The global CMP (Chemical Mechanical Planarization) equipment market is experiencing robust growth, driven by the escalating demand for advanced semiconductor devices and the continuous scaling of integrated circuits. According to a 2023 report by Mordor Intelligence, the CMP equipment market was valued at USD 6.3 billion in 2022 and is projected to grow at a CAGR of over 7.5% during the forecast period from 2023 to 2028. This expansion is fueled by increasing investments in semiconductor manufacturing, particularly in Asia-Pacific, and the rising need for precision surface finishing in 3D NAND and logic chip fabrication. As leading foundries push toward nodes below 7nm, the reliance on high-performance CMP machines has become mission-critical. In this competitive landscape, a select group of manufacturers dominate technological innovation, reliability, and market share. Based on market presence, revenue data, and technological advancements, the following eight companies stand out as the leading CMP machine manufacturers shaping the future of semiconductor manufacturing.

Top 8 Cmp Machines Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 CMP

Domain Est. 1998 | Founded: 1972

Website: cmp.com.tw

Key Highlights: Established in 1972, CMP Group now has become a world-famous manufacturer of high-end precision parts. Currently, CMP Group has been securing a strong foothold ……

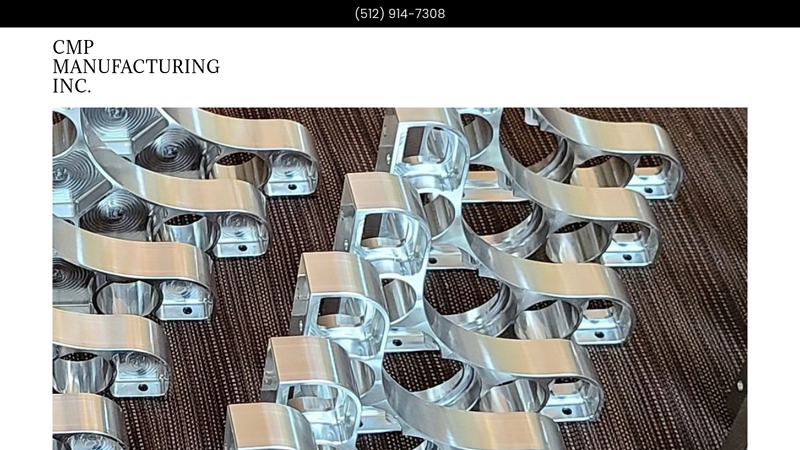

#2 CMP Manufacturing Inc.

Domain Est. 2008

Website: cmpmanufacturing.com

Key Highlights: CNC machine shop that provides precision machined parts for all industries in the Austin area and North America, prototype and production….

#3 Stainless Steel Hygienic Equipment

Domain Est. 2013

Website: cmpsol.com

Key Highlights: CM Process Solutions is a market leader in the innovation of stainless steel hygiene, lifting and dumping, and industrial washing equipment….

#4 CMP Automation

Domain Est. 2013

Website: cmpautomation.ca

Key Highlights: CMP is a medium sized, vertically integrated manufacturer of turnkey automation equipment, providing custom manufacturing automation solutions to various ……

#5 CMP Equipment

Domain Est. 2000 | Founded: 1956

Website: cmpequipment.com

Key Highlights: Since 1956, we have provided innovative, hygienic food processing solutions for our global customers. Based in Miltonvale Park, PEI, Canada….

#6 Entrepix: Your for CMP Equipment, the OnTrak DSS

Domain Est. 2004

Website: entrepix.com

Key Highlights: Entrepix is the leader in semiconductor engineered products and CMP semiconductor equipment. We offer the all new OnTrak DSS-200 cleaner and refurbish ……

#7 Equipment Attachments

Domain Est. 2011

Website: cmpattachments.com

Key Highlights: (320) 743-0109 | CMP Attachments is based in Clear Lake, MN and produces American-made equipment attachments for excavators, skid steers, mini skids, ……

#8 CNC Machining

Domain Est. 2011

Website: cmpgroup.net

Key Highlights: CMP specializes in manufacturing small to medium parts, offering CNC turning and milling services tailored for industries such as marine, transportation, and ……

Expert Sourcing Insights for Cmp Machines

H2: 2026 Market Trends for CMP (Chemical Mechanical Planarization) Machines

By 2026, the CMP machine market is projected to experience robust growth and significant technological evolution, driven primarily by the relentless demands of advanced semiconductor manufacturing. Key trends shaping the market include:

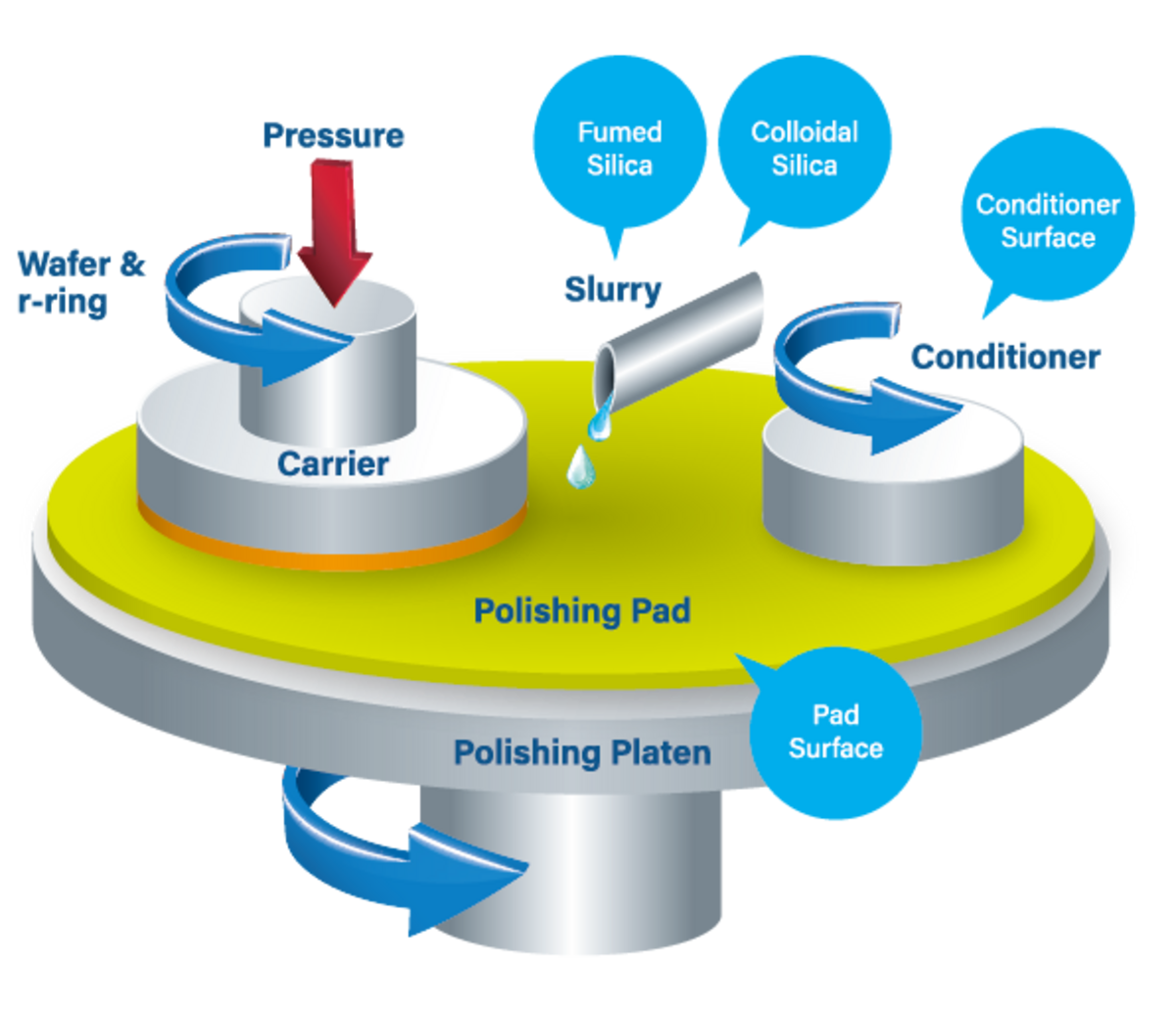

1. Surge in Demand from Advanced Node Adoption: The widespread transition to sub-3nm and emerging 2nm logic nodes, alongside continued scaling in 3D NAND (beyond 300 layers) and advanced DRAM (e.g., DDR5, GDDR7), will be the primary growth driver. These nodes require exponentially more complex and precise planarization steps, increasing the number of CMP tools per fab and driving demand for next-generation machines capable of handling novel materials (like Ru, Co, MoS₂) and structures (e.g., Gate-All-Around FETs, high-aspect-ratio channels).

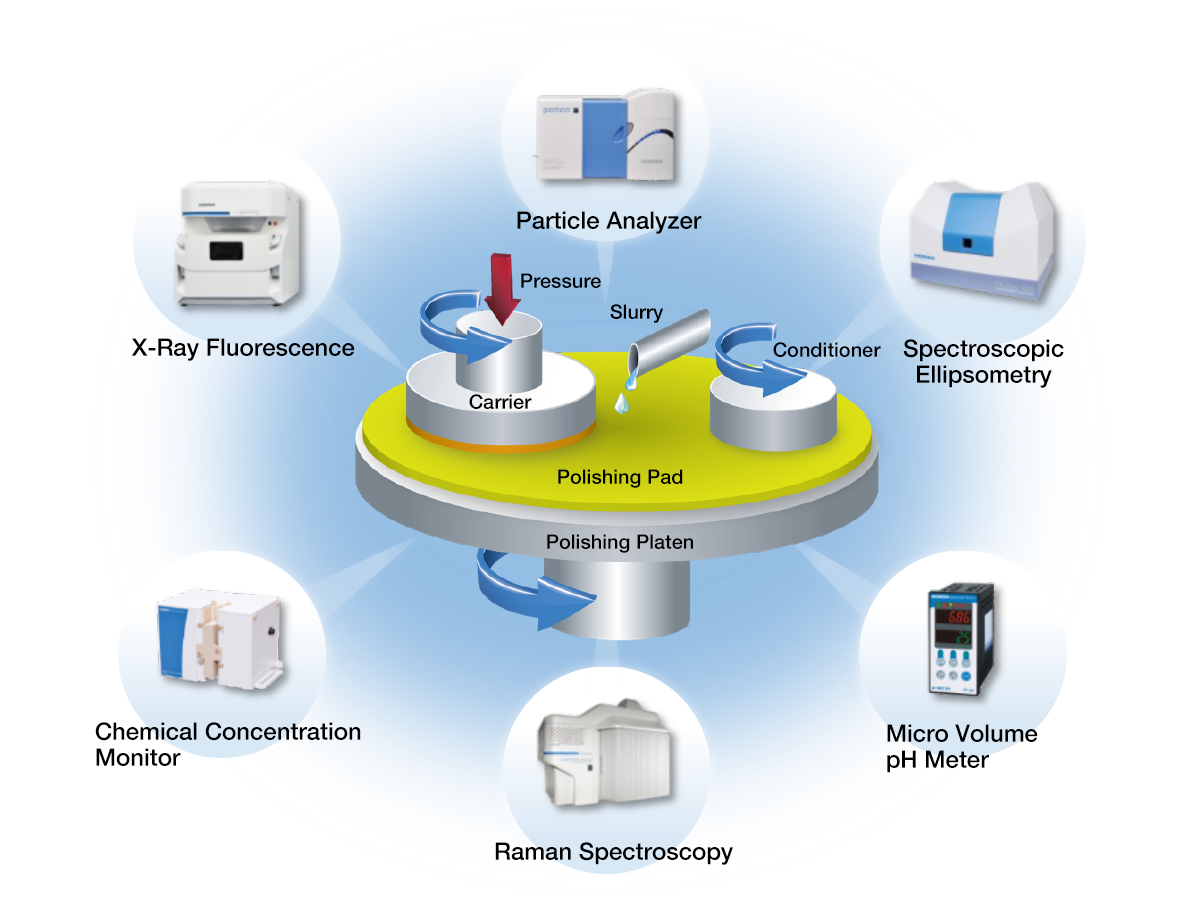

2. Intensified Focus on Precision, Uniformity, and Defect Control: As feature sizes shrink below 10nm, atomic-level control becomes critical. CMP machines in 2026 will feature enhanced real-time monitoring (e.g., advanced endpoint detection using AI/ML analysis of acoustic, optical, and electrical signals), in-situ metrology integration, and closed-loop process control. The emphasis will be on achieving nanometer-scale within-wafer non-uniformity (WIWNU) and minimizing killer defects (scratches, particles, erosion/dishing) to ensure high yield.

3. Rise of AI and Machine Learning Integration: AI/ML will be deeply embedded in CMP platforms by 2026. Algorithms will optimize pad conditioning, slurry delivery, downforce, and platen speed dynamically based on real-time sensor data and historical process outcomes. Predictive maintenance will become standard, minimizing downtime. AI will also accelerate process development and recipe optimization, reducing time-to-market for new nodes.

4. Enhanced Equipment Intelligence and Automation: Smart CMP tools will feature advanced connectivity (Industry 4.0 standards) and higher levels of automation. Integration with factory control systems (MES, APC) will enable seamless data flow for lot tracking, statistical process control (SPC), and automated fault detection and classification (ADC/FDC). Self-calibration and self-diagnostic capabilities will increase, reducing reliance on manual intervention.

5. Material and Process Innovation Driving Tool Evolution: The need to polish harder, more brittle, and novel materials (e.g., high-k dielectrics, 2D materials, low-k carbon-based films) will push the development of new polishing pads, slurries, and conditioning technologies. CMP tools will require improved thermal management, more precise slurry distribution systems, and adaptable head designs to handle these diverse materials without damage.

6. Sustainability and Cost of Ownership (CoO) Pressures: Environmental regulations (e.g., REACH, RoHS) will intensify focus on reducing slurry waste, water consumption, and chemical usage. Tools will incorporate improved slurry recycling systems, closed-loop fluid management, and reduced chemical footprints. Simultaneously, manufacturers will prioritize lowering CoO through higher throughput (e.g., multi-wafer processing advancements), extended consumable lifetimes, and improved tool uptime.

7. Supply Chain Resilience and Regionalization: Geopolitical factors and the push for semiconductor sovereignty (e.g., US CHIPS Act, EU Chips Act) will lead to increased fab construction outside traditional hubs. This will create new regional demand for CMP tools and may accelerate localized supply chains for critical components and consumables, impacting equipment suppliers’ global strategies.

8. Consolidation and Competitive Dynamics: The high R&D costs for next-gen CMP tools will likely lead to continued market consolidation or stronger partnerships between equipment vendors (e.g., Applied Materials, KLA, Ebara, Tokyo Electron) and material suppliers (e.g., Cabot Microelectronics, FUJIMI). Niche players focusing on specific materials or processes may gain importance.

In conclusion, the 2026 CMP machine market will be characterized by demand driven by extreme scaling, technological sophistication centered on AI and precision control, and a strong emphasis on sustainability and operational efficiency. Success will depend on vendors’ ability to deliver highly intelligent, adaptable, and reliable tools that enable the yield and performance required for the most advanced semiconductor devices.

Common Pitfalls When Sourcing CMP Machines: Quality and Intellectual Property Risks

When sourcing Chemical Mechanical Planarization (CMP) machines—critical equipment in semiconductor manufacturing—organizations often face significant challenges related to both equipment quality and intellectual property (IP) protection. Overlooking these aspects can lead to production delays, yield issues, legal disputes, and compromised technology advantages.

Quality-Related Pitfalls

Inadequate Machine Specifications and Performance Validation

One of the most frequent pitfalls is failing to clearly define and validate machine performance criteria. Buyers may accept vendor claims at face value without rigorous testing or benchmarking against known standards. Poorly specified machines may not meet required material removal rates, uniformity, or defect control standards, directly impacting wafer yield and process repeatability.

Lack of Due Diligence on Supplier Track Record

Sourcing from vendors without a proven history in high-volume manufacturing (HVM) environments can result in unreliable equipment. Start-up suppliers or those new to advanced node processes may offer lower prices but lack the engineering support, service network, or quality control systems needed for stable operation.

Insufficient After-Sales Support and Serviceability

Even high-quality machines can underperform if maintenance, spare parts availability, and technical support are inadequate. Buyers may underestimate the importance of service level agreements (SLAs), leading to extended downtimes and increased total cost of ownership.

Component and Subsystem Quality Variability

CMP machines rely on precision components such as polishing heads, slurry delivery systems, and endpoint detection sensors. Sourcing machines with substandard or non-OEM parts can compromise performance and longevity. Hidden use of refurbished or counterfeit components is a growing concern, especially with secondary market or reconditioned equipment.

Intellectual Property-Related Pitfalls

Unprotected Technology Transfer and Reverse Engineering Risks

When working with new or offshore suppliers, there is a risk that proprietary process knowledge—such as slurry formulations, pad conditioning algorithms, or polishing recipes—could be exposed or misappropriated. Weak contractual safeguards may allow suppliers to use or replicate sensitive IP for other clients.

Ambiguous IP Ownership in Co-Developed Equipment

In cases where the buyer collaborates with the supplier to customize the CMP tool, ownership of resulting improvements or innovations may be unclear. Without explicit agreements, suppliers may retain rights to modifications, limiting the buyer’s freedom to use or transfer the technology.

Use of Infringing Third-Party Technology

Sourcing from vendors who incorporate unlicensed or patented technologies in their machines can expose the buyer to legal liability. Even unintentional use of infringing subsystems (e.g., control software or sensor modules) may result in injunctions or costly litigation.

Weak Contractual IP Clauses and Export Control Oversights

Poorly drafted procurement contracts may omit essential IP protections, confidentiality terms, or compliance with export control regulations (e.g., EAR or ITAR). This is particularly critical when sourcing from jurisdictions with lax IP enforcement or strategic technology competition concerns.

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Conduct thorough technical audits and factory acceptance tests (FAT).

– Perform deep supplier vetting, including site visits and reference checks.

– Implement robust contracts with clear IP ownership, confidentiality, and audit rights.

– Engage legal and technical experts early in the procurement process.

– Consider geopolitical risks and supply chain resilience when selecting vendors.

By proactively addressing quality and IP concerns, companies can ensure reliable, secure, and high-performing CMP equipment integration into their semiconductor fabrication lines.

Logistics & Compliance Guide for CMP Machines

This guide outlines key logistics and compliance considerations for the transportation, handling, and operation of Chemical Mechanical Planarization (CMP) machines in semiconductor manufacturing environments. Adherence to these guidelines ensures safety, regulatory compliance, and operational efficiency.

Shipping and Transportation

CMP machines are precision equipment requiring careful handling during transit. Use only certified logistics providers experienced in high-tech industrial machinery. Machines must be securely crated with shock-absorbing materials and environmental protection (e.g., desiccants, moisture barriers). All shipments must comply with international freight standards (e.g., ISTA, ISO). Proper labeling, including fragile, orientation, and hazardous material indicators (if applicable), is required. Ensure compliance with export controls (e.g., EAR, ITAR) when shipping across borders, including proper documentation and license verification.

Site Preparation and Receiving

Prior to delivery, the installation site must meet all facility requirements, including floor load capacity (typically >1,200 kg/m²), vibration isolation, cleanroom classification (ISO 1–5), and utility availability (deionized water, process chemicals, compressed air, exhaust, and power). Upon arrival, inspect the packaging for damage and verify contents against the packing list. Perform a visual inspection of the machine before unpacking. Coordinate with facility and safety teams to ensure safe unloading using appropriate lifting equipment (e.g., forklifts with soft forks, overhead cranes).

Installation and Commissioning

Installation must be performed by qualified technicians following the manufacturer’s specifications. Verify proper leveling, anchoring, and utility connections. Conduct leak tests on fluid and gas lines. Calibration and system diagnostics should be completed during commissioning. Maintain detailed installation records, including photographs, torque logs, and calibration certificates. Confirm compliance with local electrical, plumbing, and safety codes (e.g., NEC, IEC, ASHRAE).

Regulatory Compliance

CMP machines are subject to multiple regulatory frameworks:

– Environmental Regulations: Comply with EPA, REACH, and local regulations for handling and disposal of slurry, used pads, and rinse water. Implement waste segregation and approved disposal procedures.

– Chemical Safety: Adhere to OSHA Hazard Communication Standard (HAZCOM) and GHS labeling for all process chemicals. Maintain Safety Data Sheets (SDS) on-site and accessible.

– Machine Safety: Ensure compliance with machinery directives (e.g., EU Machinery Directive 2006/42/EC, ANSI B11 standards). Install required safety interlocks, emergency stops, and guarding.

– Emissions Control: Verify exhaust systems meet local air quality standards (e.g., VOC limits); conduct periodic stack testing if required.

Operational Compliance and Maintenance

Establish documented procedures for routine maintenance, preventive maintenance (PM), and change control. Use only approved spare parts and consumables. Maintain logs for PM activities, repairs, and component replacements. Conduct periodic safety and compliance audits. Train all operators and maintenance personnel on equipment-specific procedures, chemical handling, and emergency response.

Decommissioning and Disposal

When retiring a CMP machine, follow a formal decommissioning protocol. Safely disconnect utilities and remove residual chemicals in accordance with environmental regulations. Decontaminate process chambers and fluid lines. Recycle or dispose of components (e.g., motors, electronics, metals) through certified e-waste or industrial recyclers. Maintain records of disposal activities for audit purposes.

Documentation and Recordkeeping

Maintain a comprehensive compliance file including:

– Equipment manuals and certifications

– Installation and commissioning reports

– Maintenance and calibration logs

– Safety training records

– Chemical inventory and SDS

– Regulatory permits and inspection reports

Regular reviews and updates of documentation ensure ongoing compliance and support audit readiness.

Conclusion for Sourcing CMP Machines

Sourcing Chemical Mechanical Planarization (CMP) machines is a critical decision that significantly impacts semiconductor manufacturing performance, yield, and scalability. After evaluating key factors such as machine performance, compatibility with process requirements, cost of ownership, service and support, and technological maturity, it becomes evident that a strategic and thorough supplier assessment is essential.

The ideal CMP machine supplier should offer reliable, high-precision equipment with proven process stability and defect control, aligned with current and future node requirements. Additionally, strong technical support, spare parts availability, and upgrade flexibility are crucial for minimizing downtime and ensuring long-term operational efficiency.

Furthermore, considering total cost of ownership—factoring in installation, maintenance, consumables, and training—enables more informed procurement decisions beyond initial price points. Engaging with established industry leaders or innovative emerging vendors with solid track records can provide a balance between cutting-edge technology and proven reliability.

In conclusion, successful sourcing of CMP machines requires a balanced approach that integrates technical specifications, financial considerations, and strategic supplier partnership. This ensures the integration of robust, scalable, and cost-effective CMP solutions that support high-volume manufacturing demands and drive advancements in semiconductor device fabrication.