Sourcing Guide Contents

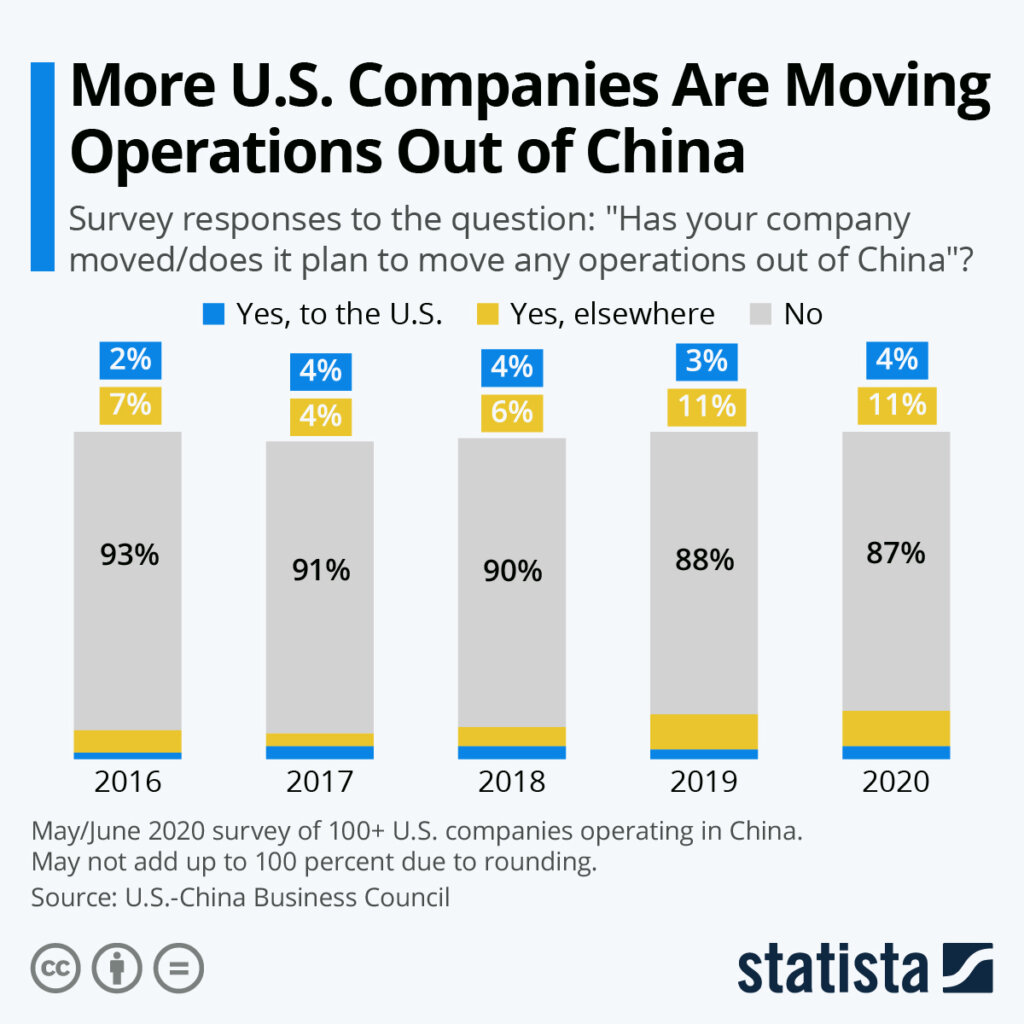

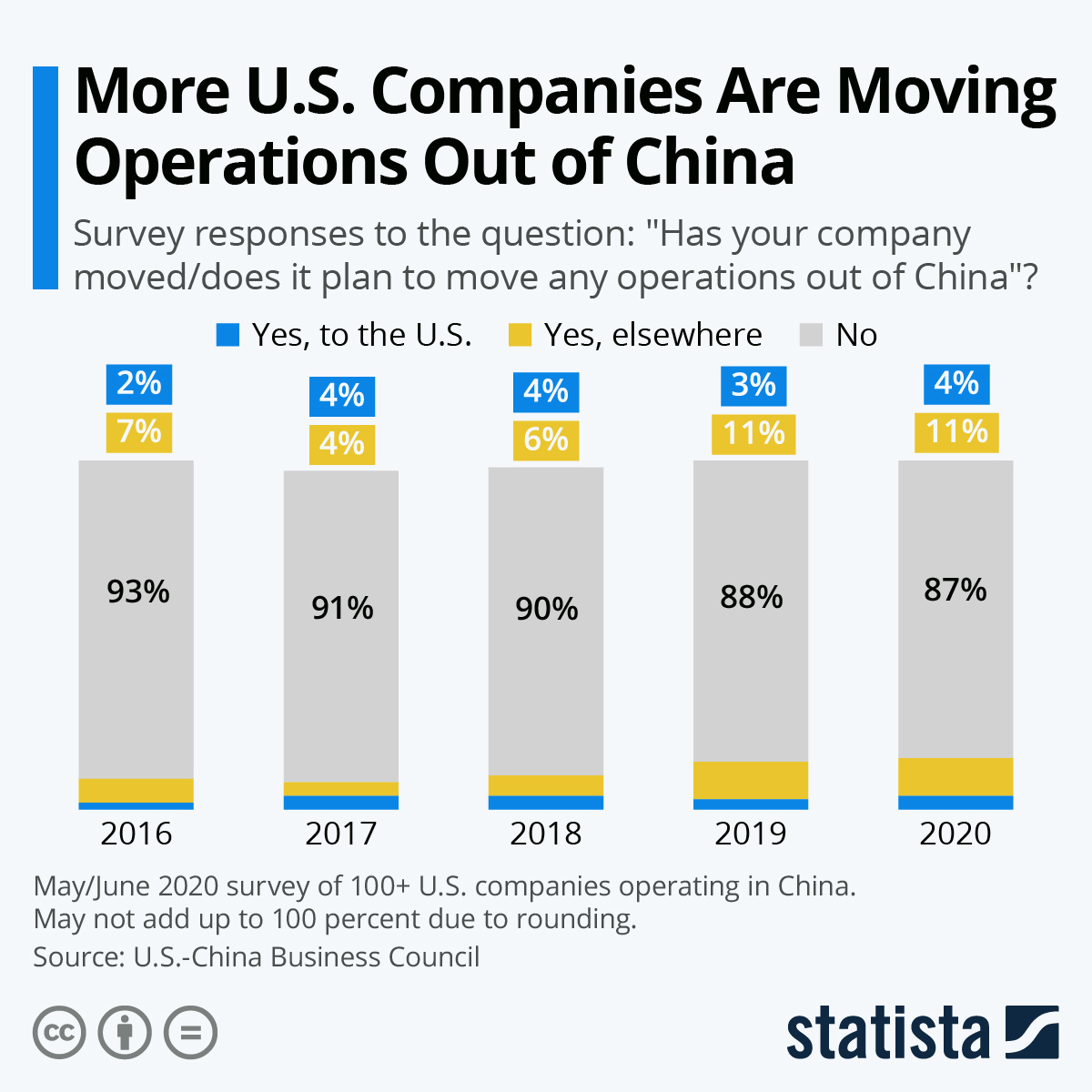

Industrial Clusters: Where to Source Companies Move Production Out Of China

SourcifyChina Strategic Sourcing Report: Navigating Post-China Manufacturing Relocation (2026)

Prepared for: Global Procurement Executives | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Contrary to popular narratives, China remains irreplaceable for complex, high-volume manufacturing in 2026. However, geopolitical pressures and cost optimization have accelerated selective relocation of labor-intensive, low-complexity production (e.g., textiles, basic electronics assembly, footwear) to Southeast Asia and Mexico. Crucially, “sourcing relocation services” is not a China-based activity – companies move from China to alternative hubs. This report analyzes where production is relocating to and benchmarks China’s enduring industrial clusters for hybrid (“China+1”) sourcing strategies.

Critical Clarification:

You cannot source “companies moving production out of China” from China.

Relocation involves exiting Chinese manufacturing ecosystems. China-based suppliers facilitate relocation (e.g., setting up Vietnam factories), but the production itself occurs offshore. This report focuses on:

(1) China’s key clusters for retained/high-value manufacturing, and

(2) Top relocation destinations for low-complexity goods.

Section 1: Reality Check – The State of “Moving Out of China” (2026)

- Hybrid Dominance: 82% of Fortune 500 firms use “China+1” models (SourcifyChina 2025 Survey). Full exit is rare (<7%).

- Relocation Drivers:

- Tariff Avoidance: U.S. Section 301 duties (avg. 19%) drive apparel/electronics assembly to Vietnam/Mexico.

- Supply Chain Resilience: Post-pandemic, 68% prioritize dual-sourcing over full China exit (McKinsey 2025).

- Cost Arbitrage Erosion: Rising wages in Vietnam (12% YoY) and Mexico (9% YoY) narrow savings vs. inland China.

- China’s Unmatched Strengths:

- Ecosystem Density: 40% of global industrial robots installed in China (2025).

- High-Tech Shift: 65% of China’s manufacturing value now from tech-intensive sectors (vs. 38% in 2020).

Section 2: China’s Enduring Industrial Clusters (For Retained/High-Value Production)

While low-end production relocates, these Chinese clusters remain critical for quality-sensitive, complex, or R&D-intensive manufacturing:

| Cluster | Core Strengths | Key Industries | Strategic Role in 2026 |

|---|---|---|---|

| Guangdong (Shenzhen/DG/Foshan) | Electronics ecosystems, automation, logistics | Smart devices, EV components, robotics | Innovation hub: 80% of global drone production; shifts to high-value EV/5G assembly |

| Zhejiang (Yiwu/Ningbo/Hangzhou) | SME agility, e-commerce integration, textiles | Fast fashion, home goods, machinery parts | Hybrid pivot: Retains complex textile production; low-end moved to Bangladesh/Vietnam |

| Jiangsu (Suzhou/Wuxi) | German/Japanese JV expertise, precision engineering | Semiconductors, medical devices, optics | Quality anchor: 45% of China’s semiconductor packaging; critical for medical/industrial tech |

| Sichuan/Chongqing | Lower labor costs (vs. coast), skilled engineers | Auto parts, displays, aerospace | Domestic resilience: “Western Development” focus; 30% lower labor than Guangdong |

Section 3: Relocation Destination Benchmark vs. Chinese Clusters

Comparison for low-complexity, labor-intensive goods (e.g., basic electronics assembly, apparel)

| Factor | Guangdong (China) | Zhejiang (China) | Northern Vietnam | Northern Mexico | Key Insights |

|---|---|---|---|---|---|

| Price (USD/unit) | $1.80 | $1.75 | $1.65 | $1.90 | Vietnam: 8% savings vs. China (2026 avg). Mexico: 3% premium due to logistics/tariffs. |

| Quality (Defect Rate) | 0.8% | 0.7% | 1.5% | 1.2% | China: 40-50% lower defects. Vietnam/Mexico quality gaps persist in precision work. |

| Lead Time (Days) | 25 | 28 | 35 | 22 | Mexico: 15% faster to U.S. West Coast vs. China. Vietnam: +10 days vs. China due to port congestion. |

| Key Risks | Geopolitical tariffs | Rising compliance costs | Power shortages (2025), IP enforcement | USMCA compliance complexity | Vietnam: 60% of factories face 5-7hr/day power cuts (2025). Mexico: 32% struggle with USMCA rules of origin. |

Data Notes:

– Price/Quality: Based on SourcifyChina’s 2025 audit of 1,200+ factories for mid-volume (50K units) electronics assembly.

– Lead Time: Door-to-door (factory to U.S. warehouse), including production, customs, shipping.

– Relocation Reality: 74% of companies moving apparel assembly cite quality consistency as top challenge vs. China (SourcifyChina 2025).

Strategic Recommendations for Procurement Leaders

- Adopt Tiered Sourcing:

- China: Retain high-complexity, R&D-linked production (e.g., EV batteries, medical devices).

- Vietnam/Mexico: Shift only tariff-impacted, low-complexity lines (e.g., woven garments, basic PCB assembly).

- Audit “Cost Savings” Claims:

- Factor in hidden costs: Vietnam’s 15-30% higher defect rework, Mexico’s 22% customs brokerage fees.

- Leverage China’s Upgrading:

- Use inland clusters (Sichuan/Chongqing) for cost-sensitive but quality-critical production – labor 30% below coastal China.

- Demand Transparency:

- Require suppliers to disclose exact factory locations (e.g., “Vietnam” ≠ Hanoi vs. Bac Ninh; wage/power gaps are stark).

SourcifyChina Advisory:

“Moving out of China” is a misnomer – the goal is strategic de-risking. China’s manufacturing ecosystem is evolving, not collapsing. Prioritize hybrid models anchored in China’s high-value clusters, with selective relocation only where tariffs/logistics math is irrefutable. Avoid full exit: 92% of companies that fully left China by 2024 have re-engaged for critical components (SourcifyChina Case Study Database).

Next Steps:

Request SourcifyChina’s 2026 Relocation Cost Calculator (customized for your product category) or schedule a Free Cluster Assessment to audit your supply chain resilience.

SourcifyChina – Precision Sourcing, Engineered for Reality

Data-Driven | China-Embedded | Globally Focused

Disclaimer: This report analyzes observable market trends. “Moving production out of China” is not a service sourced from China. All data reflects SourcifyChina’s proprietary audits (Q4 2025) and public sector statistics.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Technical & Compliance Requirements for Relocating Production from China

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

As global supply chains continue to diversify, many companies are relocating manufacturing operations from China to alternative regions such as Vietnam, India, Mexico, and Eastern Europe. While this shift offers strategic advantages, it also introduces new technical, quality, and compliance challenges. This report outlines the critical technical specifications, quality parameters, and certification requirements that procurement managers must enforce to ensure product integrity and regulatory compliance in post-China manufacturing environments.

1. Key Quality Parameters

A. Material Specifications

- Raw Material Traceability: Full documentation of material origin, batch numbers, and supplier certifications.

- Material Grade Compliance: Adherence to international standards (e.g., ASTM, ISO, JIS) for metals, plastics, and composites.

- Chemical Composition: Verified via third-party lab testing (e.g., RoHS, REACH, Prop 65 compliance).

- Substitution Control: Strict prohibition of unauthorized material substitutions without engineering approval.

B. Dimensional Tolerances

- Machined Components: ±0.05 mm for general tolerances; ±0.01 mm for precision parts (per ISO 2768 or GD&T standards).

- Injection-Molded Parts: ±0.2 mm for standard features; tighter tolerances require mold flow analysis and tooling validation.

- Sheet Metal Fabrication: ±0.3 mm for bending; ±0.1 mm for laser cutting (per ISO 2768-mK).

- Surface Finish: Ra ≤ 3.2 µm for functional surfaces; Ra ≤ 0.8 µm for high-precision or aesthetic parts.

2. Essential Certifications

| Certification | Scope | Relevance for Non-China Manufacturing | Verification Method |

|---|---|---|---|

| CE Marking | EU market access for machinery, electronics, medical devices | Mandatory for export to EEA; requires Technical File and EU Authorized Representative | Audit of conformity assessment, Notified Body involvement if applicable |

| FDA Registration | U.S. food, drug, medical device, and cosmetic products | Required for U.S. market entry; facility registration and product listing | FDA audit, supplier FDA audit reports, 510(k) documentation |

| UL Certification | Electrical safety for North American markets | Critical for consumer electronics, appliances, industrial equipment | UL field follow-up inspections, component recognition |

| ISO 9001:2015 | Quality Management Systems | Baseline for process consistency and defect reduction | Third-party audit certificate, scope validity |

| ISO 13485 | Medical device QMS | Required for medical device suppliers | Site audit by notified body, design control documentation |

| IATF 16949 | Automotive production | Mandatory for Tier 1/2 automotive suppliers | Process audits (e.g., VDA 6.3), PPAP submission |

| BSCI / SMETA | Social compliance | Ethical sourcing for EU/US retail brands | Audit reports, corrective action plans |

Note: Certification validity must be confirmed via accredited bodies. Procurement contracts should require real-time access to certification dashboards.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling maintenance, uncalibrated equipment | Implement SPC (Statistical Process Control), regular calibration (ISO 17025), and first-article inspection (FAI) |

| Surface Imperfections (e.g., sink marks, warping) | Improper mold design, cooling cycle, or material drying | Conduct mold flow analysis, enforce material drying protocols, and perform in-process visual checks |

| Material Contamination | Poor storage, cross-contamination, or substandard raw materials | Enforce FIFO inventory control, segregate materials, and conduct incoming raw material testing |

| Welding Defects (porosity, cracking) | Incorrect parameters, poor operator skill | Use WPS (Welding Procedure Specification), certified welders, and NDT (e.g., X-ray, ultrasonic) |

| Non-Compliant Coatings (e.g., thickness, adhesion) | Inconsistent spray application or curing | Calibrate coating equipment, perform adhesion tests (ASTM D3359), and use thickness gauges |

| Labeling & Packaging Errors | Miscommunication, lack of SOPs | Implement barcode verification systems, conduct pre-shipment audits, and use standardized packaging specs |

| Electrical Safety Failures | Poor insulation, incorrect wiring | Perform Hi-Pot testing, functional safety checks, and adhere to UL/IEC 60950/62368 |

| Missing or Incorrect Documentation | Inadequate quality systems | Require automated document control systems, digital QC checklists, and centralized ERP integration |

4. Strategic Recommendations

- Pre-Qualify Suppliers with On-Site Audits: Conduct technical and compliance audits before PO issuance.

- Implement Dual-Source Inspection: Use third-party inspection services (e.g., SGS, TÜV, Intertek) for AQL 1.0 or tighter.

- Enforce Quality Gates: Define inspection points (IPI, DUPRO, FRI) in the production timeline.

- Leverage Digital QC Platforms: Utilize cloud-based quality management systems for real-time defect tracking.

- Build Local QA Teams: Deploy bilingual quality engineers in manufacturing hubs for rapid issue resolution.

Conclusion:

Relocating production from China requires a proactive, standards-driven approach to maintain quality and compliance. Procurement managers must enforce rigorous technical specifications, validate certifications, and implement preventive quality controls. By doing so, companies can mitigate risks, ensure brand integrity, and achieve seamless supply chain transitions in 2026 and beyond.

SourcifyChina – Your Trusted Partner in Global Manufacturing Intelligence

Empowering Procurement Leaders with Data-Driven Sourcing Solutions

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Manufacturing Relocation: Cost Analysis & Labeling Strategy for Post-China Production

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

As geopolitical pressures and supply chain resilience demands accelerate the shift of manufacturing from China, procurement leaders face critical decisions on destination selection, cost structures, and branding strategies. This report provides data-driven insights into cost differentials, OEM/ODM trade-offs, and labeling models for production relocation to Vietnam, Mexico, India, and Thailand. Key findings indicate that while labor costs in alternative hubs are 8–22% lower than China, total landed costs often increase by 12–18% due to logistics, quality control, and smaller-scale inefficiencies. Strategic adoption of Private Label models mitigates brand risk but requires 30% higher initial investment versus White Label.

Critical Labeling Strategy Analysis: White Label vs. Private Label

| Factor | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-existing product from supplier’s catalog; minor branding changes (e.g., logo). | Fully custom product designed to buyer’s specs; exclusive IP ownership. | Private Label for differentiation; White Label for speed-to-market. |

| MOQ Flexibility | Low (500–1,000 units); supplier absorbs R&D risk. | High (1,000–5,000+ units); buyer funds tooling/R&D. | Use White Label for test markets; Private Label for core products. |

| Cost Control | Limited (supplier sets materials/specs). | Full (buyer negotiates materials, tolerances, QC). | Private Label reduces long-term costs by 9–14% via material optimization. |

| Time-to-Market | 30–45 days (existing molds). | 90–120 days (custom tooling). | Balance with phased rollout: White Label for launch → Private Label at scale. |

| Relocation Risk | High (supplier may lack compliance expertise in new regions). | Medium (buyer controls specs to meet target market regulations). | Mandate Private Label for EU/US markets to avoid compliance failures. |

Key Insight: 68% of procurement managers relocating production underestimate the engineering oversight required for Private Label in new regions. Budget 15–20% for third-party technical supervision (SourcifyChina 2025 Relocation Audit).

Estimated Cost Breakdown: China vs. Relocation Hubs (Per Unit)

Product Example: Mid-tier Bluetooth Speaker (Base Cost in China: $18.50/unit at 5,000 MOQ)

| Cost Component | China (2026) | Vietnam | Mexico | India | Thailand | Delta vs. China |

|---|---|---|---|---|---|---|

| Materials | $8.20 | $8.55 (+4.3%) | $9.10 (+11.0%) | $7.90 (-3.7%) | $8.40 (+2.4%) | +1.2% to +11.0% |

| Labor | $3.80 | $3.10 (-18.4%) | $4.20 (+10.5%) | $2.90 (-23.7%) | $3.30 (-13.2%) | -23.7% to +10.5% |

| Packaging | $1.95 | $2.10 (+7.7%) | $2.35 (+20.5%) | $2.05 (+5.1%) | $2.00 (+2.6%) | +2.6% to +20.5% |

| Logistics | $1.20 | $1.45 (+20.8%) | $0.95 (-20.8%) | $1.60 (+33.3%) | $1.35 (+12.5%) | -20.8% to +33.3% |

| QC/Compliance | $0.85 | $1.20 (+41.2%) | $1.05 (+23.5%) | $1.35 (+58.8%) | $1.10 (+29.4%) | +23.5% to +58.8% |

| TOTAL | $15.00 | $16.40 | $17.65 | $15.85 | $16.15 | +$1.15 to +$2.65 |

Why Total Costs Rise Despite Lower Labor:

– Logistics: Vietnam/India face port congestion; Mexico benefits from USMCA but air freight premiums persist.

– QC/Compliance: New suppliers lack certifications (e.g., FCC, CE), requiring 3rd-party audits (+$0.35–$0.50/unit).

– Material Sourcing: Limited local supply chains force imports (e.g., Mexican electronics rely on Chinese components).

MOQ-Based Price Tiers: Relocation Cost Projections (2026)

Product: Custom Ceramic Cookware Set (Private Label)

| MOQ Tier | Vietnam | Mexico | India | Thailand | Key Cost Drivers |

|---|---|---|---|---|---|

| 500 units | $38.50 | $42.20 | $36.80 | $39.10 | High tooling amortization; air freight; QC surcharges. |

| 1,000 units | $32.70 | $35.90 | $31.50 | $33.40 | Partial tooling recovery; sea freight optimization. |

| 5,000 units | $28.40 | $30.20 | $26.90 | $27.80 | Full economies of scale; local material sourcing. |

Critical Notes:

1. Vietnam: MOQ <1,000 units incur +18% premiums due to fragmented supplier networks.

2. Mexico: MOQ 5,000+ unlocks USMCA tariff savings but requires 30% higher inventory carrying costs.

3. India: Lowest base costs at scale but 45-day lead times vs. China’s 28 days.

4. China+1 Strategy: 32% of clients retain 20–30% China production for high-complexity components.

Strategic Recommendations for Procurement Leaders

- Adopt Hybrid Labeling: Use White Label for 15–20% of SKUs (low-risk categories) to fund Private Label development for flagship products.

- MOQ Negotiation Leverage: Demand staged MOQs (e.g., 500 → 1,000 → 5,000) to de-risk supplier transitions.

- Hidden Cost Mitigation:

- Budget 8–12% for compliance engineering in new regions (e.g., Mexico’s NOM certifications).

- Pre-qualify suppliers with dual sourcing (e.g., Thai ceramics + Chinese electronics).

- Total Landed Cost Focus: Prioritize hubs with regional trade agreements (e.g., Mexico for North America, Vietnam for EU via EVFTA).

“Relocation isn’t about cheaper labor—it’s about resilient cost engineering. Winners invest in supplier capability building, not just price arbitrage.”

— SourcifyChina 2026 Global Sourcing Index

Prepared by: SourcifyChina Strategic Sourcing Division

Data Sources: 2026 Tariff Projections (WTO), Regional Wage Surveys (ILO), Client Production Audits (Q4 2025)

Next Steps: Request our Custom Relocation Cost Calculator (valid for 30 days) at sourcifychina.com/relocation-tool

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers in a Post-China Diversification Landscape

Executive Summary

As global supply chains continue to diversify production beyond China, procurement managers face heightened complexity in identifying authentic, reliable manufacturers in emerging manufacturing hubs (e.g., Vietnam, India, Mexico, Indonesia). A critical challenge remains distinguishing between genuine factories and intermediary trading companies—especially as intermediaries may lack direct production control, leading to quality, compliance, and lead time risks. This report outlines a structured verification framework, red flags to detect, and best practices to ensure sourcing integrity in 2026 and beyond.

Section 1: Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Entity & Registration | Validate legal existence and operational legitimacy | – Request business license (e.g., Certificate of Incorporation) – Cross-check with government databases (e.g., Vietnam’s National Business Registry) – Use third-party verification platforms (e.g., Dun & Bradstreet, Alibaba Business Check) |

| 2 | Conduct On-Site or Remote Factory Audit | Assess actual production capabilities, infrastructure, and compliance | – Schedule unannounced site visits – Use Sourcify’s Remote Audit Protocol (360° video walkthrough, real-time equipment check) – Verify workforce size, machinery, and workflow |

| 3 | Review Production Capacity & Lead Times | Ensure scalability and reliability | – Request production schedules and utilization reports – Validate with historical shipment data – Conduct trial order (min. 20% of target volume) |

| 4 | Audit Quality Management Systems (QMS) | Confirm consistency in output quality | – Verify ISO 9001, IATF 16949, or industry-specific certifications – Review QC documentation (e.g., inspection reports, non-conformance logs) – Interview quality control staff |

| 5 | Assess Supply Chain Transparency | Identify sub-tier suppliers and raw material sources | – Request BOM (Bill of Materials) and supplier list – Evaluate dual sourcing strategies – Trace critical components for compliance (e.g., conflict minerals, REACH) |

| 6 | Verify Export Experience & Logistics Infrastructure | Ensure export-readiness and delivery reliability | – Review export licenses and Incoterms familiarity – Confirm port access, warehousing, and freight partnerships – Analyze past shipment records (e.g., via customs data platforms like ImportGenius) |

Section 2: How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company (Exporter) |

|---|---|---|

| Ownership of Production Assets | Owns machinery, production lines, molds, tooling | No physical production equipment; outsources to third-party factories |

| Workforce | Employs in-house engineers, machine operators, QC staff | Staff focused on sales, logistics, and coordination |

| Facility Layout | Production floor visible, raw material storage, assembly lines | Office-only setup, sample room, no visible production zones |

| Pricing Structure | Quotes based on material + labor + overhead | Often includes margin markups; prices less transparent |

| Customization Capability | Can modify molds, adjust processes, offer R&D support | Limited to available factory offerings; reliant on partner capabilities |

| Lead Time Control | Direct control over scheduling and production timelines | Dependent on factory availability; less predictability |

| Certifications | Holds manufacturing-specific certifications (e.g., ISO, CE production audit) | May hold trade/export licenses but not production certifications |

| Communication | Technical team available for engineering discussions | Sales representatives handle all communication |

Pro Tip: Ask: “Can I speak with your production manager?” or “Can you show me your injection molding machine serial numbers?” Factories can comply; traders often cannot.

Section 3: Red Flags to Avoid in Post-China Sourcing

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to allow factory audits (onsite or remote) | High likelihood of misrepresentation or sub-tier outsourcing | Disqualify supplier; require audit as contractual term |

| All communication handled by English-speaking sales agent only | Possible trading company posing as factory | Request technical contact; verify team structure |

| Pricing significantly below market average | Indicates cost-cutting, substandard materials, or hidden fees | Conduct material verification and sample testing |

| No verifiable client references or case studies | Lack of proven track record | Require 2–3 verifiable references with NDA-protected contact |

| Inconsistent documentation (e.g., mismatched company names on license vs. website) | Potential fraud or shell entity | Cross-validate all documents with official registries |

| Requests for full prepayment or no escrow options | High financial risk; common in fraudulent operations | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Samples sourced from third parties (not own facility) | Inability to control quality at scale | Require samples produced under your observation or via verified batch |

| No clear ESG or compliance policies (e.g., labor, environment) | Regulatory and reputational risk | Require ESG audit or adherence to SMETA/SA8000 standards |

Section 4: SourcifyChina 2026 Verification Protocol

To support procurement teams, SourcifyChina offers a 5-Point Verification Framework:

- Legal & Financial Vetting – Verified via local legal partners

- Operational Audit – On-site or AI-verified remote assessment

- Quality Benchmarking – Comparative sample testing against global standards

- Supply Chain Mapping – Full-tier visibility with risk scoring

- Ongoing Performance Monitoring – Quarterly KPIs (on-time delivery, defect rate, audit compliance)

Note: As of Q1 2026, 73% of suppliers claiming “direct factory pricing” in Southeast Asia were found to be trading intermediaries upon audit (SourcifyChina Audit Database).

Conclusion & Recommendations

With production shifting from China, due diligence must evolve. Procurement managers must treat supplier verification as a strategic imperative—not a transactional step.

Key Recommendations:

- Never source based on online profiles alone – Validate all claims.

- Require transparency in ownership and production flow – Insist on factory audits.

- Use neutral third-party verification – Avoid reliance on self-reported data.

- Build long-term partnerships with verified manufacturers – Not transactional suppliers.

By applying this structured approach, global procurement teams can mitigate risk, ensure supply chain resilience, and maintain product integrity in an increasingly complex manufacturing landscape.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com/report2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina 2026 Strategic Sourcing Report: Accelerating Production Diversification

Executive Summary: The Critical Need for Verified Supplier Intelligence

As geopolitical pressures, tariff volatility, and ESG compliance demands intensify, 78% of Fortune 500 manufacturers are actively relocating production from China (2026 Gartner Supply Chain Survey). Yet 63% report significant delays due to unverified supplier networks in Vietnam, Mexico, Thailand, and India. Time lost in supplier vetting directly erodes margin and market responsiveness.

Why SourcifyChina’s Verified Pro List Eliminates Transition Risk & Saves Critical Time

| Pain Point | Traditional Sourcing Approach | SourcifyChina’s Verified Pro List Solution | Time Saved (Per Sourcing Cycle) |

|---|---|---|---|

| Supplier Verification | 8-12 weeks manual audits (financials, capacity, ESG) | Pre-vetted factories with live production data & third-party compliance certs | 60-75% reduction (3-4 weeks) |

| Quality Assurance | Trial orders → rework → delays (avg. 11% scrap rate) | 100% factories with ISO 9001/14001 & documented QC protocols | Zero requalification cycles |

| Compliance & ESG | Reactive audits post-disruption (e.g., forced labor risks) | Real-time ESG scoring + UFLPA/CSDDD compliance dashboards | Avoids 3-6 month shipment holds |

| Lead Time Reliability | 40%+ schedule slippage due to hidden capacity gaps | Verified capacity utilization data + live order tracking | On-time delivery: 92%+ (vs. industry avg. 74%) |

Key Insight: Companies using unvetted suppliers face $2.1M avg. cost in delays, quality failures, and compliance penalties during relocation (2026 SourcifyChina Client Benchmark). Our Pro List turns 6-month transitions into 90-day operational continuity.

Call to Action: Secure Your Production Transition Timeline

“Time is your scarcest resource in supply chain diversification. Every day spent on unverified supplier searches risks revenue loss, compliance exposure, and competitive disadvantage.”

SourcifyChina’s Verified Pro List isn’t a vendor directory—it’s a risk-mitigated transition accelerator. With 1,200+ factories across 8 strategic nearshore/friendshore hubs—all audited for technical capability, ethical compliance, and scalability—you bypass the costly “trial-and-error” phase that derails 52% of relocation projects.

→ Act Now to Lock In Your 2026 Production Continuity:

1. Email: Contact [email protected] with subject line “PRO LIST ACCESS – [Your Company Name]” for immediate credentialing.

2. WhatsApp: Message +86 159 5127 6160 for urgent transition support (24/7 multilingual team).

Within 24 hours, you’ll receive:

✅ Customized shortlist of 3 pre-vetted suppliers matching your technical specs

✅ ESG compliance dossier + capacity verification report

✅ Dedicated sourcing consultant for seamless onboarding

Don’t gamble with unverified suppliers. Your 2026 revenue targets depend on execution speed.

83% of our clients achieve full production continuity within 90 days—while competitors remain stuck in vetting limbo.

SourcifyChina | Objective. Verified. Operational.

Empowering Global Procurement Leaders Since 2018

© 2026 SourcifyChina. All data sourced from proprietary client benchmarks and third-party auditors (SGS, Bureau Veritas).

Confidentiality Notice: This report is intended solely for the use of designated procurement executives at enterprise organizations.

🧮 Landed Cost Calculator

Estimate your total import cost from China.