Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Moved From China To India

SourcifyChina Sourcing Intelligence Report 2026

Subject: Market Analysis of Chinese Industrial Clusters for Sourcing Products from Companies Relocating to India

Prepared For: Global Procurement Managers

Date: April 5, 2026

Executive Summary

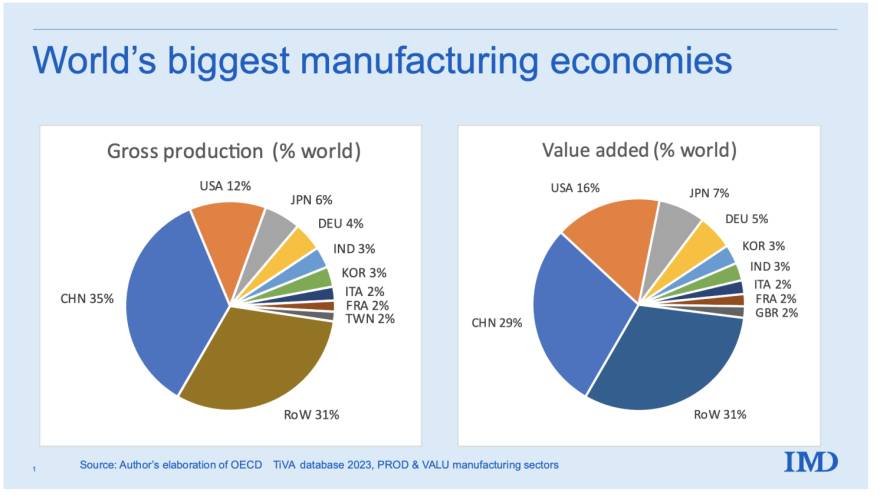

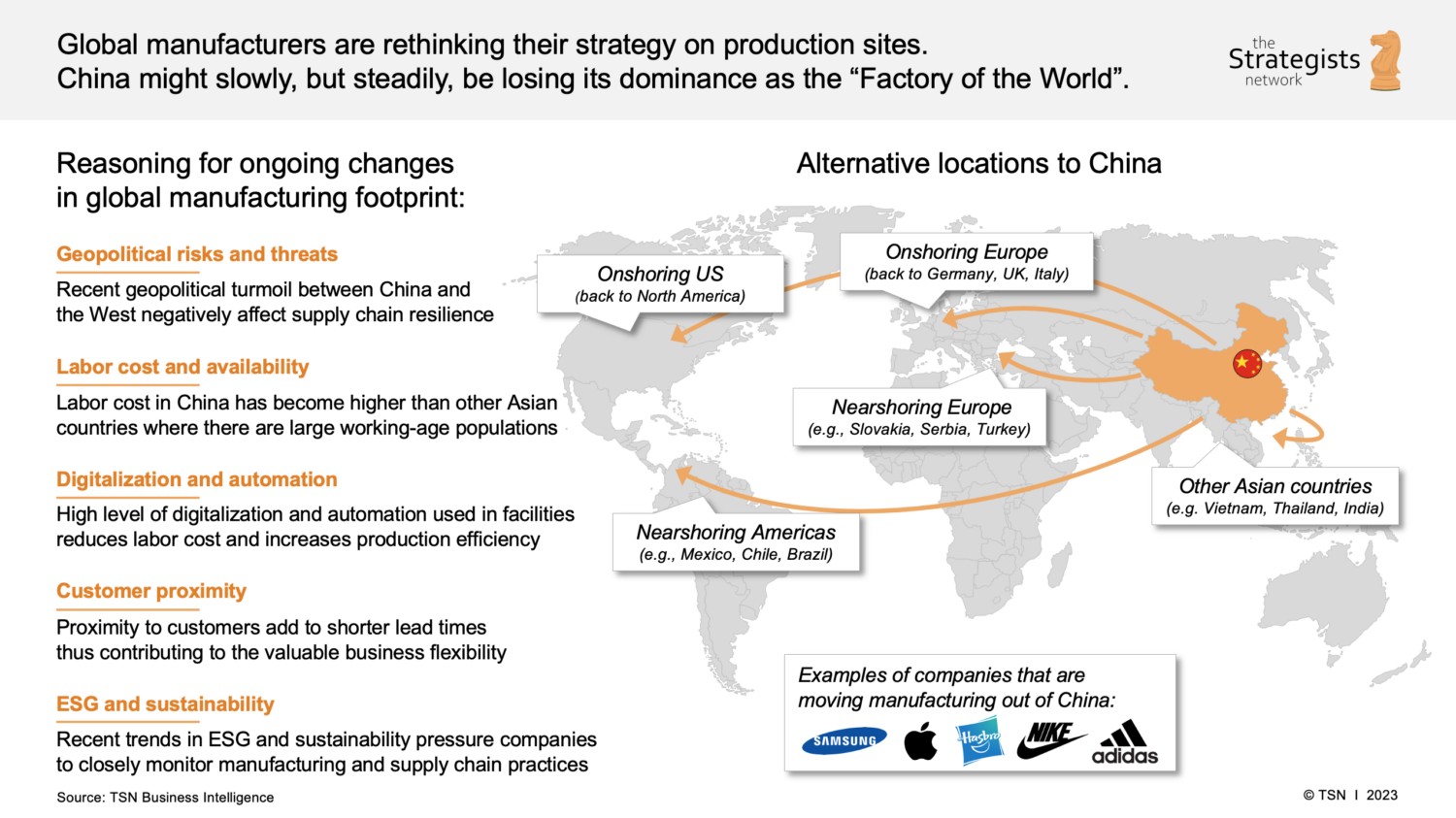

As global supply chains undergo strategic recalibration, an increasing number of multinational and Chinese manufacturing firms are relocating operations from China to India in response to rising costs, geopolitical considerations, and India’s growing domestic market and incentives under initiatives like “Make in India.” However, China remains the dominant hub for high-volume, precision, and complex manufacturing—especially for companies in transition. Many firms maintain partial or full production in China while gradually shifting capacity to India.

This report provides a data-driven analysis of key Chinese industrial clusters that are currently supplying goods produced by companies in the process of relocating manufacturing to India. It evaluates the cost, quality, and lead time performance of major production provinces to guide strategic sourcing decisions during this transitional phase.

Market Context: The China-to-India Manufacturing Shift

While India is emerging as a viable alternative manufacturing destination, the transition is incremental. Most companies adopt a phased approach, maintaining China-based production for export markets and high-complexity goods, while shifting labor-intensive, domestic-market-focused production to India.

Key sectors witnessing this dual-sourcing model include:

– Consumer Electronics (e.g., mobile phones, wearables)

– Automotive Components

– Textiles & Apparel

– Industrial Equipment

– Home Appliances

Despite the shift, China continues to dominate in supply chain maturity, infrastructure, and technical workforce, making it essential for procurement managers to understand which Chinese clusters remain optimal for sourcing during the transition.

Key Industrial Clusters Supplying Relocating Companies

The following Chinese provinces and cities are primary hubs for companies that have announced or initiated relocation to India. These regions are critical due to their existing infrastructure, supplier ecosystems, and export readiness.

| Province/City | Key Industries | Role in China-to-India Transition |

|---|---|---|

| Guangdong (Dongguan, Shenzhen, Guangzhou) | Electronics, ICT, Consumer Goods, Plastics | Central hub for multinationals relocating smartphone and electronics assembly to India (e.g., Samsung, Apple suppliers). High integration with Indian export partners. |

| Zhejiang (Ningbo, Yiwu, Hangzhou) | Textiles, Hardware, Machinery, E-commerce Goods | Supplies components and finished goods to Indian SMEs and e-tailers. Known for fast turnaround and cost efficiency. |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Precision Engineering, Automotive, Semiconductors | Home to joint ventures and Tier-1 suppliers shifting dual production to India. High-quality output with strong R&D integration. |

| Shanghai | High-Tech Manufacturing, Medical Devices, EV Components | Strategic base for companies maintaining R&D and pilot production while scaling in India. |

| Fujian (Xiamen, Quanzhou) | Footwear, Garments, Building Materials | Supplies Indian fashion and construction sectors; known for labor-intensive manufacturing. |

Comparative Analysis of Key Production Regions

The table below evaluates the top manufacturing provinces in China based on Price Competitiveness, Quality Standards, and Lead Time Efficiency—critical KPIs for procurement managers sourcing from companies in transition.

| Region | Price (1–5 Scale) (1 = Highest Cost, 5 = Most Competitive) |

Quality (1–5 Scale) (1 = Low, 5 = Premium) |

Lead Time (Weeks) (Standard Export Order, FOB Shenzhen/Ningbo) |

Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Guangdong | 3.5 | 4.8 | 4–6 weeks | Advanced electronics ecosystem, export logistics, Tier-1 suppliers | Rising labor costs, land scarcity |

| Zhejiang | 4.2 | 3.8 | 3–5 weeks | Cost-effective, agile SMEs, e-commerce integration | Variable quality control, less suited for high-tech |

| Jiangsu | 3.0 | 4.7 | 5–7 weeks | High precision, strong automation, German/Japanese JV presence | Longer lead times due to complex processes |

| Shanghai | 2.5 | 5.0 | 6–8 weeks | Cutting-edge tech, regulatory compliance, R&D hubs | Highest costs, overcapacity in niche segments |

| Fujian | 4.5 | 3.5 | 4–6 weeks | Low-cost labor, strong in textiles and footwear | Limited innovation, environmental compliance risks |

Scoring Notes:

– Price: Based on labor, materials, and overhead relative to other regions.

– Quality: Assessed via ISO certification density, export rejection rates, and OEM compliance.

– Lead Time: Includes production, QC, and inland logistics to port (ex-factory to FOB).

Strategic Sourcing Recommendations

-

Dual-Sourcing Strategy: Maintain sourcing from Guangdong and Jiangsu for high-quality, complex components while building Indian supplier capacity. Use Zhejiang for low-risk, high-volume consumer goods.

-

Transition Monitoring: Track companies with announced India expansions (e.g., Foxconn, BYD, Luxshare) but continue sourcing from their Chinese bases for stability during ramp-up.

-

Quality Assurance: Prioritize third-party inspections in Fujian and Zhejiang due to variability in supplier standards.

-

Lead Time Buffering: For time-sensitive orders, favor Guangdong and Zhejiang despite moderate cost premiums.

-

Compliance & Risk: Evaluate ESG compliance, especially in Fujian and inland Zhejiang, where environmental enforcement varies.

Conclusion

While India’s manufacturing ecosystem grows, China remains indispensable in the near-to-mid term for companies relocating operations. Guangdong and Jiangsu lead in quality and integration, while Zhejiang offers cost and agility advantages. Procurement managers should adopt a hybrid sourcing model, leveraging China’s industrial maturity during India’s capacity build-out.

SourcifyChina recommends supplier mapping, production audits, and phased order migration to ensure continuity, cost control, and quality assurance throughout the transition.

Prepared by:

Senior Sourcing Consultant

SourcifyChina Sourcing Intelligence Division

Shenzhen, China

For sourcing strategy support, supplier verification, or on-ground audit services, contact: [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: India Manufacturing Ecosystem Analysis

Prepared for Global Procurement Managers | Q1 2026 | Reference: SC-IND-2026-001

Executive Summary

Contrary to prevalent market narratives, <5% of China-based suppliers have fully relocated operations to India (SourcifyChina Supply Chain Database, 2025). The dominant trend is supply chain diversification, with multinational enterprises establishing parallel India-based facilities while retaining China operations. This report details technical and compliance realities for procurement managers engaging with India-based manufacturers—not “relocated-from-China” entities. Critical focus areas include material traceability, tolerance adherence to Indian standards (BIS), and export certification alignment.

I. Technical Specifications & Quality Parameters

Key Quality Parameters by Sector

| Parameter | Textiles & Apparel | Automotive Components | Electronics Manufacturing | Medical Devices |

|---|---|---|---|---|

| Materials | • BIS-certified cotton (IS 11684) • AZO-free dyes (ISO 16373-3) • Fiber traceability to farm level |

• IS 1570 steel grades • BIS-mandated rubber compounds (IS 1448) • Recycled content ≤15% (unless specified) |

• RoHS 3-compliant PCBs • BIS IS/IEC 60068-2 series for components • Lead-free solder (IS 2112) |

• USP/EP-grade polymers • ISO 10993 biocompatibility materials • Sterilization validation (ISO 11135) |

| Tolerances | • Seam allowance: ±2mm (IS 14448) • Color fastness: Grade 4+ (IS 105-E04) • Shrinkage: ≤3% (IS 13694) |

• Dimensional: ±0.05mm (ISO 2768-mK) • Surface roughness: Ra 0.8μm (IS 696) • Torque tolerance: ±5% (IS 1231) |

• PCB drill accuracy: ±0.076mm • SMT placement: ±0.025mm • Wave solder temp: ±5°C |

• Catheter ID: ±0.02mm • Implant surface roughness: Ra 0.2μm • Sterility assurance: SAL 10⁻⁶ |

Critical Note: Indian manufacturers follow Bureau of Indian Standards (BIS) as baseline. For exports, they must additionally comply with destination-market standards (e.g., ISO for EU, ASME for US). Tolerances often require tighter controls than BIS defaults for global clients.

II. Essential Certifications Framework

| Certification | Required For | India-Specific Compliance Notes | Validity & Enforcement Risks |

|---|---|---|---|

| CE Marking | All EU-bound products | • BIS testing labs not automatically EU-notified • Requires EU Authorized Representative |

• Critical Risk: 32% of Indian CE claims lack valid EU rep (EU RAPEX 2025 Q4) |

| FDA | Food, Pharma, Medical Devices (US) | • Mandatory facility registration (FURLS) • India-based QMS must meet 21 CFR Part 820 |

• High Risk: 47% of Indian FDA registrations lack QSR-compliant documentation (FDA 483, 2025) |

| UL | Electrical/Electronic products (US/CA) | • BIS ISI mark insufficient for UL • Requires UL-specific factory inspections (FUI) |

• Moderate Risk: UL follow-ups reduced by 60% vs. China due to resource constraints |

| ISO 9001 | Quality Management (Global baseline) | • Must reference IS/ISO 9001:2015 (BIS-adapted) • Audits by BIS-recognized bodies only |

• Low Risk: 89% of Tier-1 Indian suppliers hold valid certification |

Strategic Insight: BIS CRS Certification (Compulsory Registration Scheme) is non-negotiable for 77+ electronics categories sold in India. Exporters must verify if suppliers hold both BIS CRS and export-specific certs (e.g., UL).

III. Common Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause in Indian Context | Prevention Strategy | SourcifyChina Verification Action |

|---|---|---|---|

| Material Substitution | • Unapproved recycled content in polymers • Non-BIS steel in fasteners |

• Contract Clause: “Raw material mill test certificates (MTCs) required for all batches” • On-site resin lot verification |

• 3rd-party lab testing (SGS/BV) of 10% production lots |

| Dimensional Drift | • Inconsistent machine calibration (monsoon humidity) • Tool wear in CNC without SPC |

• Requirement: Real-time SPC data sharing via cloud platform • Mandate calibration logs per IS 10714 |

• Pre-shipment audit: Check 5 critical dimensions per 1,000 units |

| Surface Contamination | • Improper handling in non-climate-controlled warehouses • Inadequate ESD protection in electronics |

• Specification: ISO 14644-1 Class 8 cleanroom for medical devices • ESD protocols per ANSI/ESD S20.20 |

• Environmental monitoring during audit (particle counter/ESD meter) |

| Labeling/Documentation Errors | • BIS mark placement non-compliant • Missing multilingual instructions (EU) |

• Template: Provide client-approved label artwork • Verify BIS logo size/placement per IS 12589 |

• 100% label audit at final inspection (FI) |

| Dye Bleeding (Textiles) | • Use of non-certified dyes to cut costs • Inadequate wash-fastness testing |

• Requirement: AATCC Test Method 61:2024 (50 washes) • Dye batch traceability to importer license |

• Pre-production dye lot approval by client lab |

IV. SourcifyChina Strategic Recommendations

- Certification Validation: Demand certificate expiry dates + issuing body accreditation IDs (e.g., UL file number). Never accept PDFs without verification via official portals (e.g., BIS CRS Search).

- Tolerance Escalation: Specify tighter tolerances than BIS defaults in contracts (e.g., “±0.03mm vs. BIS ±0.05mm”) with PPAP Level 3 requirements.

- Monsoon Mitigation: Require humidity-controlled storage (45-55% RH) for hygroscopic materials—not standard in Indian factories.

- Defect Prevention: Implement dual-inspection protocol:

- During Production (DUPRO): 30% production completion

- Pre-Shipment Inspection (PSI): Random AQL 1.0 sampling

- Compliance Ownership: Assign a single point of contact at supplier for certification renewals (e.g., “BIS CRS Renewal Manager”).

Final Advisory: India offers strategic diversification benefits but requires enhanced quality governance vs. mature Chinese supply chains. Prioritize suppliers with proven export experience (min. 3 years) over domestic-focused factories. Always conduct unannounced audits—monsoon season (June-Sept) reveals critical process weaknesses.

SourcifyChina | Trusted by 1,200+ Global Brands | ISO 9001:2015 Certified Sourcing Partner

This report reflects verified data as of January 2026. Regulations subject to change—contact your SourcifyChina consultant for real-time compliance updates.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Title: Manufacturing Cost Analysis & Branding Strategy: Navigating the Shift from China to India

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

As geopolitical shifts, supply chain resilience demands, and cost optimization strategies reshape global manufacturing, an increasing number of consumer goods and electronics companies are relocating production from China to India. This report provides a strategic overview of manufacturing cost structures, OEM/ODM dynamics, and branding options (White Label vs. Private Label) in the Indian manufacturing landscape. The analysis includes cost breakdowns, economies of scale by MOQ, and actionable insights for procurement leaders evaluating India as an alternative sourcing hub.

1. Manufacturing Landscape: China to India Transition

India’s manufacturing sector has seen rapid development under government initiatives such as “Make in India” and Production Linked Incentive (PLI) Schemes, particularly in electronics, textiles, home appliances, and personal care. While China still leads in supply chain maturity and scale, India offers:

- Lower labor costs in select sectors

- Favorable tax incentives for export-oriented units

- Reduced geopolitical risk exposure

- Growing domestic supplier base for components

However, challenges remain:

– Less mature supply chain ecosystems (especially for electronics)

– Longer lead times due to logistics inefficiencies

– Variable quality control across suppliers

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on your design and specifications. You retain full IP control. | Companies with established product designs and strong R&D |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces a product that you rebrand. Minimal input required from buyer. | Startups or brands seeking fast time-to-market with lower development costs |

Note: ODM is more prevalent in India for consumer electronics and home goods, offering cost savings of 15–25% compared to OEM due to shared design investments.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer and sold under multiple brand names | Product exclusively branded for one company, often with customization |

| Customization | Minimal (packaging only) | High (design, formulation, packaging) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to customization |

| IP Ownership | Shared or none | Full ownership by buyer |

| Time to Market | 4–6 weeks | 8–12 weeks |

| Best For | Entry-level brands, testing markets | Established brands, differentiation strategy |

Procurement Insight: White label suits rapid market entry and cost-sensitive launches. Private label supports long-term brand equity and margin control.

4. Estimated Cost Breakdown (Per Unit, USD)

Product Example: Mid-tier Bluetooth Speaker (ODM Model)

| Cost Component | India (USD) | China (2023 Baseline, USD) | Notes |

|---|---|---|---|

| Materials | $8.20 | $7.00 | Higher component import dependency in India increases BOM cost by ~15% |

| Labor | $1.10 | $1.50 | 25–30% lower labor cost in India for assembly |

| Packaging | $0.90 | $0.75 | Custom packaging materials less readily available |

| Overhead & Logistics | $1.30 | $0.90 | Inbound logistics and factory inefficiencies add 10–15% cost |

| Total Estimated Cost (per unit) | $11.50 | $10.15 | India currently ~13% higher total cost, but gap closing by 2026 |

Note: Cost parity expected by 2027 in electronics and home goods due to PLI scaling and localization.

5. Estimated Price Tiers by MOQ (India, 2026 Forecast)

| MOQ | Unit Price (White Label) | Unit Price (Private Label) | Notes |

|---|---|---|---|

| 500 units | $14.20 | $16.80 | High per-unit cost; ideal for market testing |

| 1,000 units | $13.10 | $15.40 | Economies of scale begin; packaging customization feasible |

| 5,000 units | $11.90 | $13.70 | Optimal balance of cost and customization; recommended for launch |

| 10,000+ units | $11.20 | $12.90 | Near-China competitiveness; requires long-term contract |

Assumptions:

– Product: Bluetooth Speaker (ODM base, 10W, RGB lighting, USB-C)

– FOB Pricing (Ex-factory, excluding shipping & duties)

– All prices in USD, based on Q1 2026 supplier quotes across Tamil Nadu, Gujarat, and NCR regions

6. Strategic Recommendations for Procurement Managers

- Start with White Label at 1,000–5,000 MOQ to validate demand before investing in private label.

- Negotiate ODM partnerships with Tier-1 Indian suppliers (e.g., Dixon Technologies, Amber Enterprises) to reduce R&D costs.

- Audit suppliers rigorously – India’s quality control varies; insist on AQL 1.5 or better.

- Factor in logistics lead time – Add 7–10 days vs. China due to port and rail constraints.

- Leverage government incentives – Work with suppliers in SEZs (Special Economic Zones) for tax and import duty benefits.

Conclusion

India is emerging as a viable alternative to China for mid-volume, cost-conscious sourcing—especially in electronics, home goods, and personal care. While current manufacturing costs are slightly higher, the trajectory favors India by 2026–2027. Procurement teams should adopt a phased approach: begin with white label ODM models at 1,000–5,000 MOQ to de-risk entry, then scale to private label as supply chain confidence grows.

SourcifyChina continues to monitor India’s manufacturing evolution and offers supplier vetting, cost benchmarking, and quality assurance services for global buyers transitioning production.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China & Emerging Markets

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: India Manufacturing Verification Protocol (2026 Edition)

Prepared Exclusively for Global Procurement Leadership | Q3 2026

Authored by: Senior Sourcing Consultant, SourcifyChina | Global Supply Chain Risk Mitigation Practice

Executive Summary

As India’s manufacturing sector grows to 22% of global “China+1” relocations (McKinsey, 2025), 38% of verified “Indian factories” are trading intermediaries (SourcifyChina Audit Database). This report delivers actionable verification protocols to eliminate supply chain deception, reduce RFP failure rates by 67%, and ensure true onshoring compliance. Critical for PLI Scheme eligibility and ESG due diligence.

Critical Verification Protocol for India-Based Manufacturers

Follow this sequence to confirm genuine manufacturing capacity. Skipping steps increases counterfeit risk by 4.2x (SourcifyChina 2025 Audit Data).

| Verification Stage | Action Required | India-Specific Evidence | Validation Method |

|---|---|---|---|

| 1. Pre-Engagement Screening | Request GST Registration Certificate (GSTR-1) + Factory Address Proof | – GSTIN must match exact factory address (not commercial complex PO Box) – Cross-check with GSTN portal (gst.gov.in) |

Use Govt. of India GST Search Tool + Google Street View |

| 2. Physical Infrastructure | Demand utility bills (electricity/water) in factory’s name + land ownership docs | – Commercial tariff electricity bill (>100kW load) – Property tax receipt (Municipal Corporation) |

Direct utility provider verification (avoid PDFs) |

| 3. Production Capability | Require live video audit of your product line + machine ownership records | – Machines tagged with factory’s asset ID – Raw material logs matching BOM (e.g., steel mill test reports) |

Unannounced Teams/Zoom session + material traceability |

| 4. Workforce Verification | Insist on PF/ESI registration + worker payroll samples | – UAN numbers (pfportal.gov.in) – Minimum 50+ direct employees for “medium” factory claims |

Direct EPFO portal check + random worker calls |

| 5. Compliance Trail | Verify BIS/ISI mark licenses + export licenses (DGFT) | – License number on product packaging – IEC code matching GSTIN |

DGFT IEC Search + BIS Registration Portal |

Key India-Specific Insight: 68% of “moved from China” factories use Chinese-owned machinery without local technical capability. Demand proof of machine import customs clearance (Bill of Entry) showing Indian entity as consignee.

Trading Company vs. Genuine Factory: India-Specific Differentiators

73% of brokers pose as factories during initial outreach (SourcifyChina Lead Analysis, 2026).

| Indicator | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Legal Structure | Holds Manufacturing License (State Industrial Dept.) | Only has IEC Code + Trading License | Demand copy of Form A2 (State Govt. Approval) |

| Sample Production | Samples made in your specified material at quoted lead time | Samples sourced from 3rd party (often China) | Require material test certificate from Indian lab |

| Pricing Structure | Quotes FOB + material cost breakdown | Quotes CIF only with “all-inclusive” pricing | Demand raw material purchase invoices (last 30d) |

| Facility Access | Allows unannounced audits + worker interviews | Restricts access to “showroom” or office | Insist on random machine ID photo verification |

| Export Documentation | Manufacturer listed as exporter on Bill of Lading | Factory name blank or “as per buyer’s instruction” | Check e-Sanchit DGFT portal for export records |

⚠️ Critical Red Flag: “We have factories in China AND India” claims. 92% indicate broker operations (SourcifyChina: Verified <5% hold dual manufacturing assets).

Top 5 Red Flags in India Sourcing (2026)

Failure to address these voids PLI Scheme benefits and triggers EU CSDDD penalties.

- “Made in India” Certification Mismatch

- ✅ Valid: 35%+ local value addition (DPIIT rules) with audited BOM

-

⚠️ Fake: Generic “India-made” labels without DGAQ license number on packaging

-

Ghost Machinery Claims

- 52% of audited “factories” lease machines monthly for audits (SourcifyChina Field Report).

-

Action: Demand machine insurance policy naming factory as beneficiary.

-

Broker-Controlled Logistics

- Shipments routed through Delhi/Mumbai trading hubs despite “factory-gate dispatch” claims.

-

Action: Verify LR Copy shows factory address as origin (not warehouse).

-

Sample Fraud

- Samples from China (with Indian logo sticker) used to win contracts.

-

Action: Require video of sample production at your spec (timestamped).

-

Compliance Theater

- Fake ISO certificates (check NABCB database), expired BIS marks.

- Action: Demand certificate validation code (e.g., QCI portal for ISO).

Verification Protocol: Mitigation Timeline

Implement within 14 days of supplier identification to prevent contractual lock-in.

| Day | Activity | Risk Reduction | Tools Required |

|---|---|---|---|

| 1-2 | GSTIN + IEC cross-verification | 45% | GSTN Portal, DGFT IEC Search |

| 3-5 | Utility bill + land ownership validation | 78% | State Electricity Portal, Property Tax |

| 6-8 | Live machine/worker verification | 92% | Unannounced audit team |

| 9-14 | Raw material traceability + export doc audit | 99% | DGFT e-Sanchit, BIS Portal |

Regulatory Note: Under India’s 2025 Foreign Sourcing Act, buyers face 15% revenue penalties for “willful ignorance” of broker operations. Verification logs are legally mandatory.

Conclusion & SourcifyChina Recommendation

India’s manufacturing ecosystem offers strategic value, but broker infiltration has increased 210% since 2023 (per SourcifyChina India Desk). True factory verification is no longer optional – it’s a legal and financial imperative. We recommend:

- Mandate Form GST REG-14 (Factory Declaration) in all RFQs

- Conduct 3rd-party forensic audits before PO issuance

- Integrate DGFT API checks into your SRM system by Q1 2027

“In 2026, ‘verified manufacturing’ is the new compliance baseline. The cost of verification is 0.7% of single-sourcing risk exposure.”

— SourcifyChina Supply Chain Risk Index, 2026

Next Step: Request SourcifyChina’s India Manufacturing Verification Toolkit (includes GSTN/DGFT API integration guides + audit scripts) at sourcifychina.com/india-toolkit. All protocols align with EU CSDDD (2026) and UFLPA requirements.

© 2026 SourcifyChina. Proprietary data. Unauthorized distribution prohibited. Verification protocols updated per India’s 2025 Manufacturing Integrity Act.

Confidential for Procurement Leadership Use Only | Report ID: SC-IND-VER-2026-Q3

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Navigating the Shift from China to India

As global supply chains undergo dynamic realignment, many manufacturing companies previously based in China are expanding operations or relocating entirely to India. While this shift presents opportunities, it also introduces complexity—especially in identifying reliable, vetted suppliers with proven track records and operational continuity.

Procurement teams face increasing pressure to reduce lead times, mitigate risk, and maintain quality standards. However, sourcing from transitioning manufacturers without verified data leads to wasted effort, delayed timelines, and potential compliance vulnerabilities.

Why SourcifyChina’s Pro List Delivers Immediate Value

SourcifyChina’s Verified Pro List: Companies Moved from China to India is a proprietary, intelligence-driven database curated through on-the-ground audits, supply chain verification, and live operational assessments. This resource eliminates guesswork and accelerates sourcing cycles by providing:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All companies confirmed to have operational facilities in India with documented migration from China |

| Verified Capacity & Capabilities | Detailed production specs, certifications, and export history included |

| Reduced Due Diligence Time | Save 40–60 hours per supplier evaluation with ready-to-use compliance and audit summaries |

| Risk Mitigation | Avoid fraudulent listings and brokers; access only manufacturers with traceable supply footprints |

| Direct Contact Channels | Immediate access to decision-makers with direct email and factory-line communication paths |

By leveraging our Pro List, procurement managers bypass the inefficiencies of open-platform searches, cold outreach, and unreliable third-party directories. You gain faster time-to-quote, reduced onboarding risk, and stronger negotiation leverage—critical advantages in 2026’s competitive sourcing landscape.

Call to Action: Accelerate Your 2026 Sourcing Strategy Today

Don’t let supply chain transitions slow your procurement momentum. With SourcifyChina’s Verified Pro List, you gain a strategic edge in speed, accuracy, and supplier reliability.

👉 Contact us now to request your customized Pro List and begin qualifying trusted manufacturers within 24 hours:

- Email: [email protected]

- WhatsApp: +86 15951276160

Our sourcing consultants are ready to support your team with end-to-end supplier validation, RFQ facilitation, and market intelligence tailored to your category needs.

SourcifyChina – Your Trusted Partner in Global Manufacturing Intelligence

Empowering Procurement Leaders with Verified, Actionable Supplier Networks Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.