The global CNC foam cutting machine and precision foam fabrication market has experienced steady expansion, driven by growing demand in industries such as aerospace, automotive, packaging, and medical devices. According to Grand View Research, the global foam market was valued at USD 74.3 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by advancements in digital manufacturing technologies, including computer numerical control (CNC) systems, which enable high-precision shaping of polymer foams like EPS, XPS, and PU. As downstream sectors increasingly prioritize lightweight, energy-efficient, and customizable materials, the need for reliable CNC foam manufacturers has intensified. The following list highlights the top 10 CNC foam manufacturers leveraging automation, advanced software integration, and scalable production capabilities to meet rising global demand and deliver consistent, high-tolerance foam components.

Top 10 Cnc Foam Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Foam Factory, Inc.

Domain Est. 2000

Website: foambymail.com

Key Highlights: The most competitive foam supplier on the market. We carry mattresses, toppers, seats, cushions, sound proofing foams, memory foam, eggcrate, anti-static ……

#2 General Plastics

Domain Est. 1996

Website: generalplastics.com

Key Highlights: General Plastics is certified and equipped to offer polyurethane foam solutions, providing part design support and design production from start to finish….

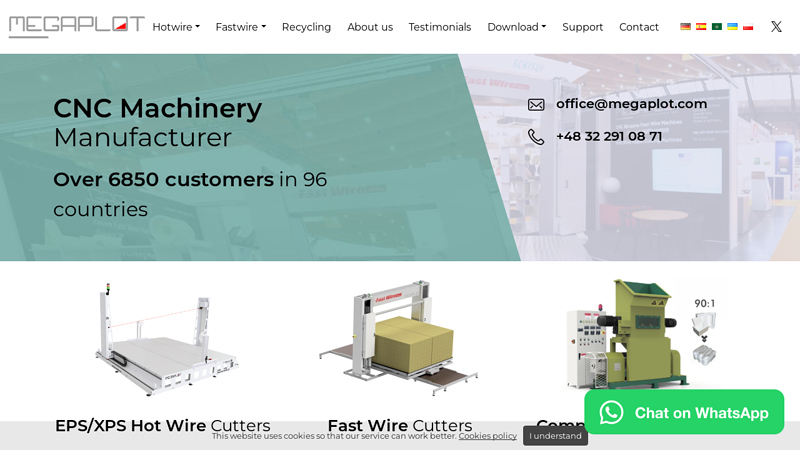

#3 MegaPlot

Domain Est. 1999

Website: megaplot.com

Key Highlights: CNC Machinery Manufacturer A wide selection of our famous EPS and XPS hot wire CNC foam cutters for contour cutting and sheet cutting. From small sign making ……

#4 CNCs

Domain Est. 2000

Website: hotwirefoamfactory.com

Key Highlights: Our line of hot wire foam cutting CNC machines are made in-house with the goal of providing a quality U.S. made product at a competitive price….

#5 Baumer foam cutting machines

Domain Est. 2021

Website: baeumer.us

Key Highlights: Baumer of America special machines and plants for the foam industry. We advise you from the single foam cutting machine up to complete plants….

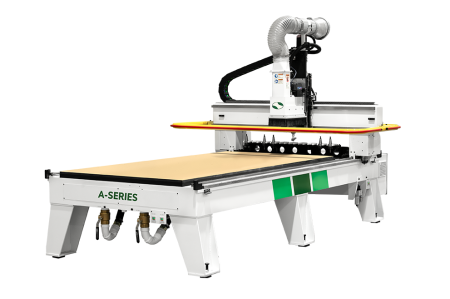

#6 American Made CNC Routers for Wood, Plastics, Aerospace and …

Domain Est. 1995

Website: thermwood.com

Key Highlights: Discover Thermwood’s high-performance, American-made CNC routers. Find the perfect 3 and 5-axis solutions for your woodworking, plastics, or aerospace ……

#7 Zotefoams

Domain Est. 1996

Website: zotefoams.com

Key Highlights: Zotefoams offers lightweight, high-performance AZOTE and ZOTEK foam solutions for aerospace, automotive, and construction industries….

#8 CNC Routing Foam

Domain Est. 1997

Website: fpcfoam.com

Key Highlights: Visit Foam Products Corporation for professional CNC routing foam services. From custom foam cutting & laminating to JIT delivery, you can rely on our team….

#9 Custom CNC Routing for Insulation

Domain Est. 1998

Website: insulfab.net

Key Highlights: Insul-Fab can create just about any shape using CNC routing and machining. We’re proud to be the trusted custom CNC routing for insulation service provider….

#10 Heubach is a leader in foam fabrication and manufacturing of …

Domain Est. 1998

Website: heubachcorp.com

Key Highlights: The Heubach Corporation, located in Dallas, Texas, is a premier leader in the conversion and manufacturing of flexible materials….

Expert Sourcing Insights for Cnc Foam

H2: Projected 2026 Market Trends for CNC Foam Cutting Technology

The global CNC (Computer Numerical Control) foam cutting market is poised for significant transformation by 2026, driven by advancements in automation, rising demand across key industries, and the growing emphasis on precision manufacturing. This analysis outlines the major trends expected to shape the CNC foam sector in the coming years.

-

Increased Demand in Packaging and Prototyping

By 2026, the packaging industry—especially for high-value and fragile goods—is expected to drive substantial growth in CNC foam applications. Custom-cut foam inserts for electronics, medical devices, and aerospace components provide superior protection and are increasingly being produced using CNC technology for exact fit and repeatability. Additionally, rapid prototyping in product development cycles will continue to rely on CNC foam cutting for creating lightweight, cost-effective models. -

Expansion in Construction and Insulation Applications

Energy efficiency regulations and green building standards are accelerating the use of foam insulation materials such as EPS (Expanded Polystyrene) and XPS (Extruded Polystyrene). CNC foam cutters enable precise shaping of insulation panels for architectural designs, curved walls, and energy-efficient building envelopes. The construction sector’s shift toward modular and prefabricated building methods will further boost CNC foam integration into manufacturing workflows. -

Adoption of Advanced Software and Automation

By 2026, CNC foam systems are expected to incorporate more sophisticated CAD/CAM software, allowing for seamless 3D modeling, nesting optimization, and real-time error correction. Integration with Industry 4.0 principles—such as IoT-enabled machines, predictive maintenance, and cloud-based design sharing—will enhance productivity and reduce material waste. Automated loading/unloading systems and robotic arms will become more common in high-volume production environments. -

Growth in Aerospace and Automotive Sectors

The aerospace and automotive industries will continue to adopt CNC-cut foam for lightweight composite tooling, wind tunnel models, and ergonomic seating prototypes. As electric vehicles (EVs) expand, demand for custom interior components and noise-dampening foam parts will rise, favoring precision CNC cutting over traditional methods. -

Sustainability and Material Innovation

Environmental regulations will push manufacturers toward recyclable and bio-based foam materials. CNC technology will play a key role in minimizing material waste through optimized cutting paths and offcut reuse. By 2026, closed-loop systems that integrate cutting, recycling, and reprocessing of foam scraps are expected to gain traction, especially in Europe and North America. -

Regional Market Shifts

Asia-Pacific is projected to emerge as a high-growth region due to industrial expansion in China, India, and Southeast Asia. Local manufacturing hubs for consumer electronics and automotive parts will increase demand for CNC foam solutions. Meanwhile, North America and Europe will focus on high-precision and automated systems, driven by innovation in medical, defense, and R&D applications. -

Competitive Landscape and Market Consolidation

The CNC foam equipment market is expected to see increased competition, with established players enhancing their portfolios through acquisitions and partnerships. Smaller manufacturers offering niche, customizable machines will cater to artisanal and small-batch producers, while larger firms focus on turnkey industrial solutions.

In conclusion, the 2026 CNC foam market will be characterized by technological sophistication, cross-industry adoption, and a strong push toward automation and sustainability. Companies that invest in integrated digital workflows, energy-efficient machinery, and eco-friendly materials are likely to lead the evolving landscape.

Common Pitfalls Sourcing CNC Foam (Quality, IP)

Sourcing CNC foam for machining applications involves more than just finding the right size and price. Overlooking critical quality and intellectual property (IP) concerns can lead to project delays, poor performance, legal issues, and reputational damage. Below are key pitfalls to avoid:

Poor Material Quality and Inconsistency

One of the most frequent issues when sourcing CNC foam is receiving material that does not meet required specifications. Low-density foams may compress under tool pressure, leading to inaccurate cuts, while inconsistent cell structure can result in surface defects and poor finish. Some suppliers may substitute lower-grade foams or mix batches without notice, affecting reproducibility—especially critical in prototyping or tooling applications.

Mitigation: Specify foam density, cell size, and compressive strength requirements clearly. Request material test reports (MTRs) and conduct batch testing upon receipt. Work with reputable suppliers who specialize in CNC-grade foams (e.g., Divinycell, Airex, or equivalent).

Lack of Traceability and Certification

Without proper documentation, it can be difficult to verify the foam’s origin, composition, or compliance with industry standards (e.g., fire resistance, off-gassing, or aerospace certifications). This is a major concern in regulated industries like aerospace, automotive, or medical modeling.

Mitigation: Insist on full traceability, including lot numbers and compliance data sheets. Ensure the foam meets relevant standards (e.g., ASTM, UL, or FAR 25.853) if required for your application.

Intellectual Property (IP) Risks with Custom Foams

When working with custom-formulated or proprietary foam materials, there’s a risk of IP leakage—especially if the supplier lacks strong confidentiality practices. Sharing detailed specifications or unique formulations with unvetted vendors may expose your design or process innovations.

Mitigation: Use Non-Disclosure Agreements (NDAs) with suppliers. Clearly define IP ownership in contracts, especially for custom-developed foam grades. Limit the technical details shared to only what is necessary.

Unauthorized Resale or Gray Market Materials

Some suppliers may resell branded CNC foams (e.g., RenShape, Minicell) without authorization, offering counterfeit or expired stock. These materials may degrade over time or fail to perform as expected, leading to machining failures.

Mitigation: Purchase directly from authorized distributors or manufacturers. Verify supplier credentials and check for batch expiration dates. Be wary of unusually low prices, which may indicate gray market or substandard products.

Inadequate Support for Machining Parameters

Not all foams machine the same. Some require specific tooling, feed rates, or cooling strategies to avoid melting, chipping, or dust issues. Suppliers who don’t provide machining guidance may leave you to troubleshoot performance problems.

Mitigation: Choose suppliers who offer technical support and machining recommendations. Request sample materials to test before bulk ordering.

Environmental and Health Compliance Oversights

Certain foams release hazardous fumes when machined or may not be compliant with environmental regulations (e.g., RoHS, REACH). Ignoring these factors can lead to workplace safety issues or regulatory violations.

Mitigation: Ensure the foam is labeled for safe machining and complies with relevant environmental and health standards. Confirm disposal and handling requirements upfront.

Avoiding these pitfalls requires due diligence in supplier selection, clear specifications, and proactive risk management—especially when quality and IP protection are mission-critical.

Logistics & Compliance Guide for CNC Foam

Overview of CNC Foam Materials

CNC foam refers to rigid or semi-rigid foam materials—such as polyurethane (PU), expanded polystyrene (EPS), or high-density urethane—that are precision-cut using computer numerical control (CNC) machining. These foams are widely used in prototyping, aerospace tooling, packaging, and architectural models. Due to their lightweight yet bulky nature, specific logistics and compliance considerations are essential for safe, cost-effective, and legal transportation and handling.

Packaging & Handling Requirements

Proper packaging is critical to protect CNC foam parts from compression, moisture, and physical damage during transit. Use rigid outer containers such as corrugated cardboard, wooden crates, or reusable plastic containers based on part size and fragility. Internal cushioning with bubble wrap, foam inserts, or custom dunnage should prevent movement. Fragile labels and orientation arrows must be clearly marked. Avoid stacking heavy items on foam parts, and store in dry, temperature-stable environments to prevent degradation.

Shipping & Transportation Considerations

CNC foam’s low density but high volume can impact freight classification and cost. Accurate dimensional weight calculations are essential for air and ground shipping. Choose carriers experienced in handling oversized or lightweight cargo. For international shipments, consolidate loads when possible to reduce per-unit costs. Ensure all foam components are securely immobilized within the package to prevent shifting. Consider using pallets for bulk shipments and employ stretch wrap or strapping for stability.

Regulatory Compliance for Foam Materials

Compliance depends on the foam type, application, and destination. Polyurethane and polystyrene foams may be subject to flammability regulations (e.g., FAA, ASTM E84, or FMVSS 302) if used in transportation or construction. Verify material certifications and test reports are available upon request. Some foams may contain flame retardants regulated under REACH (EU) or TSCA (USA). Ensure proper documentation accompanies shipments, especially for cross-border transport.

Hazardous Materials & Environmental Regulations

Most CNC foams are non-hazardous, but certain additives or post-processing treatments (e.g., flame retardants) may trigger hazardous material (hazmat) classification. Always check Safety Data Sheets (SDS) to determine if hazmat labeling, packaging, or documentation is required. Foam waste is often non-recyclable and must be disposed of in accordance with local solid waste regulations. Minimize environmental impact by reducing packaging waste and reusing cut foam scraps when feasible.

Import/Export Documentation & Restrictions

International shipments of CNC foam require accurate Harmonized System (HS) codes—common codes include 3903.30 for expanded polystyrene or 3904.21 for polyurethane foam. Provide commercial invoices, packing lists, and certificates of origin as needed. Some countries restrict the import of certain plastic foams due to environmental concerns (e.g., EPS bans in packaging). Check destination country regulations before shipping to avoid delays or penalties.

Safety & Workplace Compliance

In facilities handling CNC foam, follow OSHA (or equivalent) guidelines for dust control during machining. Use local exhaust ventilation and NIOSH-approved respirators when cutting foam to minimize inhalation of particulates. Store foam away from high heat sources and open flames due to flammability risks. Maintain fire suppression systems and ensure employees are trained in material-specific safety procedures.

Best Practices for Supply Chain Efficiency

To optimize logistics, standardize foam block sizes to reduce waste and improve packing density. Work with suppliers to provide pre-cut or near-net-shape blanks. Implement a traceability system using barcodes or RFID tags for high-value or regulated components. Regularly audit shipping and compliance processes to ensure alignment with evolving regulations and carrier requirements.

Conclusion for Sourcing CNC Foam

Sourcing the right CNC foam is a critical step in ensuring precision, efficiency, and quality in machining and prototyping applications. By carefully evaluating material specifications—such as density, cell structure, temperature resistance, and compatibility with CNC equipment—manufacturers and fabricators can significantly enhance the outcome of their projects. Key considerations include aligning the foam type (e.g., polystyrene, polyurethane, or polyethylene) with the intended application, whether for molding, modeling, insulation, or aerospace components.

Additionally, selecting reliable suppliers who offer consistent quality, customization options, and technical support contributes to long-term success. Cost-effectiveness should not overshadow performance needs; investing in high-grade CNC foam can reduce waste, minimize machining time, and improve surface finishes. Environmental factors, such as recyclability and chemical composition, are also becoming increasingly important in sustainable manufacturing practices.

In summary, a strategic approach to sourcing CNC foam—grounded in technical requirements, supplier reliability, and cost-performance balance—ensures optimal results in CNC machining processes and supports innovation across industries ranging from automotive to product design.