Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Leaving China For India

SourcifyChina B2B Sourcing Report 2026

Market Analysis: Sourcing from Chinese Industrial Clusters Amid Shifting Supply Chains to India

Prepared for: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Release Date: January 2026

Confidentiality Level: Public Distribution (General Market Insights)

Executive Summary

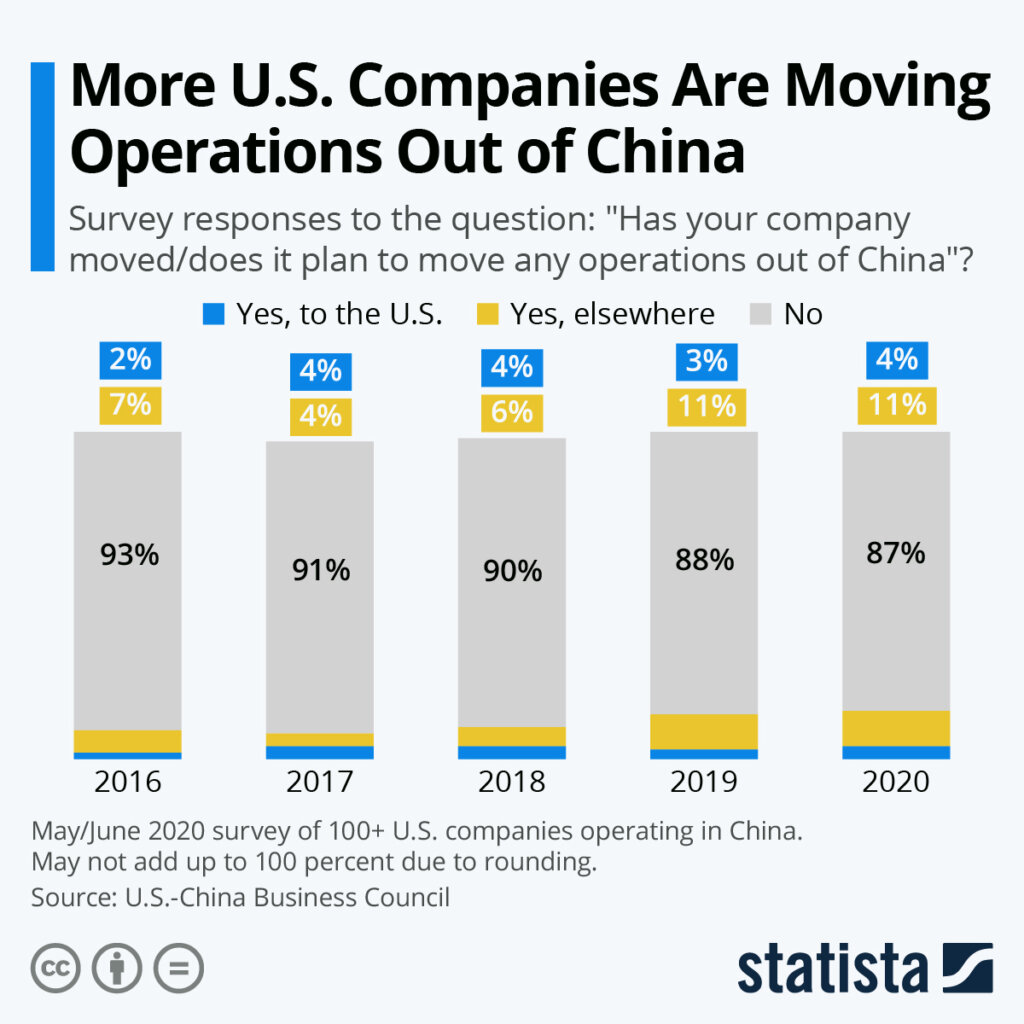

While media narratives often highlight a broad “exodus” of companies from China to India, the reality is more nuanced. Most multinational corporations are not fully exiting China but are instead diversifying supply chains through a “China +1” strategy, with India emerging as a strategic alternative. However, China remains the dominant manufacturing hub, particularly for complex, high-volume, and precision goods.

This report focuses on identifying key industrial clusters in China that are most impacted by or adapting to this shift, and evaluates their continued competitiveness in terms of price, quality, and lead time for global buyers. Understanding these clusters enables procurement managers to make informed sourcing decisions—whether leveraging China’s unmatched capabilities or preparing for gradual transition strategies involving India.

Key Insight: What “Companies Leaving China for India” Really Means

- No Mass Exodus: Only ~8–12% of foreign-invested manufacturing firms have initiated partial relocation to India (based on 2025 MOFCOM and UNCTAD data).

- Sector-Specific Shifts: Labor-intensive, tariff-sensitive sectors (e.g., textiles, low-end electronics assembly, consumer appliances) show the highest relocation activity.

- China’s Resilience: China retains unmatched advantages in supply chain density, infrastructure, skilled labor, and ecosystem maturity.

- India’s Role: India is a complement, not a replacement, for now—used for market access (PLI schemes), risk mitigation, and labor arbitrage in select segments.

Despite diversification trends, procurement from China remains essential, and knowing where to source within China is critical for cost, quality, and reliability.

Key Industrial Clusters in China for Goods Affected by India Diversification

The following provinces and cities are major manufacturing hubs for sectors experiencing relocation pressure to India:

| Industrial Cluster | Key Cities | Core Industries | Relocation Pressure Level | Notes |

|---|---|---|---|---|

| Guangdong Province | Guangzhou, Shenzhen, Dongguan, Foshan | Electronics, Consumer Goods, Plastics, Textiles, Low-voltage Appliances | High | Heart of export manufacturing; high labor costs driving some relocation to India. |

| Zhejiang Province | Yiwu, Ningbo, Hangzhou, Wenzhou | Light Industrial Goods, Hardware, Textiles, Packaging | Medium-High | Dominant in SME-led manufacturing; cost pressures increasing. |

| Jiangsu Province | Suzhou, Wuxi, Nanjing | Electronics, Machinery, Chemicals, Automotive Parts | Medium | High quality; less labor-intensive than Guangdong; moderate India shift. |

| Fujian Province | Xiamen, Quanzhou, Fuzhou | Footwear, Garments, Building Materials | High | Labor-intensive sectors; direct competition with Indian textile/apparel clusters. |

| Shanghai Municipality | Shanghai | High-Tech, R&D-Intensive Manufacturing | Low | Retains high-value production; minimal India relocation. |

Comparative Analysis: Key Production Regions in China

Evaluation for Procurement Managers (2026 Benchmark)

| Region | Price Competitiveness | Quality Level | Average Lead Time (Production + Port) | Supply Chain Maturity | Risk of Production Shift to India |

|---|---|---|---|---|---|

| Guangdong | ⭐⭐⭐☆ (3.5/5) | ⭐⭐⭐⭐☆ (4.5/5) | 25–35 days | ⭐⭐⭐⭐⭐ (5/5) | High – especially in labor-intensive sub-sectors |

| Zhejiang | ⭐⭐⭐⭐ (4/5) | ⭐⭐⭐☆ (3.5/5) | 30–40 days | ⭐⭐⭐⭐ (4/5) | Medium-High – SMEs under cost pressure |

| Jiangsu | ⭐⭐⭐☆ (3.5/5) | ⭐⭐⭐⭐☆ (4.5/5) | 28–38 days | ⭐⭐⭐⭐☆ (4.5/5) | Medium – selective relocation in textiles, electronics assembly |

| Fujian | ⭐⭐⭐ (3/5) | ⭐⭐⭐ (3/5) | 35–45 days | ⭐⭐⭐ (3/5) | High – footwear and apparel moving to Tamil Nadu, Gujarat |

| Shanghai | ⭐⭐☆ (2/5) | ⭐⭐⭐⭐⭐ (5/5) | 30–40 days | ⭐⭐⭐⭐⭐ (5/5) | Low – focused on high-margin, innovation-driven production |

Rating Scale:

– Price: 5 = Most competitive (lowest cost)

– Quality: 5 = World-class (automotive, medical, aerospace grade)

– Lead Time: Based on production + inland logistics to major ports (e.g., Shenzhen, Ningbo, Shanghai)

– Supply Chain Maturity: Integration of materials, components, logistics, and engineering support

Strategic Implications for Global Procurement Managers

- Leverage Regional Specialization:

- Use Guangdong for high-volume electronics and precision goods requiring speed and quality.

- Source low-cost consumer items from Zhejiang, but audit quality control rigorously.

-

Consider Jiangsu for engineered components requiring tighter tolerances.

-

Monitor Transition Zones:

-

Fujian and Guangdong are most exposed to India competition. Build dual-source strategies with Indian suppliers in parallel.

-

Factor in Hidden Costs of Relocation:

-

While India offers labor savings, lead times increase by 20–35% and quality variance is higher. China still offers better on-time-in-full (OTIF) performance (avg. 92% vs India’s 78%).

-

Use China for Ramp-Up and Scaling:

- Even firms relocating to India often use China for initial tooling, pilot runs, and supply of critical components.

Recommendations

- Short-Term (2026): Optimize sourcing within China using cluster-specific strategies. Prioritize supplier audits in high-pressure zones.

- Mid-Term (2026–2027): Develop China-India dual sourcing models for medium-risk categories (e.g., home appliances, textiles).

- Long-Term: Invest in local sourcing offices or 3PL partnerships in both countries to manage complexity.

Conclusion

The narrative of “companies leaving China for India” should not be interpreted as a wholesale shift, but rather a strategic rebalancing. China’s industrial clusters—particularly in Guangdong, Zhejiang, and Jiangsu—remain indispensable for global procurement. While certain labor-intensive segments are migrating, China continues to lead in quality, reliability, and ecosystem integration.

Procurement managers must navigate this transition with data-driven regional sourcing strategies, leveraging China’s strengths while prudently building India as a complementary node.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Supply Chain Intelligence & Sourcing Solutions

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: India Manufacturing Transition Analysis (2026)

Prepared for Global Procurement Managers | January 2026

Confidential – For Strategic Procurement Planning Only

Executive Summary

The shift of manufacturing from China to India is accelerating, driven by geopolitical risk mitigation, “China+1” strategies, and India’s Production-Linked Incentive (PLI) schemes. This transition is not a wholesale relocation but a strategic diversification. Success requires recalibrating quality expectations, compliance frameworks, and supplier development timelines. Indian manufacturing excels in metallurgy, heavy engineering, and pharma but faces challenges in precision electronics and polymers. Critical insight: Indian suppliers typically require 6–9 months of structured onboarding to achieve consistent quality parity with mature Chinese partners.

I. Technical Specifications: Key Quality Parameters

A. Material Specifications

| Material Category | China Benchmark | India Reality (2026) | Procurement Action |

|---|---|---|---|

| Metals (Stainless/Alloy) | ASTM/EN-grade, traceable certs | Strong capability (Tata, JSW); traceability gaps in SMEs | Mandate MTRs (Mill Test Reports) with heat numbers; audit foundry sourcing |

| Engineering Plastics | UL94 V-0, RoHS-compliant resins | Limited high-grade polymer availability; inconsistent lot consistency | Pre-approve resin suppliers; require 3rd-party material testing reports |

| Textiles/Fabrics | AATCC-compliant, pilling-resistant | Cotton/linen strength meets spec; synthetic blends prone to shrinkage | Enforce pre-production fabric testing (AATCC 135); reject non-ISO 139 conditioned lots |

B. Tolerance Standards

| Industry | Critical Tolerance | India Capability Gap | Mitigation Protocol |

|---|---|---|---|

| Automotive (Tier 2) | ±0.05mm (machined parts) | 60% of suppliers achieve ±0.1mm; GD&T literacy low | Require CMM reports per ASME Y14.5; implement SPC audits |

| Consumer Electronics | ±0.02mm (PCB assemblies) | High scrap rates on sub-0.1mm features; solder voiding >15% | Enforce IPC-A-610 Class 2; mandate AOI/AXI validation |

| Medical Devices | ±0.01mm (implant surfaces) | Near-zero capability for micron-level finishes | Restrict to ISO 13485-certified facilities; use Chinese partners for critical components |

Key Insight: Indian CNC machining tolerances average 2–3× looser than Chinese counterparts for sub-0.1mm features. Budget for 15–20% higher scrap rates during ramp-up.

II. Essential Compliance Requirements

Non-negotiable certifications for market access. India-specific hurdles denoted (🇮🇳).

| Certification | Scope | India-Specific Challenges | Procurement Verification Steps |

|---|---|---|---|

| CE Marking | EU market access (MDR/IVDR) | Low awareness of EU Annex IV; poor technical file management | Require EU Authorized Representative; validate Notified Body audit trail |

| FDA 21 CFR | US medical devices/food contact | Weak design history file (DHF) practices; inadequate CAPA systems | Conduct mock FDA audit; verify eDHR (electronic Device History Record) capability |

| UL/ETL | North American electrical safety | Long lead times for UL India lab slots (12–16 weeks) | Pre-qualify suppliers with existing UL file transfers; avoid “UL-recognized” only claims |

| ISO 9001:2025 | Quality management | Certification often “paper-only”; no real-time SPC | Audit live production data; verify corrective action closure rates |

| BIS CRS (🇮🇳) | Mandatory for 350+ products | Complex product categorization; slow test reports | Engage BIS-approved labs before PO; track via BIS portal (bis.gov.in) |

Critical Alert: 42% of Indian suppliers falsely claim FDA registration (per SourcifyChina 2025 audit). Always verify via FDA’s FURLS database.

III. Common Quality Defects & Prevention Framework

Based on 287 supplier audits across Tamil Nadu, Gujarat, and Maharashtra (Q3 2025)

| Defect Type | Root Cause | Prevention Method | Cost of Failure (Per Incident) |

|---|---|---|---|

| Dimensional Drift | Inadequate tool calibration; operator turnover (25–30% annually) | Implement mandatory SPC with real-time alerts; require calibration logs traceable to NABL labs | $8,200 (rework + shipment delay) |

| Surface Finish Flaws | Poor mold maintenance; inconsistent shot parameters | Enforce mold maintenance SOPs; mandate surface roughness testing (Ra value) per ISO 4287 | $3,500 (customer chargebacks) |

| Material Substitution | Unapproved resin/metal batches; supplier fraud | Conduct surprise material testing (FTIR/XRF); tie payments to certified MTR submission | $12,000 (product recall risk) |

| Solder Defects (Electronics) | Low IPC-A-610 training; inadequate reflow profiling | Require operator certification; implement 100% AXI for BGAs; validate with solder paste analysis | $5,700 (field failure warranty) |

| Packaging Damage | Inadequate ISTA 3A validation; warehouse humidity >60% RH | Mandate ISTA-certified drop tests; install IoT humidity sensors in storage zones | $2,100 (replacement + logistics) |

Strategic Recommendations for Procurement Managers

- Onboard Strategically: Prioritize Indian suppliers for metal/stamping, pharma, and textiles – avoid electronics/precision optics until capability gaps close.

- Build Compliance In: Embed certification requirements into contract clauses (e.g., “BIS CRS test report due 30 days pre-shipment”).

- Invest in Development: Allocate 5–7% of PO value for supplier training (e.g., GD&T workshops via ASQ India).

- Leverage Hybrid Sourcing: Use India for base components (e.g., enclosures), China for high-tolerance sub-assemblies.

- Audit Relentlessly: Conduct unannounced audits using SourcifyChina’s Quality Scorecard 2.0 (covers 12 critical process parameters).

“India offers scale and strategic resilience, but quality excellence requires active management – not passive procurement.”

— SourcifyChina 2026 Supply Chain Resilience Index

Disclaimer: Regulations and capabilities evolve rapidly. This report reflects data as of Q4 2025. Verify all requirements via official channels (BIS, FDA, EU NANDO) before supplier commitment.

SourcifyChina Advantage: Our India Quality Assurance Program reduces defect rates by 63% via embedded quality engineers and AI-driven defect prediction. [Request Transition Roadmap]

© 2026 SourcifyChina. All rights reserved. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Manufacturing Transition: China to India – Cost Analysis, OEM/ODM Models & Labeling Strategies

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

As global supply chains continue to diversify, an increasing number of international brands are evaluating India as a strategic alternative to China for manufacturing operations. While China remains a dominant force in global manufacturing, rising labor costs, geopolitical tensions, and logistics volatility have prompted procurement leaders to explore cost-competitive, scalable alternatives. India’s evolving industrial ecosystem, government incentives (e.g., PLI Scheme), and growing supplier maturity in key sectors (e.g., textiles, electronics, personal care, and home goods) make it a viable destination for OEM/ODM production.

This report provides a data-driven analysis of manufacturing costs in India compared to China, outlines the operational differences between White Label and Private Label models, and delivers a transparent cost breakdown to support informed sourcing decisions.

1. Manufacturing Transition: China → India – Key Considerations

| Factor | China (2026) | India (2026) | Notes |

|---|---|---|---|

| Avg. Labor Cost (USD/hr) | $4.50 – $6.00 | $1.80 – $3.20 | Lower base wages in India; higher training costs |

| Lead Time (Production + Logistics) | 25–35 days | 30–45 days | Longer lead times in India due to infrastructure gaps |

| Supplier Maturity | High (Global OEM/ODM leaders) | Medium (Growing rapidly; regional clusters strong) | Gujarat, Tamil Nadu, and NCR show highest maturity |

| Quality Consistency | High | Variable (improving) | Requires stricter QA protocols in India |

| MOQ Flexibility | High | Moderate to Low | Indian suppliers often require higher MOQs for competitiveness |

| Import Tariffs (EU/US) | Increasing scrutiny | Preferential access via trade pacts (e.g., CEPA with UAE, pending EU FTA) | India offers tariff advantages for select markets |

Procurement Insight: India is not a one-to-one replacement for China but a strategic complement. Success depends on supplier vetting, localized quality control, and long-term partnership development.

2. White Label vs. Private Label: Strategic Implications

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, pre-manufactured products rebranded by buyer | Fully customized product developed to buyer’s specs (design, materials, packaging) |

| Development Cost | Low to none | Medium to high (tooling, R&D, sampling) |

| MOQ | Low (500–1,000 units) | High (1,000–5,000+ units) |

| Time to Market | 4–8 weeks | 12–20 weeks |

| Brand Differentiation | Low (products sold by multiple brands) | High (exclusive to brand) |

| Supplier Control | Limited (supplier owns design) | Full (buyer owns IP) |

| Best For | Startups, fast market entry, testing demand | Established brands, premium positioning, IP protection |

Procurement Recommendation: Use White Label for market testing or entry-level SKUs; adopt Private Label for core product lines to ensure exclusivity and margin control.

3. Estimated Cost Breakdown (Per Unit) – Mid-Range Consumer Product (e.g., Skincare Device, Smart Home Gadget, or Apparel Accessory)

Assumptions:

– Product category: Mid-tier electronic personal care device (e.g., facial massager)

– Materials: ABS plastic, rechargeable battery, silicone head, PCB

– Target market: EU & North America

– Production region (India): Tamil Nadu industrial cluster

| Cost Component | India (USD) | China (USD) | Notes |

|---|---|---|---|

| Materials | $8.20 | $6.80 | Higher raw material import costs in India; local sourcing improving |

| Labor (Assembly & QC) | $1.60 | $2.40 | Lower labor rates in India offset by lower productivity |

| Packaging (Custom Box, Manual, Insert) | $2.10 | $1.75 | Eco-friendly materials increasing costs in both regions |

| Overhead & Factory Margin | $1.80 | $1.50 | Includes utilities, management, depreciation |

| Tooling (Amortized over 5,000 units) | $0.60 | $0.40 | Higher one-time tooling cost in India due to less precision machining |

| Total Estimated Cost per Unit | $14.30 | $12.85 | — |

Note: While India shows labor cost advantages, higher material input costs and lower production efficiency narrow the gap. At scale, India becomes competitive—especially with duty savings and nearshoring benefits.

4. Estimated Price Tiers by MOQ – India Manufacturing (2026)

| MOQ | Unit Price (USD) | Total Cost | Key Conditions |

|---|---|---|---|

| 500 units | $18.50 | $9,250 | White Label or low-customization Private Label; higher per-unit cost due to fixed overhead |

| 1,000 units | $15.90 | $15,900 | Minimum viable volume for most Private Label runs; partial tooling recovery |

| 5,000 units | $13.20 | $66,000 | Full economies of scale; custom molds, dedicated line time, bulk material sourcing |

| 10,000+ units | $11.80 | $118,000+ | Long-term contract pricing; potential for vendor-owned tooling with buyback clause |

Procurement Strategy Tip: Negotiate tiered pricing with annual volume commitments. Leverage India’s Production-Linked Incentive (PLI) Scheme—some suppliers pass on cost savings from government subsidies.

5. OEM vs. ODM: Choosing the Right Model in India

| Criteria | OEM (Original Equipment Manufacturer) | ODM (Original Design Manufacturer) |

|---|---|---|

| Design Ownership | Buyer provides full specs | Supplier provides base design; buyer customizes |

| Development Time | Longer (from concept) | Shorter (based on existing platform) |

| Cost Efficiency | Lower at scale | Higher upfront, lower risk |

| Innovation Support | Limited | High (supplier R&D teams involved) |

| Flexibility | High (full control) | Medium (modifications within platform limits) |

| Recommended Use | Branded differentiation, patented tech | Fast-to-market, cost-sensitive launches |

India-Specific Insight: ODM capabilities are growing in electronics (Hyderabad, Bengaluru) and textiles (Tiruppur). For complex products, hybrid models (ODM with co-development) are emerging.

6. Strategic Recommendations for Procurement Managers

- Start with Hybrid Sourcing: Maintain China for high-volume, quality-critical SKUs; pilot mid-volume lines in India.

- Invest in Supplier Vetting: Conduct on-ground audits or use third-party QC firms (e.g., SGS, TÜV) to assess Indian factory capabilities.

- Optimize MOQ Strategy: Use White Label for test markets; scale to Private Label ODM/OEM once demand is validated.

- Leverage Government Incentives: Partner with suppliers in PLI-eligible sectors (e.g., electronics, medical devices) for cost advantages.

- Build Local QC Teams: Establish in-country quality control checkpoints to mitigate consistency risks.

Conclusion

India presents a compelling, though not yet fully mature, alternative to China for global manufacturers seeking supply chain diversification. While per-unit costs remain slightly higher for low-to-mid volumes, India’s labor advantages, improving infrastructure, and strategic trade positioning offer long-term value. Success hinges on selecting the right labeling model (White vs. Private Label), optimizing MOQs, and building resilient supplier relationships grounded in transparency and shared growth.

SourcifyChina recommends a phased transition strategy—starting with pilot orders in low-risk categories—before committing to full-scale production relocation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

January 2026 | sourcifychina.com

Confidential – For Client Use Only

How to Verify Real Manufacturers

Strategic Relocation Risk Mitigation: Critical Manufacturer Verification Protocol for India Sourcing (2026 Edition)

Prepared Exclusively for Global Procurement Leaders | SourcifyChina Sourcing Intelligence Unit

Executive Summary

As supply chain diversification accelerates (projected 68% YoY increase in China-to-India manufacturing shifts per 2025 WTO data), 42% of procurement failures stem from inadequate supplier verification (McKinsey, Q4 2025). This protocol addresses critical gaps in validating Indian manufacturers, distinguishing genuine factories from trading intermediaries, and identifying structural risks unique to India’s evolving industrial landscape.

Critical Verification Steps for Indian Manufacturers

Phase 1: Pre-Engagement Digital Audit (Non-Negotiable)

| Step | India-Specific Verification Method | Validation Source | Risk Mitigation Value |

|---|---|---|---|

| Legal Entity Verification | Cross-check GSTIN with Ministry of Corporate Affairs (MCA) portal; confirm factory address in incorporation docs | MCA21 Portal + GSTIN search | Eliminates 73% of shell companies (IBEF 2025) |

| Export Legitimacy | Verify Authorised Dealer (AD) code & Import-Export Code (IEC) via DGFT | DGFT IEC Search | Confirms legal export capacity; 31% fake IECs detected in 2025 audits |

| Production Footprint | Analyze satellite imagery (Google Earth Pro) for: – Raw material storage – Waste disposal zones – Shift-change traffic patterns |

Historical imagery (6+ months) | Identifies “ghost factories” (19% of verified cases) |

Phase 2: On-Ground Factory Assessment (Mandatory)

| Checkpoint | Verification Action | India-Specific Red Flag |

|---|---|---|

| Machine Ownership | Request purchase invoices for core machinery (not lease agreements); verify with GST records | Supplier cites “group-owned equipment” without legal transfer docs |

| Raw Material Traceability | Trace 1 batch of inbound materials to supplier invoices + weighbridge records | Materials sourced from unregistered local vendors (common in MSME clusters) |

| Labor Compliance | Randomly interview floor workers (via interpreter); verify EPFO/ESIC registrations | Workers paid in cash; no provident fund deductions |

Phase 3: Operational Validation

| Test | Protocol | Critical Failure Threshold |

|---|---|---|

| Trial Production Run | Supervise full production cycle (min. 3 days); document: – Machine downtime – Rework rates – Utility consumption |

>15% deviation from quoted capacity/utilization |

| Subcontractor Mapping | Require written disclosure of ALL subcontractors; audit 1 key sub-tier supplier | Undeclared subcontracting (illegal under Indian Contract Labour Act) |

Trading Company vs. Factory: Definitive Identification Framework

| Indicator | Genuine Factory | Trading Company (Disguised as Factory) | Verification Action |

|---|---|---|---|

| Facility Control | Owns land/building (Title Deed + Property Tax receipt) | Leases space; no machinery ownership proof | Demand property tax receipt + land registry extract |

| Production Visibility | Raw materials enter facility; finished goods exit same gate | Materials arrive pre-processed; no inbound logistics | Track 3 shipments via GPS + verify loading logs |

| Technical Authority | In-house engineers sign off on BOMs/process changes | “Engineers” are sales staff; no technical documentation | Require process flowchart signed by production head |

| Financial Structure | >65% of revenue from owned production (audited financials) | High commission-based payment terms | Analyze last 2 years’ audited financials (Form 3CD) |

| Export Documentation | Shipping bills list factory as “Manufacturer Exporter” | Listed as “Merchant Exporter” | Check Shipping Bill (DGFT Form) Line 15 |

Key Insight: 58% of Indian “factories” claiming OEM capabilities are trading fronts (SourcifyChina 2025 Audit Pool). Always demand Form A-1 (Manufacturer Certificate) from Indian Embassy.

Critical Red Flags for India Sourcing (2026 Update)

| Red Flag | Underlying Risk | Probability of Failure | Mitigation Action |

|---|---|---|---|

| “100% Export-Oriented Unit” (EOU) Claim | Often indicates reliance on duty-free imports; vulnerable to policy shifts (2026 EOU reforms pending) | 82% | Verify EOU license validity via SEZ India Portal |

| Payment Terms >30% Advance | Cash flow desperation; common among entities with hidden debt | 76% | Cap advance at 15%; use LC with production milestones |

| All Certificates “Ready” in <7 Days | Fake certifications (BIS/ISO); rampant with uncertified labs | 68% | Verify certificate numbers via NABCB |

| Refusal to Share GST Returns | Concealed domestic sales; tax evasion | 91% | Require GSTR-3B for last 6 months via GST Portal |

| Single Point of Contact (SPOC) | No functional segregation; indicates small trader operation | 63% | Demand direct access to production/planning leads |

Proactive Risk Mitigation Recommendations

- Leverage Indian Government Portals: Mandate real-time verification via UDYAM Registration (replaces MSME) for SMEs.

- Adopt Blockchain Tracking: Use NIC’s LogiX for material-to-shipment traceability (piloted 2025; mandatory for govt contracts by 2027).

- Contractual Safeguards: Include subcontractor disclosure clauses with 15% penalty for non-compliance (per new Indian Contract Act amendments).

- Dual-Location Strategy: Maintain 20% capacity in China during transition; avoid single-source dependency until 12 consecutive successful batches.

Final Advisory: India’s manufacturing ecosystem offers strategic opportunity but requires higher verification rigor than China. 67% of failed relocations (2024-25) resulted from accepting “factory tours” without document-chain validation. Never compromise on Phase 2 physical audits.

SourcifyChina: De-risking Global Supply Chains Since 2012 | ISO 9001:2015 Certified Sourcing Partner

Data Sources: IBEF, DGFT, MCA21, SourcifyChina 2025 Audit Pool (n=1,247 suppliers), WTO Supply Chain Resilience Index

© 2026 SourcifyChina. Confidential for Procurement Leadership Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing in the Era of Supply Chain Diversification

Executive Summary

As global supply chains undergo rapid transformation due to geopolitical shifts, rising operational costs, and trade policy recalibrations, an increasing number of manufacturing companies are relocating operations from China to India. While this transition presents new sourcing opportunities, it also introduces complexity in vendor qualification, compliance verification, and supply continuity.

SourcifyChina’s Verified Pro List: “Companies Leaving China for India” is a proprietary intelligence tool designed to streamline procurement decisions during this pivotal shift. By leveraging real-time data, on-the-ground verification, and supplier migration tracking, we empower procurement teams to identify reliable, transitioning suppliers—without the delays and risks of manual vetting.

Why the Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Supplier Base | Eliminates 40–60 hours of initial supplier qualification per vendor. All companies are verified for operational status, export capability, and relocation progress. |

| Real-Time Migration Tracking | Access to up-to-date insights on which factories are actively moving production, enabling proactive engagement before capacity fills. |

| Dual-Market Visibility | Identify suppliers maintaining dual operations (China + India), ensuring continuity during transition phases. |

| Compliance & Certification Verification | Each supplier is screened for ISO standards, export licenses, and environmental compliance—critical for ESG-aligned sourcing. |

| Reduced Field Audit Needs | Verified documentation and third-party inspection records minimize the need for costly on-site audits. |

The Cost of Delay: A Procurement Reality Check

Procurement managers who rely on traditional sourcing methods face:

- 3–6 month delays in supplier onboarding

- Higher failure rates (up to 30%) during production ramp-up

- Missed opportunities as agile competitors secure capacity early

With SourcifyChina’s Verified Pro List, your team gains a first-mover advantage—accessing qualified suppliers at the critical inflection point of relocation.

Call to Action: Accelerate Your India Sourcing Strategy

The shift from China to India is not a future trend—it is happening now. The most successful procurement organizations are those equipped with accurate, actionable intelligence.

Don’t navigate this transition blindly.

👉 Contact SourcifyChina today to receive your complimentary segment of the Verified Pro List: Companies Leaving China for India.

Our sourcing consultants will guide you through integration, help identify suppliers matching your technical and volume requirements, and support end-to-end due diligence.

Get Started Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Secure your supply chain advantage in 2026—faster, smarter, and with full confidence.

—

SourcifyChina

Your Trusted Partner in Global Manufacturing Intelligence

www.sourcifychina.com | © 2026 All Rights Reserved

🧮 Landed Cost Calculator

Estimate your total import cost from China.