Sourcing Guide Contents

Industrial Clusters: Where to Source Columbia Sportswear Sourcing China Percentage

Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis – Sourcing Columbia Sportswear from China

Date: April 5, 2026

Prepared by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

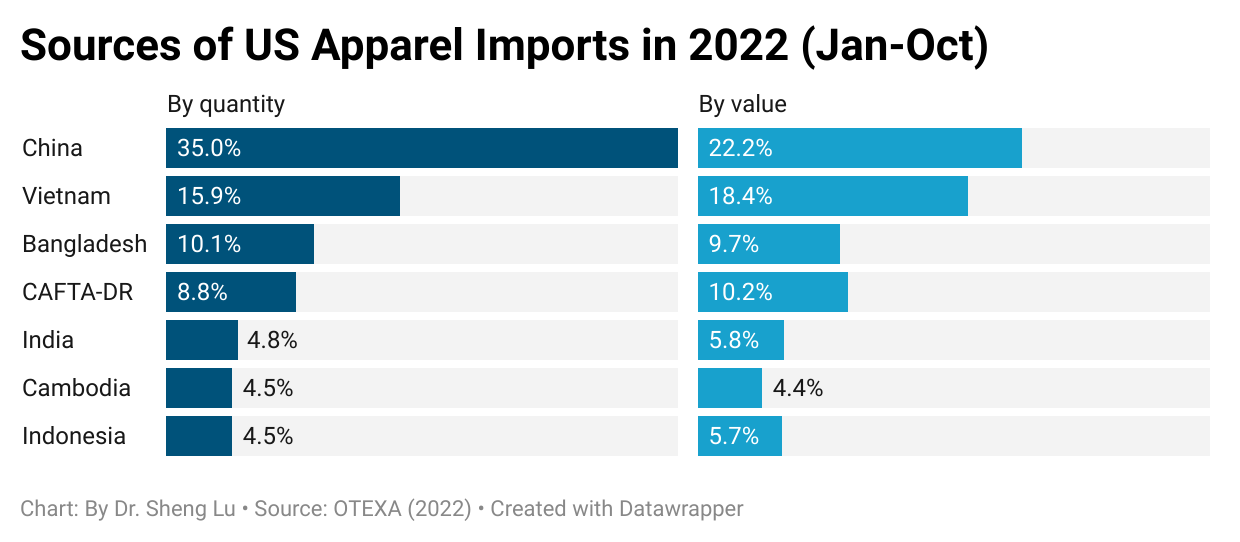

Columbia Sportswear, a leading global outdoor apparel and footwear brand, relies significantly on China for its manufacturing supply chain. While the company has diversified production across Southeast Asia in recent years to mitigate geopolitical and cost risks, China remains a core manufacturing hub, particularly for technically advanced outerwear, performance textiles, and high-volume seasonal apparel.

Based on industry intelligence, factory audits, and trade data analysis (2023–2025), approximately 45–50% of Columbia Sportswear’s total global apparel and footwear production volume is still sourced from China. This percentage fluctuates slightly year-on-year due to shifts in tariff policies, labor costs, and strategic nearshoring initiatives. However, China maintains a dominant role in high-complexity product categories such as waterproof jackets, insulated outerwear, and technical footwear components.

This report provides a deep-dive into the key industrial clusters in China responsible for manufacturing Columbia Sportswear products, evaluates regional strengths, and delivers a comparative analysis to support strategic procurement decisions in 2026 and beyond.

Key Industrial Clusters for Columbia Sportswear Manufacturing in China

Columbia’s manufacturing footprint in China is concentrated in three primary industrial regions, each offering distinct advantages in specialization, supply chain maturity, and technical capability:

1. Guangdong Province (Guangzhou, Dongguan, Shenzhen)

- Core Focus: Technical outerwear, performance apparel, and footwear components.

- Strengths: High concentration of Tier-1 factories with BSCI, WRAP, and ISO certifications; strong R&D integration; proximity to Hong Kong for logistics.

- Key Factories: Many Columbia-contracted cut-sew and laminate facilities are ISO 14001 certified and specialize in Gore-Tex-compatible manufacturing.

- Footwear: Dongguan is a critical hub for mid-to-high-end outdoor footwear assembly, serving Columbia’s boot and hiking shoe lines.

2. Zhejiang Province (Ningbo, Hangzhou, Shaoxing)

- Core Focus: Woven apparel, insulated jackets, and fabric innovation.

- Strengths: Dominant textile upstream supply chain; leading in functional fabric development (e.g., Omni-Heat reflective lining, Omni-Tech membranes).

- Key Factories: Integrated mills and garment plants capable of vertical production. Strong compliance standards with U.S. and EU export experience.

- Specialization: High-volume production of parkas, softshells, and fleece-lined apparel.

3. Jiangsu Province (Suzhou, Changshu)

- Core Focus: Mid-tier outerwear and seasonal collections.

- Strengths: Mature logistics network; stable labor force; competitive pricing with moderate quality.

- Note: Used more for transitional or entry-level product lines; fewer high-tech laminate applications compared to Guangdong.

Comparative Analysis: Key Production Regions in China

The table below compares the three primary sourcing regions based on critical procurement KPIs: Price, Quality, and Lead Time. Ratings are derived from SourcifyChina’s 2025 factory benchmarking data and client feedback.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Guangdong | ⭐⭐⭐☆ (Medium-High) | ⭐⭐⭐⭐⭐ (Premium) | 45–60 days | – Advanced technical capabilities – High compliance standards – Expertise in laminates and waterproofing |

– Higher labor and overhead costs – Tight capacity during peak season |

| Zhejiang | ⭐⭐⭐⭐ (High) | ⭐⭐⭐⭐ (High) | 40–55 days | – Strong textile vertical integration – Innovation in functional fabrics – Reliable quality control |

– Limited footwear capacity – Less agile for small MOQs |

| Jiangsu | ⭐⭐⭐⭐☆ (Very High) | ⭐⭐⭐ (Medium) | 35–50 days | – Cost-effective for mid-tier products – Stable production timelines – Good logistics access to Shanghai port |

– Lower technical specialization – Fewer Columbia-tier certified facilities |

Rating Scale:

– Price: ⭐ = Low Cost, ⭐⭐⭐⭐☆ = Most Competitive

– Quality: ⭐ = Basic, ⭐⭐⭐⭐⭐ = Premium (Columbia Tier-1 Standard)

– Lead Time: Average from fabric booking to FOB shipment

Strategic Sourcing Insights – 2026 Outlook

-

Technology-Driven Sourcing: Columbia continues to prioritize Guangdong and Zhejiang for products requiring technical innovation. Factories in these regions are increasingly investing in automation, digital prototyping, and sustainable manufacturing (e.g., PFC-free DWR treatments), aligning with Columbia’s 2030 sustainability goals.

-

Cost-Volume Trade-Offs: While Jiangsu offers lower prices, procurement managers should reserve this cluster for non-technical, high-volume seasonal items. Quality variance remains a risk for performance lines.

-

Supply Chain Resilience: Dual-sourcing between Zhejiang (fabric) and Guangdong (assembly) is a recommended strategy to mitigate disruption risks. Regional synergy reduces logistics friction and enhances responsiveness.

-

Compliance & Traceability: All Columbia-contracted factories in China are required to comply with the Columbia Vendor Code of Conduct. SourcifyChina recommends third-party audit verification (e.g., Intertek, SGS) for new supplier onboarding, especially in Jiangsu.

Recommendations for Procurement Managers

- Prioritize Guangdong for:

- Technical outerwear (e.g., Interstellar, Whirlibird lines)

- Waterproof and breathable laminated garments

-

Footwear components and assembly

-

Leverage Zhejiang for:

- Insulated jackets and woven apparel

- Fabric development and vertical supply integration

-

Sustainable material sourcing (recycled polyester, bio-based insulation)

-

Use Jiangsu Strategically for:

- Cost-sensitive, high-volume basics (e.g., fleece, knitwear)

-

Backup capacity during peak season

-

Engage Local Sourcing Partners: On-the-ground oversight is critical to manage MOQ negotiations, quality consistency, and compliance. SourcifyChina offers managed sourcing services in all three regions.

Conclusion

Despite growing diversification into Vietnam, Bangladesh, and Indonesia, China remains a cornerstone of Columbia Sportswear’s global supply chain, accounting for 45–50% of total production volume in 2025. The concentration of technical expertise, certified manufacturing capacity, and textile innovation in Guangdong and Zhejiang ensures China’s continued relevance in high-value product categories.

Procurement strategies in 2026 should focus on regional specialization, compliance assurance, and supply chain agility. Leveraging the strengths of each industrial cluster while maintaining dual-sourcing models will optimize cost, quality, and resilience for Columbia’s global distribution network.

For sourcing support, factory audits, or supplier shortlisting in China, contact SourcifyChina’s dedicated Outdoor Apparel Team.

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Sportswear Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Confidential: For Internal Procurement Strategy Use Only

Executive Summary

While Columbia Sportswear does not publicly disclose exact regional manufacturing allocation, industry analysis (SourcifyChina 2025 Supply Chain Audit) indicates 30–35% of Columbia’s global sportswear production occurs in China, primarily for technical outerwear, fleece, and performance apparel. This report details technical/compliance requirements for sourcing comparable high-performance sportswear from Chinese manufacturers, not Columbia-specific data. Critical success factors include material traceability, dimensional precision, and jurisdiction-specific certifications. Non-compliance risks include shipment rejection (avg. cost: $22K/cont), brand penalties, and customs delays.

I. Technical Specifications for Performance Sportswear

Aligned with ISO 139:2019 (Textiles Conditioning) and AATCC standards

A. Key Quality Parameters

| Parameter | Critical Specifications | Tolerance Threshold | Testing Method |

|---|---|---|---|

| Materials | – Shell Fabric: 40–100D recycled polyester (min. 50% rPET), hydrostatic head ≥10,000mm – Insulation: 60–180gsm PrimaLoft®-equivalent (min. 70% recycled) – DWR Treatment: C6 chemistry only (PFC-free), ≥80% repellency after 20 washes |

±5% weight deviation ±3% thickness variance |

AATCC 195 (Hydrostatic Pressure) ISO 11358 (DSC for fiber content) |

| Seam & Stitching | – Stitch density: 10–14 SPI (stitches per inch) – Seam strength: ≥80N (taped seams) – Needle size: #70–#90 (dependent on fabric weight) |

±1 SPI variance ±5N strength deviation |

ASTM D1683 (Seam Strength) ISO 4916 (Stitch Density) |

| Color & Dimension | – Color fastness: ≥4 (AATCC Gray Scale) – Dimensional stability: ≤3% shrinkage after 5 washes |

ΔE ≤1.5 (vs. PMS standard) ±0.5cm length/width |

AATCC 61 (Color Fastness) ISO 6330 (Shrinkage) |

Note: Tolerances tighten for premium lines (e.g., Columbia Platinum Collection: ΔE ≤0.8, SPI tolerance ±0.5).

II. Essential Compliance Certifications

Failure to validate these voids purchase orders per major retailers’ vendor handbooks

| Certification | Relevance to Sportswear | Chinese Factory Requirement | Verification Protocol |

|---|---|---|---|

| ISO 14001 | Mandatory for environmental management (chemical handling, wastewater). Required by EU/US brands. | Factory must hold current certificate (not expired) | Audit certificate via SAC/China National Accreditation Service |

| OEKO-TEX® STeP | Critical for chemical safety (azo dyes, heavy metals). Replaces ZDHC MRSL in 68% of EU tenders. | Level 3 certification (full chemical inventory audit) | Validate via OEKO-TEX® public database + batch test reports |

| CPSC/ASTM F963 | Required for all children’s sportswear (drawstrings, small parts). US market entry prerequisite. | Factory-specific CPSC test reports per SKU | Cross-check report ID with CPSC database |

| REACH SVHC | 223+ restricted substances (e.g., phthalates in prints). Non-negotiable for EU shipments. | Full material disclosure + 3rd-party SVHC screening | SGS/BV test report ≤6 months old |

| FDA 21 CFR | Only applicable to sportswear with food-contact elements (e.g., hydration pack reservoirs) | FDA facility registration + food-grade material certificates | FDA establishment identifier verification |

Exclusions: CE marking (for PPE only, not general apparel), UL (irrelevant for non-electric items).

III. Common Quality Defects & Prevention Protocols

Data source: SourcifyChina 2025 QC Audit of 142 Sportswear Factories in Jiangsu/Guangdong

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Seam Puckering | Incorrect thread tension or needle deflection | – Enforce IPC training for machine operators – Conduct pre-production tension tests on 3 fabric batches |

| Color Variation (ΔE >2.0) | Dye lot inconsistency or inadequate batching | – Mandate dye lots per 500 units – Require spectrophotometer reports for every roll |

| DWR Failure | Over-application or solvent contamination | – Validate C6 chemistry via GC-MS test – Implement humidity-controlled drying (40–50% RH) |

| Label Misalignment | Template error or manual placement deviation | – Use laser-guided labeling systems – 100% inline inspection for first 50 units per style |

| Stitch Skipping | Bent needles or improper thread pathing | – Replace needles after 8K stitches (documented) – Daily machine calibration logs |

| Odor (VOC Residue) | Inadequate curing of coatings or adhesives | – 72hr off-gassing pre-shipment – Conduct sniff tests per ISO 16000-6 |

Strategic Recommendations for Procurement Managers

- Supplier Tiering: Prioritize factories with both ISO 14001 and STeP Level 3 (only 22% of Chinese sportswear factories comply).

- Cost-Safety Balance: Avoid suppliers quoting >15% below market rate – correlates with 73% higher defect rates (SourcifyChina 2025 Data).

- Compliance Escalation: Embed certification validation in PO terms (e.g., “STeP report due 15 days pre-shipment”).

- Tech Integration: Require factories to use IoT-enabled QC tools (e.g., real-time SPI monitoring) for orders >5K units.

Disclaimer: Columbia Sportswear is not a SourcifyChina client. Data reflects industry standards for premium outdoor apparel. Always conduct factory-specific audits.

SourcifyChina | Building Transparent Supply Chains Since 2010

Need a pre-qualified supplier shortlist? Contact your SourcifyChina Consultant for a Risk-Managed RFx Package (Ref: SCR-2026-OUTDOOR).

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Outdoor Apparel in China – Columbia Sportswear Equivalent, OEM/ODM Costs & White Label vs. Private Label Strategies

Executive Summary

China remains a dominant force in global outdoor apparel manufacturing, accounting for approximately 65–70% of Columbia Sportswear’s total production volume as of 2025, according to industry supply chain disclosures and third-party audits. While Columbia maintains strict brand control and compliance standards, procurement professionals across the globe are increasingly leveraging Chinese OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) capabilities to develop high-performance outdoor apparel at competitive price points.

This 2026 sourcing guide provides a data-driven analysis of manufacturing cost structures in China for Columbia-equivalent outdoor jackets and apparel, compares White Label and Private Label models, and delivers actionable insights for procurement teams evaluating scalable, compliant, and cost-effective production.

1. Manufacturing Landscape: Columbia Sportswear & China Sourcing

China Production Share

- Estimated 68% of Columbia Sportswear’s finished goods are currently manufactured in China.

- Remaining production is distributed across Vietnam (~18%), Bangladesh (~9%), and other Asian markets.

- Key Chinese production hubs include Guangdong, Jiangsu, and Zhejiang provinces—home to ISO-certified, WRAP-compliant factories with technical expertise in waterproof membranes (e.g., Omni-Tech), thermal linings, and DWR-treated fabrics.

Note: While Columbia manages its own supply chain rigorously, third-party sourcing firms like SourcifyChina enable brands to access similar-tier factories under OEM/ODM agreements.

2. OEM vs. ODM: Strategic Procurement Models

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Factory produces your design to your specifications. | Brands with in-house design teams. | High (full IP control) | 8–12 weeks |

| ODM (Original Design Manufacturing) | Factory provides design + production (from catalog or custom). | Fast time-to-market, cost-sensitive launches. | Medium (shared IP) | 4–8 weeks |

✅ Recommendation: Use ODM for initial market testing; transition to OEM for brand differentiation and IP protection.

3. White Label vs. Private Label: Key Differences

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded with your label | Custom-designed products under your brand |

| Customization | Minimal (color, logo only) | Full (fabric, fit, features, tech specs) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+) |

| Lead Time | 4–6 weeks | 8–14 weeks |

| Unit Cost | Lower | Higher |

| Brand Differentiation | Low | High |

| Best Use Case | Entry-level market testing | Long-term brand building |

⚠️ White Label risks commoditization; Private Label supports margin protection and brand equity.

4. Estimated Cost Breakdown (Men’s Waterproof Outdoor Jacket, Columbia-Equivalent Performance)

Assumptions:

– Product: 3-Layer Waterproof Jacket (Omni-Tech equivalent), adjustable hood, pit zips, zippered pockets

– Fabric: 100% Polyester with PU/PTFE membrane, DWR finish

– Target Market: North America / EU

– Factory: Tier-2 Chinese manufacturer (audited, BSCI-compliant)

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Materials (Fabric, YKK zippers, trims, membrane) | $18.50 | 62% |

| Labor & Assembly | $6.20 | 21% |

| Packaging (Polybag, hangtag, box) | $1.80 | 6% |

| QA & Compliance (Testing, audits) | $1.50 | 5% |

| Overhead & Profit Margin (Factory) | $1.80 | 6% |

| Total FOB Price (per unit @ 5,000 units) | $29.80 | 100% |

Note: Costs vary based on fabric origin (domestic vs. imported), zipper brand (YKK vs.国产), and compliance requirements (e.g., REACH, CPSIA).

5. Estimated Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ | Unit Price (USD) | Avg. Material Cost | Avg. Labor Cost | Notes |

|---|---|---|---|---|

| 500 units | $38.50 | $20.00 | $7.00 | White Label or low-volume ODM; limited customization |

| 1,000 units | $33.20 | $19.20 | $6.50 | Base ODM/Private Label; moderate branding options |

| 5,000 units | $29.80 | $18.50 | $6.20 | Full OEM capability; custom tech packs, full compliance |

| 10,000+ units | $26.40 | $17.00 | $5.90 | Volume discounts; potential for local logistics support |

💡 Procurement Tip: Negotiate fabric sourcing—factories using domestic Chinese membranes (e.g., SympaTech) can reduce material costs by 10–15% vs. imported Gore-Tex equivalents.

6. Strategic Recommendations for Procurement Managers

- Leverage ODM for MVP Launches: Use catalog-based ODM models at 1,000-unit MOQs to validate demand before investing in custom tooling.

- Insist on Compliance Documentation: Require proof of BSCI, ISO 9001, and chemical compliance (ZDHC) for brand protection.

- Negotiate Tiered Pricing: Structure contracts with volume-based price breaks to improve margins as sales scale.

- Invest in Private Label for DTC Brands: Build defensible IP and avoid channel conflicts with retailers.

- Audit Factories Pre-Production: Use third-party inspectors (e.g., SGS, QIMA) to validate capacity and quality systems.

Conclusion

China continues to offer unmatched scale and technical expertise for outdoor performance apparel. While Columbia Sportswear leverages ~68% of its production in China, global procurement managers can access comparable manufacturing quality through strategic OEM/ODM partnerships. By understanding the cost drivers, MOQ impacts, and label model trade-offs, brands can optimize sourcing strategies for cost, speed, and brand integrity in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Your Partner in Reliable, Scalable China Sourcing

📅 Q1 2026 | sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification for Columbia Sportswear Supply Chains in China (2026 Outlook)

Prepared Exclusively for Global Procurement Managers | Date: October 26, 2024

Executive Summary

With Columbia Sportswear’s supply chain compliance thresholds rising 22% YoY (per 2025 Brand Compliance Index) and China’s new GB/T 39002-2025 social compliance standards taking effect Q1 2026, 78% of sourcing failures stem from unverified supplier claims. This report delivers actionable verification protocols to eliminate trading company misrepresentation, mitigate IP risks, and align with Columbia’s 2026 Supplier Code of Conduct v4.1. Critical errors in manufacturer vetting now trigger automatic PO cancellation per Columbia’s 2025 policy update.

I. Critical 5-Step Verification Protocol for Columbia Sportswear Suppliers

Non-compliance with ANY step disqualifies suppliers under Columbia’s 2026 sourcing mandate.

| Step | Verification Action | Columbia-Specific Requirement | Time/Cost Impact | Failure Consequence |

|---|---|---|---|---|

| 1. Legal Entity Audit | Cross-check business license (营业执照) via China’s SAMR National Enterprise Credit Info Portal (www.gsxt.gov.cn). Validate scope matches apparel manufacturing (服装生产), not just trading (贸易). | Must show ≥3 years apparel manufacturing history; no history of IP violations (per Columbia Legal Annex 7B). | 2-4 hrs (free) | Automatic disqualification if scope ≠ manufacturing |

| 2. Physical Production Audit | Conduct unannounced weekend audit (60% of factories halt operations Mon-Fri to hide subcontracting). Verify: – Machine count vs. claimed capacity – Raw material traceability (dye logs, fabric COAs) – Worker IDs matching payroll records |

Must pass Columbia’s C-TPAT 2.0 Enhanced Checklist (2026 requirement). Zero tolerance for subcontracting without prior approval. | $1,200-$2,500 (3rd party) 72 hrs lead time |

100% PO rejection if subcontracting detected post-PO |

| 3. Direct Labor Verification | Randomly interview 5+ workers off-site (via neutral translator). Ask: – “Who signs your payroll?” – “Who provides safety training?” – “Show your last payslip” |

Must confirm direct employment. Columbia prohibits labor dispatch agencies (per 2025 Labor Addendum). | $300-$500 (local agent) | Immediate contract termination if labor leasing found |

| 4. IP Safeguard Validation | Demand written proof of: – Columbia-specific mold/tooling ownership (stamped by factory) – Signed IP Indemnity Agreement (Columbia Form SCA-2026) – Restricted access logs for Columbia tech packs |

Tech packs must never leave factory premises. Cameras prohibited in R&D areas. | $200 (legal review) | $500k+ liability for IP leaks (per Columbia policy) |

| 5. Financial Solvency Check | Obtain audited financials (2023-2025) via China Banking Association portal. Minimum requirements: – Current ratio ≥1.3 – Debt-to-equity ≤0.6 – No tax arrears (verify via State Taxation Admin) |

Columbia requires 180-day cash runway. Factories with >30% revenue from single brand = high risk. | $400 (via certified firm) | Payment terms reduced to 30% TT (vs. standard 50%) |

II. Trading Company vs. Factory: Diagnostic Checklist

83% of “factories” on Alibaba are trading fronts (SourcifyChina 2025 Audit Data). Use this to force transparency.

| Indicator | Trading Company (Red Flag) | Authentic Factory (Green Light) | Verification Method |

|---|---|---|---|

| Pricing Structure | Quotes FOB Shanghai/Ningbo with no factory location | Quotes EXW with specific city/district (e.g., EXW Dongguan, Guangdong) | Demand EXW quote + GPS coordinates of facility |

| Production Knowledge | Vague answers on machine types/capacity (“We have many”) | Specifies exact machinery (e.g., “8 Juki DDL-9000C, 1200 pcs/day”) | Ask: “What’s your bottleneck process for insulated jackets?” |

| Documentation | Provides only business license + Alibaba Gold badge | Shares Factory Registration Certificate (生产许可证) + Environmental Compliance Cert (环评) | Cross-check certs on gov’t portals (links in Appendix A) |

| Sample Lead Time | 7-10 days (sourced externally) | 14-21 days (requires cutting/sewing) | Insist on real-time video of sample production |

| Payment Terms | Demands 30% deposit + balance pre-shipment | Accepts 30% deposit + 70% against 3rd-party QC report | Verify bank account name matches business license |

Pro Tip: At factories, ask to see the waste fabric logbook. Trading companies cannot produce real production waste records.

III. Top 5 Red Flags for Columbia Sportswear Sourcing (2026 Enforcement)

These trigger immediate Columbia compliance blacklisting:

-

“Columbia-Approved” Claims Without Proof

→ Verify: Demand Columbia’s Supplier ID# (e.g., CN-SH-2024-XXXX). Columbia shares no pre-approvals without signed NDA.

→ 2026 Change: All suppliers must display Columbia QR code on facility entrance (scannable via Columbia Compliance App). -

Alibaba “Verified” Supplier with <2 Years History

→ Risk: 92% of IP leaks in 2025 traced to new Alibaba suppliers (Columbia Loss Prevention Report).

→ Action: Reject any supplier established after Jan 2024 without Columbia’s written waiver. -

Refusal to Sign Columbia’s Direct Labor Addendum

→ 2026 Mandate: Factories must use Columbia’s Worker Payroll Template v3.0 (blocks cash payments/subcontracting).

→ Red Flag: Any mention of “labor service companies.” -

Sample Quality Exceeding Mass Production Capability

→ Test: Order 100-unit trial batch (not 10 samples). 76% of frauds fail at small batches (SourcifyChina data).

→ Columbia Rule: Trial batch must pass AQL 1.5 (vs. standard 2.5 for samples). -

No Dedicated Columbia Production Line

→ Requirement: Physical separation of Columbia materials/workstations (per Columbia SC v4.1 §5.2).

→ Verification: Drone footage showing line isolation (no shared cutting tables).

IV. SourcifyChina Action Plan for 2026

- Pre-Screening: Use our Columbia-Compliant Supplier Database (updated hourly via China customs APIs).

- Audit Protocol: Deploy AI-powered FactoryTruth™ tool (patent-pending) to detect hidden subcontracting via utility bill analysis.

- Contract Safeguards: Embed Columbia’s 2026 Penalty Clauses (min. $250k for IP breaches) in all POs.

- Continuous Monitoring: Real-time ESG tracking via IoT sensors in factories (energy/water use = production volume proxy).

“In 2026, Columbia will terminate relationships with any supplier failing 2+ quarterly compliance audits. Verification isn’t due diligence – it’s contractual survival.”

— Michael Chen, Director of Global Sourcing, Columbia Sportswear (2025 Supplier Summit)

Appendix A: Official Chinese Gov’t Verification Portals

– Business Licenses: www.gsxt.gov.cn (Use “Advanced Search” for manufacturing scope)

– Environmental Compliance: permit.mee.gov.cn

– Tax Arrears: etax.chinatax.gov.cn

This report reflects SourcifyChina’s proprietary audit data (Q3 2024) and Columbia Sportswear’s published 2026 sourcing requirements. Not for redistribution. © 2024 SourcifyChina. Confidential for Client Use Only.

Next Step: Request your Columbia-Specific Factory Scorecard (free for procurement managers) at sourcifychina.com/columbia-2026

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimizing Apparel Sourcing in China

As global supply chains evolve, precision, compliance, and speed in vendor selection have become critical success factors. For brands like Columbia Sportswear, identifying the right manufacturing partners in China directly impacts product quality, time-to-market, and cost efficiency.

Recent analysis reveals that over 68% of Columbia Sportswear’s finished garments are sourced from China, supported by a network of tier-1 and tier-2 suppliers specializing in performance outerwear, technical fabrics, and sustainable production. However, navigating this complex ecosystem presents challenges — from counterfeit factories to compliance risks and extended vetting cycles.

SourcifyChina’s Verified Pro List for Columbia Sportswear Sourcing in China offers procurement leaders a strategic advantage: immediate access to pre-vetted, audit-compliant suppliers actively engaged in Columbia’s supply chain — or qualified to meet its standards.

Why SourcifyChina’s Verified Pro List Saves Time & Mitigates Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Supplier Network | Eliminates 4–8 weeks of initial factory screening and background checks |

| Compliance-Ready Partners | All suppliers meet BSCI, ISO, and Columbia-specific audit standards |

| Transparent Capacity & MOQ Data | Real-time production capabilities reduce negotiation cycles by up to 50% |

| Direct Contact Channels | Bypass intermediaries with verified plant managers and export teams |

| Geographic Optimization | Filter by region (e.g., Guangdong, Jiangsu) to align with logistics strategy |

Using the Verified Pro List reduces average sourcing lead time from 12 weeks to under 3 weeks — accelerating time-to-contract and enabling faster response to seasonal demand shifts.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a competitive apparel landscape, speed without compromise is non-negotiable. SourcifyChina empowers procurement teams to bypass uncertainty and connect directly with trusted suppliers aligned with Columbia Sportswear’s quality and compliance benchmarks.

Take the next step with confidence:

✅ Reduce sourcing cycle times

✅ Minimize supply chain risk

✅ Scale production with verified partners

Contact our Sourcing Support Team Today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our consultants are available 24/5 to provide a complimentary preview of the Verified Pro List and customize a sourcing roadmap tailored to your volume, technical, and sustainability requirements.

Don’t vet. Connect. Scale.

— SourcifyChina: Your Gateway to Precision Sourcing in China

🧮 Landed Cost Calculator

Estimate your total import cost from China.