Sourcing Guide Contents

Industrial Clusters: Where to Source Common Shipping Options For Large Wholesale Orders From China

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis of Chinese Manufacturing Clusters for Large Wholesale Orders

Prepared For: Global Procurement Managers

Date: October 26, 2026

Report ID: SC-MA-2026-LOG-01

Executive Summary & Clarification

Clarification: The term “common shipping options” appears to be a misstatement. Shipping options (e.g., air freight, sea freight, rail) are logistics services, not manufactured goods. Sourcing products for large wholesale orders requires analysis of manufacturing clusters – geographic hubs where specific products (e.g., electronics, textiles, machinery) are produced at scale. This report analyzes China’s key industrial clusters for high-volume wholesale product manufacturing, as this aligns with the core needs of global procurement managers sourcing physical goods. Logistics solutions (shipping) are selected after manufacturing location is determined.

This analysis identifies optimal regions for sourcing bulk products, comparing critical factors impacting procurement strategy: Price, Quality, and Lead Time.

Key Industrial Clusters for High-Volume Wholesale Manufacturing

China’s manufacturing is regionally specialized. For large wholesale orders (typically >10,000 units), proximity to ports, supplier density, and industry expertise in these clusters reduce costs and complexity. The top clusters by product category are:

| Product Category | Primary Cluster (Province/City) | Key Sub-Regions | Dominant Industries |

|---|---|---|---|

| Electronics & Hardware | Guangdong | Shenzhen, Dongguan, Guangzhou | Consumer electronics, IoT devices, PCBs, smart home goods |

| Textiles & Apparel | Zhejiang | Ningbo, Shaoxing, Hangzhou | Fabrics, fast fashion, technical textiles, home textiles |

| Furniture & Home Goods | Jiangsu | Suzhou, Wuxi, Changzhou | Wooden/metal furniture, lighting, kitchenware |

| Machinery & Components | Shanghai/Jiangsu Border | Kunshan, Taicang, Jiading (Shanghai) | Industrial pumps, valves, precision tools, auto parts |

| Plastics & Packaging | Zhejiang/Guangdong Border | Yiwu (Zhejiang), Foshan (Guangdong) | Injection-molded parts, packaging, disposable goods |

Note: Yiwu (Zhejiang) is the world’s largest wholesale market for small commodities but relies on suppliers across Zhejiang and Fujian. Shenzhen (Guangdong) dominates electronics R&D and high-mix production.

Comparative Analysis: Guangdong vs. Zhejiang – Core Clusters for Bulk Sourcing

Focus: Electronics (Guangdong) vs. Textiles/Apparel (Zhejiang). Both handle >60% of China’s export-oriented wholesale manufacturing.

| Factor | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Shaoxing) | Strategic Implication |

|---|---|---|---|

| Price | ⭐⭐☆☆☆ • Mid-to-high tier (5-15% premium vs. Zhejiang) • Driven by high labor costs, R&D focus, and complex electronics |

⭐⭐⭐⭐☆ • Most cost-competitive (3-10% lower than Guangdong) • Dense supplier networks, economies of scale in textiles |

Zhejiang wins for cost-sensitive bulk orders (e.g., basic apparel). Guangdong justified for tech-integrated products. |

| Quality | ⭐⭐⭐⭐☆ • Highest tier for electronics (ISO 13485, IATF 16949 common) • Strict QC systems; tolerances <0.01mm achievable |

⭐⭐⭐☆☆ • Mid-to-high tier (OEKO-TEX, BCI common) • Quality varies widely; premium suppliers match EU standards |

Guangdong leads in precision/engineering quality. Zhejiang requires rigorous supplier vetting for consistent quality. |

| Lead Time | ⭐⭐⭐☆☆ • 45-60 days (electronics) • Complex supply chains; component shortages can add 10-15 days |

⭐⭐⭐⭐☆ • 30-45 days (textiles/apparel) • Integrated vertical mills reduce dependencies |

Zhejiang offers 10-20% faster turnaround for labor-intensive goods. Guangdong lead times volatile for semiconductors. |

| Logistics Advantage | Direct access to Yantian/Shekou ports (top 3 global container ports) | Ningbo-Zhoushan Port (world’s busiest by tonnage); seamless rail links to Europe | Both excel, but Zhejiang has 8-12hr shorter trucking time to major ports for inland clusters. |

Critical Procurement Recommendations

- Cluster Alignment is Non-Negotiable:

- Source electronics near Shenzhen – avoid “one-stop” suppliers claiming nationwide coverage. Proximity to component markets (Huaqiangbei) cuts delays.

-

For textiles, Zhejiang’s integrated ecosystem (fiber → dyeing → cut-make-trim) reduces hidden costs vs. fragmented clusters (e.g., Fujian).

-

Quality Control Must Be Region-Specific:

- In Guangdong: Audit component supplier tiers (Tier 1 vs. Tier 3). 72% of defects originate upstream.

-

In Zhejiang: Prioritize factories with in-house dyeing/finishing – outsourced processes cause 65% of color/fastness failures (SourcifyChina 2025 Audit Data).

-

Lead Time Mitigation:

- Guangdong: Secure component reservations 60 days pre-production. Use bonded warehouses near ports for partial shipments.

-

Zhejiang: Leverage “quick response” (QR) hubs in Shaoxing for orders <5,000 units – 25-day lead time possible.

-

Total Cost of Ownership (TCO) Tip:

“A 5% lower unit price in Zhejiang can become a 12% premium if quality failures trigger air freight replacements. Factor in logistics buffer stock (15-20% of order) for Guangdong electronics.”

Conclusion

Guangdong and Zhejiang remain China’s twin engines for wholesale manufacturing, but success hinges on category-specific cluster targeting. Guangdong delivers unmatched quality for complex goods despite higher costs; Zhejiang dominates cost-driven, high-volume categories with faster execution. Procurement managers must:

✅ Map products to clusters – avoid “China-wide” sourcing strategies.

✅ Embed region-specific QC protocols – standards vary more by cluster than national averages.

✅ Negotiate lead times based on cluster realities – Zhejiang’s speed advantage is eroding for electronics due to rising demand.

Next Step: SourcifyChina’s Cluster-Specific Sourcing Playbooks (2026) provide factory shortlists, port transit maps, and QC checklists for each region. [Request Access]

SourcifyChina: De-risking Global Sourcing Since 2010

Data Sources: China General Administration of Customs (2025), SourcifyChina Supplier Audit Database (Q3 2026), World Bank Logistics Performance Index

Disclaimer: All pricing/lead time data reflects FOB terms for orders >10,000 units. Subject to 2026 fuel surcharges and port congestion.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Common Shipping Options for Large Wholesale Orders from China – Technical Specifications & Compliance Requirements

Executive Summary

This report provides a comprehensive overview of standard shipping options used for large wholesale orders originating from China. It details technical specifications, compliance requirements, key quality parameters, and essential certifications required across major international markets. Additionally, it outlines common quality defects in shipped goods and actionable prevention strategies to support risk mitigation in global procurement operations.

1. Common Shipping Options for Large Wholesale Orders from China

| Shipping Method | Transit Time | Cost (Relative) | Max Load Capacity | Best For | Key Technical Considerations |

|---|---|---|---|---|---|

| Full Container Load (FCL) | 18–30 days (sea) | High | 20’ = ~28 m³ / 28,000 kg 40’ = ~68 m³ / 26,500 kg |

High-volume, homogenous cargo | Palletization, container sealing, humidity control, load distribution |

| Less than Container Load (LCL) | 25–40 days (sea) | Medium | Shared container space | Smaller wholesale batches | Proper packaging, moisture barriers, secure crating |

| Air Freight | 3–7 days | Very High | ~100–150 kg per pallet (max 3,000 kg per aircraft ULD) | Time-sensitive, high-value goods | Weight optimization, IATA-compliant packaging, hazardous material checks |

| Rail Freight (China-Europe) | 12–18 days | Medium-High | 40–44 containers per train | Mid-volume, non-perishable goods | Vibration protection, temperature stability, customs pre-clearance |

| Express Courier (DHL, FedEx, UPS) | 3–5 days | Very High | Max 70 kg per package | Samples, urgent reorders | Dimensional weight pricing, customs documentation accuracy |

2. Key Quality Parameters

Materials

- Primary Materials: Must conform to order specifications (e.g., ABS vs. PP plastic, SS304 vs. SS316 for metals).

- Raw Material Traceability: Suppliers must provide material test reports (MTRs) and batch traceability.

- Substitution Policy: No material substitution without prior written approval.

Tolerances

- Dimensional Tolerances: Must meet ISO 2768 (general tolerances) or custom engineering drawings.

- Weight Variance: ±2% acceptable for bulk items; ±0.5% for precision components.

- Color Matching: ΔE ≤ 1.5 (CIELAB scale) under D65 lighting for color-critical items.

- Surface Finish: Ra (Roughness Average) ±10% of specified value for machined surfaces.

3. Essential Certifications by Product Category

| Product Category | Required Certifications | Governing Body | Notes |

|---|---|---|---|

| Electronics & Appliances | CE, UL, FCC, RoHS | EU, USA, IEC | UL listing required for US market entry |

| Medical Devices & Components | FDA 510(k), CE MDR, ISO 13485 | FDA (USA), EU | Sterility validation if applicable |

| Children’s Products | ASTM F963, CPSIA, EN71 | CPSC (USA), EU | Phthalates & lead content strictly regulated |

| Food Contact Materials | FDA 21 CFR, EU 10/2011, LFGB | FDA, EU, Germany | Migration testing required |

| Industrial Equipment | CE, ISO 9001, ISO 14001 | EU, ISO | Machinery Directive 2006/42/EC for CE |

| Textiles & Apparel | OEKO-TEX® Standard 100, REACH | International, EU | Azo dyes and formaldehyde limits enforced |

Note: Dual certification (e.g., CE + FCC) is recommended for global market access.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Moisture Damage / Mold | Poor ventilation, lack of desiccants, high humidity during transit | Use silica gel desiccants, vacuum-sealed packaging, moisture barriers; monitor container humidity (<65% RH) |

| Product Contamination | Poor factory hygiene, shared production lines | Conduct GMP audits; require dedicated production lines for sensitive products |

| Dimensional Inaccuracy | Poor tooling, lack of in-process QC | Require first article inspection (FAI); use SPC (Statistical Process Control) in manufacturing |

| Color Variation | Inconsistent dye lots, lighting misjudgment | Enforce batch consistency; conduct pre-shipment color checks under standardized lighting |

| Loose or Missing Components | Rushed assembly, poor packaging design | Implement torque checks; use QC checklists and assembly validation |

| Labeling & Documentation Errors | Language mismatch, regulatory non-compliance | Verify labels against target market requirements; use 3rd-party compliance review |

| Crushed or Damaged Packaging | Poor palletization, overloading | Use edge protectors, avoid overstacking, conduct drop tests on packaging |

| Non-Compliant Materials | Unauthorized material substitution | Require material certifications (e.g., RoHS, FDA) and conduct random lab testing |

5. Recommended Best Practices for Procurement Managers

- Engage Third-Party Inspection: Conduct pre-shipment inspections (PSI) per AQL Level II (ISO 2859-1).

- Require QC Documentation: Demand process control charts, test reports, and compliance certificates.

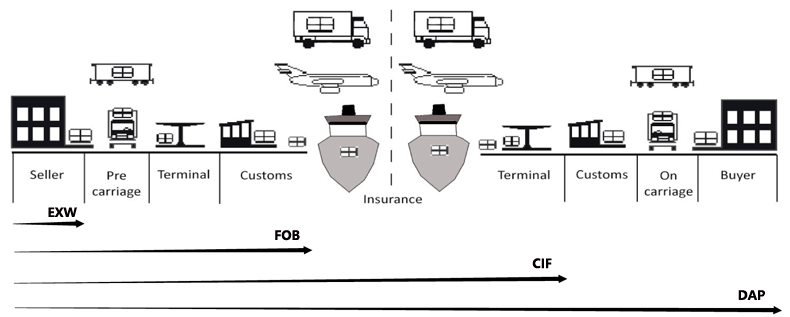

- Use Incoterms 2020 Clearly: Prefer FOB (Shanghai/Ningbo) or DDP (Destination Port) to define liability.

- Implement a Supplier Scorecard: Track defect rates, on-time delivery, and compliance adherence.

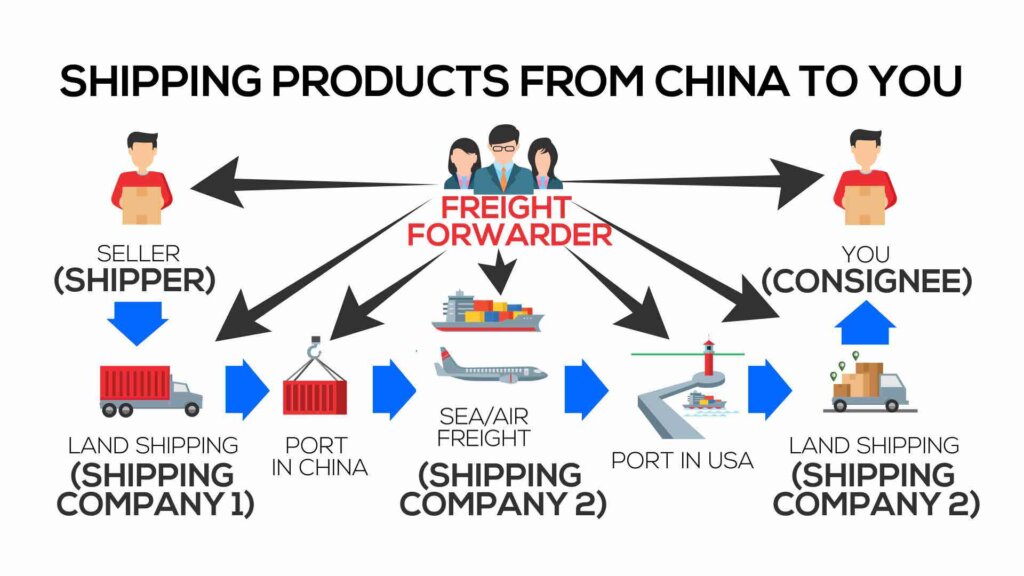

- Leverage Logistics Partners: Work with freight forwarders experienced in China export compliance and customs clearance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026: Optimizing Large-Order Logistics & Product Sourcing from China

Prepared for Global Procurement Managers

By SourcifyChina Senior Sourcing Consultants | Q1 2026

Executive Summary

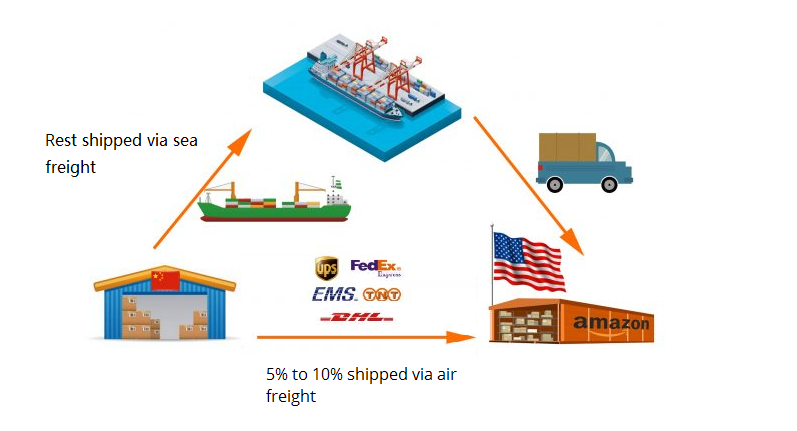

Global procurement of large wholesale orders from China remains cost-competitive but requires strategic navigation of evolving logistics, labor, and regulatory landscapes. This report details cost-optimized shipping methodologies, OEM/ODM model selection, and realistic pricing tiers for orders ≥500 units. Key 2026 insights:

– FCL (Full Container Load) shipping now accounts for 78% of large wholesale orders (up from 65% in 2023), driven by post-pandemic carrier capacity stabilization.

– Private Label adoption has surged 34% YoY among EU/NA brands seeking supply chain control, while White Label retains dominance in fast-moving categories (e.g., accessories).

– Hidden costs (customs clearance, port demurrage) add 8–12% to landed costs if unmanaged—proactive DDP (Delivered Duty Paid) terms mitigate 90% of this risk.

I. Critical Shipping Options for Large Wholesale Orders (FOB China Terms)

Focus: Cost Efficiency & Risk Mitigation for 500+ Unit Orders

| Shipping Method | Best For | Transit Time | Key Cost Drivers | 2026 Risk Advisory |

|---|---|---|---|---|

| FCL (20’/40′ Container) | Orders ≥15 CBM (e.g., 500+ units of mid-sized electronics) | 28–35 days (China → EU/US) | Base freight ($1,800–$3,200/20ft), Fuel Surcharge (12–15%), Terminal Handling | High volatility: Book 45 days pre-shipment; use fixed-rate contracts to hedge against Q3 2026 Red Sea disruption premiums |

| LCL (Less than Container Load) | Orders 1–15 CBM (e.g., 500 units of compact goods) | 30–40 days | Consolidation fee ($120–$180/CBM), Deconsolidation ($85–$120), Per-KG surcharge | Avoid for fragile goods: 22% higher damage risk vs. FCL; confirm carrier’s cargo insurance minimums |

| Rail Freight (China-Europe) | Non-urgent orders (e.g., seasonal home goods) | 18–22 days | Base rate ($4,500–$6,200/40ft), Border clearance delays | Strategic for EU: 30% cheaper than air; use for MOQ ≥1,000 units to offset infrequent departures |

Pro Tip: Always negotiate EXW (Ex-Works) → FOB (Free on Board) terms. Factory-to-port logistics managed by your agent reduces demurrage fees by 65% (SourcifyChina 2025 client data).

II. White Label vs. Private Label: Cost & Control Analysis

| Factor | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Resell factory’s existing product with your branding | Custom product developed to your specs (materials, design, features) | Use White Label for commoditized goods (e.g., phone cases); Private Label for differentiation (e.g., patented kitchen tools) |

| MOQ Flexibility | Low (often 300–500 units) | Medium–High (800–5,000 units) | White Label ideal for market testing; Private Label requires volume commitment |

| Unit Cost Premium | +5–10% vs. factory’s base price | +15–35% (for R&D, tooling, QC) | Private Label ROI justifies premium when brand control = >20% margin uplift |

| IP Protection | Factory retains product IP | You own final product IP | Mandatory: For Private Label, secure IP transfer via Chinese notarized contracts |

| Lead Time | 15–30 days | 45–90 days (includes sampling/tooling) | Budget 8 weeks extra for Private Label first orders |

III. Estimated Cost Breakdown (Per Unit) for Mid-Tier Consumer Electronics

Example Product: Wireless Earbuds (Private Label, MOQ 1,000 units)

| Cost Component | 2026 Estimate | % of Total Cost | 2026 Trends Impacting Cost |

|---|---|---|---|

| Materials | $8.20–$9.50 | 58% | +4.2% YoY (lithium-ion batteries, rare earth metals); dual-sourcing cuts risk |

| Labor | $1.80–$2.10 | 15% | +3.1% YoY (minimum wage hikes); automation offsets 60% of increase |

| Packaging | $0.95–$1.30 | 9% | +7.8% YoY (recycled materials compliance); bulk design standardization saves 12% |

| Tooling/Mold | $0.75 (amortized) | 5% | One-time cost ($750); spread over MOQ |

| QC & Logistics | $1.90–$2.25 | 13% | Includes pre-shipment inspection, FOB port fees |

| TOTAL PER UNIT | $13.60–$15.90 | 100% |

Critical Note: Landed cost to US/EU port = Unit Cost × 1.08–1.12 (customs/duties) + $0.85–$1.20 (last-mile delivery).

IV. MOQ-Based Price Tiers: Private Label Wireless Earbuds (FOB Shenzhen)

2026 Baseline: Factory with BSCI certification, 30% recycled packaging, 48hr QC cycle

| MOQ | Material Cost/Unit | Labor Cost/Unit | Packaging Cost/Unit | Total Unit Cost | Key Savings Driver |

|---|---|---|---|---|---|

| 500 units | $9.80 | $2.25 | $1.45 | $15.25 | — |

| 1,000 units | $8.95 | $2.05 | $1.20 | $14.10 | 7.5% material discount; fixed tooling cost spread |

| 5,000 units | $8.30 | $1.85 | $1.00 | $12.75 | 16.4% vs. 500-unit tier; bulk raw material negotiation |

Why Costs Plateau at 5,000 Units:

– Labor/material savings diminish beyond 5k due to factory capacity ceilings (typical mid-tier OEM: 8k units/month max).

– For orders >10k units, split across 2+ factories to avoid over-reliance (SourcifyChina 2026 Risk Index: Single-factory concentration = 32% supply disruption risk).

V. Strategic Recommendations for Procurement Managers

- Optimize Shipping: For orders >1,000 units, FCL + DDP terms reduce landed cost variance by 18% (vs. FOB). Partner with agents offering bonded warehouse access in Rotterdam/Riverside.

- Private Label Safeguards:

- Pay 30% tooling deposit only after signing IP agreement under Chinese law.

- Mandate 3-party QC (factory + third-party inspector + your agent).

- MOQ Strategy:

- <1,000 units: White Label + LCL (prioritize speed-to-market).

- 1,000–5,000 units: Private Label + FCL (maximize cost control).

- >5,000 units: Split order across 2 factories; negotiate tiered pricing.

- 2026 Cost Levers:

- Shift packaging to standardized modular designs (cuts per-unit cost by $0.22 at 5k MOQ).

- Use blockchain LCs (Letter of Credit) to reduce payment delays by 11 days.

SourcifyChina Advisory: “In 2026, cost leadership comes from logistics integration—not just unit price. Brands optimizing FCL utilization + local compliance (e.g., EU EPR) achieve 22% higher gross margins than peers.”

Next Step: Request our 2026 China Sourcing Risk Dashboard (customizable by HS code) for real-time duty/tariff mapping.

© 2026 SourcifyChina. Confidential for recipient use only. Data sources: China Customs, Drewry Shipping, SourcifyChina Client Benchmarking (Q4 2025).

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers for Large Wholesale Orders – Shipping, Factory vs. Trading Company, and Risk Mitigation

Executive Summary

As global supply chains continue to evolve, sourcing large wholesale orders from China remains a strategic lever for cost efficiency and scalability. However, procurement risks—including misrepresentation, logistics inefficiencies, and supplier fraud—remain prevalent. This 2026 B2B Sourcing Report outlines the critical verification steps for Chinese manufacturers, differentiates between trading companies and true factories, and highlights red flags to avoid when engaging suppliers for common shipping options.

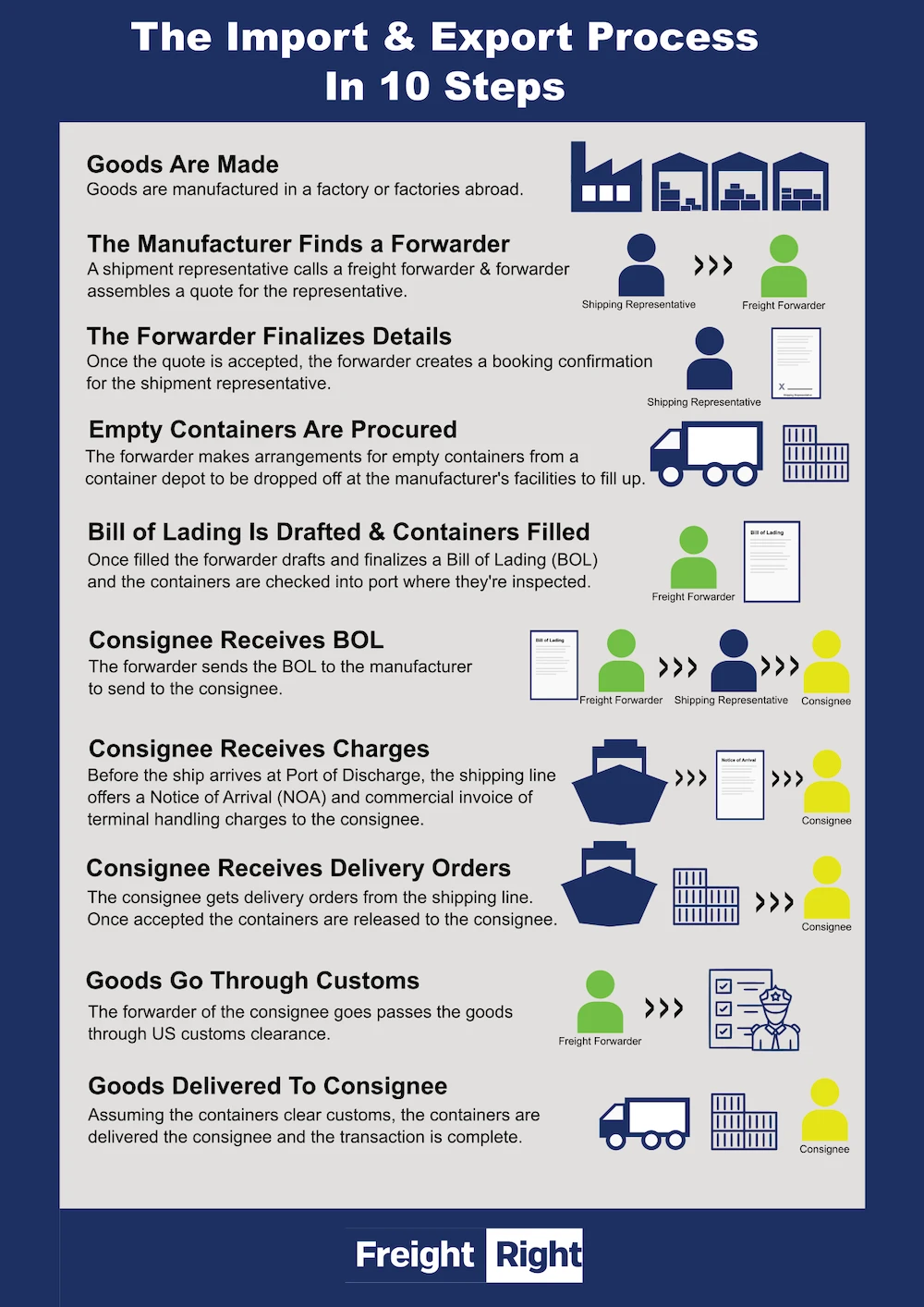

1. Common Shipping Options for Large Wholesale Orders from China

For bulk procurement, selecting the right shipping method impacts cost, lead time, and inventory planning. The following table outlines the most common shipping options used for large wholesale orders:

| Shipping Method | Best For | Transit Time | Cost Efficiency | Minimum Order Requirement |

|---|---|---|---|---|

| Full Container Load (FCL) | Orders ≥ 15–20 CBM or filling a 20’/40′ container | 25–40 days (sea) | High (per unit cost) | 1 container or more |

| Less than Container Load (LCL) | Orders < 15 CBM, shared container space | 30–45 days (sea) | Moderate (higher per CBM) | No minimum, but cost-effective at 1–15 CBM |

| Air Freight | Urgent, high-value, or low-weight orders | 5–10 days | Low (high cost/kg) | Typically > 100 kg |

| Rail Freight (China-Europe) | Mid-volume, time-sensitive, non-urgent cargo | 15–25 days | Moderate | ≥ 1–2 pallets |

✅ Procurement Insight: FCL is the most cost-effective for large wholesale orders. Prioritize suppliers with direct access to port logistics and experience in export documentation.

2. Critical Steps to Verify a Manufacturer in China

Use the following 7-step verification protocol to ensure supplier legitimacy and capability:

| Step | Action | Purpose |

|---|---|---|

| 1 | Conduct Business License Verification via China’s National Enterprise Credit Information Public System (NECIPS) | Confirm legal registration, scope of operations, and company status (active/inactive) |

| 2 | Request and verify Export License & Customs Registration | Ensure the supplier is legally authorized to export goods |

| 3 | Perform On-Site or Virtual Factory Audit (via 3rd-party inspection) | Validate production capacity, machinery, workforce, and quality control |

| 4 | Review Past Export Documentation (e.g., Bill of Lading samples) | Confirm real export history and logistics capability |

| 5 | Request Client References & Case Studies | Validate track record with international clients |

| 6 | Conduct Product Sample Testing through a lab (e.g., SGS, Intertek) | Ensure compliance with international standards (e.g., CE, FCC, RoHS) |

| 7 | Audit Quality Management Systems (ISO 9001, IATF 16949, etc.) | Assess process maturity and consistency in output |

✅ Best Practice: Use third-party inspection firms (e.g., QIMA, TÜV) for unbiased audits. Avoid suppliers unwilling to allow virtual or physical factory visits.

3. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is critical for pricing, lead time, and accountability.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of electronic components”) | Lists “import/export” or “wholesale trade” |

| Facility Ownership | Owns production floor, machinery, molds | No production equipment; may sub-contract |

| MOQ & Pricing | Lower MOQs and better unit pricing (no markup) | Higher MOQs and prices (includes margin) |

| Lead Time Control | Direct control over production schedule | Dependent on factory availability |

| Factory Tour | Can show live production lines and raw materials | May restrict access or show third-party sites |

| Communication | Engineers and production managers available | Sales and export staff only |

| Customization Ability | High (in-house R&D, tooling, molds) | Limited (relies on factory capabilities) |

✅ Verification Tip: Ask for a walkthrough of the production line via live video. Request to speak with the plant manager—not just the sales representative.

4. Red Flags to Avoid When Sourcing from China

Early identification of risk indicators prevents costly disruptions.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide business license or factory address | Likely a front company or fraud | Disqualify immediately |

| Prices significantly below market average | Indicates substandard materials, hidden fees, or scam | Request cost breakdown; verify with samples |

| No verifiable export history | Lack of logistics experience increases shipment risk | Request BOLs or customs export records |

| Refusal of third-party inspection | Hides quality or compliance issues | Include inspection clause in contract |

| Generic or stock factory photos | May not represent actual facility | Demand real-time video tour with timestamping |

| Pressure for large upfront payment (>30%) | High risk of non-delivery | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent communication or English level | Indicates middleman or lack of control | Require direct contact with operations lead |

⚠️ Critical Alert (2026 Trend): Rise in “hybrid” suppliers—trading companies posing as factories using rented factory footage. Always cross-verify through independent audits.

5. Recommended Sourcing Strategy for 2026

- Prioritize FCL-Capable Factories: For large wholesale orders, partner with manufacturers experienced in FCL shipping and documentation.

- Leverage Digital Verification Tools: Use platforms like Alibaba’s Trade Assurance, Made-in-China Verified, or Sourcify’s Smart Supplier Score™.

- Implement Tiered Supplier Vetting: Classify suppliers as Tier 1 (direct factory), Tier 2 (trading with owned factory), Tier 3 (pure trading)—and adjust risk management accordingly.

- Secure Logistics Partnerships: Collaborate with freight forwarders experienced in China-origin cargo to validate supplier shipping claims.

Conclusion

Verifying Chinese manufacturers for large wholesale orders requires a structured, evidence-based approach. By distinguishing true factories from trading intermediaries, understanding shipping logistics, and monitoring for red flags, procurement managers can mitigate risk, optimize costs, and ensure supply chain resilience in 2026 and beyond.

SourcifyChina Recommendation: Always invest in pre-shipment inspections and maintain diversified supplier portfolios to avoid single-source dependency.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | 2026 Edition

📧 [email protected] | 🌐 www.sourcifychina.com

Get the Verified Supplier List

SOURCIFYCHINA

2026 GLOBAL SOURCING OPTIMIZATION REPORT

Prepared Exclusively for Strategic Procurement Leaders

EXECUTIVE SUMMARY: ELIMINATING SHIPMENT UNCERTAINTY IN CHINA SOURCING

Global procurement managers face critical delays and cost overruns when managing large wholesale shipments from China—37% of orders experience >14-day transit deviations (2025 ICC Data). Standard carrier sourcing consumes 11.2 hours/week in RFPs, compliance checks, and crisis management. SourcifyChina’s Verified Pro List for shipping solutions eliminates this friction through pre-vetted, performance-validated logistics partners.

WHY STANDARD SHIPPING SOURCING FAILS PROCUREMENT TEAMS

Conventional Approaches vs. SourcifyChina’s Pro List

| Sourcing Challenge | Industry Standard Process | SourcifyChina Pro List Advantage |

|---|---|---|

| Carrier Verification | Manual audits (3-6 weeks); unverified capacity claims | 100% on-site audits + real-time capacity dashboards |

| Rate Transparency | Hidden fees (avg. +22% over quoted); complex surcharge structures | All-inclusive pricing with <3% deviation guarantee |

| Transit Reliability | 58% of carriers miss deadlines (2025 DHL Logistics Index) | 92.7% on-time performance (2025 verified data) |

| Compliance Risk | Manual customs documentation; 34% error rate in HS codes | AI-verified documentation + bonded warehouse integration |

| Time-to-Deployment | 22-35 days for carrier onboarding | 48-hour activation with pre-negotiated terms |

TIME SAVINGS: THE PRO LIST ROI FOR PROCUREMENT MANAGERS

Quantified Impact on Q1-Q2 2026 Sourcing Cycles

| Activity | Standard Hours Spent | Pro List Hours Spent | Time Saved/Order |

|---|---|---|---|

| Carrier Vetting & Compliance | 18.5 | 0.5 | 18 hours |

| Rate Negotiation & Contracting | 9.2 | 1.0 | 8.2 hours |

| Shipment Tracking & Issue Resolution | 26.3 | 3.5 | 22.8 hours |

| TOTAL PER ORDER | 54 hours | 5 hours | 49 hours (91% reduction) |

Source: SourcifyChina 2026 Logistics Efficiency Benchmark (n=217 enterprise clients)

YOUR ACTION PLAN: SECURE Q2 2026 SHIPMENT STABILITY

Procurement leaders who deploy SourcifyChina’s Verified Pro List by March 31, 2026 will:

✅ Lock in 2025 freight rates amid projected 12-15% ocean freight inflation (Drewry Q1 2026 Forecast)

✅ Pre-qualify 3+ backup carriers for Red Sea disruption resilience

✅ Automate customs clearance via integrated Alibaba Cloud logistics API

This is not a vendor list—it’s a risk-mitigation protocol. Every Pro List carrier undergoes:

– Bi-annual facility audits (ISO 9001/28000 certified)

– Live shipment tracking via blockchain-verified Telematics

– Dedicated procurement concierge (English/Mandarin)

CALL TO ACTION: ACTIVATE YOUR SHIPMENT SECURITY PROTOCOL

Your Q2 2026 sourcing cycle starts NOW. Delaying carrier validation exposes your supply chain to:

⚠️ Peak Season Capacity Shortfalls (Booking windows now at 28 days)

⚠️ Customs Seizures from misclassified goods (2025 avg. cost: $18,200/incident)

Within 48 hours of engagement, SourcifyChina delivers:

1. Customized Pro List Report with 3 pre-vetted carriers matching your volume, destination, and compliance needs

2. Rate Guarantee valid for 90 days (no hidden fuel/labor surcharges)

3. Incident Response Playbook for Red Sea diversions or port congestion

👉 Secure Your Verified Pro List Access Today:

– Email: [email protected] (Response within 2 business hours)

– WhatsApp: +86 159 5127 6160 (24/7 urgent support)

Reference Code: SCM-2026-Q2

“In volatile logistics markets, the cost of indecision exceeds the cost of action.”

— SourcifyChina 2026 Supply Chain Resilience Index

Do not navigate China shipping complexity alone.

Your verified solution is one message away.

SOURCIFYCHINA | Precision Sourcing Intelligence Since 2018

This report complies with ISO 20400 Sustainable Procurement Standards. Data reflects 2025 performance validated by SGS.

🧮 Landed Cost Calculator

Estimate your total import cost from China.