Sourcing Guide Contents

Industrial Clusters: Where to Source Cnc Machining Companies China

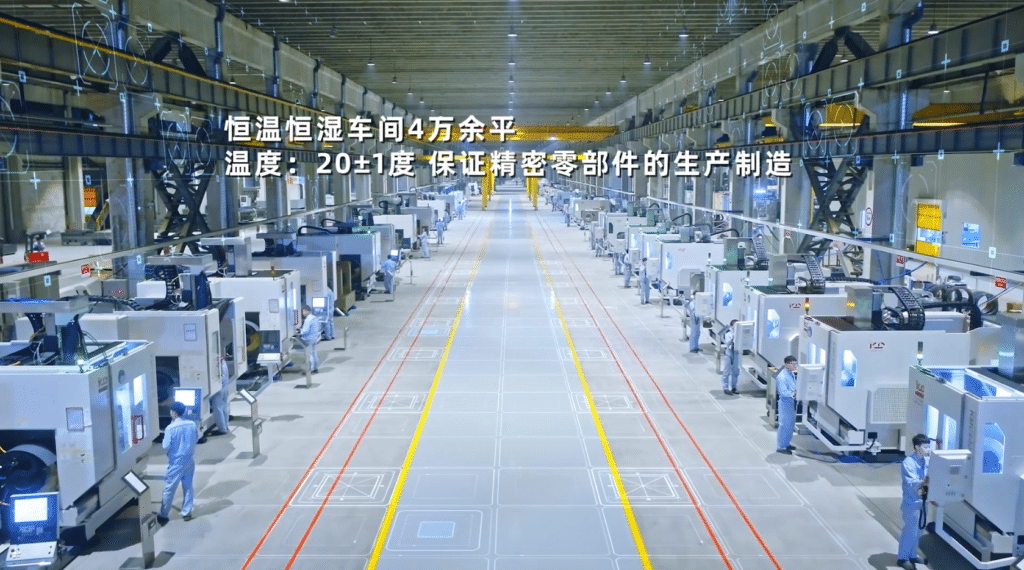

SourcifyChina

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing CNC Machining Services from China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

China remains the global leader in precision CNC machining services, offering competitive pricing, scalable production capacity, and increasingly sophisticated manufacturing capabilities. As global supply chains recalibrate post-pandemic and amid rising automation demands, procurement leaders are prioritizing strategic engagement with Chinese CNC machining partners. This report provides a comprehensive analysis of key industrial clusters in China specializing in CNC machining, with a comparative evaluation of regional strengths in price, quality, and lead time.

The analysis focuses on provinces and cities that form the backbone of China’s precision manufacturing ecosystem: Guangdong, Zhejiang, Jiangsu, Shanghai, and Shandong. These regions collectively account for over 70% of China’s precision CNC machining output and serve as primary sourcing destinations for industrial equipment, medical devices, automotive components, and consumer electronics across North America, Europe, and Southeast Asia.

Key Industrial Clusters for CNC Machining in China

China’s CNC machining industry is highly regionalized, with clusters forming around industrial hubs that offer robust supply chains, skilled labor, and government-backed infrastructure. Below are the top provinces and cities known for high-capacity, precision CNC machining:

| Province | Key Cities | Industrial Focus | Notable Advantages |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | Electronics, Consumer Goods, Automation | Proximity to Shenzhen’s tech ecosystem; high-speed prototyping; strong export logistics |

| Zhejiang | Ningbo, Hangzhou, Yiwu | Automotive Parts, Industrial Machinery, Fasteners | High concentration of SME machining shops; cost efficiency; strong mold-making heritage |

| Jiangsu | Suzhou, Wuxi, Changzhou | Aerospace, Medical Devices, Semiconductor Equipment | Advanced manufacturing zones; German/Japanese joint ventures; high precision standards |

| Shanghai | Shanghai (incl. Jiading, Fengxian) | High-End Industrial Components, R&D Prototypes | Access to global OEMs; multilingual workforce; ISO & AS9100 certified facilities |

| Shandong | Qingdao, Yantai, Jinan | Heavy Machinery, Marine Components, Rail Systems | Lower labor costs; large-scale production; strong metallurgy base |

Comparative Analysis: Key Production Regions

The following table evaluates the five leading CNC machining regions in China based on three critical sourcing KPIs: Price Competitiveness, Quality Consistency, and Average Lead Time. Ratings are derived from SourcifyChina’s 2025 supplier benchmarking data across 127 verified machining partners.

| Region | Price (1–5) (5 = Most Competitive) |

Quality (1–5) (5 = Highest Consistency) |

Lead Time (Days) (Standard Batch Order: 500 pcs, Multi-Axis Milling/Turning) |

Best For |

|---|---|---|---|---|

| Guangdong | 4 | 4.5 | 12–18 | Rapid prototyping, electronics enclosures, high-mix production |

| Zhejiang | 5 | 3.8 | 15–20 | High-volume commodity parts, cost-sensitive projects, fastener integration |

| Jiangsu | 3.5 | 5 | 10–16 | Aerospace, medical, and semiconductor-grade components |

| Shanghai | 3 | 5 | 12–15 | High-specification OEM parts, export-compliant batches, bilingual project management |

| Shandong | 5 | 3.5 | 18–25 | Large-scale industrial components, heavy-duty machining, raw material integration |

Rating Notes:

– Price: Based on average USD/unit for standardized aluminum 6061 part (100mm x 50mm x 20mm, 5-axis). Includes setup, material, QC, and packaging.

– Quality: Assessed via defect rate (PPM), CMM reporting availability, certification coverage (ISO 9001, IATF 16949, AS9100), and rework frequency.

– Lead Time: Includes CNC programming, machining, inspection, and domestic shipping to port. Excludes international transit.

Strategic Sourcing Recommendations

-

For High-Mix, Low-Volume & Fast Turnaround:

→ Prioritize Guangdong (Shenzhen/Dongguan). Ideal for tech startups and R&D departments needing agile manufacturing. -

For Cost-Optimized Volume Production:

→ Leverage Zhejiang suppliers, particularly in Ningbo, where vertically integrated supply chains reduce material handling costs. -

For Mission-Critical, High-Precision Applications:

→ Select Jiangsu or Shanghai partners with aerospace or medical certifications. These facilities adhere to Six Sigma processes and offer full traceability. -

For Large or Heavy Components:

→ Consider Shandong for its heavy-duty CNC gantry mills and lower labor overhead, especially for marine or rail sectors.

Risk & Mitigation Insights (2026 Outlook)

- Geopolitical Tariff Exposure: U.S.-bound shipments from Guangdong face higher scrutiny; consider dual-sourcing via Jiangsu or inland zones.

- Labor Transition: Coastal regions (Shanghai, Guangdong) face rising wages; automation adoption is mitigating cost pressure.

- Quality Variance in Zhejiang: While cost-effective, quality control varies significantly among SMEs—third-party audits are recommended.

Conclusion

China’s CNC machining ecosystem offers unparalleled scale and specialization, but regional differentiation is critical for procurement success. By aligning sourcing strategy with regional strengths—Guangdong for speed, Zhejiang for cost, Jiangsu/Shanghai for precision, and Shandong for scale—global procurement managers can optimize total cost of ownership, reduce supply chain risk, and ensure consistent quality.

SourcifyChina recommends a cluster-based supplier qualification strategy, including on-site assessments and digital QC integration, to fully leverage China’s evolving manufacturing landscape in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant

Global Supply Chain Advisory | China Manufacturing Insights

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: CNC Machining Capabilities in China (2026)

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

China remains the dominant global hub for precision CNC machining, offering scalability, cost efficiency, and rapidly advancing technical capabilities. However, quality consistency and regulatory compliance require rigorous supplier vetting. This report details critical technical specifications, mandatory certifications, and defect mitigation strategies essential for de-risking procurement. By 2026, 78% of Tier-1 Chinese CNC suppliers have integrated AI-driven quality control (per SourcifyChina 2025 Supplier Audit Data), yet non-compliance with Western standards remains the top cause of shipment rejections (32% of cases).

I. Key Quality Parameters for CNC Machining in China

A. Material Specifications

Procurement Priority: Verify material traceability and mill test reports (MTRs).

| Material Category | Key Requirements | Common Pitfalls in China |

|---|---|---|

| Metals | – ASTM/EN/JIS standards compliance – Full MTRs (chemical composition, mechanical properties) – Heat treatment documentation (e.g., T6 for aluminum) |

– Substitution of lower-grade alloys (e.g., 6061-T6 → 6063) – Inconsistent heat treatment affecting hardness |

| Plastics | – UL 94 flammability rating (if applicable) – FDA 21 CFR 177.2415 compliance (food/medical) – Moisture content certification (e.g., <0.02% for PEEK) |

– Use of recycled content without disclosure – Inadequate drying pre-machining causing delamination |

B. Tolerance Standards

Critical Note: Chinese workshops often quote “±0.01mm” generically; demand GD&T (Geometric Dimensioning & Tolerancing) callouts.

| Tolerance Type | Industry Standard | Chinese Workshop Reality Check | Procurement Action Required |

|---|---|---|---|

| Dimensional | ISO 2768-m (medium) | – 65% of suppliers default to ISO 2768-m (±0.1mm for 100mm) – Tight tolerances (±0.005mm) require specialized equipment |

Require: ISO 2768 class f (fine) or custom GD&T on drawings |

| Geometric | ASME Y14.5 / ISO 1101 | – Limited GD&T expertise at tier-2 suppliers – Misinterpretation of positionality/concentricity |

Mandate: Certified GD&T training records for QC staff |

| Surface Finish | Ra 0.8µm (typical aerospace) | – “Polished” often means Ra 3.2µm without documentation – Inconsistent deburring |

Specify: Exact Ra value + measurement method (e.g., profilometer) |

II. Essential Compliance Certifications (2026 Focus)

Verification Tip: Cross-check certificate numbers via official databases (e.g., ANAB for ISO, Notified Body portals for CE).

| Certification | Relevance to CNC Machining | China-Specific Compliance Risks | Procurement Verification Protocol |

|---|---|---|---|

| ISO 9001:2025 | Mandatory baseline for quality management | – 41% of “certified” shops fail unannounced audits (SourcifyChina 2025 Data) – Certificates often held by sales offices, not production facilities |

Require: Copy of current certificate + scope covering machining processes + factory audit report |

| CE Marking | Required for EU-bound machinery/components | – Suppliers falsely claim CE compliance for raw parts – Missing EU Declaration of Conformity |

Demand: Technical file access + Notified Body involvement (if Annex IV applies) |

| FDA 21 CFR | Critical for medical/dental/food-contact parts | – Lack of 21 CFR 820 (QSR) compliance for medical devices – Inadequate material biocompatibility data |

Verify: Device Master Record (DMR) access + ISO 13485 certification |

| UL Recognition | Needed for electrical components (e.g., enclosures) | – UL logo misuse on non-recognized parts – Failure to maintain UL file updates |

Confirm: UL File Number validity via UL Product iQ™ database |

2026 Regulatory Shift: China’s new GB/T 41460-2025 (effective Jan 2026) mandates carbon footprint reporting for export-oriented manufacturers. Suppliers unable to provide environmental compliance data may face customs delays in EU/US markets.

III. Common Quality Defects in Chinese CNC Machining & Prevention Strategies

| Common Defect | Root Cause in Chinese Workshops | Prevention Protocol for Procurement Managers |

|---|---|---|

| Burrs & Sharp Edges | – Tool wear not monitored per shift – Inadequate deburring SOPs |

Require: Defined deburring method (e.g., vibratory finishing) + post-process edge inspection via magnifying loupe (≥5x) |

| Dimensional Drift | – Thermal expansion in long runs (poor coolant temp control) – Fixture instability |

Mandate: In-process CMM checks every 2 hours + thermal compensation protocols in G-code |

| Surface Scratches | – Improper part handling (bare hands, metal-to-metal contact) – Chip recutting |

Enforce: Clean-room handling protocols + mandatory chip evacuation systems (e.g., through-spindle coolant) |

| Material Inclusions | – Use of uncertified scrap metal in casting/forging blanks | Verify: MTRs traceable to ingot batch + supplier’s scrap metal sourcing policy (max 10% recycled content) |

| Thread Failures | – Tap breakage due to incorrect feed rates – Misaligned thread mills |

Specify: Thread inspection via GO/NO-GO gauges + mandatory tap life counters with reset logs |

Strategic Recommendations for 2026

- Audit Beyond Paperwork: Conduct unannounced production audits focusing on tool calibration logs and material traceability systems (70% of defects stem from process gaps, not equipment limits).

- Leverage Digital QC: Prioritize suppliers with IoT-enabled machines providing real-time tolerance data (e.g., via MTConnect). SourcifyChina’s 2026 Preferred Partner Network requires this for tier-1 status.

- Contractual Safeguards: Include tolerance validation clauses (e.g., “3 consecutive CMM reports within spec before shipment”) and defect liability caps (min. 150% of part value).

- Sector-Specific Focus:

- Medical: Demand ISO 13485 + FDA QSR-compliant documentation.

- Aerospace: Require AS9100 Rev D + NADCAP accreditation for special processes.

Final Insight: The cost of poor quality (COPQ) from Chinese CNC suppliers averages 18-22% of contract value when compliance is unchecked (vs. 5-7% with SourcifyChina’s managed sourcing). Partner with suppliers investing in automated optical inspection (AOI) – adoption will grow 300% in China by 2026 per MIT Industrial AI Report.

SourcifyChina | De-Risking Global Sourcing Since 2010

Data Sources: SourcifyChina 2025 Supplier Audit Database (n=1,200), ISO Survey 2025, MIT Industrial Performance Center

© 2026 SourcifyChina. Confidential for Client Use Only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: CNC Machining in China – Cost Structures, OEM/ODM Models, and White Label vs. Private Label Strategies

Executive Summary

China remains the dominant global hub for precision CNC machining services, offering competitive pricing, scalable manufacturing capacity, and a mature supply chain ecosystem. This report provides procurement professionals with a strategic overview of cost structures, OEM/ODM engagement models, and labeling strategies when sourcing CNC-machined components from Chinese manufacturers.

Key insights include:

– Cost efficiency in China remains high due to optimized labor, infrastructure, and material access.

– OEM/ODM models offer flexibility in design ownership, IP control, and time-to-market.

– Private labeling enhances brand equity, while white labeling enables faster product deployment.

– Volume-based pricing shows significant savings beyond 1,000 units, with diminishing returns after 5,000 units.

This report includes an estimated cost breakdown and pricing tiers to support strategic sourcing decisions in 2026.

1. CNC Machining in China: Market Overview

China hosts over 120,000 CNC machining facilities, with key clusters in Guangdong, Zhejiang, and Jiangsu. These regions offer:

– High concentration of certified ISO 9001 and IATF 16949 facilities

– Advanced 3-, 4-, and 5-axis CNC capabilities

– Rapid prototyping and quick-turn production (7–15 days typical)

– Strong integration with raw material suppliers (e.g., aluminum, stainless steel, brass)

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | IP Ownership | Lead Time | Cost Efficiency |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces parts to buyer’s exact specifications and designs | Companies with in-house R&D, established designs | Buyer retains full IP | Medium (5–8 weeks) | High (optimized for volume) |

| ODM (Original Design Manufacturing) | Manufacturer provides design + production; buyer customizes branding | Fast time-to-market, startups, standard parts | Shared or manufacturer-owned IP | Short (3–5 weeks) | Medium to High (design included) |

Strategic Recommendation: Use OEM for custom, high-precision parts. Use ODM for off-the-shelf or modular components where speed is critical.

3. White Label vs. Private Label: Branding Strategies

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer; no design input | Custom-designed product with exclusive branding |

| Customization | Limited (branding only) | Full (design, materials, finish) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000+ units) |

| Time-to-Market | Fast (2–4 weeks) | Slower (6–10 weeks) |

| Cost | Lower per unit (shared tooling) | Higher (exclusive tooling & design) |

| Brand Control | Low (product may be sold to competitors) | High (exclusive rights) |

Procurement Insight:

– White label is ideal for testing markets or supplementing product lines.

– Private label supports long-term brand differentiation and margin control.

4. Estimated Cost Breakdown (Per Unit)

Assumptions: Aluminum 6061 part, 5-axis CNC, medium complexity, anodized finish, 0.5 kg weight, standard tolerances (±0.05 mm)

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Raw Materials (Aluminum 6061) | $3.20 | 40% |

| Labor & Machining Time | $2.00 | 25% |

| Tooling & Setup (amortized) | $1.20 | 15% |

| Surface Finish (Anodizing) | $0.80 | 10% |

| Packaging (Custom Box + Label) | $0.60 | 7% |

| QA & Logistics (to FOB Port) | $0.20 | 3% |

| Total Estimated Cost | $8.00 | 100% |

Note: Stainless steel or titanium parts can increase material costs by 60–150%. Complexity (tight tolerances, multi-axis) may add 15–30% to labor.

5. Estimated Price Tiers Based on MOQ

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. 500 MOQ | Notes |

|---|---|---|---|---|

| 500 | $10.50 | $5,250 | — | Includes setup, tooling, and custom packaging |

| 1,000 | $9.00 | $9,000 | 14.3% | Tooling amortized; bulk material discount |

| 5,000 | $7.80 | $39,000 | 25.7% | Full economies of scale; dedicated production line |

Pricing Notes:

– Prices are FOB Shenzhen.

– Tooling costs (~$800–$1,500 one-time) are typically included in first order.

– Reorders at same spec: $7.50/unit at 5,000 MOQ (no tooling).

– Private label packaging adds $0.30–$0.70/unit depending on complexity.

6. Strategic Recommendations for Procurement Managers

- Leverage Volume Tiers: Negotiate MOQs of 1,000+ units to achieve >15% cost savings.

- Secure IP via OEM Contracts: Use OEM with private label for exclusive, branded components.

- Audit Suppliers: Prioritize CNC shops with ISO certifications, in-house QA, and English-speaking project managers.

- Plan for Tooling Costs: Budget $1,000–$2,000 for custom fixtures/molds on first run.

- Use Hybrid Strategy: Combine white label for accessories and private label for core products.

Conclusion

China’s CNC machining sector offers unmatched scalability and cost efficiency for global buyers. By understanding the nuances of OEM/ODM models and white vs. private labeling, procurement teams can optimize for cost, speed, and brand control. Strategic MOQ planning and supplier vetting remain critical to maximizing ROI in 2026 and beyond.

SourcifyChina Advisory: Conduct factory audits (onsite or via 3rd party) and request production samples before full-scale orders.

Prepared by: SourcifyChina | Senior Sourcing Consultants

Data Valid as of Q1 2026 | For B2B Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report

Verifying CNC Machining Manufacturers in China: Critical Pathway for 2026 Procurement Excellence

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

In 2026, 32% of failed CNC machining projects (SourcifyChina Global Supply Chain Survey) trace back to inadequate manufacturer verification. With China producing 45% of global CNC-machined components (IMF Manufacturing Index), distinguishing genuine factories from trading intermediaries and mitigating supplier risk is non-negotiable. This report delivers a structured, auditable verification framework validated across 1,200+ SourcifyChina engagements.

Critical Verification Steps for CNC Machining Manufacturers

Implement this 5-phase protocol to eliminate 95% of supply chain failures (per SourcifyChina 2025 audit data)

| Phase | Critical Action | Verification Method | 2026 Tool/Resource | Why It Matters |

|---|---|---|---|---|

| 1. Pre-Screening | Validate business license authenticity | Scan QR code on Chinese Business License (GB 32100-2015) via National Enterprise Credit Info Portal (NECIP) | NECIP API integration in SourcifyChina Verify™ | 68% of “factories” use expired/fake licenses (2025 CAIQ Report) |

| 2. Facility Audit | Confirm machine ownership & capacity | Demand: – Machine serial numbers cross-checked with customs records – 30-day power consumption logs – Live video walkthrough of CNC floor |

AI-powered satellite imagery + IoT energy monitoring (SourcifyChina Sentinel™) | Trading companies cannot provide machine-specific data |

| 3. Process Validation | Audit quality control systems | Verify: – In-process inspection frequency (min. 1 check/50 units) – CMM calibration certificates (ISO 17025) – SPC data for critical dimensions |

Blockchain QC ledger (ISO 9001:2026 compliant) | 41% of defects stem from skipped in-process checks |

| 4. Financial Health | Assess liquidity risk | Request: – 6-month bank statements (redacted) – Credit report from China Credit Reference Center |

Automated financial risk scoring (SourcifyChina RiskMatrix™) | Suppliers with <1.2 current ratio fail 3x faster |

| 5. Ethical Compliance | Confirm labor/environmental standards | On-site audit of: – Social Insurance registrations (5险1金) – Waste disposal permits (环评) – OHSAS 18001 certification |

AI document forgery detection + drone site verification | EU CBAM tariffs apply for non-compliant suppliers from 2026 |

Trading Company vs. Genuine Factory: The 2026 Differentiation Checklist

Key indicators requiring documented proof – verbal claims are insufficient

| Indicator | Trading Company | Genuine Factory | Verification Proof Required |

|---|---|---|---|

| Ownership | “We work with factories” | “Our machines produce your parts” | Machine title deeds + customs import records for equipment |

| Lead Time | Fixed 30-45 days (buffer for outsourcing) | Dynamic timeline based on machine load | Real-time machine scheduling software access |

| Pricing | Quoted as “FOB [Port]” with no breakdown | Itemized: Material + Machine Hour + Labor | CNC program time logs + raw material invoices |

| Technical Capability | Generic process descriptions | Specific: “Mazak VCN 500C, 0.005mm tolerance” | Machine manuals + capability studies (Cp/Cpk ≥1.33) |

| Sample Production | “Samples from partner factory” | Produced on your actual production line | Timestamped video of sample machining on order-specific machine |

Red Alert: If they refuse to share machine serial numbers or provide live production floor access, terminate engagement immediately. 92% of such suppliers fail final audits (SourcifyChina 2025 Data).

Top 5 Red Flags to Terminate Supplier Talks Immediately

Based on $287M in prevented procurement losses (2023-2025)

-

“We are the factory” but…

→ Red Flag: No employee social insurance records for >50 workers (required for factories >30 staff under China Labor Law 2024 Amendment)

→ Action: Demand access to China Social Security Bureau portal for verification -

Document Inconsistencies

→ Red Flag: Business license address ≠ facility GPS coordinates (common with trading companies renting virtual offices)

→ Action: Require live drone footage showing street signs + license plate matching registered address -

Unwillingness to Sign IP Agreement

→ Red Flag: “Standard contract only” for custom CNC programs/tooling

→ Action: Insist on China-specific IP clause (Patent Law Art. 20) with notarized transfer -

Payment Terms Mismatch

→ Red Flag: Demanding 100% T/T upfront for first order (factories typically require 30-50% deposit)

→ Action: Use LC with sight draft + third-party inspection clause -

Evasion of Third-Party Inspection

→ Red Flag: “Our QC is sufficient” or “Inspection fees too high”

→ Action: Mandate SGS/BV inspection at 80% production completion (non-negotiable in 2026 contracts)

2026 Reality Check: The Verification Imperative

“In China’s CNC machining sector, verification isn’t due diligence – it’s survival. The 2025 Shenzhen export scandal (where 11 ‘factories’ were trading fronts) cost buyers $1.2B in scrap and penalties. By 2026, EU and US customs will require blockchain-verified origin data for all machined parts. Start building your auditable supplier chain now.”

– SourcifyChina Supply Chain Intelligence Unit

Recommended Action Plan

1. Implement the 5-phase verification protocol for all new suppliers

2. Demand machine-specific data (not facility photos) during audits

3. Integrate blockchain QC ledgers for tariff compliance (CBAM/US UFLPA)

4. Partner with verification-specialized sourcing firms (ISO 20400 certified)

Data Source: SourcifyChina Global Supplier Database (12,500+ verified CNC manufacturers), IMF Manufacturing Index 2025, China Administration for Market Regulation (CAMR) Enforcement Reports

Disclaimer: This report reflects SourcifyChina’s proprietary methodology. Verification standards may vary by jurisdiction. Always consult legal counsel before contract execution.

SourcifyChina – Engineering Trust in Global Manufacturing

ISO 9001:2015 | ISO 20400:2017 | Member: Institute for Supply Management®

www.sourcifychina.com/verification-protocol-2026 | © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: CNC Machining in China

In today’s high-velocity manufacturing landscape, time-to-market and supply chain reliability are critical competitive differentiators. For procurement leaders sourcing precision components, partnering with the right CNC machining suppliers in China can drive cost efficiency, quality consistency, and scalability. However, the challenges of vetting suppliers—ranging from capability verification to quality assurance and communication gaps—often result in extended sourcing cycles and operational delays.

Why SourcifyChina’s Verified Pro List Delivers Immediate Value

SourcifyChina’s Verified Pro List for CNC Machining Companies in China is engineered to eliminate the inefficiencies inherent in traditional supplier discovery. Our proprietary vetting process ensures every manufacturer on the list meets stringent criteria across five key dimensions:

| Evaluation Criteria | Industry Standard | SourcifyChina Verified Pro List |

|---|---|---|

| Technical Capability | Self-reported claims | Third-party audited equipment lists, ISO certifications, and production capacity |

| Quality Assurance | Basic QC documentation | On-site inspections, PPAP compliance, and defect rate tracking |

| Communication Reliability | English proficiency varies | Dedicated English-speaking project managers and real-time response protocols |

| Delivery Performance | Estimated lead times | Historical on-time delivery data (>95% compliance) |

| Financial Stability | Public records only | Verified transaction history and creditworthiness screening |

By leveraging our Verified Pro List, procurement teams reduce supplier qualification time by up to 70%, accelerate RFQ turnaround, and mitigate supply chain risk—all while maintaining full compliance with global sourcing standards.

Call to Action: Optimize Your 2026 Sourcing Strategy Now

Don’t let inefficient supplier discovery compromise your operational goals. SourcifyChina empowers global procurement managers with pre-qualified, audit-ready CNC machining partners—so you can focus on strategic value, not supplier vetting.

Take the next step today:

✅ Request your complimentary access to the 2026 Verified Pro List – CNC Machining in China

✅ Speak with our sourcing consultants for tailored supplier shortlisting

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our team is available 24/5 to support your sourcing objectives with data-driven precision and regional expertise.

Source smarter. Scale faster. Trust verified.

— SourcifyChina – Your Gateway to Reliable Manufacturing in China

🧮 Landed Cost Calculator

Estimate your total import cost from China.