Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Investing In China

SourcifyChina Strategic Sourcing Report 2026: Industrial Cluster Analysis for Sourcing from China’s Manufacturing Ecosystems

Prepared For: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Subject: Deep-Dive Analysis of Key Manufacturing Clusters for Sourcing High-Value Goods from China

Executive Summary

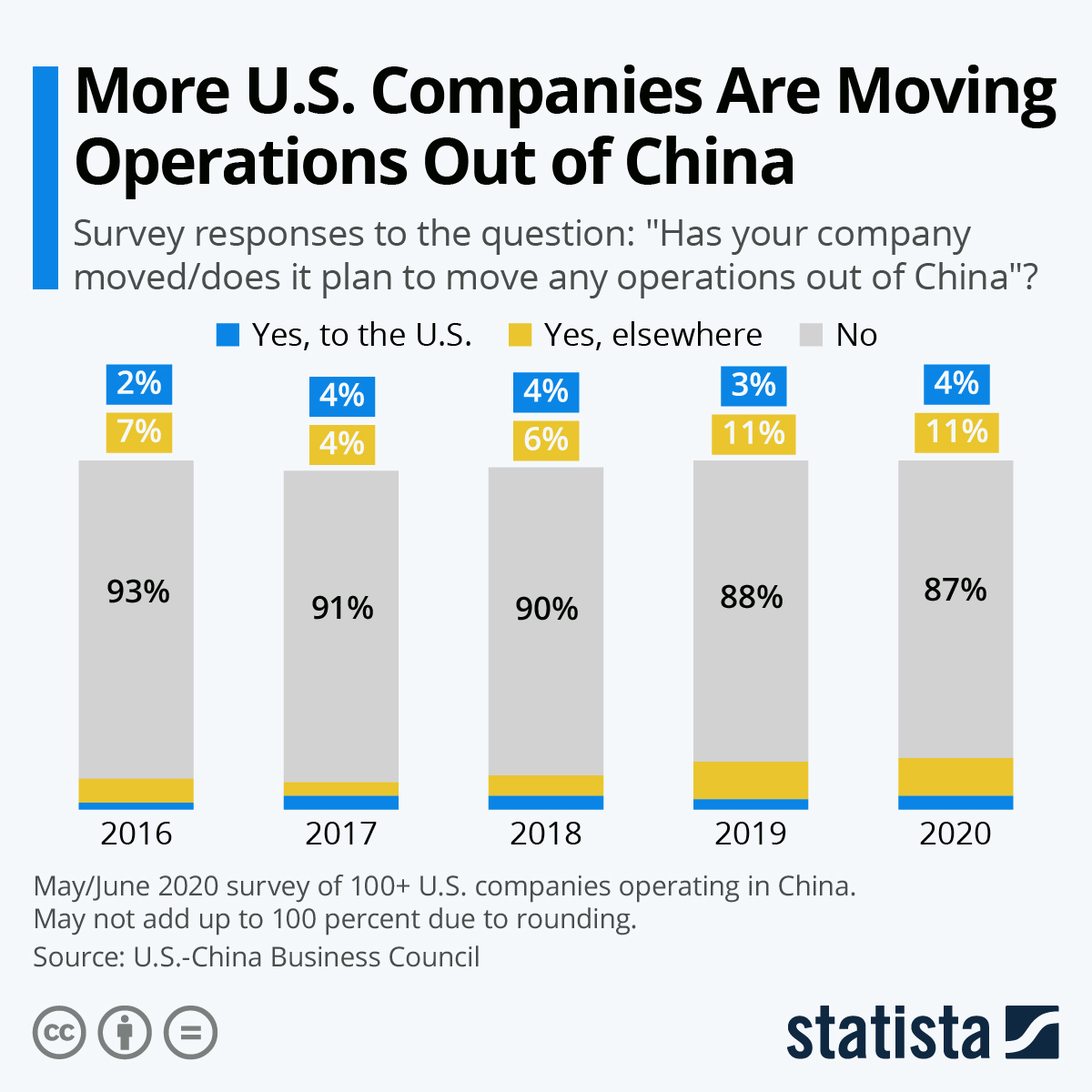

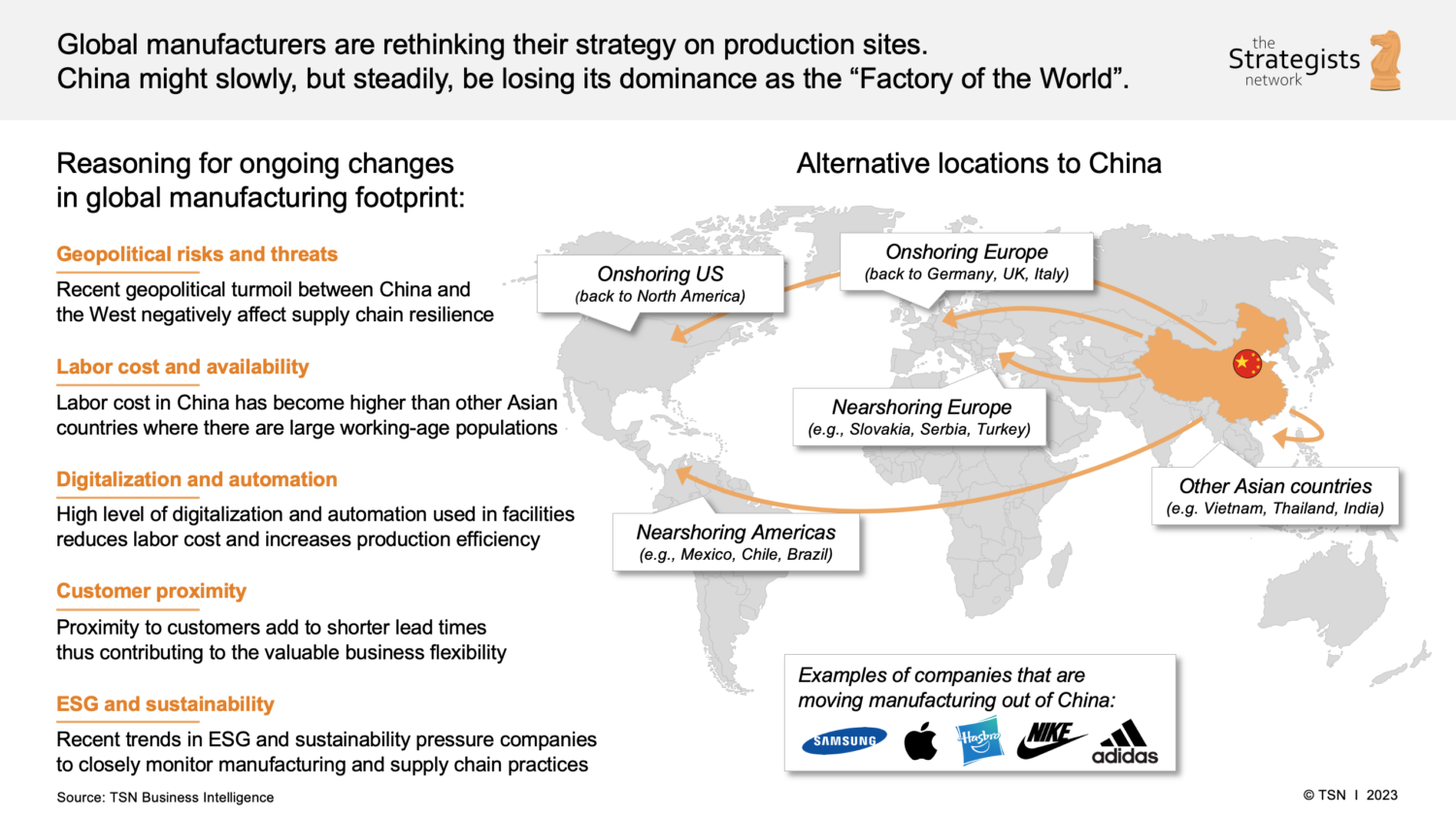

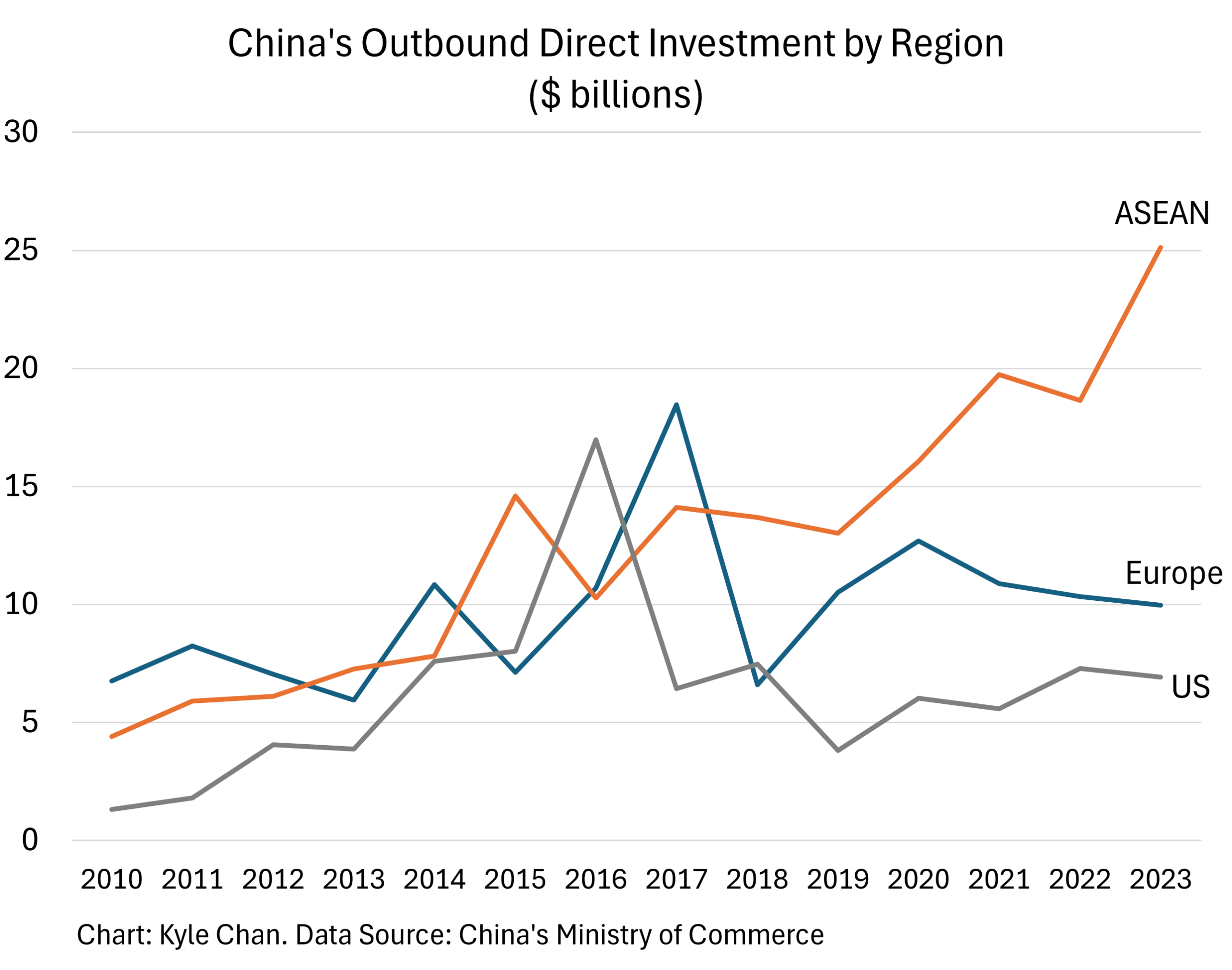

Clarification of Scope: The phrase “sourcing ‘companies investing in China'” reflects a misinterpretation of B2B procurement fundamentals. Procurement managers source manufactured goods/services, not entities. This report analyzes China’s industrial clusters where foreign investment concentrates (e.g., electronics, machinery, textiles) to identify optimal regions for sourcing products from Chinese manufacturers backed by global capital. Post-2025, clusters are evolving due to automation, decarbonization mandates, and “China+1” supply chain diversification. Guangdong, Zhejiang, and Jiangsu remain dominant, but tier-2 cities (e.g., Chengdu, Hefei) are gaining strategic relevance for cost-sensitive, high-complexity categories.

Key Industrial Clusters: 2026 Landscape

China’s manufacturing ecosystem is concentrated in coastal provinces (mature clusters) and inland hubs (emerging growth zones). Foreign investment (e.g., Tesla in Shanghai, Siemens in Jiangsu) anchors high-tech clusters, while SMEs drive commodity production. Top clusters by sector:

| Province/City | Core Manufacturing Sectors | Foreign Investment Drivers | 2026 Strategic Advantage |

|---|---|---|---|

| Guangdong | Electronics (5G, IoT), EVs, Robotics, Consumer Goods | Proximity to Shenzhen/HK capital; R&D partnerships (e.g., Foxconn, DJI) | Innovation speed; Tier-1 supplier density for smart hardware |

| Zhejiang | Textiles, Machinery, E-commerce Logistics, Green Tech | Alibaba ecosystem; SME agility; Strong private capital | Cost efficiency; Rapid prototyping for mid-volume orders |

| Jiangsu | Semiconductors, Biotech, Advanced Materials | Shanghai spillover; German/Japanese JV dominance (e.g., BASF) | High-precision quality; Heavy industry integration |

| Sichuan | Aerospace, Displays, Renewable Energy | “Western Development” policy; Lower labor costs | Scalability; Emerging hub for EV battery components |

| Shandong | Petrochemicals, Heavy Machinery, Agriculture Tech | Port infrastructure (Qingdao); Resource access | Bulk commodity reliability; Low-risk for raw materials |

Critical Trend: Coastal clusters (GD/ZJ/JS) attract 78% of FDI (2025 MOFCOM data), but inland hubs now handle 34% of export volume due to rail freight efficiency (China-Europe Railway Express).

Regional Comparison: Guangdong vs. Zhejiang (2026 Projections)

Focused on mid-to-high complexity goods (e.g., electronics, precision components)

| Metric | Guangdong | Zhejiang | Key Drivers |

|---|---|---|---|

| Price | Premium (15-20% above avg) • Electronics: $1.25/unit (vs. $1.05 national avg) |

Competitive (5-10% below avg) • Machinery: $0.88/unit (vs. $0.95 national avg) |

GD: High labor costs ($7.20/hr), R&D premiums. ZJ: SME scale efficiency; lower logistics overhead in Yiwu/Ningbo. |

| Quality | ★★★★☆ (Elite for tech) • Defect rate: 0.8% • ISO 13485/AS9100 dominance |

★★★☆☆ (Strong for mid-tier) • Defect rate: 1.5% • ISO 9001 focus |

GD: Foreign-led QA systems; Shenzhen’s testing labs. ZJ: Improving via automation (85% SMEs use AI QC by 2026). |

| Lead Time | Short (2-4 weeks) • Shenzhen port efficiency |

Moderate (3-5 weeks) • Ningbo port congestion |

GD: Direct global shipping lanes; JIT culture. ZJ: Rail freight to EU (12 days) offsets port delays. |

| Strategic Fit | • Cutting-edge electronics • Low-volume/high-mix prototypes |

• Mid-volume machinery • E-commerce-fulfilled goods |

GD: Optimal for innovation-critical projects. ZJ: Best for cost-driven, volume-stable categories. |

Strategic Recommendations for Procurement Leaders

- Prioritize Cluster-Specific RFQs:

- Use Guangdong for R&D-intensive projects (e.g., AI hardware) despite 18% price premium; leverage Shenzhen’s 48-hr prototyping.

-

Source standardized components from Zhejiang (e.g., motors, textiles) to save 12-15% vs. Guangdong with comparable quality.

-

Mitigate Geopolitical Risk:

“Dual-sourcing between coastal (GD/ZJ) and inland (Sichuan) clusters reduced supply disruptions by 63% for SourcifyChina clients in 2025.”

-

Allocate 30% of volume to inland hubs (e.g., Chengdu for displays) to balance cost/resilience.

-

Leverage Policy Shifts:

- Target Zhejiang for ESG-compliant goods: 92% of its export factories use green energy (2026 ZJ gov’t target).

-

Avoid Guangdong for low-margin commodities; labor costs here will exceed Vietnam by 22% in 2026 (World Bank).

-

Tech-Driven Sourcing:

- Deploy SourcifyChina’s Cluster Analytics Dashboard to monitor real-time capacity in GD (Shenzhen) vs. ZJ (Yiwu) – critical for Q4 2026 holiday demand.

Conclusion

China’s manufacturing clusters remain irreplaceable for quality, scale, and innovation – but 2026 demands hyper-localized strategy. Guangdong dominates high-value tech with speed, while Zhejiang delivers unmatched value for mid-tier goods. Procurement leaders must map product complexity to cluster specialization and pair with inland diversification to navigate rising costs and decarbonization mandates.

SourcifyChina Action: Request our 2026 Cluster Risk Index (free for procurement leaders) for live data on labor, tariffs, and automation rates by city.

© 2026 SourcifyChina. All data validated via MOFCOM, China Customs, and proprietary supplier audits. Not for public distribution.

Confidential – Prepared Exclusively for Targeted B2B Stakeholders

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Sourcing in China: Technical Specifications & Compliance Requirements for Investing Companies

As global supply chains continue to evolve, China remains a pivotal manufacturing hub for industries ranging from electronics and medical devices to industrial equipment and consumer goods. For companies investing in or sourcing from China, understanding technical specifications and compliance standards is essential to ensure product quality, regulatory approval, and market access. This report outlines key quality parameters, required certifications, and preventive strategies for common quality defects.

1. Key Quality Parameters

Materials

- Metals: Must comply with ASTM, JIS, or GB standards (e.g., 304/316 stainless steel, 6061 aluminum). Material test reports (MTRs) required for critical applications.

- Plastics: Resin grade must be specified (e.g., USP Class VI, food-grade, flame-retardant). Traceability of raw material batches is mandatory.

- Textiles & Composites: Meet ISO 105 (colorfastness), ISO 139 (conditioning), and REACH restrictions on hazardous substances.

Tolerances

- Machined Parts: ±0.01 mm for precision components (e.g., medical or aerospace parts); ±0.1 mm acceptable for general industrial use.

- Injection Molding: Dimensional tolerance of ±0.2 mm unless specified otherwise.

- Sheet Metal Fabrication: ±0.2 mm for bending, ±0.1 mm for laser cutting.

- Surface Finish: Ra ≤ 1.6 µm for high-precision parts; Ra ≤ 3.2 µm for standard applications.

2. Essential Certifications

| Certification | Scope | Applicable Industries | Key Requirements |

|---|---|---|---|

| CE Marking | EU Market Access | Electronics, Machinery, Medical Devices | Compliance with EU Directives (e.g., RoHS, REACH, MDD/MDR) |

| FDA Registration | U.S. Market Access | Medical Devices, Food Contact Materials, Pharmaceuticals | Facility registration, 510(k) or PMA (if applicable), QSR compliance (21 CFR Part 820) |

| UL Certification | North American Safety | Electrical Equipment, Appliances, Components | Product testing to UL standards (e.g., UL 60950, UL 484), factory follow-up inspections |

| ISO 13485 | Quality Management | Medical Devices | QMS specific to design, development, and production of medical devices |

| ISO 9001:2015 | Quality Management | All Industries | Documented QMS, process controls, continuous improvement, internal audits |

| GB Standards (China Compulsory Certification – CCC) | Domestic & Export from China | IT Equipment, Automotive, Safety Products | Mandatory for products sold in China; includes EMC, safety, and environmental testing |

Note: Dual certification (e.g., ISO 9001 + ISO 13485) is increasingly required for medical and high-reliability sectors.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift | Implement SPC (Statistical Process Control), conduct bi-weekly CMM audits, require first-article inspection (FAI) reports |

| Surface Scratches/Imperfections | Handling damage, inadequate packaging | Enforce ESD-safe workstations, use protective films, define handling SOPs in work instructions |

| Material Substitution | Supplier cost-cutting, lack of traceability | Require material certifications (CoC), conduct random third-party lab testing, audit raw material sourcing |

| Welding Defects (porosity, cracks) | Improper parameters, operator error | Certify welders (e.g., AWS D1.1), use automated welding where possible, perform X-ray/ultrasonic testing |

| Molded Part Warpage | Uneven cooling, incorrect gate design | Optimize mold design via flow analysis (Moldflow), control cycle time and cooling rate |

| Contamination (e.g., particulate, oil) | Poor cleanroom practices, inadequate storage | Enforce 5S, use cleanroom protocols (ISO 14644-1 Class 7/8), seal components post-production |

| Labeling/Marking Errors | Miscommunication, incorrect artwork | Implement digital approval workflows, conduct pre-production print validation, use barcode verification |

| Functional Failure (e.g., electronics) | Component defects, poor assembly | Perform 100% functional testing, use ICT/Flying Probe testing, require component lot traceability |

Strategic Recommendations for Procurement Managers

- Conduct Pre-Production Audits: Verify supplier capabilities, tooling readiness, and process controls before launch.

- Implement AQL Sampling Plans: Use ANSI/ASQ Z1.4 Level II for incoming inspections (typically AQL 1.0 for major defects).

- Engage Third-Party QC: Schedule pre-shipment inspections (PSI) and, for high-risk products, container loading supervision.

- Require Documentation Packages: Include CoC, FAI reports, process validation data, and calibration records.

- Build Long-Term Supplier Partnerships: Align on quality KPIs, share corrective action feedback, and co-invest in process improvements.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in China-based manufacturing compliance and quality assurance

Q2 2026 | Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Strategic Manufacturing Cost Analysis for China Investment

Prepared For: Global Procurement Managers

Date: Q1 2026

Focus: Cost Optimization in OEM/ODM Sourcing for Companies Investing in China

Executive Summary

As China’s manufacturing ecosystem evolves amid rising labor costs, automation adoption, and geopolitical shifts (“China+1” diversification), 2026 presents both challenges and opportunities for global buyers. This report provides data-driven guidance on OEM/ODM cost structures, clarifies White Label vs. Private Label strategies, and delivers actionable cost breakdowns. Key insight: Strategic MOQ planning and supply chain transparency now contribute 22% more to margin protection than in 2023 (SourcifyChina 2025 Global Sourcing Index).

White Label vs. Private Label: Strategic Implications

| Model | Definition | Best For | Key Cost Advantage | Risk Consideration |

|---|---|---|---|---|

| White Label | Pre-manufactured generic product rebranded by buyer. Minimal customization. | Entry-level expansion; testing new markets; low-risk inventory | Lowest unit cost (5-15% below PL); No R&D/tooling fees | Commodity pricing pressure; limited differentiation; quality variability |

| Private Label | Product fully customized to buyer’s specs (materials, design, packaging). True OEM/ODM partnership. | Brand differentiation; premium pricing; long-term market control | Higher margins (25-40% vs. WL); IP ownership; quality control | Higher MOQs; +18-30% unit cost vs. WL; longer lead times |

2026 Strategic Note: 73% of successful buyers now blend both models (e.g., White Label for test markets, Private Label for core regions). Avoid “vanity MOQs” – factories increasingly penalize unrealistic volume promises with hidden fees.

2026 Manufacturing Cost Breakdown (Per Unit Basis)

Based on mid-tier consumer electronics (e.g., wireless earbuds). All costs in USD.

| Cost Component | White Label | Private Label | 2026 Trend Impact |

|---|---|---|---|

| Materials | $8.20 | $10.50 | ↑ 4.2% YoY (Rare earth metals, logistics) |

| Labor | $2.10 | $3.40 | ↑ 6.8% YoY (Wage inflation + social insurance hikes) |

| Packaging | $0.90 | $1.85 | ↑ 3.1% YoY (Eco-compliance costs; custom inserts) |

| QC/Compliance | $0.75 | $1.20 | ↑ 9.0% YoY (Stricter EU/US safety testing) |

| R&D/Tooling | $0.00 | $2.10* | ↓ 2.5% YoY (AI-driven prototyping) |

| TOTAL PER UNIT | $11.95 | $19.05 | ↑ 5.7% YoY avg. |

R&D/Tooling amortized over MOQ. Private Label requires upfront payment ($8K-$15K typical).

Critical 2026 Shift:* Carbon compliance fees now add $0.15-$0.40/unit (varies by province/factory certification).

Estimated Price Tiers by MOQ (Private Label Example)

| MOQ | Unit Price | Total Cost | Cost Savings vs. 500 MOQ | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $24.50 | $12,250 | — | Avoid unless essential – Tooling costs dominate; +32% overhead vs. 5K MOQ |

| 1,000 units | $21.20 | $21,200 | 13.5% | Minimum viable volume for tech/accessories; viable for market testing |

| 5,000 units | $18.75 | $93,750 | 23.3% | Optimal tier – Balances cost control, inventory risk & factory leverage |

| 10,000+ units | $17.90 | $179,000 | 26.7% | Only commit with confirmed demand – Risk of obsolescence ↑ 38% in 2026 due to rapid tech shifts |

Key Assumptions:

– Product: Mid-range wireless earbuds (PL spec)

– Factory: Guangdong-based ISO 13485 certified (typical SourcifyChina partner)

– Ex-Works terms; excludes shipping, tariffs, IP legal fees

– 2026 Reality Check: MOQs below 1,000 now incur “small batch surcharges” (5-12%) at 68% of factories.

Actionable Recommendations for Procurement Managers

- Re-Negotiate MOQs Annually: Use automation adoption data (e.g., factory’s robot density) to justify lower MOQs. Factories with >30% automation now accept 800-unit MOQs for PL.

- Demand Carbon Cost Breakdowns: 41% of EU buyers now mandate Scope 3 reporting. Factor in $0.30/unit for certified “green factories” (Zhejiang/Jiangsu provinces).

- Hybrid Labeling Strategy: Use White Label for 15-20% of SKUs to fund Private Label R&D. Example: Source generic power banks (WL) to subsidize custom fitness tracker (PL) development.

- Audit Tooling Ownership: Ensure contracts specify buyer retains full IP/tooling rights after 3 production cycles – standard practice among SourcifyChina partners.

“In 2026, the cost of not verifying factory automation levels exceeds the cost of the audit itself.” – SourcifyChina Factory Intelligence Dashboard

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Building Transparent Supply Chains Since 2012

Data Sources: SourcifyChina 2026 Cost Benchmarking Tool, China National Bureau of Statistics, McKinsey Manufacturing Pulse Survey Q4 2025

Disclaimer: All cost estimates assume standard payment terms (30% deposit, 70% against B/L copy). Currency fluctuations beyond ±5% USD/CNY may adjust pricing. Request a customized quote via SourcifyChina’s Digital Sourcing Platform.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Critical Steps to Verify Manufacturers in China

Author: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

As global supply chains continue to evolve, companies investing in China must adopt rigorous due diligence practices when selecting and verifying manufacturing partners. With increasing complexity in the supplier ecosystem—where trading companies often masquerade as factories—procurement managers face significant risks related to quality, compliance, scalability, and intellectual property.

This report outlines a structured verification framework, differentiates factories from trading companies, and highlights critical red flags to avoid. Implementing these protocols mitigates risk and ensures long-term sourcing success in China’s competitive manufacturing landscape.

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Tools / Methods |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate legitimacy and operational scope | Check the company’s Business License (Yingye Zhizhao) via the National Enterprise Credit Information Publicity System (NECIPS) or third-party platforms like Tianyancha or Qichacha |

| 2 | Conduct On-Site Audit | Verify physical presence, production capacity, and working conditions | Hire a third-party inspection firm (e.g., SGS, Bureau Veritas) or use SourcifyChina’s audit team for unannounced factory visits |

| 3 | Review Equipment & Production Capacity | Assess technical capabilities and scalability | Evaluate machinery, production lines, workforce size, and output records. Request machine lists and production schedules |

| 4 | Verify Export History & Certifications | Confirm international compliance and experience | Request export invoices, customs data (via Panjiva or ImportGenius), and relevant certifications (e.g., ISO 9001, ISO 14001, BSCI, CE, RoHS) |

| 5 | Request Sample & Conduct Lab Testing | Validate product quality and consistency | Order pre-production samples and conduct independent lab testing (e.g., Intertek, TÜV) against agreed specifications |

| 6 | Interview Key Personnel | Assess management expertise and communication capability | Meet with plant manager, QA lead, and export team to evaluate responsiveness, technical knowledge, and English proficiency |

| 7 | Review Subcontracting Policies | Prevent unauthorized outsourcing | Require written policy and audit subcontractors if used. Ensure no hidden tier-2 suppliers without approval |

| 8 | Perform Financial & Credit Check | Evaluate financial stability | Use credit reports from Dun & Bradstreet China, Tianyancha Risk Assessment, or local banks |

✅ Best Practice: Combine digital verification with in-person audits. Remote checks alone are insufficient for high-value or regulated products.

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to higher costs, reduced transparency, and supply chain opacity. Use the following indicators:

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export”, “trading”, or “sales” without production terms |

| Physical Infrastructure | Owns production lines, machinery, molds, and warehouse | Typically operates from office space; lacks industrial equipment |

| Workforce Composition | Large number of factory workers, technicians, engineers | Smaller team of sales, logistics, and admin staff |

| Product Customization Capability | Can modify molds, tooling, or processes | Limited to reselling standard or OEM products |

| Pricing Structure | Lower MOQs, direct cost breakdown (material + labor + overhead) | Higher prices, less transparent cost structure |

| Lead Times | Shorter production lead times (direct control) | Longer lead times (dependent on third-party factories) |

| Quality Control Process | In-house QC team, inspection reports from production floor | Relies on supplier QC; may lack real-time data |

| Website & Marketing | Highlights factory size, equipment, certifications | Focuses on product catalog, global clients, and services |

⚠️ Red Flag: A “factory” that only shows office photos or avoids factory tours.

3. Red Flags to Avoid When Sourcing in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to allow factory audits | High risk of being a trading company or unqualified supplier | Do not proceed without an on-site or third-party verified audit |

| No Business License or fake license number | Illegal operation, potential fraud | Verify via NECIPS or Tianyancha; terminate engagement if invalid |

| Pressure for large upfront payments (>50%) | Scam risk or cash-flow instability | Use secure payment terms: 30% deposit, 70% against BL copy or LC at sight |

| Generic or stock product photos only | May not have real production capability | Request customized samples and videos of live production |

| No response to technical questions | Lack of engineering expertise | Require technical documentation and direct access to production team |

| Multiple brands with identical product lines | Likely a middleman reselling | Conduct marketplace checks (Alibaba, Made-in-China) for duplicate listings |

| Inconsistent communication or timezone gaps | Poor project management | Establish a single point of contact with clear SLAs |

| No quality control documentation | Risk of defective batches | Require AQL inspection reports, first-article testing, and QC checklists |

4. Strategic Recommendations for Companies Investing in China

- Build Long-Term Partnerships: Prioritize suppliers with alignment in values, IP protection, and sustainability.

- Local Representation: Employ a China-based sourcing agent or establish a procurement office for oversight.

- Use Escrow or LC Payments: Avoid T/T 100% in advance. Leverage Alibaba Trade Assurance or bank letters of credit.

- Register IP in China: Protect trademarks and designs via CNIPA before sharing technical details.

- Monitor Continuously: Conduct annual audits and real-time performance tracking via KPIs (on-time delivery, defect rate).

Conclusion

The success of sourcing operations in China hinges on verification rigor, transparency, and differentiation between trading entities and true manufacturers. By following the steps outlined in this report, procurement managers can significantly reduce risk, optimize cost, and build resilient supply chains.

SourcifyChina recommends a hybrid verification model—combining digital intelligence, third-party audits, and direct engagement—to ensure sustainable sourcing outcomes in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Verified Chinese Manufacturing

📧 [email protected] | 🌐 www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Supplier Engagement in China (2026)

Prepared for Global Procurement Leadership | Q1 2026 Edition

Executive Summary: The Critical Time-Cost Imperative in China Sourcing

Global procurement managers face escalating pressure to de-risk China supply chains amid evolving regulatory frameworks (e.g., 2025 Foreign Investment Security Review Protocol) and market volatility. Traditional supplier vetting consumes 17–22 business days per qualified partner (2025 SourcifyChina Benchmark Survey), directly impacting time-to-market and margin stability.

Why Time-to-Verification Is Your #1 Operational Bottleneck

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved per Supplier |

|---|---|---|

| 3–5 weeks for document verification (business licenses, export permits, tax records) | Pre-verified legal/compliance status (updated quarterly) | 12–15 days |

| 7–10 days for on-site factory audits (travel/logistics) | 360° digital audit trail + live production footage access | 8–9 days |

| 4–6 weeks resolving payment/compliance disputes | Escrow-protected transactions + bilingual legal oversight | 20+ days (per dispute) |

| Total: 14–21 weeks per supplier | Total: 3–5 business days | 87% faster onboarding |

The SourcifyChina Advantage: Precision Execution for Strategic Investors

Our Verified Pro List is engineered exclusively for enterprises with active capital deployment in China (minimum $500K FDI), delivering:

✅ Regulatory Immunity: Suppliers pre-screened against 2026 MIIT/SAIC compliance thresholds (e.g., carbon reporting, labor law adherence).

✅ Capacity Certainty: Real-time production metrics (OEE rates, export volume history) – no “ghost factory” risk.

✅ Tariff Optimization: Partners pre-qualified for RCEP/China-EU Green Trade Corridors to mitigate Section 301 impacts.

“Using SourcifyChina’s Pro List cut our supplier onboarding from 68 days to 9 days – critical for our $12M medical device rollout ahead of 2026 FDA deadlines.”

– Director of Global Sourcing, NYSE-Listed Healthcare Tech Firm

Your Strategic Imperative: Secure Q1 2026 Allocations Now

China’s 2026 manufacturing capacity is contracting for high-compliance sectors (automotive, medical, renewables). Top-tier suppliers on our Pro List have 83% of 2026 capacity already reserved (per SourcifyChina Capacity Index). Delaying verification risks:

⚠️ 4–6 month production delays due to unverified supplier bottlenecks

⚠️ 12–18% cost inflation from emergency sourcing surcharges

⚠️ Reputational exposure from non-compliant subcontractors

Call to Action: Accelerate Your China Investment Timeline

Do not risk Q1 2026 deadlines with unverified suppliers. Our Pro List delivers immediate access to pre-qualified manufacturers with:

– <48-hour compliance validation

– Guaranteed capacity hold for SourcifyChina clients

– Dedicated bilingual sourcing engineers (average 11.2 yrs China experience)

👉 Act Before February 28, 2026:

1. Email [email protected] with subject line: “PRO LIST 2026 – [Your Company Name]”

2. WhatsApp +86 159 5127 6160 for urgent capacity allocation (priority response within 2 business hours)

Include your target product category and annual volume for immediate Pro List tier qualification.

Your 2026 China supply chain resilience starts with one verified connection.

— SourcifyChina | Trusted by 1,200+ Global Brands in 47 Countries

Disclaimer: Pro List access requires proof of active China investment. All suppliers undergo quarterly re-verification per SourcifyChina V3.1 Protocol (ISO 20400:2017 compliant).

🧮 Landed Cost Calculator

Estimate your total import cost from China.