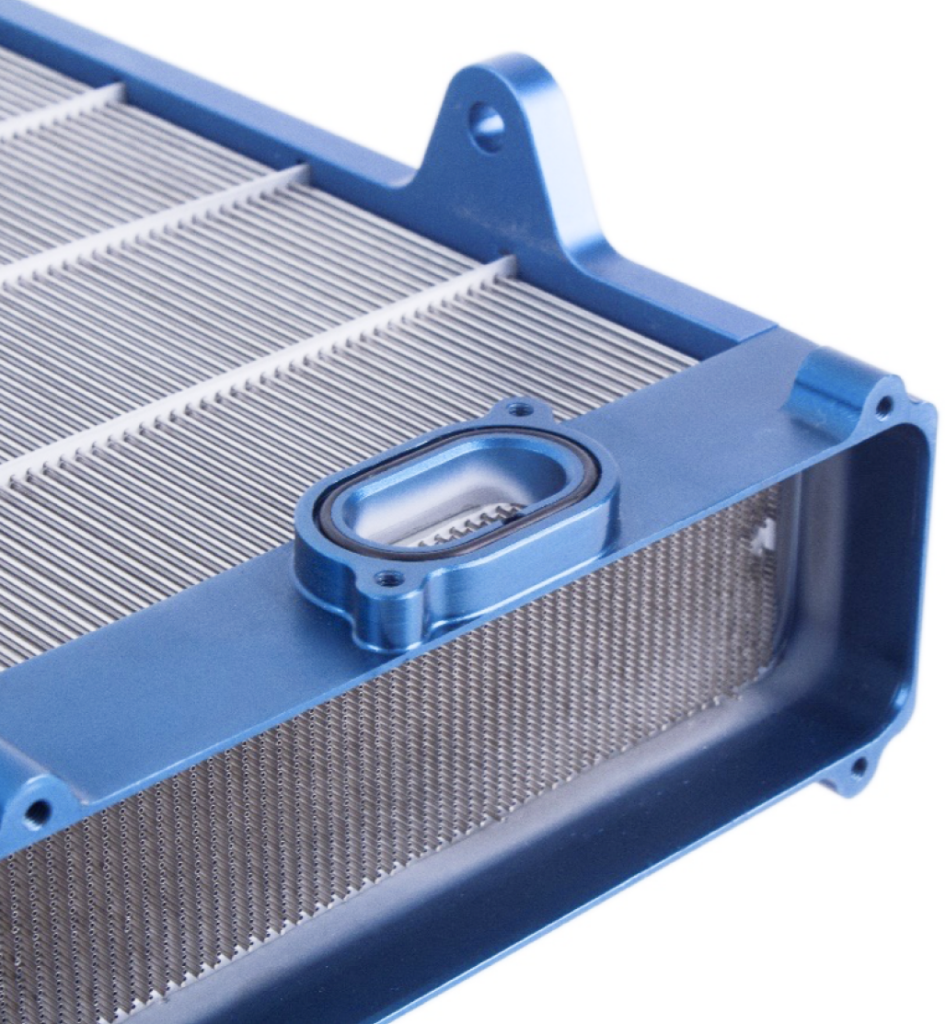

The global compact heat exchangers market is experiencing robust growth, driven by increasing demand for energy-efficient thermal solutions across industries such as automotive, aerospace, HVAC, and power generation. According to a report by Mordor Intelligence, the market was valued at USD 4.8 billion in 2023 and is projected to reach USD 6.5 billion by 2028, growing at a CAGR of approximately 6.2% during the forecast period. This expansion is fueled by rising industrial automation, stricter energy regulations, and the need for space-saving heat transfer solutions in compact systems. Grand View Research also highlights a similar trajectory, citing advancements in materials and manufacturing techniques that enhance thermal efficiency and durability. As industries prioritize sustainability and operational efficiency, the role of compact heat exchangers becomes increasingly critical—making the leading manufacturers in this space key enablers of next-generation thermal management. Here are the top 10 compact heat exchangers manufacturers shaping the future of this evolving market.

Top 10 Compact Heat Exchangers Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Heat Exchangers for Industrial & Mobile Applications

Domain Est. 1997

Website: thermaltransfer.com

Key Highlights: Leading US-based manufacturer of heat exchangers for industrial and mobile applications. Custom, pre-engineered and off-the-shelf solutions with fast lead ……

#2 Emmegi Heat Exchangers

Domain Est. 2009

Website: emmegiinc.com

Key Highlights: Emmegi is a worldwide manufacturer of oil coolers and heat exchangers for industrial applications. View our wide range of heat exchangers and accessories….

#3 Global Manufacturer of Heat Exchangers

Domain Est. 1998

Website: heatex.com

Key Highlights: Heatex specializes in plate and rotary heat exchangers used in ventilation and thermal management applications worldwide….

#4 Compact Heat Exchanger for High Temperature High Pressure …

Domain Est. 1999

Website: arpa-e.energy.gov

Key Highlights: CompRex aims to transform heat exchange technology for high temperature (>800°C or 1472°F) and high pressure (80 bar or 1160 psi) applications through the ……

#5 Kelvion

Domain Est. 2005

Website: kelvion.com

Key Highlights: Kelvion, your manufacturer for heat exchangers & cooling & heating solutions: plate heat exchangers, cooling heat exchangers & more!…

#6 Heat Exchanger Repair & Fabrication

Domain Est. 2012

Website: altexinc.com

Key Highlights: Altex Industries designs and manufactures high-performance industrial heat exchangers for energy, chemical, and process industries with superior efficiency ……

#7 FUNKE

Website: funke.de

Key Highlights: FUNKE Wärmeaustauscher Apparatebau GmbH is a leading specialist in the development and production of heat exchangers for industrial use. Find out more now!…

#8 Our types of compact heat exchangers, heat transfer products

Domain Est. 1997

Website: barriquand.com

Key Highlights: Barriquand heat exchangers portfolio suits all your thermal requirements for heating, cooling, condensation, evaporation or energy saving….

#9 Heat Exchanger

Domain Est. 2006

Website: us.mersen.com

Key Highlights: Mersen is the global leader in designing and manufacturing graphite shell and tube heat exchangers, offering exceptional corrosion resistance, high thermal ……

#10 Mezzo Technologies

Domain Est. 2011

Website: mezzotechnologies.com

Key Highlights: SPACE. Mezzo provides light weight, compact heat exchangers for propulsion applications and cryogenic heat exchangers for long term space habitation….

Expert Sourcing Insights for Compact Heat Exchangers

H2: 2026 Market Trends for Compact Heat Exchangers

The global compact heat exchanger (CHE) market is poised for significant evolution by 2026, driven by powerful cross-industry demands for efficiency, sustainability, and space optimization. Key trends shaping this landscape include:

1. Accelerated Adoption in Energy Transition & Sustainability:

The push for decarbonization is a primary driver. Compact heat exchangers are critical in emerging clean energy technologies:

* Hydrogen Economy: CHEs are essential for hydrogen liquefaction (LH2), purification, fuel cell thermal management, and high-pressure gas processing due to their efficiency and compactness.

* Carbon Capture, Utilization, and Storage (CCUS): High-efficiency CHEs are vital in amine regeneration, CO2 compression, and refrigeration cycles within CCUS facilities, where space and thermal performance are paramount.

* Geothermal & Waste Heat Recovery (WHR): The need to maximize energy extraction from low-grade heat sources favors CHEs’ superior surface area-to-volume ratio, boosting efficiency in Organic Rankine Cycles (ORCs) and industrial WHR systems.

* Nuclear (SMRs/Advanced Reactors): The rise of Small Modular Reactors (SMRs) and advanced designs prioritizes compact, reliable, and high-performance components. Printed Circuit Heat Exchangers (PCHEs) are particularly favored for their ability to handle high pressures/temperatures and corrosive coolants (e.g., supercritical CO2, molten salts) efficiently in tight spaces.

2. Dominance of Advanced Manufacturing & Material Innovation:

Manufacturing techniques are enabling next-generation performance:

* Additive Manufacturing (3D Printing): Gaining traction for complex, biomimetic, or highly optimized geometries (e.g., lattices, conformal channels) impossible with traditional methods. This allows for ultra-compact, application-specific designs with enhanced performance.

* Improved Brazing & Joining Technologies: Critical for maintaining integrity in demanding environments (high temp/pressure, thermal cycling). Advancements in vacuum brazing and diffusion bonding ensure reliability, especially for PCHEs and plate-fin exchangers.

* Advanced Materials: Increased use of high-performance alloys (Inconel, Hastelloy, titanium) and coatings to combat corrosion in aggressive environments (e.g., chemical processing, offshore, hydrogen service). Research into composites and functionally graded materials continues.

3. Demand Surge in Transportation & Mobility:

Efficiency and electrification are reshaping transportation needs:

* Electric Vehicles (EVs): CHEs are crucial for battery thermal management systems (BTMS), power electronics cooling, and cabin HVAC, where minimizing size, weight, and parasitic power loss is critical for range. Plate and microchannel heat exchangers dominate.

* Aerospace & Aviation: Continued focus on fuel efficiency drives adoption in aircraft environmental control systems (ECS), engine oil cooling, and emerging electric/hybrid-electric propulsion thermal management. Weight reduction via CHEs is a key benefit.

* Marine: Adoption grows in LNG carriers (BOG reliquefaction), hybrid propulsion systems, and onboard power generation, benefiting from CHEs’ footprint reduction in space-constrained vessels.

4. Growth in Industrial Efficiency & Process Intensification:

Industries seek operational excellence:

* Oil & Gas (Upstream/Midstream): Use in subsea processing, LNG liquefaction (especially modular trains), and gas processing units where compactness and reliability are essential. Resistance to fouling and corrosion remains critical.

* Chemicals & Petrochemicals: Adoption in process intensification, modular plants (skid-mounted), and heat integration networks to improve efficiency and reduce capital/operating costs. Focus on handling viscous or fouling fluids.

* HVAC&R: Growing use of microchannel heat exchangers in high-efficiency chillers, data center cooling, and refrigeration systems due to higher heat transfer coefficients and reduced refrigerant charge.

5. Key Challenges & Competitive Landscape:

Cost: Advanced CHEs (PCHEs, 3D printed) often have high upfront costs, though lifecycle cost (efficiency, footprint) drives adoption. Cost reduction through scale and manufacturing innovation is key.

* Fouling & Maintenance: Susceptibility to fouling in certain fluids remains a challenge, requiring design optimization (e.g., wider passages, CFD analysis) and sometimes increased maintenance access considerations.

* Standardization & Design Complexity: Lack of universal standards and the need for sophisticated CFD/FEA modeling for optimization create barriers, favoring established players with deep engineering expertise.

* Competition:* Intense competition from established players (Alfa Laval, Danfoss, Kelvion, Chart Industries, API Heat Transfer, SWEP) and regional manufacturers. Differentiation occurs through technology (PCHE, 3D printing), materials, application-specific design, and service.

Conclusion:

By 2026, the compact heat exchanger market will be characterized by technology-driven growth fueled by the energy transition, electrification, and relentless pursuit of efficiency. Success will depend on leveraging advanced manufacturing (especially AM and improved joining), developing robust materials for harsh environments, and providing application-specific, high-performance solutions that deliver tangible lifecycle value despite potential higher initial costs. The market will remain dynamic, with innovation focused on pushing the boundaries of compactness, efficiency, and reliability across critical sectors like clean energy, transportation, and advanced manufacturing.

Common Pitfalls Sourcing Compact Heat Exchangers: Quality and Intellectual Property (IP) Concerns

Sourcing Compact Heat Exchangers (CHEs) offers significant advantages in terms of efficiency and space savings, but it also introduces specific challenges related to quality assurance and intellectual property protection. Overlooking these aspects can lead to performance failures, project delays, and legal risks. Below are key pitfalls to avoid:

Quality-Related Pitfalls

1. Inadequate Supplier Qualification and Track Record

A common mistake is selecting suppliers based solely on cost or delivery timelines without rigorously evaluating their technical capabilities, manufacturing experience, and quality management systems. CHEs often involve complex geometries and high-precision manufacturing (e.g., brazing, diffusion bonding). Sourcing from unproven or low-tier suppliers increases the risk of defects such as micro-leaks, poor thermal performance, or premature failure under operational stress.

Best Practice: Conduct thorough due diligence, including audits of the supplier’s ISO certifications (e.g., ISO 9001, ASME), review of past project references, and verification of in-house testing capabilities (e.g., pressure testing, non-destructive testing).

2. Insufficient Material and Process Verification

CHEs are frequently used in demanding environments (high temperature, pressure, corrosive media). Using substandard materials or inconsistent manufacturing processes can compromise integrity. Some suppliers may substitute materials without approval or fail to maintain traceability.

Best Practice: Require material test reports (MTRs), enforce strict adherence to specified alloys (e.g., stainless steel, titanium, aluminum), and mandate process control documentation such as brazing cycle records or weld procedures.

3. Lack of Performance Validation and Testing Protocols

Assuming that design specifications equate to real-world performance is risky. Without clear contractual requirements for performance testing—such as thermal efficiency, pressure drop verification, or endurance testing—there is no objective measure of quality.

Best Practice: Define acceptance criteria in the procurement contract and require third-party witnessed testing when applicable. Include performance guarantees backed by penalties or warranties.

Intellectual Property (IP) Pitfalls

1. Unclear Ownership of Design IP

Many CHE designs are proprietary, involving custom geometries, fin types, or flow configurations. If contracts do not explicitly assign IP ownership, disputes can arise—especially if the supplier develops the design or uses prior knowledge.

Best Practice: Clearly define in the supply agreement whether the design is customer-owned, supplier-owned, or jointly developed. Use work-for-hire clauses where appropriate to ensure the buyer retains IP rights.

2. Risk of Reverse Engineering and Unauthorized Replication

CHEs, particularly plate-fin or printed circuit types, can be reverse-engineered if not adequately protected. Sourcing from suppliers in regions with weak IP enforcement increases the risk of unauthorized duplication or resale to competitors.

Best Practice: Implement robust confidentiality agreements (NDAs), limit design data sharing to what is strictly necessary, and consider filing design patents or utility models where feasible. Monitor supplier locations and subcontractor chains.

3. Inadequate Protection of Manufacturing Know-How

Beyond design, the manufacturing process (e.g., brazing parameters, cleaning procedures) often constitutes valuable trade secrets. Disclosing sensitive process details without safeguards can expose proprietary methods.

Best Practice: Separate design deliverables from process-sensitive information. Use tiered data access and ensure suppliers sign comprehensive IP and confidentiality clauses covering both design and process IP.

By proactively addressing these quality and IP pitfalls during the sourcing process, organizations can ensure reliable performance, protect innovation, and mitigate legal and operational risks associated with Compact Heat Exchangers.

Logistics & Compliance Guide for Compact Heat Exchangers

Compact Heat Exchangers (CHEs) are high-efficiency thermal devices widely used in industries such as oil & gas, power generation, HVAC, marine, and chemical processing. Their compact design and performance make them ideal for space-constrained applications. However, their international use requires strict adherence to logistics and compliance standards. This guide outlines key considerations for the safe, legal, and efficient transportation and deployment of CHEs.

Regulatory Compliance

Compliance with international, regional, and local regulations is critical for the legal operation and transport of Compact Heat Exchangers. Non-compliance can result in shipment delays, fines, or safety hazards.

Pressure Equipment Directive (PED) – EU

In the European Union, CHEs operating above specific pressure thresholds must comply with the Pressure Equipment Directive (2014/68/EU). This includes proper CE marking, technical file documentation, notified body involvement (if required), and adherence to harmonized standards such as EN 13445 or EN 13480 for pressure vessels and piping.

ASME Boiler and Pressure Vessel Code – USA & Global

In the United States and many other countries, compliance with the ASME Boiler and Pressure Vessel Code (particularly Section VIII for pressure vessels) is mandatory. CHEs must be stamped with the appropriate ASME “U” or “U2” stamp and certified by an authorized inspector. Documentation must include material certifications, design calculations, and test reports.

PED vs. ASME Equivalency

For international trade, it’s essential to verify if PED and ASME certifications are recognized in the destination country. Some regions accept one or both; others may require additional national approvals (e.g., GOST-R in Russia, CRN in Canada).

Environmental & Chemical Regulations

CHEs used in chemical or petrochemical applications may be subject to REACH (EU), TSCA (US), or other chemical safety regulations, particularly if they contain hazardous materials or involve process fluids regulated under these laws.

Material & Design Certification

The materials used in CHE manufacturing must meet specified standards to ensure durability and safety under operating conditions.

Material Traceability

Full material traceability (Mill Test Certificates – MTCs) is required for all pressure-retaining components. This includes stainless steels, titanium, nickel alloys, and exotic materials commonly used in CHEs.

Welding Standards

Welding must comply with recognized codes such as ASME Section IX or ISO 15614. Welders must be certified, and procedures qualified. Records of weld inspections (RT, PT, UT) must be maintained.

Design & Performance Validation

Designs must be validated through thermal, mechanical, and structural analysis. Simulation reports, FEA (Finite Element Analysis), and performance test data should be included in the technical dossier.

Packaging & Handling

Due to their precision construction and sensitivity to damage, CHEs require specialized packaging and handling procedures.

Protective Packaging

– Use wooden crates or custom-designed skids with corner protectors.

– Seal internal passages with end caps or plastic plugs to prevent contamination.

– Apply anti-corrosion inhibitors (VCI paper or vapor rust protection) for long-term storage or sea transport.

– Label packages with “Fragile,” “This Side Up,” and “Do Not Stack” indicators.

Lifting & Rigging

– Use only designated lifting lugs or spreader bars; never lift by tubes or nozzles.

– Follow manufacturer’s weight and center-of-gravity specifications.

– Use soft slings to avoid surface damage.

On-Site Handling

– Use forklifts or cranes with adequate capacity and precision control.

– Avoid dragging or rolling the unit.

– Store in a dry, covered area off the ground on wooden blocks.

Transportation Requirements

Proper transport planning ensures CHEs arrive undamaged and on schedule.

Mode of Transport

– Road: Use flatbed or lowboy trailers for oversized units; secure with chains and dunnage.

– Sea: Containerized (20’ or 40’ HC) or breakbulk depending on size. Consider saltwater exposure; use moisture barriers.

– Air: Rare due to weight and size, but possible for critical spares using cargo aircraft.

Customs Documentation

Prepare complete export documentation, including:

– Commercial invoice

– Packing list

– Certificate of Origin

– Compliance certificates (ASME, PED, etc.)

– Dangerous Goods Declaration (if applicable, e.g., residual test fluids)

HS Codes

Use correct Harmonized System codes for customs classification. Example:

– 8419.89 – Other heat exchangers (varies by region and design)

Import & Export Controls

Certain CHEs may be subject to export controls due to dual-use potential (e.g., in military, nuclear, or high-pressure applications).

EAR & ITAR – USA

Check if the CHE or its technology falls under the Export Administration Regulations (EAR) or International Traffic in Arms Regulations (ITAR). Items with high-pressure ratings or special materials (e.g., titanium) may require export licenses.

Wassenaar Arrangement

Many countries follow this multilateral export control regime. Verify if the CHE design or performance exceeds thresholds for heat exchangers listed in the control list (e.g., surface area density, operating pressure).

Destination Restrictions

Be aware of sanctions or embargoes on certain countries. Conduct end-user screening to prevent unauthorized transfers.

Installation & Commissioning Compliance

Final compliance is ensured during installation and startup.

Inspection & Testing

– Perform hydrostatic or pneumatic pressure tests per ASME or PED requirements.

– Conduct leak tests on all joints and connections.

– Verify alignment with piping to prevent stress on nozzles.

Regulatory Inspections

In some jurisdictions, a local inspector must witness testing and approve startup (e.g., NBIC inspector in the US, TÜV in Germany).

Operator Training & Documentation

Provide operation and maintenance manuals, P&IDs, and safety data. Train operators on emergency procedures and compliance responsibilities.

Maintenance & Lifecycle Compliance

Ongoing compliance includes periodic inspections and record-keeping.

Inspection Intervals

Follow ASME NB-23 or local regulations for in-service inspection schedules. Document all maintenance, repairs, and modifications.

Modifications & Repairs

Any repairs involving pressure parts must comply with original design codes. Use qualified personnel and re-certify if required.

Conclusion

Successfully managing the logistics and compliance of Compact Heat Exchangers requires proactive planning across regulatory, material, packaging, transport, and operational domains. By adhering to international standards and maintaining thorough documentation, companies can ensure the safe, legal, and efficient deployment of CHEs worldwide. Always consult with legal, technical, and logistics experts when entering new markets or handling high-risk shipments.

Conclusion: Sourcing Compact Heat Exchangers

In conclusion, sourcing compact heat exchangers requires a strategic approach that balances performance, space constraints, cost, and long-term reliability. Their high thermal efficiency, small footprint, and suitability for applications with limited space make them ideal for industries such as aerospace, automotive, HVAC, refrigeration, and energy systems. When selecting a supplier, it is essential to evaluate factors including material compatibility, manufacturing quality, design customization capabilities, and adherence to industry standards.

Partnering with reputable manufacturers who offer proven engineering support, robust testing procedures, and responsive service ensures optimal integration and operational performance. While the initial investment may be higher compared to conventional heat exchangers, the long-term benefits—such as improved energy efficiency, reduced maintenance, and lower operational costs—typically justify the expense. Ultimately, sourcing the right compact heat exchanger involves a comprehensive assessment of technical requirements and supplier expertise to achieve reliable, efficient, and sustainable thermal management solutions.