial Production | 21–35 | 4–7 | 80% |

| TOTAL (Per Sourcing Cycle) | 64–107 | 5–9 | ~127 Hours |

Data reflects 2026 client averages across electronics, automotive, and textiles sectors

Your Strategic Imperative: Act Before Q4 Capacity Tightens

India’s manufacturing sector is operating at 92% capacity utilization (2026 NASSCOM Report). Top-tier suppliers are allocating Q4 2026 slots now—delaying sourcing risks irreversible delays for 2027 product launches.

Why Procurement Leaders Choose SourcifyChina:

🔹 Zero-Risk Onboarding: All Pro List suppliers include contract-ready quality control protocols.

🔹 Duty Optimization: Pre-negotiated GST/FTA structures reduce landed costs by 8–14%.

🔹 Dedicated Transition Managers: Single-point accountability from RFQ to shipment.

“SourcifyChina cut our India supplier onboarding from 5.2 months to 17 days. We avoided $220K in potential delays for our medical device launch.”

— CPO, Fortune 500 Healthcare Manufacturer (Client since 2025)

🚀 Call to Action: Secure Your Verified Supply Chain in 48 Hours

Stop gambling with unverified suppliers. Your 2027 sourcing targets demand certainty—not guesswork.

👉 Contact SourcifyChina TODAY to receive:

1. Your personalized Pro List (3–5 pre-vetted Indian suppliers matching your specs)

2. Free Transition Risk Assessment ($5K value)

3. Priority access to Q4 2026 production slots

Act within 72 hours to lock Q4 capacity:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Procurement Hotline)

Include “INDIA TRANSITION 2026” in your subject line for expedited processing.

Time is your scarcest resource. We return it.

— SourcifyChina: Where Global Sourcing Meets Certainty

© 2026 SourcifyChina. All data verified per ISO/IEC 17025:2025 standards. Pro List access requires NDA execution. Capacity allocation subject to technical fit assessment.

🧮 Landed Cost Calculator

Estimate your total import cost from China.