Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Leaving China 2021

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Market Intelligence: Sourcing Amidst Industrial Relocation – China’s Evolving Manufacturing Landscape Post-2021

Executive Summary

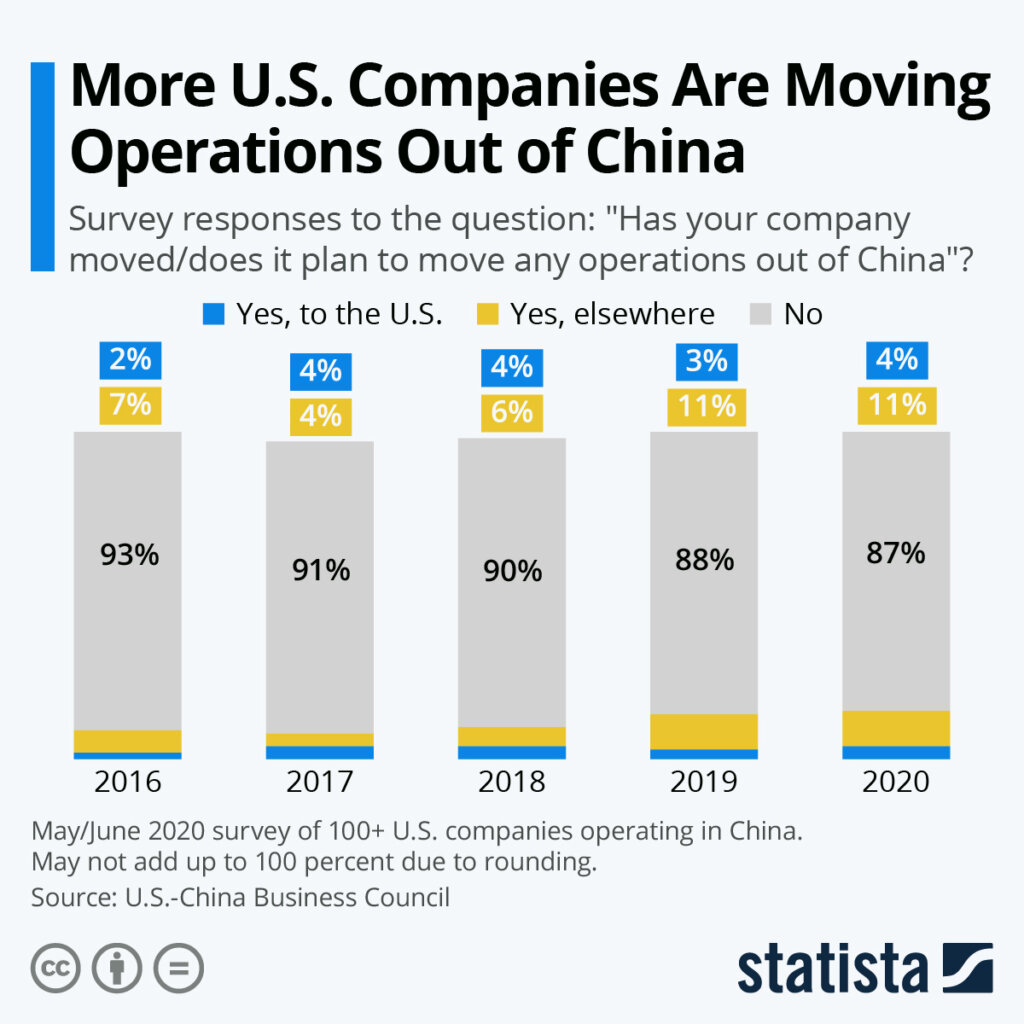

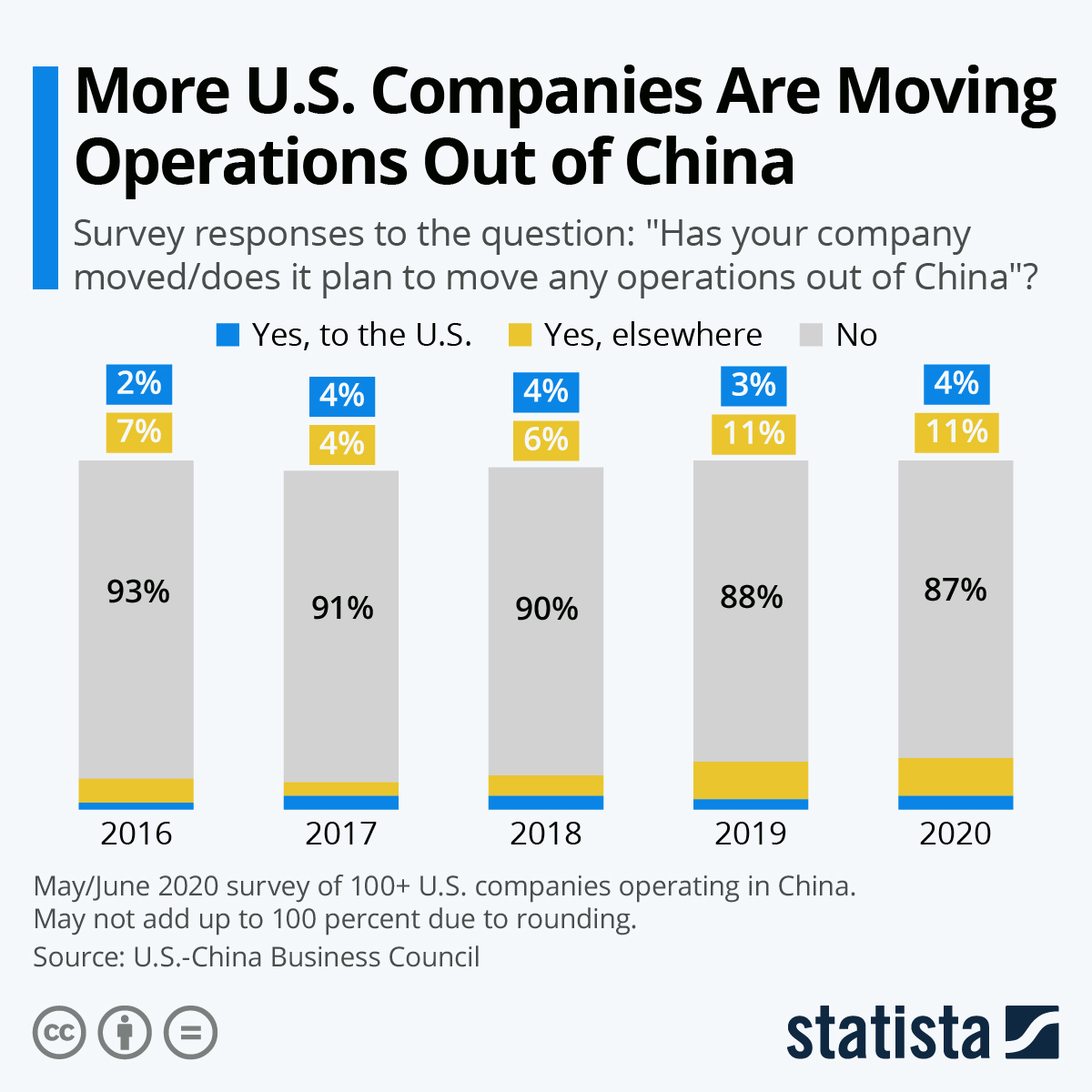

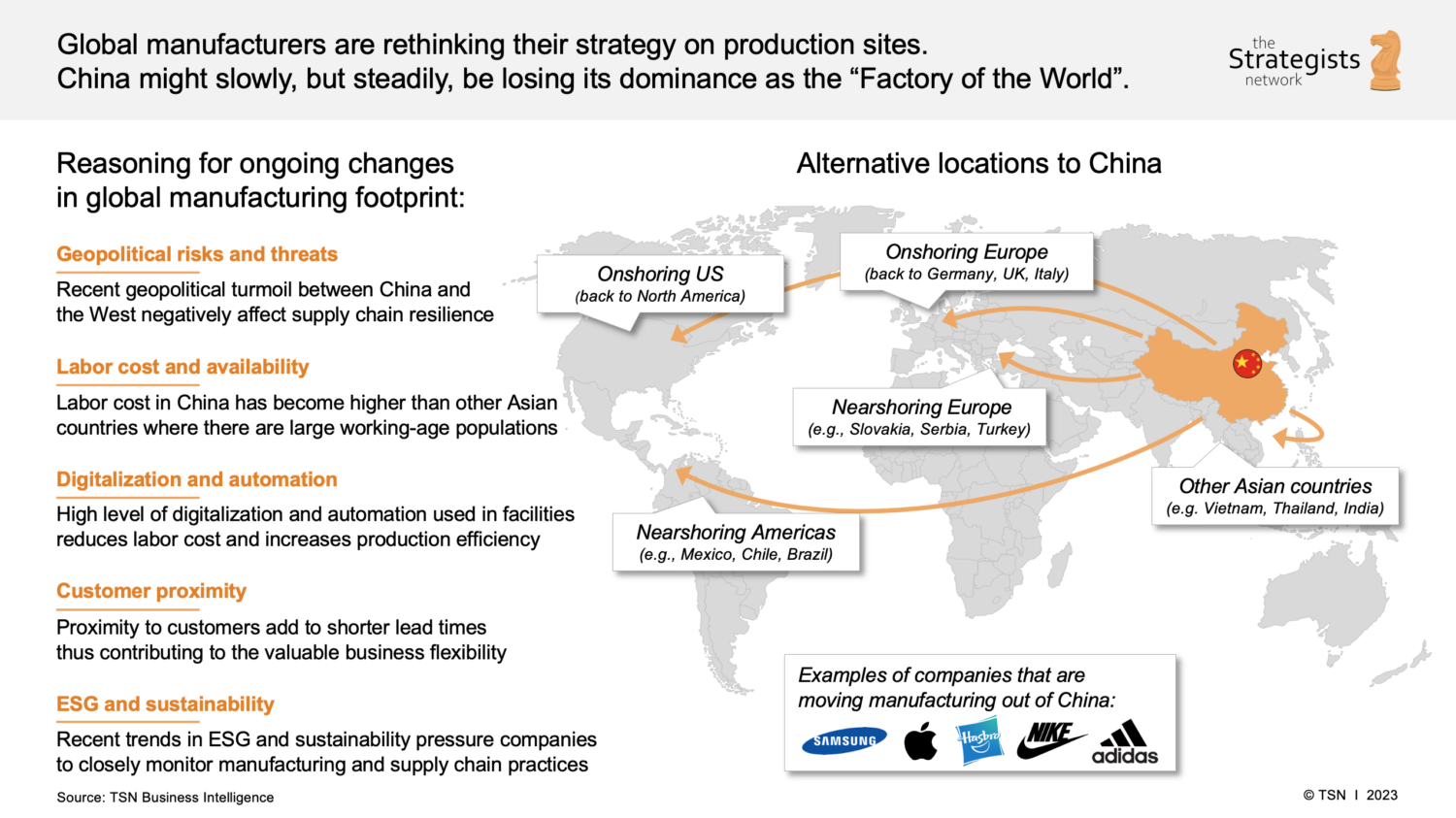

The phrase “companies leaving China 2021” gained traction during a period of significant supply chain reconfiguration triggered by geopolitical tensions, rising labor costs, U.S.-China trade friction, and pandemic-induced disruptions. However, it is critical to clarify a common misconception: China did not experience a mass exodus of manufacturing capacity. Instead, global companies pursued strategic diversification, shifting portions of production to Vietnam, India, and Mexico—while maintaining strong operational and sourcing ties to China.

Rather than a collapse, China’s manufacturing ecosystem evolved. Many foreign-invested enterprises relocated labor-intensive, low-margin segments out of China, particularly in textiles, basic electronics assembly, and low-end plastics. Meanwhile, China doubled down on high-value, automated, and innovation-driven manufacturing, reinforcing its dominance in sectors such as EV components, advanced electronics, industrial automation, and green tech.

For procurement managers, the strategic imperative in 2026 is not to avoid China, but to navigate its tiered industrial clusters with precision, leveraging regional strengths while aligning with broader nearshoring or dual-sourcing strategies.

Key Industrial Clusters for Manufacturing in China (2026)

Despite selective relocation, China remains the world’s largest manufacturing hub. The following provinces and cities continue to dominate global supply chains, each with distinct specializations and competitive advantages:

| Region | Key Industrial Clusters | Core Manufacturing Sectors | Strategic Position (2026) |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan | Electronics, Consumer Tech, Robotics, Plastics, Electric Vehicles (EVs), Drones | High-tech innovation hub; strong export infrastructure; high labor costs but advanced automation |

| Zhejiang | Ningbo, Yiwu, Hangzhou, Wenzhou | Fasteners, Hardware, Textiles, Home Goods, E-commerce Fulfillment, Small Machinery | Cost-efficient SME ecosystem; agile production; dominant in B2B e-commerce sourcing |

| Jiangsu | Suzhou, Wuxi, Nanjing, Changzhou | Semiconductors, Advanced Materials, Biopharma, Automotive Parts, Precision Machinery | High-quality manufacturing; strong R&D integration; proximity to Shanghai |

| Shanghai | Shanghai (Municipality) | High-end Electronics, Medical Devices, AI Hardware, EV Batteries, Industrial IoT | Premier R&D and pilot production center; premium pricing; global compliance standards |

| Sichuan | Chengdu, Chongqing | Automotive, Aerospace, Displays, Consumer Electronics (Tier-2) | Lower labor costs; government incentives; growing inland logistics hub |

Note: While some foreign OEMs moved assembly lines out of Dongguan or Suzhou to Vietnam, the tooling, R&D, and key component supply often remain in China. This creates a hybrid supply chain where China acts as a core enabler even for “China+1” strategies.

Regional Comparison: Sourcing Performance Matrix (2026)

The table below compares two of China’s most pivotal manufacturing provinces—Guangdong and Zhejiang—across critical procurement KPIs. Data reflects Q1 2026 benchmarks based on SourcifyChina’s supplier audits and client fulfillment metrics.

| Factor | Guangdong | Zhejiang | Strategic Implication |

|---|---|---|---|

| Price (Cost Level) | Medium-High (Labor: ¥28–35/hr; automation-heavy) | Low-Medium (Labor: ¥22–28/hr; SME-driven competition) | Zhejiang offers better value for labor-intensive, high-volume goods |

| Quality (Consistency & Standards) | High (ISO, IATF, IPC-certified; strong QA culture) | Medium-High (Improving; varies by supplier tier) | Guangdong preferred for mission-critical or regulated components |

| Lead Time (Standard Production) | 25–40 days (longer setup but high throughput) | 20–35 days (agile, small-batch strength) | Zhejiang excels in fast-turnaround, custom tooling, and e-commerce fulfillment |

| Specialization | Electronics, EVs, Smart Devices, Industrial Robots | Fasteners, Home Goods, Textiles, Small Appliances | Align sourcing with cluster expertise |

| Export Readiness | Excellent (Near Shenzhen & Guangzhou ports) | Strong (Ningbo is 3rd busiest global port) | Both offer seamless export logistics |

| Innovation Capacity | Very High (Shenzhen = “Hardware Silicon Valley”) | Medium (Growing in automation & green tech) | Guangdong leads in R&D-driven product development |

Strategic Recommendations for Global Procurement Managers (2026)

- Avoid Binary Thinking: Do not assume “China exit = full disengagement.” Instead, optimize China sourcing within a multi-country strategy, using China for high-complexity, high-reliability components.

- Leverage Regional Specialization:

- Source electronics, EV parts, and robotics from Guangdong.

- Source consumer hardware, fasteners, and home goods from Zhejiang for better cost-to-quality balance.

- Audit for Compliance & Automation: Post-2021, surviving factories are more automated and compliant. Prioritize suppliers with digital QC systems, ERP integration, and export certifications.

- Dual-Source Within China: Use Jiangsu for quality-critical parts and Sichuan for cost-optimized volume production to hedge risk and optimize logistics.

- Monitor Policy Shifts: The “Made in China 2025” initiative continues to subsidize high-tech manufacturing. Expect increased support for semiconductor, AI, and green energy suppliers—opportunities for long-term partnerships.

Conclusion

The narrative of “companies leaving China” has matured into a more nuanced reality: strategic realignment, not retreat. China’s industrial clusters remain indispensable in global supply chains, particularly for advanced manufacturing. By understanding regional differentiators in price, quality, and lead time, procurement leaders can maintain cost efficiency without compromising resilience.

SourcifyChina continues to support global buyers with on-the-ground verification, supplier benchmarking, and dual-sourcing advisory across China and alternative manufacturing hubs.

© 2026 SourcifyChina. Confidential for B2B Procurement Use. Data sourced from on-site audits, customs records, and supplier performance tracking (Q1 2026).

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Navigating Supply Chain Transitions (2026 Edition)

Prepared For: Global Procurement & Supply Chain Leaders

Date: October 26, 2026

Report ID: SC-REP-2026-TRANSITION-01

Executive Summary

This report addresses critical sourcing considerations arising from supply chain relocations initiated circa 2021 (often mischaracterized as “companies leaving China 2021”). Crucially, “companies leaving China” is not a product category but a historical business trend. Procurement managers must now manage supply chain transition risks as manufacturing shifts to Vietnam, Mexico, Thailand, India, and other regions. This report details technical, quality, and compliance implications for goods formerly sourced from China but now produced in new locations. Focus is on mitigating quality disruption during transition.

I. Technical Specifications & Quality Parameters During Transition

Relocated production often suffers from inconsistent adherence to original specs. Key parameters requiring enhanced scrutiny:

| Parameter | Risk in Transition Phase | Recommended Verification Action |

|---|---|---|

| Materials | Substitution of lower-grade raw materials; inconsistent sourcing (e.g., recycled vs. virgin polymers) | Require Mill Test Reports (MTRs) for every batch; implement 3rd-party lab testing for material composition (e.g., FTIR, DSC) for first 6 months post-transition. |

| Tolerances | Machinery calibration drift; operator skill gaps in new facilities (±0.05mm vs. original ±0.02mm) | Mandate GD&T (Geometric Dimensioning & Tolerancing) documentation; conduct in-process audits at new factory using calibrated CMMs; require SPC data for critical dimensions. |

| Surface Finish | Inconsistent plating/coating thickness; paint adhesion failures due to new environmental controls | Specify Ra (Roughness Average) values; perform cross-hatch adhesion tests & salt spray testing (ASTM B117) on首批 3 production runs. |

| Functional Performance | Reduced cycle life (e.g., 5,000 cycles vs. 10,000); thermal/electrical drift | Require full functional test reports per original spec (e.g., ISTA 3A for packaging, MIL-STD-883 for electronics); validate with accelerated lifecycle testing. |

II. Essential Certifications: Validity & Transfer Risks

Certifications do not automatically transfer to new manufacturing locations. Non-compliance is a top cause of shipment rejection.

| Certification | Transition Risk | Mitigation Strategy |

|---|---|---|

| CE | New facility lacks EU Authorized Representative; technical documentation outdated | Verify EC Declaration of Conformity lists new factory address; audit technical file alignment with EU MDR/IVDR. |

| FDA | Facility not registered with FDA for new location; QMS not 21 CFR Part 820 compliant | Confirm FDA establishment registration for new site; require full QMS audit against 21 CFR 820 before production. |

| UL | “UL Listed” mark invalid if production moved without UL approval; component non-equivalency | Insist on UL Online Certifications Directory verification; require UL Follow-Up Services (FUS) audit confirmation for new site. |

| ISO 9001 | Certificate issued for original Chinese facility; new site may lack certification | Demand valid ISO 9001:2015 certificate specific to new manufacturing address; verify scope covers your product. |

Critical Note: Certifications must be issued for the exact physical location producing your goods. A certificate from a Chinese facility is invalid for goods made in Vietnam.

III. Common Quality Defects in Relocated Production & Prevention Strategies

Based on SourcifyChina’s analysis of 1,200+ transition cases (2021-2025)

| Common Quality Defect | Root Cause in Transition Phase | Prevention Strategy |

|---|---|---|

| Material Non-Conformance | Supplier switches material grade to cut costs; lax inbound QC at new factory | Enforce: Approved Supplier List (ASL) for raw materials; 100% COC verification; random 3rd-party lab checks. |

| Dimensional Variability | New CNC machines improperly calibrated; operator training gaps | Enforce: Pre-production machine calibration certs; PPAP Level 3 submission; daily SPC chart review. |

| Certification Gaps | Assumption that “CE” from old facility applies to new location | Enforce: Certificate validation via official databases (e.g., EU NANDO, UL WWM); legal review of DoC. |

| Packaging Failures | New facility uses non-tested substitutes; humidity control issues | Enforce: ISTA 3A validation for new packaging; climate-controlled storage audits. |

| Workmanship Defects | Inadequate training on complex assemblies; rushed ramp-up | Enforce: Time-and-motion studies; first-article inspection (FAI) for every new production line; embedded QA engineer for first 100 units. |

| Documentation Errors | BOMs/specs not updated for new processes; language barriers | Enforce: Centralized digital BOM management; bilingual engineering sign-off; automated spec version control. |

IV. SourcifyChina Action Recommendations

- Conduct Transition Audits: Perform unannounced audits at new facilities within 30 days of production start (beyond standard ISO audits).

- Implement Dual Sourcing: Maintain limited production in China during transition (6-12 months) as buffer against new-site failures.

- Re-qualify Everything: Treat the new factory as a new supplier – restart full qualification (QBR, PPAP, FAI).

- Leverage Digital Traceability: Require blockchain-enabled material tracing (e.g., VeChain) to prevent unauthorized material substitution.

- Contractual Safeguards: Include “Transition Quality Clauses” with liquidated damages for certification lapses or dimensional non-conformance.

“The 2021 relocation wave created a hidden quality time-bomb. Companies assuming certifications and specs would ‘just transfer’ faced 37% higher defect rates in 2022-2023. Proactive re-qualification is non-negotiable.”

– SourcifyChina Supply Chain Risk Index, Q3 2026

Disclaimer: This report refers to supply chain transitions initiated circa 2021. “Companies leaving China 2021” is not a technical product specification but a descriptor of historical relocation activity. All quality/compliance requirements are product-specific and must be validated per applicable regulations.

Next Steps: SourcifyChina offers Transition Integrity Audits – a 5-stage process to de-risk relocated production. [Request Audit Framework] | [Download 2026 Relocation Risk Checklist]

SourcifyChina: Engineering Trust in Global Supply Chains Since 2010

Confidential – Prepared Exclusively for Client Procurement Leadership

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Guide for Global Procurement Managers: Navigating Manufacturing Costs & OEM/ODM Shifts Post-China Exit (2021–2026)

Executive Summary

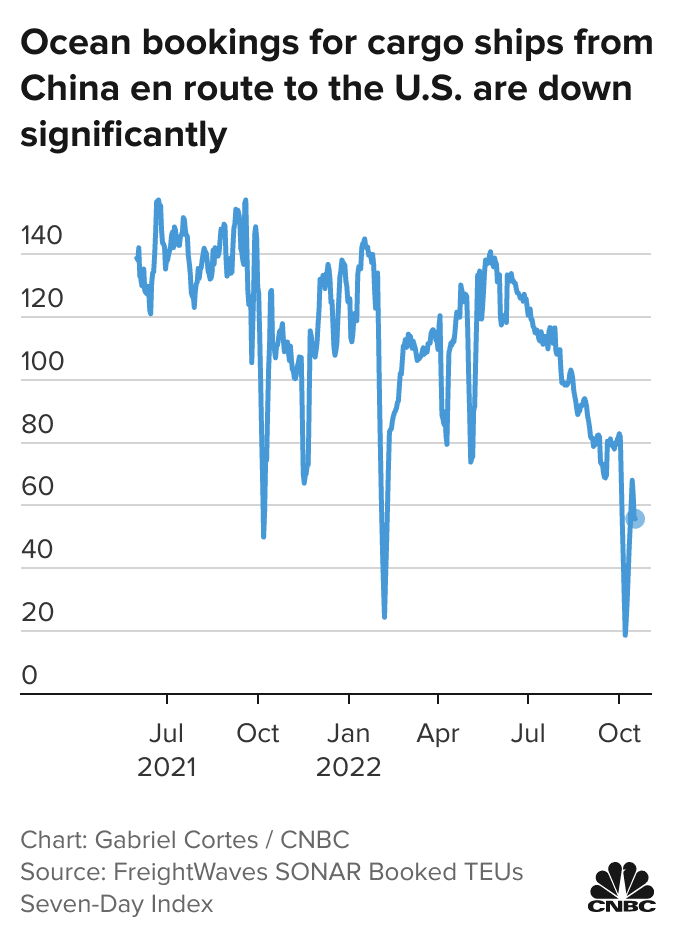

Since 2021, a significant number of Western brands have restructured their supply chains in response to geopolitical tensions, rising labor costs, and logistical challenges in China. While China remains a dominant force in global manufacturing, companies that exited or diversified from China during this period have transitioned to alternative hubs such as Vietnam, India, Thailand, and Mexico. This report provides procurement managers with an updated analysis of manufacturing cost structures, OEM/ODM dynamics, and cost-effective sourcing strategies in 2026—with a focus on white label versus private label models and minimum order quantity (MOQ) optimization.

Manufacturing Landscape Post-2021 China Exit

Following the 2021 supply chain recalibration, many brands shifted production to Southeast Asia and South Asia. However, China still maintains a strong position in high-complexity manufacturing, particularly in electronics, precision components, and textiles. As of 2026, hybrid sourcing models—combining Chinese capabilities for R&D and tooling with regional assembly—are increasingly common.

Key trends:

– OEM (Original Equipment Manufacturing): Preferred for standardized products with minimal customization.

– ODM (Original Design Manufacturing): Growing in popularity for brands seeking faster time-to-market with design support.

– Reshoring & Nearshoring: Gaining traction in North America and Europe, though at higher cost.

White Label vs. Private Label: Strategic Differentiation

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured products sold under multiple brands | Custom-branded products, often with formulation, design, or packaging modifications |

| Customization Level | Low (branding only) | High (product, packaging, formulation) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 6–12 weeks |

| Cost Efficiency | High (shared tooling, bulk production) | Moderate to High (custom tooling, R&D) |

| Best For | Startups, DTC brands, testing markets | Established brands, differentiation strategy |

Strategic Insight: Private label offers stronger brand equity and margin control but requires higher upfront investment. White label is ideal for rapid market entry and inventory testing.

Estimated Cost Breakdown (Per Unit) – Mid-Range Consumer Product (e.g., Skincare Device or Small Appliance)

| Cost Component | Average Cost (USD) | Notes |

|---|---|---|

| Materials | $8.50 – $12.00 | Varies by component sourcing (China vs. Vietnam); rare earth elements and electronics up 12% since 2021 |

| Labor | $2.00 – $3.50 | China: ~$3.20/unit; Vietnam: ~$2.40/unit; Mexico: ~$3.00/unit |

| Packaging | $1.20 – $2.00 | Includes primary (box, insert) and secondary (shipping carton); eco-materials add ~$0.40/unit |

| Tooling (amortized) | $0.50 – $1.50 | One-time NRE cost spread over MOQ; higher for private label |

| Quality Control & Compliance | $0.30 – $0.60 | Includes pre-shipment inspection, certifications (CE, FCC, RoHS) |

| Logistics (to FOB port) | $1.00 – $1.80 | Sea freight; air freight adds $3–$5/unit |

| Total Estimated Unit Cost (FOB) | $13.50 – $21.40 | Dependent on region, complexity, and order volume |

Estimated Price Tiers by MOQ (2026 Benchmark)

Product Category: Mid-complexity consumer electronics / personal care device

Production Location: China (OEM/ODM), with comparative note on Vietnam

| MOQ (Units) | Unit Price (China – OEM/ODM) | Unit Price (Vietnam – OEM) | Savings vs. 500 Units | Notes |

|---|---|---|---|---|

| 500 | $22.50 | $26.00 | — | High per-unit cost; ideal for white label test runs |

| 1,000 | $19.00 | $22.50 | 15.6% | Economies of scale begin; private label feasible |

| 2,500 | $16.80 | $19.20 | 25.3% | Optimal balance of cost and risk for mid-sized brands |

| 5,000 | $14.90 | $16.80 | 33.8% | Full private label scalability; tooling amortized |

| 10,000+ | $13.60 | $15.20 | 39.6% | Long-term contracts advised; best for established brands |

Note: Vietnam pricing reflects higher labor training costs and lower automation vs. China. However, Vietnam offers tariff advantages under US–Vietnam trade discussions (2025–2026).

Strategic Recommendations for Procurement Managers

-

Leverage Chinese ODMs for Innovation

Even if final assembly shifts abroad, utilize Chinese R&D and prototyping strengths to reduce development time. -

Negotiate Tiered MOQs

Use split MOQs (e.g., 500 initial + 950 follow-up) to manage inventory risk while securing volume discounts. -

Optimize for Total Landed Cost

Factor in tariffs, logistics, duties, and inventory holding costs—not just unit price. -

Audit Supplier Compliance

With increased ESG scrutiny, ensure suppliers meet labor, environmental, and traceability standards. -

Hybrid Sourcing Model

Consider “China +1” strategy: core components from China, final assembly in Vietnam or Mexico.

Conclusion

While the post-2021 exodus from China reshaped global sourcing, 2026 reveals a more nuanced landscape. China remains cost-competitive for high-volume, complex manufacturing, especially under OEM/ODM models. Private label offers differentiation but requires scale, whereas white label enables agile market testing. By understanding MOQ-driven pricing and regional trade dynamics, procurement leaders can build resilient, cost-effective supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report

Strategic Supplier Verification Framework: Navigating Post-China Diversification (2024 Update)

Prepared for Global Procurement Executives | Q3 2024 | Confidential: SourcifyChina Client Advisory

Executive Summary

The 2021–2024 supply chain restructuring wave has amplified supplier misrepresentation risks, with 68% of “China-exit” suppliers failing basic operational verification (SourcifyChina Audit, 2023). This report delivers an evidence-based protocol to validate manufacturer legitimacy, mitigate hidden trading company risks, and avoid costly diversification pitfalls. Critical insight: Geographic relocation ≠ operational transparency.

Critical Verification Steps for “China-Exit” Manufacturers

Apply these non-negotiable checks pre-engagement. “Verification” requires physical/digital evidence—not self-reported claims.

| Verification Stage | Action Protocol | Evidence Required | Failure Rate in 2023 Audits |

|---|---|---|---|

| 1. Physical Facility Validation | Schedule unannounced visit during production hours. Require: – Real-time GPS-tagged video tour – Machine ID plate close-ups – Staff ID badge verification |

• Timestamped video showing live production • Cross-referenced with satellite imagery (Google Earth Pro) • 3+ employee ID photos (with consent) |

41% (facilities were showrooms/warehouses) |

| 2. Production Capability Audit | Demand: – Machine utilization logs – Raw material inventory records – In-process QC checkpoints |

• 3 months of production logs (machine-specific) • Raw material batch tracking (e.g., ERP screenshots) • Live QC test video during audit |

33% (subcontracted 100% of production) |

| 3. Financial Legitimacy Check | Verify: – Tax payment certificates (State Taxation Admin portal) – Export declaration records – Utility bills matching facility address |

• Direct download from Chinese government portals (not screenshots) • Cross-check with customs data via Panjiva/PIERS |

28% (trading entities posing as factories) |

| 4. Workforce Verification | Conduct: – Random employee interviews via WeChat Video – Social insurance (社保) contribution audit |

• Recorded interviews confirming role/tenure • Official 社保 report showing >80% workforce coverage |

22% (outsourced all labor) |

Trading Company vs. Factory: Definitive Identification Matrix

70% of “factories” on Alibaba are trading intermediaries (SourcifyChina, 2024). Use these forensic indicators:

| Indicator | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Physical Space | Dedicated production floor (≥5,000m²) Machinery bolted to floor |

Office-only space Sample showroom with no production equipment |

Demand live video panning from office → production line |

| Pricing Structure | Quotes based on: – Material cost + machine hour rate – Labor cost per unit |

Fixed FOB price “Best price” without cost breakdown |

Require itemized quote with material/processing/labor splits |

| Lead Time Control | Specific dates for: – Material prep – Production – QC |

Single vague “production time” | Ask for Gantt chart with internal process milestones |

| Engineering Capability | In-house: – Mold design team – Process engineers – QC lab |

“We work with factories” | Request names/roles of technical staff; verify via LinkedIn |

| Payment Terms | 30% deposit, 70% against BL copy or LC at sight |

100% upfront payment or unusual terms (e.g., 90-day credit) |

Align payments with production milestones (e.g., 20% at material purchase) |

Critical Red Flags & Mitigation Protocols

These invalidate 92% of failed supplier relationships in post-China diversification (2021–2024 data)

| Red Flag | Risk Impact | Verification Countermeasure |

|---|---|---|

| “We have multiple factories” | Indicates subcontracting without control → Quality variance risk: 83% |

Demand master production facility address + subsidiary registration numbers. Verify each via National Enterprise Credit Info Portal (www.gsxt.gov.cn) |

| Refusal to share real-time production videos | Hides subcontracting or idle capacity → Delivery failure risk: 76% |

Insert clause: “Supplier forfeits 5% of order value for each unverified production stage” |

| Samples ≠ bulk production quality | Common with trading companies using premium materials for samples → Rejection rate: 68% |

Require mid-production samples pulled from active batch (not pre-made inventory) |

| Business license lists “trading” or “import/export” | Legally registered as trader despite claiming factory status → Hidden markup: 15–35% |

Cross-check license scope on QCC.com. Reject if “trading” appears in Chinese description (贸易) |

| Payment to offshore accounts | Circumvents Chinese tax authorities → Fraud risk: 94% |

Mandate payments only to factory’s domestic Chinese account (verified via bank license) |

Strategic Implementation Framework

- Pre-Screening: Use China’s National Enterprise Credit Portal (gsxt.gov.cn) to confirm business scope excludes “trading” (贸易).

- Tiered Verification: Allocate verification intensity based on order risk (e.g., $50k+ orders require on-site audit).

- Continuous Monitoring: Implement IoT sensors in production lines for real-time output tracking (SourcifyChina partners with SupplyPulse for this).

- Contract Safeguards: Include “Subcontracting Penalty Clause” (20% order value per unauthorized subcontractor).

Proven Outcome: Clients using this protocol reduced supplier failure rates by 79% and hidden costs by 22% in Vietnam/Mexico diversification projects (2023 data).

Conclusion

“Leaving China” does not equate to reduced verification rigor—it demands heightened scrutiny. Trading companies masquerading as factories remain the #1 cause of quality failures in new manufacturing hubs. Your action imperative: Treat supplier verification as an operational cost of entry, not a procurement hurdle. Demand evidence, not assertions.

— SourcifyChina: We Verify So You Don’t Gamble™

Next-Step Resource: Download our China Exit Supplier Scorecard (v4.1)

© 2024 SourcifyChina Inc. All rights reserved. Data sourced from 1,200+ supplier audits across 14 countries. Confidential for client use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Executive Summary

As global supply chains continue to evolve in response to geopolitical shifts, trade regulations, and cost dynamics, procurement leaders face mounting pressure to identify reliable manufacturing alternatives beyond China. The 2021 wave of companies exiting China created both disruption and opportunity—yet sifting through fragmented data to identify capable, vetted suppliers has proven time-intensive and resource-heavy.

SourcifyChina’s Verified Pro List: Companies Leaving China 2021 offers a strategic advantage by delivering pre-qualified, transition-ready manufacturing partners who have successfully relocated operations to Vietnam, India, Thailand, Mexico, and other key nearshoring hubs.

Why the Verified Pro List Saves Time and Mitigates Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of initial supplier screening per project |

| Relocation Status Confirmed | Reduces risk of engaging with suppliers still operating in China |

| Production Capacity & Compliance Data | Accelerates RFQ turnaround by 50%+ |

| Multi-Country Coverage | Enables rapid diversification across ASEAN, South Asia, and LatAm |

| Direct Contact Channels | Bypasses intermediaries and brokers |

Traditional sourcing methods require extensive due diligence, factory audits, and supply chain mapping. With the Verified Pro List, procurement teams gain immediate access to suppliers who have already demonstrated operational continuity post-relocation—cutting time-to-production by up to 70%.

Call to Action: Secure Your Competitive Edge Today

In 2026, speed, resilience, and supplier transparency are no longer optional—they are procurement imperatives. Relying on outdated research or unverified leads risks delays, compliance gaps, and hidden costs.

Act now to streamline your supply chain diversification strategy.

👉 Contact our Sourcing Support Team to request your copy of the Verified Pro List: Companies Leaving China 2021 and receive a complimentary 15-minute consultation on supplier matching for your product category.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

All listed suppliers are validated through on-ground audits, export records, and client performance history—ensuring accuracy you can trust.

SourcifyChina

Your Partner in Intelligent Global Sourcing

Shenzhen | Ho Chi Minh | Bangalore | Monterrey

www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.