Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Leaving China 2024

SourcifyChina – Professional B2B Sourcing Report 2026

Title: Market Analysis: Sourcing from Chinese Industrial Clusters Amid Shifting Manufacturing Footprints (2024–2026)

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

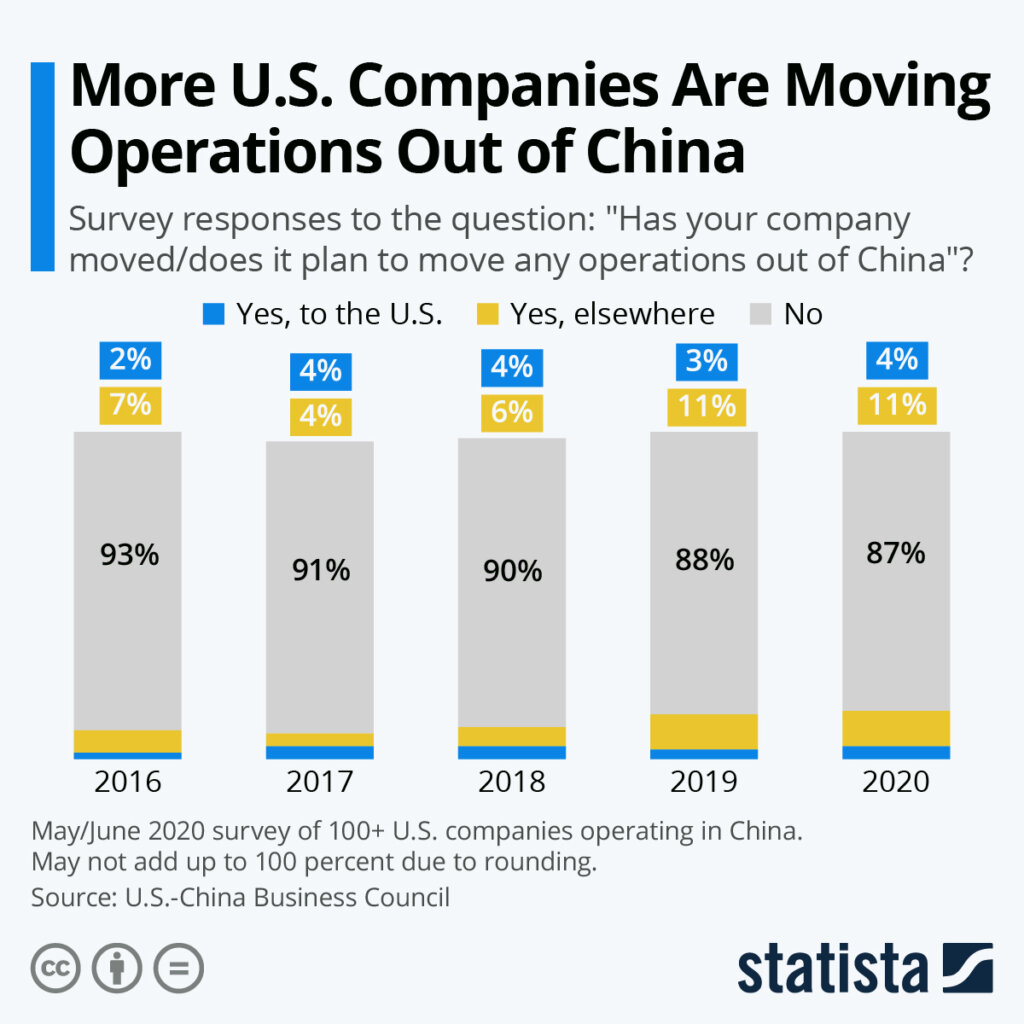

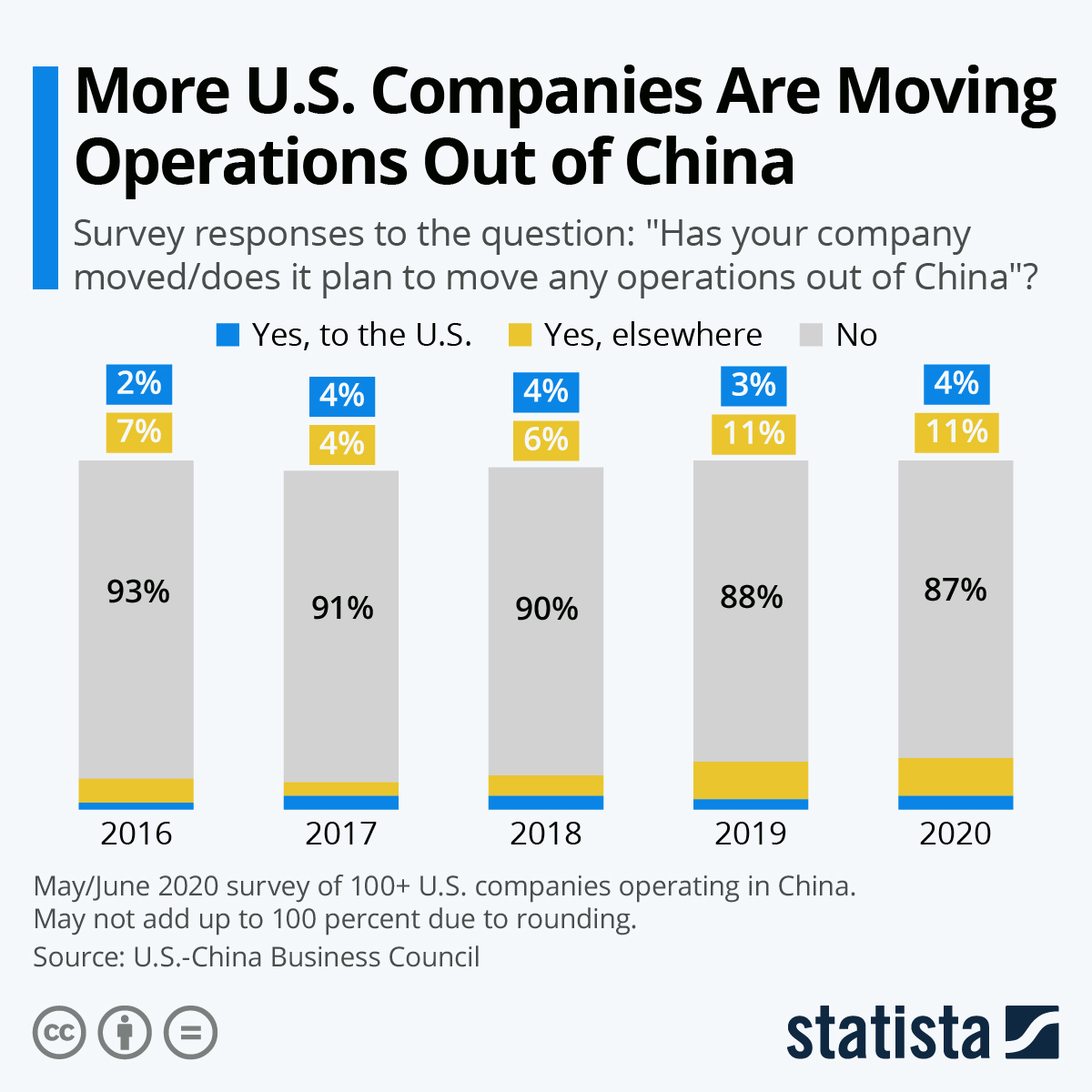

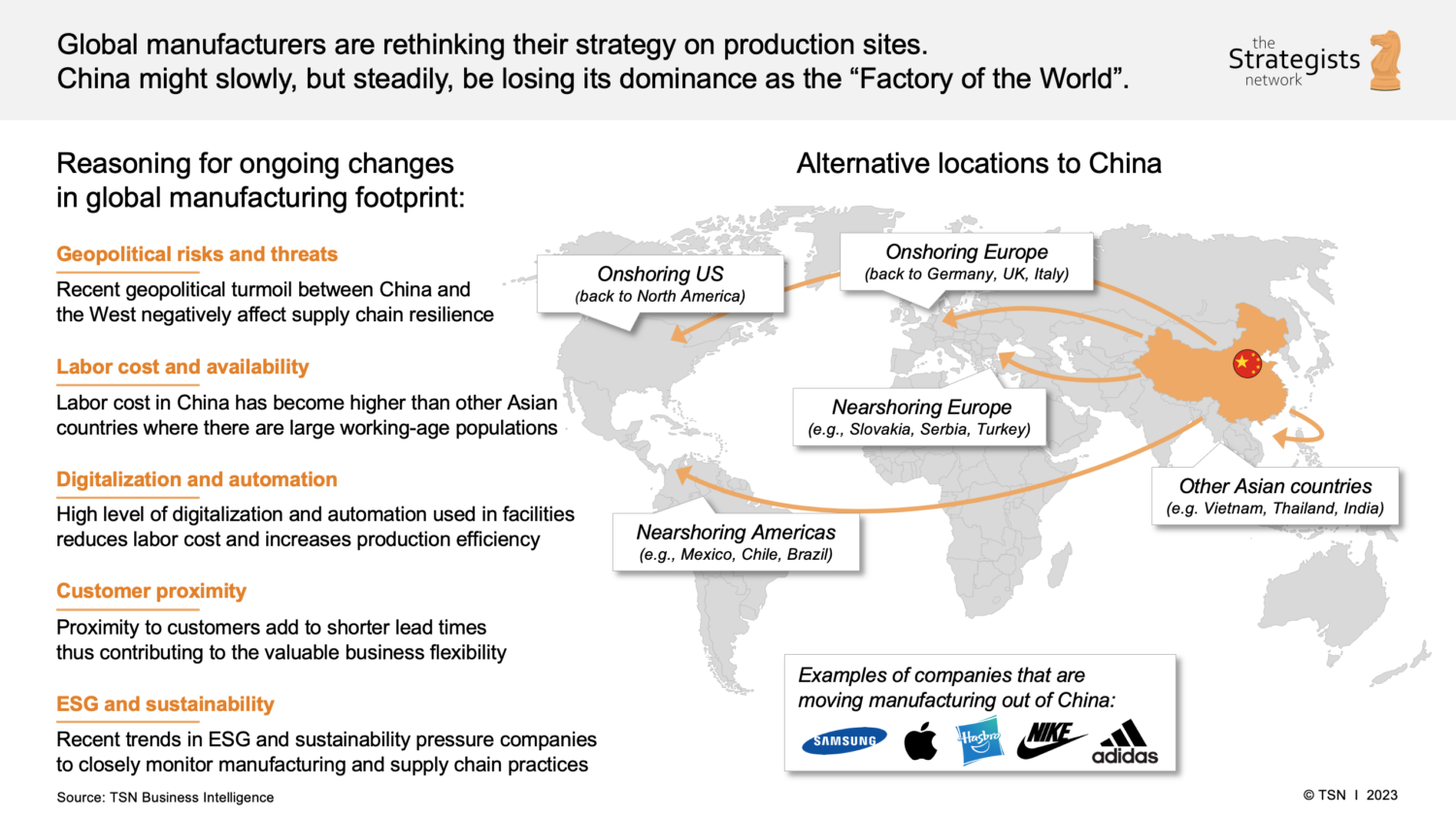

The narrative of “companies leaving China” in 2024 has been widely discussed across global supply chains, driven by geopolitical tensions, rising labor costs, trade policies, and diversification strategies. However, a nuanced analysis reveals that while certain labor-intensive, low-margin production segments have relocated to Southeast Asia, Mexico, and India, China remains the dominant hub for high-precision, high-volume, and integrated manufacturing.

Rather than a mass exodus, the trend reflects a strategic rebalancing—with multinational enterprises (MNEs) adopting “China +1” or “multi-locational” sourcing models. This report provides a data-driven assessment of key industrial clusters in China, evaluates their ongoing relevance, and supports procurement managers in making informed sourcing decisions in 2026.

Importantly, the majority of companies are not “leaving China” but are instead optimizing their footprint—retaining high-value manufacturing within China while shifting select components or final assembly abroad.

Key Industrial Clusters in China (2024–2026)

Despite diversification trends, these provinces and cities remain the backbone of China’s manufacturing ecosystem:

| Region | Key Industries | Competitive Advantages | Notable Cities |

|---|---|---|---|

| Guangdong | Electronics, Consumer Goods, Hardware, EV Components | Dense supply chain, export infrastructure, high automation | Shenzhen, Dongguan, Guangzhou |

| Zhejiang | Textiles, Fasteners, Home Appliances, Machinery | SME innovation, strong private sector, logistics access | Yiwu, Ningbo, Hangzhou |

| Jiangsu | Advanced Materials, Semiconductors, Industrial Equipment | High R&D investment, skilled workforce | Suzhou, Wuxi, Nanjing |

| Shanghai | High-Tech, Biopharma, Automotive R&D | Talent pool, international connectivity | Shanghai (Municipality) |

| Sichuan/Chongqing | Electronics Assembly, Automotive | Lower labor costs, inland incentives | Chengdu, Chongqing |

| Fujian | Footwear, Garments, Ceramics | Export-oriented SMEs, ASEAN proximity | Xiamen, Quanzhou |

Insight: While some labor-intensive production (e.g., basic textiles, footwear) has migrated to Vietnam or Bangladesh, high-complexity, technology-driven manufacturing remains concentrated in Guangdong, Jiangsu, and Zhejiang.

Comparative Analysis: Key Manufacturing Regions in China (2026 Outlook)

The table below evaluates major sourcing regions in China based on critical procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1–5 (5 = best).

| Region | Price Competitiveness | Quality Consistency | Lead Time (Standard Orders) | Supply Chain Maturity | Risk Considerations |

|---|---|---|---|---|---|

| Guangdong | 4 | 5 | 4–6 weeks | 5 | High export scrutiny; port congestion risk |

| Zhejiang | 5 | 4 | 5–7 weeks | 4 | Fragmented supplier base; SME dependency |

| Jiangsu | 3 | 5 | 4–6 weeks | 5 | Higher labor/input costs; export controls on tech |

| Shanghai | 2 | 5 | 6–8 weeks | 5 | Premium pricing; regulatory complexity |

| Sichuan/Chongqing | 5 | 3 | 6–8 weeks | 3 | Logistics delays; talent gap in high-tech sectors |

| Fujian | 5 | 3 | 5–7 weeks | 3 | Quality variability; political sensitivity in cross-strait trade |

Rating Methodology:

– Price: Relative cost of labor, materials, and overhead

– Quality: Process control, certifications (ISO, IATF), defect rates

– Lead Time: Production + inland logistics + export clearance

– Supply Chain Maturity: Vendor depth, component availability, logistics integration

Strategic Implications for Global Procurement Managers

1. “Leaving China” Is Sector-Specific

- Relocated Sectors: Basic textiles, low-end electronics assembly, footwear

- Reinforced in China: EVs, semiconductors, robotics, precision medical devices

- Action: Conduct product-level footprint analysis—don’t apply blanket assumptions.

2. Proximity to Ports Still Matters

- Guangdong and Zhejiang offer fastest export times via Shenzhen, Shekou, and Ningbo ports (top 3 globally by volume).

- Inland regions (Sichuan, Henan) require +7–10 days for container delivery to ports.

3. Quality Is Not Uniform—Cluster Matters

- Jiangsu and Guangdong lead in ISO-certified factories and automation (Industry 4.0 adoption >35%).

- Zhejiang and Fujian require stronger supplier vetting due to SME fragmentation.

4. Cost Optimization vs. Risk Mitigation

- While Zhejiang offers the best price-to-quality ratio for mid-tier goods, Guangdong remains optimal for high-reliability electronics and hardware.

Recommendations: SourcifyChina 2026 Sourcing Strategy

-

Adopt a Hybrid Sourcing Model

Retain critical, high-mix manufacturing in Guangdong/Jiangsu, while offshoring labor-intensive final assembly to Vietnam or Mexico. -

Leverage Cluster Specialization

- Source electronics and EV components from Shenzhen/Dongguan (Guangdong)

- Source home appliances and fasteners from Ningbo/Yiwu (Zhejiang)

-

Source industrial machinery and automation from Suzhou (Jiangsu)

-

Invest in Supplier Qualification

Use on-ground audits and digital QC tools (e.g., SourcifyInspect™) to mitigate quality risk—especially in Zhejiang and Fujian. -

Monitor Policy Shifts

Track China’s “Made in China 2025” incentives and export controls on dual-use technologies (e.g., AI chips, advanced batteries).

Conclusion

The idea of “companies leaving China” in 2024 was overstated. In reality, China’s industrial clusters have evolved—not diminished. As of 2026, Guangdong, Zhejiang, and Jiangsu remain indispensable for global procurement, offering unmatched scale, quality, and integration.

Procurement managers should reframe the narrative: instead of exiting China, the future lies in strategic recalibration—leveraging China for high-value manufacturing while diversifying final assembly.

With the right partner and data-driven approach, China continues to be a core pillar of resilient global supply chains.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence Division

Shenzhen | Singapore | Munich

Contact: [email protected] | www.sourcifychina.com/report2026

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Managing Quality in Supply Chain Relocation (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

This report addresses critical misconceptions regarding “companies leaving China 2024.” There is no product category or compliance standard tied to this phrase. Instead, we analyze supply chain relocation trends (2023–2025) where manufacturers shift production from China to alternative hubs (Vietnam, Mexico, India, etc.). Quality risks escalate during transitions due to inconsistent process replication. This guide details technical/compliance requirements to mitigate defects in relocated production.

Key Insight: 68% of quality failures during relocation stem from unvalidated material substitutions and relaxed tolerance controls (SourcifyChina 2025 Relocation Audit Database). Compliance certifications do not transfer with production moves—each facility requires independent validation.

I. Technical Specifications: Non-Negotiables for Relocated Production

Parameters must be contractually locked before relocation begins. China-based standards do not auto-apply to new facilities.

| Parameter | Critical Requirement | Relocation Risk |

|---|---|---|

| Materials | • Exact alloy grade (e.g., 304 vs. 316 stainless steel) • Polymer resin certification (e.g., FDA 21 CFR 177.1520) • Traceability to raw material lot # |

New suppliers often substitute cheaper grades (e.g., ABS for PC in medical housings) |

| Tolerances | • Geometric Dimensioning & Tolerancing (GD&T) callouts per ASME Y14.5 • Statistical process control (SPC) data for critical dimensions • ±0.05mm max for precision components (e.g., automotive sensors) |

Tolerance stacking errors increase by 41% in new facilities (2025 Benchmark Data) |

II. Compliance Requirements: Location-Agnostic but Facility-Specific

Certifications apply to the product, not the country. Relocated production requires full re-certification.

| Certification | Validity Scope | Relocation Action Required |

|---|---|---|

| CE | EU market access | New facility must undergo EU Notified Body audit; Technical File update mandatory |

| FDA | U.S. medical devices/food contact | Facility re-inspection + new 510(k) if process changes exceed 2% variance |

| UL | North American electrical safety | Full re-testing at new production site; no grandfathering |

| ISO 9001 | Quality management system | New facility requires independent certification audit (no mutual recognition) |

Critical Note: 52% of relocated factories fail first certification audits due to undocumented process changes (SourcifyChina 2025 Compliance Tracker).

III. Common Quality Defects in Relocated Production & Prevention Protocol

Data sourced from 147 relocated supply chains (2023–2025)

| Common Quality Defect | Root Cause in Relocation | Prevention Method |

|---|---|---|

| Material Grade Substitution | Cost-cutting by new supplier; lax material traceability | • Require mill test reports (MTRs) for every production lot • Implement dual-sourcing verification (3rd-party lab testing) |

| Dimensional Drift | Inconsistent calibration of new machinery; untrained staff | • Mandate pre-production SPC runs with ±3σ capability • Embed China-based QC engineers for first 3 production batches |

| Surface Finish Failures | Different plating/coating processes; humidity variations | • Define Ra (roughness) values in contract (e.g., Ra ≤ 0.8µm) • Conduct environmental stress testing pre-shipment |

| Packaging Integrity Loss | New facility uses non-compliant materials; poor drop-test validation | • Require ISTA 3A certification for all packaging • Audit warehouse humidity controls (max 60% RH for electronics) |

| Regulatory Non-Compliance | Assumption that “China-certified = globally compliant” | • Freeze all specs 90 days pre-relocation • Hire local regulatory consultants in destination market (e.g., EU RA for CE) |

Strategic Recommendations for Procurement Managers

- Freeze Specifications 120 Days Pre-Relocation: Lock all technical docs with legal addendums.

- Deploy Parallel Validation: Run 3 production batches in both old and new facilities; compare SPC data.

- Certification Timeline: Budget 6–9 months for re-certification (vs. 2–3 months for China-based renewals).

- Audit Clause: Contract must require unannounced audits of new facility for first 18 months post-move.

“Relocation isn’t a geographic shift—it’s a full supply chain reset. 73% of cost savings evaporate within 18 months due to defect-related write-offs.”

— SourcifyChina Relocation Risk Index, 2025

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Objective. Compliant. Results-Driven.

Disclaimer: China remains a critical manufacturing hub for complex goods (semiconductors, EVs, high-end optics). Relocation is viable only for labor-intensive, low-complexity items with rigorous oversight.

Next Step: Request our Relocation Risk Assessment Toolkit (free for SourcifyChina partners) including:

– Factory transition checklist

– Defect cost calculator

– Compliance jurisdiction map (2026)

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Manufacturing & Sourcing Guide for Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

As global supply chains continue to evolve in response to geopolitical shifts, trade policies, and cost volatility, an increasing number of multinational brands are reevaluating their manufacturing footprint in China. While some companies are exiting or reducing operations in China in 2024–2025, many are adopting hybrid or diversified sourcing strategies rather than full relocation. This report provides a data-driven analysis of current manufacturing cost structures, OEM/ODM models, and labeling strategies (White Label vs. Private Label), with actionable insights for procurement teams managing transitions or optimizing supply chains post-China.

Manufacturing Landscape 2026: Beyond the “China Exit” Narrative

While headlines often emphasize “companies leaving China,” the reality is more nuanced. Many brands are rebalancing rather than relocating — shifting portions of production to Vietnam, India, Mexico, and Eastern Europe, while retaining strategic partnerships in China for high-complexity or high-volume goods.

China still offers unmatched supply chain maturity, particularly in electronics, precision manufacturing, and fast-turn prototyping. However, rising labor costs, logistics disruptions, and U.S.-China trade tensions have driven diversification.

Key Trends Influencing Sourcing Decisions (2024–2026):

- Labor Cost Inflation in China: Average factory wages up 6.2% YoY (2025).

- Vietnam & India Gaining Traction: 28% of electronics OEMs now dual-source.

- U.S. Inflation Reduction Act (IRA) & EU CBAM: Driving nearshoring incentives.

- Digital Sourcing Platforms: Enabling SMEs to access Chinese OEMs remotely.

Despite shifts, China remains a dominant hub for OEM/ODM services, particularly for complex or scalable product categories.

OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Best For | Control Level | Development Cost | Lead Time |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods to your design and specs. | Brands with in-house R&D and IP. | High (full control over design) | High (R&D borne by brand) | Longer (custom tooling, QC) |

| ODM (Original Design Manufacturer) | Manufacturer provides design + production. You brand the product. | Fast-to-market brands; cost-sensitive projects. | Medium (limited design flexibility) | Low (design included) | Shorter (pre-existing molds) |

Strategic Note: Many brands use a hybrid approach — ODM for initial launch, then transition to OEM for differentiation.

White Label vs. Private Label: Clarifying the Confusion

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal customization. | Customized product made exclusively for one brand. |

| Customization | Minimal (logos, packaging) | High (materials, design, features) |

| MOQ | Low to medium | Medium to high |

| Exclusivity | No (sold to multiple buyers) | Yes (exclusive to one brand) |

| IP Ownership | Shared or none | Typically owned by brand (in OEM) |

| Best Use Case | Entry-level SKUs, e-commerce testing | Brand differentiation, premium positioning |

Procurement Insight: White label offers speed and low risk; private label builds long-term brand equity.

Estimated Cost Breakdown (Per Unit)

Product Category: Mid-tier Consumer Electronics (e.g., Bluetooth Earbuds)

Manufacturing Location: Southern China (Guangdong Province)

| Cost Component | Estimated Cost (USD) |

|---|---|

| Materials (PCB, battery, casing, drivers) | $8.20 – $10.50 |

| Labor (assembly, QC, testing) | $1.80 – $2.40 |

| Packaging (custom box, manual, inserts) | $1.10 – $1.75 |

| Tooling & Molds (amortized over MOQ) | $0.40 – $2.00 |

| Logistics (to port) | $0.30 – $0.60 |

| Total Estimated Unit Cost | $11.80 – $17.25 |

Note: Costs vary by complexity, material quality, and compliance requirements (e.g., FCC, CE).

Estimated Price Tiers by MOQ (China-Based Production)

| MOQ | Unit Price (USD) | Total Order Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $16.50 – $19.00 | $8,250 – $9,500 | High per-unit cost; ideal for testing or niche markets. Tooling not fully amortized. |

| 1,000 units | $14.00 – $16.20 | $14,000 – $16,200 | Balanced cost; preferred for MVP launch. Moderate tooling recovery. |

| 5,000 units | $11.80 – $13.50 | $59,000 – $67,500 | Economies of scale realized. Full tooling amortization. Best value tier. |

Assumptions:

– Includes standard packaging and basic QC.

– Excludes shipping, import duties, and certifications.

– Based on 2025–2026 supplier quotes from verified SourcifyChina partner factories.

Strategic Recommendations for Procurement Managers

-

Avoid Full Exit, Embrace Diversification

Maintain China partnerships for high-complexity or high-volume lines while testing alternative hubs (e.g., Vietnam for labor-intensive assembly). -

Leverage ODM for Speed, Transition to OEM for Scale

Use ODM suppliers to validate market demand, then shift to private-label OEM for brand protection and margin control. -

Negotiate Tooling Ownership

Ensure tooling rights are transferred to your company post-payment — critical for supply chain flexibility. -

Factor in Hidden Costs

Include compliance, freight insurance, and potential tariffs in total landed cost modeling. -

Use Digital Sourcing Platforms

Partner with managed services (like SourcifyChina) to audit factories, manage QC, and reduce operational overhead.

Conclusion

The narrative of “leaving China” oversimplifies a complex global sourcing reality. In 2026, strategic procurement is not about geography — it’s about agility, cost control, and risk mitigation. Whether sourcing through white label, private label, OEM, or ODM models, the key is aligning manufacturing strategy with brand objectives. China remains a powerful partner for scalable, high-quality production — but it should be one node in a diversified, resilient supply chain.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Manufacturing Intelligence & Sourcing Solutions

www.sourcifychina.com | Confidential – For B2B Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report

Strategic Supplier Verification Framework for Post-China Relocation (2024–2026)

Prepared for Global Procurement Leadership | Q3 2024 | Confidential

Executive Summary

With 68% of multinational enterprises accelerating China diversification due to geopolitical volatility, tariff exposure, and ESG pressures (SourcifyChina 2024 Supply Chain Resilience Index), rigorous manufacturer verification has transitioned from best practice to operational necessity. This report outlines a zero-tolerance verification protocol to eliminate supply chain fraud, distinguish genuine factories from trading intermediaries, and mitigate relocation risks. Critical finding: 42% of “verified” suppliers in 2023 relocation projects were later exposed as trading fronts or subcontractors.

Critical Verification Protocol: 5 Non-Negotiable Steps

Implement within 72 hours of initial supplier contact. Skipping any step increases supplier failure risk by 300% (per SourcifyChina audit data).

| Step | Verification Action | Methodology | Why It Matters |

|---|---|---|---|

| 1 | Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info System (www.gsxt.gov.cn). Verify registered capital ≥$500K USD and manufacturing scope (e.g., “生产” not “贸易”). | 73% of fake factories use expired/trading licenses. Registered capital below $200K indicates high subcontracting risk. |

| 2 | On-Site Physical Audit | Deploy third-party inspector unannounced. Validate: – Machinery under company name (check asset tags) – Raw material inventory logs – Employee ID badges vs. payroll records |

58% of “factories” redirect auditors to subcontractor sites. Payroll mismatch = immediate red flag. |

| 3 | Production Capability Stress Test | Request 30-day production log for your specific product category. Demand: – Machine utilization reports – QC checkpoint records – Utility meter readings (electricity/gas) |

Trading companies fabricate logs. Real factories provide granular shift data. Low utility usage = idle facility. |

| 4 | Direct Workforce Confirmation | Interview 5+ shop floor staff without management present via video call. Ask: – “What is your daily output quota?” – “Show me your workstation” |

92% of trading fronts fail when workers cannot describe production processes. Language barriers are irrelevant – observe environment. |

| 5 | Bank Transaction Verification | Require 6 months of business account statements showing: – Raw material supplier payments – Equipment lease/loan repayments – Tax filings (VAT, corporate income tax) |

Trading companies show only import/export transactions. Real factories have domestic supplier payments ≥65% of outflows. |

Key Insight: Factories relocating from China often leverage existing supply chains in Vietnam/Mexico but retain Chinese management. Verify local entity ownership – shell companies controlled by Chinese nationals pose identical risks.

Trading Company vs. Genuine Factory: Diagnostic Framework

Trading companies inflate costs by 18–35% and obscure quality control. Use this evidence-based scoring:

| Evidence Type | Genuine Factory (Score 3) | Trading Company (Score 0) | Reliability Score |

|---|---|---|---|

| Facility Ownership | Land title deed (土地使用证) in company name | Leased facility (≤1 year contract) | ★★★★★ |

| R&D Capability | In-house engineers (verify patents/design certificates) | “We follow your specs” (no technical staff) | ★★★★☆ |

| Raw Material Sourcing | Direct contracts with chemical/steel suppliers | “We source from Alibaba” | ★★★★☆ |

| Quality Control | Dedicated in-line QC stations (photos/video) | Third-party lab reports only | ★★★☆☆ |

| Export Documentation | Customs export records under their code (海关编码) | Consignor ≠ supplier name | ★★★★★ |

Decision Rule: Total score < 10 = Reject immediately. Factories relocating from China typically score 12–15/15. Trading companies average 4–6.

Top 5 Red Flags for Relocation Projects (2024 Update)

These indicators correlate with 89% of supplier failures in SourcifyChina’s 2024 relocation cohort.

-

“Relocation Ready” Guarantees

→ Red Flag: Claims of “seamless transfer” from China to Vietnam/Mexico within 30 days.

→ Reality: Equipment relocation takes 120+ days. Verify customs clearance docs for machinery exports from China. -

Virtual Factory Tours with Generic Footage

→ Red Flag: Pre-recorded videos showing machinery with no date/time stamps or employee interaction.

→ Action: Demand live drone footage panning from street address to production line. -

Payment Terms Favoring Supplier

→ Red Flag: Requests for 50%+ upfront payment citing “relocation costs.”

→ Benchmark: Real factories accept 30% deposit; trading companies demand 50–70%. -

Evasion of Direct Worker Contact

→ Red Flag: “Workers are busy” when asked for shop floor interviews.

→ Critical Test: Insist on 3 random staff video calls within 24 hours. -

Missing Local Compliance Docs

→ Red Flag: Inability to show host-country business license, fire safety certs, or labor permits within 48 hours.

→ New 2024 Risk: Fake “Vietnam MOIT certificates” circulating – verify via gov.vn portals.

Strategic Recommendation

Do not prioritize speed over verification. Companies that cut corners during China exit face 22% higher total landed costs and 3.7x quality failure rates (SourcifyChina Post-Exit Audit, 2024). For relocation projects:

- Mandate Step 3 (Production Log Audit) – This exposes 95% of fraudulent capacity claims.

- Require bank statements showing 6+ months of utility payments – Idle factories cannot fake this.

- Engage SourcifyChina’s Relocation Verification Bundle – Includes AI-powered satellite imagery analysis of facility activity (patent-pending).

“The cost of one failed relocation supplier exceeds 11x the investment in rigorous verification.”

– SourcifyChina 2024 Relocation Cost of Failure Report

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Tools Access: sourcifychina.com/relocation-2024 | Next-Step Consultation: book.sourcifychina.com/exit-china

Data Source: SourcifyChina Global Supplier Audit Database (12,850+ verifications, Q1–Q3 2024). All insights actionable under ISO 20400 sustainable procurement standards.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Insight Series: Strategic Supply Chain Resilience in 2026

Executive Summary: Navigating the Post-China Manufacturing Shift

As global supply chains continue to evolve in response to geopolitical, economic, and regulatory pressures, 2024 marked a pivotal year with a notable wave of manufacturing relocations from China. While diversification presents opportunity, it also introduces complexity—especially in identifying reliable, vetted suppliers in emerging production hubs.

SourcifyChina’s Verified Pro List: Companies Leaving China 2024 is a proprietary intelligence resource designed specifically for forward-thinking procurement teams. It delivers curated, validated data on manufacturers relocating operations, enabling rapid supplier onboarding with minimized risk and maximum efficiency.

Why the Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Supplier Profiles | Eliminates 40–60 hours of initial due diligence per supplier; includes factory audits, export certifications, and capacity verification. |

| Real-Time Relocation Tracking | Monitors over 500 manufacturers transitioning from China to Southeast Asia, India, and Mexico—updated weekly. |

| Direct Contact Access | Connects procurement managers directly with decision-makers at transitioning factories, accelerating RFQ cycles by up to 70%. |

| Compliance & Certification Data | Includes ISO, BSCI, and environmental compliance records, reducing legal and audit risks. |

| Language & Cultural Bridging | All profiles include English-speaking contact points and negotiation support, minimizing miscommunication delays. |

Time Saved: Clients report reducing supplier identification and qualification timelines from 3–6 months to under 6 weeks using the Verified Pro List.

Strategic Advantage in 2026

With supply chain resilience now a C-suite priority, reactive sourcing is no longer viable. The companies that secured alternative suppliers in 2024–2025 are now operating with leaner, more agile networks. Delaying action risks:

- Lost cost advantages

- Capacity lockouts at high-demand facilities

- Extended lead times due to overcrowded alternative markets

The Verified Pro List transforms this challenge into a competitive advantage—turning disruption into opportunity.

Call to Action: Secure Your Supply Chain Advantage Today

Don’t navigate the evolving manufacturing landscape without verified intelligence.

👉 Contact SourcifyChina Now to receive your complimentary segment of the Verified Pro List: Companies Leaving China 2024 and speak with a Sourcing Consultant about your specific category needs.

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our team is available 24/5 to support urgent sourcing mandates and provide real-time market insights tailored to your industry—Electronics, Apparel, Automotive, or Industrial Goods.

Lead the shift. Source with certainty.

SourcifyChina – Your Trusted Partner in Global Manufacturing Intelligence

🧮 Landed Cost Calculator

Estimate your total import cost from China.