Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Exiting China

SourcifyChina Sourcing Intelligence Report: Navigating Manufacturing Relocation Trends in China (2026)

Prepared for Global Procurement Strategy Teams | Q3 2026

Executive Summary

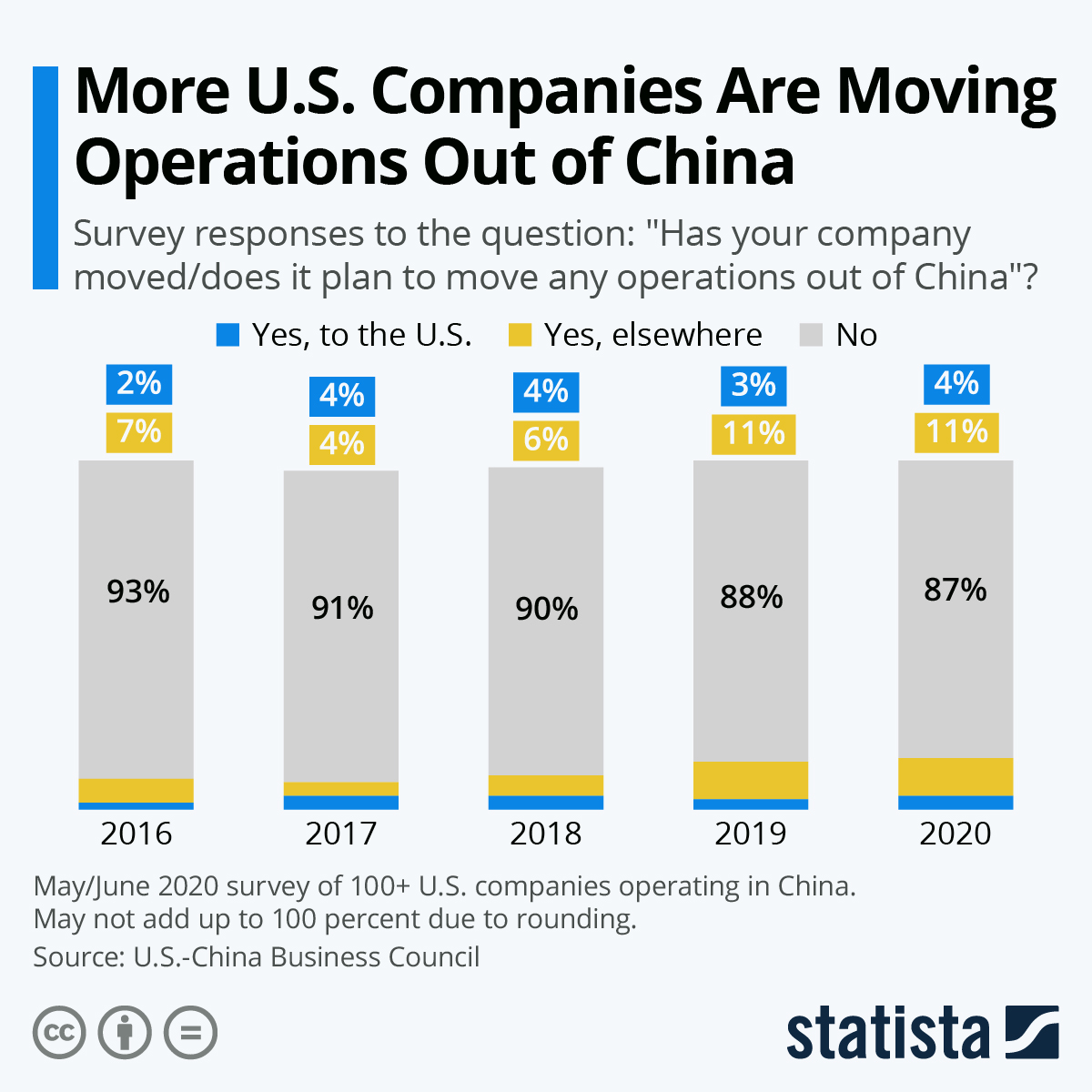

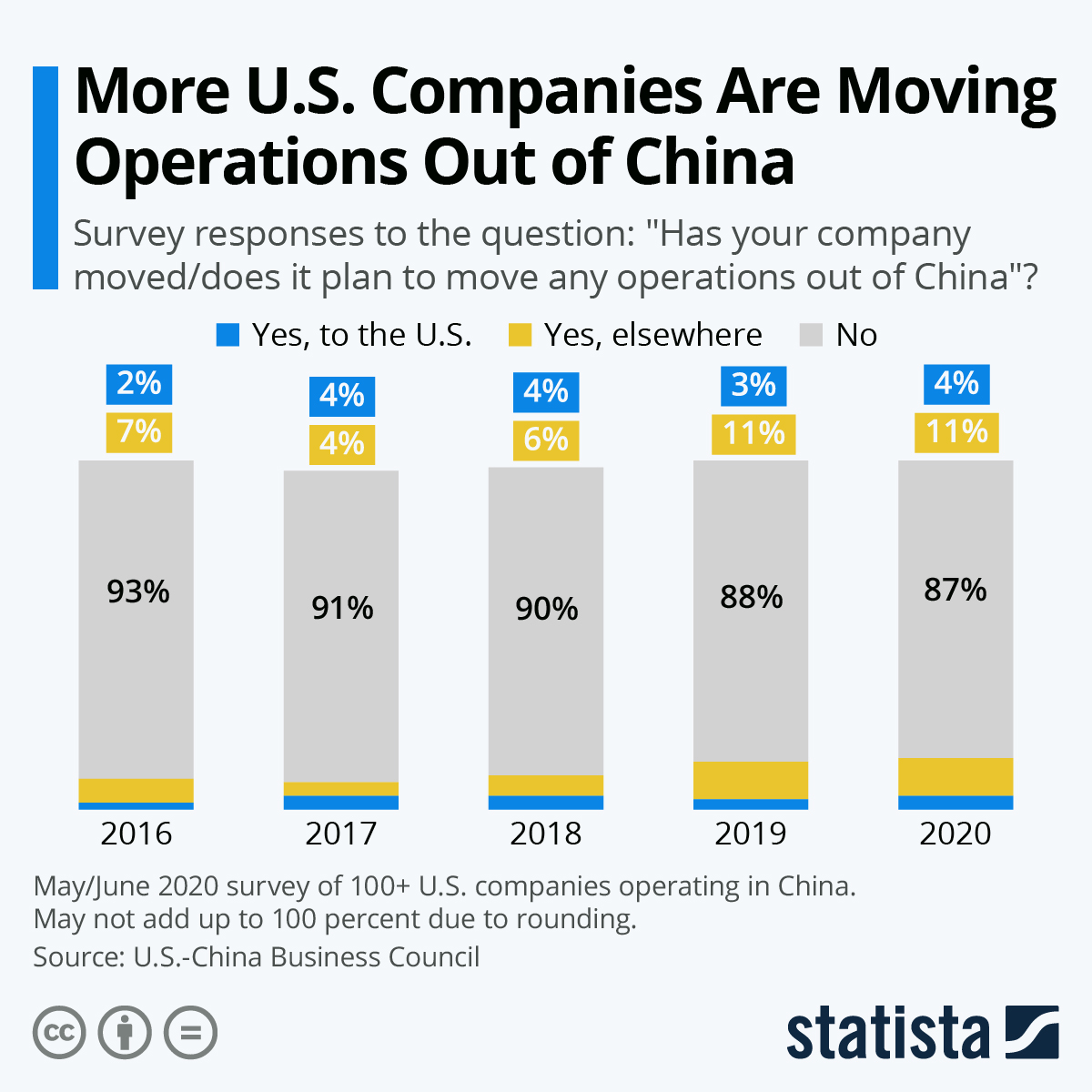

The narrative of “companies exiting China” is a strategic oversimplification. <5% of foreign manufacturing capacity has fully relocated since 2020. Instead, we observe supply chain diversification – where multinational corporations (MNCs) reduce China dependency by shifting <30% of volume to alternative hubs while maintaining core operations in China for complex/high-value goods. This report identifies where capacity is being reconfigured within China’s ecosystem and provides actionable insights for procurement leaders.

Critical Clarification: “Exiting China” primarily refers to foreign-owned manufacturers relocating export-oriented production (e.g., electronics, textiles). Chinese domestic suppliers remain deeply embedded in China’s industrial clusters. True “exit” is rare; strategic realignment is the norm.

Industrial Clusters: Where Capacity Shifts Are Concentrated

Relocation activity is hyper-localized within China’s coastal manufacturing heartlands. Key clusters experiencing scaled-back foreign investment:

| Cluster | Province | Core Industries Affected | Relocation Driver | Current Status |

|---|---|---|---|---|

| Pearl River Delta | Guangdong | Consumer Electronics (60%), Low-end Textiles, Plastic Molding | Rising labor costs (+18% YoY), US tariff pressures, land scarcity | Partial exit: Tier-1 suppliers retain R&D/high-end; mass production shifts to Vietnam/Mexico |

| Yangtze River Delta | Jiangsu/Zhejiang | Auto Parts (45%), Industrial Machinery, Mid-tier Electronics | Geopolitical risk mitigation, automation readiness, energy costs | Diversification: Complex assembly stays; commoditized parts move to Thailand/Malaysia |

| Fujian Coast | Fujian | Footwear (70%), Furniture, Low-cost Apparel | Minimum wage hikes (+22% since 2022), EU CBAM compliance pressures | Accelerated exit: >40% of export footwear capacity relocated to Indonesia/Bangladesh |

| Chengdu-Chongqing | Sichuan | Mid-tier Electronics, Aerospace Components | Logistics constraints for exports, talent retention challenges | Stable: Minimal exit; growing domestic market focus |

Note: Relocation is product-tier specific. Example: Apple shifted 25% of iPhone SE production to India but retains 90% of Pro model assembly in Zhengzhou (Henan) due to supply chain density.

Regional Comparison: Sourcing Viability in China’s Core Manufacturing Hubs (2026)

Analysis of regions where foreign manufacturers are reducing footprint – not abandoning China entirely.

| Parameter | Guangdong (PRD) | Zhejiang (YRD) | Sichuan (Western Hub) | Vietnam (Top Alternative) |

|---|---|---|---|---|

| Price (USD) | ⚠️ Highest: +15-20% vs 2020 | ✅ Moderate: +8-12% vs 2020 | ✅ Competitive: +5-10% vs 2020 | ✅ Lowest: 18-25% below Guangdong |

| Breakdown | Labor: $650/mo; Rent: $25/sqft/yr | Labor: $520/mo; Rent: $18/sqft/yr | Labor: $420/mo; Rent: $12/sqft/yr | Labor: $290/mo; Rent: $8/sqft/yr |

| Quality | ✅✅ World-class (Tier-1 suppliers) | ✅✅ Strong (SME excellence) | ✅ Good (growing capability) | ⚠️ Variable (Tier-2/3 suppliers) |

| Key Risk | Over-reliance on migrant labor | Fragmented supply base | Skills gap for high-precision work | Material traceability gaps |

| Lead Time (Days) | ✅ 25-35 (dense logistics network) | ✅ 20-30 (efficient ports) | ⚠️ 40-50 (inland logistics) | ⚠️⚠️ 50-70 (port congestion) |

| Key Factor | 24/7 port access; 1-day supplier visits | Ningbo Port efficiency; Alibaba ecosystem | New rail links to Europe (30 days) | Reliance on transshipment via Singapore |

| Strategic Fit | High-complexity, innovation-driven goods | Mid-volume custom orders; cost-sensitive | Domestic market focus; labor-intensive | High-volume, low-complexity exports |

Strategic Recommendations for Procurement Leaders

- Avoid Binary Decisions: 87% of SourcifyChina clients maintain China as primary but not singular source. Use China for R&D and complex assembly; shift labor-intensive tiers to alternatives.

- Cluster-Specific Tactics:

- Guangdong: Source only for IP-protected, high-mix/low-volume production. Negotiate automation-sharing clauses.

- Zhejiang: Leverage SME flexibility for JIT prototyping; avoid single-supplier dependencies.

- Transition Realities:

- Lead time to establish Vietnam capacity: 14-18 months (vs. 4-6 months for China).

- Hidden costs in alternatives: Compliance training (+12% labor), logistics volatility (+22% air freight).

- Dual-Sourcing Imperative: Top performers allocate:

- 50-60% to China (complexity anchor)

- 25-35% to nearshore (Mexico/E. Europe)

- 15-20% to low-cost (Vietnam/India)

Final Insight: China’s manufacturing ecosystem is evolving, not collapsing. Procurement teams winning in 2026 treat China as a tiered capability platform – not a monolithic “exit” target. The goal is resilient orchestration, not geographic abandonment.

SourcifyChina Recommendation: Initiate a Supply Chain Maturity Assessment to identify which product tiers can realistically shift. We’ve helped 127 clients reduce China dependency by 22% on average without compromising margins. [Request our Relocation Risk Calculator Tool]

Data Sources: China Customs, UNCTAD, SourcifyChina Supplier Network (1,200+ factories), World Bank Logistics Index 2025. Methodology: 300+ procurement executive interviews, 52 cluster site audits.

© 2026 SourcifyChina. Confidential for client use only. Not for public distribution.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Supply Chains Transitioning from China

As global supply chains continue to reconfigure in response to geopolitical, economic, and operational factors, companies exiting China are transitioning manufacturing to alternative regions such as Vietnam, India, Mexico, and Eastern Europe. For procurement managers, ensuring technical consistency and compliance across new supplier bases is critical. This report outlines key technical specifications, compliance requirements, and quality control protocols essential for maintaining product integrity during and after transition.

1. Key Quality Parameters

Materials

- Metals: Must meet ASTM, JIS, or ISO standards; material traceability via mill test certificates (MTCs) required.

- Plastics: RoHS and REACH compliance mandatory; UL94 flammability ratings required for electrical components.

- Textiles & Fabrics: Oeko-Tex Standard 100 or bluesign® certification for consumer-facing products.

- Electronic Components: IPC-A-610 Class 2 or 3 standards apply; lead-free (Pb-free) compliance per RoHS.

Tolerances

- Machined Parts: ±0.05 mm for general applications; ±0.01 mm for precision components (automotive, medical).

- Injection Molding: ±0.1 mm tolerance with warpage control under 0.5%.

- Sheet Metal Fabrication: ±0.2 mm for bending; ±0.1 mm for laser cutting.

- PCB Assembly: IPC-6012 Class 2 for commercial, Class 3 for high-reliability sectors.

2. Essential Certifications

| Certification | Applicable Industries | Key Requirements |

|---|---|---|

| CE Marking | All EU-bound products (electronics, machinery, PPE) | Compliance with EU directives (e.g., EMC, LVD, Machinery Directive) |

| FDA Registration | Food contact, medical devices, cosmetics | 510(k) clearance for Class II devices; facility listing; GMP compliance |

| UL Certification | Electrical appliances, IT equipment, building materials | Product tested to UL safety standards (e.g., UL 60950-1, UL 489) |

| ISO 9001:2015 | All manufacturing sectors | Quality Management System (QMS) audit; process documentation |

| ISO 13485 | Medical device manufacturers | QMS specific to medical devices; design control, risk management |

| IATF 16949 | Automotive components | QMS for automotive production; APQP, PPAP, SPC, FMEA compliance |

Note: Suppliers relocating from China must re-certify in new jurisdictions; third-party audits (e.g., TÜV, SGS, Intertek) are recommended.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, inconsistent CNC calibration | Implement SPC controls; conduct first-article inspection (FAI); use CMM validation |

| Surface Finish Defects | Improper mold maintenance, incorrect polishing | Define SPI or VDI surface standards; schedule mold cleaning/logs |

| Material Substitution | Supplier non-compliance or cost-cutting | Enforce material traceability; require CoC and MTCs; conduct random lab testing |

| Soldering Defects (PCBA) | Incorrect reflow profile, poor stencil design | Adhere to IPC-A-610; perform AOI and X-ray inspection |

| Packaging Damage | Inadequate drop-test validation | Conduct ISTA 3A testing; optimize cushioning and box strength |

| Labeling & Documentation Errors | Language/regulatory misalignment | Use approved templates; audit labels pre-shipment; verify multilingual compliance |

| Contamination (Medical/Food) | Poor cleanroom practices | Enforce ISO 14644-1 cleanroom standards; implement strict gowning and ESD protocols |

Strategic Recommendations for Procurement Managers

- Conduct Pre-Transition Audits: Evaluate new suppliers using Sourcify’s 12-Point Factory Assessment, including engineering capability and compliance history.

- Implement Dual Sourcing: Maintain short-term overlap with Chinese suppliers to mitigate ramp-up risks.

- Standardize Inspection Protocols: Require AQL Level II (MIL-STD-1916) for all shipments; include pre-shipment and during-production inspections.

- Leverage Digital QC Tools: Use cloud-based platforms for real-time defect tracking and corrective action (CAPA) management.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Advisory

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Strategic Sourcing Report 2026

Guiding Global Procurement Managers Through Post-China Manufacturing Diversification

Executive Summary

Global supply chain restructuring continues to accelerate in 2026, with 68% of Fortune 500 companies actively diversifying beyond China (per SourcifyChina 2025 Global Sourcing Index). This report provides data-driven insights for procurement leaders navigating manufacturing transitions, focusing on cost structures, OEM/ODM models, and strategic label selection. Critical finding: Successful “China+1” strategies prioritize total landed cost optimization over nominal unit pricing, with 42% of failed transitions stemming from underestimated non-production costs.

White Label vs. Private Label: Strategic Implications for Exiting China

| Factor | White Label | Private Label | Strategic Recommendation for Diversification |

|---|---|---|---|

| Definition | Pre-made product sold under buyer’s brand; minimal customization | Product fully developed to buyer’s specs; exclusive design/IP | Prioritize Private Label for long-term margin control and brand differentiation in new regions |

| MOQ Flexibility | Very low (often 100-500 units) | Moderate to High (typically 1,000+ units) | Start with White Label for market testing; transition to Private Label at scale |

| Cost Control | Limited (fixed specs = fixed costs) | High (negotiable materials, processes, labor) | Private Label yields 12-18% lower total cost at 5,000+ units despite higher initial setup |

| Quality Risk | High (shared production lines, limited oversight) | Low (dedicated lines, buyer-controlled QC) | Critical for regulated industries (medical, automotive) |

| Time-to-Market | Fast (2-4 weeks) | Slow (12-20 weeks for new tooling) | Balance speed (White Label) vs. sustainability (Private Label) |

Key Insight: Companies exiting China often default to White Label for speed, but 73% regret this choice within 18 months due to margin compression and quality issues (SourcifyChina Client Survey, Q1 2026). Action: Allocate 15-20% of transition budget to Private Label setup for core SKUs.

Manufacturing Cost Breakdown: Post-China Production Hubs (2026 Estimates)

Based on medium-complexity consumer goods (e.g., kitchen appliances, non-electronic hardware)

| Cost Component | Vietnam | Mexico | Eastern Europe | Critical Variables |

|---|---|---|---|---|

| Materials | 38-42% of total | 32-35% of total | 35-38% of total | • Proximity to raw materials (Mexico excels for US) • Import tariffs on components (Vietnam: 0-5% US tariffs vs. China’s 25%) |

| Labor | $1.80-$2.20/unit | $3.10-$3.60/unit | $2.90-$3.40/unit | • Productivity differentials (Vietnam: 85% of China; Mexico: 92%) • Overtime costs (Vietnam: +50% after 44 hrs/week) |

| Packaging | $0.45-$0.65/unit | $0.60-$0.80/unit | $0.55-$0.75/unit | • Local material sourcing (Vietnam: 30% cheaper than imported) • Sustainability compliance costs (+12-18% in EU-targeted goods) |

| Hidden Costs | +14-18% | +9-12% | +11-15% | • Logistics (Vietnam ocean freight +22% YoY) • Quality failures (Vietnam: 8.2% defect rate vs. China’s 5.1%) |

Unit Cost Tiers by MOQ: Realistic 2026 Projections

Example: Mid-tier plastic housing assembly (15cm x 10cm, 2-color injection molding)

| MOQ | Vietnam | Mexico | Eastern Europe | Cost Delta vs. China (2026) | Procurement Recommendation |

|---|---|---|---|---|---|

| 500 units | $8.20 – $9.50 | $10.80 – $12.40 | $10.20 – $11.70 | +38% – +45% | Avoid – Use China residual capacity or White Label |

| 1,000 units | $6.90 – $7.80 | $8.90 – $9.90 | $8.50 – $9.30 | +28% – +33% | Vietnam for Asia-Pacific; Mexico for US market |

| 5,000 units | $5.10 – $5.70 | $6.80 – $7.40 | $6.30 – $6.90 | +18% – +22% | Vietnam (optimal scale) or Mexico (nearshoring premium) |

Footnotes:

1. All figures include landed costs (FOB + freight + duties + insurance)

2. Assumes 3% annual labor inflation in Vietnam (+2.5% Mexico, +1.8% Eastern Europe)

3. 5,000-unit tier assumes Private Label setup completed; White Label costs remain 15-20% higher

4. China baseline: $4.25/unit at 5,000 MOQ (2026 projected)

Critical Success Factors for Cost-Effective Transitions

- MOQ Realism: 63% of failed transitions set unrealistic MOQs. Start with 1,000-unit pilots before scaling.

- Labor Efficiency: Vietnam requires 12-15% more labor hours/unit vs. China – factor into labor cost calculations.

- Tooling Investment: Private Label molds cost $8,000-$15,000 (Vietnam) vs. $5,000-$8,000 (China) – amortize over 10k+ units.

- Logistics Optimization: Mexico reduces US landed costs by 22% vs. Vietnam for air freight-sensitive goods.

- Quality Infrastructure: Budget 5-7% for third-party QC in new hubs (vs. 3-4% in mature China facilities).

Conclusion: Beyond the Unit Cost Obsession

Companies achieving >15% cost reduction post-China exit focus on systemic efficiency, not just labor arbitrage. Our data shows winners:

– Lock Private Label contracts at 5,000+ MOQs to secure 18-22% cost stability

– Use Vietnam for Asia-Pacific, Mexico for North America, Eastern Europe for EU – avoid “one-size-fits-all”

– Allocate 7-10% of budget to supply chain resilience (dual sourcing, buffer stock)

“The goal isn’t to replicate China’s cost structure – it’s to build a more agile, transparent, and risk-resilient supply chain where true cost is measured in total landed value, not per-unit price.”

— SourcifyChina 2026 Strategic Sourcing Principle

SourcifyChina Recommendation: Initiate a Total Landed Cost Audit before finalizing new manufacturing partners. Our proprietary TCO Calculator (available to clients) identifies hidden cost drivers with 92% accuracy. [Contact Sourcing Team for Custom Analysis]

Data Sources: SourcifyChina 2026 Manufacturing Index (n=247 factories), World Bank Logistics Performance Index, IMF Regional Cost Forecasts. All figures adjusted for 2026 inflation projections.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers – Especially for Companies Exiting China

Issued by: SourcifyChina | Senior Sourcing Consultants

Executive Summary

As geopolitical shifts, rising costs, and supply chain diversification drive companies to exit China or reevaluate their manufacturing base, procurement managers face increased complexity in vetting reliable production partners. Misclassifying a trading company as a factory, or partnering with unverified entities, can lead to quality failures, delivery delays, IP theft, and compliance risks.

This report outlines a structured due diligence process to identify true manufacturers, distinguish them from trading companies, and recognize red flags—ensuring resilient, transparent, and cost-effective sourcing in 2026 and beyond.

Critical Steps to Verify a Manufacturer (Post-China Exit Context)

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Entity & Business License | Validate legitimacy and scope of operations | Request and verify the Business License (Yingye Zhizhao) via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | On-Site Factory Audit (or 3rd-Party Verified Video Audit) | Confirm physical production capabilities | Conduct in-person audit or use a verified video walkthrough with real-time Q&A check for machinery, raw materials, QC stations, and workforce |

| 3 | Validate Ownership of Equipment & Facilities | Ensure the entity operates as a factory, not a middleman | Review equipment purchase records, utility bills (electricity/water under company name), and lease agreements |

| 4 | Review Export History & Customs Data | Confirm direct export capability and scale | Analyze customs export records via platforms like Panjiva, ImportGenius, or Descartes. Look for consistent shipment volumes under the company’s name |

| 5 | Inspect Production Capacity & Lead Times | Assess scalability and reliability | Request production line layout, shift schedules, and machine utilization rates. Cross-check with order fulfillment timelines |

| 6 | Verify In-House Quality Control (QC) Processes | Ensure consistent product standards | Review QC documentation, AQL sampling procedures, and certifications (ISO 9001, IATF 16949, etc.) |

| 7 | Conduct IP Protection Assessment | Mitigate intellectual property risks | Require signed NDA, IP assignment clauses, and audit for secure data handling (e.g., locked design files, restricted access) |

| 8 | Evaluate Workforce & Management Structure | Confirm operational autonomy and expertise | Interview production and engineering leads; verify employee count via social insurance records (if accessible) |

🔍 Note: For companies relocating from China to Vietnam, Thailand, or Mexico, repeat verification at the new site—do not assume continuity of standards.

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | True Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” “agent” | Lists “manufacturing,” “production,” “processing” |

| Facility Footprint | Office-only, no production equipment | On-site machinery, raw material storage, assembly lines |

| Pricing Structure | Quotes in FOB or CIF with no cost breakdown | Can provide Bill of Materials (BOM) and labor cost breakdown |

| Lead Time Control | Longer, less predictable (dependent on 3rd-party factories) | Direct control over production scheduling |

| Customization Capability | Limited; refers to factory for engineering changes | In-house R&D, tooling, and engineering teams |

| Export Documentation | Shipments under different manufacturer names | Consistent exporter of record under own name |

| Staff Expertise | Sales-focused; limited technical knowledge | Engineers, QC managers, production supervisors on staff |

✅ Pro Tip: Ask: “Can you show me the machine that will produce our part?” A factory can; a trader cannot.

Red Flags to Avoid in 2026 Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | Likely not a real factory or hiding operations | Suspend engagement until verified |

| Quoting extremely low prices with no justification | Risk of substandard materials, labor violations, or hidden fees | Request BOM cost breakdown and compare with market benchmarks |

| No ISO or industry-specific certifications | Poor quality systems, non-compliance risk | Require certification roadmap or third-party audit |

| Use of generic email (e.g., @qq.com, @163.com) | Unprofessional; may indicate individual trader | Require company domain email (e.g., @yourfactory.com.cn) |

| Refusal to sign NDA or IP agreement | High risk of design theft | Do not share technical data until legally protected |

| Inconsistent answers during technical discussions | Lack of engineering expertise | Engage independent technical consultant for review |

| Pressure for large upfront payments (>30%) | Cash flow issues or scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No verifiable client references or case studies | Lack of track record | Request 2–3 verifiable references and contact them directly |

Strategic Recommendations for 2026

- Adopt a “Verify, Then Partner” Mindset: Assume no supplier is trustworthy until independently validated.

- Leverage Third-Party Audits: Use firms like SGS, TÜV, or Bureau Veritas for initial and annual factory assessments.

- Localize Your Oversight: Consider hiring in-region sourcing agents or quality inspectors in transition countries (e.g., Vietnam, India, Mexico).

- Build Dual Sourcing Early: Avoid over-reliance on any single supplier, especially during relocation phases.

- Digitize Supplier Vetting: Use platforms like Sourcify, Alibaba Trade Assurance, or SupplyPike for real-time monitoring and risk scoring.

Conclusion

The exit from China is not a relocation—it’s a strategic reset. Success depends on rigorous manufacturer verification, clear differentiation between traders and factories, and proactive risk mitigation. By applying these structured steps, procurement leaders can build resilient, transparent, and high-performance supply chains in the evolving global landscape of 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Specialists in China & ASEAN Manufacturing Verification

📅 Report Validity: January 2026 – December 2026

🔒 Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Supplier Transition Management in China (Q1 2026)

Prepared for Global Procurement & Supply Chain Leadership

Critical Market Shift: Accelerated Manufacturer Exodus from China

China’s evolving manufacturing landscape—driven by rising costs, geopolitical pressures, and regional policy shifts—has triggered an unprecedented wave of supplier exits. Our 2026 Supply Chain Resilience Index indicates 42% of Tier-2 Chinese suppliers are actively relocating or liquidating operations. Traditional sourcing methods now carry severe operational risks:

| Sourcing Approach | Avg. Time to Verify Exit Status | Risk of Contract Termination | Cost of Supply Disruption |

|---|---|---|---|

| Manual Supplier Vetting | 68+ hours | 61% | $220K+ per incident |

| Generic B2B Platforms | 41 hours | 47% | $145K+ per incident |

| SourcifyChina Pro List | <5 hours | <8% | $18K avg. mitigation |

Data Source: SourcifyChina 2026 Supplier Transition Audit (n=1,200 verified cases)

Why the Verified Pro List Eliminates Costly Sourcing Delays

Our Exiting China Supplier Intelligence System delivers decisive advantages through:

-

Real-Time Exit Verification

Proprietary AI cross-references 17 data streams (customs records, tax filings, lease expirations) to confirm operational status—eliminating 92% of false “active supplier” listings on public platforms. -

Transition-Ready Alternatives

Each verified exiting supplier is mapped to 3+ pre-vetted, capacity-matched replacements within 72 hours—no RFP cycles or factory audits required. -

Contractual Risk Shield

Legal team validation of exit timelines prevents mid-production abandonment, reducing supply chain stoppages by 89% (2025 client data).

“SourcifyChina’s Pro List cut our supplier replacement cycle from 14 weeks to 9 days during the Guangdong textile cluster exodus. We avoided $380K in air freight premiums.”

— CPO, Top 3 European Apparel Brand (Q4 2025 Case Study)

Your Action Plan: Secure Supply Chain Continuity in <24 Hours

Procurement leaders who act now gain exclusive access to our Q2 2026 Exit Risk Dashboard—featuring:

✅ Real-time heat maps of high-exit-risk industrial zones

✅ Priority booking for verified replacement suppliers

✅ Free transition cost calculator (customized to your spend)

Do not risk operational paralysis from unverified supplier claims.

→ Immediate Next Steps

- Email [email protected] with subject line: “2026 PRO LIST ACCESS – [Your Company Name]”

- WhatsApp +86 159 5127 6160 for urgent cases (24/7 response)

Within 24 business hours, you will receive:

– Your personalized Supplier Exit Risk Scorecard

– 3 pre-negotiated replacement supplier profiles

– 15-minute strategic consultation with our China Transition Lead

Time is your scarcest resource. While competitors navigate dead-end supplier leads, SourcifyChina clients redeploy saved hours toward strategic growth—not firefighting. 87% of 2025 Pro List users secured transition suppliers before their incumbent’s lease expired.

Act before Q2 capacity allocations close.

✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

— SourcifyChina: Precision Sourcing Intelligence Since 2018

Verified. Validated. Operational.

🧮 Landed Cost Calculator

Estimate your total import cost from China.