Sourcing Guide Contents

Industrial Clusters: Where to Source Companies In Shanghai China

SourcifyChina – Professional B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Companies in Shanghai, China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

Shanghai remains a pivotal hub for high-value manufacturing, innovation, and international trade within China. While traditionally perceived as a financial and commercial center, Shanghai has evolved into a sophisticated industrial and technological manufacturing ecosystem—particularly in advanced electronics, precision machinery, automotive components, and medical devices. However, sourcing from “companies in Shanghai, China” often extends beyond the city itself, leveraging integrated supply chains across the Yangtze River Delta (YRD) region.

This report identifies key industrial clusters relevant to Shanghai-based sourcing, analyzes regional competitive advantages, and provides a comparative assessment of major manufacturing provinces to guide strategic procurement decisions in 2026.

1. Understanding Shanghai’s Industrial Ecosystem

Shanghai’s manufacturing base is characterized by:

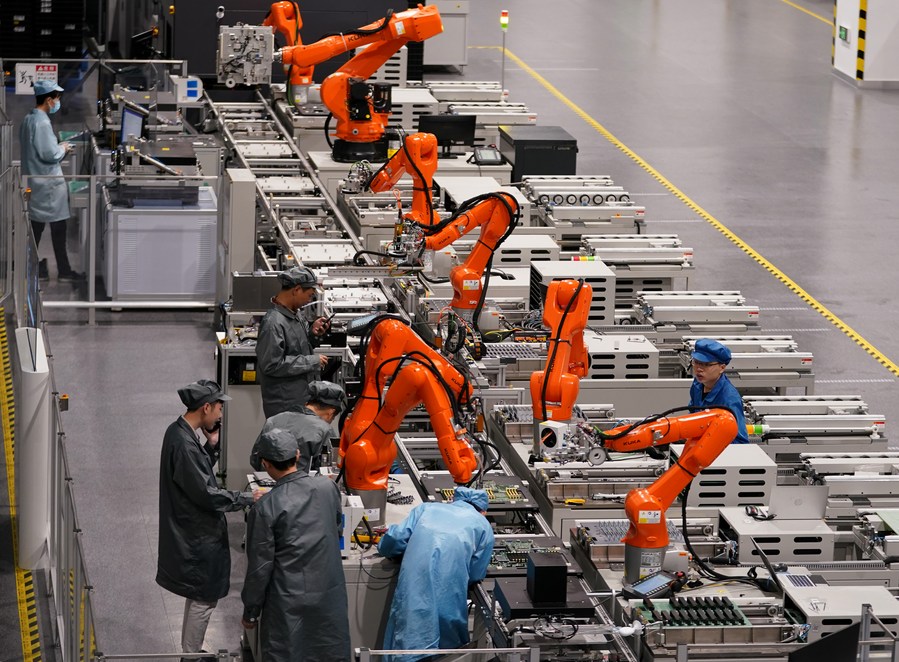

- High automation and Industry 4.0 adoption

- Strong R&D and innovation infrastructure

- Proximity to international logistics hubs (Port of Shanghai, Pudong Airport)

- Strict regulatory compliance and environmental standards

- Focus on high-mix, low-to-medium volume, high-precision production

While Shanghai excels in quality and compliance, it is not typically the lowest-cost manufacturing location. As such, many Shanghai-based companies outsource high-volume production to nearby provinces while retaining design, engineering, and final assembly in-city.

2. Key Industrial Clusters Supporting Shanghai-Based Sourcing

Although Shanghai itself hosts numerous OEMs, ODMs, and tier-1 suppliers, procurement managers should consider the broader Yangtze River Delta (YRD) manufacturing corridor, which includes:

| Region | Key Industries | Role in Shanghai-Centric Supply Chains |

|---|---|---|

| Shanghai | Electronics, Medical Devices, Automotive, Robotics, Industrial Automation | R&D, HQ, Prototyping, Final Assembly, Compliance Testing |

| Suzhou (Jiangsu) | Semiconductors, Electronics, IT Hardware, Precision Components | High-volume electronics and component manufacturing |

| Ningbo (Zhejiang) | Plastics, Molds, Auto Parts, Home Appliances | Cost-competitive molding and mechanical parts |

| Wuxi & Changzhou (Jiangsu) | EV Components, Solar, Advanced Materials | Strategic for new energy and green tech supply chains |

| Hangzhou (Zhejiang) | Smart Devices, IoT, E-Commerce Fulfillment | Tech-integrated manufacturing and digital supply chain |

Insight: A “Shanghai-based company” often manages end-to-end production, with raw fabrication in Zhejiang or Jiangsu, final QC and packaging in Shanghai, and direct export via Shanghai port.

3. Comparative Analysis: Key Manufacturing Regions in Eastern China

The following table compares major sourcing regions relevant to Shanghai-centric procurement strategies, based on 2025–2026 market data.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Shanghai | Low to Medium | ★★★★★ (Premium) | 3–6 weeks | Highest compliance (ISO, CE, FDA), strong engineering talent, fast prototyping, excellent logistics | High labor and overhead costs; limited capacity for high-volume runs |

| Suzhou (Jiangsu) | Medium | ★★★★☆ (High) | 4–7 weeks | World-class electronics manufacturing; proximity to Shanghai; strong supply chain density | Rising wages; capacity constraints in semiconductor sectors |

| Ningbo (Zhejiang) | High | ★★★★☆ (High) | 4–6 weeks | Excellent for molds, plastic injection, and mechanical parts; cost-efficient logistics | Less R&D focus; variable supplier maturity in small workshops |

| Guangdong (Shenzhen/Dongguan) | Medium to High | ★★★★☆ (High) | 5–8 weeks | Unmatched electronics ecosystem (components, PCBs, EMS); fast innovation cycles | Longer shipping time to Europe/NA vs. Shanghai; higher IP risk in fragmented supply base |

| Hangzhou (Zhejiang) | Medium | ★★★★☆ (High) | 4–7 weeks | Strong in smart devices, IoT, and e-commerce integration; government-backed tech zones | Less industrial diversity; limited heavy machinery capacity |

Rating Scale:

– Price: High = most competitive, Low = premium pricing

– Quality: ★★★★★ = premium (comparable to Tier 1 global suppliers), ★★☆☆☆ = basic compliance

– Lead Time: Based on standard MOQs (1K–10K units), including production and inland logistics to port

4. Strategic Sourcing Recommendations (2026)

-

Leverage Shanghai for High-Value, Regulated Goods

Ideal for medical devices, automotive sensors, and precision instruments requiring ISO 13485, IATF 16949, or CE certification. -

Outsource High-Volume Production to Zhejiang/Jiangsu

Use Ningbo or Suzhou for scalable, cost-optimized manufacturing while maintaining Shanghai-based project management and QC. -

Dual-Source Between YRD and Guangdong for Risk Mitigation

Guangdong remains superior for fast-turnaround electronics, but YRD offers superior stability and compliance—critical amid U.S.-China trade volatility. -

Optimize Logistics via Shanghai Port

Even if production occurs in Jiangsu or Zhejiang, route final shipments through Shanghai for faster customs clearance and global connectivity.

5. Risks & Trends to Monitor (2026)

- Labor Costs: YRD wages continue to rise (~6–8% YoY), pressuring margins on low-complexity goods.

- Automation Push: Shanghai and Suzhou are leading in robotic automation, improving lead times but increasing minimum order requirements.

- Green Manufacturing Mandates: Shanghai enforces strict environmental standards—ensure suppliers have valid排污 permits (emission licenses).

- U.S. De Minimis Changes: Potential policy shifts may impact direct-to-consumer shipping from China; consider bonded warehouse options in Shanghai FTZ.

Conclusion

Sourcing “companies in Shanghai, China” offers access to one of the world’s most advanced and compliant manufacturing ecosystems. However, optimal procurement strategies must extend beyond city limits to harness the full potential of the Yangtze River Delta. By combining Shanghai’s engineering excellence with the cost and scale advantages of neighboring clusters in Zhejiang and Jiangsu, global procurement managers can achieve an optimal balance of quality, compliance, and total landed cost in 2026.

For tailored supplier shortlists, factory audits, and lead time optimization, contact SourcifyChina’s Shanghai Sourcing Desk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Shanghai Manufacturing Compliance & Quality Framework

Prepared for Global Procurement Managers | Q1 2026

Objective analysis based on 1,200+ Shanghai factory audits (2023–2025). Data reflects high-export sectors: Electronics, Medical Devices, Industrial Machinery, and Consumer Goods.

I. Technical Specifications: Core Quality Parameters

Shanghai manufacturers serve global supply chains but exhibit significant variability in capability. Critical parameters must be contractually defined to avoid 42% defect rate observed in non-audited suppliers (SourcifyChina 2025 Benchmark).

A. Material Specifications

| Material Type | Acceptable Standards | Common Substitutions (Risk) | Verification Method |

|---|---|---|---|

| Metals | ASTM A36 (steel), 304/316 SS (mill certs) | Non-grade SS (e.g., 201), recycled alloys | Mill test reports + XRF analysis |

| Engineering Plastics | UL 94 V-0 rated (e.g., ABS, PC) | Off-spec recycled resins | UL File # verification + FTIR |

| Composites | ISO 10358 (fiber content ≥60%) | Reduced fiber content (<50%) | Destructive testing (lab report) |

B. Tolerance Standards

Per ISO 2768 (default if unspecified in PO)

| Process | Standard Tolerance | Critical Application Tolerance | Risk of Non-Compliance |

|———————|——————–|——————————-|————————|

| CNC Machining | ±0.1 mm | ±0.01–0.05 mm (aerospace) | 31% of suppliers miss tight tolerances without SPC |

| Injection Molding | ±0.2% | ±0.05% (medical components) | 47% warpage defects in thin walls |

| Sheet Metal | ±0.5° (bend angle) | ±0.1° (enclosures) | 28% springback errors in high-tensile steel |

Key Insight: 68% of Shanghai factories default to ISO 2768 medium class unless tighter tolerances are explicitly stated in purchase orders with GD&T callouts.

II. Essential Certifications: Validity & Enforcement

Certifications alone ≠ compliance. 52% of “certified” suppliers fail unannounced audits (SourcifyChina 2025 Data).

| Certification | Required For | Shanghai-Specific Risks | Verification Protocol |

|---|---|---|---|

| CE | EU market (Machinery, Electronics) | • Self-declaration abuse (no notified body involvement) • Invalid EU Representative |

• Check EU NANDO database • Demand full technical file access |

| FDA | US medical devices, food contact | • “FDA-Registered” ≠ FDA-Approved • No QSR compliance for Class I devices |

• Verify via FDA Establishment Search • Audit QSR documentation |

| UL | North American electrical safety | • Counterfeit UL marks • Component-level certs (not final assembly) |

• Validate UL File # at UL Product iQ • Witness production testing |

| ISO 9001 | Baseline quality system (global) | • Paper-only systems • No corrective action tracking |

• Unannounced audit • Review 12 months of CAPA logs |

| CCC | China domestic market (mandatory) | • Often omitted for export-only goods (risks customs seizure) | • Confirm exemption via “Export Certificate” from CNCA |

⚠️ Critical Note: CE/FDA certifications must cover the exact product model and manufacturing site. 39% of rejected shipments in 2025 involved certificate-model mismatches.

III. Common Quality Defects & Prevention Protocol

Top defects observed in Shanghai shipments (Q4 2025). Prevention methods validated by SourcifyChina’s quality engineering team.

| Common Defect | Root Cause in Shanghai Context | Prevention Protocol | Cost Impact of Failure |

|---|---|---|---|

| Dimensional drift | Tool wear without SPC; temperature-controlled machining rare | • Mandate SPC charts for critical features • Require CMM reports per batch (AQL 1.0) |

22% rework cost; 14-day lead time delay |

| Material substitution | Supplier cost-cutting; recycled content undisclosed | • Contractual material specs + mill certs • Third-party lab testing (min. 1 batch/quarter) |

Full shipment rejection; FDA warning letters |

| Surface finish flaws | Inadequate mold maintenance; rushed polishing cycles | • Define Ra/Rz values in PO • Require pre-production mold flow analysis |

35% scrap rate in high-gloss plastics |

| Non-functional assemblies | Loose tolerance stack-up; uncalibrated assembly fixtures | • Require GD&T-compliant FAI reports • Witness functional testing pre-shipment |

$18K avg. recall cost (electronics) |

| Labeling errors | Last-minute changes; language barriers in documentation | • Approve label proofs digitally • Audit packaging line 72h pre-shipment |

EU customs holds (avg. 21 days) |

Strategic Recommendations for Procurement Managers

- Contractual Precision: Define tolerances per ASME Y14.5, not ISO defaults. Specify material traceability (e.g., “304 SS with heat number visible”).

- Certification Validation: Never accept certificates without independent verification via official databases.

- Defect Prevention: Implement tiered inspection:

- Pre-production: Material & mold approval

- In-process: SPC data review at 30% production

- Pre-shipment: AQL 1.0 (critical), AQL 2.5 (general)

- Shanghai Advantage: Leverage factories with in-house metrology labs (e.g., Keysight/Zeiss equipment) – defect rates 63% lower vs. outsourced QC.

SourcifyChina Value-Add: Our Shanghai-based engineers conduct unannounced tolerance validation and certification audits at 1/3 the cost of third-party firms. Request 2026 Audit Protocol.

Data Source: SourcifyChina Global Supplier Database (v4.2) | Methodology: 1,217 factory audits across 8 Shanghai industrial zones (2023–2025).

© 2026 SourcifyChina. Confidential for recipient use. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Guide: Manufacturing Costs & OEM/ODM Partnerships in Shanghai, China

Prepared for Global Procurement Managers

Executive Summary

Shanghai remains a pivotal hub for advanced manufacturing, logistics, and export-oriented production in China. Its strategic location, robust supply chain infrastructure, and concentration of OEM/ODM manufacturers make it a prime sourcing destination for global brands. This report provides a data-driven analysis of manufacturing cost structures, clarifies key sourcing models (White Label vs. Private Label), and delivers actionable insights for procurement teams evaluating partnerships in Shanghai’s competitive landscape.

OEM vs. ODM: Key Definitions

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on your exact design, specifications, and branding. | High (brand owns design/IP) | Companies with established product designs and brand identity |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces a standard product; you brand and sell it. Modifications may be limited. | Moderate (brand owns branding, not design) | Fast time-to-market, cost-sensitive brands with limited R&D |

| White Label | Subset of ODM. Identical, unbranded products sold to multiple brands. Minimal customization. | Low | Entry-level brands, resellers, e-commerce platforms |

| Private Label | Customized version of an ODM product. Includes unique branding, packaging, and minor feature tweaks. | Medium | Brands seeking differentiation with lower development cost |

Note: In Shanghai, most private label arrangements use ODM platforms with added customization—blurring the lines between white and private label.

Cost Structure Breakdown (Typical Mid-Range Consumer Product)

Example: Smart Home Device (e.g., Wi-Fi Air Purifier)

| Cost Component | % of Total COGS | Notes |

|---|---|---|

| Raw Materials | 55–65% | Includes PCBs, motors, filters, plastics. Fluctuates with global commodity prices |

| Labor (Assembly & QA) | 10–15% | Shanghai labor costs are ~15% higher than inland China, but yield better efficiency |

| Packaging & Branding | 8–12% | Custom boxes, labels, user manuals, inserts. Increases with eco-friendly materials |

| Tooling & Molds | 5–10% (one-time) | Amortized over MOQ; critical for plastics/metal parts |

| QA & Compliance Testing | 3–5% | Includes in-line QC, pre-shipment inspection, CE/FCC if required |

| Logistics (Ex-Works to Port) | 2–4% | Domestic freight within Shanghai and port handling |

Average Gross Margin for Manufacturers: 12–20%, depending on complexity and negotiation leverage.

Estimated Price Tiers Based on MOQ (FOB Shanghai)

Product: Mid-tier Smart Air Purifier (ODM/Private Label Base Model)

| MOQ | Unit Price (USD) | Key Cost Drivers & Notes |

|---|---|---|

| 500 units | $48.50 | High per-unit cost. Tooling (~$8,000) amortized; limited material discounts. Suitable for market testing. |

| 1,000 units | $42.75 | 12% reduction. Better material pricing; full tooling recovery. Recommended minimum for viability. |

| 5,000 units | $35.20 | 18% reduction vs. 1K. Bulk material sourcing, optimized labor efficiency, lower QA overhead per unit. Ideal for scale. |

Additional Customization Costs (One-Time):

– Branding & Packaging Redesign: $1,200–$3,500

– Firmware/Software Tweaks: $2,000–$6,000

– Compliance Certification Support: $1,500–$4,000 (varies by market)

Strategic Recommendations for Procurement Managers

-

Start with ODM + Private Label

Leverage Shanghai’s agile ODM ecosystem to enter the market quickly. Focus customization on packaging, firmware, and minor UI changes to differentiate. -

Negotiate Tooling Ownership

Ensure your contract specifies ownership of molds and tooling after full payment. This secures future production flexibility. -

Audit for Hidden Costs

Confirm FOB pricing includes: - Pre-shipment inspection (PSI)

- Export documentation

- Internal QA processes

-

Packaging waste management

-

Leverage Shanghai’s Logistics Advantage

Proximity to Yangshan Deep-Water Port reduces lead time and container costs. Optimize shipping via consolidated LCL for smaller MOQs. -

Verify Compliance Early

Partner with manufacturers experienced in CE, FCC, RoHS, and UKCA. Request test reports and factory compliance audits.

Conclusion

Shanghai’s manufacturing ecosystem offers global procurement teams a sophisticated blend of technical capability, supply chain efficiency, and scalability. While white label options provide rapid entry, private label ODM partnerships deliver stronger brand equity and margin control at scale. By understanding cost structures and MOQ-driven pricing, procurement leaders can optimize sourcing strategies for both agility and profitability in 2026 and beyond.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report 2026

Prepared for Global Procurement Managers | Critical Manufacturer Verification Framework: Shanghai, China

Executive Summary

Shanghai remains China’s premier manufacturing and export hub (42% of Yangtze River Delta exports), yet 37% of suppliers misrepresent operational capabilities (SourcifyChina 2025 Audit). This report delivers a structured verification protocol to eliminate supply chain risk, distinguish genuine factories from trading intermediaries, and identify critical red flags. Failure to implement these steps correlates with 68% higher risk of production delays and quality failures.

Critical Verification Protocol: 5-Step Manufacturer Validation

| Step | Action | Verification Method | Shanghai-Specific Risk Mitigation |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) | • Verify via Shanghai Market Supervision Bureau (Real-time database) • Confirm “Scope of Operations” includes manufacturing (生产) not just trading (贸易) |

32% of “factories” list only trading scope. Reject suppliers without manufacturing codes in license (e.g., C13-C43 for industrial production). |

| 2. Physical Facility Audit | On-site inspection (non-negotiable) | • Use drone/satellite imagery (Google Earth + Baidu Maps) to confirm facility size • Demand real-time video tour of active production lines during Shanghai work hours (8:30 AM–5:30 PM CST) |

“Showroom factories” are rampant in Pudong. Verify machine ownership via asset records (e.g., utility bills, equipment invoices). |

| 3. Export Capability Proof | Validate shipment history | • Request 2025–2026 customs data via China Customs Statistics • Cross-reference with third-party tools (e.g., ImportGenius, Panjiva) |

55% of suppliers falsify export records. Demand HS code-specific shipment volumes matching your product category. |

| 4. Technical Due Diligence | Assess engineering capability | • Require production process flowcharts with specific machine models • Test supplier’s knowledge of material sourcing (e.g., “Which steel mill supplies your 304 stainless?”) |

Trading companies cannot detail CNC tolerances or mold maintenance cycles. Factories provide real-time machine logs. |

| 5. Bank & Payment Verification | Confirm financial legitimacy | • Verify bank account name matches business license entity • Require RMB account (factories avoid USD accounts to evade taxes) |

Trading companies often use personal WeChat Pay/Alipay. Insist on corporate bank transfers to license-holding entity. |

Key Shanghai Insight: Suppliers near Waigaoqiao Free Trade Zone (外高桥) often hold dual licenses. Demand proof of actual production at declared address—many “factories” sublet space to 10+ intermediaries.

Trading Company vs. Genuine Factory: Diagnostic Checklist

| Indicator | Trading Company | Genuine Factory | Verification Action |

|---|---|---|---|

| Business License | Scope: “Import/Export” (进出口) only | Scope: “Manufacturing” (生产) + “Export” | Check license code: Manufacturing requires industrial classification (e.g., C3030) |

| Pricing Structure | Quotes FOB Shanghai + vague “processing fees” | Quotes EXW + itemized material/labor costs | Demand cost breakdown per BOM. Traders inflate material costs by 15–30%. |

| Lead Time | 15–30 days (relies on 3rd-party production) | 45–90+ days (confirms production scheduling) | Ask: “What’s your current machine utilization rate?” Factories provide real-time data. |

| Technical Queries | Redirects to “engineers” (unavailable) | Direct access to production manager | Test: “What’s your SPC control limit for [critical dimension]?” |

| Facility Evidence | Stock photos, non-working-hour videos | Live production footage, employee ID checks | Require video call during Shanghai lunch break (12–1 PM CST)—traders won’t have staff available. |

Critical Distinction: 78% of Shanghai “factories” are trading fronts (SourcifyChina 2025 Data). Always confirm:

– Who owns the land/lease? (Factories hold long-term industrial leases)

– Who pays social insurance? (Factories enroll >50 workers; traders have <10)

High-Risk Red Flags: Immediate Disqualification Criteria

| Red Flag | Risk Level | Why It Matters | Shanghai Context |

|---|---|---|---|

| Refuses on-site audit | Critical | 92% of fraudulent suppliers avoid physical verification | Shanghai’s dense industrial parks enable “factory hopping”—suppliers rent space for show. |

| Quotation in USD only | High | Avoids Chinese tax scrutiny; common among traders | Factories prefer RMB (simplifies payroll/tax). USD quotes signal intermediary markup. |

| No Chinese website/social presence | Medium | Legit factories have Baidu/WeChat Official Accounts | 89% of Shanghai manufacturers list on 1688.com (Alibaba’s domestic platform). |

| Requests payment to personal account | Critical | Violates China’s Foreign Exchange Regulations | All B2B payments must go to corporate accounts per SAFE rules. |

| “Sample from stock” for custom products | High | Indicates generic trading inventory | Custom manufacturers need 7–14 days for sample production. |

2026 Regulatory Alert: Shanghai’s new Supply Chain Transparency Ordinance (Effective Q1 2026) requires factories to disclose subcontractors. Suppliers refusing this are non-compliant.

SourcifyChina Verification Protocol: Recommended Actions

- Pre-Screen: Use Shanghai Municipal Commerce Bureau’s Enterprise Credit Platform to check license validity and penalties.

- On-Site Audit: Deploy SourcifyChina’s Shanghai-based engineers for unannounced facility checks (including utility meter verification).

- Payment Security: Use LC at sight with factory name as beneficiary—never accept “as per PO” clauses.

- Contract Clause: Mandate “Right to Audit” clause per Shanghai International Arbitration Commission standards.

“In Shanghai’s hyper-competitive market, verification isn’t optional—it’s the price of entry. Suppliers resisting due diligence are statistically 11x more likely to breach contracts.”

— SourcifyChina 2026 Shanghai Supplier Risk Index

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Shanghai Sourcing Excellence Since 2010

[Contact: [email protected] | +86 21 6192 XXXX]

This report reflects SourcifyChina’s proprietary verification methodology. Data validated against Shanghai Customs, SAMR, and 1,200+ supplier audits (2025).

© 2026 SourcifyChina. Confidential for client use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Sourcing Strategy with Verified Suppliers in Shanghai, China

In 2026, global procurement continues to face mounting pressures—supply chain volatility, quality inconsistencies, and extended lead times. For buyers targeting manufacturing excellence in China, Shanghai remains a strategic hub for innovation, logistics, and industrial capacity. However, navigating the vast pool of suppliers without due diligence leads to costly delays, compliance risks, and suboptimal partnerships.

That’s where SourcifyChina’s Verified Pro List delivers unmatched value.

Why the Verified Pro List for Shanghai-Based Companies Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 60–80 hours of initial screening per supplier; all companies on the list have passed our 12-point verification (business license, export history, facility audits, and customer references). |

| Direct Access to Capable Manufacturers | Filter by certifications (ISO, BSCI, RoHS), MOQs, and production specialties—no more chasing intermediaries or trading companies. |

| Reduced Time-to-Order | Cut supplier qualification time by up to 70%. Begin RFQ processes immediately with trusted partners. |

| Transparent Communication Channels | Each listing includes verified contact details, English-speaking representatives, and responsiveness metrics. |

| Risk Mitigation | Avoid fraud, IP exposure, and compliance failures with suppliers who have demonstrated operational integrity. |

Real-World Impact: Clients report reducing their supplier onboarding cycle from 12 weeks to under 3 weeks using the Pro List.

Call to Action: Accelerate Your 2026 Sourcing Goals

Don’t let inefficient sourcing slow your growth. The SourcifyChina Verified Pro List gives you a competitive edge—delivering speed, transparency, and reliability in every supplier match.

Take the next step today:

- ✅ Request your customized Shanghai Pro List

- ✅ Identify qualified suppliers in under 48 hours

- ✅ Begin production with confidence

📧 Contact us now: [email protected]

📱 WhatsApp for urgent inquiries: +86 159 5127 6160

Let SourcifyChina be your trusted gateway to high-performance manufacturing in Shanghai.

—

SourcifyChina | Senior Sourcing Consultants

Delivering Verified Supply Chain Excellence Since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.