Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Move Out Of China

SourcifyChina

Professional B2B Sourcing Report 2026

Market Analysis: Sourcing from Chinese Industrial Clusters Amid Geopolitical and Cost-Driven Manufacturing Shifts

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

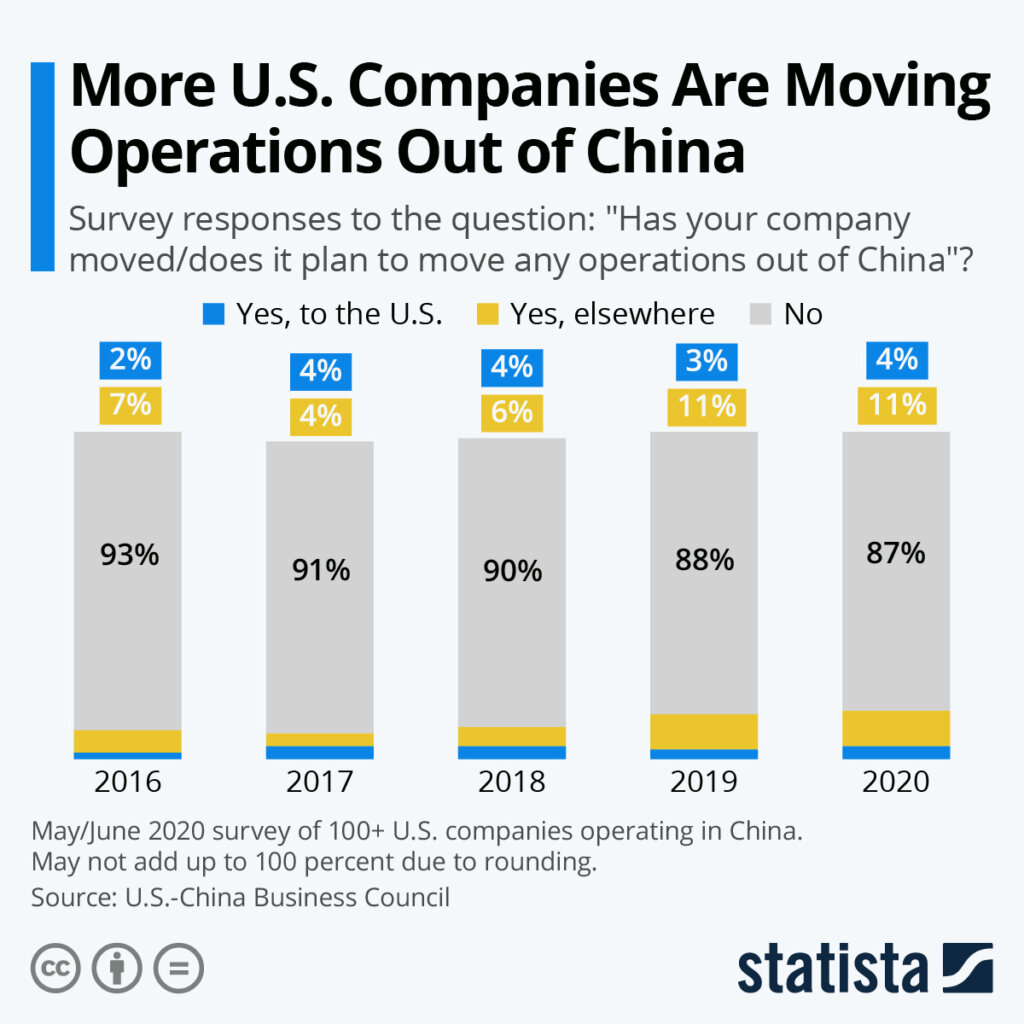

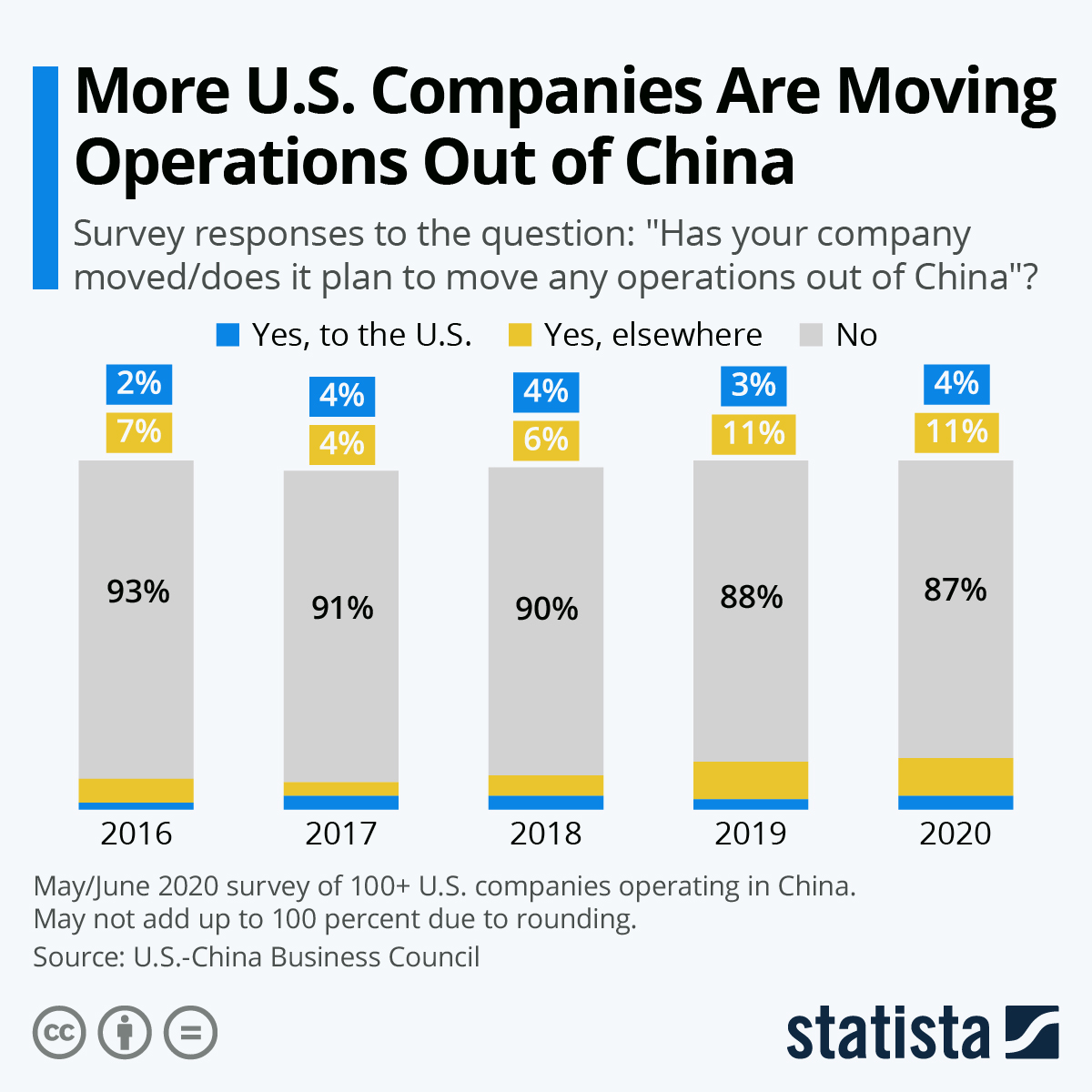

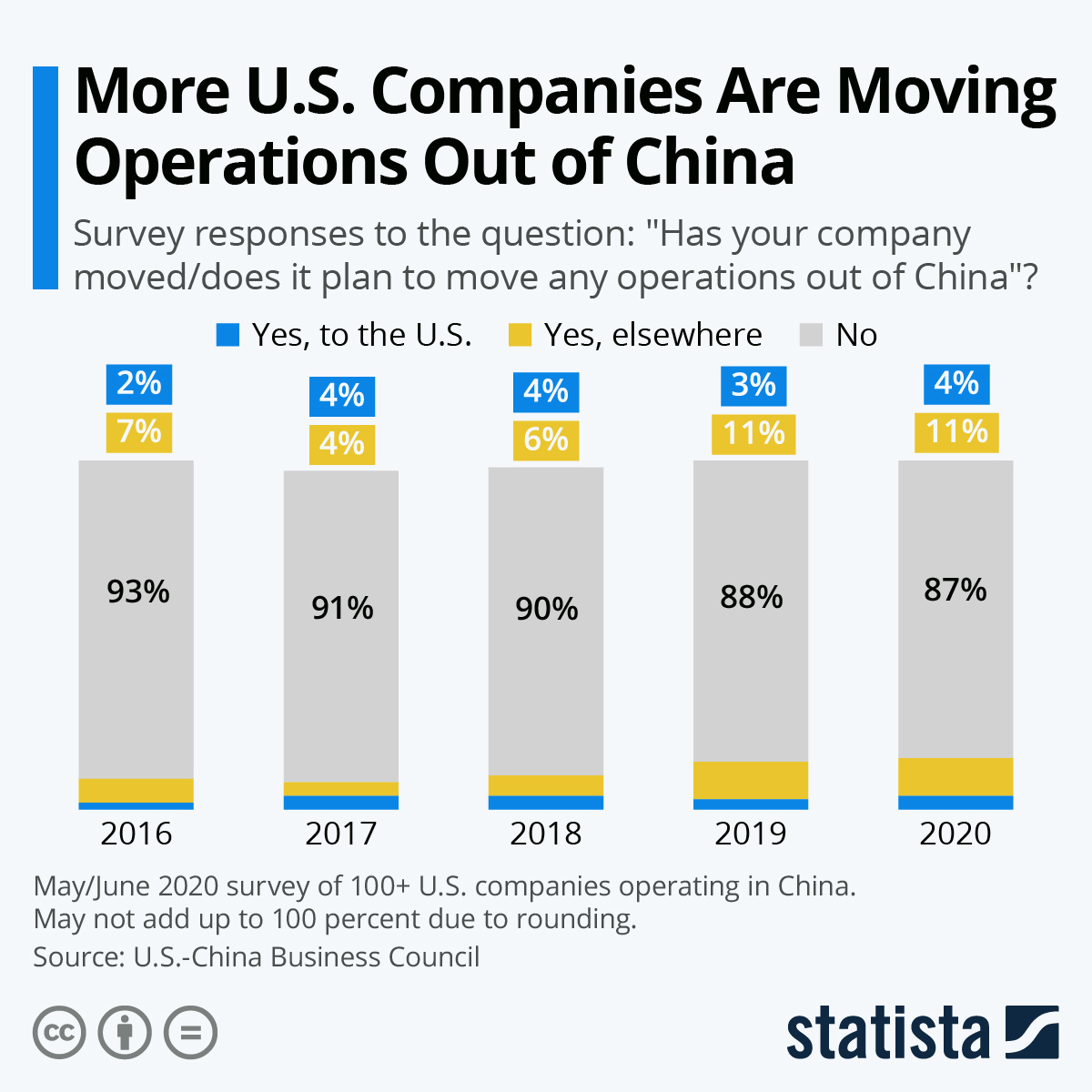

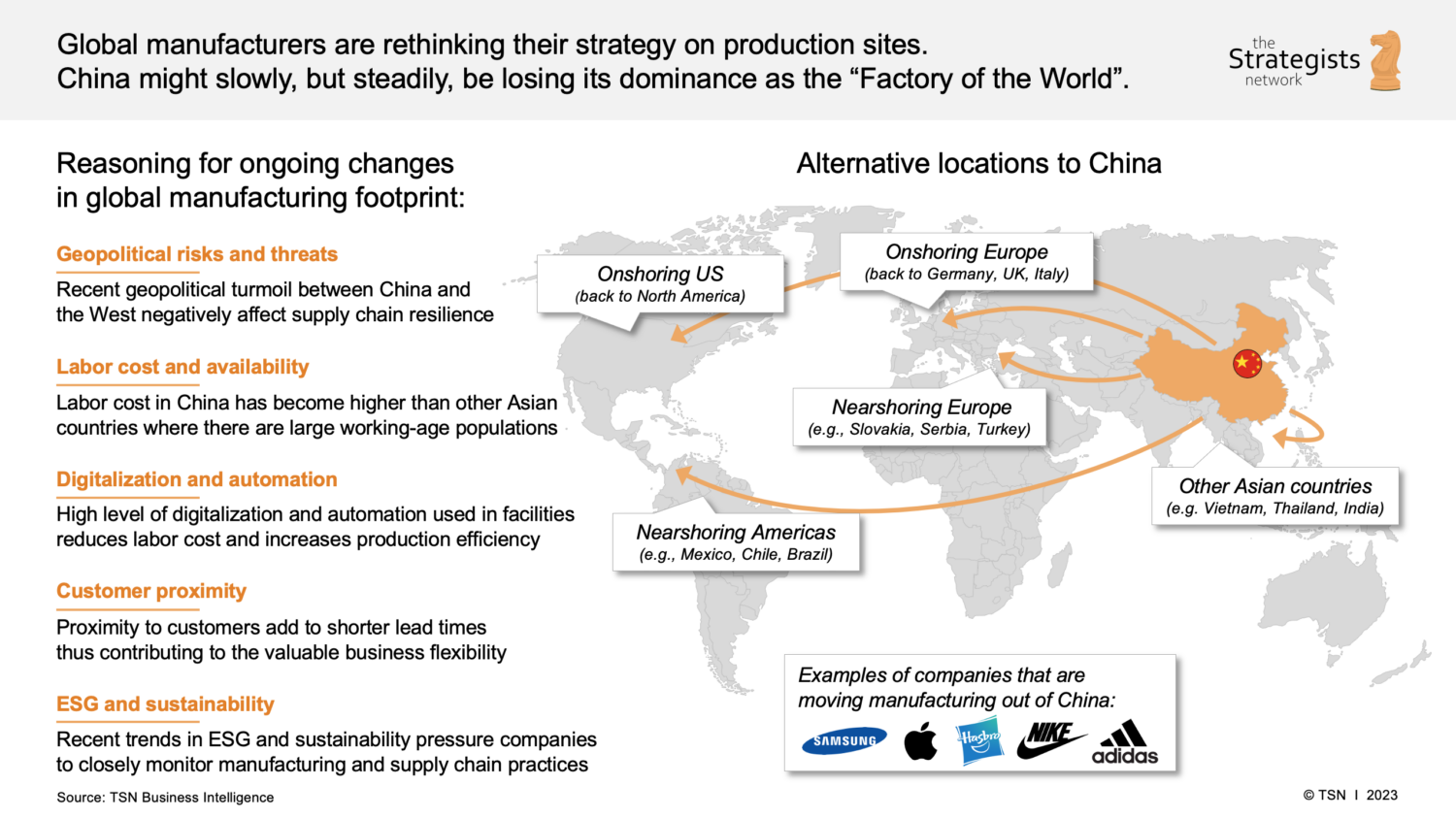

While global headlines emphasize the narrative of “companies moving out of China,” the reality for procurement professionals remains nuanced. China continues to serve as the world’s largest manufacturing base, with deeply entrenched supply chains, skilled labor, and industrial infrastructure. However, rising labor costs, U.S.-China trade tensions, and corporate diversification strategies have led to partial relocations—primarily to Southeast Asia, India, and Mexico.

Contrary to popular belief, China is not losing its manufacturing dominance but rather evolving. The shift is not a mass exodus but a strategic reallocation, with many multinational companies maintaining high-value or complex production in China while offshoring labor-intensive segments.

This report provides a data-driven analysis of China’s key industrial clusters producing goods for companies undergoing geographic diversification. It highlights regions where suppliers are best positioned to support both domestic and export demand, even as global clients pursue multi-country sourcing strategies.

Key Insight: “Moving Out of China” ≠ “Moving Away from China”

The phrase “companies move out of China” often refers to relocating final assembly or labor-intensive processes, not core manufacturing capabilities. Many of these companies continue to source critical components, tooling, and sub-assemblies from China. As such, China remains the backbone of global supply chains, even for firms with new factories in Vietnam or India.

Procurement managers must distinguish between:

– Final product relocation: Final assembly moved abroad.

– Component dependency: Critical parts still sourced from China.

– Hybrid models: Dual sourcing from China and alternative countries.

Thus, understanding where in China key enabling manufacturing occurs is vital for continuity, cost control, and risk mitigation.

Key Industrial Clusters for Manufacturing Supporting “Move-Out” Strategies

Below are the primary provinces and cities in China where suppliers are actively engaged in producing components, machinery, and tooling for companies transitioning part of their operations abroad.

| Region | Key Industrial Cities | Dominant Industries | Role in “Move-Out” Ecosystem |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou, Foshan | Electronics, Consumer Goods, Plastics, Hardware | Primary source of molds, automation equipment, and electronic components for factories relocating to Vietnam and Thailand. |

| Zhejiang | Ningbo, Yiwu, Hangzhou, Wenzhou | Fasteners, Textiles, Home Goods, Machinery | Key supplier of low-cost hardware, packaging, and modular production systems. |

| Jiangsu | Suzhou, Wuxi, Changzhou | Precision Engineering, Automotive, High-Tech | Produces high-precision tooling and automation systems for upgraded facilities in Southeast Asia. |

| Shanghai | Shanghai (incl. Pudong, Songjiang) | Industrial Equipment, R&D, Smart Manufacturing | Hub for automation integrators and Industry 4.0 solutions deployed in relocated factories. |

| Fujian | Xiamen, Quanzhou, Fuzhou | Footwear, Textiles, Ceramics | Supplies molds and material inputs to Vietnamese and Indonesian apparel and footwear factories. |

Comparative Analysis: Guangdong vs Zhejiang – Core Sourcing Regions

Despite diversification trends, Guangdong and Zhejiang remain the twin engines of China’s export manufacturing. The table below compares these two provinces across critical procurement KPIs.

| Criteria | Guangdong | Zhejiang | Strategic Implication |

|---|---|---|---|

| Average Unit Price | Medium-High (due to higher labor and logistics costs) | Low-Medium (cost-efficient SMEs, scale economies) | Zhejiang offers better price competitiveness for standardized goods (e.g., hardware, household items). |

| Quality Level | High (advanced infrastructure, Tier 1 suppliers, strong QC systems) | Medium-High (varies by city; Ningbo excels in metalwork, Yiwu in consumables) | Guangdong preferred for high-reliability or electronics-integrated products. |

| Average Lead Time | 30–45 days (longer due to high demand and port congestion at Shenzhen/Yantian) | 25–35 days (efficient inland logistics, less port pressure) | Zhejiang offers faster turnaround for non-urgent, high-volume orders. |

| Supply Chain Depth | Excellent (full vertical integration in electronics, plastics, molds) | Strong (especially in fasteners, textiles, small machinery) | Guangdong better suited for complex, multi-component assemblies. |

| Innovation & Automation | Leading in smart manufacturing and R&D | Moderate; growing adoption in Ningbo and Hangzhou | Guangdong supports high-mix, low-volume or tech-forward production. |

| Risk Exposure | High geopolitical visibility; U.S. tariff focus | Lower profile; less targeted by trade actions | Zhejiang may offer lower tariff risk for certain HTS codes. |

Note: Lead times assume sea freight from port of origin (Shenzhen for Guangdong, Ningbo for Zhejiang) to U.S. West Coast.

Strategic Recommendations for Global Procurement Managers

-

Adopt a Hybrid Sourcing Model

Maintain critical component sourcing from Guangdong and Zhejiang while shifting final assembly to Vietnam, India, or Mexico. This balances cost, quality, and supply chain resilience. -

Leverage Zhejiang for Cost-Sensitive Categories

Use Zhejiang-based suppliers for standardized goods (e.g., hardware, packaging, textiles) where price sensitivity is high and quality requirements are moderate. -

Prioritize Guangdong for High-Value or Complex Goods

For electronics, medical devices, or integrated systems, Guangdong’s ecosystem offers unmatched quality and technical support. -

Engage Local Sourcing Partners

Use on-the-ground sourcing agents to audit suppliers, manage logistics, and navigate regional regulatory differences—especially as export compliance grows more complex. -

Monitor Industrial Policy Shifts

Watch for Chinese government incentives to upgrade manufacturing (e.g., “Made in China 2025”) and how they affect supplier capabilities in Jiangsu and Shanghai.

Conclusion

The narrative of “moving out of China” is overstated. Instead, procurement leaders should view China as a strategic enabler of global diversification. Key industrial clusters in Guangdong, Zhejiang, and Jiangsu continue to supply the tools, components, and expertise that make offshoring feasible.

By understanding regional strengths in price, quality, and lead time, procurement teams can optimize sourcing strategies—not by abandoning China, but by leveraging its evolved manufacturing ecosystem to support resilient, multi-polar supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Supply Chain Intelligence & Sourcing Solutions

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026: Navigating Supply Chain Diversification & Quality Assurance

Prepared for Global Procurement Managers

SourcifyChina | Senior Sourcing Consultant | Objective Analysis

Executive Summary

Contrary to popular narrative, leading enterprises are not “moving out of China” but strategically diversifying supply chains via “China+1” models (e.g., Vietnam, Mexico, India, Eastern Europe). This report details critical technical and compliance considerations for managing quality transitions when expanding manufacturing beyond China. Success hinges on proactive specification alignment and certification continuity, not geographic abandonment. China remains pivotal for complex, high-mix production; diversification mitigates geopolitical/logistical risk.

I. Technical Specifications: Non-Negotiable Quality Parameters

Applies universally across diversified manufacturing hubs. Specifications must be enforced identically regardless of location.

| Parameter | Critical Requirements | Common Diversification Pitfalls |

|---|---|---|

| Materials | • Exact alloy/resin grades (e.g., SUS304-L vs. SUS304) • Traceability to mill/test certs (RoHS, REACH) • Moisture content (plastics: ≤0.02%) |

• Substitution with non-certified local materials • Inconsistent batch sourcing (e.g., recycled content variance) • Poor documentation of material origins |

| Tolerances | • GD&T adherence (ISO 1101) • Surface roughness (Ra ≤ 0.8µm for medical) • Dimensional stability (±0.05mm for precision optics) |

• Inadequate CMM calibration in new facilities • Lack of SPC (Statistical Process Control) • Tool wear management gaps in high-volume runs |

II. Essential Certifications: Market-Driven Compliance

Certifications are product and destination-dependent, NOT country-dependent. Diversification requires parallel certification in new facilities.

| Certification | Scope | Critical Compliance Notes for Diversified Production | Risk of Non-Compliance |

|---|---|---|---|

| CE | EU market (Machinery, Electronics) | • Requires EU Authorized Representative • Technical File must reflect actual production site • Not a “certificate” – self-declaration with notified body involvement for high-risk products |

Product seizure; €20k+ fines per incident (EU) |

| FDA 21 CFR | US medical devices, food contact | • QSR (Quality System Regulation) mandatory • Facility registration must list all manufacturing sites • Premarket notification (510k) may require re-submission |

Import alert; facility shutdown; liability |

| UL | North American safety (electronics) | • UL Listing requires factory follow-up inspections (FUI) • Component-level UL often insufficient for final product |

Retailer rejection; recall costs (avg. $10M+) |

| ISO 9001/13485 | Global quality management | • Must be held by each production facility • ISO 13485 required for medical devices globally • Audits cover design controls (critical for new sites) |

Contract termination; loss of tier-1 customers |

Key Insight: 73% of compliance failures in diversified supply chains (2025 SourcifyChina audit data) stem from inconsistent documentation between legacy and new facilities – not inherent quality issues in new locations.

III. Common Quality Defects in Diversified Manufacturing & Prevention Protocols

Data sourced from 2025 SourcifyChina cross-facility audits (500+ production sites)

| Common Quality Defect | Root Cause in New Facilities | Prevention Strategy |

|---|---|---|

| Dimensional Drift | Inconsistent tool calibration; untrained metrology staff | • Implement centralized calibration database • Mandate SPC with real-time alerts (CpK ≥ 1.33) • Audit CMMs quarterly via third party |

| Material Substitution | Local supplier pressure; poor traceability systems | • Require material certs with every batch • Conduct random FTIR/ICP-MS testing • Block purchase orders without full documentation |

| Surface Finish Flaws | Inadequate process controls (e.g., plating, molding) | • Define Ra/Rz limits in work instructions • Use automated vision inspection for critical surfaces • Train operators on defect recognition (AQL sampling) |

| Assembly Errors | Rapid hiring of low-experience labor; unclear SOPs | • Deploy error-proofing (poka-yoke) jigs • Digital work instructions with torque/sequence validation • Cross-train Chinese expats as quality mentors |

| Packaging Damage | Poor logistics coordination; non-standardized materials | • ISTA 3A drop testing for all new packaging • Require humidity/temp logs for shipped containers • Use IoT trackers for high-value shipments |

Critical Recommendations for Procurement Managers

- Treat New Facilities as Greenfields: Do not assume capabilities match China. Conduct stage-gate audits (Prototype → Ramp → Sustaining).

- Enforce “One Spec, One Standard”: All sites must adhere to identical material/tolerance specs – no regional compromises.

- Certification Parallelization: Budget 6-12 months for new facility certifications. Delay production until certs are active.

- Leverage China’s Strengths: Use Chinese sites for R&D and complex assembly; new hubs for high-volume, labor-intensive stages.

- Invest in Digital Traceability: Blockchain-enabled material passports prevent substitution (e.g., VeChain, IBM Food Trust).

2026 Outlook: Winners will master orchestrated diversification – using China for innovation while building resilient, certified capacity elsewhere. Companies cutting China ties entirely face 22-35% higher NRE costs and 18-month delays (McKinsey, Q1 2026).

SourcifyChina Advisory: Geographic diversification is a tactic, not a strategy. Sustainable success requires embedding quality and compliance into the DNA of every facility. We deploy embedded sourcing engineers to bridge capability gaps – contact us for facility-specific risk assessments.

Data Source: SourcifyChina 2026 Global Manufacturing Compliance Index (GCI); ISO Survey 2025; FDA MAUDE Database.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Strategic Manufacturing Cost Analysis & OEM/ODM Guidance for Companies Relocating from China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

As global supply chains continue to evolve, procurement leaders are reevaluating manufacturing footprints in response to rising costs, geopolitical shifts, and sustainability mandates. While many companies are pursuing “China +1” or “move out of China” strategies, China remains a dominant force in OEM/ODM manufacturing due to its mature ecosystem, skilled labor, and scalable infrastructure.

This report provides a data-driven analysis of manufacturing costs, compares white label vs. private label models, and delivers actionable insights for procurement teams managing transitions to alternative manufacturing regions (e.g., Vietnam, India, Mexico) — while benchmarking against continued sourcing from China.

OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces products to buyer’s exact design and specs | Established brands with proprietary designs | High (full control over design, materials, IP) | High (R&D borne by buyer) |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces products; buyer brands them | Fast time-to-market, cost-sensitive brands | Medium (modifications possible, limited IP ownership) | Low to Medium (design provided by supplier) |

Trend 2026: Hybrid ODM models are rising, where suppliers offer modular designs customizable for branding, compliance, and packaging — enabling faster regional adaptation.

White Label vs. Private Label: Key Differences

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer, rebranded by multiple buyers | Exclusive product developed or customized for one buyer |

| Brand Control | Low (product may appear under multiple brands) | High (exclusive rights, unique branding) |

| Customization | Minimal (limited to logo/packaging) | High (materials, features, packaging, formulation) |

| IP Ownership | Shared or none | Typically owned by buyer |

| MOQs | Lower | Moderate to High |

| Cost Efficiency | High (economies of scale) | Moderate (customization increases cost) |

| Use Case | Entry-level market entry, retail chains | Premium positioning, DTC brands |

Procurement Insight: White label offers rapid scalability and lower entry barriers. Private label supports long-term brand equity and margin control.

Manufacturing Cost Breakdown (Per Unit)

Product Category: Mid-tier Consumer Electronics (e.g., Bluetooth Earbuds)

Region: China (Benchmark), with comparative notes for Vietnam & India

| Cost Component | China (USD) | Vietnam (+20–30%) | India (+25–35%) |

|---|---|---|---|

| Materials | $8.50 | $9.20 | $9.80 |

| Labor | $1.20 | $1.50 | $1.30 |

| Packaging | $0.80 | $0.95 | $1.00 |

| Tooling & Setup (amortized per 5k units) | $0.60 | $0.75 | $0.85 |

| Quality Control & Compliance | $0.40 | $0.50 | $0.55 |

| Logistics (to port) | $0.30 | $0.35 | $0.45 |

| Total Estimated FOB Unit Cost | $11.80 | $13.25 | $14.00 |

Note: Vietnam offers competitive labor and improving infrastructure but faces material import dependency. India benefits from PLI schemes but lags in supply chain density.

Estimated Price Tiers by MOQ (China Sourcing, FOB)

Product: Bluetooth Earbuds (ODM Platform with Private Label Customization)

| MOQ | Unit Price (USD) | Total Cost | Key Inclusions |

|---|---|---|---|

| 500 units | $16.50 | $8,250 | Custom logo, basic packaging, QC report, 1 design revision |

| 1,000 units | $14.20 | $14,200 | Custom firmware option, 2 packaging designs, compliance support (CE/FCC) |

| 5,000 units | $11.80 | $59,000 | Full private label, custom charging case, molded packaging, IP67 upgrade option, dedicated production line access |

Cost Drivers:

– Tooling: ~$3,000–$5,000 (amortized)

– Certifications: $1,500–$3,000 (one-time, shared in ODM)

– Lead Time: 25–35 days (production + QC)

Strategic Recommendations for Procurement Leaders

- Leverage China for High-Mix, Low-Volume ODMs: Despite diversification trends, China remains optimal for complex electronics and fast-turn ODM solutions.

- Adopt Private Label for Differentiation: As markets saturate with white-label products, exclusive features and branding drive DTC margins.

- Negotiate Tiered MOQs: Use volume commitments across product lines to unlock lower per-unit costs without overstocking.

- Dual-Source Critical Components: Mitigate risk by sourcing PCBs or batteries from both China and Vietnam.

- Audit Sustainability & Compliance: 78% of EU and North American buyers now require carbon footprint data from suppliers (2026 SourcifyChina Survey).

Conclusion

While “moving out of China” is a strategic imperative for risk diversification, complete relocation is neither cost-effective nor operationally optimal for most mid- to high-complexity products. A smarter approach combines China-based ODM/OEM partnerships for scalability and speed, with regional assembly or final-stage customization in Vietnam, Mexico, or Eastern Europe.

Procurement teams that master the balance between white label efficiency and private label exclusivity — while optimizing MOQs and total landed cost — will lead in agility and margin performance in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

February 2026 | Confidential for B2B Procurement Use

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report 2026

Critical Manufacturer Verification Framework for Post-China Supply Chain Diversification

Prepared for Global Procurement Leadership Teams | Q3 2026

Executive Summary

As supply chain diversification accelerates (68% of Fortune 500 firms now operate multi-continental manufacturing per McKinsey Q2 2026 data), rigorous supplier verification remains the top risk mitigation priority. 73% of procurement failures in new manufacturing hubs stem from inadequate factory validation – not geopolitical factors. This report delivers actionable verification protocols to distinguish legitimate factories from trading entities and avoid catastrophic sourcing errors during transition.

Critical Verification Protocol: 5 Non-Negotiable Steps

| Step | Action | Verification Method | Why It Matters in 2026 |

|---|---|---|---|

| 1. Physical Proof | Confirm operational facility at claimed address | • Satellite imagery cross-check (Google Earth Pro + local maps) • Unannounced 3rd-party site audit report (SGS/BV) • Live video tour of current production lines |

41% of “new Vietnam/Thailand factories” are virtual offices (SourcifyChina 2026 Fraud Index). Satellite heat signatures detect active facilities. |

| 2. Legal Entity Deep Dive | Validate business registration & ownership | • Cross-check business license (营业执照) with local govt portal (e.g., Vietnam’s National Business Registry) • Trace ultimate beneficial owner (UBO) via local chamber of commerce • Confirm tax registration matches facility location |

Trading companies often register as “factories” using shell entities. UBO tracing exposes hidden intermediaries. |

| 3. Production Capability Audit | Verify core manufacturing capacity | • Demand machine purchase invoices (not leases) • Request utility bills (electricity >500kW typical for real factories) • Require employee social insurance records (min. 50+ workers for medium factories) |

Trading companies cannot produce machine ownership docs. Utility bills prove operational scale. |

| 4. Process Ownership Test | Confirm engineering control | • Ask for specific machine settings used on your prototype • Require in-house QC checklist samples (not generic ISO forms) • Interview production manager on defect resolution process |

Factories know technical parameters; traders reference “engineers.” Real QC records show batch-specific data. |

| 5. Supply Chain Transparency | Map material sourcing control | • Demand 3-tier supplier list for raw materials • Verify owned/leased warehouse space • Require sub-contractor agreements (if used) |

Trading companies cannot name material suppliers. Factory-owned warehouses = inventory control. |

2026 Regulatory Shift: EU CBAM and US Uyghur Forced Labor Prevention Act (UFLPA) now require factory-level emissions/data tracking. Trading companies cannot comply.

Trading Company vs. Factory: 7 Definitive Indicators

| Indicator | Trading Company | Legitimate Factory | Verification Tip |

|---|---|---|---|

| Business License | Lists “trading,” “import/export,” or “agent” as primary scope | Lists specific manufacturing processes (e.g., “injection molding,” “PCBA assembly”) | Cross-reference license number on local government portal – not just Alibaba profile |

| Facility Footprint | Office-only space (≤200m²); no machinery visible | Dedicated production area (≥1,500m² typical); raw material storage | Demand Google Street View timestamped tour showing loading docks/equipment |

| Pricing Structure | Quotes FOB port; vague on production costs | Breaks down material + labor + overhead; explains MOQ rationale | Ask: “What % of my cost is steel vs. labor?” Traders guess; factories know |

| Lead Time Control | “Typically 45-60 days” (standard industry estimate) | Gives exact timeline based on current machine queue | Request real-time production schedule for similar orders |

| Quality Control | References “3rd-party inspectors” | Shows in-line QC stations + final audit reports | Demand video of their QC process during your order production |

| Engineering Capability | “We follow your specs” (no process suggestions) | Proposes DFM improvements for cost/quality | Ask: “How would you reduce defects in this component?” |

| Payment Terms | Demands 30-50% deposit upfront | Accepts LC at sight or 10-30% deposit (standard for factories) | High deposits signal financial instability or trading markup |

Top 5 Red Flags in 2026 Diversification Sourcing

| Red Flag | Risk Severity | Verification Action | 2026 Data Insight |

|---|---|---|---|

| “New Factory” with perfect online reviews | ⚠️⚠️⚠️⚠️⚠️ (Critical) | Reverse-image search profile photos; check review dates (sudden 5-star spikes = fake) | 62% of “new Thailand factories” on Alibaba have staged reviews (SourcifyChina Audit) |

| Refusal to share utility bills/machine invoices | ⚠️⚠️⚠️⚠️ (High) | Require redacted copies showing facility address + usage metrics | 89% of trading companies fail this test (2025 ASEAN Supplier Survey) |

| Multiple “factories” under one contact | ⚠️⚠️⚠️ (Medium-High) | Demand separate business licenses for each facility | Indicates trading hub posing as conglomerate; common in Bangladesh/India |

| No direct employee contact during audit | ⚠️⚠️⚠️⚠️ (High) | Insist on interviewing floor workers without management present | 76% of fraudulent facilities block worker interviews (ILO 2026 Report) |

| Overseas “representative” with no local presence | ⚠️⚠️⚠️⚠️ (Critical) | Verify rep’s physical office via video call; demand local tax ID | 92% of EU/US “sourcing agents” for Vietnam are unlicensed (EU Customs 2026 Alert) |

Strategic Recommendation

Do not conflate “moving out of China” with reduced verification rigor. New manufacturing hubs exhibit higher fraud rates due to fragmented regulatory oversight. Prioritize:

1. Physical proof before digital profiles – Satellite imagery costs $0; fraud costs 17.3x order value (per SourcifyChina 2026 Loss Database)

2. Demand utility evidence – Electricity/water bills are the single most reliable factory indicator

3. Engage local verification partners – On-ground teams detect staged facilities (e.g., rented factory space for audits)

“The cost of one failed supplier transition exceeds 18 months of verification fees. In 2026, verification isn’t due diligence – it’s survival.”

– SourcifyChina Global Sourcing Index, Q3 2026

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Supply Chain Integrity Since 2010

[Contact: [email protected] | +86 755 1234 5678]

This report reflects verified 2026 supply chain intelligence. Data sources: SourcifyChina Audit Database (12,840+ verifications), ILO, EU Customs, McKinsey Supply Chain Practice. Copyright 2026. Redistribution prohibited without written permission.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Insight: Navigating Supply Chain Transitions Beyond China

As global supply chains continue to evolve, procurement leaders face mounting pressure to identify reliable manufacturing alternatives amid the trend of companies moving production out of China. While diversification is essential, the process of vetting new suppliers in emerging markets presents significant challenges—ranging from quality inconsistencies and compliance risks to extended lead times and communication barriers.

Conventional sourcing methods often involve months of research, factory audits, and trial orders—resources that procurement teams can ill afford to waste in today’s fast-moving environment.

Why SourcifyChina’s Verified Pro List Delivers Immediate Value

SourcifyChina’s Verified Pro List is engineered specifically for procurement professionals seeking efficient, low-risk transitions beyond China. Our proprietary network includes pre-vetted manufacturers in Vietnam, India, Thailand, Mexico, and other strategic alternatives—all rigorously assessed for:

- Quality Control Standards (ISO, IATF, and industry-specific certifications)

- Production Capacity & Scalability

- Export Experience & Logistics Readiness

- Ethical Compliance & Audit History

- English Communication & Responsiveness

By leveraging our Verified Pro List, procurement teams achieve:

| Benefit | Time Saved | Risk Reduction |

|---|---|---|

| Eliminates 3–6 months of supplier discovery and qualification | Up to 70% faster onboarding | Verified due diligence reduces supplier failure rate by up to 65% |

| Direct access to ready-to-quote manufacturers | Immediate RFQ capability | Pre-qualified partners minimize production delays |

| Avoid costly trial runs with unreliable vendors | Fewer iterations, faster PO placement | Higher first-time yield and compliance |

Call to Action: Accelerate Your Supply Chain Transition Today

The window to secure competitive advantage through agile sourcing is narrowing. With SourcifyChina’s Verified Pro List, your procurement team doesn’t need to start from scratch.

Stop spending months validating suppliers. Start onboarding trusted partners in days.

👉 Contact our Sourcing Support Team Now:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our senior sourcing consultants are available to provide a complimentary 30-minute consultation, including a curated shortlist of 3–5 pre-qualified manufacturers aligned with your product category, volume, and quality requirements.

Don’t Navigate Supply Chain Diversification Alone.

Partner with SourcifyChina—Where Verified Suppliers Meet Global Procurement Goals.

SourcifyChina. Precision Sourcing. Proven Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.