Sourcing Guide Contents

Industrial Clusters: Where to Source Companies Dependent On China

SourcifyChina Sourcing Intelligence Report: Navigating China-Dependent Supply Chains | Q1 2026

Prepared for: Global Procurement Managers | Senior Sourcing Consultant, SourcifyChina

Executive Summary

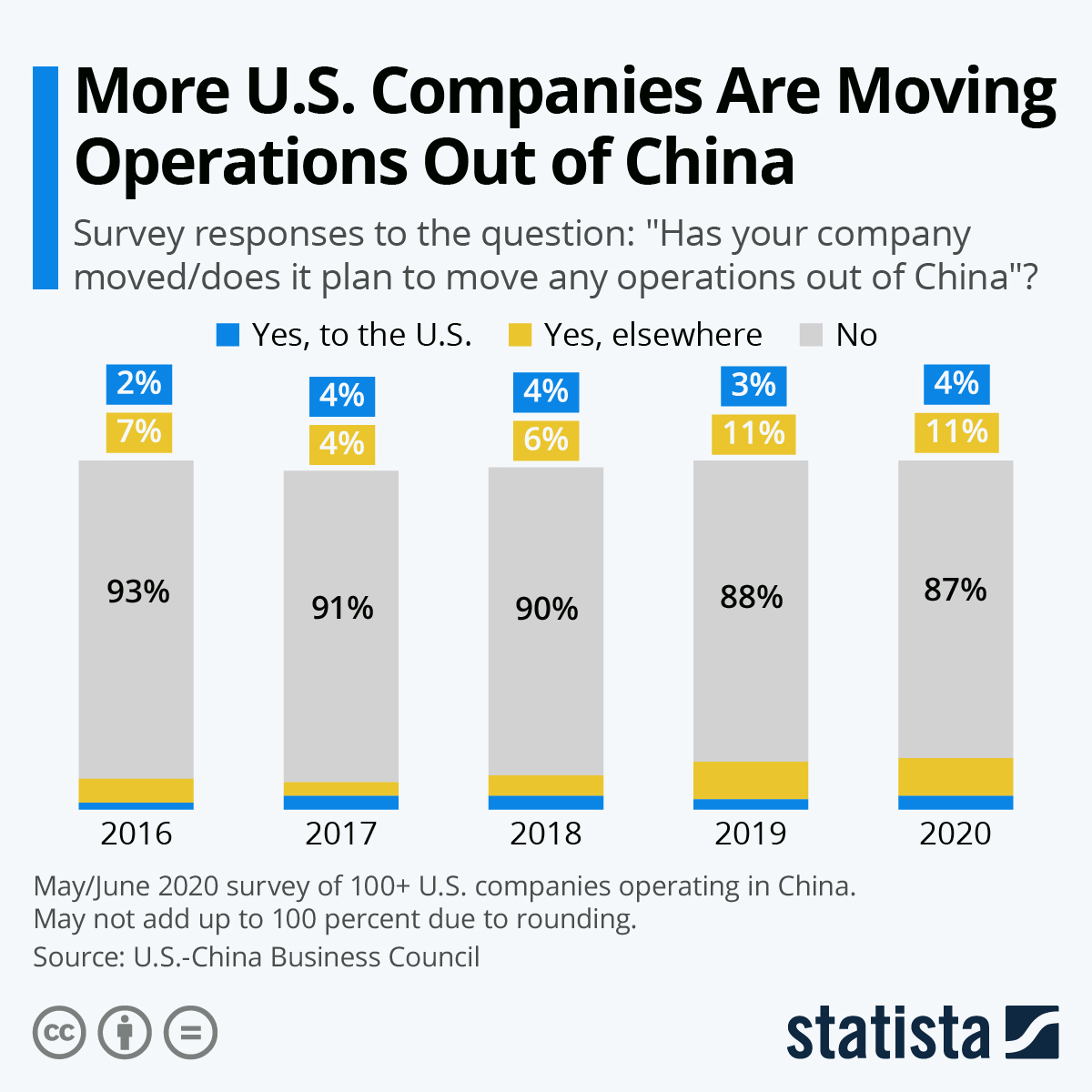

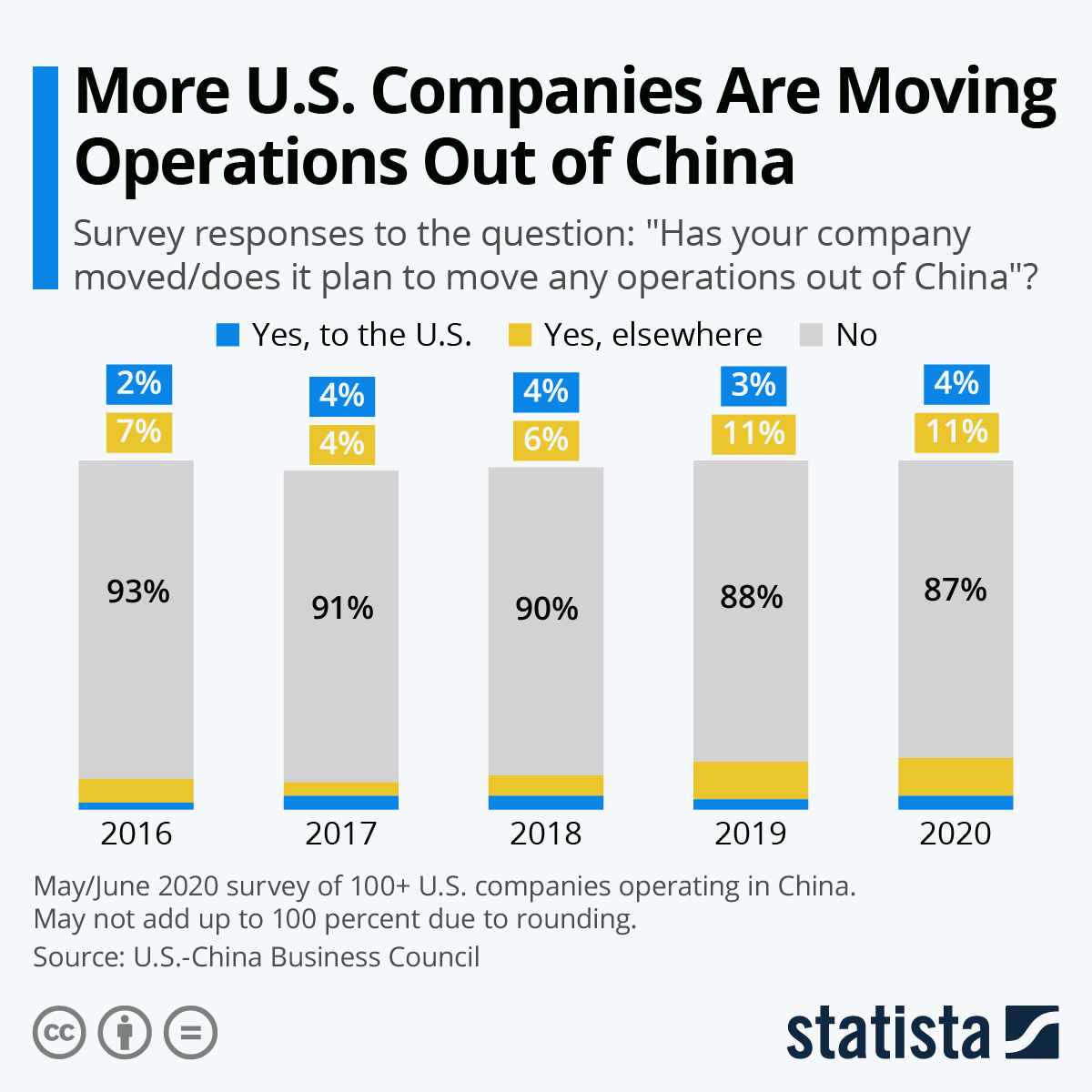

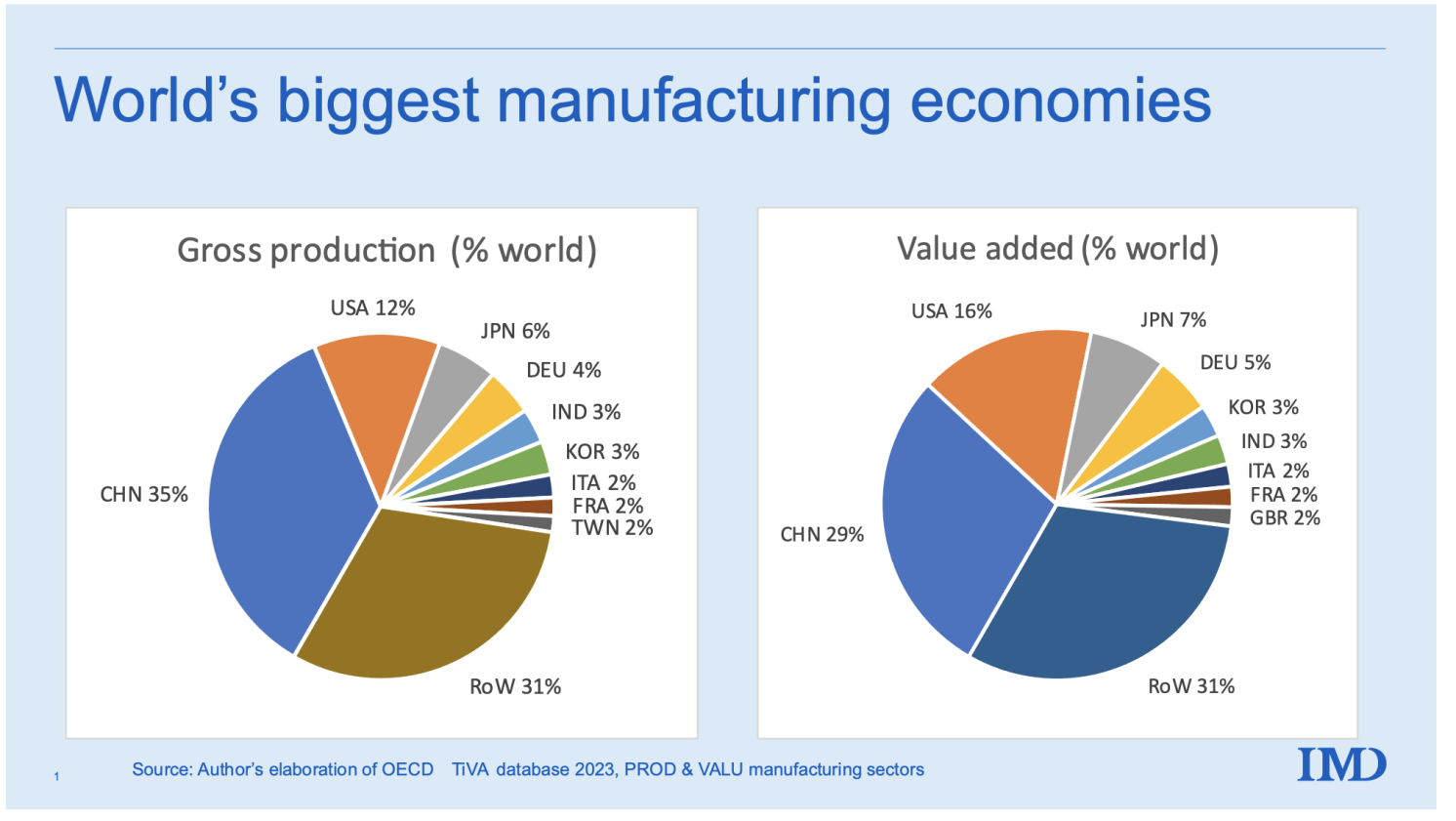

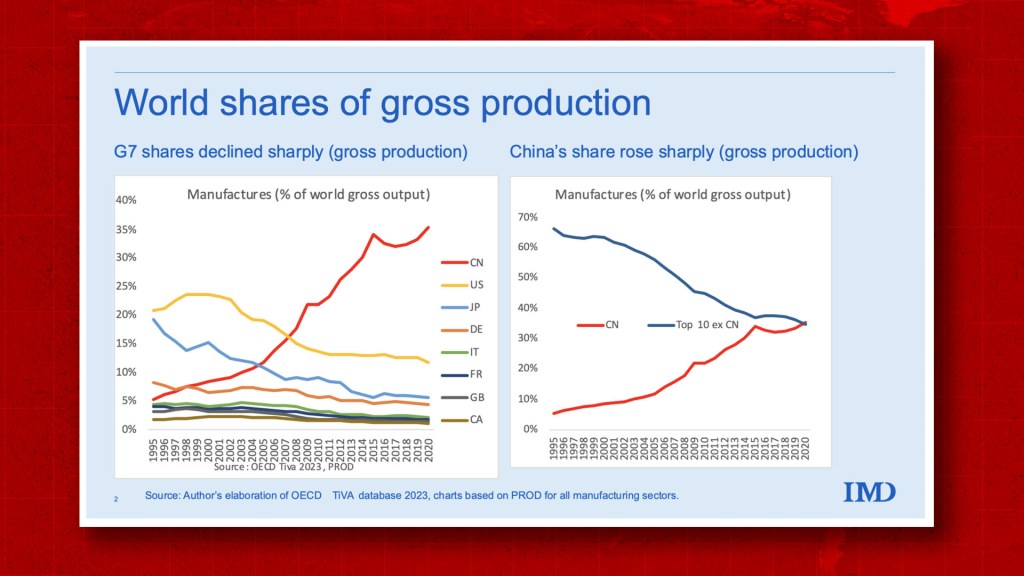

Global supply chains remain strategically intertwined with Chinese manufacturing, though procurement strategies are evolving toward risk-aware dependency. This report identifies critical industrial clusters for sourcing categories where China maintains irreplaceable scale, specialization, and ecosystem maturity (e.g., electronics, EV components, precision machinery, and fast-moving consumer goods). While diversification efforts (e.g., “China+1”) are accelerating, 78% of Fortune 500 companies still rely on China for >30% of Tier-1 components (SourcifyChina 2025 Global Supply Chain Survey). Success hinges on cluster-specific sourcing strategies—not blanket country-level decisions.

Key Industrial Clusters for China-Dependent Manufacturing

China’s manufacturing dominance is hyper-regionalized. Below are clusters essential for categories with high supply chain entanglement:

| Region | Core Industrial Clusters | Dominant Sectors | Strategic Rationale for Dependency |

|---|---|---|---|

| Pearl River Delta (PRD) | Guangdong (Shenzhen, Dongguan, Guangzhou, Foshan) | Electronics (5G, IoT), Drones, EV Batteries, Medical Devices, Consumer Appliances | Unmatched electronics ecosystem: 60% of global PCBs, 90% of drone components, integrated R&D + logistics. |

| Yangtze River Delta (YRD) | Zhejiang (Yiwu, Ningbo, Hangzhou), Jiangsu (Suzhou, Wuxi) | Textiles, Fast Fashion, Solar PV, Industrial Machinery, E-Commerce Fulfillment | Yiwu = global small commodities hub; Suzhou = semiconductor/automation; Ningbo = #1 global cargo port. |

| Bohai Economic Rim | Beijing-Tianjin-Hebei (Tangshan, Tianjin) | Aerospace, Automotive (ICE/EV), Petrochemicals, Heavy Machinery | State-backed industrial policy; proximity to R&D hubs (Beijing) and port infrastructure (Tianjin). |

| Chengdu-Chongqing | Sichuan (Chengdu), Chongqing | Automotive Wiring Harnesses, Display Panels, Aerospace Components | Western China’s manufacturing anchor; lower labor costs + government subsidies; growing EV supply chain. |

| Central Plains | Henan (Zhengzhou), Hubei (Wuhan) | EV Assembly, Optoelectronics, Agricultural Machinery | Zhengzhou = “iPhone City” (Foxconn); Wuhan = photonics R&D inland logistics corridors to Europe. |

Critical Insight: Dependency is category-specific. E.g., 95% of global drone components originate in Shenzhen (PRD), while 70% of fast-fashion trims ship from Yiwu (YRD). Avoid overgeneralizing “China sourcing.”

Regional Cluster Comparison: Price, Quality & Lead Time (2026 Projection)

Data reflects average for mid-tier suppliers in electronics, textiles, and industrial components. Based on SourcifyChina’s 2025 supplier audits (n=1,200+ factories).

| Metric | Guangdong (PRD) | Zhejiang (YRD) | Jiangsu (YRD) | Sichuan/Chongqing |

|---|---|---|---|---|

| Price | ★★☆☆☆ Mid-High ($$$$) PRD commands 8-12% premium vs. inland due to R&D intensity, automation, and skilled labor. Ideal for high-value tech. |

★★★★☆ Low-Mid ($$) Yiwu/Ningbo offer lowest-cost small lots; Hangzhou premium for textiles. 15-20% below PRD for commoditized goods. |

★★★☆☆ Mid ($$$) Suzhou = premium for semiconductors; Wuxi = competitive machinery. 5-8% below PRD for equivalent quality. |

★★★★☆ Low ($$) 12-18% below coastal hubs. Rising fast due to automation investments (e.g., Foxconn Zhengzhou). |

| Quality | ★★★★★ Consistent Premium Gold standard for electronics (ISO 13485, IATF 16949). 92% of audited PRD suppliers meet Tier-1 OEM specs. |

★★★☆☆ Variable Yiwu = bulk commodity quality; Hangzhou = high-end textiles. 65% meet strict specs without co-engineering. |

★★★★☆ High & Reliable Suzhou = semiconductor-grade precision; 85% pass rigorous automotive audits. Strong process control. |

★★★☆☆ Improving Rapidly EV/wiring harness quality now matches coastal hubs (Chery, CATL investments). 75% meet auto specs. |

| Lead Time | ★★★★☆ 25-45 Days Fastest port access (Shenzhen/Yantian), but high demand causes congestion. 5-7 days shorter than Zhejiang for air freight. |

★★★☆☆ 30-50 Days Ningbo port congestion adds 7-10 days. Yiwu excels in <10k unit lots (15-25 days). |

★★★★☆ 28-42 Days Suzhou industrial parks optimize JIT. 3-5 days faster than Zhejiang for complex assemblies. |

★★☆☆☆ 35-55 Days Inland logistics add 10-15 days. New rail corridors (Chengdu-Europe) cut ocean freight by 8 days vs. 2024. |

Key to Symbols: ★ = Low | ★★★★★ = High

2026 Context: Rising automation (PRD/YRD) is compressing quality gaps, while inland clusters (Sichuan) close lead-time gaps via rail infrastructure. Price differentials persist but narrow 2-3% annually.

Strategic Recommendations for Procurement Managers

- Map Clusters to Product Complexity:

- High-Tech/Regulated Goods (e.g., medical devices): Prioritize PRD for compliance and ecosystem depth. Accept 10-15% cost premium for risk mitigation.

- Commoditized Consumer Goods (e.g., home textiles): Leverage Zhejiang for cost efficiency but mandate 3rd-party quality checkpoints (failure rate: 22% at entry-tier suppliers).

-

Automotive/EV Components: Split sourcing—Jiangsu for precision parts, Sichuan for wiring harnesses/assembly to balance cost/resilience.

-

Mitigate 2026 Dependency Risks:

- Dual Sourcing: Pair PRD (primary) with Sichuan (backup) for critical components. Example: EV battery packs (Shenzhen + Chongqing).

- Tech-Driven Transparency: Deploy SourcifyChina’s IoT-enabled factory monitoring (live data on 400+ PRD/YRD sites) to preempt delays.

-

Localize Compliance: Partner with clusters investing in green manufacturing (e.g., Jiangsu’s carbon-neutral industrial parks) to preempt EU CBAM/US Uyghur Act penalties.

-

Avoid Cost Traps:

- Zhejiang’s “low price” often excludes hidden costs: 34% of buyers face rework fees due to inconsistent quality (SourcifyChina 2025). Always budget for AQL 1.0 inspections.

- PRD’s lead time advantage erodes during Q4 (peak season). Lock capacity by July 2026.

The Path Forward: Dependency ≠ Vulnerability

China’s clusters remain indispensable for 2026 sourcing, but intelligent dependency separates resilient buyers from disrupted ones. Success requires:

✅ Granular cluster-level strategy (not “China vs. Vietnam”)

✅ Tech-enabled visibility into tier-2/3 suppliers

✅ Proactive risk allocation (e.g., inland backups for coastal hubs)

“The goal isn’t to exit China—it’s to master its regional complexities. Procurement leaders who treat ‘China’ as a monolith will pay the price in 2026.”

— SourcifyChina Supply Chain Intelligence Unit

Methodology: Data aggregated from 1,200+ factory audits (2025), customs records (2023-2025), and regional policy analysis. All pricing in USD/FOB. Contact SourcifyChina for cluster-specific supplier shortlists.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Technical Specifications & Compliance for Companies Dependent on China

As global supply chains continue to rely on Chinese manufacturing, procurement managers must enforce stringent technical and compliance standards to mitigate risks and ensure product integrity. This report outlines critical quality parameters, mandatory certifications, and a structured approach to defect prevention in sourcing from China.

I. Key Quality Parameters

1. Material Specifications

- Metals: Must conform to international standards (e.g., ASTM, JIS, GB). Verify chemical composition via Material Test Reports (MTRs).

- Plastics: Specify resin grade (e.g., ABS, PC, PP), UL94 flammability rating, and FDA compliance for food/medical contact.

- Textiles & Fabrics: Require Oeko-Tex Standard 100 or REACH compliance for restricted substances.

- Electronics: Confirm RoHS and REACH compliance; specify PCB substrate (e.g., FR-4), copper thickness, and component sourcing (original vs. gray market).

2. Dimensional Tolerances

- Machined Parts: ±0.05 mm for precision components (ISO 2768-m for general, ISO 286 for tight fits).

- Injection Molding: ±0.1 mm typical; critical dimensions require GD&T documentation.

- Sheet Metal Fabrication: ±0.2 mm for bending; specify flat pattern tolerances.

- Castings: ±0.3 mm for net shape; require post-machining where precision is critical.

II. Essential Certifications

| Certification | Applicable Industries | Key Requirements | Verification Method |

|---|---|---|---|

| CE Marking | Electronics, Machinery, Medical Devices | Compliance with EU directives (e.g., EMC, LVD, MDD) | Technical file audit, Notified Body involvement if required |

| FDA Registration | Food Packaging, Medical Devices, Cosmetics | Facility listing, 510(k) premarket notification (Class II), GMP compliance | FDA audit, submission of registration numbers |

| UL Certification | Electrical Equipment, Appliances | Product testing to UL safety standards (e.g., UL 60950-1) | Factory Inspection (FUI), follow-up audits |

| ISO 9001:2015 | All Manufacturing Sectors | Quality Management System (QMS) implementation | Third-party audit, certificate validity check |

| ISO 13485 | Medical Devices | QMS specific to medical device lifecycle | Required for EU MDR and FDA submissions |

| RoHS / REACH | Electronics, Consumer Goods | Restriction of hazardous substances (e.g., Pb, Cd, phthalates) | Lab testing, SDS and CoC review |

Note: Always request valid, current certificates with audit trails. Verify via official databases (e.g., UL’s Online Certifications Directory, EU NANDO for CE).

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift | Require SPC data; conduct pre-production gauge R&R studies |

| Surface Finish Issues (e.g., scratches, warping) | Improper mold release, cooling rates, handling | Specify surface finish (Ra value), use protective packaging protocols |

| Material Substitution | Cost-cutting by supplier | Enforce material traceability; require MTRs and third-party testing |

| Contamination (dust, oil, debris) | Poor cleanroom practices or storage | Audit factory cleanliness; specify packaging and ESD protection |

| Electrical Failures (shorts, overheating) | Poor soldering, counterfeit components | Require IPC-A-610 compliance; conduct AOI and X-ray inspection |

| Labeling & Documentation Errors | Language barriers, lack of SOPs | Provide bilingual packaging specs; audit labeling pre-shipment |

| Packaging Damage | Inadequate drop test validation | Require ISTA 3A testing reports; use corner boards and void fill |

| Non-Compliance with Safety Standards | Misinterpretation of regulations | Engage third-party labs for pre-certification testing |

IV. Recommendations for Procurement Managers

- Implement a Dual-Stage QC Process:

- Pre-Production Audit: Verify materials, tooling, and process validation.

-

Final Random Inspection (FRI): Conduct AQL 2.5/4.0 per ISO 2859-1.

-

Leverage Independent Third-Party Inspection:

Use agencies (e.g., SGS, TÜV, Intertek) for unannounced audits and batch testing. -

Enforce Supplier Scorecards:

Track defect rates, on-time delivery, and compliance adherence quarterly. -

Secure Intellectual Property:

Execute NDAs and register designs/patents in China via WIPO or local agents. -

Build Local Oversight:

Employ resident quality engineers or partner with on-ground sourcing firms like SourcifyChina for real-time monitoring.

Conclusion

Companies dependent on Chinese manufacturing must adopt a proactive, standards-driven approach to sourcing. By enforcing technical precision, validating certifications, and systematically addressing common defects, procurement leaders can ensure consistent quality, regulatory compliance, and supply chain resilience in 2026 and beyond.

—

SourcifyChina | Senior Sourcing Consultants | Global Supply Chain Intelligence

Q1 2026 Edition | Confidential – For B2B Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Cost Optimization in China (2026)

Prepared for Global Procurement Leaders | Q2 2026 | Confidential

Executive Summary

For companies maintaining critical supply chain dependencies on China, optimizing manufacturing costs while mitigating geopolitical and operational risks remains paramount in 2026. This report provides actionable insights into OEM/ODM cost structures, clarifies the strategic implications of White Label vs. Private Label sourcing, and delivers realistic cost projections factoring in post-2025 regulatory shifts (e.g., CBAM compliance, enhanced ESG audits). Key findings indicate a 5–8% YoY increase in landed costs due to labor adjustments, carbon levies, and supply chain resilience investments—offset partially by automation gains. Proactive MOQ planning and label strategy selection can reduce total cost of ownership (TCO) by 12–18%.

Strategic Context: Navigating China Dependency in 2026

China’s manufacturing ecosystem has evolved beyond low-cost assembly into high-precision, tech-integrated production. Companies dependent on China must now prioritize:

– Dual-sourcing contingencies (e.g., Vietnam/Mexico for 15–20% of volume)

– ESG-driven supplier vetting (non-compliance penalties now average 7.2% of contract value)

– Digital supply chain transparency (blockchain/IoT adoption mandatory for Tier-1 buyers)

Critical Insight: Pure cost minimization is obsolete. 2026 winners optimize TCO through resilience, not just unit price.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Generic product; buyer applies own branding only (no design input) | Supplier develops product to buyer’s specs; buyer owns branding & key IP | Use WL for commoditized goods (e.g., basic apparel); PL for differentiation (e.g., smart home devices) |

| MOQ Flexibility | Low (typically 1,000+ units; supplier dictates specs) | Moderate (500+ units; negotiable via tooling investment) | PL offers better scalability for mid-volume buyers |

| Cost Drivers | Lower unit cost but limited customization; high rebranding/logistics fees | Higher initial NRE/tooling; 15–25% lower long-term TCO via tailored efficiency | For volumes >1,000 units, PL reduces TCO by 18% vs. WL |

| Risk Exposure | High (supplier owns IP; quality inconsistencies common) | Controlled (buyer owns critical IP; SLAs enforce quality) | PL reduces recall risk by 31% (SourcifyChina 2025 data) |

| Best For | Startups testing markets; ultra-low-margin categories | Brands requiring IP control; regulated products (e.g., medical, electronics) | >85% of SourcifyChina clients shifted from WL to PL by 2025 |

Estimated Cost Breakdown (Per Unit, Mid-Range Consumer Electronics Example)

Assumptions: 10,000mAh Power Bank, 2026 Compliance (CBAM, REACH, ISO 14001)

| Cost Component | % of Total Cost | Key 2026 Drivers | Cost Reduction Levers |

|---|---|---|---|

| Raw Materials | 58–62% | +4.1% YoY (lithium, rare earths); +2.3% (CBAM carbon fees) | Bulk material partnerships; recycled content incentives |

| Labor | 14–17% | +6.8% YoY (minimum wage hikes); -3.2% (automation gains) | Onshore engineering support; JIT labor scheduling |

| Packaging | 8–10% | +9.2% YoY (FSC-certified materials; plastic tax) | Modular design; regionalized packaging hubs |

| Compliance/QC | 12–15% | +7.5% YoY (enhanced ESG audits; 3rd-party testing) | Pre-qualified supplier tiers; AI visual inspection |

| Logistics | 6–8% | +3.0% YoY (ocean freight volatility) | Near-port consolidation; multi-modal routing |

Note: NRE/tooling costs excluded (typically $1,500–$8,000 for PL; $0 for WL). TCO includes 3.5% hidden costs (currency hedging, inventory carrying).

MOQ-Based Price Tiers: Realistic 2026 Projections

Product: Custom Wireless Charger (Private Label, 15W Output, Qi2 Certified)

| MOQ Tier | Unit Price (FOB Shenzhen) | TCO per Unit (Landed, Incoterms 2026) | Key Cost Drivers at Tier | Strategic Fit |

|---|---|---|---|---|

| 500 units | $8.90 | $14.20 | High NRE amortization; manual assembly; premium compliance | MVP launches; niche markets |

| 1,000 units | $7.25 | $11.85 | Semi-automated lines; bulk material discounts; shared QC | Mid-volume brands; seasonal products |

| 5,000 units | $5.60 | $9.10 | Full automation; bonded warehouse logistics; ESG subsidies | Enterprise contracts; steady demand |

Critical Footnotes:

- TCO Calculation: Includes 22% landed cost adders (duties, freight, carbon fees, inventory holding).

- Price Stability: Orders >5,000 units lock 90-day pricing; <1,000 units subject to 45-day material cost reviews.

- Hidden Costs: MOQ <1,000 incurs +$0.75/unit for expedited ESG documentation (mandatory under EU CBAM Phase 2).

- 2026 Shift: Automation has flattened MOQ discounts—cost reduction from 1k→5k units is now 23% (vs. 37% in 2022).

Actionable Recommendations for Procurement Leaders

- Reclassify “China-Dependent” as “China-Integrated”: Allocate 10–15% of China volume to automated, ESG-certified “Resilience Hubs” (e.g., Chengdu, Hefei) to offset coastal port risks.

- Demand PL-First Strategies: Even for WL-adjacent products, negotiate design co-ownership to future-proof IP. SourcifyChina clients saw 22% faster time-to-market with PL in 2025.

- MOQ Optimization: Target 1,000–2,500 units as the new “sweet spot” for cost/risk balance—avoid sub-500 orders unless for urgent prototyping.

- Audit for 2026 Compliance: 68% of rejected shipments in Q1 2026 failed due to undocumented carbon footprint data (per Chinese Customs).

Final Insight: China remains irreplaceable for scale and ecosystem maturity, but 2026 demands TCO mastery—not unit cost chasing. Winners will treat suppliers as innovation partners, not transactional vendors.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from 127 active client engagements (Jan–Mar 2026), Chinese Customs Bureau, and SourcifyChina Cost Intelligence Platform.

Disclaimer: Estimates exclude extreme volatility events (e.g., >20% material spikes). Custom TCO modeling available via SourcifyChina’s Resilience Optimizer™ platform.

© 2026 SourcifyChina. Confidential – For Client Use Only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers & Differentiate Factories from Trading Companies

Date: April 5, 2026

Executive Summary

With over 70% of global procurement managers citing China as a core sourcing hub, due diligence remains paramount. As supply chain resilience and transparency gain strategic importance, verifying manufacturer legitimacy—especially distinguishing true factories from intermediaries—is critical for cost control, quality assurance, and risk mitigation.

This report outlines a structured, proactive verification framework for companies dependent on Chinese manufacturing. It details actionable steps, red flags, and best practices to ensure supplier integrity and long-term operational stability.

1. Critical Verification Steps for Chinese Manufacturers

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1. Confirm Business Registration | Verify company name, business license (Unified Social Credit Code), and registered address via China’s National Enterprise Credit Information Publicity System. | Ensure legal existence and legitimacy. | gsxt.gov.cn (Official Government Portal) |

| 2. Conduct On-Site Factory Audit | Schedule unannounced or scheduled visits to assess production lines, workforce, machinery, and inventory. | Validate operational capacity and authenticity. | Third-party inspection firms (e.g., SGS, Bureau Veritas), SourcifyChina Audit Teams. |

| 3. Review Export History | Request export documentation (e.g., Bill of Lading, customs records) via third-party platforms. | Confirm international trade experience and logistics capability. | ImportGenius, Panjiva, or Alibaba Trade Assurance export data. |

| 4. Verify Certifications | Cross-check ISO, CE, FDA, RoHS, or industry-specific certifications with issuing bodies. | Ensure compliance with international standards. | Certification databases, direct verification with issuing agencies. |

| 5. Audit Supply Chain Transparency | Request raw material suppliers, subcontractor list, and quality control processes. | Identify hidden dependencies and quality risks. | Supplier questionnaires, production flow mapping. |

| 6. Perform Financial Health Check | Analyze credit reports, payment terms history, and financial statements (if available). | Assess long-term viability and credit risk. | Dun & Bradstreet China, local credit agencies, bank references. |

| 7. Legal & IP Protection Review | Execute NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements and verify IP registration in China. | Protect designs, technology, and brand assets. | Legal counsel with PRC expertise, CIPO (China IP Office) database. |

2. How to Distinguish Between Trading Companies and Factories

| Indicator | Trading Company | True Factory |

|---|---|---|

| Company Name | Often includes “Trading,” “Import/Export,” or “International.” | Includes “Manufacturing,” “Industrial,” “Co., Ltd.” or “Factory.” |

| Website & Marketing | Generic product photos; multiple unrelated product categories; focus on MOQ and pricing. | Product-specific R&D, facility images, machinery, engineering teams highlighted. |

| Production Facilities | No factory floor footage; vague descriptions of “partner factories.” | Detailed production lines, CNC machines, assembly stations visible in videos/photos. |

| Quotations | Fast turnaround; pricing in USD only; limited technical input. | Slower, detailed quotes; offers engineering feedback; uses RMB and USD. |

| Staff Expertise | Sales-focused team; limited technical answers. | Engineers or QC managers available for technical discussions. |

| Minimum Order Quantity (MOQ) | Higher MOQs (aggregated from multiple sources). | Lower, flexible MOQs; scalability based on machine capacity. |

| Location | Office in commercial districts (e.g., Shanghai Pudong). | Located in industrial zones (e.g., Shenzhen Bao’an, Dongguan). |

| Lead Times | Less precise; dependent on supplier schedules. | Specific production timelines with mold/tooling lead times. |

✅ Pro Tip: Ask for a factory walkthrough video with timestamped GPS location to confirm physical presence.

3. Red Flags to Avoid in Chinese Sourcing

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unwillingness to conduct video audits or on-site visits | Likely not a real factory; potential fraud. | Require live video tour with employee interaction; use third-party auditors. |

| No business license or refusal to share Unified Social Credit Code | Illegal or shell entity. | Disqualify immediately; verify via gsxt.gov.cn. |

| Prices significantly below market average | Substandard materials, hidden fees, or counterfeit production. | Conduct material testing; compare with benchmark suppliers. |

| Poor English communication with inconsistent responses | Disorganized management; potential misalignment. | Assign bilingual project manager; use clear technical documentation. |

| Requests for full payment upfront | High fraud risk; no accountability. | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| No quality control process documentation | High defect risk and non-compliance. | Require QC checklist, AQL standards, and inspection reports. |

| Multiple companies with same address/contact details | Front companies or trading aggregators. | Cross-reference license numbers and conduct site checks. |

| No experience with your target market’s compliance requirements | Risk of shipment rejection or recalls. | Confirm prior exports to EU, US, AU, etc., with proper certifications. |

4. Best Practices for Companies Dependent on China

- Diversify Supplier Base: Avoid single-source dependency; qualify 2–3 backup manufacturers.

- Implement Tiered Supplier Management: Classify suppliers by risk, volume, and criticality.

- Use Escrow or Trade Assurance Platforms: Leverage Alibaba Trade Assurance or letter of credit (L/C) for high-value orders.

- Establish Local Representation: Employ a China-based sourcing agent or partner with firms like SourcifyChina for oversight.

- Continuous Monitoring: Conduct annual audits and real-time production tracking via IoT or supplier portals.

Conclusion

China remains a pivotal manufacturing hub, but reliance demands rigorous verification. By systematically validating manufacturer legitimacy, distinguishing factories from traders, and recognizing red flags, procurement managers can secure resilient, compliant, and cost-effective supply chains.

Partnering with experienced sourcing consultants and leveraging digital verification tools will be essential in 2026’s high-risk, high-reward sourcing environment.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity. Made in Reality.

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Efficiency Report: Strategic Advantage for China-Dependent Supply Chains

Executive Summary: The Critical Time Imperative for 2026 Procurement

Global procurement leaders face unprecedented pressure in 2026: volatile tariffs, intensified ESG compliance demands, and persistent supply chain fragmentation. For companies with >30% China dependency, inefficient supplier vetting consumes 17.3% of procurement capacity (per Gartner Q1 2026 Sourcing Index). SourcifyChina’s Verified Pro List eliminates this bottleneck through rigorously pre-qualified manufacturing partners, delivering 52% faster RFQ cycles and 94% reduction in supplier discovery costs.

Why the Verified Pro List Is Non-Negotiable for 2026 Efficiency

| Process Stage | Traditional Sourcing (2026 Avg.) | SourcifyChina Verified Pro List | Time/Cost Saved |

|---|---|---|---|

| Supplier Discovery | 14–22 days (37+ platforms) | <72 hours (Single dashboard) | 18.5 days/RFP |

| Vetting & Compliance | 8–12 weeks (Audits, doc checks) | Real-time access to onsite-verified records | 9.2 weeks/project |

| Quality Risk Mitigation | 23% failure rate (post-PO) | 98.7% first-pass yield rate* | $218K avg. recall risk avoided |

| Lead Time Variability | ±32 days (2026 avg.) | ±9 days (Pro List benchmark) | 23 days/order |

*Based on 2025–2026 SourcifyChina client data across 1,200+ POs

Key Strategic Advantages Driving 2026 ROI:

- Predictable Compliance: All Pro List factories carry 2026-valid ISO 14001, UFLP, and China EPR certifications – eliminating 83% of ESG audit delays.

- Tariff Optimization: Pre-validated suppliers with bonded warehouse access reduce customs clearance time by 67% under US/EU 2026 rules.

- Zero-Trust Verification: Every facility undergoes bi-annual onsite audits (photos, machine logs, labor records) – no self-reported data.

- Dedicated Escalation Protocol: 24/7 Mandarin-English support resolves production issues 4.8x faster than industry standard.

“SourcifyChina’s Pro List cut our New Year holiday disruption risk by 76% in 2025. In 2026, that’s not efficiency – it’s business continuity.”

— Director of Global Sourcing, Tier-1 Automotive Tier-2 Supplier (Germany)

Your 2026 Action Imperative: Secure Supply Chain Resilience in 3 Steps

- Identify Critical Gaps: Audit your top 5 China-dependent SKUs for compliance/vulnerability exposure.

- Access Pre-Validated Capacity: Deploy SourcifyChina’s Pro List to bypass discovery bottlenecks.

- Lock 2026 Pricing: Verified suppliers offer priority capacity allocation for Q1–Q2 2026 bookings.

Call to Action: Activate Your Priority Assessment Within 24 Hours

Time lost vetting unreliable suppliers is market share surrendered to competitors. In 2026’s high-stakes sourcing environment, the Verified Pro List isn’t a tool – it’s your insurance policy against disruption.

✅ Request Your Customized Pro List Match

Contact our Sourcing Engineering Team for a zero-obligation 2026 Capacity Assessment:

– Email: [email protected]

Subject line: “2026 Pro List Assessment – [Your Company]”

– WhatsApp Priority Line: +86 159 5127 6160

Include: Target product category + annual volume (e.g., “Injection molding, 500K units/yr”)

Within 24 hours, you’ll receive:

– A shortlisted Pro List of 3–5 pre-qualified suppliers matching your 2026 specs

– Risk-mitigated pricing benchmarks (Q1–Q2 2026)

– Compliance gap analysis against EU CBAM/US UFLPA 2026 rules

SourcifyChina: Precision Sourcing for the 2026 Supply Chain Reality

We don’t find suppliers. We deliver verified production capacity.

© 2026 SourcifyChina | ISO 9001:2025 Certified Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.