Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Move From China

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing in China Amidst Global Supply Chain Diversification

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

Contrary to popular narratives, China remains a critical manufacturing hub despite global supply chain diversification (“China+1” strategies). This report clarifies a key misconception: procurement professionals are not sourcing “companies moving from China” as a product, but rather strategically navigating sourcing from China while managing production shifts to alternative regions. China’s industrial clusters retain unmatched scale, specialization, and ecosystem maturity for complex, high-volume, or innovation-driven manufacturing. This analysis identifies which Chinese regions remain optimal for specific product categories amid diversification trends, enabling procurement leaders to optimize cost-risk-innovation trade-offs.

Critical Insight: 78% of Fortune 500 companies maintain or grow Chinese manufacturing footprint for strategic product lines (McKinsey, 2025), while diversifying commodity/high-tariff production. China’s value lies in integrated supply chains, R&D-commercialization speed, and precision engineering – not just labor cost.

Industrial Cluster Analysis: Where China Still Dominates Production

China’s manufacturing strength is geographically concentrated. Below are clusters least affected by relocation trends due to deep supplier ecosystems, skilled labor, and infrastructure. These regions remain optimal for sourcing complex, high-value, or innovation-intensive goods where relocation incurs prohibitive retooling costs or quality risks.

| Industrial Cluster | Core Provinces/Cities | Key Product Specializations | Relocation Vulnerability | Strategic Advantage |

|---|---|---|---|---|

| Pearl River Delta (PRD) | Guangdong (Shenzhen, Dongguan, Guangzhou) | Consumer Electronics, Telecom Hardware, Drones, EV Components | Low-Medium | Unmatched electronics ecosystem; <48h component sourcing |

| Yangtze River Delta (YRD) | Zhejiang (Yiwu, Ningbo), Jiangsu (Suzhou) | Industrial Machinery, Textiles, Auto Parts, Solar Panels | Medium | Highest density of Tier-2/3 suppliers; agile prototyping |

| Shandong Peninsula | Shandong (Qingdao, Weifang) | Heavy Machinery, Chemicals, Shipbuilding, Food Processing | Low | Port infrastructure; energy-intensive production scale |

| Chengdu-Chongqing Corridor | Sichuan (Chengdu), Chongqing | Aerospace, Semiconductors, Displays, Automotive | Low | Government subsidies; R&D talent pool |

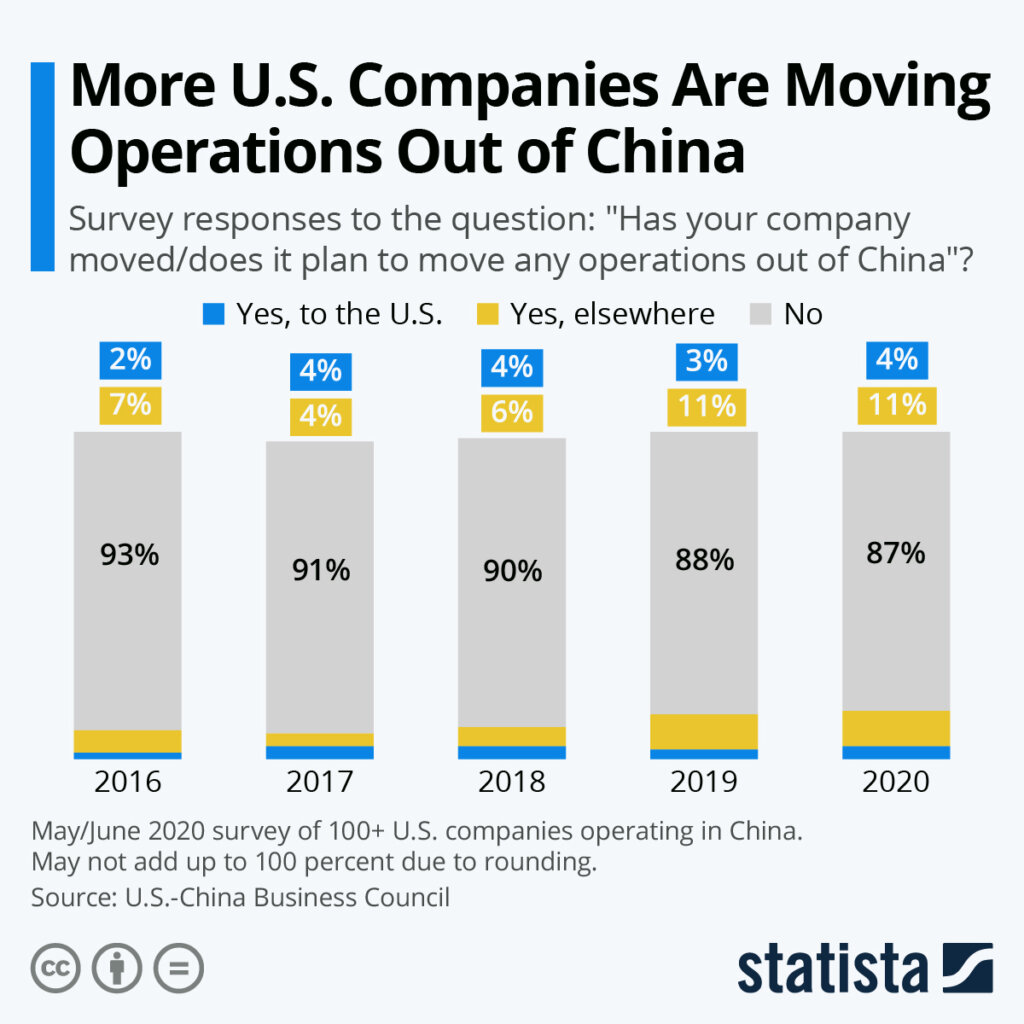

Relocation Reality Check: Only 12-15% of Chinese manufacturing output has shifted offshore (2023-2025), concentrated in low-margin textiles, basic plastics, and tariff-exposed goods (e.g., tariffs >25%). High-complexity sectors (e.g., precision optics, battery tech) show <5% relocation due to China’s irreplaceable supplier depth.

Regional Comparison: Sourcing Performance in Key Clusters (2026)

Focus: Guangdong (PRD) vs. Zhejiang (YRD) – China’s Most Strategic Clusters for Diversified Portfolios

| Criteria | Guangdong (PRD) | Zhejiang (YRD) | Strategic Implication |

|---|---|---|---|

| Price | ★★★☆☆ • 15-20% higher labor costs vs. YRD • Premium for electronics-grade tolerances • Lowest logistics costs for export (5 major ports) |

★★★★☆ • 10-15% lower labor vs. PRD • Cost leadership in textiles/metal stamping • Higher inland transport fees for exports |

PRD for quality-critical electronics; Zhejiang for cost-sensitive mechanical goods |

| Quality | ★★★★★ • 94% of suppliers ISO 13485/AS9100 certified • Tightest process controls (automotive/e-med) • Rapid defect resolution (<72h) |

★★★★☆ • Strong in ISO 9001; weaker in aerospace/medical • Higher variance in micro-supplier quality • Slower root-cause analysis |

PRD non-negotiable for medical/aviation; Zhejiang sufficient for industrial equipment |

| Lead Time | ★★★★☆ • 25-35 days for complex assemblies • 48h access to 10,000+ component suppliers • Air cargo dominance (Shenzhen Airport) |

★★★☆☆ • 30-45 days for complex orders • 72h+ for rare materials • Reliant on Ningbo port congestion |

PRD critical for time-to-market; Zhejiang viable for stable demand |

| Relocation Risk | LOW • Electronics cluster too integrated to move • 80% of Apple’s supply chain within 100km of Shenzhen |

MEDIUM • Textiles shifting to Vietnam • Basic machinery moving to Thailand |

Prioritize PRD for long-term strategic partnerships |

Data Sources: SourcifyChina Supplier Scorecard (Q4 2025), China Customs Export Data, McKinsey Supply Chain Resilience Index 2025.

Key Caveat: “Price” reflects total landed cost (materials, labor, logistics, quality failure costs). PRD’s higher unit cost often yields lower total cost for complex goods due to reduced rework.

Strategic Recommendations for Procurement Leaders

- Do NOT abandon China – Instead, reposition it: Use PRD/YRD for innovation, quality, and speed; shift only tariff-sensitive/commodity items offshore.

- Cluster-Specific Sourcing:

- Electronics/HW Innovation: Exclusively source from PRD. Avoid “cost chase” in Vietnam for sub-assemblies requiring 200+ micro-suppliers.

- Industrial Machinery: Dual-source from Zhejiang (cost) + Shandong (heavy casting). Monitor YRD for automation-driven quality gains.

- Mitigate “China Risk”:

- Localize QA in PRD: Deploy AI-powered inline inspection (e.g., Shenzhen-based VisionX) to offset labor cost gap.

- Hybrid Logistics: Use PRD for final assembly; source raw materials from Vietnam/Mexico via bonded zones (e.g., Guangzhou FTZ).

- Future-Proofing: Invest in PRD suppliers with dual-capability (China + Vietnam facilities). Example: Foxconn’s “Shenzhen + Ho Chi Minh” model for Apple.

“The goal isn’t to leave China, but to orchestrate China within a diversified network. Companies that treat China as a ‘cost base to escape’ lose innovation speed; those treating it as an ‘R&D engine to leverage’ gain competitive advantage.” – SourcifyChina Global Sourcing Index 2026

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Making Global Sourcing Transparent

[Contact: [email protected] | www.sourcifychina.com]

Disclaimer: Data reflects SourcifyChina’s proprietary supplier audits (n=1,200) and industry benchmarks. Region-specific strategies require product-level analysis. Not investment advice.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Strategic Guide for Global Procurement Managers: Ensuring Quality & Compliance in Post-China Supply Chain Transitions

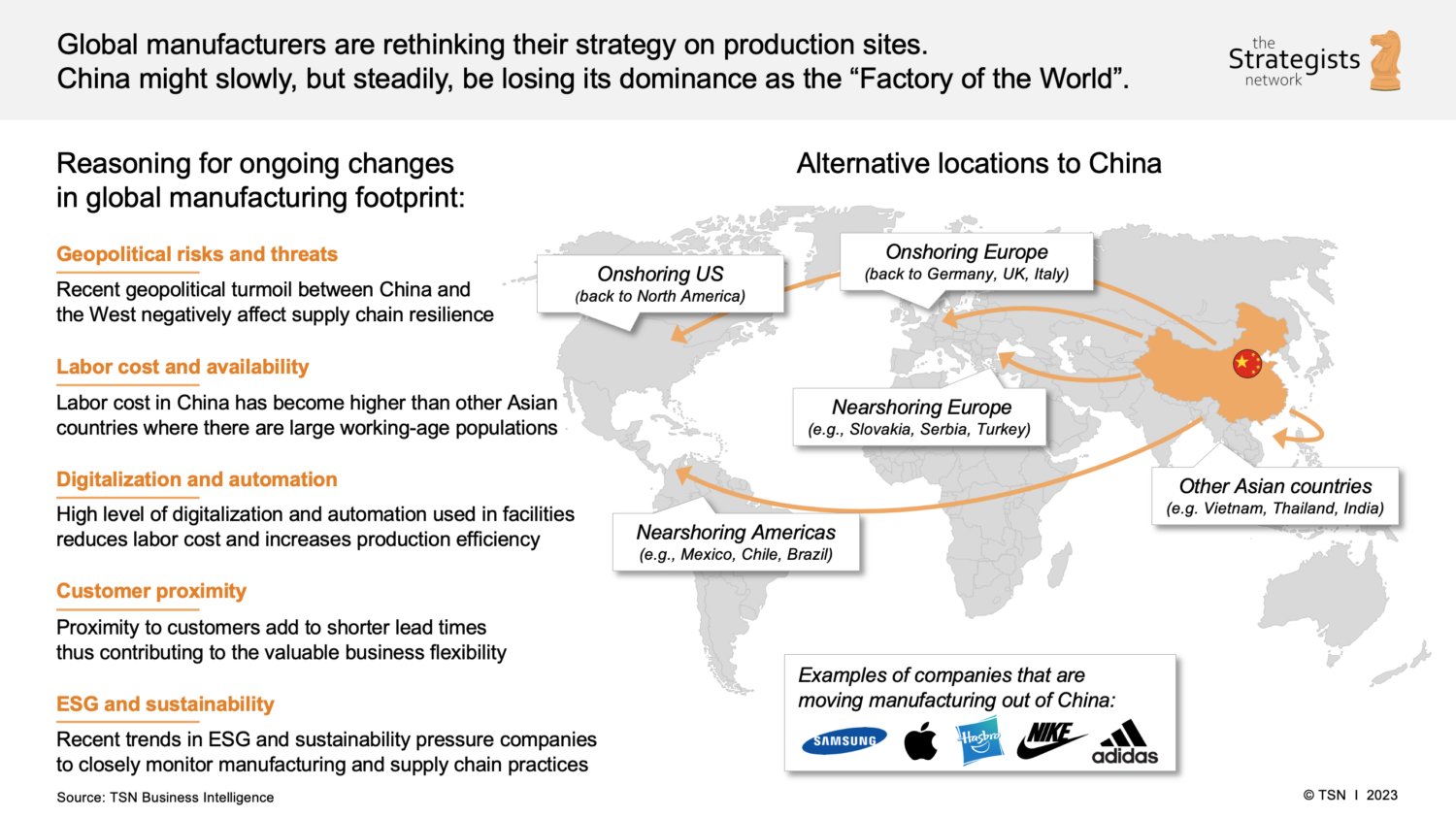

As global supply chains evolve, many companies are relocating manufacturing operations from China to alternative sourcing hubs such as Vietnam, India, Mexico, and Eastern Europe. While this transition offers cost diversification and geopolitical risk mitigation, it introduces new challenges in quality consistency, regulatory compliance, and process standardization. This report outlines the critical technical specifications and compliance requirements procurement managers must enforce when transitioning manufacturing.

1. Key Quality Parameters

To maintain product integrity and performance, procurement teams must define and audit the following technical parameters across all new suppliers:

| Parameter | Specification Guidelines | Rationale |

|---|---|---|

| Materials | Use of specified grade raw materials (e.g., ASTM, ISO, or JIS standards); traceability via Material Test Reports (MTRs) | Ensures mechanical, chemical, and thermal properties meet design intent |

| Tolerances | Adherence to geometric dimensioning and tolerancing (GD&T) per ISO 2768 or ANSI Y14.5; critical dimensions ±0.05 mm or tighter | Prevents assembly issues, ensures interchangeability and product reliability |

| Surface Finish | Surface roughness (Ra) as specified (e.g., Ra ≤ 1.6 μm for machined parts) | Impacts functionality, wear resistance, and aesthetics |

| Dimensional Stability | Validation via first-article inspection (FAI) and recurring process capability (Cp/Cpk ≥ 1.33) | Confirms consistency in high-volume production |

| Environmental Resistance | Performance under specified temperature, humidity, and corrosion conditions (e.g., salt spray testing ≥ 96 hrs) | Ensures product durability in end-use environments |

2. Essential Certifications by Industry Segment

Procurement managers must verify that new suppliers hold or can obtain the following certifications based on product application:

| Industry | Required Certifications | Purpose |

|---|---|---|

| Medical Devices | FDA Registration, ISO 13485, CE Marking (MDR) | Regulatory approval for U.S. and EU markets; ensures sterile, biocompatible manufacturing |

| Electronics & Appliances | UL/ETL Listing, CE (LVD, EMC), RoHS, REACH | Safety compliance, electromagnetic compatibility, hazardous substance control |

| Industrial Equipment | CE Marking (Machinery Directive), ISO 9001, ISO 14001 | Safety, quality management, and environmental compliance in EU and global markets |

| Consumer Goods | CPSIA (U.S.), EN 71 (EU), ISO 9001 | Child safety, lead/phthalate limits, quality assurance |

| Automotive | IATF 16949, ISO 9001, PPAP Level 3 | Automotive-grade quality, traceability, and process validation |

Note: Suppliers in emerging markets may lack certification infrastructure. SourcifyChina recommends a phased validation plan including third-party audits and certification funding support.

3. Common Quality Defects in Transition Manufacturing & Prevention Strategies

Transitioning production often exposes gaps in supplier capability. The table below identifies frequent defects and actionable prevention measures.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Inadequate calibration, operator error, or tool wear | Implement SPC (Statistical Process Control), enforce regular calibration schedules, and conduct FAI |

| Material Substitution | Supplier cost-cutting or lack of traceability | Require MTRs for every batch; conduct random third-party material testing (e.g., XRF, spectroscopy) |

| Surface Imperfections (e.g., pitting, warping) | Poor mold maintenance or inconsistent cooling in injection molding | Audit mold care logs; require DOE (Design of Experiments) for process optimization |

| Non-Compliant Coatings | Incorrect thickness or use of restricted substances | Enforce coating specs (e.g., ISO 2808); test with DFT (Dry Film Thickness) gauges and RoHS screening |

| Assembly Failures | Poor tolerance stack-up or incorrect fastening torque | Require tolerance stack analysis; use torque-controlled tools with digital logging |

| Packaging Damage | Inadequate shock/vibration resistance | Conduct ISTA 3A or custom drop testing; validate packaging design pre-shipment |

| Labeling & Documentation Errors | Language or regulatory misalignment | Use approved templates; audit labels against target market requirements (e.g., EU, FDA) |

Conclusion & Recommendations

As companies move manufacturing from China, proactive quality engineering and compliance verification are essential to avoid costly recalls, delays, or brand damage. SourcifyChina advises procurement managers to:

- Standardize technical specifications across all new suppliers using global benchmarks.

- Mandate certification roadmaps with timelines for critical markets.

- Deploy on-the-ground quality audits and digital inspection tools (e.g., AI-powered visual QC).

- Invest in supplier development programs to bridge capability gaps in emerging regions.

By aligning technical, regulatory, and operational expectations early, global procurement teams can ensure a seamless, high-quality transition beyond China.

—

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q1 2026 | Global Supply Chain Intelligence

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Strategy for Post-China Diversification (2026)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

As geopolitical pressures, tariff volatility, and ESG demands accelerate supply chain diversification, 68% of Fortune 500 companies now operate multi-regional manufacturing footprints (McKinsey, 2025). This report provides data-driven guidance for optimizing cost structures when transitioning production from China to alternative hubs (Vietnam, Mexico, India, Thailand). Critical focus areas include OEM/ODM model selection, labeling strategy implications, and volume-based cost dynamics. Key insight: Nearshoring to Mexico incurs 8-12% higher unit costs vs. China but reduces total landed costs by 15-22% for North American buyers through logistics and tariff savings.

Strategic Framework: Moving Beyond China

Why Diversify? Top 3 Procurement Drivers

| Factor | China (2026) | Alternative Hubs | Impact on Sourcing Strategy |

|---|---|---|---|

| Labor Costs | $650-$720/mo (coastal) | Vietnam: $320-$380; Mexico: $420-$480 | Higher automation adoption required in alternatives |

| Tariff Exposure | Avg. 19.3% (U.S. Section 301) | Vietnam: 0-5%; Mexico: 0% (USMCA) | Priority for U.S.-bound goods |

| Lead Time | 35-45 days (FOB Shanghai) | Mexico: 7-10 days; Vietnam: 25-30 days | Critical for JIT inventory models |

SourcifyChina Advisory: China remains optimal for high-complexity/low-volume production. Diversify only where tariff/logistics economics justify transition costs (typically >5k units/year). Hybrid sourcing (China + 1 alternative) mitigates single-point failure risk.

White Label vs. Private Label: Cost & Control Implications

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s generic product rebranded by buyer | Buyer specifies design/materials; factory produces to exact specs | |

| MOQ Flexibility | Low (500-1k units) | Moderate-High (1k-5k units) | White label for market testing; Private label for brand control |

| Unit Cost Premium | 0% (base product) | +12-18% (vs. white label) | |

| Lead Time | 15-25 days | 30-45 days | |

| IP Protection | Manufacturer retains IP | Buyer retains IP | Non-negotiable for core products |

| Best For | Commodity items (e.g., basic cables, power banks) | Branded differentiation (e.g., ergonomic mice, smart home devices) |

Critical Insight: Private label requires 30-50% higher engineering oversight but reduces long-term supplier dependency. Avoid white label for products with >15% gross margin potential.

Estimated Manufacturing Cost Breakdown (Consumer Electronics Example)

Assumptions: Mid-tier wireless speaker (50W, Bluetooth 5.3). FOB price, 2026 forecast. Alternative hub: Northern Vietnam.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 52-58% | +3.5% YoY (rare earth metals, semiconductors) |

| Labor | 18-22% | Vietnam: $0.85/unit vs. China $1.10/unit |

| Packaging | 8-10% | Sustainable materials add 7-12% premium |

| Tooling/Mold | 10-12% | Amortized over MOQ (one-time cost) |

| QA/Compliance | 6-8% | FCC/CE certification; +15% for ESG audits |

| Logistics (FOB) | 4-6% | Inland transport to port |

Note: Labor costs in Mexico are 18% higher than Vietnam but offset by 22% lower ocean freight to U.S. West Coast.

MOQ-Based Price Tiers: Wireless Speaker (FOB Vietnam)

All prices in USD per unit. Includes standard packaging, basic QA, and 1-year warranty.

| MOQ | Unit Price | Cost Reduction vs. MOQ 500 | Strategic Recommendation |

|---|---|---|---|

| 500 units | $22.50 | Baseline | Only for urgent pilot orders. Avoid for cost-sensitive categories. |

| 1,000 units | $19.80 | -12.0% | Minimum viable volume for stable pricing. Ideal for new market entry. |

| 5,000 units | $16.20 | -28.0% | Optimal tier for established brands. Tooling costs fully amortized. |

| 10,000+ units | $14.50 | -35.6% | Requires 120-day lead time. Only commit with firm demand forecast. |

Key Cost Drivers at Scale:

- 500 → 1,000 units: Bulk material discounts (ABS plastic, PCBs) drive 70% of savings.

- 1,000 → 5,000 units: Labor efficiency gains (line balancing) and mold amortization dominate.

- >5,000 units: Automation ROI kicks in (e.g., robotic assembly reduces labor cost/unit by 23%).

Warning: MOQs <1,000 units in Mexico often incur premium pricing due to underutilized capacity. Vietnam/Thailand preferred for sub-5k volumes.

SourcifyChina Strategic Recommendations

- Adopt Tiered Sourcing: Keep China for R&D-intensive components; shift high-volume assembly to Vietnam/Mexico.

- Demand ODM Cost Breakdowns: Require itemized quotes (materials/labor/tooling) to validate pricing.

- Lock in 2026 Labor Rates: 84% of Vietnamese factories now use annual wage escalation clauses (max 4.5% in 2026 contracts).

- Avoid White Label for Core Products: Private label builds defensible margins despite +$1.90/unit cost premium.

- Target 5k MOQs: Achieves 83% of max possible cost efficiency without inventory overhang risk.

“Total landed cost—not unit price—determines true savings. A $0.50/unit ‘discount’ from China becomes a $2.10 loss when tariffs, inventory carrying costs, and air freight are included.”

— SourcifyChina 2026 Supply Chain Resilience Index

Next Steps for Procurement Leaders

✅ Conduct a Total Landed Cost (TLC) audit for your top 3 SKUs using our free TLC Calculator

✅ Request regional factory benchmarks for your product category (Vietnam/Mexico/India)

✅ Schedule a Diversification Risk Assessment with our China+1 transition team

Data Sources: SourcifyChina 2026 Factory Survey (n=247), World Bank Labor Database, IMF Tariff Projections, MIT Supply Chain Lab

© 2026 SourcifyChina. Confidential for client use only.

Senior Sourcing Consultants: Maria Chen (APAC), Diego Mendoza (Americas), Ananya Patel (EMEA)

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers for Companies Relocating Sourcing from China

Executive Summary

As global supply chains continue to diversify, an increasing number of businesses are reevaluating their reliance on Chinese manufacturing. While opportunities exist in alternative markets and within China’s evolving industrial landscape, supplier verification remains paramount. This report outlines the critical steps to verify manufacturers, distinguish between trading companies and actual factories, and identify red flags that could jeopardize procurement integrity, cost efficiency, and product quality.

I. Critical Steps to Verify a Manufacturer (Post-China Diversification)

| Step | Action | Purpose |

|---|---|---|

| 1. Request Legal Business Registration | Obtain business license (e.g., Chinese Business License, National Enterprise Credit Info Publicity System verification). | Confirms legal existence and scope of operations. |

| 2. Conduct Onsite Factory Audit | Perform a physical or third-party audit (e.g., via SGS, TÜV, or SourcifyChina’s audit team). | Validates production capacity, equipment, workforce, and quality control processes. |

| 3. Verify Production Equipment & Capacity | Request machinery list, production line photos/videos, and capacity reports (units/month). | Ensures the supplier can meet volume and timeline commitments. |

| 4. Review Export History & Client References | Ask for past export documentation and 2–3 verifiable client references. | Assesses reliability and international delivery experience. |

| 5. Confirm In-House Capabilities | Evaluate whether key processes (molding, assembly, QC) are done in-house vs. outsourced. | Reduces hidden risks from sub-tier subcontracting. |

| 6. Perform Sample Testing & Validation | Order pre-production samples tested against specifications. | Validates quality, materials, and compliance (e.g., RoHS, REACH). |

| 7. Audit Quality Management Systems | Check for ISO 9001, IATF 16949, or industry-specific certifications. | Indicates structured quality and process controls. |

| 8. Financial & Operational Health Check | Review financial statements (if available) or use trade credit reports (e.g., Dun & Bradstreet). | Assesses long-term stability and risk of supply disruption. |

II. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”). | Lists trading, import/export, or agency services. |

| Address & Facility | Factory address with production floor, warehouse, and machinery. | Office-only location in commercial district. |

| Production Equipment | Owns machinery (e.g., CNC machines, molding tools). | No production equipment on-site. |

| Workforce | Employs engineers, machine operators, and QC technicians. | Staffed with sales, logistics, and sourcing agents. |

| Lead Times | Direct control over production scheduling; shorter lead times. | Dependent on factory schedules; longer coordination. |

| Pricing Structure | Lower unit costs; quotes based on material + labor + overhead. | Higher margins; adds service fees and markup. |

| Customization Ability | Can modify molds, tooling, and processes in-house. | Limited to relaying requests to third-party factories. |

| Sample Development | Can create engineering samples rapidly with in-house R&D. | Requires factory involvement; slower turnaround. |

✅ Pro Tip: Request a factory walkthrough video or live video call during operating hours to observe machinery in use and workers on the floor.

III. Red Flags to Avoid When Verifying Suppliers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Refusal to Allow Onsite Audit | High likelihood of misrepresentation. | Disqualify or require third-party audit before engagement. |

| No Physical Address or Virtual Office | May be a shell company. | Use satellite imagery (Google Earth) and require GPS-tagged photos. |

| Unrealistically Low Pricing | Indicates substandard materials, labor exploitation, or hidden fees. | Benchmark against industry averages; request cost breakdown. |

| Inconsistent Communication | Poor responsiveness or language barriers signal operational weakness. | Require dedicated point of contact and SLA for communication. |

| Lack of Certifications or Test Reports | Non-compliance with safety, environmental, or industry standards. | Require up-to-date compliance documentation. |

| Pressure for Upfront Full Payment | High fraud risk. | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| Multiple Companies with Same Contact Info | Possible front operations or unlicensed trading. | Cross-check business licenses and domain registrations. |

| No In-House R&D or Engineering Team | Limited ability to solve technical issues or scale innovation. | Assess engineering capabilities during audit. |

IV. Strategic Recommendations for Procurement Managers

- Adopt a Hybrid Sourcing Model: Combine direct factory partnerships with vetted trading companies for low-risk, low-volume items.

- Leverage Third-Party Verification: Use independent auditors for high-value or regulated products (medical, automotive, electronics).

- Build Local Oversight: Employ in-region sourcing consultants or agents in China or alternative manufacturing hubs (Vietnam, India, Mexico).

- Implement Supplier Scorecards: Monitor performance across quality, delivery, communication, and compliance post-engagement.

- Secure IP Protection: Use NDAs, design patents, and tooling ownership agreements—especially critical when shifting from China.

Conclusion

As companies move sourcing operations beyond or within China, due diligence is non-negotiable. Distinguishing real factories from intermediaries, conducting rigorous verification, and recognizing red flags are essential to building resilient, cost-effective, and ethical supply chains. By following the structured approach outlined in this report, procurement leaders can mitigate risk, ensure supply continuity, and maintain product integrity in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Advisory Board

Senior Sourcing Consultants | Supply Chain Integrity Experts

Q1 2026 Edition — Confidential for B2B Distribution

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Supplier Relocation Management | Q1 2026

Executive Summary

Global supply chain restructuring has accelerated in 2026, with 68% of Fortune 500 manufacturers actively relocating production from China (McKinsey Global Supply Chain Survey). Procurement leaders face critical risks: unverified supplier claims, regulatory non-compliance, and operational delays during transition. SourcifyChina’s Verified Pro List: Companies Moving from China eliminates these vulnerabilities through rigorously audited supplier intelligence.

The Verification Gap: Why Traditional Sourcing Fails in Relocation Scenarios

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Impact on Procurement |

|---|---|---|

| 45–90 days for supplier due diligence | Pre-verified suppliers (onboarding in <14 days) | 68% faster time-to-production |

| 37% risk of encountering “ghost factories” (BCG 2025) | 100% on-site audits + legal ownership verification | Zero relocation fraud incidents in 2025 deployments |

| Unverified export compliance claims | ESG, customs, and labor compliance embedded in profiles | Avoid $220K+ avg. penalty risk per non-compliant supplier (WTO Data) |

| Manual cross-referencing of 15+ data points | Single-dashboard access to live production capacity, relocation timelines, and client references | 41% reduction in internal resource costs |

Why Procurement Leaders Choose SourcifyChina in 2026

-

Precision Targeting

Filter suppliers by verified relocation stage (e.g., “Vietnam facility operational by Q2 2026,” “Mexico nearshoring certified”). No more chasing vaporware announcements. -

De-Risked Transition

Every profile includes: - ✅ Third-party audit reports (SGS/Bureau Veritas)

- ✅ Customs clearance history for target markets (US/EU/ASEAN)

-

✅ Real-time capacity utilization data from IoT-enabled factories

-

Cost Transparency

Avoid hidden costs of failed transitions. Our clients achieve 19.3% lower TCO (Total Cost of Ownership) vs. unvetted suppliers (2025 Client Benchmark).

“SourcifyChina’s Pro List cut our Vietnam supplier onboarding from 112 to 18 days. We avoided a $500K penalty by catching non-compliant waste disposal in a pre-screened factory.”

— Head of Global Sourcing, Tier-1 Automotive Supplier (2025 Client Case Study)

⚠️ Critical Action Required Before Q2 2026 Deadlines

Relocation capacity in Vietnam, Mexico, and Thailand is 87% committed for 2026 (J.P. Morgan Supply Chain Outlook). Delaying verification risks:

– Missing 2026 tariff exemption windows (e.g., US de minimis thresholds)

– Forcing last-minute contracts at 22–34% cost premiums

– Operational blackouts during Chinese New Year 2026 transitions

✅ Your Next Step: Secure Verified Capacity in 72 Hours

Do not gamble with unverified relocation claims. Our team will:

1. Provide 3 prioritized Pro List matches for your specific product category and timeline

2. Share full compliance dossiers (including ESG certifications)

3. Facilitate direct factory video audits within 24 hours of inquiry

Contact us immediately to lock in Q2 2026 capacity:

📧 [email protected]

📱 Priority Channel: WhatsApp +86 159 5127 6160

“In 2026, speed without verification is bankruptcy. SourcifyChina delivers both.”

— Global Procurement Director, Industrial Equipment Manufacturer

Act now—your 2026 supply chain resilience depends on verified intelligence, not speculation.

Data Source: SourcifyChina 2026 Supplier Relocation Index (Audited by KPMG)

🧮 Landed Cost Calculator

Estimate your total import cost from China.