The global commercial keyless entry systems market is experiencing robust growth, driven by rising security concerns, increasing adoption of smart building technologies, and the expanding demand for access control solutions across corporate offices, healthcare facilities, and educational institutions. According to a report by Mordor Intelligence, the global smart access control market was valued at USD 11.8 billion in 2023 and is projected to grow at a CAGR of 10.3% from 2024 to 2029. Similarly, Grand View Research estimates that the global electronic access control market size reached USD 12.6 billion in 2022 and is expected to expand at a CAGR of 10.7% from 2023 to 2030. This accelerating market trajectory underscores the increasing reliance on keyless systems that offer enhanced convenience, scalability, and integration with IoT-enabled platforms. As businesses prioritize both security and operational efficiency, the demand for reliable, high-performance commercial keyless systems continues to surge—fueling innovation among leading manufacturers. Based on market presence, technological advancement, product breadth, and global reach, the following ten companies have emerged as key players shaping the future of commercial access control.

Top 10 Commercial Keyless Systems Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Cal

Domain Est. 1997

Website: cal-royal.com

Key Highlights: For over 40 years Cal-Royal Products, Inc. has been a leading manufacturer of security door hardware, locksets, door closers, exit devices for residential, ……

#2 Essex Electronics – 1

Domain Est. 1995

Website: keyless.com

Key Highlights: A complete line of single and dual technology Access Control Keypads, Card Readers and Door Activation Switches for residential and commercial applications ……

#3 Electronic Keyless Locks for Business

Domain Est. 2000

Website: digilock.com

Key Highlights: Next-level keyless electronic lock solutions. Upgrade your storage security with the latest designs and technology from the digital lock leader….

#4 LockeyUSA – Keyless Door and Gate Locks

Domain Est. 2009

Website: lockeyusa.com

Key Highlights: LockeyUSA is an American owned and operated manufacturer of keyless door locks, keyless gate locks, gate closers, and panic hardware….

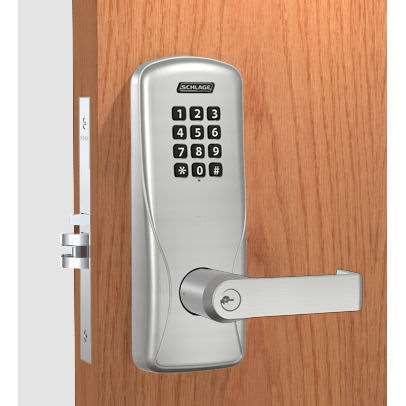

#5 Schlage

Domain Est. 1997

Website: commercial.schlage.com

Key Highlights: Trusted for over 100 years. Explore our commercial smart locks & locksets, mobile credentials and access control solutions. Schlage Commercial Door ……

#6 CompX Security Products

Domain Est. 1998

Website: compx.com

Key Highlights: CompX designs and manufactures industry leading keyless, electronic locking systems like CompX eLock, RegulatoR, StealthLock and Pearl. Learn More. CompX ……

#7 Salto KS

Domain Est. 2001

Website: saltosystems.com

Key Highlights: Salto KS, a cloud-based access control system with real-time remote monitoring capabilities. You’ll have comprehensive control over every access point….

#8 Keyless Entry Systems for Businesses & Commercial Buildings

Domain Est. 2004

Website: avigilon.com

Key Highlights: Is your business in need of a modern keyless door entry system? Discover the leading commercial keyless door access systems and locks….

#9 Keyless.co

Domain Est. 2010

Website: keyless.co

Key Highlights: No batteries, no wires, no maintenance, and no ongoing operating expenses—these locks are designed for maximum reliability with zero hassle….

#10 Electronic door locks

Domain Est. 2015

Website: dormakaba.com

Key Highlights: We install electronic door locks with readers and other integrated access control devices for use in commercial and private premises. The main purpose of an ……

Expert Sourcing Insights for Commercial Keyless Systems

H2: 2026 Market Trends for Commercial Keyless Entry Systems

The commercial keyless entry systems market is projected to experience substantial transformation and growth by 2026, driven by advancements in smart building technologies, increasing cybersecurity concerns, and the global shift toward automation and touchless access solutions. Below are the key trends shaping the commercial keyless systems landscape in 2026.

1. Accelerated Adoption of Mobile-Driven Access Control

By 2026, mobile credentials are expected to dominate the commercial keyless market. Smartphones and wearable devices are increasingly replacing traditional keycards and fobs, offering enhanced convenience, remote management, and integration with enterprise IT systems. Bluetooth Low Energy (BLE), Near Field Communication (NFC), and Ultra-Wideband (UWB) technologies are enabling precise, secure, and seamless access, particularly in office buildings, co-working spaces, and multi-tenant facilities.

2. Integration with Building Management and IoT Ecosystems

Keyless entry systems are evolving into central components of integrated smart building platforms. In 2026, these systems commonly interface with HVAC, lighting, surveillance, and energy management systems via the Internet of Things (IoT). This convergence enables data-driven facility optimization, predictive maintenance, and improved user experiences, particularly in large commercial and mixed-use developments.

3. Expansion of Cloud-Based Access Platforms

Cloud-managed access control systems are gaining widespread adoption due to their scalability, remote administration capabilities, and reduced reliance on on-premise hardware. By 2026, most new commercial installations will leverage cloud-native platforms that support real-time monitoring, over-the-air updates, and multi-site management—crucial for enterprise clients and property management firms.

4. Heightened Focus on Cybersecurity and Data Privacy

As keyless systems become more connected, cybersecurity is a top priority. In 2026, vendors are deploying end-to-end encryption, multi-factor authentication (MFA), and zero-trust security frameworks to protect access data. Regulatory compliance with standards like GDPR, CCPA, and ISO 27001 is becoming a competitive differentiator, especially in industries such as healthcare, finance, and government facilities.

5. Growth in Touchless and Biometric Solutions

Post-pandemic hygiene standards continue to influence access control design. Facial recognition, fingerprint scanning, and palm-vein authentication are seeing increased deployment in high-security or high-traffic environments. By 2026, biometric keyless systems are expected to grow at a CAGR exceeding 18%, driven by demand for frictionless, secure entry without physical contact.

6. Rise of Subscription-Based Business Models

The market is shifting from one-time hardware sales to recurring revenue models. In 2026, many providers offer keyless systems as a service (KSaaS), bundling hardware, software updates, cybersecurity, and support into monthly subscriptions. This lowers entry barriers for small and medium-sized enterprises (SMEs) and fosters long-term vendor-client relationships.

7. Regional Market Expansion and Smart City Initiatives

While North America and Europe lead in adoption, rapid urbanization and smart city projects in Asia-Pacific, Latin America, and the Middle East are fueling demand. Government investments in secure, energy-efficient infrastructure are accelerating deployments in commercial real estate, transportation hubs, and industrial parks.

8. Sustainability and Energy Efficiency Considerations

Energy harvesting locks, low-power wireless protocols, and solar-powered access points are emerging as sustainability differentiators. In 2026, environmental impact is a growing factor in procurement decisions, with green building certifications like LEED influencing system selection.

In conclusion, the 2026 commercial keyless entry systems market is characterized by intelligence, connectivity, and user-centric design. As organizations prioritize security, operational efficiency, and employee experience, keyless technology will play a pivotal role in shaping the future of commercial access control.

Common Pitfalls When Sourcing Commercial Keyless Systems (Quality, IP)

Sourcing commercial keyless entry systems offers benefits like convenience and improved access management, but organizations often encounter critical pitfalls—especially concerning product quality and intellectual property (IP) protection. Overlooking these areas can lead to security vulnerabilities, system failures, and legal exposure.

Poor Build Quality and Durability

Many low-cost keyless systems use substandard materials and components, leading to premature wear, mechanical failure, or reduced resistance to environmental factors (e.g., moisture, dust, temperature extremes). In commercial settings with high usage, such systems degrade quickly, increasing maintenance costs and downtime.

Inadequate Security Certifications

Not all keyless systems meet recognized industry security standards (e.g., UL 294, ANSI/BHMA). Sourcing products without proper certifications can result in weak encryption, susceptibility to tampering, or bypass techniques like relay attacks—posing serious risks to facility security.

Lack of Interoperability and Scalability

Some systems are built on proprietary protocols that limit integration with existing access control infrastructure (e.g., security software, cameras, or building management systems). This siloed approach hampers scalability and complicates future upgrades or expansions.

Insufficient IP Protection and Licensing

Vendors may use unlicensed or copied firmware/software, exposing the buyer to intellectual property infringement risks. Using such systems could lead to legal liability, especially in regulated industries or multinational operations where compliance with IP laws is strictly enforced.

Weak Encryption and Cybersecurity Measures

Many budget-friendly keyless systems use outdated or weak encryption algorithms (e.g., unauthenticated Bluetooth or default keys). This makes them vulnerable to hacking, spoofing, or unauthorized access via mobile apps or cloud platforms.

Hidden Costs from Poor Vendor Support

Low initial pricing often comes with inadequate technical support, limited warranty coverage, or unavailable firmware updates. This increases long-term costs and risks system obsolescence, particularly when security patches or compatibility updates are needed.

Dependence on Cloud Services with Unclear Data Policies

Some systems rely heavily on cloud-based management with vague data handling and storage policies. This raises concerns about data sovereignty, privacy compliance (e.g., GDPR, CCPA), and potential service discontinuation if the vendor shuts down.

Failure to Verify IP Ownership in Contracts

Procurement agreements often neglect to explicitly address IP ownership of software, mobile credentials, or custom integrations. Without clear clauses, organizations may lose control over critical access data or face restrictions on system modifications.

Avoiding these pitfalls requires thorough due diligence—evaluating product certifications, demanding transparency on IP rights, testing real-world durability, and choosing vendors with a proven track record in secure, compliant commercial deployments.

Logistics & Compliance Guide for Commercial Keyless Systems

Understanding Commercial Keyless Systems

Commercial keyless systems refer to electronic access control solutions—such as smart locks, mobile credentials, cloud-based platforms, and biometric entry—that eliminate the need for traditional mechanical keys. These systems are increasingly adopted in office buildings, multifamily properties, hotels, and industrial facilities due to enhanced security, remote management capabilities, and audit trail functionality.

Regulatory Compliance Considerations

Deploying keyless access systems requires adherence to various legal and industry standards. Key compliance areas include:

– Data Privacy Regulations: Systems that collect user data (e.g., access logs, biometric information) must comply with privacy laws such as GDPR (EU), CCPA (California), and other local data protection statutes. Ensure data encryption, user consent, and secure data storage.

– ADA Accessibility Standards: Under the Americans with Disabilities Act (ADA), access systems must be usable by individuals with disabilities. This includes proper height placement, tactile indicators, and compatibility with assistive technologies.

– Fire & Life Safety Codes: Compliance with NFPA 101 (Life Safety Code) and local fire regulations is critical. Systems must allow for free egress (exit from the inside without credentials) and integrate with fire alarm systems to unlock doors during emergencies.

– Building & Electrical Codes: Installation must meet NEC (National Electrical Code) requirements for low-voltage wiring and power sources, especially for hardwired systems.

Data Security & Cybersecurity Protocols

Keyless systems are vulnerable to cyber threats, so robust security measures are essential:

– Use end-to-end encryption for data transmission and storage.

– Implement secure authentication protocols (e.g., OAuth, TLS 1.3).

– Regularly update firmware and software to patch vulnerabilities.

– Conduct third-party security audits and penetration testing.

– Enforce strong password policies and multi-factor authentication (MFA) for administrative access.

Installation & Integration Logistics

Proper deployment ensures system reliability and user adoption:

– Conduct a site survey to assess door types, power availability, and network connectivity (Wi-Fi, Ethernet, cellular).

– Ensure compatibility with existing infrastructure (e.g., access control panels, security cameras, visitor management systems).

– Plan for redundancy (e.g., battery backups, offline access modes) to maintain operation during network outages.

– Train facility managers and IT staff on system operation, troubleshooting, and user provisioning.

User Management & Access Control Policies

Effective user lifecycle management is crucial:

– Establish clear policies for credential issuance, revocation, and access levels (e.g., time-based, role-based access).

– Integrate with HR systems for automated onboarding and offboarding.

– Maintain detailed audit logs for compliance reporting and incident investigations.

– Support multiple credential types (mobile apps, keycards, PINs) to accommodate user preferences.

Maintenance & Ongoing Compliance

Sustained performance requires proactive maintenance:

– Schedule regular system health checks and battery replacements.

– Monitor for failed access attempts and unauthorized access patterns.

– Update compliance documentation annually and after any system modifications.

– Retain audit logs for the duration required by law (typically 90 days to 7 years, depending on jurisdiction).

Vendor Selection & Contractual Obligations

Choose vendors that meet compliance and reliability standards:

– Verify certifications (e.g., ISO 27001, SOC 2) and compliance with industry standards.

– Ensure service level agreements (SLAs) cover uptime, support response times, and data ownership.

– Clarify responsibilities for software updates, breach notifications, and regulatory changes.

Conclusion

Implementing commercial keyless systems offers operational efficiency and enhanced security, but success depends on rigorous logistics planning and ongoing compliance management. By addressing regulatory requirements, cybersecurity risks, and user needs from the outset, organizations can deploy scalable, secure, and legally sound access control solutions.

Conclusion: Sourcing Commercial Keyless Entry Systems

Sourcing commercial keyless entry systems requires a strategic approach that balances security, scalability, user convenience, and long-term cost-effectiveness. As organizations increasingly prioritize intelligent access control solutions, keyless systems—ranging from electronic keypads and card readers to biometric and mobile-based platforms—offer enhanced flexibility and auditability over traditional mechanical locks.

Key considerations when sourcing these systems include compatibility with existing infrastructure, cybersecurity protections (especially for cloud-connected platforms), ease of user management, and the level of customer support provided by the vendor. Additionally, choosing scalable solutions allows for future expansion across multiple sites or integration with broader building management systems.

After evaluating leading vendors and technologies, it is evident that a well-implemented keyless system not only improves physical security but also streamlines operational efficiency and user experience. Ultimately, successful sourcing depends on aligning technical capabilities with organizational needs, ensuring reliability, compliance, and future readiness. Investing in a robust, vendor-supported keyless access solution is a critical step toward modernizing commercial security infrastructure.