The global CNC parts manufacturing industry is experiencing robust expansion, driven by increasing demand for precision components across aerospace, automotive, and medical device sectors. According to a 2023 report by Grand View Research, the global CNC machine market was valued at USD 76.7 billion and is expected to grow at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. This surge is fueled by advancements in automation, rising adoption of Industry 4.0 technologies, and the critical need for high repeatability and accuracy in manufacturing. Mordor Intelligence also projects steady growth, anticipating the CNC machine market to reach USD 115.8 billion by 2028. As competition intensifies and customer expectations evolve, identifying top-tier CNC parts manufacturers has become essential for businesses seeking reliable, high-quality production partners. Based on capacity, certifications, technological capabilities, and global reach, the following ten companies represent the leaders shaping the future of precision manufacturing.

Top 10 Cnc Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 CNC Factory

Domain Est. 2013

Website: cncfactory.com

Key Highlights: Welcome to 5th Generation CNC Technology. No thinking needed. No back- breaking work. Create beautiful products by just pressing a few buttons….

#2 Haas Automation Inc.

Domain Est. 1996

Website: haascnc.com

Key Highlights: Haas Automation is the largest machine tool builder in the western world, manufacturing a complete line of CNC vertical machining centers, ……

#3 Makino

Domain Est. 1996

Website: makino.com

Key Highlights: Achieve superior results with Makino’s CNC machining. Makino machines and engineering services provide precision and reliability across applications….

#4 Rottler Manufacturing

Domain Est. 1998

Website: rottlermfg.com

Key Highlights: A complete range of 5 Axis CNC Head Porting Machines, Automatic Tool Changer, Multi Purpose CNC, Seat & Guide Machines, Honing Machines, Connecting Rod ……

#5 eMachineShop

Domain Est. 1999

Website: emachineshop.com

Key Highlights: eMachineShop manufactures low-cost prototype and production runs of custom parts. Get a fast quote or design and order your parts with our free CAD software ……

#6 MultiSource Manufacturing

Domain Est. 2002

Website: multisourcemfg.com

Key Highlights: MultiSource Manufacturing is a precision machining company and full-service supply chain partner specializing in tight tolerance components….

#7 Aerostar Mfg

Domain Est. 2003

Website: aerostarmfg.com

Key Highlights: Learn about Aerostar’s manufacturing capabilities from casting to CNC production machining ensuring high standards for automotive, manufacturing & more….

#8 CNCShop USA

Domain Est. 2005

Website: cncshop.com

Key Highlights: 3-day delivery 30-day returnsCNC Shop is One-Stop Shop of Premium parts for CNC Routers & WaterJet Machines. Shop Online for all AXYZ routers & WARDJet parts….

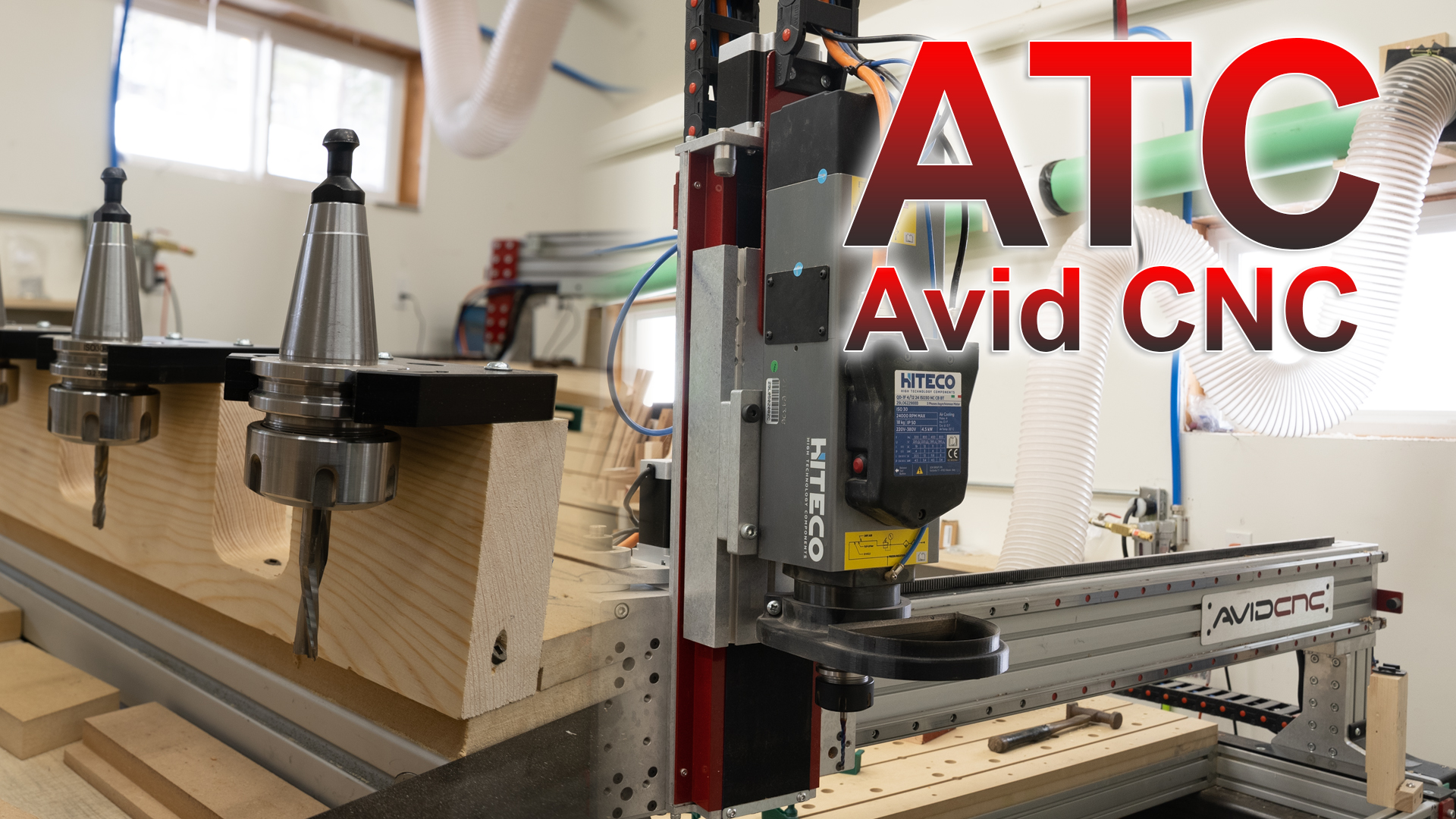

#9 Avid CNC

Domain Est. 2016

Website: avidcnc.com

Key Highlights: AVID CNC is an excellent partner and supplier of both hardware and knowledge. With their help we have been able to build the custom machines tailored for ……

#10 Online CNC Machine Shop

Domain Est. 2016

Website: parts-badger.com

Key Highlights: PartsBadger is Your Online CNC Machine Shop. Get a rapid quote on your parts. Based in Greater Milwaukee, WI with reps nationwide. Get started today!…

Expert Sourcing Insights for Cnc Parts

H2: Analysis of 2026 Market Trends for CNC Parts

The global market for CNC (Computer Numerical Control) parts is poised for significant transformation by 2026, driven by technological innovation, evolving manufacturing demands, and macroeconomic shifts. This analysis explores key trends shaping the CNC parts sector, including advancements in automation, rising demand in high-tech industries, regional market dynamics, and the growing influence of sustainability and digital integration.

-

Increased Adoption of Smart Manufacturing and Industry 4.0

By 2026, CNC machining is expected to be deeply integrated into smart factories powered by Industry 4.0 principles. The use of IoT-enabled CNC machines, real-time data monitoring, and AI-driven predictive maintenance will enhance precision, reduce downtime, and improve production efficiency. CNC parts manufacturers are investing in machine connectivity and digital twins to simulate and optimize machining processes before physical production, reducing waste and accelerating time-to-market. -

Growth in High-Precision and Customized Components

Industries such as aerospace, medical devices, electric vehicles (EVs), and renewable energy are demanding increasingly complex and high-tolerance CNC-machined parts. This trend is pushing suppliers to adopt multi-axis CNC machines (5-axis and beyond) capable of producing intricate geometries with minimal human intervention. Customization and rapid prototyping will become standard offerings, particularly in sectors requiring short production runs and iterative design improvements. -

Expansion in Electric Vehicle and Renewable Energy Sectors

The global push toward electrification and carbon neutrality is fueling demand for CNC-machined components in EV motors, battery housings, power electronics, and wind turbine systems. By 2026, CNC parts producers will play a critical role in the EV supply chain, offering lightweight, high-strength components made from advanced materials such as aluminum alloys and titanium. Growth in solar and wind infrastructure projects will further increase demand for precision gears, shafts, and structural CNC parts. -

Regional Shifts and Supply Chain Resilience

Geopolitical factors and supply chain disruptions have prompted a reevaluation of manufacturing footprints. Nearshoring and reshoring trends, especially in North America and Europe, are expected to benefit local CNC machining hubs. Meanwhile, Asia-Pacific—particularly China, India, and Vietnam—will remain dominant due to cost advantages and growing domestic demand. Investment in automation will help lower-cost regions maintain competitiveness while improving quality consistency. -

Sustainability and Green Machining Practices

Environmental regulations and corporate ESG (Environmental, Social, and Governance) goals are pushing CNC manufacturers to adopt greener practices. By 2026, expect wider use of energy-efficient machines, recycling of metal chips and coolant, and optimization of toolpaths to reduce material waste. Sustainable sourcing of raw materials and carbon footprint tracking throughout the production cycle will become competitive differentiators. -

Rise of Hybrid Manufacturing and Additive Integration

Hybrid CNC machines that combine subtractive machining with additive manufacturing (3D printing) are gaining traction. This convergence allows for the production of complex parts with internal features that would be impossible using traditional methods. By 2026, hybrid systems will be increasingly used in aerospace, defense, and high-performance engineering applications, enabling faster iteration and material savings. -

Labor Shortages and Workforce Automation

Despite technological advances, the CNC machining industry continues to face skilled labor shortages. This challenge is accelerating investments in automation, including robotic palletizing, automated tool changers, and lights-out manufacturing. By 2026, fully automated CNC cells capable of running unattended for extended periods will become more common, especially among mid- to large-scale manufacturers.

Conclusion

The 2026 CNC parts market will be characterized by higher levels of automation, smarter production systems, and deeper integration into advanced industries. Companies that embrace digitalization, sustainability, and flexibility will gain a strategic edge. As global manufacturing evolves, CNC machining will remain a cornerstone of precision engineering, adapting to meet the demands of a faster, cleaner, and more connected industrial landscape.

Common Pitfalls When Sourcing CNC Parts: Quality and Intellectual Property

Sourcing CNC (Computer Numerical Control) machined parts, especially from overseas or third-party vendors, introduces several risks. Two of the most critical areas where businesses often encounter problems are quality control and intellectual property (IP) protection. Overlooking these aspects can lead to production delays, increased costs, legal disputes, and reputational damage.

Quality-Related Pitfalls

Inconsistent Material Specifications

One of the most frequent quality issues arises when suppliers substitute specified materials with cheaper or non-compliant alternatives. Without proper verification—such as material test reports (MTRs) or third-party certification—this can compromise part performance, durability, and safety, particularly in industries like aerospace, medical, or automotive.

Poor Dimensional Accuracy and Tolerances

CNC machining is prized for precision, but not all shops maintain consistent quality control. Parts may fall outside required tolerances due to machine calibration issues, operator error, or inadequate inspection processes. Lack of proper documentation (e.g., first article inspection reports or CMM results) makes it difficult to validate conformance.

Inadequate Surface Finish and Post-Processing

Surface finish, deburring, and secondary operations (e.g., anodizing, plating, heat treatment) are often overlooked in initial sourcing. Suppliers may deliver parts that meet dimensional specs but fail in function due to rough edges, improper coatings, or residual stresses, leading to assembly or performance issues.

Lack of Process Documentation and Traceability

Reliable suppliers provide detailed process documentation, including tool paths, inspection plans, and batch traceability. When this is missing, diagnosing quality failures becomes challenging, and repeat issues are more likely. This is especially critical for regulated industries requiring full audit trails.

Insufficient Quality Assurance Systems

Working with suppliers that lack certified quality management systems (e.g., ISO 9001) increases the risk of inconsistent output. Without standardized procedures, corrective actions, and internal audits, long-term reliability cannot be assured.

Intellectual Property-Related Pitfalls

Unprotected Design Files and Drawings

Sharing CAD files, technical drawings, or tooling designs without proper legal safeguards exposes companies to IP theft. Suppliers may replicate or sell designs to competitors, especially in regions with weak IP enforcement. Using unencrypted or unrestricted files heightens this risk.

Absence of Strong Legal Agreements

Many businesses fail to implement comprehensive Non-Disclosure Agreements (NDAs) or manufacturing agreements that explicitly define IP ownership, usage rights, and confidentiality obligations. Without such contracts, legal recourse in case of infringement is limited or nonexistent.

Unauthorized Tooling and Mold Replication

When custom tooling or fixtures are created for a part, suppliers may retain ownership or replicate them without permission. This allows them to produce and sell identical parts to other customers, diluting the original company’s market advantage.

Reverse Engineering Risks

Even without direct access to design files, suppliers can reverse-engineer physical parts. If no contractual or technical controls (e.g., watermarking, obfuscating critical dimensions) are in place, this can lead to counterfeit production.

Jurisdictional IP Enforcement Challenges

Sourcing from countries with less stringent IP laws makes enforcement difficult. Even with solid contracts, pursuing legal action abroad can be costly, time-consuming, and ineffective, leaving companies vulnerable despite best efforts.

Mitigation Strategies

To avoid these pitfalls, businesses should:

– Require material certifications and conduct incoming inspections.

– Define and verify tolerances and surface finishes in procurement specs.

– Use NDAs and manufacturing agreements that clearly assign IP ownership.

– Limit access to sensitive design data and use digital rights management (DRM).

– Audit supplier quality systems and request process documentation.

– Consider local or nearshore sourcing for high-value or IP-sensitive components.

By proactively addressing quality and IP concerns, companies can reduce risk and ensure reliable, secure CNC part sourcing.

Logistics & Compliance Guide for CNC Parts

Overview of CNC Parts in Global Trade

CNC (Computer Numerical Control) parts are precision-engineered components widely used in industries such as aerospace, automotive, medical devices, and industrial machinery. Due to their technical specifications and global demand, shipping and importing CNC parts require careful attention to logistics and regulatory compliance.

Classification and Harmonized System (HS) Codes

Proper classification under the Harmonized System (HS) is essential for customs clearance and tariff assessment. CNC parts are typically classified under HS codes related to the material and function of the component. Common categories include:

– 8484: Gaskets and packing; mechanical seals

– 8466: Parts and accessories for machine tools (e.g., CNC lathes, milling machines)

– 7308: Structural elements of iron or steel (if applicable)

– 7616: Other articles of aluminum (for aluminum-machined parts)

Accurate classification ensures correct duty rates and helps avoid customs delays.

Export Controls and Dual-Use Regulations

Some CNC parts—especially those used in aerospace, defense, or high-precision technology—may be subject to export controls due to their potential dual-use (civilian and military applications). Key regulations include:

– ITAR (International Traffic in Arms Regulations) – Applies if parts are listed on the U.S. Munitions List (USML)

– EAR (Export Administration Regulations) – Administered by the U.S. Department of Commerce; governs dual-use items under the Commerce Control List (CCL)

– Wassenaar Arrangement – Multilateral export control regime followed by many countries

Manufacturers must determine if their CNC parts require export licenses based on technical specifications, destination country, and end-use.

Packaging and Shipping Best Practices

To ensure safe delivery and compliance with carrier requirements:

– Use anti-corrosion packaging (e.g., VCI paper) for metal components

– Secure parts to prevent movement during transit; use custom foam inserts or wooden crates for fragile or high-value items

– Clearly label packages with part numbers, customer PO, and handling instructions (e.g., “Fragile,” “Do Not Stack”)

– Include a detailed packing list and commercial invoice inside and outside the shipment

Documentation Requirements

Complete and accurate documentation is critical for customs clearance. Required documents typically include:

– Commercial Invoice – Must include description, quantity, value, HS code, country of origin, and terms of sale (e.g., Incoterms®)

– Packing List – Details weight, dimensions, and contents of each package

– Certificate of Origin – Required by some countries for preferential tariff treatment (e.g., under USMCA, EU trade agreements)

– Export Declaration (e.g., AES in the U.S.) – Mandatory for shipments above a certain value

– Material Certifications – Such as mill test reports (MTRs) or RoHS/REACH compliance for regulated materials

Incoterms® and Responsibility Allocation

Choosing the correct Incoterms® rule clarifies responsibilities between buyer and seller:

– EXW (Ex Works) – Buyer arranges and pays for all logistics from seller’s facility

– FCA (Free Carrier) – Seller delivers goods to a carrier; risk transfers at that point

– DAP (Delivered at Place) – Seller bears all costs and risks to destination but not unloading

– DDP (Delivered Duty Paid) – Seller handles all logistics, import clearance, and duties

Selecting the appropriate term prevents disputes and ensures clarity on cost and liability.

Import Duties and Taxes

Importers are responsible for paying duties and taxes based on:

– Declared value of goods (customs value)

– Applicable tariff rates in the destination country

– Local VAT, GST, or other consumption taxes

– Possible anti-dumping or countervailing duties on certain metal parts

Conducting a duty optimization analysis (e.g., using free trade agreements or bonded warehouses) can reduce costs.

Compliance with Product Safety and Environmental Standards

CNC parts may need to meet destination-specific standards, especially in regulated industries:

– RoHS and REACH (EU) – Restrict hazardous substances in electrical and electronic components

– FDA Regulations – For CNC parts used in medical devices

– ISO 9001/AS9100 – Quality management standards often required by buyers

Ensure traceability and documentation of compliance during manufacturing and shipping.

Recordkeeping and Audit Preparedness

Maintain records for a minimum of 5 years (longer in some jurisdictions), including:

– Export licenses and authorizations

– Shipping documents and customs filings

– Compliance certifications and test reports

– Internal classification and screening decisions

These records support audits and demonstrate adherence to trade regulations.

Risk Mitigation and Carrier Selection

Work with experienced freight forwarders familiar with precision components and international trade compliance. Consider:

– Insuring high-value shipments against loss or damage

– Using trackable and secure transportation modes (air, sea, or express courier)

– Screening customers and end-users against denied party lists (e.g., OFAC, BIS)

Proactive risk management reduces delays, penalties, and reputational damage.

Conclusion

Successfully managing the logistics and compliance of CNC parts requires a structured approach to classification, documentation, export controls, and transportation. By adhering to international standards and maintaining accurate records, companies can ensure timely delivery, regulatory compliance, and customer satisfaction in global markets.

In conclusion, sourcing CNC parts requires a strategic approach that balances quality, cost, lead time, and supplier reliability. By clearly defining specifications, selecting the right materials, and choosing experienced and certified manufacturers—whether local or overseas—businesses can ensure precision, consistency, and scalability in their production processes. Leveraging digital manufacturing platforms and requesting prototypes or samples can further mitigate risks and improve decision-making. Ultimately, successful CNC part sourcing hinges on strong communication, thorough evaluation of capabilities, and ongoing quality control, enabling companies to integrate high-performance components efficiently into their operations.