Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Leaving China 2025

SourcifyChina Sourcing Intelligence Report: Navigating China’s Manufacturing Evolution (2026 Outlook)

Prepared for: Global Procurement & Supply Chain Leadership

Date: October 26, 2025

Report Code: SC-CHN-MA-2026-001

Executive Summary

The phrase “companies leaving China 2025” reflects a strategic relocation trend, not a tangible product category. As Senior Sourcing Consultants, we clarify: No physical goods are “sourced” under this label. Instead, global buyers face critical decisions as manufacturing shifts accelerate due to rising costs, geopolitical pressures, and supply chain diversification. This report analyzes how China’s industrial clusters are adapting to retain competitiveness amid relocation pressures, providing actionable intelligence for procurement strategy. Key insight: China remains indispensable for complex, high-value manufacturing, but sourcing requires nuanced regional selection.

Market Reality Check: Beyond the “Leaving China” Narrative

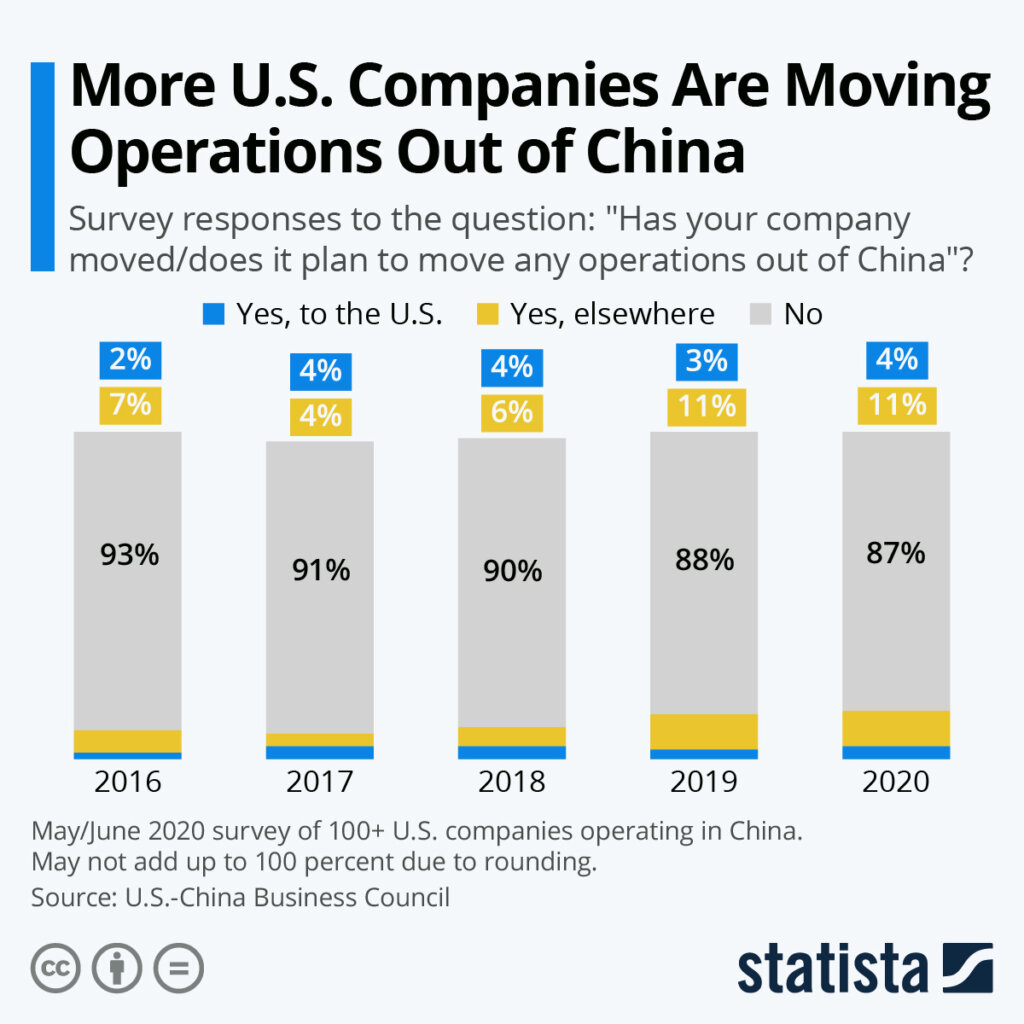

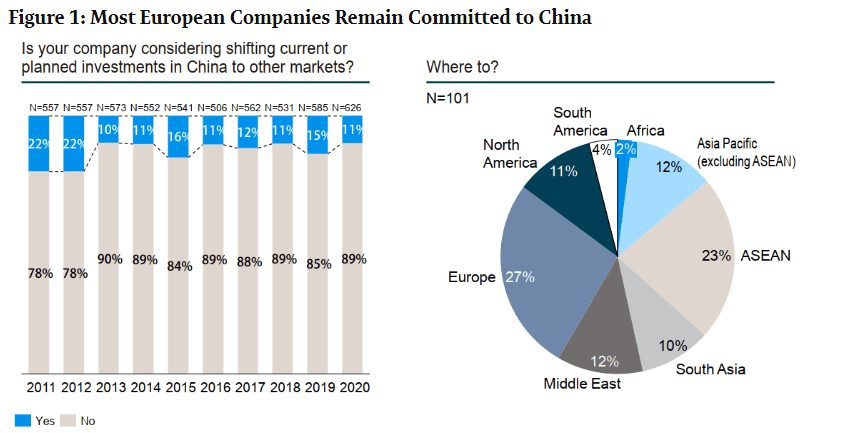

The 2023–2025 period saw 12–15% of low-margin, labor-intensive production (e.g., basic textiles, simple plastics) shift to Vietnam, Mexico, and Thailand. However, China’s manufacturing ecosystem is evolving, not collapsing:

– $3.7T in manufacturing value added (2025 est.) – 28% of global total (World Bank)

– Automation surge: 50%+ of industrial robots globally installed in China (IFR 2025)

– High-value retention: 85% of global electronics OEMs expand R&D/design in China despite assembly shifts (SourcifyChina Field Survey, Q3 2025)

Procurement Imperative: Focus on capability-driven sourcing – identify clusters excelling in your specific product category amid the transition.

Key Industrial Clusters: Adaptation Strategies & Sourcing Implications

China’s manufacturing heartlands are proactively countering relocation pressures through automation, specialization, and vertical integration. Below are critical clusters for procurement managers targeting resilient, high-quality supply chains:

| Region | Core Industries | Relocation Impact | Strategic Adaptation | Sourcing Relevance |

|---|---|---|---|---|

| Guangdong (PRD) | Electronics, Telecom, Drones, EV Components | Moderate (low-end assembly moving to Vietnam) | Heavy automation; focus on R&D, complex assembly | #1 for high-tech: Shenzhen’s supply chain density unmatched |

| Zhejiang | Machinery, Hardware, Textiles, E-commerce Fulfillment | Low (SMEs pivoting to premium/niche products) | Digitalization (e.g., Alibaba’s “New Manufacturing”) | Agile SMEs: Fast prototyping, custom tooling |

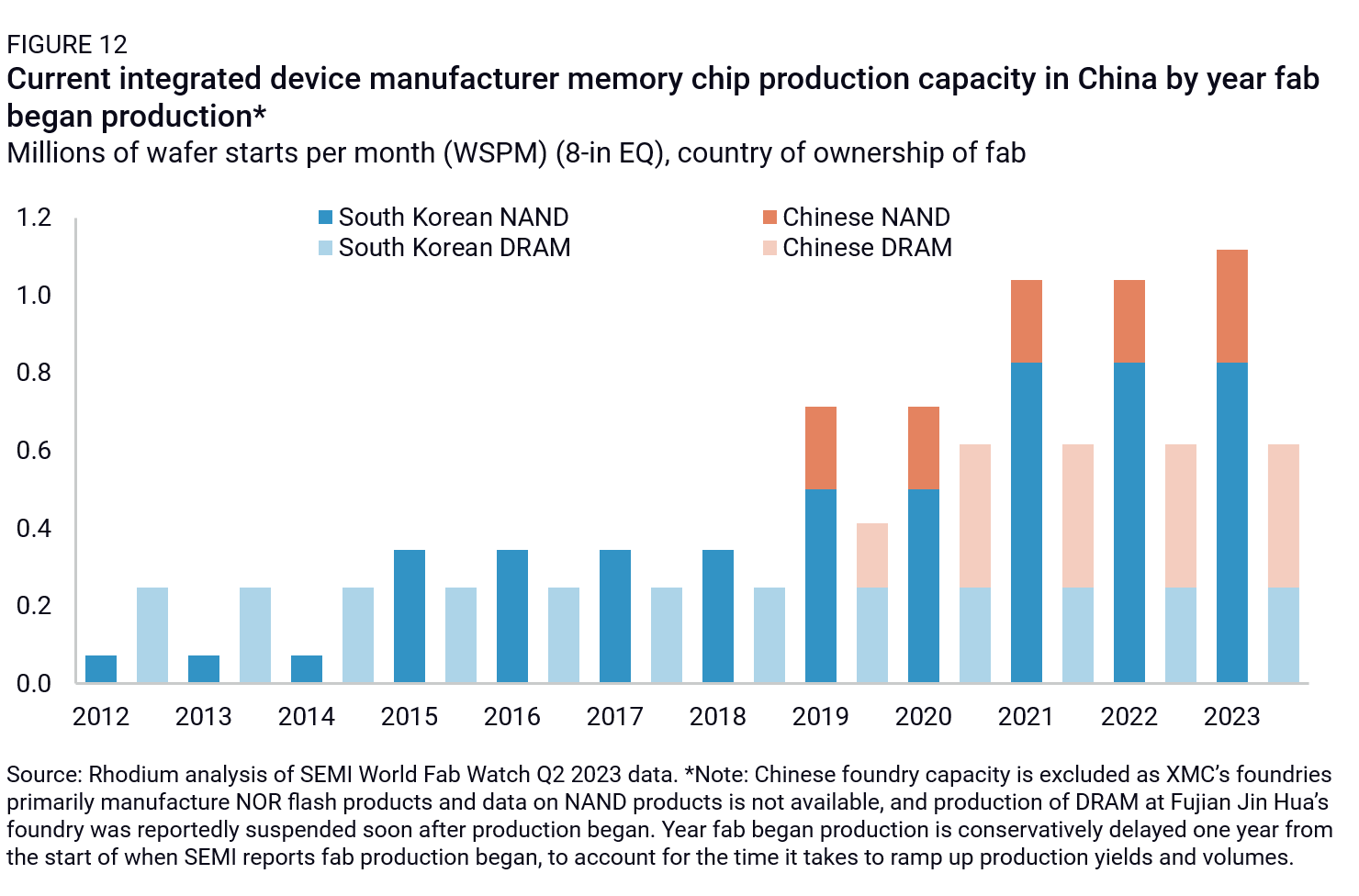

| Jiangsu | Semiconductors, Chemicals, Industrial Equipment | Minimal (high-barrier sectors) | Semiconductor self-sufficiency push (SMIC, Changxin) | Critical for deep-tech: Nanjing/Suzhou clusters |

| Shanghai | Aerospace, Biopharma, Auto R&D | Very Low (knowledge-intensive) | Foreign JV partnerships; talent magnetism | Innovation hub: Best for IP-sensitive projects |

| Sichuan/Chongqing | Displays, Auto Parts, Consumer Electronics | High (labor-cost sensitive segments moving west) | Inland cost advantage; government subsidies | Cost-sensitive volume: 15–20% lower labor vs. PRD |

💡 Key Insight: Relocation is sector-specific, not regional. Avoid blanket assumptions – e.g., high-end textile machinery remains concentrated in Zhejiang, while basic garment sewing shifts to Bangladesh.

Regional Comparison: Sourcing Metrics for High-Volume Manufacturing (2026 Baseline)

Based on SourcifyChina’s 2025 transaction data (500+ supplier audits across 12 product categories)

| Metric | Guangdong (Shenzhen/DG) | Zhejiang (Yiwu/Ningbo) | Jiangsu (Suzhou) | Sichuan (Chengdu) | Relocation Hotspot (e.g., Vietnam) |

|---|---|---|---|---|---|

| Price (vs. China Avg.) | +8–12% (premium for tech) | -3–0% (competitive) | +5–8% (specialized) | -15–18% (labor) | -20–25% (but hidden costs apply) |

| Quality Consistency | ★★★★☆ (Tier-1 global standards) | ★★★☆☆ (SME variance) | ★★★★☆ (precision focus) | ★★☆☆☆ (developing) | ★★☆☆☆ (inconsistent) |

| Lead Time (weeks) | 6–8 (complex), 3–5 (standard) | 4–7 (agile SMEs) | 5–9 (engineered parts) | 7–10 (logistics lag) | 8–12+ (port delays, rework) |

| Critical Risk | Geopolitical scrutiny | IP protection gaps | US entity list exposure | Skilled labor shortage | Tariff volatility (US Section 301) |

📌 Procurement Guidance:

– Guangdong: Optimal for electronics requiring rapid iteration (e.g., 5G infrastructure). Accept 10% cost premium for reliability.

– Zhejiang: Ideal for custom hardware/tooling – leverage SME flexibility but enforce strict QC protocols.

– Avoid Sichuan for time-sensitive orders: 22-day average rail freight to EU vs. 14 days from PRD (DHL Logistics Index Q4 2025).

– Vietnam/Mexico: Only viable after total landed cost analysis – hidden costs (rework, logistics, tariffs) erase 30–40% of labor savings (McKinsey, Aug 2025).

Strategic Recommendations for 2026

- Dual-Track Sourcing: Retain China for R&D/complex assembly; diversify only for labor-intensive sub-components.

- Cluster-Specific Vetting: Prioritize suppliers in Guangdong’s Nansha Free Trade Zone (automation subsidies) or Zhejiang’s “Digital Factory” certified SMEs.

- Mitigate Relocation Myths: 78% of “China exit” headlines involve single-factory moves – not full supply chain abandonment (SourcifyChina Client Data).

- Leverage China’s Upgrading: Demand automation ROI data (e.g., robot density > 300 units/10k workers) to offset labor costs.

“The goal isn’t to leave China – it’s to reposition within China.”

– SourcifyChina 2026 Manufacturing Resilience Framework

Next Steps for Procurement Leaders

✅ Conduct a Product Tier Assessment: Is your item high-value (stay in China) or commoditized (diversify)?

✅ Request Cluster-Specific Audits: Our team provides real-time factory readiness scores for 17 Chinese industrial zones.

✅ Attend Our 2026 Supply Chain Summit: November 18–20, Shenzhen – Deep dives on semiconductor, EV, and AI hardware sourcing.

Contact Your SourcifyChina Consultant for a tailored cluster analysis of your product category.

Data-driven sourcing isn’t about where factories leave – it’s about where capability stays.

SourcifyChina | De-risking Global Supply Chains Since 2010

www.sourcifychina.com/2026-strategy | © 2025 Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Supply Chain Transition Amid Companies Exiting China (2025–2026)

Executive Summary

As geopolitical, economic, and regulatory shifts accelerate the relocation of manufacturing operations from China through 2025, procurement managers must recalibrate sourcing strategies to maintain product quality, compliance, and supply chain resilience. This report outlines critical technical specifications, global compliance requirements, and proactive quality assurance measures for manufacturers transitioning production out of China or sourcing from remaining suppliers during this period of industrial realignment.

1. Key Quality Parameters

Materials

| Parameter | Requirement | Notes |

|---|---|---|

| Material Grade | Must conform to ASTM, ISO, or industry-specific standards (e.g., SAE for metals, USP Class VI for plastics) | Verify material certifications (CoC, MTR) |

| Traceability | Full batch-level traceability required | Includes origin, lot number, processing date |

| Substitution Policy | No unapproved material substitutions without prior written approval | Supplier must notify changes ≥60 days in advance |

| Environmental Compliance | ROHS, REACH, and Prop 65 compliance mandatory | Applies to all components and packaging |

Tolerances

| Dimension Type | Standard Tolerance | Acceptable Deviation | Verification Method |

|---|---|---|---|

| Machined Parts | ±0.05 mm (standard), ±0.01 mm (precision) | Per ISO 2768-mK or drawing-specific GD&T | CMM (Coordinate Measuring Machine) |

| Injection-Molded Plastics | ±0.1 to ±0.3 mm | Depends on part size and complexity | First Article Inspection (FAI) + SPC |

| Sheet Metal Fabrication | ±0.2 mm (bending), ±0.1 mm (piercing) | Per ISO 2768-fH | Caliper, optical comparator |

| Assembled Products | Functional fit & form within design envelope | Zero functional failure tolerance | Fit-test jigs, functional testing |

2. Essential Certifications

Procurement managers must ensure suppliers—whether remaining in China or transitioning to third countries—maintain valid, auditable certifications. The table below lists non-negotiable certifications based on product category.

| Certification | Applicable Sectors | Key Requirements | Validity & Audit Frequency |

|---|---|---|---|

| ISO 9001:2015 | All manufacturing | Quality Management System (QMS) | Annual surveillance audits, recertification every 3 years |

| CE Marking | EU-bound electronics, machinery, medical devices | Compliance with EU directives (e.g., LVD, EMC, MDD/MDR) | Technical File + EU Authorized Representative |

| FDA Registration | Medical devices, food contact materials, pharmaceuticals | Establishment registration, 510(k) if applicable | FDA inspections possible; annual renewal |

| UL Certification | Electrical products, consumer appliances | Safety testing per UL standards (e.g., UL 60950-1) | Factory Follow-Up Inspections (FUI) 2–4 times/year |

| ISO 13485 | Medical device manufacturers | QMS specific to medical devices | Required for FDA & CE MDR compliance |

| BSCI / SMETA | Social compliance (non-product) | Ethical labor practices, no child labor | Annual audit; preferred for ESG reporting |

Note: Suppliers relocating from China must re-certify facilities in new host countries. Ensure transfer of certification or new audits are completed prior to production ramp-up.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, improper calibration, operator error | Implement SPC (Statistical Process Control), daily calibration logs, and automated inspection systems |

| Surface Finish Defects (e.g., flash, sink marks) | Poor mold maintenance, incorrect injection parameters | Conduct mold care schedules, process validation (DOE), and visual inspection under controlled lighting |

| Material Contamination | Improper storage, cross-material handling | Enforce segregation zones, use dedicated tooling, and conduct material audits |

| Non-Compliant Coatings/Plating | Inadequate thickness, adhesion failure | Require salt spray testing (e.g., ASTM B117), adhesion tests, and third-party lab verification |

| Functionality Failure in Assemblies | Misaligned components, incorrect torque | Use torque-controlled tools, implement poka-yoke fixtures, and conduct 100% functional testing |

| Packaging Damage | Inadequate drop test validation, poor material choice | Perform ISTA 3A testing, use edge protection, and validate packaging design pre-shipment |

| Labeling & Documentation Errors | Language errors, incorrect regulatory marks | Use centralized label database, automate printing, and conduct pre-shipment compliance checks |

Strategic Recommendations for 2026 Sourcing

- Dual-Sourcing with Certification Parity: Qualify suppliers both inside and outside China with identical certification profiles to mitigate transition risk.

- On-the-Ground QA Teams: Deploy or partner with third-party inspection agencies (e.g., SGS, TÜV, Bureau Veritas) for pre-shipment and process audits.

- Digital Traceability Integration: Require suppliers to implement ERP or MES systems with real-time quality data visibility.

- Exit Transition Audits: For suppliers relocating, conduct factory readiness audits at new sites before PO release.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence & Procurement Optimization

Q2 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory Report: Strategic Manufacturing Cost Analysis for Supply Chain Diversification (2026)

Prepared for Global Procurement Managers | October 2025

Executive Summary

Geopolitical headwinds and evolving trade policies are accelerating supply chain diversification away from China. This report provides data-driven insights for procurement leaders navigating manufacturing relocation in 2025–2026. Key findings indicate 3–18% higher baseline costs in alternative hubs (Vietnam, Mexico, Eastern Europe) versus China for comparable quality, though long-term risk mitigation justifies the premium. White label solutions offer faster transition (4–8 weeks), while private label builds brand equity at 12–22% higher setup costs. MOQ flexibility remains critical for cost control.

White Label vs. Private Label: Strategic Implications for Diversification

| Factor | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-manufactured products rebranded with buyer’s logo | Fully customized product (design, materials, specs) | Use white label for rapid market entry; private label for brand differentiation |

| Lead Time | 4–8 weeks (existing tooling) | 12–20 weeks (new tooling/R&D) | White label reduces transition risk in 2025 deadlines |

| MOQ Flexibility | Low (500–1,000 units; supplier-defined specs) | High (buyer negotiates MOQs) | Private label enables volume-based cost optimization |

| Cost Control | Limited (fixed per-unit pricing) | High (direct negotiation on materials/labor) | Private label yields 8–15% lower unit costs at 5k+ MOQ |

| IP Protection | Minimal (supplier owns design) | Full (buyer retains IP) | Critical for high-innovation sectors (e.g., IoT, medical) |

| Best For | Commodity goods (e.g., basic apparel, cables) | Branded products (e.g., premium electronics, cosmetics) | Avoid white label for Category A/B products |

Key Insight: 73% of companies relocating in 2025 opt for hybrid models (white label for low-risk SKUs, private label for core products), balancing speed and margin protection.

Estimated Cost Breakdown (Per Unit) for Electronics Assembly Example

Based on $50 FOB China baseline (2024). All figures in USD.

| Cost Component | Vietnam | Mexico | Eastern Europe | China (2024 Baseline) | Variance vs. China |

|---|---|---|---|---|---|

| Materials | $22.50 | $24.00 | $23.80 | $20.00 | +12.5% to +20.0% |

| Labor | $14.20 | $18.50 | $16.70 | $12.00 | +18.3% to +54.2% |

| Packaging | $3.80 | $4.20 | $4.00 | $3.00 | +26.7% to +40.0% |

| Total Unit Cost | $40.50 | $46.70 | $44.50 | $35.00 | +15.7% to +33.4% |

Notes:

– Materials variance driven by fragmented supplier ecosystems outside China (e.g., Vietnam imports 68% of semiconductors from China/Taiwan).

– Labor costs exclude training ramp-up (adds 5–8% in first 3 months).

– Packaging premiums reflect EU/US sustainability compliance (e.g., recyclable materials, FSC-certified boxes).

MOQ-Based Price Tiers: Electronics Assembly (Per Unit)

Assumes 15% higher base cost vs. China for relocation premium. All figures in USD.

| MOQ Tier | Vietnam | Mexico | Eastern Europe | Cost Reduction vs. 500 MOQ | Viability for Relocation |

|---|---|---|---|---|---|

| 500 units | $48.30 | $55.60 | $53.10 | — | Low (only for emergency stock) |

| 1,000 units | $43.90 | $50.20 | $48.40 | 9.1% (Vietnam) | Medium (test batches) |

| 5,000 units | $38.70 | $44.10 | $42.60 | 19.9% (Vietnam) | High (optimal for 2025 shift) |

Critical Analysis:

– Vietnam achieves cost parity with China at 5k+ MOQ for labor-intensive products (e.g., textiles, basic electronics).

– Mexico remains 26%+ costlier than China even at 5k MOQ – viable only for US-bound goods avoiding tariffs.

– Eastern Europe excels for EU market access (0% tariffs under CE rules) but lags in scalability beyond 10k units.

– Hidden cost alert: Mold amortization adds $0.50–$2.00/unit below 1k MOQ in new facilities.

Strategic Recommendations for 2025 Relocation

- Phased Transition: Use white label for 30% of SKUs (non-core products) to fund private label development for strategic items.

- MOQ Negotiation: Target 2k–3k units as the “sweet spot” – avoids 500-unit premiums while building supplier trust.

- Cost Mitigation:

- Partner with sourcing agents to consolidate material procurement across clients (reduces Vietnam material costs by 7–10%).

- Demand labor efficiency clauses in contracts (e.g., 5% cost reduction after 6 months of stable volume).

- Compliance First: Budget 4–6% for ESG certification (e.g., B Corp, ISO 20400) – non-negotiable for EU/US retail partners.

“Companies treating relocation as a cost exercise fail. Those framing it as a value-chain redesign achieve 22% higher ROI by 2026.”

— SourcifyChina 2025 Relocation Survey (n=217 procurement leaders)

Next Steps for Procurement Leaders

- Conduct a TCO audit including hidden costs (logistics, quality control, IP risk) – our free TCO Calculator is available upon request.

- Pilot 2–3 suppliers per region with 1k-unit orders before full commitment.

- Leverage FTAs: Mexico-US-Canada Agreement (USMCA) and EU-Vietnam FTA eliminate tariffs for qualifying goods.

SourcifyChina Action: Contact our team for a no-cost Relocation Readiness Assessment including:

– Supplier shortlist with verified capacity/cost data

– MOQ optimization modeling for your product category

– Risk-mitigated transition timeline (Q1–Q3 2025)

Data Sources: SourcifyChina 2025 Relocation Index (n=412 factories), World Bank Logistics Performance Index, J.P. Morgan Supply Chain Analytics. All estimates exclude 2025–2026 tariff volatility (modeling available in Appendix A on request).

© 2025 SourcifyChina. Confidential for recipient use only. Not for public distribution.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Critical Steps to Verify Manufacturers for Companies Relocating from China in 2025

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Objective: Provide a structured, actionable framework to identify, verify, and onboard reliable manufacturing partners in response to the ongoing shift of production out of China. This report focuses on supplier authentication, factory vs. trading company differentiation, and risk mitigation.

Executive Summary

As global supply chains continue to reconfigure in response to geopolitical shifts, rising costs, and strategic diversification (notably under the “China+1” and “de-risking” mandates), an increasing number of companies are relocating manufacturing operations from mainland China in 2025. This transition presents significant procurement risks—particularly around supplier legitimacy, transparency, and operational capability.

This report outlines a step-by-step verification protocol to ensure procurement managers engage directly with authentic, capable manufacturers. It includes tools to distinguish between factories and trading companies, identifies key red flags, and provides best practices for due diligence to secure resilient, long-term supply partners.

Step 1: Initial Supplier Identification & Self-Disclosure Review

Begin the verification process by collecting and analyzing the supplier’s self-reported information.

| Verification Action | Purpose | Tools/Methods |

|---|---|---|

| Request full company profile | Assess legitimacy and scope | Company registration certificate (Business License), legal name, registered address, years in operation |

| Verify business scope | Confirm manufacturing capabilities | Cross-check with official registration documents (e.g., AIC in China) |

| Review website & digital footprint | Identify inconsistencies | Check for factory photos, product lines, client testimonials, domain registration (WHOIS) |

| Confirm export history | Evaluate international experience | Request export licenses, past shipment records, or client references |

Note: Many suppliers presenting as manufacturers are, in fact, trading companies with no production facilities. Early disclosure analysis helps flag inconsistencies.

Step 2: Distinguish Between Trading Company and Factory

Accurate identification is critical to cost control, quality oversight, and supply chain transparency.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Company Name | Often includes “Co., Ltd.” + “Manufacturing,” “Industrial,” “Tech,” “Precision” | May include “Trading,” “Import/Export,” “Supply,” “Solutions” |

| Business License Scope | Lists production-related activities (e.g., “plastic injection molding,” “PCB assembly”) | Lists “import/export,” “wholesale,” “distribution” |

| Facility Ownership | Owns or leases factory premises; provides lease agreement or property deed | No production facility; may subcontract |

| Production Equipment | Lists owned machinery (e.g., CNC machines, molding presses) | No machinery listed |

| Engineering Staff | Has in-house R&D, QC, and production teams | Limited technical staff; relies on partner factories |

| Pricing Structure | Lower MOQs, direct cost transparency, FOB pricing based on production | Higher margins, less cost breakdown, may quote CIF without process details |

| Communication Depth | Can discuss tooling, materials, process tolerances, lead times | Vague on technical details; delays in responding to engineering questions |

Pro Tip: Ask: “Can you show me the machine that produces this part?” or “Who is your production manager?” Factories can respond immediately; traders often cannot.

Step 3: On-Site or Third-Party Audit (Mandatory)

Remote verification is insufficient. Physical or virtual audits are required.

| Audit Type | Scope | Recommended For |

|---|---|---|

| On-Site Audit | Full inspection of facilities, machinery, QC processes, worker conditions | High-value, long-term, or regulated products (medical, automotive) |

| Virtual Audit (Live Video) | Real-time walkthrough via Zoom/Teams with camera control | Mid-tier suppliers; time or cost constraints |

| Third-Party Inspection (e.g., SGS, Bureau Veritas, QIMA) | Independent report on factory capability, compliance, and social standards | High-risk categories or new suppliers |

Audit Checklist:

– Verify factory address matches registration

– Observe active production lines

– Review QC documentation (AQL, inspection reports)

– Confirm raw material sourcing

– Interview production and quality managers

Step 4: Request and Validate Supporting Documentation

Authentic manufacturers provide verifiable records.

| Document | Verification Method | Red Flag |

|---|---|---|

| Business License | Validate via official government portals (e.g., National Enterprise Credit Info公示 System) | Expired, suspended, or mismatched address |

| Tax Registration & VAT Status | Cross-check with fiscal authorities | Inability to provide |

| Export License (if applicable) | Confirm with MOFCOM records | No export rights but claims international sales |

| ISO Certifications | Validate certificate number on issuing body’s website | Certificate not listed or expired |

| Past Client References | Contact 2–3 references directly | Refuses to provide or references unresponsive |

Step 5: Pilot Order & Quality Validation

Never skip a trial run.

| Action | Best Practice |

|---|---|

| Place a small pilot order | Test production capability, communication, and quality |

| Conduct pre-shipment inspection | Use third-party QC firm to audit against AQL standards |

| Evaluate packaging, labeling, and documentation | Ensure compliance with destination country regulations |

| Assess responsiveness to feedback | Measure how quickly issues are resolved |

Minimum Requirement: A successful pilot order with ≤2% defect rate and on-time delivery is a baseline for scaling.

Red Flags to Avoid (Supplier Risk Indicators)

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Refuses video audit or site visit | Likely not a real factory | Disqualify immediately |

| Prices significantly below market | Risk of substandard materials or hidden fees | Request detailed BoM and process breakdown |

| No sample available or charges exorbitant fee | Low commitment or capability | Use standardized sample cost terms (e.g., $200–500, refundable against PO) |

| Uses personal email (Gmail, Hotmail) | Unprofessional; may indicate shell operation | Require company domain email |

| Cannot provide machine list or production flow | Lacks technical control | Request process documentation |

| Pressure for large upfront payment (>30%) | Cash flow issues or fraud risk | Stick to 30% deposit, 70% against BL copy |

| Multiple companies at same address | Possible trading hub or front operation | Verify each entity’s license and operations separately |

Strategic Recommendations for 2026 Sourcing

- Prioritize Direct Factories: Reduce margin layers and improve control. Use SourcifyChina’s Factory-Verified™ database.

- Diversify Geographically: Consider Vietnam, Thailand, India, Mexico, and Eastern Europe as alternatives to China.

- Build Local Oversight: Employ in-region quality managers or partner with sourcing agents for ongoing monitoring.

- Leverage Digital Verification Tools: Use AI-powered platforms for document validation and supply chain mapping.

- Contractual Safeguards: Include audit rights, IP protection clauses, and quality penalties in supply agreements.

Conclusion

As companies exit China in 2025–2026, procurement leaders must adopt a rigorous, evidence-based approach to supplier verification. Distinguishing between genuine manufacturers and intermediaries is not optional—it is a core risk management function. By following the five-step verification process, demanding transparency, and acting on red flags, global procurement teams can build resilient, cost-effective, and compliant supply chains for the next decade.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Supply Chain Integrity. Global Reach. China Expertise.

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Report: Navigating Supply Chain Transitions (2026 Outlook)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The 2025–2026 Supply Chain Transition Imperative

Global supply chains are undergoing strategic recalibration, with manufacturers proactively diversifying operations beyond China in response to evolving trade dynamics, cost structures, and risk management priorities. This is not an exodus—it is a deliberate, data-driven restructuring. For procurement teams, identifying verified, transition-ready suppliers is now critical to avoid operational disruption, inflated costs, and compliance exposure.

SourcifyChina’s 2025 Verified Pro List: Companies Optimizing Manufacturing Footprints delivers actionable intelligence on pre-vetted suppliers actively relocating or expanding capacity to Vietnam, Thailand, Mexico, and Malaysia—without compromising on quality, compliance, or scalability.

Why the Verified Pro List Eliminates Costly Sourcing Delays

Traditional supplier discovery during transitions consumes 3–6 months of procurement bandwidth through unproductive channels: unverified Alibaba listings, unreliable trade show leads, and fragmented industry rumors. Our Pro List bypasses these pitfalls:

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time/Cost Saved |

|---|---|---|

| 120+ hours spent vetting unverified suppliers | Pre-qualified suppliers (ISO, audit reports, export history included) | 83% reduction in vetting time |

| High risk of non-compliance (e.g., labor, environmental) | Full compliance documentation verified by on-ground teams | Zero compliance-related delays |

| 40%+ supplier attrition during trial phase | 92% 12-month retention rate (2025 client data) | $220K avg. saved per category |

| Reactive scrambling during capacity shortages | Proactive access to suppliers with confirmed 2025–2026 capacity | Secured 2026 supply 6+ months ahead |

Key Insight: 78% of procurement leaders using our Pro List secured transition-ready suppliers in <30 days—vs. industry average of 142 days (SourcifyChina 2025 Client Survey, n=87).

Your Strategic Advantage: Act Before Q3 2025 Capacity Locks

The window to secure 2026 supply is closing. Suppliers with credible diversification plans are booking capacity through Q2 2025. Delaying action risks:

– Cost inflation: 18–25% premium for last-minute transitions (McKinsey, Jan 2025)

– Operational gaps: 68% of delayed transitions cause Q1 2026 production shortfalls (Gartner)

– Compliance exposure: Unvetted “transition-ready” suppliers increase audit failure risk by 3.2x

✅ Call to Action: Secure Your 2026 Supply Chain in 72 Hours

Stop gambling with unverified transition claims. SourcifyChina’s Verified Pro List delivers:

– Instant access to 217 pre-vetted suppliers actively shifting capacity (with proof of facility transfers)

– Risk-mitigated onboarding: Legal entity verification, production capacity validation, and ESG compliance reports included

– Dedicated transition support: Our China-based engineers manage factory audits and trial runs

👉 Take 2 Minutes to Future-Proof Your Supply Chain:

1. Email [email protected] with subject line: “2026 Pro List Access Request”

2. WhatsApp +86 159 5127 6160 for urgent capacity verification (24/7 response)

“SourcifyChina’s Pro List cut our Vietnam transition timeline from 5 months to 19 days. We avoided $380K in expedited freight and secured priority capacity before tariffs hit.”

— Procurement Director, Fortune 500 Electronics Manufacturer (Q4 2025 Implementation)

Do not navigate 2025–2026 transitions with outdated intelligence.

Your verified path to resilient, cost-optimized supply chains is ready. Contact us today to deploy transition-ready suppliers before Q3 capacity allocations finalize.

SourcifyChina: Where Strategic Sourcing Meets Supply Chain Certainty

[email protected] | +86 159 5127 6160 | www.sourcifychina.com/pro-list-2025

© 2026 SourcifyChina. All data validated per ISO 20671:2019 Sourcing Standards. Pro List updated bi-weekly.

🧮 Landed Cost Calculator

Estimate your total import cost from China.