The global CNC electric supply market is experiencing robust growth, driven by increasing automation across manufacturing, automotive, and aerospace sectors. According to Mordor Intelligence, the CNC machine tool market is projected to grow at a CAGR of approximately 7.2% from 2024 to 2029, underpinned by rising demand for high-precision components and advancements in smart manufacturing technologies. A critical enabler of this growth is the reliability and efficiency of CNC electric supply systems, which power essential operations such as spindle control, axis movement, and automated tool changes. As industries shift toward Industry 4.0 integration, the need for stable, high-performance electrical components has intensified. This has elevated the role of specialized CNC electric supply manufacturers, who provide tailored power solutions that ensure consistent machine operation, reduce downtime, and support digital connectivity. Based on market presence, innovation, and product reliability, the following four manufacturers stand out as leaders in delivering advanced CNC electric supply systems critical to modern machining environments.

Top 4 Cnc Electric Supply Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 CNC Electric

Domain Est. 2005 | Founded: 1988

Website: m.cncele.com

Key Highlights: CNC Electric was founded in 1988 specialized in Low-voltage electrical and Power Transmission and Distribution industries….

#2 Products

Domain Est. 2018

Website: cncelectricwholesales.com

Key Highlights: We stock material and supplies for residential, commercial and industrial jobs, and everyday repairs, large or small….

#3 CNC ELECTRIC

Domain Est. 2022

Website: cnc-official.com

Key Highlights: The company specializes in R&D and production of industrial electrical products, mainly intelligent low-voltage power distribution and industrial control ……

#4 High-Quality Low Voltage Electrical Products

Domain Est. 2005

Website: cncele.com

Key Highlights: Explore CNC ELECTRIC’s extensive range of low voltage electrical products, including circuit breakers, contactors, and wall switches. As a leading….

Expert Sourcing Insights for Cnc Electric Supply

H2 2026 Market Trends Analysis for CNC Electric Supply

As we approach H2 2026, CNC Electric Supply (CNCE) operates within a dynamic landscape shaped by technological innovation, evolving energy demands, and shifting industrial priorities. Below is an analysis of key market trends expected to influence CNCE’s performance and strategic positioning during this period.

1. Accelerated Industrial Electrification and Automation

H2 2026 will see continued momentum in industrial electrification, driven by corporate decarbonization goals and government incentives. CNC machinery, robotics, and automated production lines are increasingly reliant on high-efficiency electric components—precisely the core offerings of CNCE. Demand for precision control systems, servo drives, and programmable logic controllers (PLCs) will rise, especially in advanced manufacturing hubs across North America and Europe. CNCE is well-positioned to benefit as manufacturers upgrade legacy systems to meet energy efficiency standards.

2. Growth in Sustainable and Energy-Efficient Solutions

Environmental regulations and energy cost pressures are pushing industries toward energy-efficient motors, variable frequency drives (VFDs), and smart power distribution systems. CNCE’s product portfolio, particularly in energy management and power quality solutions, aligns with this trend. Expect increased demand for products that reduce harmonic distortion, optimize power usage, and integrate with renewable energy sources. Partnerships with OEMs focused on green manufacturing will be critical for CNCE to capture market share.

3. Supply Chain Resilience and Nearshoring

Ongoing supply chain volatility and geopolitical risks are prompting manufacturers to adopt nearshoring and onshoring strategies. In H2 2026, North American industrial production is expected to grow, supported by policies like the U.S. Inflation Reduction Act (IRA) and CHIPS Act. This regional rebalancing favors domestic suppliers like CNCE, which can offer faster delivery, localized support, and reduced logistics risk. CNCE should leverage its regional distribution network to attract clients seeking supply chain stability.

4. Digitalization and IIoT Integration

The Industrial Internet of Things (IIoT) continues to transform manufacturing. CNC systems are increasingly connected, requiring intelligent power components that support real-time monitoring, predictive maintenance, and data analytics. In H2 2026, demand will grow for smart electrical components—such as IoT-enabled breakers, sensors, and gateway modules—that interface with digital twin platforms and SCADA systems. CNCE can expand its value proposition by offering integrated digital solutions or partnering with software providers.

5. Talent and Skills Gap in Industrial Electrical Services

As automation rises, there is a growing shortage of skilled technicians capable of installing and maintaining advanced CNC electrical systems. This presents both a challenge and an opportunity for CNCE. In H2 2026, companies that offer technical support, training programs, or value-added services (e.g., commissioning, troubleshooting) will gain a competitive edge. CNCE could differentiate itself by developing certified training partnerships or expanding its field service capabilities.

6. Competitive Pressure and Consolidation

The electrical distribution sector remains competitive, with large players (e.g., Graybar, Rexel) and e-commerce platforms increasing digital engagement. In H2 2026, mid-sized suppliers like CNCE must emphasize niche expertise, customer intimacy, and responsiveness. Strategic acquisitions or partnerships with regional distributors could enhance market reach and product breadth.

Conclusion:

H2 2026 presents strong growth potential for CNC Electric Supply, driven by industrial modernization, sustainability mandates, and digital transformation. To capitalize on these trends, CNCE should focus on:

– Expanding offerings in energy-efficient and smart power technologies

– Strengthening regional supply chain advantages

– Investing in digital tools and technical service capabilities

– Building strategic partnerships in automation and renewable integration

By aligning with these macro trends, CNC Electric Supply can solidify its role as a trusted partner in the evolving industrial electrification ecosystem.

Common Pitfalls When Sourcing CNC Electric Supply (Quality, IP)

Sourcing CNC electric supply components—such as servo drives, motors, power supplies, control units, and connectors—requires careful attention to both quality and intellectual property (IP) concerns. Overlooking these factors can lead to operational failures, legal complications, and long-term cost overruns. Below are key pitfalls to avoid:

Poor Component Quality and Reliability

One of the most frequent issues when sourcing CNC electric supply parts, especially from low-cost suppliers, is substandard quality. Components may fail prematurely due to poor materials, inadequate heat dissipation, or lack of proper testing. This leads to machine downtime, increased maintenance costs, and compromised machining precision. Always verify certifications (e.g., CE, UL, ISO), request samples, and conduct third-party testing when possible.

Counterfeit or Non-Compliant Components

The market is rife with counterfeit or re-marked electrical components falsely labeled as genuine or compliant. These parts may not meet safety or performance standards, posing fire hazards or causing system failure. For example, fake servo drives may lack overcurrent protection or fail under load. To mitigate risk, source only from authorized distributors and verify component authenticity through batch numbers and supplier reputation.

Inadequate IP Protection and Licensing

Using unlicensed or reverse-engineered CNC control software or firmware can expose your business to intellectual property infringement claims. Some suppliers offer “compatible” controllers that mimic proprietary systems (e.g., Fanuc, Siemens) without proper licensing. While they may appear functional, they can violate copyright or patent laws, leading to legal disputes, import bans, or forced system replacements.

Lack of Technical Support and Documentation

Low-cost suppliers often fail to provide comprehensive technical documentation, schematics, or firmware updates. This absence hampers troubleshooting, integration, and compliance with safety standards. Without proper manuals or software access, maintenance becomes difficult, and long-term support is unreliable—especially critical for CNC systems requiring precise calibration.

Non-Compliance with Regional Electrical Standards

CNC electric supplies must adhere to regional electrical and safety regulations (e.g., NEC in the U.S., IEC in Europe). Sourcing components not rated for local voltage, frequency, or environmental conditions can violate codes, void insurance, or endanger personnel. Always confirm that parts meet local regulatory requirements before integration.

Hidden Costs from Integration and Retrofit Challenges

Components that appear cost-effective may require extensive modification to integrate with existing CNC systems. Differences in communication protocols (e.g., EtherCAT vs. Profibus), pin configurations, or software interfaces can lead to unexpected engineering expenses and project delays. Evaluate compatibility thoroughly during the sourcing phase.

Supply Chain and Long-Term Availability Risks

Some suppliers offer CNC electric components with no guarantee of long-term availability. If a critical part goes out of production and no replacement is available, it can render entire machines obsolete. Prioritize suppliers who offer lifecycle support and clear obsolescence management policies.

By addressing these pitfalls proactively—focusing on quality assurance, IP compliance, and supplier due diligence—you can ensure reliable, legal, and efficient operation of CNC systems.

Logistics & Compliance Guide for CNC Electric Supply

Overview

This guide outlines the essential logistics and compliance procedures for CNC Electric Supply to ensure efficient operations, regulatory adherence, and customer satisfaction. It covers supply chain management, transportation, inventory control, import/export regulations, safety standards, and industry-specific compliance requirements.

Supply Chain Management

Coordinate with suppliers, manufacturers, and distributors to maintain a reliable flow of electrical components and CNC equipment. Establish vendor qualification criteria, including quality certifications and delivery performance. Implement just-in-time (JIT) inventory practices where appropriate to reduce holding costs and minimize stockouts.

Transportation & Distribution

Utilize certified freight carriers experienced in handling electrical and industrial equipment. Ensure proper packaging and labeling to prevent damage during transit. Maintain real-time shipment tracking and provide delivery updates to customers. For domestic shipments, comply with Department of Transportation (DOT) regulations; for international deliveries, adhere to Incoterms® 2020 standards.

Inventory Control & Warehousing

Conduct regular cycle counts and annual physical inventories to maintain accuracy. Use warehouse management systems (WMS) to track stock levels, expiration dates (if applicable), and storage conditions. Store sensitive electrical components in climate-controlled, ESD-safe environments to prevent damage.

Import/Export Compliance

For international operations, ensure compliance with U.S. Customs and Border Protection (CBP) and relevant foreign customs authorities. Maintain accurate Harmonized System (HS) codes for all products. Prepare and retain documentation including commercial invoices, packing lists, and certificates of origin. Adhere to export control regulations such as the Export Administration Regulations (EAR) and avoid restricted parties via Automated Export System (AES) filings.

Regulatory & Safety Standards

Ensure all electrical products meet National Electrical Manufacturers Association (NEMA), Underwriters Laboratories (UL), and Canadian Standards Association (CSA) requirements where applicable. Comply with Occupational Safety and Health Administration (OSHA) standards in warehouse and distribution operations. Maintain records of equipment safety certifications and product testing reports.

Environmental & Sustainability Compliance

Follow Environmental Protection Agency (EPA) guidelines for handling and disposal of electronic waste (e-waste) and hazardous materials. Partner with certified recyclers for end-of-life products. Minimize packaging waste and promote sustainable logistics practices such as route optimization and fuel-efficient vehicles.

Documentation & Recordkeeping

Maintain comprehensive records for a minimum of five years, including bills of lading, customs documentation, compliance certifications, and safety data sheets (SDS). Implement a secure digital document management system to ensure easy access during audits or inspections.

Training & Continuous Improvement

Provide regular training for logistics and compliance personnel on regulatory updates, safety protocols, and best practices. Conduct internal audits and risk assessments to identify improvement opportunities. Stay informed on changes to trade policies, electrical codes, and supply chain regulations affecting CNC and electrical supply operations.

Conclusion

Adhering to this logistics and compliance guide ensures CNC Electric Supply operates efficiently, meets legal obligations, and maintains trust with customers and regulators. Regular review and updates to policies are essential to adapt to evolving industry standards and global trade dynamics.

Conclusion for Sourcing CNC Electric Supply

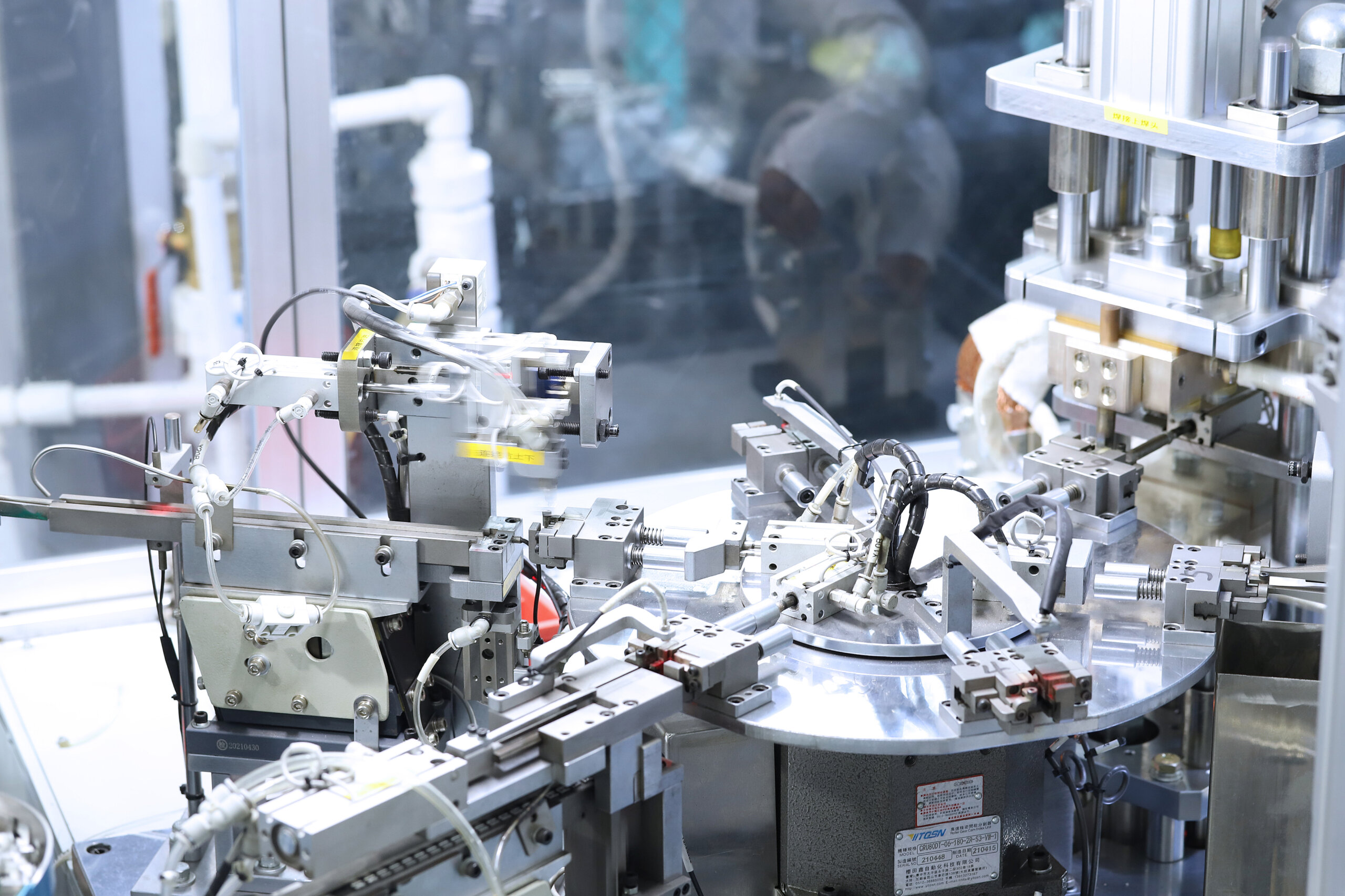

In conclusion, sourcing a reliable and efficient electrical supply for CNC (Computer Numerical Control) machines is a critical factor in ensuring optimal performance, precision, and operational safety. A stable and appropriately specified power supply minimizes voltage fluctuations, reduces downtime, and protects sensitive electronic components from damage due to surges or harmonics. When selecting a CNC electric supply, factors such as voltage compatibility, power quality, redundancy, energy efficiency, and compliance with industry standards must be thoroughly evaluated.

Partnering with reputable suppliers who offer robust technical support, certified products, and scalable solutions contributes significantly to long-term reliability and cost-effectiveness. Additionally, considering future expansion and integrating advanced power management systems can enhance productivity and sustainability in manufacturing environments.

Ultimately, a well-sourced and properly maintained electrical supply system forms the backbone of CNC operations, enabling consistent, high-precision machining and supporting overall manufacturing excellence.