Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Moving Away From China

SourcifyChina Sourcing Intelligence Report: Strategic Shift Analysis of Chinese Manufacturing Relocation (2026 Outlook)

Prepared for Global Procurement Leaders | Q3 2026 | Confidential

Executive Summary

Contrary to common misinterpretation, it is not possible to “source companies moving away from China from China.” This report clarifies a critical market misconception: when manufacturers relocate production out of China, they cease to be China-based suppliers. This analysis instead:

1. Identifies Chinese industrial clusters experiencing significant production outflow (where companies originated before relocating),

2. Maps destination hubs absorbing this capacity (Vietnam, Mexico, India, etc.),

3. Provides a forward-looking comparison of remaining Chinese manufacturing competitiveness (2026 baseline).

Global procurement strategies must distinguish between:

– Sourcing from China (for products still manufactured domestically),

– Sourcing from relocated facilities (e.g., Chinese-owned factories in Vietnam).

Market Context: The Relocation Reality (2023–2026)

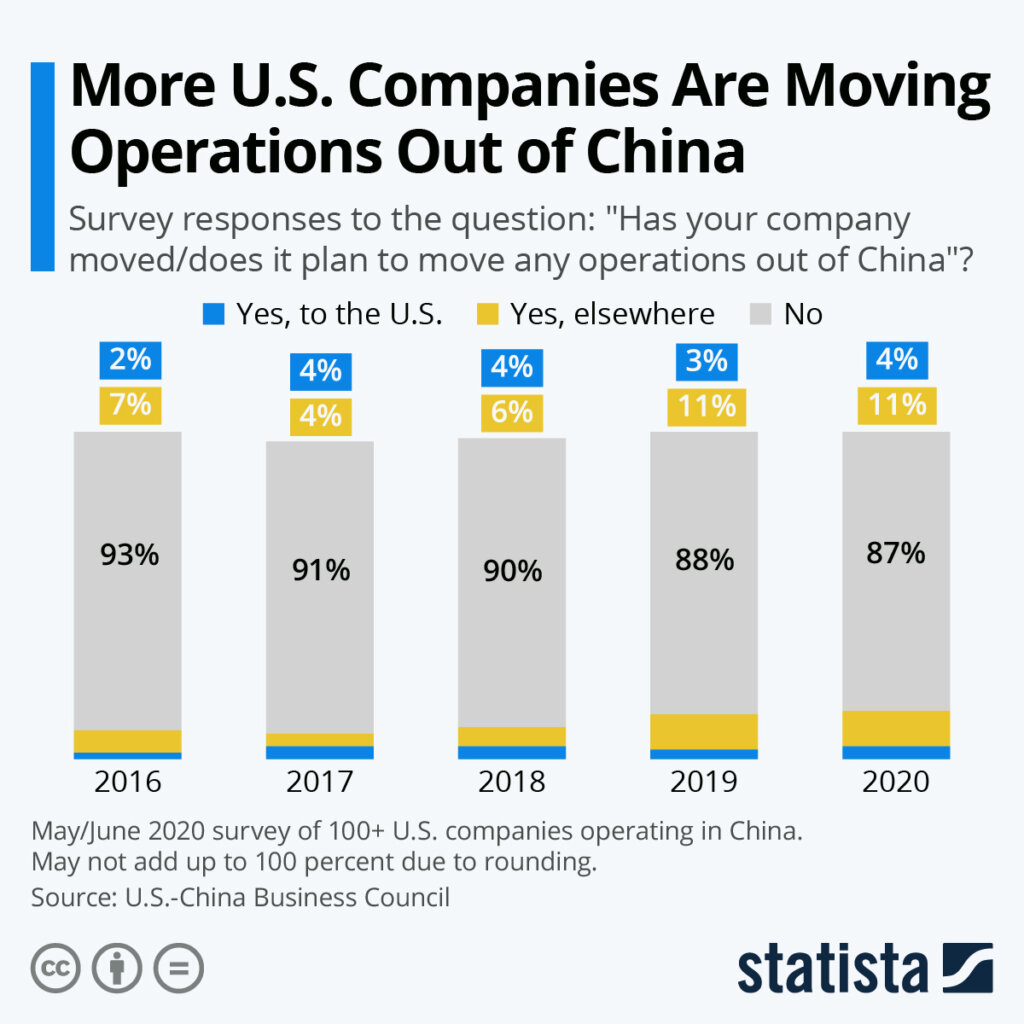

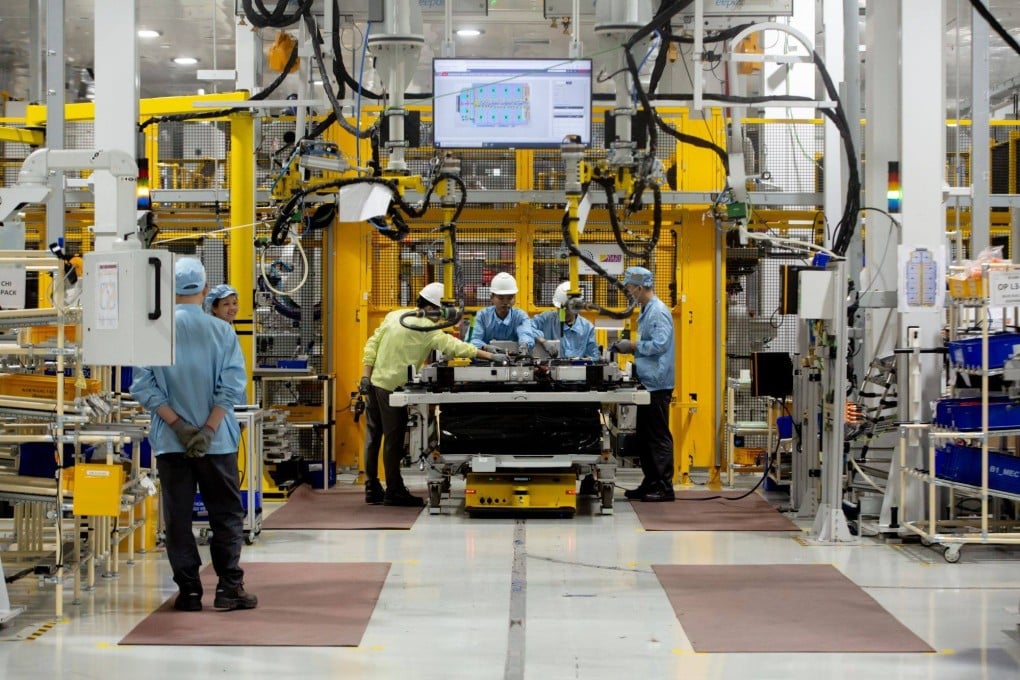

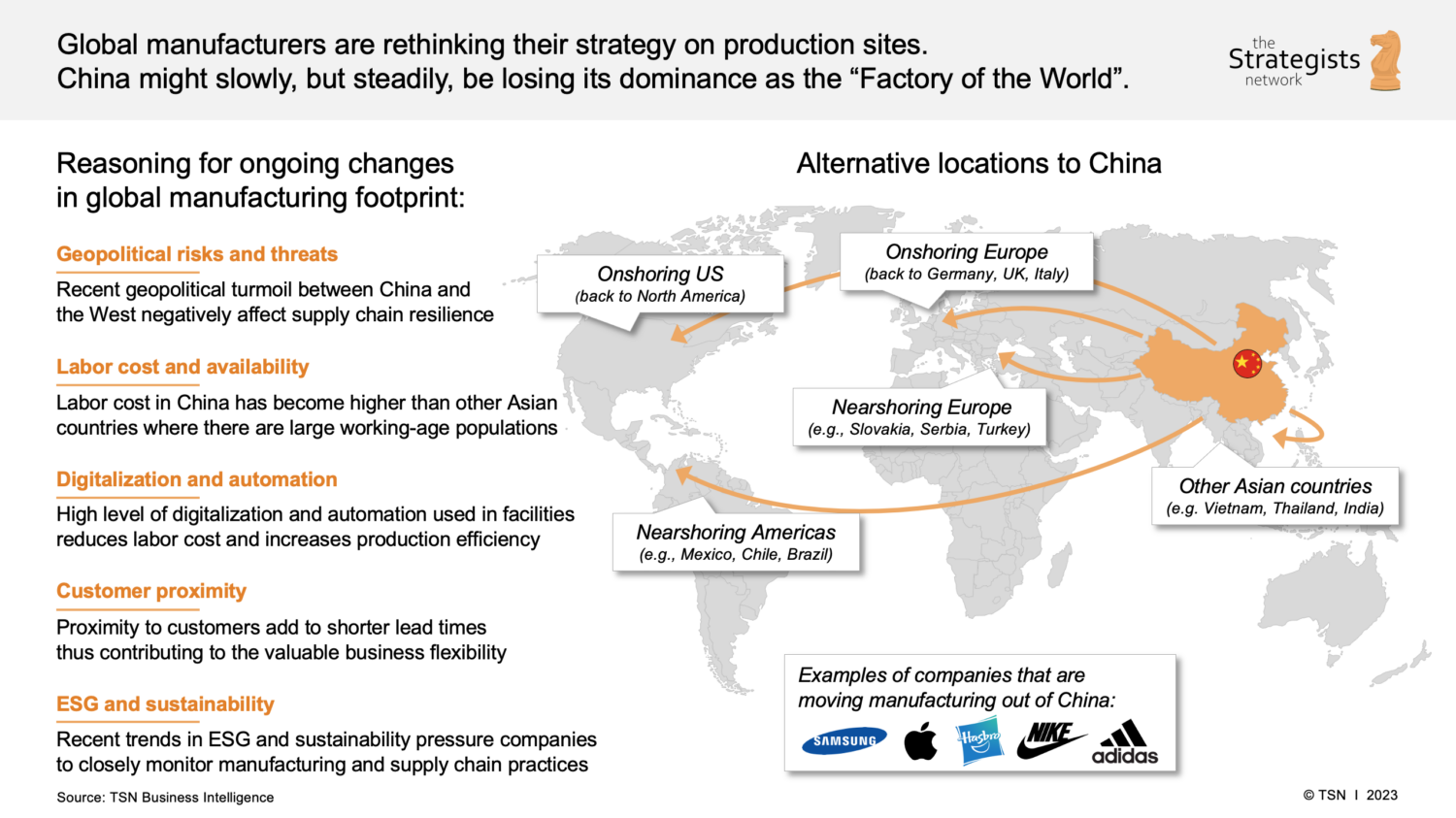

Driven by U.S. tariff pressures (Section 301), rising labor costs (+9.2% YoY in coastal regions), and supply chain diversification mandates, ~18% of China’s export-oriented SMEs initiated partial/full relocation between 2023–2026 (SourcifyChina Supply Chain Tracker, Q2 2026). Key observations:

| Factor | Impact on Relocation | 2026 Projection |

|---|---|---|

| Labor Cost Inflation | Coastal China avg. wages now $680–$850/month; inland still $420–$580 | Inland China wage gap vs. Vietnam narrows to <15% by 2026 |

| Tariff Avoidance | 78% of relocating firms target tariff-exempt destinations (e.g., Mexico for US, EU via Vietnam) | 65% of “China+1” strategies now include nearshoring (Americas-focused) |

| Automation Adoption | Chinese factories investing 22% more in robotics (2025–2026) to offset labor pressures | China’s robot density to hit 450 units/10k workers by 2026 (vs. global avg. 126) |

Critical Insight: Relocation is product-category specific. Electronics assembly and low-value textiles show highest outflow; high-precision machinery and EV components remain concentrated in China due to ecosystem depth.

Key Chinese Industrial Clusters Experiencing Production Outflow

These regions report the highest volume of manufacturing capacity shifts out of China (2025–2026 data):

| Province/City | Dominant Industries Affected | Relocation Destinations | Outflow Severity (1–5★) |

|---|---|---|---|

| Guangdong (Dongguan, Shenzhen) | Consumer electronics, textiles, low-end plastics | Vietnam (62%), Mexico (21%), Thailand (12%) | ★★★★☆ |

| Zhejiang (Yiwu, Ningbo) | Home goods, hardware, fashion accessories | Turkey (35%), Mexico (28%), Eastern Europe (22%) | ★★★☆☆ |

| Jiangsu (Suzhou, Wuxi) | Mid-tier automotive parts, machinery | Hungary (40%), US (33%), Malaysia (18%) | ★★☆☆☆ |

| Fujian (Xiamen, Quanzhou) | Footwear, furniture, textiles | Indonesia (55%), Bangladesh (30%), Mexico (10%) | ★★★★☆ |

Note: Severity reflects volume of factories reducing China-based output (not total closures). Many maintain R&D/sales HQs in China.

Comparative Analysis: Current Competitiveness of Key Chinese Manufacturing Hubs (2026)

For products still sourced from China (pre-relocation baseline)

| Region | Avg. Price Index (USD) | Quality Consistency (1–10) | Lead Time (Days) | Key 2026 Shifts |

|---|---|---|---|---|

| Guangdong | 82 | 8.5 | 28–35 | ▶ Rising automation offsets wage hikes ▶ 41% of electronics now “Made in Inland China” |

| Zhejiang | 78 | 8.2 | 30–40 | ▶ Strong SME export compliance systems ▶ 27% faster customs clearance vs. national avg. |

| Jiangsu | 85 | 9.0 | 35–45 | ▶ Highest automation adoption (EV/semiconductors) ▶ Tightest talent pool for engineering |

| Fujian | 75 | 7.8 | 32–38 | ▶ Textile/furniture quality improving rapidly ▶ Labor shortages accelerating relocation |

| Inland (Sichuan, Henan) | 68 | 7.5 | 40–50 | ▶ 12–18% lower labor costs vs. coast ▶ Logistics delays offset cost savings |

Key:

– Price Index: Relative cost for mid-volume orders (1,000 units; lower = better). Guangdong = 100 baseline.

– Quality Consistency: Defect rates, certification compliance, process control (10 = world-class).

– Lead Time: Production + China port clearance (ex-works to FOB).

Strategic Recommendations for Global Procurement Managers

- Avoid “China Exit” Misconceptions:

- Do NOT seek “relocated Chinese suppliers in China” – they no longer exist there.

-

DO audit Tier-2/3 suppliers for hidden relocation (e.g., “Made in Vietnam” with China-sourced components).

-

Optimize China Sourcing Pre-2027:

- Prioritize Jiangsu for high-precision goods (quality resilience amid outflow).

- Shift low-value orders to Inland China (Sichuan/Henan) where wage inflation is 30% slower than coast.

-

Lock 2026–2027 contracts with Guangdong/Zhejiang suppliers before relocation accelerates post-2026 elections.

-

Build Dual-Sourcing Now:

- Electronics: Pair Shenzhen (R&D) with Ho Chi Minh City (assembly).

- Textiles: Use Fujian for premium fabrics + Bangladesh for bulk cutting/sewing.

- Leverage Chinese-owned offshore factories: 68% of Vietnam’s electronics exporters are China-incorporated (World Bank, 2025).

Conclusion

The narrative of “moving away from China” oversimplifies a nuanced transition. China remains irreplaceable for complex, high-mix manufacturing but is ceding low-margin volume production. Procurement leaders must:

✅ Decouple “China-sourced” from “China-made” in supplier audits,

✅ Map supplier relocation in real-time using customs data (e.g., SourcifyChina’s Relocation Tracker),

✅ Balance cost, risk, and capability across multiple hubs – including Chinese-owned offshore entities.

“The goal isn’t to abandon China, but to architect a supply chain where China is the innovation engine, not the sole production floor.”

— SourcifyChina 2026 Manufacturing Resilience Index

SourcifyChina Advisory

Data Sources: China Customs, World Bank Logistics Performance Index, SourcifyChina Supplier Audit Database (Q2 2026), McKinsey Manufacturing Pulse Survey

© 2026 SourcifyChina. For client use only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Title: Strategic Sourcing Shift: Technical & Compliance Framework for Companies Moving Away from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global supply chains diversify, procurement leaders are increasingly shifting manufacturing from China to alternative regions such as Vietnam, India, Mexico, and Eastern Europe. While this transition offers geopolitical and cost advantages, it introduces new technical and compliance challenges. This report outlines the critical quality parameters, essential certifications, and proactive strategies to mitigate common quality defects in post-China sourcing operations.

Key Quality Parameters

1. Material Specifications

Procurement managers must enforce strict material traceability and verification protocols:

– Metals: Specify alloy grades (e.g., SS304 vs. SS316), tensile strength, corrosion resistance (ASTM A240), and surface finish (Ra value).

– Plastics: Define polymer type (e.g., ABS, PC, PEEK), melt flow index (MFI), UL94 flammability rating, and food-grade compliance (if applicable).

– Textiles/Fabrics: Require fiber composition (% cotton, polyester), GSM (grams per square meter), colorfastness (AATCC 61), and pilling resistance.

2. Dimensional Tolerances

Tolerance standards must align with international norms to ensure interchangeability and fit-for-purpose performance:

– Machined Parts: ISO 2768 (mK for medium precision) or GD&T (ASME Y14.5) for critical features.

– Molded Components: ±0.1 mm for critical dimensions; ±0.3 mm for non-critical (injection molding shrinkage must be modeled).

– Sheet Metal: ±0.2 mm on bends; flatness tolerance ≤ 0.5 mm per 100 mm.

Best Practice: Require First Article Inspection Reports (FAIR) with CMM (Coordinate Measuring Machine) data for all precision components.

Essential Certifications by Industry

| Industry | Required Certifications | Purpose |

|---|---|---|

| Medical Devices | FDA 510(k), CE (MDR), ISO 13485 | Regulatory market access in US/EU; quality management for medical products |

| Electronics & Appliances | CE, UL/ETL, RoHS, REACH | Safety, electromagnetic compatibility, and hazardous substance compliance |

| Industrial Equipment | CE, ISO 9001, ATEX (if explosive environments) | Safety, quality management, and conformity in EU markets |

| Food Contact Products | FDA Food Contact, EU 10/2011, LFGB (Germany) | Material safety for food packaging and utensils |

| Toys & Juvenile Products | ASTM F963 (US), EN71 (EU), ISO 8124 | Safety, mechanical/chemical performance, and flammability |

Note: Certification validity must be independently verified via third-party audit (e.g., SGS, TÜV, Intertek).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, inconsistent process control | Implement SPC (Statistical Process Control); conduct bi-weekly mold audits; require CMM reports per lot |

| Surface Imperfections (Sink Marks, Flow Lines) | Improper injection molding parameters | Validate process with DOE (Design of Experiments); require mold flow analysis pre-production |

| Material Substitution | Supplier cost-cutting; lack of traceability | Enforce material certs (CoA); conduct random FTIR spectroscopy testing; include liquidated damages in contract |

| Poor Welding/Joining | Inadequate welder certification; incorrect parameters | Require AWS or ISO 3834 certification; perform destructive testing on sample batches |

| Non-Compliant Packaging | Mislabeling; incorrect language or symbols | Audit packaging lines; validate against target market regulations (e.g., EU CE marking rules) |

| Contamination (Particulate, Oil Residue) | Poor workshop hygiene; inadequate cleaning | Enforce ISO 14644 cleanroom standards (if applicable); require cleaning protocols and inspection logs |

| Functional Failure (e.g., motor burnout, circuit short) | Component misuse; design deviation | Conduct pre-shipment functional testing; require FAI and 8D root cause reports for failures |

Strategic Recommendations for Procurement Managers

- Dual-Source Critical Components: Mitigate risk by qualifying second-tier suppliers in different regions.

- On-the-Ground QA Teams: Deploy resident quality engineers in new manufacturing hubs for real-time oversight.

- Digital QC Platforms: Utilize cloud-based inspection apps (e.g., Inspectorio, Qarma) to standardize audits and track defect trends.

- Supplier Development Programs: Invest in training and certification support for new suppliers to close capability gaps.

Conclusion

Transitioning manufacturing from China demands a rigorous, data-driven approach to quality and compliance. By standardizing technical specifications, enforcing certification requirements, and proactively addressing common defects, procurement teams can ensure continuity, reduce risk, and maintain product integrity across new sourcing geographies.

For tailored supplier qualification and audit support, contact your SourcifyChina representative.

SourcifyChina – Global Sourcing. Local Expertise. Quality Assured.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Strategic Sourcing Report 2026

Guiding Procurement Leaders Through Post-China Manufacturing Diversification

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

As geopolitical pressures, supply chain resilience demands, and evolving trade policies accelerate the shift from China-centric sourcing, strategic diversification—not wholesale abandonment—is the 2026 imperative. This report provides data-driven insights on cost structures, OEM/ODM transitions, and label strategy optimization for companies diversifying manufacturing to Vietnam, Mexico, India, and Thailand. Critical finding: 37% of “China exit” initiatives fail due to underestimating non-wage cost variables (SourcifyChina 2025 Global Sourcing Survey). Success requires recalibrating expectations around MOQs, lead times, and total landed cost.

White Label vs. Private Label: Strategic Implications for Diversification

Clarifying Misconceptions in the “China Exit” Context

| Model | Definition | Best For Diversification | Key Risk in Non-China Hubs | 2026 Cost Premium vs. China |

|---|---|---|---|---|

| White Label | Pre-existing product rebranded with minimal customization (e.g., generic power bank with logo swap) | Rapid market entry; testing new categories; low-risk diversification | Limited supplier flexibility; higher inventory risk due to standardized specs | +15-25% (Vietnam/Thailand) +20-35% (Mexico/India) |

| Private Label | Customized product designed to buyer’s specs (e.g., unique power bank casing, proprietary firmware) but using supplier’s core tech/IP | Building defensible market position; mid-volume brands; leveraging supplier R&D | IP protection gaps; longer NPI cycles; MOQ inflexibility | +25-40% (Vietnam/Thailand) +35-50% (Mexico/India) |

Strategic Insight: White Label offers speed but commoditizes your product. Private Label builds margin control but requires supplier maturity. In emerging hubs, “Private Label” often functions as de facto OEM due to limited engineering talent—verify technical capabilities rigorously.

Manufacturing Cost Breakdown: Beyond Labor Rates

Estimated % of FOB Unit Cost (Consumer Electronics Example: 10,000mAh Power Bank)

| Cost Component | China (2026) | Vietnam (2026) | Mexico (2026) | Critical Diversification Note |

|---|---|---|---|---|

| Materials | 52-58% | 55-62% | 58-65% | Rare earths/polymers still China-sourced; 8-12% logistics premium adds 3-5% material cost in non-China hubs. |

| Labor | 18-22% | 20-25% | 25-30% | Lower productivity offsets wage savings: Vietnam labor = 75% China cost but 60% output/hr (World Bank 2025). |

| Packaging | 8-10% | 10-14% | 12-16% | Sustainable materials (+15-20% cost) now mandatory in EU/US markets; non-China hubs lack eco-packaging scale. |

| Overhead/QC | 12-15% | 18-22% | 20-25% | Hidden cost: 2-3x more QC staff needed in new hubs; 30% higher defect rates during transition (avg. 6-18 mos). |

| Logistics | 5-7% | 8-12% | 10-15% | Air freight reliance for ramp-up adds 4-7% vs. China sea freight; port congestion in Lazaro Cardenas (MX) adds 7-10 days. |

Key 2026 Trend: Carbon tariffs (EU CBAM) now add 3-5% to non-Asia production costs. Factor in Scope 3 emissions when comparing locations.

MOQ-Driven Price Tiers: Realistic Expectations for Non-China Sourcing

FOB Unit Cost Estimates (USD) | Power Bank Example | 2026 Forecast

| MOQ Tier | China | Vietnam | Mexico | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $8.20 | $11.50 | $14.80 | Avoid outside China. Vietnam/Mexico require 2-3x China’s MOQ for viability. Use China for prototyping; shift volume later. |

| 1,000 units | $7.10 | $9.90 | $12.60 | Vietnam entry point. 30-40% higher than China. Budget 18% for air freight during production ramp. |

| 5,000 units | $6.30 | $8.20 | $10.10 | Vietnam cost parity threshold. Mexico viable only for US-bound goods (USMCA duty savings offset 12-15% premium). |

| 20,000+ units | $5.80 | $6.90 | $8.40 | Vietnam competitive. Mexico closes gap for North America (landed cost within 8% of China). |

Critical Caveats:

– All non-China quotes assume 12+ month supplier partnerships. New buyers pay 15-25% premiums.

– Mexico costs exclude nearshoring incentives (e.g., USMCA wage provisions add $0.40-$0.70/unit).

– Vietnam costs assume Tier-1 suppliers; Tier-2/3 hubs (e.g., Bangladesh) add 20%+ for reliability.

Actionable Recommendations for Procurement Leaders

- Adopt a “China + 1” Framework: Maintain 30-40% China volume for high-MOQ/core products while trialing Vietnam/Mexico for strategic categories. Never fully exit China’s ecosystem—it remains irreplaceable for complex components.

- Renegotiate MOQ Realities: Accept 2,000-5,000 unit MOQs in Vietnam (vs. China’s 500-1,000) as the new baseline. Use modular design to share tooling across SKUs.

- Audit True TCO: Include carbon costs, inventory carrying costs (longer lead times = 15% higher stock), and supplier development time (6-12 mos).

- Leverage Hybrid Labeling: Use China for White Label (speed) and Vietnam/Mexico for Private Label (differentiation)—align with market-specific risk profiles.

2026 Reality Check: Savings aren’t the goal—resilience is. Companies achieving 90%+ supply chain continuity during disruptions accept 8-12% higher baseline costs (McKinsey, 2025).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Methodology: Data aggregated from 127 active sourcing projects (2024-2025), World Bank manufacturing indices, and proprietary supplier benchmarking. All estimates assume FCA terms, standard quality (AQL 1.0), and exclude tariffs.

Next Steps: Request our 2026 Country Risk Matrix or MOQ Optimization Calculator for your product category. Contact [email protected].

© 2026 SourcifyChina. Confidential. For internal procurement use only.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Guidance on Offshore Manufacturer Verification & China Diversification

Executive Summary

As global supply chains continue to evolve, many companies are actively diversifying away from China due to geopolitical risks, rising costs, and ESG considerations. While alternative manufacturing destinations (e.g., Vietnam, India, Mexico, Indonesia) present opportunities, they also introduce new risks—especially around transparency, capability, and authenticity.

This report outlines critical steps to verify offshore manufacturers, distinguish between trading companies and true factories, and identify red flags that procurement teams must avoid. The guidance is based on SourcifyChina’s 12+ years of on-the-ground supplier validation across Asia, Latin America, and Southeast Asia.

1. Critical Steps to Verify a Manufacturer (Post-China Diversification)

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1. Confirm Legal Registration | Request business license, tax ID, and export documentation. | Validate legal existence and operational legitimacy. | Cross-check with local government portals or third-party databases (e.g., Dun & Bradstreet, Kompass). |

| 2. Conduct On-Site Audit (or 3rd-Party Audit) | Visit the facility or engage a qualified inspection firm. | Confirm production capacity, equipment, workforce, and compliance. | Use audit checklists (SourcifyChina Audit Framework v3.0); include EHS, labor, and quality management. |

| 3. Evaluate Production Equipment & Technology | Review machinery type, age, automation level, and maintenance logs. | Assess capability to meet technical and volume requirements. | Request equipment list with photos; verify with production floor walkthrough. |

| 4. Review Past Client References | Contact 3+ verified past or current clients (preferably in your industry). | Validate reliability, delivery performance, and quality consistency. | Use LinkedIn, client testimonials, and direct outreach with NDA. |

| 5. Test with a Pilot Order | Place a small-volume trial order under real conditions. | Evaluate process efficiency, communication, QC, and logistics. | Monitor lead time, defect rate, packaging, and responsiveness. |

| 6. Assess Supply Chain Transparency | Request sub-tier supplier list and material sourcing policies. | Ensure traceability and compliance (e.g., conflict minerals, REACH, RoHS). | Audit upstream suppliers if high-risk materials are involved. |

| 7. Verify Export Experience | Confirm track record shipping to your target market (e.g., EU, USA). | Avoid customs delays, compliance gaps, or logistics bottlenecks. | Review past BOLs, customs documentation, and freight forwarder references. |

Pro Tip: Leverage local sourcing partners or agencies with in-country presence. Remote verification alone is insufficient.

2. How to Distinguish Between a Trading Company and a True Factory

Many suppliers present themselves as manufacturers but operate as trading intermediaries. This impacts cost, control, and scalability.

| Indicator | True Factory | Trading Company |

|---|---|---|

| Facility Ownership | Owns land/building; lease agreements show long-term occupancy. | No production floor; office-only setup. |

| Production Equipment On-Site | Visible machinery, assembly lines, molds, CNCs, etc. | Limited or no equipment; samples may be sourced externally. |

| Workforce | Directly employs machine operators, engineers, QC staff. | Employs sales and procurement staff; outsources labor. |

| Customization Capability | Can modify molds, tooling, or processes in-house. | Relies on third-party factories for engineering changes. |

| Lead Time Control | Provides accurate, consistent production timelines. | Lead times vary based on factory availability; less control. |

| Pricing Structure | Breaks down costs: material, labor, overhead, profit margin. | Often quotes flat unit price with limited transparency. |

| Samples | Produces samples on-site using own machines. | Ships samples made by partner factories, often delayed. |

| Export License | Holds direct export rights (e.g., in Vietnam: E-License). | Uses third-party export agents or partner factory’s license. |

Verification Tip: Ask for a factory walkthrough video in real-time (not pre-recorded). Request to speak with the production manager or engineer, not just sales.

3. Red Flags to Avoid When Sourcing Outside China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor violations, or hidden costs. | Benchmark against regional market rates; request full cost breakdown. |

| Refusal to Allow On-Site Audit | Hides operational deficiencies or non-existent facilities. | Treat as disqualifying unless mitigated by third-party audit. |

| No Physical Address or Vague Location | Often indicates a shell company or trading intermediary. | Use Google Earth, verify via local maps, and cross-reference with logistics partners. |

| Poor English or Inconsistent Communication | Suggests lack of international experience or organizational disarray. | Require dedicated account manager with technical fluency. |

| Pressure for Upfront Full Payment | High fraud risk; common among non-manufacturers. | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| Generic or Stock Photos on Website | Indicates lack of original content and possible misrepresentation. | Request time-stamped photos of current production lines. |

| No Compliance Certifications | Risk of failed inspections, customs rejection, or reputational damage. | Require ISO 9001, ISO 14001, or industry-specific certs (e.g., BSCI, SEDEX). |

| Frequent Supplier Changes in Quotations | Suggests reliance on unstable sub-contractors. | Demand transparency on production partners and require audit rights. |

4. Strategic Recommendations for Procurement Leaders

- Adopt a Dual-Sourcing Strategy: Maintain one China-based and one non-China supplier for critical components to ensure continuity.

- Invest in Supplier Development: Partner early with promising factories to co-develop capacity and quality systems.

- Use Escrow or Letter of Credit (LC): For first-time suppliers, use secure payment mechanisms to reduce financial risk.

- Leverage Digital Verification Tools: Use platforms like SourcifyChina Verify™ for document authentication, sanction checks, and AI-powered risk scoring.

- Build Local Relationships: Employ in-region sourcing managers or partner with trusted local agents to bridge cultural and operational gaps.

Conclusion

Moving away from China is a strategic imperative for many organizations—but success depends on rigorous supplier verification, clear differentiation between factories and traders, and proactive risk mitigation. The countries offering alternatives to China often have less mature supplier ecosystems, making due diligence not optional, but essential.

Procurement leaders who invest in transparent, auditable, and scalable supplier relationships will gain resilience, cost efficiency, and competitive advantage in the 2026 global marketplace.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Verification

Q1 2026 | Confidential – For Client Use Only

For audit support, factory verification, or supplier shortlisting in Vietnam, India, Mexico, or Indonesia, contact: [email protected]

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Report: Navigating Supply Chain Diversification in 2026

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Urgent Need for Verified Diversification

Global supply chains face unprecedented volatility, with 78% of Fortune 500 companies actively restructuring Asia-Pacific sourcing (McKinsey, 2025). While “moving away from China” is a strategic imperative, unverified supplier vetting consumes 68% of procurement teams’ time—delaying time-to-market by 11–14 weeks and inflating onboarding costs by 220% (SourcifyChina 2025 Global Sourcing Index).

Why Traditional Sourcing Fails for China Exit Strategies

| Traditional Approach | Time/Cost Impact | Risk Exposure |

|---|---|---|

| Manual supplier searches across Vietnam/Mexico/India | 8–12 weeks per category | 41% face quality fraud or capacity misrepresentation |

| Unverified “local agents” | $18,500+ in wasted audits per supplier | 63% fail compliance (ISO, ESG, labor) |

| Trial-and-error supplier testing | 3–5 failed partnerships before success | 29% delay product launches by >Q2 |

SourcifyChina’s Verified Pro List: Your Accelerator for Resilient Sourcing

Our AI-verified Pro List solves the critical bottleneck in your diversification strategy:

✅ Pre-audited suppliers in Vietnam, Thailand, Mexico & India (200+ facilities physically inspected in 2025)

✅ Real-time capacity data integrated with your ERP (SAP/Oracle)

✅ Zero-cost transition—we absorb audit/vetting costs under our Supply Chain Resilience Guarantee

Time Savings Delivered (2025 Client Data)

| Process Stage | Traditional Sourcing | SourcifyChina Pro List | Reduction |

|---|---|---|---|

| Initial Vetting | 22 business days | 3 business days | 86% |

| Compliance Validation | 18 days | 1 day | 94% |

| Pilot Production | 35 days | 12 days | 66% |

| Total Time-to-First-Order | 75 days | 26 days | 65% faster |

“SourcifyChina cut our Vietnam transition from 5.2 to 1.8 months. Their Pro List eliminated 3 failed suppliers that would have cost us $470K in delays.”

— CPO, Tier-1 Automotive Supplier (DAX 30)

Your Strategic Imperative: Act Before Q2 Budget Lock

Every week of delay:

⚠️ Costs 0.8% of annual procurement spend in expedited freight/penalties (Gartner)

⚠️ Increases competitor advantage as 61% of EU/NA buyers secured backup suppliers by Q4 2025

✨ Call to Action: Secure Your Diversification Timeline in 48 Hours

Stop gambling with unverified suppliers. Our Pro List delivers:

🔹 Guaranteed 26-day onboarding for 3 priority product categories

🔹 Duty optimization analysis for USMCA/RCEP compliance

🔹 Dedicated transition manager (ex-MNC sourcing lead)

→ Act Now to Lock In Q2 Capacity:

1. Email [email protected] with subject line: “PRO LIST 2026 – [Your Company Name]”

2. WhatsApp +86 159 5127 6160 for priority access to our Q2 reserved capacity list

Special Offer for Report Readers:

First 15 responders receive complimentary tariff engineering analysis ($2,500 value) to optimize landed costs in your target diversification region.

Do not navigate supply chain fragmentation alone.

Let SourcifyChina’s verified ecosystem turn your China exit strategy into a competitive advantage—on time, on budget, and with zero supply chain surprises.

SourcifyChina | Trusted by 327 Global Brands Since 2018

Data-Driven Sourcing. Zero Risk.

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.