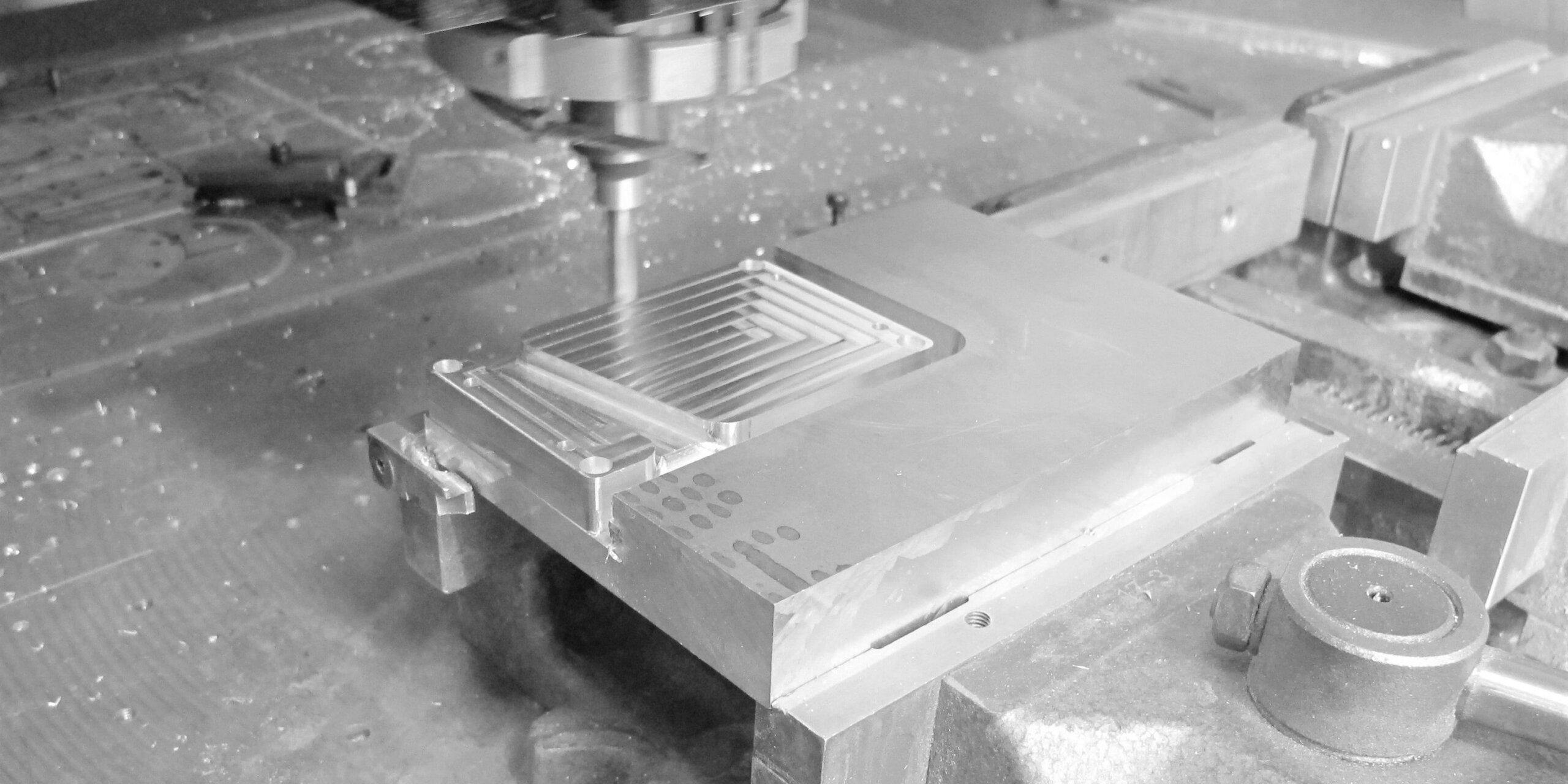

The global CNC metal cutting machine market is experiencing robust growth, driven by increasing demand for high-precision machining across industries such as aerospace, automotive, and heavy machinery. According to a report by Mordor Intelligence, the CNC machine tools market was valued at USD 92.78 billion in 2023 and is projected to reach USD 133.34 billion by 2029, growing at a CAGR of approximately 6.3% during the forecast period. This expansion is fueled by advancements in automation, the integration of AI and IoT in manufacturing, and rising adoption of smart factory technologies. As industries prioritize efficiency, accuracy, and scalable production, the role of leading CNC metal cutter manufacturers becomes increasingly critical. These companies are not only innovating in machine performance and reliability but are also setting benchmarks in energy efficiency and digital connectivity. Based on market presence, technological capabilities, customer feedback, and production scale, the following list highlights the top 10 CNC metal cutter manufacturers shaping the future of modern manufacturing.

Top 10 Cnc Metal Cutter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Haas Automation Inc.

Domain Est. 1996

Website: haascnc.com

Key Highlights: Haas Automation is the largest machine tool builder in the western world, manufacturing a complete line of CNC vertical machining centers, ……

#2 Makino

Domain Est. 1996

Website: makino.com

Key Highlights: Achieve superior results with Makino’s CNC machining. Makino machines and engineering services provide precision and reliability across applications….

#3 MultiCam Inc.

Domain Est. 1996

Website: multicam.com

Key Highlights: MultiCam is a premier CNC Cutting Machine company, producing knife, waterjet and router cutting machines for your application and budget….

#4 Mazak Leading Laser Machine Manufacturer

Domain Est. 1998

Website: mazak.com

Key Highlights: Mazak provides products and solutions that can support a wide range of parts machining processes, such as high-speed and high-accuracy machines….

#5 Tormach

Domain Est. 2002

Website: tormach.com

Key Highlights: Tormach makes CNC machines and automation tools that offer precision across a range of materials, without the need for expensive industrial three-phase power….

#6 Wattsan

Domain Est. 2016

Website: wattsan.com

Key Highlights: Wattsan is a manufacturer of laser and cnc milling machines of European quality at affordable prices with worldwide delivery….

#7 Fiber Laser Cutting Machine and CO2 Laser Cutter Manufacturer …

Domain Est. 2016

Website: gwklaser.com

Key Highlights: Leading manufacturer of laser cutting machine, CO2 laser cutter, laser welding machine, laser bending machine and laser cleaning machine, etc….

#8 Langmuir Systems

Domain Est. 2017

Website: langmuirsystems.com

Key Highlights: Powerful, affordable, and well-supported CNC Machines for hobbyists, small business owners, educational institutions, and industrial facilities….

#9 PlasmaCAM

Domain Est. 1999

Website: plasmacam.com

Key Highlights: The PlasmaCAM machine cuts flat shapes out of metal with incredible precision and speed. Cut steel, stainless steel, galvanized steel, aluminum, copper, brass, ……

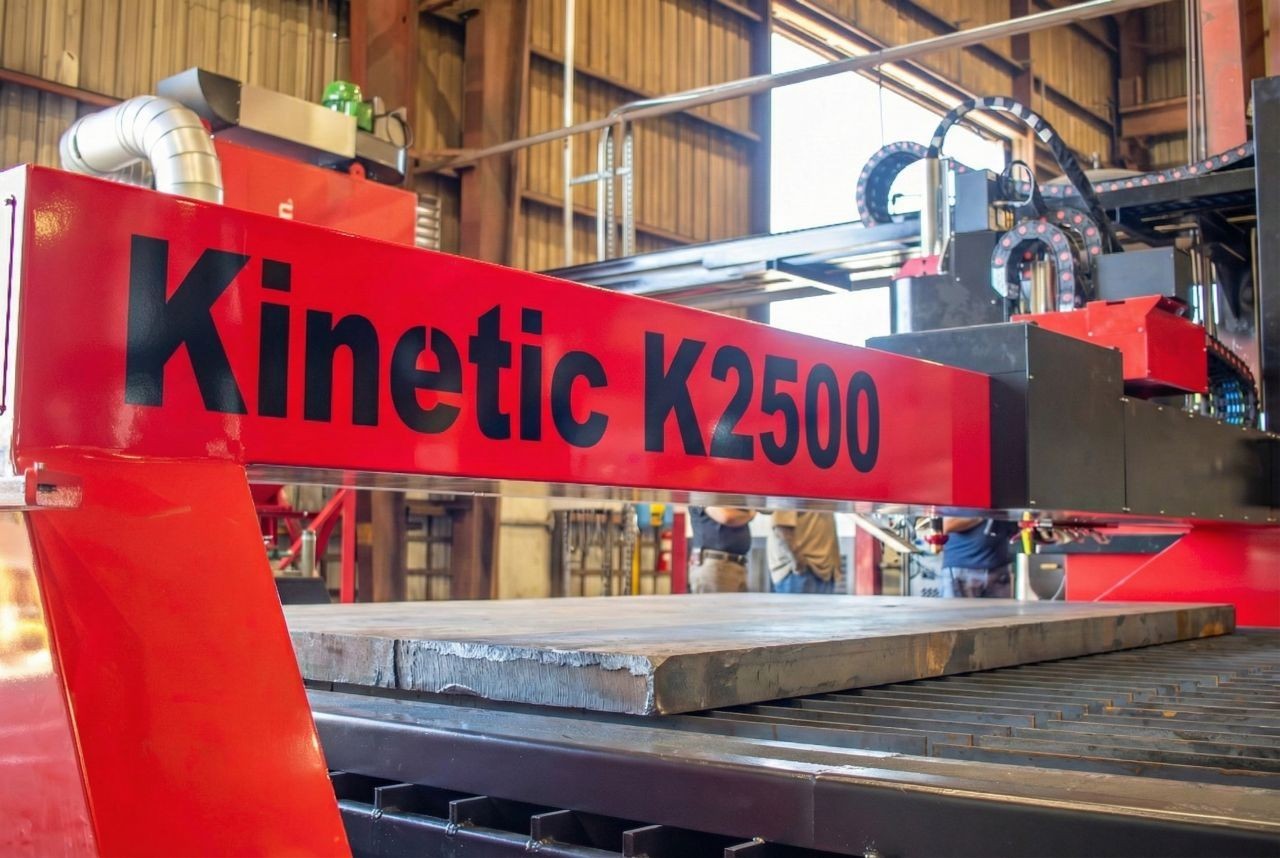

#10 Kinetic

Domain Est. 2000

Website: kineticusa.com

Key Highlights: We’re a productivity company. Our innovative large format laser cutting systems, plasma cutting machines and combination cutting, drilling and milling machines ……

Expert Sourcing Insights for Cnc Metal Cutter

2026 Market Trends for CNC Metal Cutters

The global market for CNC (Computer Numerical Control) metal cutters is poised for significant transformation by 2026, driven by technological innovation, evolving manufacturing demands, and macroeconomic shifts. As industries prioritize precision, efficiency, and automation, CNC metal cutting machines are becoming increasingly integral across sectors such as aerospace, automotive, energy, and industrial manufacturing. This analysis explores key market trends expected to shape the CNC metal cutter landscape in 2026.

Rising Demand for Automation and Smart Manufacturing

One of the most prominent drivers of the CNC metal cutter market by 2026 is the accelerated adoption of automation and Industry 4.0 technologies. Manufacturers are integrating smart CNC systems equipped with IoT (Internet of Things) connectivity, real-time monitoring, and predictive maintenance capabilities. These intelligent machines can communicate with other factory systems, optimize cutting parameters dynamically, and reduce downtime. As labor costs rise and skilled labor shortages persist, particularly in developed economies, automated CNC solutions offer scalable and consistent production, fueling market growth.

Advancements in Laser and Plasma Cutting Technologies

Technological progress in laser and plasma cutting systems is redefining the capabilities of CNC metal cutters. By 2026, high-power fiber lasers are expected to dominate the market due to their superior energy efficiency, faster cutting speeds, and ability to process reflective metals like copper and aluminum. Innovations such as hybrid laser-plasma systems and adaptive beam control are enhancing precision and reducing operational costs. Additionally, green laser technology is emerging as a solution for challenging materials, expanding the range of applications in high-end manufacturing.

Growth in Aerospace and Automotive Sectors

The aerospace and automotive industries are major consumers of precision metal components, and their continued expansion is a key factor driving CNC metal cutter demand. In aerospace, the push for lightweight, high-strength components made from titanium, Inconel, and advanced alloys necessitates high-accuracy CNC cutting systems. Similarly, the rise of electric vehicles (EVs) is increasing the need for precisely cut motor components, battery enclosures, and structural parts. CNC machines that support multi-axis machining and high-speed cutting are especially in demand to meet these rigorous specifications.

Regional Market Shifts and Supply Chain Reconfiguration

Geopolitical factors and supply chain resilience are influencing regional CNC metal cutter markets. By 2026, North America and Europe are expected to see increased investment in onshoring and nearshoring of manufacturing, driven by trade policies and supply chain security concerns. This shift is boosting local demand for advanced CNC equipment. Meanwhile, Asia-Pacific—particularly China, India, and Southeast Asia—will remain the largest market due to rapid industrialization, government support for manufacturing (e.g., “Make in India,” “Smart Manufacturing” initiatives), and expanding infrastructure projects.

Sustainability and Energy Efficiency Focus

Environmental regulations and corporate sustainability goals are pushing CNC machine manufacturers to develop more energy-efficient and eco-friendly systems. By 2026, CNC metal cutters with lower power consumption, reduced coolant usage, and closed-loop recycling systems will gain market favor. Additionally, manufacturers are exploring alternative cutting methods—such as waterjet and cold plasma—that minimize heat-affected zones and environmental impact, especially in sensitive applications.

Integration with AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are increasingly being embedded into CNC control systems. These technologies enable adaptive learning from past operations, optimizing tool paths, detecting anomalies, and improving cutting quality over time. By 2026, AI-driven CNC platforms will offer predictive programming, reducing material waste and enhancing productivity. This trend is particularly beneficial for small-batch, high-mix production environments common in job shops and custom fabrication.

Conclusion

The CNC metal cutter market in 2026 will be defined by smarter, faster, and more sustainable technologies. Growth will be fueled by automation, sector-specific demand, and digital integration, while regional dynamics and environmental considerations will shape investment patterns. Companies that embrace innovation, offer scalable solutions, and align with Industry 4.0 principles will be well-positioned to lead in this evolving market landscape.

Common Pitfalls When Sourcing CNC Metal Cutters: Quality and Intellectual Property Risks

Sourcing CNC metal cutters, especially from international suppliers, can present significant challenges related to both product quality and intellectual property (IP) protection. Being aware of these pitfalls is crucial for ensuring a successful procurement process and safeguarding your business interests.

Quality-Related Pitfalls

Inaccurate or Overstated Machine Specifications

Suppliers may exaggerate performance metrics such as cutting speed, precision (tolerances), spindle power, or tool life. This can lead to machines that fail to meet production requirements, resulting in rework, downtime, and increased costs. Always verify specifications through third-party testing or on-site demonstrations.

Use of Substandard Components

Some manufacturers cut costs by using low-quality bearings, motors, linear guides, or control systems. These components degrade faster, reduce machine accuracy over time, and increase maintenance needs. Request detailed component lists and insist on reputable brands (e.g., Fanuc, Siemens, THK, or NSK).

Inadequate Build Quality and Calibration

Poor assembly practices or insufficient factory calibration can lead to misalignment, vibration, and inconsistent cutting performance. Machines may require extensive rework upon arrival. Opt for suppliers with documented quality control processes and request ISO 9001 certification.

Lack of After-Sales Support and Spare Parts Availability

Even high-quality machines require maintenance and repairs. Sourcing from suppliers without reliable technical support or accessible spare parts—especially overseas—can result in prolonged downtime. Confirm service response times and spare parts logistics before purchase.

Inconsistent Batch-to-Batch Quality

Especially with high-volume manufacturers, quality can vary between production runs. Implement a clear acceptance protocol and consider third-party inspection before shipment to ensure consistency.

Intellectual Property-Related Pitfalls

Unauthorized Replication of Designs or Software

Some CNC suppliers may reverse-engineer or copy patented machine designs, control systems, or proprietary software. Purchasing such equipment can expose your business to legal liability, particularly if the machine infringes on third-party IP rights in your region.

Embedded Pirated or Unlicensed Software

CNC machines often run on proprietary control software (e.g., CAM or CNC operating systems). Suppliers may install unlicensed or pirated versions to reduce costs. Using such software violates copyright laws and can lead to legal action, compliance audits, or forced shutdowns.

Data and Program Security Risks

Machines with internet connectivity or cloud-based features may transmit operational data or stored cutting programs back to the manufacturer. Without clear agreements, your proprietary machining processes could be compromised or exploited.

Lack of IP Clauses in Contracts

Many sourcing agreements fail to define ownership of custom modifications, software updates, or process data. This ambiguity can lead to disputes over who owns improvements or adaptations made during use.

Supply Chain Transparency Gaps

When sourcing through intermediaries or OEMs, it can be difficult to trace the original manufacturer. This opacity increases the risk of inadvertently acquiring equipment with questionable IP provenance.

Mitigation Strategies

To avoid these pitfalls:

– Conduct thorough due diligence on suppliers, including site audits and reference checks.

– Require certification documentation for components and software licenses.

– Include strong IP indemnification clauses in procurement contracts.

– Use third-party inspection services for quality verification.

– Consult legal experts to assess IP risks, especially when sourcing from high-risk jurisdictions.

By proactively addressing both quality and IP concerns, businesses can reduce risk and ensure they acquire reliable, compliant CNC metal cutting equipment.

Logistics & Compliance Guide for CNC Metal Cutter

Overview

This guide outlines the essential logistics considerations and compliance requirements for managing and operating a CNC (Computer Numerical Control) metal cutting machine. Proper handling of transportation, installation, safety, environmental regulations, and documentation ensures operational efficiency and legal adherence.

Equipment Transportation & Handling

Ensure the CNC metal cutter is transported securely using appropriate methods. Use crated packaging with shock-absorbing materials to prevent damage during transit. Utilize forklifts or lifting equipment with adequate load capacity for unloading. Always follow the manufacturer’s handling instructions and avoid tilting or dropping the machine.

Site Preparation & Installation

Prepare a level, vibration-resistant foundation capable of supporting the machine’s weight. Ensure adequate space for operation, maintenance, and material handling. Provide proper electrical supply (voltage, phase, grounding) and compressed air if required. Install in a controlled environment with stable temperature and low dust levels. Follow the manufacturer’s installation manual and involve certified technicians.

Regulatory Compliance

Adhere to all local, national, and international regulations. Key compliance areas include:

– OSHA (Occupational Safety and Health Administration): Ensure machine guarding, lockout/tagout (LOTO) procedures, and employee training are in place.

– ISO Standards: Follow ISO 12100 (safety of machinery) and ISO 2768 (geometric tolerances) as applicable.

– CE Marking (EU): Confirm the machine complies with EU Machinery Directive (2006/42/EC) if operating in Europe.

– EPA Regulations: Comply with emissions and waste disposal rules, especially regarding metal coolants and swarf.

Safety Protocols

Implement strict safety practices:

– Install emergency stop buttons within easy reach.

– Use protective enclosures and light curtains to prevent access during operation.

– Provide appropriate personal protective equipment (PPE): safety glasses, hearing protection, gloves, and steel-toed boots.

– Conduct regular safety training and machine-specific hazard assessments.

Environmental Management

Manage waste materials responsibly:

– Collect metal chips (swarf) in designated containers for recycling.

– Treat and dispose of cutting fluids according to environmental regulations.

– Prevent coolant leaks and implement spill containment measures.

– Monitor air quality if dust or fumes are generated; use extraction systems as needed.

Maintenance & Calibration

Follow a scheduled maintenance program as specified by the manufacturer. Keep logs for lubrication, component inspections, and software updates. Periodically calibrate the machine to ensure precision and repeatability. Use only authorized spare parts to maintain compliance and warranty validity.

Documentation & Recordkeeping

Maintain comprehensive records, including:

– Machine manuals and safety data sheets (SDS) for coolants and materials.

– Maintenance logs and calibration certificates.

– Employee training records and safety inspection reports.

– Import/export documentation if relocating the machine across borders (e.g., commercial invoice, bill of lading, customs forms).

Import/Export Considerations

When moving the CNC machine internationally:

– Verify export controls (e.g., EAR or ITAR) if the machine has advanced capabilities.

– Classify the machine under the correct HS code for customs.

– Obtain necessary permits or licenses for controlled technology.

– Work with a licensed freight forwarder experienced in industrial equipment.

Operator Training & Certification

Ensure all operators are formally trained on the specific CNC model. Training should cover programming, tooling setup, emergency procedures, and quality control. Maintain certification records and conduct periodic refresher courses to ensure continued compliance and safety.

Conclusion

Effective logistics and compliance management for a CNC metal cutter reduces downtime, ensures workplace safety, and avoids regulatory penalties. By following this guide, businesses can maintain efficient, legal, and safe CNC operations.

Conclusion for Sourcing a CNC Metal Cutter

Sourcing a CNC metal cutter is a strategic decision that significantly impacts manufacturing efficiency, product quality, and long-term operational costs. After evaluating suppliers, machine specifications, pricing, after-sales support, and technological capabilities, it is essential to select a solution that aligns with your production volume, material requirements, and precision needs. Investing in a reliable and scalable CNC metal cutting system from a reputable supplier ensures improved accuracy, reduced waste, and enhanced productivity. Additionally, considering factors such as service support, training, and future maintenance will contribute to sustained performance and minimal downtime. Ultimately, a well-informed sourcing decision leads to a solid return on investment and strengthens competitive advantage in the evolving manufacturing landscape.