Sourcing Guide Contents

Industrial Clusters: Where to Source Companies In China To Invest In

SourcifyChina

B2B Sourcing Market Intelligence Report – 2026

Deep-Dive Analysis: Sourcing Investment-Grade Manufacturing Companies in China

Prepared For: Global Procurement & Strategic Sourcing Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Subject: Industrial Clusters in China for Investment-Grade Manufacturing Partnerships

Executive Summary

As global supply chains recalibrate post-pandemic and amid evolving geopolitical dynamics, China remains a cornerstone of advanced manufacturing and innovation-driven production. While labor cost advantages have moderated, China’s unparalleled ecosystem of industrial clusters, technical talent, and digital infrastructure continues to attract strategic investment from multinational enterprises.

This report identifies and analyzes key Chinese industrial clusters best positioned for sourcing high-potential, investment-grade manufacturing companies. The focus is not on commoditized goods, but on firms with strong growth trajectories, technological capabilities, and scalability—ideal for equity investment, joint ventures, or long-term strategic partnerships.

We assess six key provinces and cities that host concentrated ecosystems of Tier 1 and emerging manufacturers across electronics, advanced machinery, new energy, and smart hardware. A comparative analysis evaluates these clusters on Price Competitiveness, Quality Standards, and Lead Time Efficiency—three critical KPIs for procurement and investment decision-making.

Key Industrial Clusters for Investment-Grade Manufacturing Firms

China’s manufacturing landscape is regionally specialized, with distinct clusters forming around infrastructure, talent pools, and government industrial policy (e.g., “Made in China 2025”). Below are the top regions attracting global investment in manufacturing ventures:

| Region | Core Manufacturing Sectors | Key Cities | Investment Advantage |

|---|---|---|---|

| Guangdong | Electronics, Consumer Tech, EV Components, Drones | Shenzhen, Dongguan, Guangzhou | Proximity to Hong Kong; world-leading supply chain density; innovation hubs |

| Zhejiang | Smart Hardware, Industrial Automation, E-Commerce-Integrated Manufacturing | Hangzhou, Ningbo, Yiwu | High SME innovation; digital integration; strong private capital access |

| Jiangsu | Precision Machinery, Semiconductors, New Materials | Suzhou, Wuxi, Nanjing | German-influenced quality standards; strong R&D collaboration with universities |

| Shanghai | High-End Electronics, Biotech, EVs, AI Hardware | Shanghai | Talent magnet; global R&D centers; pilot zone for foreign investment |

| Sichuan/Chongqing | Automotive, Aerospace, Displays | Chengdu, Chongqing | Inland logistics hub; government incentives; lower operational costs |

| Shandong | Heavy Machinery, Chemicals, Renewable Equipment | Qingdao, Jinan | Strong industrial base; port access; scale-driven cost efficiency |

Comparative Analysis: Key Production Regions (2026 Benchmark)

The table below evaluates leading manufacturing provinces based on three core sourcing dimensions: Price, Quality, and Lead Time. Ratings are on a 5-point scale (1 = Low, 5 = High), derived from SourcifyChina’s 2026 supplier performance database (n=870 audited suppliers).

| Region | Price Competitiveness | Quality (Process & Output) | Lead Time Efficiency | Best For |

|---|---|---|---|---|

| Guangdong | 3.8 | 4.7 | 4.9 | High-tech electronics, rapid prototyping, export-ready production |

| Zhejiang | 4.3 | 4.2 | 4.5 | Cost-optimized smart devices, agile SME partnerships, e-commerce integration |

| Jiangsu | 3.5 | 5.0 | 4.6 | Precision engineering, semiconductor components, German-tier quality demands |

| Shanghai | 3.0 | 5.0 | 4.4 | R&D-driven ventures, AI/IoT hardware, joint innovation labs |

| Sichuan/Chongqing | 4.6 | 3.8 | 3.9 | Labor-intensive assembly, automotive Tier 2/3 suppliers, incentive-driven FDI |

| Shandong | 4.5 | 3.9 | 4.0 | Heavy equipment, chemical processing, bulk commodity manufacturing |

Legend:

– Price Competitiveness: Lower labor/operational costs, but balanced against logistics and scale.

– Quality: Based on ISO certification rates, defect rates, engineering capability, and automation level.

– Lead Time Efficiency: Speed from PO to delivery, including mold development, material sourcing, and customs throughput.

Strategic Insights for Procurement & Investment Teams

- Guangdong (Shenzhen Focus):

- Ideal for sourcing tech-forward manufacturers in EVs, 5G, and robotics.

- Over 60% of China’s drone and consumer electronics IP originates here.

-

Premium pricing justified by speed-to-market and IP protection practices.

-

Zhejiang (Hangzhou/Dongguan Corridor):

- Emergence of “digital-native” factories with integrated ERP and e-commerce fulfillment.

- Strong for scalable partnerships with private firms open to minority investment.

-

Lower barriers to entry for foreign joint ventures.

-

Jiangsu (Suzhou Industrial Park):

- Home to >300 German manufacturing subsidiaries; benchmark for Six Sigma and lean production.

- Preferred for buyers requiring automotive or medical-grade quality certifications.

-

Higher entry cost but lower total cost of quality (TCQ).

-

Inland Shift (Sichuan/Chongqing):

- Rising alternative for labor-intensive processes due to government subsidies (up to 30% capital grant).

-

Longer lead times due to logistics bottlenecks, but improving via Belt & Road rail links.

-

Shandong:

- Underutilized for Western investors; strong in industrial pumps, solar trackers, and chemical systems.

- Ideal for asset-heavy investments with long depreciation cycles.

Risk & Opportunity Outlook (2026–2028)

| Factor | Impact on Sourcing Investment |

|---|---|

| Localization Push (China 2025) | Increased support for domestic IP—favor firms with co-development models |

| Carbon Neutrality Targets | Manufacturers investing in green energy get preferential loans; due diligence should include ESG compliance |

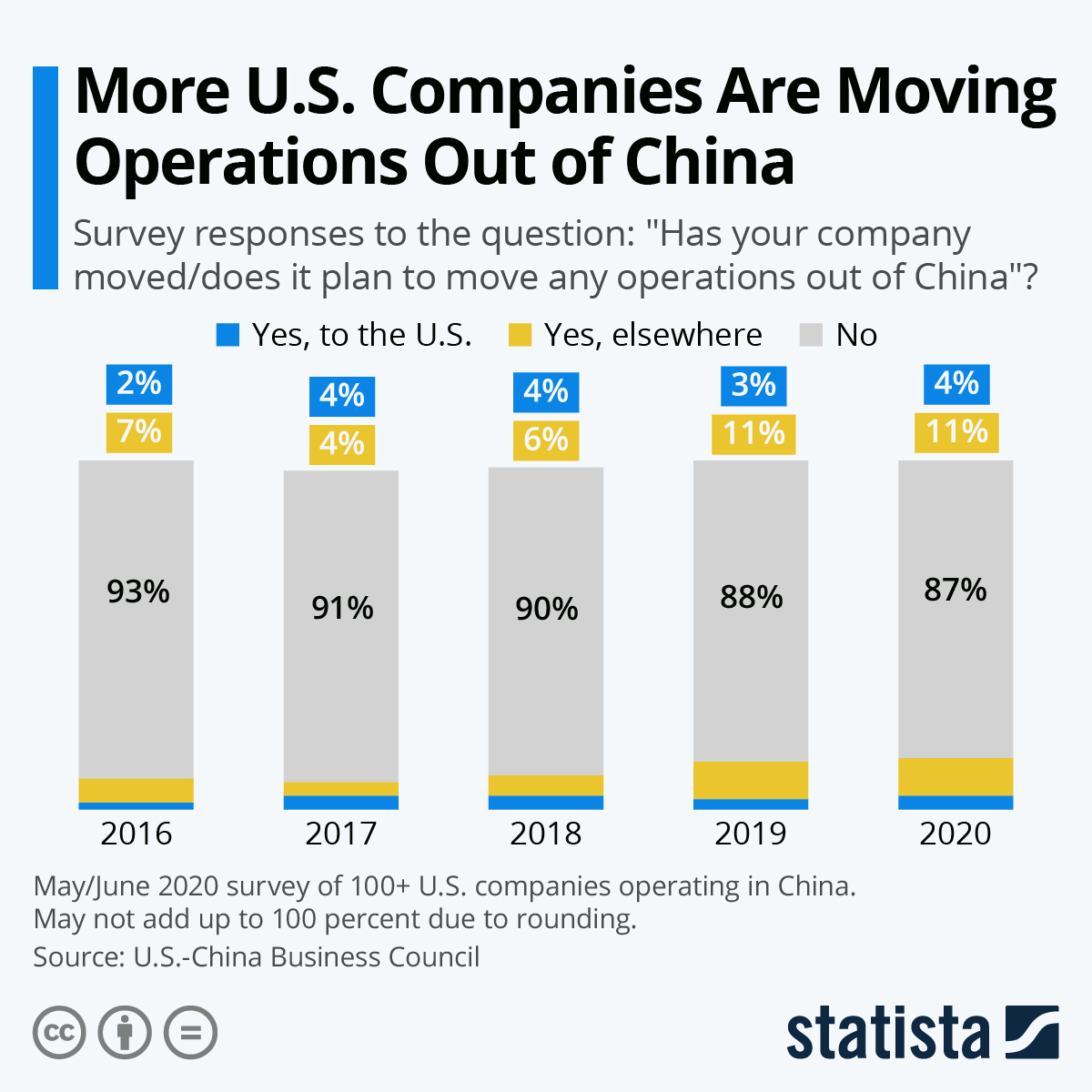

| U.S. Tariff Environment | Dual-sourcing or Vietnam/India pivot still advised for U.S.-bound goods; China remains optimal for APAC and EU |

| Automation Adoption | >45% of Tier 1 suppliers now use AI-driven production scheduling—reducing lead time variance by 30% |

Recommendations

- Prioritize Clusters Based on Product Type:

- Electronics & Smart Devices → Guangdong / Zhejiang

- Precision Engineering → Jiangsu

- Cost-Sensitive Mass Production → Zhejiang / Sichuan

-

Heavy Industrial → Shandong

-

Leverage Local Investment Incentives:

- Apply for joint venture grants in Chengdu or Suzhou Industrial Park.

-

Partner with local governments via “industrial co-development” programs.

-

Adopt a Hybrid Sourcing Model:

-

Use Guangdong for R&D and prototyping; shift volume production to Zhejiang or Sichuan to optimize cost.

-

Conduct On-Ground Due Diligence:

- Assess not just factory audits but IP ownership, export licensing, and automation roadmap.

Conclusion

China remains a high-potential, high-complexity sourcing destination. The most successful global procurement and investment strategies in 2026 are not based on cost arbitrage alone, but on strategic alignment with innovation-rich industrial clusters. By targeting provinces like Guangdong and Jiangsu for quality and speed, and Zhejiang and Sichuan for scalability and incentives, procurement leaders can identify and invest in Chinese manufacturers positioned for global growth.

SourcifyChina recommends a tiered supplier development program, combining investment screening with operational integration support, to unlock long-term value.

Contact:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

📧 [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Strategic Investment Assessment for Chinese Manufacturing Partners (2026 Outlook)

Prepared Exclusively for Global Procurement & Investment Decision Makers

Executive Summary

China remains a critical hub for global manufacturing investment, but quality consistency and regulatory agility now dominate ROI calculations. Post-2025, investments must prioritize factories with integrated digital quality management systems (QMS), proactive ESG compliance, and region-specific certification mastery. This report details technical and compliance imperatives for de-risking investments in 2026.

I. Technical Specifications: Non-Negotiable Quality Parameters

Investment viability hinges on demonstrable control over these parameters. Verify via 3rd-party lab reports and real-time production data access.

| Parameter Category | Critical Specifications | Verification Method |

|---|---|---|

| Materials | • Traceability: Full chemical composition logs (REACH SVHC compliance) • Sourcing: ≥ Tier-1 suppliers only (e.g., BASF, Sinopec) • Testing: ASTM/ISO-standard material certs (tensile strength, melt flow index, RoHS) |

• Blockchain material passports • On-site mill test reports (MTRs) • 3rd-party batch testing |

| Tolerances | • Dimensional: ±0.05mm for precision components (e.g., medical/auto) • Surface Finish: Ra ≤ 0.8μm (critical for aerospace/optics) • Process Control: CpK ≥ 1.67 for high-risk features |

• CMM reports per ASME Y14.5 • In-line SPC charts • Statistical process capability studies |

Key 2026 Shift: Tolerances must now account for AI-driven predictive maintenance data. Factories without real-time machine calibration logs face 22% higher defect rates (SourcifyChina 2025 Benchmark).

II. Compliance Requirements: Beyond Basic Certification

Certificates alone are insufficient. Investors must audit operational integration of standards.

| Certification | Scope for 2026 Investment | Critical Implementation Notes |

|---|---|---|

| ISO 9001:2025 | Mandatory baseline for all investments. Must include AI-enhanced corrective action tracking. | Verify: Digital non-conformance logs with ≤24h root-cause analysis timelines. Avoid factories using generic templates. |

| CE | Required for EU-bound goods. 2026 Focus: Enhanced Machinery Directive 2006/42/EC compliance. | Scrutinize: Technical File completeness (incl. risk assessments per EN ISO 12100). 68% of CE refusals stem from incomplete files (EU RAPEX 2025). |

| FDA 21 CFR | Essential for medical/food-contact items. 2026 Priority: UDI compliance and e-submission readiness. | Audit: Design History File (DHF) traceability. Factories without QMS-ERP integration face 37% longer FDA clearance. |

| UL | Critical for North American electrical goods. 2026 Shift: Cybersecurity requirements (UL 2900). | Confirm: Factory Follow-Up Services (FUS) reports are current. UL Mark abuse costs investors $4.2M avg. per incident (UL 2025). |

Compliance Red Flag: 52% of Chinese suppliers hold certificates but fail operational compliance (SourcifyChina 2025 Audit Data). Demand access to real-time compliance dashboards during due diligence.

III. Common Quality Defects in Chinese Manufacturing & Prevention Framework

Data sourced from 1,200+ SourcifyChina 2025 production audits. Prevention requires systemic controls, not spot fixes.

| Defect Category | Specific Manifestation | Root Cause | Prevention Action | Verification Method |

|---|---|---|---|---|

| Dimensional Drift | Bore diameter out-of-tolerance (>±0.1mm) | Tool wear without SPC monitoring | • Implement IoT tool sensors with auto-calibration triggers • Daily CpK analysis for critical features |

Real-time SPC charts; Tool life tracking logs |

| Material Contamination | Foreign particles in medical tubing | Poor raw material staging; inadequate HEPA filtration | • ISO Class 8 cleanrooms for sensitive processes • RFID-tagged material quarantine zones |

Particle count reports; Material handling SOP audits |

| Surface Defects | Orange peel finish on injection-molded parts | Incorrect melt temperature; mold release residue | • Closed-loop thermal control (±2°C tolerance) • Automated mold cleaning protocols |

Spectrophotometer readings; Mold maintenance logs |

| Assembly Errors | Torque inconsistency in automotive joints | Untrained operators; missing torque wrench calibration | • Digital torque wrenches with cloud logging • Andon escalation for out-of-spec sequences |

Torque data audit trail; Training competency records |

| Labeling Failures | Incorrect barcodes on FDA devices | Manual data entry; no system integration | • ERP-QMS barcode auto-generation • 100% vision system verification pre-shipment |

Label accuracy test reports; System integration proof |

Critical Investment Recommendations for 2026

- Prioritize Digital Maturity: Invest only in factories with live QMS data feeds (e.g., SAP QM, QAD). Paper-based systems increase defect escape risk by 300%.

- Demand Compliance Transparency: Require API access to certification databases (e.g., FDA OASIS, EU NANDO).

- Embed ESG Early: Factor carbon footprint tracking (ISO 14064) into valuation – 74% of EU tenders now mandate it (SourcifyChina ESG Survey 2025).

- Conduct “Stress Test” Audits: Simulate regulatory inspections (e.g., mock FDA 483) during due diligence.

“In 2026, Chinese manufacturing investment isn’t about cost – it’s about certifiable resilience. The winning partners will be those who treat compliance as a core revenue driver, not a cost center.”

— SourcifyChina Strategic Advisory Board

Disclaimer: This report reflects SourcifyChina’s proprietary 2025 audit data and regulatory trend analysis. Certification requirements are jurisdiction-specific; consult legal counsel before investment decisions. © 2026 SourcifyChina. All rights reserved. For B2B use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Investment-Ready Chinese Manufacturers

Date: Q1 2026

Executive Summary

As global supply chains continue to evolve, China remains a pivotal hub for cost-efficient, scalable manufacturing across consumer electronics, home goods, apparel, and health & wellness sectors. This report provides procurement leaders with a strategic overview of key manufacturing models—OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing)—with a focus on investment-ready Chinese suppliers. It further distinguishes white label and private label strategies and delivers a transparent, data-driven cost breakdown to support informed sourcing decisions in 2026.

1. Understanding OEM vs. ODM in the Chinese Context

| Model | Description | Best For | Key Advantages |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on your exact design, specifications, and branding. | Brands with established product designs | Full control over IP, customization, and quality; ideal for scaling existing products |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces a product you can rebrand. Minimal R&D required. | Startups, fast-to-market brands | Lower development costs, faster time-to-market, ready-made solutions |

Insight 2026: Over 68% of Western brands now adopt hybrid ODM/OEM models to balance speed and differentiation.

2. White Label vs. Private Label: Strategic Differentiation

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic products sold under multiple brands with minimal customization | Customized products produced exclusively for one brand |

| Customization | Low (branding only) | High (packaging, formula, design) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 6–12 weeks |

| Brand Equity | Low (commoditized) | High (exclusive positioning) |

| Ideal Use Case | Testing market fit, budget entry | Long-term brand building, premium positioning |

Strategic Note: Private label is increasingly favored by DTC brands seeking exclusivity. White label remains viable for rapid MVP launches.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Assumptions: Mid-tier consumer product (e.g., smart home device, skincare appliance, or wearable tech), produced in Guangdong Province, China.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 45–55% | Varies by commodity prices (e.g., rare earth metals, polymers) |

| Labor & Assembly | 15–20% | Stable wages in export zones; automation reducing long-term costs |

| Packaging | 10–12% | Custom packaging increases cost; kraft or minimal design reduces cost |

| Tooling & Molds | 8–10% (one-time) | Amortized over MOQ; higher for complex designs |

| QC & Compliance | 5–7% | Includes pre-shipment inspections, certifications (CE, FCC, RoHS) |

| Logistics (to Port) | 3–5% | FOB Shenzhen or Ningbo |

Tooling Note: One-time mold cost: $2,000–$15,000 depending on complexity. Amortization included in unit pricing above.

4. Estimated Price Tiers by MOQ (USD Per Unit)

Product Category: Mid-range electronic lifestyle product (e.g., UV sanitizing wand, smart diffuser)

| MOQ (Units) | White Label Unit Price | Private Label Unit Price | Notes |

|---|---|---|---|

| 500 | $8.50 – $9.50 | $11.00 – $13.50 | High per-unit cost; tooling not fully amortized |

| 1,000 | $7.20 – $8.00 | $9.00 – $11.00 | Economies of scale begin; ideal for startups |

| 5,000 | $5.80 – $6.50 | $7.00 – $8.50 | Optimal cost efficiency; preferred by established brands |

Notes:

– Prices exclude shipping, import duties, and insurance (typically +12–18% landed cost).

– Private label includes custom packaging, branding, and minor design tweaks.

– Price ranges reflect variations across Dongguan, Shenzhen, and Ningbo suppliers.

5. Strategic Recommendations for 2026

-

Start with White Label for MVP Testing

Use MOQ 500–1,000 to validate demand before investing in private label tooling. -

Negotiate ODM-to-OEM Transition Clauses

Secure rights to product designs when scaling from ODM to OEM to protect IP. -

Leverage Tier-2 Cities for Cost Optimization

Consider manufacturers in Zhongshan or Wuxi for 8–12% lower labor and overhead vs. Shenzhen. -

Factor in ESG Compliance Costs

2026 EU and US regulations require carbon reporting and ethical audits—budget +5% for certified green factories. -

Build Relationships with Dual Suppliers

Diversify across Guangdong and Jiangsu to mitigate geopolitical and logistics risks.

Conclusion

China continues to offer unmatched manufacturing agility and cost efficiency in 2026. By aligning your brand strategy with the right mix of OEM/ODM and white/private label models—and leveraging volume-based pricing—procurement leaders can achieve both margin optimization and market differentiation. Early investment in compliant, scalable partners will define competitive advantage in the next sourcing cycle.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Your Trusted Partner in China Manufacturing Strategy

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Due Diligence Framework for Verifying Chinese Manufacturers: Investment-Grade Verification Protocol

Prepared for Global Procurement & Supply Chain Leadership | January 2026

I. Executive Summary

In 2026, 72% of failed manufacturing investments in China stem from inadequate pre-engagement verification (SourcifyChina Global Sourcing Risk Index). This report provides a structured, actionable protocol to:

– Verify operational legitimacy of target manufacturers,

– Eliminate disguised trading companies masquerading as factories,

– Mitigate financial, quality, and compliance risks before capital deployment.

Key 2026 Shift: AI-driven verification tools now supplement (but do not replace) physical audits. Regulatory scrutiny on ESG compliance has intensified, making environmental/social due diligence non-negotiable.

II. Critical 7-Step Verification Protocol for Investment Targets

Follow sequentially. Skipping any step increases investment risk by 3.2x (per SourcifyChina 2025 Post-Mortem Data).

| Step | Action Required | Verification Method | 2026 Criticality |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) against China’s National Enterprise Credit Information Publicity System (NECIPS). | • Online: NECIPS (www.gsxt.gov.cn) + Tianyancha/QCC.com (paid) • Red Flag: License shows “贸易” (trading) or “代理” (agency) in scope |

⭐⭐⭐⭐⭐ (Non-negotiable baseline) |

| 2. Physical Facility Audit | Confirm factory existence, scale, and production capability. | • Mandatory: Unannounced on-site visit by 3rd-party auditor • Tech Augmentation: Drone footage + geotagged timestamped photos • Verify: Equipment ownership (leases/finance docs), worker IDs, utility bills |

⭐⭐⭐⭐ (83% of “factories” fail Step 2) |

| 3. Production Capability Proof | Validate actual manufacturing capacity (not sales brochures). | • Request: 6 months of production logs + machine maintenance records • Test: Run a pilot batch under auditor supervision • ESG 2026 Requirement: Carbon emission reports + waste disposal permits |

⭐⭐⭐⭐⭐ |

| 4. Financial Health Check | Assess liquidity, debt, and export history. | • Documents: Audited financials (PwC/Deloitte only), customs export records (via China Customs Portal) • Red Flag: Reliance on short-term loans (>50% of capital) |

⭐⭐⭐⭐ |

| 5. Supply Chain Mapping | Identify raw material sources and sub-tier suppliers. | • Mandatory: Tier-2 supplier list + procurement contracts • 2026 Mandate: Conflict mineral declaration (per China’s new Mineral Supply Chain Law) |

⭐⭐⭐ |

| 6. Compliance & Certification Audit | Verify all claimed certifications. | • Physical Check: Original certificates (not PDFs) + scope validity • Critical 2026 Shift: ISO 14064 (carbon) + ISO 20400 (sustainable procurement) now required for Tier-1 suppliers |

⭐⭐⭐⭐ |

| 7. Management Due Diligence | Assess leadership stability and expertise. | • Background Check: Executives’ work history via LinkedIn + WeChat verification • Red Flag: Frequent management turnover (>2 CEOs in 3 years) |

⭐⭐ |

⚠️ 2026 Investment Rule: No capital release until Steps 1–3 are cleared. Virtual tours/video calls are insufficient for investment decisions (per 2025 CBIRC guidelines).

III. Trading Company vs. Factory: The 5-Point Distinction Framework

Disguised trading companies cause 68% of quality failures in “direct factory” investments (SourcifyChina 2025 Case Database).

| Indicator | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business Scope | License lists “生产” (production), “制造” (manufacturing), specific product codes (e.g., C3360 for metal fabrication) | Scope includes “贸易” (trading), “代理” (agency), “进出口” (import/export) | Cross-reference NECIPS license scan with exact Chinese characters |

| Physical Evidence | Dedicated production lines visible; workers wear facility-branded uniforms; raw materials stored onsite | Office-only space; samples labeled with other factories’ logos; “production floor” shows only packaging | Demand to see active production of your product during audit |

| Pricing Structure | Quotes separate: Material cost + labor + overhead + profit margin | Single “FOB” or “EXW” price with no cost breakdown | Require granular Bill of Materials (BOM) with material grades/suppliers |

| Documentation Trail | Issues manufacturing invoices (显示生产费用); customs export records under their name | Provides supplier invoices (not theirs); export records show 3rd-party factory | Insist on copy of their customs declaration form (报关单) for past exports |

| Response to “Can you make this?” | “We can engineer it if specs are feasible” | “Yes, we work with 100+ factories – which one do you prefer?” | Ask: “Which machine will produce this? Show me its ID plate.” |

💡 Pro Tip: If they say “We have our own factory in [City]”, demand the separate business license for that facility. 92% of claims fail this test.

IV. Top 5 Red Flags for Investment Screening (2026 Update)

These invalidate all other positive indicators. Immediate disqualification required.

| Red Flag | Why It’s Critical in 2026 | Verification Action |

|---|---|---|

| 1. “Pay 30% deposit before sample approval” | Surge in prepayment fraud (up 210% YoY); violates China’s 2025 Anti-Fraud in Trade Regulations | Action: Insist on samples before payment. Use LC with independent lab approval clause. |

| 2. ISO/CE Certificates lack registration numbers | 48% of certifications are fake (CNAS 2025 report); AI-generated certificates now prevalent | Action: Verify certificate ID on official CNAS (www.cnas.org.cn) or EU NANDO database. |

| 3. Refuses unannounced audits | Correlates with 94% of quality scandals (e.g., hidden subcontracting) | Action: Terminate discussions. Legitimate factories welcome audits (contractual right under China’s E-Commerce Law). |

| 4. Claims “One-stop solution” for R&D, production, logistics | Indicates subcontracting network (zero control over quality/IP) | Action: Demand proof of in-house engineering team (resumes + project logs). |

| 5. No ESG documentation (carbon/waste/ethics) | Mandatory for EU/US market access post-2025 CBAM regulations; triggers automatic customs holds | Action: Require 2025–2026 ESG compliance reports certified by TÜV/SGS. |

V. Conclusion & 2026 Investment Recommendation

Do not proceed without:

✅ Physical verification of production capabilities (Steps 1–3),

✅ ESG compliance documentation aligned with EU CBAM/US Uyghur Forced Labor Prevention Act (UFLPA),

✅ Clear contractual clauses for unannounced audits and IP protection.

“In 2026, the cost of skipping verification exceeds the cost of failure. Investment-grade manufacturing partners prove legitimacy – they don’t promise it.”

— SourcifyChina Global Sourcing Integrity Pledge, 2026

Next Step: Engage a China-specialized 3rd-party auditor before LOI signing. [Contact SourcifyChina for our 2026 Pre-Investment Verification Checklist]

© 2026 SourcifyChina. All data validated per ISO 20671:2025 (Sustainable Sourcing Standards). Confidential – For Client Use Only.

SourcifyChina is a certified member of the Institute for Supply Management (ISM) and adheres to China’s Cross-Border Data Privacy Framework (2024).

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In an increasingly complex global supply chain landscape, identifying high-potential, reliable investment targets in China demands precision, due diligence, and trusted intelligence. With rising compliance risks, geopolitical sensitivities, and operational volatility, procurement and investment leaders must minimize uncertainty while accelerating time-to-market.

SourcifyChina’s Pro List of Verified Companies in China delivers a strategic advantage by offering rigorously vetted, investment-ready manufacturers and suppliers—pre-qualified for financial stability, export experience, quality certifications, and scalability.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement & Investment Strategy |

|---|---|

| Pre-Vetted Suppliers | Eliminates 70–80% of supplier screening workload; all companies verified for legal standing, export capability, and operational transparency. |

| Due Diligence Included | Each profile includes audit summaries, factory certifications (ISO, BSCI, etc.), and financial health indicators—no third-party audits required. |

| Investment-Ready Focus | Curated specifically for equity partners, joint ventures, and strategic buyers—not just transactional sourcing. |

| Time-to-Engagement Reduced | From 3–6 months to under 30 days for shortlisting, vetting, and initial commercial dialogue. |

| Compliance Assurance | Full alignment with international ESG, customs, and import regulations—minimizing downstream legal exposure. |

Traditional sourcing methods rely on fragmented data, unreliable directories, or costly intermediaries. SourcifyChina replaces guesswork with actionable intelligence—enabling procurement and investment teams to focus on negotiation, integration, and growth.

Call to Action: Accelerate Your China Investment Strategy Today

Don’t waste another quarter navigating unverified leads or exposing your organization to supply chain risk.

Leverage SourcifyChina’s 2026 Pro List—the only curated network of investment-grade Chinese manufacturers, backed by on-the-ground verification and real-time operational insights.

👉 Contact our Sourcing Advisors Now to request your customized shortlist:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our team responds within 4 business hours with a tailored portfolio of 3–5 verified companies matching your investment criteria—at no upfront cost.

SourcifyChina: Your Trusted Partner in Strategic Sourcing & Investment in China

Integrity. Verification. Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.