The global coaxial cable market is experiencing steady growth, driven by increasing demand in telecommunications, broadcasting, and broadband infrastructure. According to a report by Mordor Intelligence, the market was valued at USD 10.3 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 4.8% from 2024 to 2029. A key segment within this expansion is direct burial coaxial cables, which are engineered for underground installation without conduit, offering enhanced durability, moisture resistance, and long-term reliability. These attributes make them essential for rural broadband deployments, cable TV networks, and utility communications. With rising investments in last-mile connectivity and next-generation network infrastructure, manufacturers specializing in direct burial coaxial cables are positioned at the forefront of industry innovation. Based on global production capacity, quality certifications, market reach, and technological advancement, the following nine manufacturers represent the leading players in the direct burial coaxial cable sector.

Top 9 Coaxial Cable Direct Burial Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Direct Burial

Domain Est. 1996

Website: timesmicrowave.com

Key Highlights: This landing page displays the Direct Burial cables and assemblies. Waterproof versions of the LMR cable with an addition of a waterproofing compound….

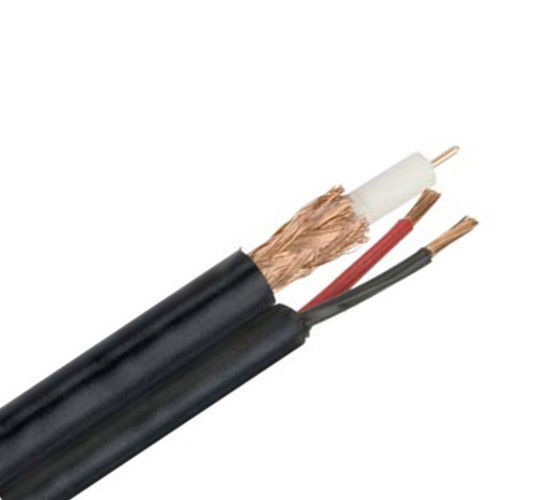

#2 RG59/U Coaxial & 18 AWG Siamese Construction Direct Burial …

Domain Est. 1998

Website: omnicable.com

Key Highlights: Download Spec Sheet RG59/U Coaxial & 18 AWG Siamese Construction Direct Burial & Sun Resistant Type CL2 or CM (ETL)…

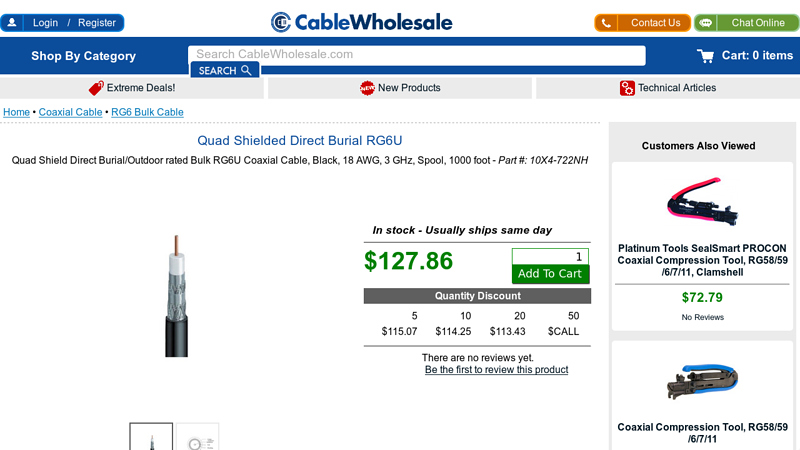

#3 Quad Shield Direct Burial RG6U, 18 AWG, 3 GHz, Spool, 1000ft

Domain Est. 1999

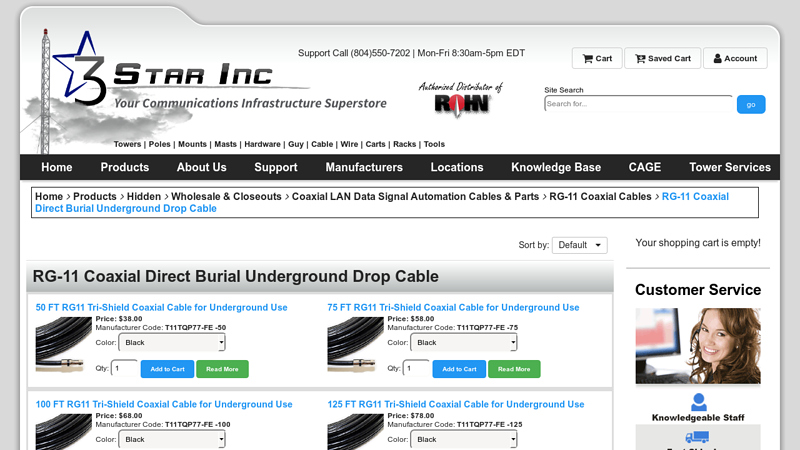

#4 RG

Domain Est. 2000

Website: 3starinc.com

Key Highlights: Free deliveryThis RG11 Cable Product is designed for Underground and Direct Burial Usage (Inside a Conduit or Out). It Features a Polyethylene Jacket with a Flooding Film or ……

#5 Direct Burial RG6 Outdoor Cable

Domain Est. 2007

#6 Direct Burial Coax

Domain Est. 2008

Website: discount-low-voltage.com

Key Highlights: Free delivery over $200 · 30-day returns…

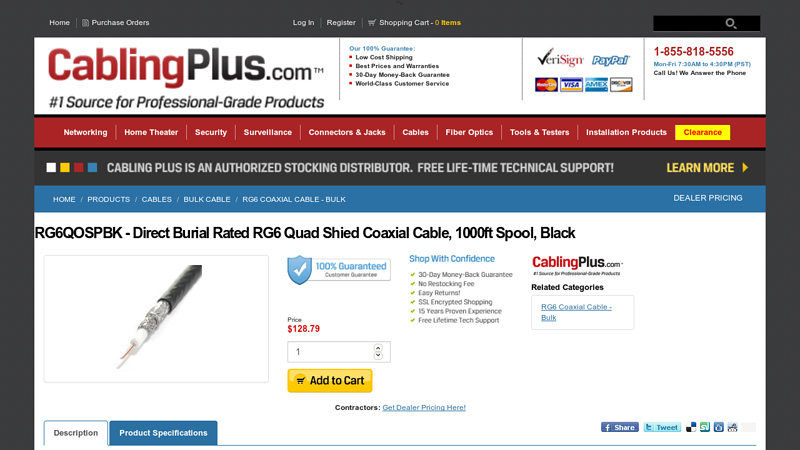

#7 Direct Burial Rated RG6 Quad Shield Coaxial Cable

Domain Est. 2008

#8 350′ length direct burial cable

Domain Est. 2014

Website: txmstore.com

Key Highlights: In stock Free deliveryRG-6 Direct Burial Coax Cable for CATV, 1,000 ft Reel. MSRP: Now: $220.00….

#9 Shop Coaxial Cable

Domain Est. 2021

Expert Sourcing Insights for Coaxial Cable Direct Burial

H2: 2026 Market Trends for Coaxial Cable Direct Burial

The global market for direct burial coaxial cables is poised for measured growth by 2026, driven by sustained demand in broadband infrastructure, evolving telecommunications standards, and regional deployment of hybrid fiber-coaxial (HFC) networks. While fiber optics continue to dominate new high-speed installations, coaxial cables—particularly direct burial variants—retain a strategic role in last-mile connectivity, rural broadband initiatives, and cost-effective network expansions.

One key trend shaping the 2026 landscape is the modernization of existing cable infrastructure. Telecommunications providers in North America and parts of Europe are upgrading legacy coaxial networks to support DOCSIS 4.0, enabling multi-gigabit speeds over existing coax lines. This backward compatibility enhances the lifecycle of coaxial cable installations, including direct burial types designed for durability and moisture resistance in underground applications. As a result, demand for high-performance, UV- and corrosion-resistant coaxial cables with improved shielding (e.g., quad-shield or foil-braided designs) is rising.

Additionally, expanding broadband access in rural and underserved areas is fueling demand for direct burial coaxial cables. In regions where full fiber-to-the-home (FTTH) deployment is economically unfeasible, cable operators are leveraging direct burial coaxial solutions to extend HFC networks. These cables offer advantages such as lower installation costs, reduced right-of-way conflicts, and faster deployment compared to aerial installations, especially in areas prone to severe weather or vegetation overgrowth.

Technological advancements are also influencing material composition and cable design. By 2026, manufacturers are increasingly adopting environmentally resilient materials—such as cross-linked polyethylene (XLPE) jackets and flooded cores—to enhance moisture and rodent resistance. These improvements align with longer service life expectations and reduced maintenance costs, critical factors for underground deployments.

Regionally, Asia-Pacific is expected to see accelerated growth due to government-backed digital inclusion programs and urban development in emerging economies. Meanwhile, North America remains a mature but steady market, supported by ongoing network maintenance and upgrades by major MSOs (Multiple System Operators).

However, market growth faces constraints. The long-term shift toward full fiber deployment poses a structural challenge, limiting coaxial cable expansion in greenfield developments. Moreover, fluctuations in copper and polyethylene prices can impact production costs and pricing strategies.

In summary, the 2026 market for direct burial coaxial cables will be characterized by niche resilience rather than explosive growth. It will thrive in upgrade cycles, hybrid network architectures, and underserved regions where cost, reliability, and deployment speed are paramount. Innovation in cable durability and signal performance will be essential for maintaining relevance in an increasingly fiber-centric ecosystem.

Common Pitfalls When Sourcing Coaxial Cable for Direct Burial

Sourcing coaxial cable rated for direct burial requires careful attention to specifications and supplier credibility. Overlooking key factors can lead to premature failure, signal loss, and costly repairs. Below are common pitfalls to avoid:

Poor Cable Quality and Substandard Materials

Many low-cost suppliers offer coaxial cables that appear suitable for direct burial but use inferior materials. These may include thin or non-uniform shielding, low-grade dielectric insulation, or inadequate jacketing. Such cables degrade quickly when exposed to moisture, UV radiation, or soil chemicals, resulting in signal attenuation and service interruptions.

Misleading or Inaccurate IP Ratings

Some vendors falsely claim high Ingress Protection (IP) ratings, such as IP68, without independent certification. A genuine IP68 rating ensures protection against continuous submersion in water under specified conditions. Always verify test reports or certifications from recognized bodies—never rely solely on vendor claims.

Lack of UV and Rodent Resistance

Direct burial cables must resist ultraviolet radiation and rodent damage. Cables without UV-stabilized jackets deteriorate when exposed during installation or in shallow trenches. Similarly, absence of a rodent barrier (e.g., armored sheathing or gel-filled cores) increases the risk of chew damage, especially in rural or agricultural areas.

Inadequate Jacketing for Soil Conditions

Not all direct burial cables are suited for every soil type. Polyethylene (PE) jackets are standard, but chemical composition matters. In acidic, alkaline, or high-moisture soils, non-resistant jackets can crack or swell. Ensure the cable is rated for the specific environmental conditions of the installation site.

Omission of Grounding and Shielding Specifications

Effective shielding (e.g., dual or quad-shield construction) is critical to prevent interference in buried runs. Poorly shielded cables can suffer from signal noise, especially near power lines or industrial equipment. Additionally, cables must support proper grounding practices—verify compatibility with grounding kits and connectors.

Insufficient Manufacturer Support and Documentation

Reputable suppliers provide detailed datasheets, installation guides, and warranty information. Sourcing from manufacturers or distributors lacking these resources increases the risk of improper installation and limited recourse in case of failure.

Ignoring Compliance with Regional Standards

Cables must meet regional electrical and safety standards (e.g., NEC Article 820 in the U.S., EN standards in Europe). Using non-compliant cable can lead to failed inspections, liability issues, and voided insurance coverage.

Avoiding these pitfalls requires due diligence: verify certifications, request sample testing, and source from reputable suppliers with proven track records in outdoor and underground installations.

Logistics & Compliance Guide for Coaxial Cable Direct Burial

Planning and Site Assessment

Before initiating a direct burial project involving coaxial cable, conduct a thorough site assessment. Evaluate soil composition, moisture levels, potential for ground shifting, and the presence of rocks or debris. Identify existing underground utilities using local “call before you dig” services (e.g., 811 in the U.S.) to avoid damage and ensure safety. Consider environmental conditions such as temperature extremes and rodent activity that may affect cable integrity over time.

Cable Selection and Specifications

Use only coaxial cables specifically rated for direct burial. These cables feature robust outer jackets made of materials like UV-resistant polyethylene or armored sheathing to protect against moisture, abrasion, and mechanical damage. Verify compliance with standards such as NEC Article 820 (U.S.) or IEC 61196 internationally. Ensure impedance, shielding, and attenuation specifications meet the system’s performance requirements.

Depth and Trenching Requirements

Excavate trenches to a minimum depth of 18–24 inches (45–60 cm) in residential areas, or as specified by local codes. Trenches under driveways, roads, or high-traffic areas may require deeper burial (typically 24–36 inches or conduit protection). Maintain a safe distance from power lines—typically at least 12 inches horizontally, as per NEC 820.47. Slope trench walls as needed for stability and safety.

Installation Best Practices

Lay the cable smoothly along the trench bottom without kinks or sharp bends. Avoid pulling with excessive tension; use cable lubricants if needed. Place a 2–4 inch (5–10 cm) layer of sand or screened soil beneath and over the cable to cushion it from rocks. Do not backfill with construction debris. Mark the cable route with tracer wire and warning tape placed 6–12 inches above the cable.

Grounding and Bonding

Properly ground all coaxial cable entry points and grounding blocks in accordance with NEC Article 820 and local electrical codes. Use UL-listed grounding clamps and conductors sized per code (typically 10 AWG copper). Bond the cable shield to the building’s grounding electrode system to prevent lightning damage and electrical surges.

Permits and Regulatory Compliance

Obtain required permits from local authorities before excavation. Ensure compliance with national, state, and municipal regulations including the National Electrical Code (NEC), local building codes, and environmental protection rules. For large-scale or public infrastructure projects, adhere to FCC regulations (e.g., for signal leakage) and environmental impact requirements.

Documentation and Recordkeeping

Maintain detailed installation records, including cable type, burial depth, route maps, splice locations, and grounding details. Submit as-built drawings to relevant stakeholders and retain copies for future maintenance or repairs. This documentation supports compliance audits and facilitates safe excavation in the future.

Inspection and Testing

Schedule a post-installation inspection by a qualified inspector or utility representative where required. Perform continuity, shielding, and signal integrity tests to verify performance. Check for water intrusion and ensure all connections are secure and properly sealed. Address any deficiencies before backfilling and finalizing the project.

Maintenance and Long-Term Monitoring

Implement a routine maintenance schedule to inspect above-ground entry points, grounding connections, and signal performance. Monitor for signs of cable degradation, excavation damage, or water ingress. Keep burial route maps updated and accessible to prevent accidental damage during future landscaping or construction.

Conclusion for Sourcing Coaxial Cable for Direct Burial:

When sourcing coaxial cable for direct burial applications, it is essential to prioritize durability, environmental resistance, and long-term performance. Direct burial coaxial cables must be specifically designed to withstand moisture, soil acidity, temperature fluctuations, and physical stress. Key factors to consider include a robust outer jacket (typically UV-resistant polyethylene), a solid or corrugated metal barrier for moisture protection, proper shielding (such as foil and braid), and a dielectric that maintains signal integrity over distance.

It is recommended to select cables that meet industry standards (such as RG-6 or RG-11 with direct burial ratings) and are certified for outdoor use (e.g., CMX or outdoor-rated). Working with reputable suppliers or manufacturers ensures product quality, compliance, and availability of technical support. Additionally, proper installation practices—including adequate depth, use of conduit where necessary, and grounding—will extend the cable’s lifespan and maintain signal performance.

In conclusion, sourcing the right direct burial coaxial cable involves balancing technical specifications, environmental suitability, and cost-efficiency. Investing in high-quality, purpose-built cable upfront minimizes maintenance, reduces signal loss, and ensures reliable long-term connectivity in outdoor or underground installations.