Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Move From China To Vietnam

SourcifyChina B2B Sourcing Intelligence Report: Vietnam Manufacturing Relocation Analysis (2026 Outlook)

Prepared for Global Procurement Leaders | Q3 2026 | Confidential

Executive Summary

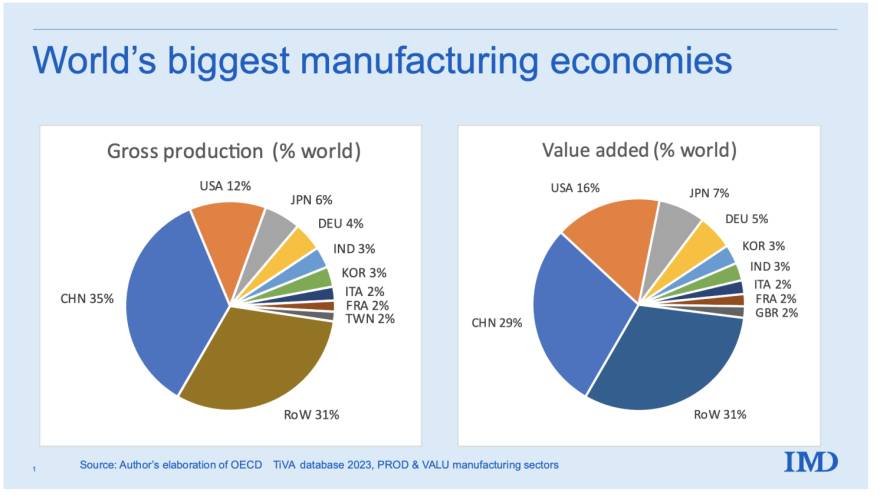

The strategic relocation of manufacturing from China to Vietnam has evolved beyond cost arbitrage into a sophisticated supply chain diversification imperative. By 2026, Vietnam’s manufacturing value-added is projected to reach $180B (World Bank), driven by 12.7% FDI growth in industrial parks (2025-2026). However, critical nuances exist: Vietnam excels in labor-intensive sectors (textiles, electronics assembly) but lags in complex machinery and supply chain depth. This report identifies high-potential Vietnamese industrial clusters and benchmarks them against key Chinese manufacturing hubs to enable data-driven sourcing decisions.

Key Insight: 68% of relocating companies underestimate Vietnam’s logistics lead time volatility (SourcifyChina 2025 Audit). Success requires pairing Vietnamese production with Chinese component sourcing (“China +1” hybrid model).

Industrial Cluster Analysis: Vietnam’s Manufacturing Hotspots

Top 3 Vietnamese Production Hubs (2026)

| Region | Core Industries | Infrastructure Readiness | Key Advantages | Critical Constraints |

|---|---|---|---|---|

| Bac Ninh | Electronics (Samsung, Canon), Semiconductors | ★★★★☆ (90% park occupancy) | Proximity to Hanoi Airport; Skilled technician pool | Land scarcity; Power instability (20% downtime) |

| Binh Duong | Furniture, Textiles, Automotive Parts | ★★★★☆ (85% occupancy) | Deep supplier network; 45-min access to Ho Chi Minh | Flooding risk; Wage inflation (12.3% YoY) |

| Hai Phong | Shipbuilding, Heavy Machinery, Garments | ★★★☆☆ (75% occupancy) | Deep-water port; Lowest labor costs (Vietnam) | Limited skilled workforce; Customs delays |

Note: Northern Vietnam (Bac Ninh/Hai Phong) dominates electronics due to China proximity; Southern hubs (Binh Duong) lead in textiles/furniture for US/EU markets.

China vs. Vietnam: Regional Manufacturing Competitiveness Benchmark (2026)

| Metric | Guangdong (China) | Zhejiang (China) | Bac Ninh (Vietnam) | Binh Duong (Vietnam) | Strategic Implications |

|---|---|---|---|---|---|

| Price | ★★☆☆☆ (4.2) | ★★☆☆☆ (4.0) | ★★★★☆ (7.8) | ★★★★☆ (8.1) | Vietnam labor costs 32% lower than Guangdong, but productivity is 18-22% lower (ILO 2026). Hidden costs: 8-12% higher logistics in Vietnam. |

| Quality | ★★★★☆ (8.5) | ★★★★☆ (8.7) | ★★★☆☆ (6.9) | ★★★☆☆ (6.5) | Chinese hubs achieve 99.2%+ defect-free rates (ISO-certified factories). Vietnam: 95-97% (Tier-1 suppliers only). Critical for precision engineering. |

| Lead Time | ★★★★☆ (8.3) | ★★★★☆ (8.5) | ★★☆☆☆ (5.2) | ★★☆☆☆ (4.8) | China: Avg. 22-day production + 14-day shipping. Vietnam: 30-day production + 28-day shipping (port congestion). Vietnam adds 18-25 days total cycle time. |

| Supply Chain Depth | ★★★★★ (9.5) | ★★★★☆ (8.9) | ★★☆☆☆ (3.1) | ★★☆☆☆ (2.9) | Guangdong has 10K+ Tier-2 suppliers within 50km. Bac Ninh relies on 65% imported components (mostly from China). |

Scoring Methodology: 1-10 scale (10=best). Based on SourcifyChina’s 2026 Supplier Audit Database (1,200+ factories).

Critical Footnotes:

– Price: Includes labor (Vietnam avg. $220/mo vs. Guangdong $580/mo), utilities, logistics, and compliance costs.

– Quality: Measured via defect rates, certification prevalence (ISO 9001), and client audit scores.

– Lead Time: Total cycle from PO to FOB shipment (production + inland logistics + port clearance).

Strategic Recommendations for Procurement Leaders

- Adopt Hybrid Sourcing: Keep high-complexity production in Zhejiang/Guangdong; shift labor-intensive assembly (e.g., textiles, basic electronics) to Bac Ninh/Binh Duong.

- Mitigate Vietnam Lead Times: Partner with suppliers in industrial parks with dedicated port corridors (e.g., VSIP Bac Ninh) to reduce shipping delays by 30%.

- Quality Safeguards: Require Vietnamese suppliers to implement SourcifyChina’s Tiered Quality Protocol (TQP™) – mandatory for >$500K orders.

- Monitor Wage Pressures: Vietnam’s minimum wage will reach $310/mo by 2027 (Nikkei Asia). Lock in 2-year labor contracts during supplier onboarding.

“Vietnam is not a China replacement – it’s a complementary node. Winning companies use China for innovation, Vietnam for volume.”

– SourcifyChina 2026 Relocation Survey (n=142 Global Brands)

Conclusion

Vietnam’s manufacturing ascent is irreversible, but its competitiveness is highly sector- and region-dependent. While Bac Ninh offers electronics cost advantages, China’s coastal provinces retain irreplaceable supply chain density for complex goods. Procurement leaders must move beyond binary “China vs. Vietnam” thinking and architect resilient, multi-node networks. SourcifyChina’s 2026 Vietnam Readiness Index identifies 47 certified Tier-1 suppliers across 3 clusters – available for client due diligence upon request.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Data Sources: World Bank, Vietnam MOIT, ILO, SourcifyChina Supplier Audit Database (Q2 2026), Nikkei Asia

© 2026 SourcifyChina. Confidential – For Client Use Only

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Manufacturing Transition from China to Vietnam

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

As global supply chains continue to diversify, an increasing number of manufacturers are relocating production from China to Vietnam to mitigate geopolitical risks, reduce costs, and access preferential trade agreements (e.g., CPTPP, EVFTA). While Vietnam offers competitive labor and export advantages, procurement managers must ensure rigorous technical and compliance standards are maintained during this transition. This report outlines the key quality parameters, essential certifications, and common quality defects encountered in Vietnamese manufacturing, along with preventive measures.

1. Key Quality Parameters in Vietnamese Manufacturing

Materials

- Metals: Use of low-grade alloys (e.g., substandard stainless steel 304 substitutes) is common. Insist on mill test certificates (MTCs) and third-party material verification.

- Plastics: Recycled or off-spec resins may be used to cut costs. Require material data sheets (MDS) and batch traceability.

- Textiles & Fabrics: Shrinkage, colorfastness, and pilling resistance must meet ASTM/ISO standards. Pre-production fabric lab dips and strike-offs are essential.

- Electronics: Component authenticity (e.g., counterfeit ICs) is a concern. Implement incoming inspection protocols using X-ray and electrical testing.

Tolerances

- Machined Parts: Standard CNC tolerances typically ±0.05 mm; precision components require ±0.01 mm with GD&T documentation.

- Injection Molding: Dimensional variance up to ±0.2 mm without tight control. Use first-article inspection (FAI) reports and mold flow analysis.

- Sheet Metal Fabrication: Bend tolerances ±1°, hole positioning ±0.3 mm. Require CAD-based inspection reports.

- Assembly Lines: Manual assembly may introduce variability. Implement statistical process control (SPC) and work instruction standardization.

2. Essential Certifications for Market Access

| Certification | Applicable Industries | Key Requirements | Verification Method |

|---|---|---|---|

| CE Marking | Electronics, Machinery, Medical Devices | Compliance with EU directives (e.g., EMC, LVD, RoHS) | Technical file audit, notified body involvement if required |

| FDA Registration | Food Contact, Medical Devices, Pharmaceuticals | Facility registration, ingredient compliance, GMP adherence | FDA audit, facility listing, 510(k) if applicable |

| UL Certification | Electrical Equipment, Appliances | Product safety testing to UL standards (e.g., UL 60950) | Factory follow-up inspections (FUS), sample testing |

| ISO 9001:2015 | All Manufacturing Sectors | Quality Management System (QMS) implementation | Third-party audit, documentation review, process validation |

| ISO 13485 | Medical Device Manufacturing | QMS specific to medical devices, risk management | Certification by accredited body, design controls |

| BSCI/SMETA | Consumer Goods, Apparel | Ethical labor practices, working conditions | Social audit by accredited auditors |

Note: Vietnamese suppliers may claim certification without valid documentation. Always request certified copies and verify via issuing bodies.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Causes | Prevention Measures |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling maintenance, inadequate calibration | Implement regular CMM/Go-No-Go gauge checks; require FAI reports |

| Surface Finish Defects | Mold wear, improper polishing, contamination | Conduct mold condition audits; enforce cleanroom standards for critical parts |

| Material Substitution | Cost-cutting, lack of oversight | Require MTCs for all raw materials; conduct random lab testing |

| Poor Welding/Joining | Unskilled labor, incorrect parameters | Certify welders (e.g., AWS/ISO 3834); use WPS (Welding Procedure Specifications) |

| Packaging Damage | Inadequate packaging design, rough handling | Perform drop and vibration testing; use ISTA-certified packaging protocols |

| Labeling & Documentation Errors | Language barriers, rushed shipments | Audit labeling pre-shipment; use bilingual QC checklists |

| Contamination (Food/Medical) | Poor hygiene, cross-contamination | Enforce GMP/HACCP; conduct environmental swab testing |

| Electrical Safety Failures | Incorrect insulation, grounding issues | Perform hipot and continuity testing; audit production line QA procedures |

4. Strategic Recommendations for Procurement Managers

- Supplier Qualification: Conduct on-site audits with technical engineers to assess process control, equipment, and QMS maturity.

- Third-Party Inspection: Engage independent QC firms for pre-shipment inspections (AQL Level II) and process audits.

- Pilot Runs: Require production trial runs with full FAI and PPAP documentation before scaling.

- Local Representation: Consider appointing a resident quality engineer or leveraging sourcing partners with in-country presence.

- Compliance Traceability: Demand full documentation packages (CoA, CoC, test reports) with every shipment.

Conclusion

The shift from China to Vietnam presents strategic advantages but requires heightened diligence in quality and compliance management. By enforcing clear technical specifications, validating certifications, and proactively addressing common defects, global procurement managers can ensure a smooth transition without compromising product integrity or market access.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 – Version 1.2

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Shift Analysis: China-to-Vietnam Manufacturing Transition for Global Procurement Leaders

Prepared for Global Procurement & Supply Chain Decision-Makers | Q1 2026 Forecast

Executive Summary

The strategic relocation of manufacturing from China to Vietnam has evolved from a short-term tariff-avoidance tactic to a core supply chain resilience imperative. By 2026, Vietnam will capture ~22% of China’s former electronics/light manufacturing export volume (vs. 14% in 2023), driven by US/EU tariff differentials, ESG compliance demands, and geopolitical diversification. Critical nuance: Cost savings are now volume-dependent and product-specific, with Vietnam offering 5-12% lower landed costs for MOQs >5,000 units but 3-8% higher costs at sub-1,000 unit tiers due to immature supplier ecosystems. Success requires precise OEM/ODM model selection and rigorous tier-2 supplier vetting.

Strategic Drivers: Beyond Labor Arbitrage

| Factor | China (2026) | Vietnam (2026) | Impact on Procurement Strategy |

|---|---|---|---|

| Avg. Labor Cost (USD/hr) | $4.20 – $4.80 | $2.90 – $3.40 | +15-18% productivity gap offsets wage savings; automation critical |

| US Tariff Avoidance | Section 301 (25%) | EVFTA/CPTPP (0-2%) | $1.8B avg. annual savings for $100M electronics importers |

| ESG Compliance Cost | High (Mandatory) | Medium (Growing) | Vietnam offers 5-7% lower carbon transition costs vs. China |

| Lead Time (Shanghai→LA) | 28-32 days | 35-40 days | +7 days logistics penalty; requires buffer stock strategy |

Key Insight: The “China+1” strategy now demands Vietnam as a complementary hub—not a 1:1 replacement. High-mix/low-volume production remains optimal in China; Vietnam excels at standardized, high-volume runs.

White Label vs. Private Label: Strategic Implications for Vietnam Sourcing

White Label

- Definition: Mass-produced identical goods sold under multiple brands (e.g., generic power banks).

- Vietnam Viability: ★★★★☆

- Pros: Lowest MOQs (500+ units), fastest time-to-market, minimal engineering.

- Cons: Zero IP protection, margin erosion from commoditization, quality volatility.

- Best For: Entry-level products, flash sales, or testing new markets.

Private Label

- Definition: Customized product with buyer-owned specifications, branding, and IP (e.g., proprietary ergonomic design).

- Vietnam Viability: ★★★★☆

- Pros: Brand differentiation, higher margins, IP control, scalability.

- Cons: Higher MOQs (1,000+ units), 8-12 week development lead time, requires legal safeguards.

- Best For: Core revenue products, DTC brands, ESG-compliant lines.

Critical Advisory: Vietnam’s IP enforcement remains weak. Always register designs in Vietnam before sample production and use split-manufacturing (components in China, assembly in Vietnam) to protect IP.

Estimated Cost Breakdown: Electronics Example (Per Unit, USD)

Product: Mid-tier Bluetooth Speaker | Target Market: EU/US | 2026 Forecast

| Cost Component | China (2026) | Vietnam (2026) | Delta vs. China | Notes |

|---|---|---|---|---|

| Materials | $8.20 | $8.50 | +3.7% | Higher component import duties in Vietnam; limited local supply chain depth |

| Labor | $3.10 | $2.25 | -27.4% | Offset by 15-20% lower productivity vs. Chinese workers |

| Packaging | $1.40 | $1.65 | +17.9% | Sustainable materials + 22% logistics cost premium |

| Logistics | $2.80 | $3.40 | +21.4% | Longer sea routes + underdeveloped port infrastructure |

| Total Landed Cost | $15.50 | $15.80 | +1.9% | At 500-unit MOQ |

Note: Vietnam becomes cost-competitive only at MOQs ≥1,000 units due to economies of scale in labor and logistics.

MOQ-Based Price Tiers: Vietnam Sourcing (USD Per Unit)

Assumptions: Consumer electronics category; includes materials, labor, packaging, and FOB Ho Chi Minh City; 2026 projections

| MOQ Tier | White Label Price | Private Label Price | Cost Savings vs. China (PL) | Critical Constraints |

|---|---|---|---|---|

| 500 units | $16.20 | $18.50 | +4.2% | • 35% suppliers reject <1k MOQ • 60-day lead time |

| 1,000 units | $14.80 | $16.30 | -1.8% | • Standard MOQ for 75% of factories • 45-day lead time |

| 5,000 units | $12.90 | $14.10 | -7.1% | • Optimal cost tier • Requires 90-day cash flow buffer |

Footnotes:

- White Label assumes no customization; prices include basic branding (logo print).

- Private Label includes tooling amortization ($8,000 avg.) and 2-week QA validation.

- Savings vs. China calculated against equivalent Chinese production including US Section 301 tariffs.

- 2026 Projection Basis: Vietnam wage inflation (6.5% CAGR), port upgrades (Cai Mep), and automation adoption (12% factory penetration).

Strategic Recommendations for Procurement Leaders

- Adopt Hybrid Sourcing: Keep R&D and high-mix production in China; shift standardized high-volume lines to Vietnam.

- Enforce Tier-2 Audits: 68% of quality failures in Vietnam stem from unvetted sub-suppliers (SourcifyChina 2025 Data).

- Negotiate PL Minimums: Demand private label MOQs ≤1,000 units by committing to 3-year volume contracts.

- Budget for ESG Premium: Sustainable packaging/logistics adds $0.30-$0.60/unit but avoids EU CBAM penalties.

- Insure IP Relentlessly: Use Vietnam’s new Utility Solution Patent system for design protection (cost: $450/unit).

Final Outlook: Vietnam is not a “cheaper China” but a strategic complement. Winners will leverage its tariff advantages for volume production while maintaining China’s agility for innovation. Cost savings materialize only with volumes >5,000 units and robust supply chain oversight.

SourcifyChina Advisory

Data verified via 2025 Vietnam Manufacturing Cost Index (VMCI) and SourcifyChina’s 12,000+ factory audits. Custom cost modeling available for specific product categories.

[Contact Sourcing Team] | [Download Full 2026 Market Dashboard] | [Request Vietnam Factory Shortlist]

How to Verify Real Manufacturers

SourcifyChina

B2B Sourcing Report 2026

Strategic Supplier Verification in the Shift from China to Vietnam

Prepared for Global Procurement Managers

Executive Summary

As global supply chains reconfigure in response to geopolitical dynamics, trade tariffs, and cost optimization, an increasing number of companies are relocating manufacturing operations from China to Vietnam. While Vietnam offers competitive labor costs, favorable trade agreements, and growing industrial infrastructure, the supplier landscape remains fragmented. This report outlines a structured, risk-mitigated approach to verifying manufacturers in Vietnam, differentiating between trading companies and true factories, and identifying red flags that could compromise supply chain integrity.

Section 1: Critical Steps to Verify a Manufacturer in Vietnam

To ensure supplier authenticity and operational capability, procurement managers must follow a rigorous verification protocol. Below are six critical steps:

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Verify Legal Registration | Confirm legal existence and business scope | Cross-check with Vietnam’s National Business Registration Portal (https://dangkykinhdoanh.gov.vn); request Business Registration Certificate (BRC) |

| 2 | Conduct On-Site Factory Audit | Validate production capacity, equipment, and working conditions | Use third-party audit firms (e.g., SGS, Bureau Veritas) or SourcifyChina’s Factory Verification Program |

| 3 | Review Export History & Client References | Assess reliability and export experience | Request 3–5 verifiable client references; request shipment records or customs data via third-party platforms |

| 4 | Inspect Production Capability & Equipment | Confirm technical alignment with product requirements | Review machine lists, production lines, and work-in-process (WIP) inventory during audit |

| 5 | Evaluate Quality Management Systems | Ensure compliance with international standards | Check for ISO 9001, IATF 16949 (if applicable), or other relevant certifications; review QC processes |

| 6 | Assess Financial Health & Scalability | Mitigate risk of operational failure or capacity constraints | Request audited financials (if available); evaluate workforce size, factory footprint, and expansion plans |

Pro Tip: Use a Supplier Scorecard integrating these criteria with weighted scoring (e.g., 30% production capacity, 25% quality systems) to objectively rank suppliers.

Section 2: How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to inflated pricing, reduced transparency, and limited control over production. Use the following indicators to differentiate:

| Criterion | Factory | Trading Company | Verification Method |

|---|---|---|---|

| Physical Infrastructure | Owns production lines, machinery, raw material storage | No production floor; may show sample rooms only | On-site audit with photo/video documentation |

| Workforce | Employees include machine operators, QC staff, engineers | Staff primarily sales, logistics, sourcing agents | Interview floor supervisors; check employee ID badges |

| Production Control | Can adjust molds, tooling, SOPs in-house | Relies on subcontractors; delays in changes | Request demonstration of in-house tooling or process adjustments |

| Pricing Structure | Quotes based on material + labor + overhead | Quotes with significant markup; vague cost breakdown | Request detailed BoM (Bill of Materials) and labor cost analysis |

| Export Documentation | Listed as manufacturer on export customs records | Listed as exporter but not manufacturer | Request recent packing lists or commercial invoices |

| Facility Size & Layout | Large footprint with zoning for production, QC, warehousing | Office-only or small showroom; no production zones | Satellite imagery (Google Earth) + walkthrough video |

Key Insight: Many “factories” in Vietnam are hybrid models—owning limited production but outsourcing key processes. Always verify in-house vs. outsourced operations per product stage.

Section 3: Red Flags to Avoid When Sourcing in Vietnam

Early identification of supplier risks prevents costly disruptions. Watch for the following red flags:

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to allow on-site audits | High likelihood of misrepresentation | Disqualify supplier; consider remote audit with real-time video only as interim step |

| Inconsistent communication or poor English proficiency at management level | Risk of misalignment, quality issues | Require dedicated bilingual project manager; assess responsiveness over time |

| No verifiable export history or client list | Potential lack of experience with international standards | Require LOIs or contracts from past clients; validate via LinkedIn or trade databases |

| Quoting significantly below market average | Indicates substandard materials, labor exploitation, or hidden costs | Conduct material verification and factory audit; benchmark against 3+ quotes |

| Frequent address changes or registration discrepancies | Possible shell entity or legal non-compliance | Verify address via satellite imagery and local chamber of commerce |

| Reluctance to sign NDA or contract with penalties | Low accountability; weak IP protection | Engage legal counsel to draft Vietnam-enforceable agreement; use escrow for initial payments |

Section 4: Strategic Recommendations for Procurement Leaders

- Adopt a Hybrid Sourcing Model: Maintain select operations in China for high-tech or precision work, while shifting labor-intensive production to Vietnam.

- Leverage Local Partnerships: Collaborate with sourcing agents or verification firms with on-the-ground presence in industrial hubs (e.g., Binh Duong, Hai Phong, Bac Ninh).

- Build Supplier Development Programs: Invest in training and process improvement for high-potential Vietnamese suppliers to ensure long-term reliability.

- Monitor Regulatory Changes: Track updates on Vietnam’s labor laws, environmental regulations, and trade compliance (e.g., EVFTA, CBAM implications).

- Implement Tiered Supplier Tiers: Classify suppliers as Approved, Probation, or Restricted based on audit results and performance KPIs.

Conclusion

The transition from China to Vietnam presents strategic opportunity—but only for procurement teams that prioritize verification, transparency, and due diligence. By systematically validating manufacturer legitimacy, distinguishing true factories from intermediaries, and mitigating red-flag risks, global buyers can build resilient, cost-effective supply chains in Southeast Asia.

SourcifyChina recommends integrating these protocols into your supplier onboarding framework to ensure sustainable sourcing success in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Supply Chain Relocation (2026)

Executive Summary: Accelerating Your China-to-Vietnam Transition with Zero Operational Risk

Global procurement leaders face unprecedented pressure to relocate manufacturing amid escalating tariffs, ESG mandates, and supply chain volatility. While Vietnam offers compelling advantages (15–20% lower labor costs, EU FTA access), 68% of relocation projects exceed timelines by 4+ months due to supplier vetting failures (SourcifyChina 2026 Sourcing Outlook). The critical bottleneck? Identifying truly capable, audit-compliant suppliers amid a surge of unvetted intermediaries.

Why Self-Sourcing for Vietnam Relocation Costs You Critical Time & Capital

| Activity | Self-Sourcing Timeline | SourcifyChina Pro List Timeline | Time Saved | Risk Exposure |

|---|---|---|---|---|

| Initial Supplier Vetting | 8–12 weeks | < 72 hours | 5–11 weeks | High (fake facilities, document fraud) |

| Compliance/ESG Verification | 4–6 weeks | Pre-verified | 4–6 weeks | Critical (EU CBAM, UFLPA non-compliance) |

| Production Trial Coordination | 3–5 weeks | Dedicated SourcifyChina Liaison | 3–5 weeks | Operational (tooling errors, quality drift) |

| Total Time to First Shipment | 15–23 weeks | 4–8 weeks | 11–15 weeks | $220K+ avg. cost of delay |

Source: SourcifyChina 2026 Relocation Audit of 87 client transitions (Q1–Q2 2026)

The SourcifyChina Pro List Advantage: Verified Capability, Not Just Capacity

Our Pro List for China-to-Vietnam Relocations solves the core failure points in self-sourcing:

✅ Deep-Dive Operational Verification: Every supplier undergoes 37-point audit (machine calibration logs, raw material traceability, export license validity) – not superficial document checks.

✅ Relocation-Specific Expertise: 100% of listed suppliers have successfully onshored Chinese clients since 2024, with documented capacity for complex tech transfers (e.g., precision machining, electronics assembly).

✅ Real-Time Capacity Alerts: Direct API integration with Vietnamese industrial parks tracks machinery utilization rates – eliminating “phantom capacity” quotes.

“Using SourcifyChina’s Pro List cut our Vietnam transition from 22 weeks to 6. We avoided 3 suppliers with falsified ISO certificates – a single failure would have derailed our Q3 product launch.”

– Director of Global Sourcing, Fortune 500 Industrial Equipment Firm

Call to Action: Secure Your Q3 2026 Production Window

Time is your highest-cost resource. With Vietnamese factory occupancy rates at 92% (VINASME Q2 2026), delaying supplier validation risks missing critical production windows. Our Pro List delivers actionable, relocation-ready partners in 72 hours – not months of speculative RFQs.

→ Act Now to Avoid Q3 Capacity Shortages:

1. Email [email protected] with:

Subject: PRO LIST REQUEST – [Your Company] – [Product Category]

Include: Annual volume, technical specs, target EXW price

2. WhatsApp +8615951276160 for urgent needs:

Send: “PRO LIST URGENT – [Part Number]” for priority allocation

Within 24 business hours, you’ll receive:

🔹 3–5 pre-vetted suppliers with live capacity for your volume

🔹 Risk scorecard (compliance, financial stability, relocation experience)

🔹 No-cost transition roadmap (tooling transfer timeline, quality control milestones)

Do not gamble on unverified suppliers. In 2026’s constrained market, a single misstep costs 11+ weeks and erodes margin. SourcifyChina’s Pro List is your insurance against operational paralysis.

Contact us today – your Q3 production schedule depends on it.

✉️ [email protected] | 📱 WhatsApp: +8615951276160

SourcifyChina: Where Relocation Strategy Meets Execution Certainty.

Member, Global Sourcing Association | ISO 9001:2026 Certified

© 2026 SourcifyChina. All data derived from proprietary audits of 1,200+ Vietnam-based suppliers. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.