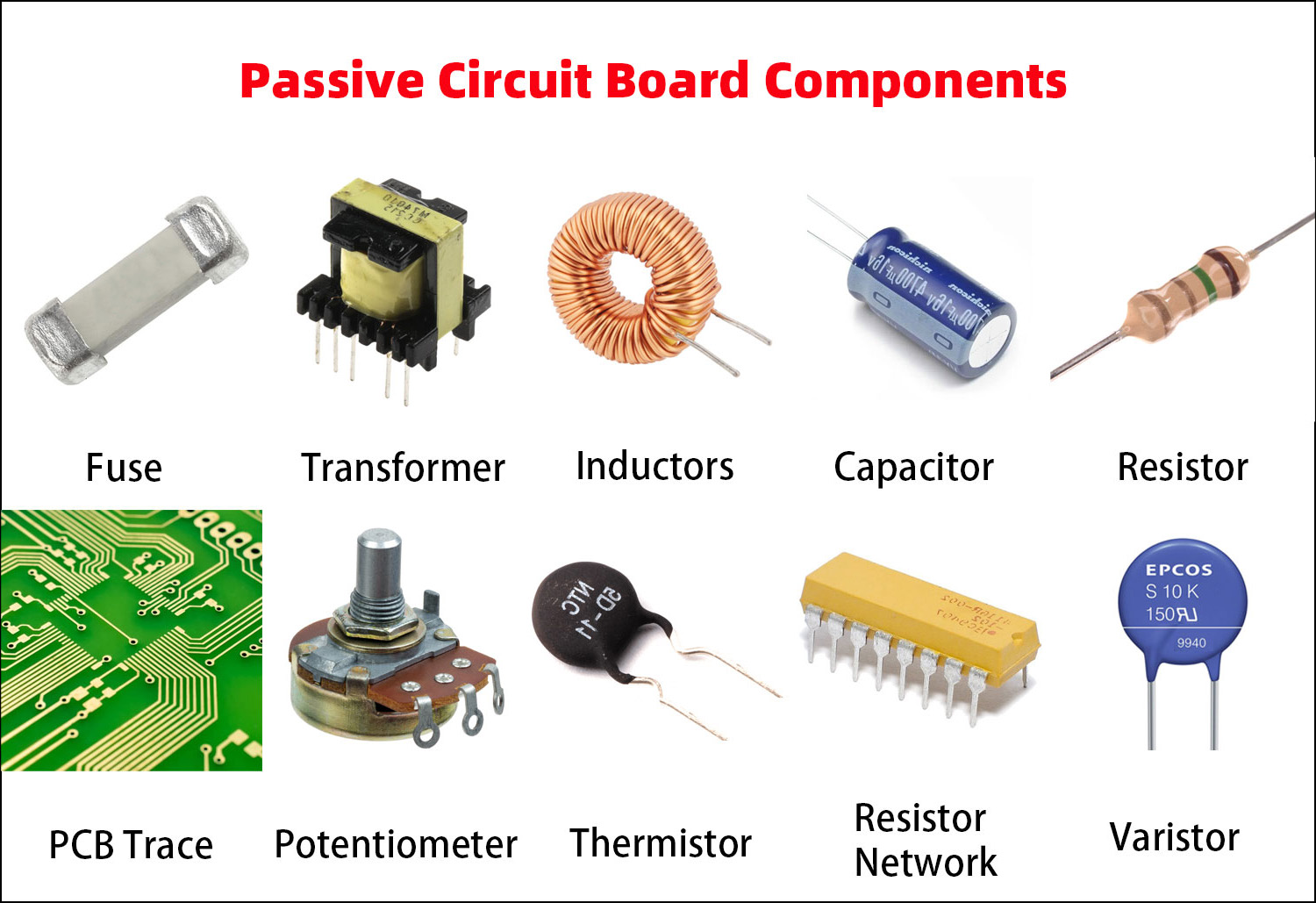

The global capacitor market is experiencing steady growth, driven by rising demand for electronics, electric vehicles, renewable energy systems, and advanced consumer devices. According to Grand View Research, the global capacitor market size was valued at USD 25.5 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by the increasing miniaturization of electronic components and the proliferation of high-frequency and high-temperature applications, particularly in automotive and telecommunications sectors. As critical passive components in circuit boards, capacitors play a vital role in energy storage, filtering, and signal conditioning. With escalating production volumes of printed circuit boards (PCBs) worldwide, the need for reliable, high-performance capacitors has intensified. In this competitive landscape, a select group of manufacturers has emerged as leaders, combining innovation, scale, and quality to serve diverse industrial needs. The following analysis highlights the top eight circuit board capacitor manufacturers shaping the future of electronics through technological advancement and global supply chain integration.

Top 8 Circuit Board Capacitor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Capacitor

Domain Est. 1994

Website: murata.com

Key Highlights: Capacitor. Murata offers ceramic, polymer aluminum, single-layer microchip, variable, silicon, film, and various other types of capacitors….

#2 Cornell Dubilier

Domain Est. 1995

Website: cde.com

Key Highlights: A leading manufacturer of high-quality capacitors, Cornell Dubilier serves companies in the power electronics industry with the goal of collaborating with ……

#3 Aluminum Electrolytic Capacitors

Domain Est. 1990

Website: industrial.panasonic.com

Key Highlights: Wide variety of SMT aluminum electrolytic capacitors in the industry. Low ESR and long life compared to general types. We provide the best capacitor suited for ……

#4 Capacitors

Domain Est. 1996

Website: product.tdk.com

Key Highlights: TDK offers a large selection of highly reliable capacitors ranging from miniaturized MLCCs (multilayer ceramic chip capacitors) used in smartphones and cars….

#5 Capacitors passive electronic components

Domain Est. 2009

Website: exxelia.com

Key Highlights: Exxelia is expert in manufacturing different types of capacitors including tantalum capacitors, ceramic capacitors, film capacitors, RF capacitors and ……

#6 Knowles Precision Devices

Domain Est. 2013

Website: knowlescapacitors.com

Key Highlights: At Knowles Precision Devices we make Multilayer, Single Layer, High Reliability and Precision Variable Capacitors, EMI Filters and Microwave Devices….

#7 FICT LIMITED

Domain Est. 2021

Website: fict-g.com

Key Highlights: We develop highly reliable, high-performance semiconductor packaging substrates and multilayer printed circuit boards (PCBs) for a wide variety of applications….

#8 Rubycon Corporation

Website: rubycon.co.jp

Key Highlights: Rubycon Corporation is a Japanese electronics company, whose main products are electrolytic capacitors, film capacitors and power supply units with a wide ……

Expert Sourcing Insights for Circuit Board Capacitor

2026 Market Trends for Circuit Board Capacitor

Rising Demand from Consumer Electronics and 5G Technology

The global circuit board capacitor market is projected to experience robust growth by 2026, driven primarily by the escalating demand for advanced consumer electronics and the widespread rollout of 5G infrastructure. Smartphones, wearable devices, and next-generation tablets require increasingly compact and high-performance capacitors to support miniaturization and enhanced functionality. As 5G networks expand globally, the need for high-frequency, high-reliability capacitors in base stations, routers, and edge computing devices will further accelerate market expansion.

Growth in Electric Vehicles and Automotive Electronics

The automotive sector, especially the electric vehicle (EV) market, is expected to be a major growth driver for circuit board capacitors through 2026. EVs require significantly more electronic content than traditional internal combustion engine vehicles, including power inverters, onboard chargers, and advanced driver-assistance systems (ADAS). These systems rely heavily on ceramic, aluminum, and film capacitors for power conditioning and signal filtering. With increasing government regulations promoting clean energy and advancements in battery technology, capacitor manufacturers are focusing on developing automotive-grade components with higher temperature stability and longer lifespans.

Advancements in Multilayer Ceramic Capacitors (MLCCs)

Multilayer Ceramic Capacitors (MLCCs) are anticipated to dominate the circuit board capacitor market by 2026 due to ongoing innovations in materials science and manufacturing techniques. Trends include the development of ultra-miniaturized MLCCs with higher capacitance values in smaller footprints, such as 01005 and 00804 case sizes. Additionally, advancements in base-metal electrode (BME) technology are reducing production costs while maintaining performance, making high-capacitance MLCCs more accessible for mass-market applications.

Supply Chain Diversification and Regional Manufacturing Shifts

Following disruptions in recent years, capacitor manufacturers are reevaluating supply chain strategies. By 2026, there will be a noticeable shift toward regionalized production, particularly in Southeast Asia and North America, to mitigate geopolitical risks and reduce dependency on single-source suppliers. Countries like Vietnam, India, and Mexico are emerging as key manufacturing hubs, supported by government incentives and growing local electronics ecosystems. This trend is expected to improve supply resilience and shorten lead times for capacitor procurement.

Focus on Sustainability and Material Innovation

Environmental regulations and corporate sustainability goals are pushing capacitor producers to innovate in eco-friendly materials and lead-free manufacturing processes. By 2026, the industry is expected to see increased adoption of bio-based resins, recyclable packaging, and reduced use of rare or conflict materials. Additionally, research into alternative dielectric materials, such as barium titanate composites and high-k ceramics, aims to improve energy efficiency and thermal performance while minimizing environmental impact.

Increasing Adoption in Industrial IoT and Smart Infrastructure

The proliferation of Industrial Internet of Things (IIoT) devices and smart city initiatives is creating new opportunities for circuit board capacitors. Sensors, programmable logic controllers (PLCs), and wireless communication modules used in smart factories, energy grids, and building automation systems require reliable, long-life capacitors capable of operating in harsh environments. This trend is driving demand for ruggedized and extended-temperature-range capacitor solutions, particularly in solid aluminum and tantalum variants.

Competitive Landscape and Strategic Consolidation

The capacitor market is likely to witness increased consolidation by 2026 as leading players acquire niche manufacturers to strengthen their technology portfolios and geographic reach. Companies such as Murata, TDK, Samsung Electro-Mechanics, and KEMET (a subsidiary of Panasonic) are investing heavily in R&D and automation to maintain competitive advantage. Meanwhile, Chinese and Taiwanese manufacturers are gaining market share through cost-efficient production and rapid innovation, intensifying global competition.

Conclusion

By 2026, the circuit board capacitor market will be shaped by technological innovation, shifting supply chains, and growing demand from high-growth industries such as EVs, 5G, and IoT. Manufacturers that can deliver miniaturized, reliable, and sustainable capacitor solutions will be well-positioned to capitalize on these evolving trends.

Common Pitfalls Sourcing Circuit Board Capacitors (Quality, IP)

Sourcing the right capacitors for circuit boards involves navigating several critical challenges, particularly concerning quality assurance and intellectual property (IP) risks. Overlooking these pitfalls can lead to product failures, supply chain disruptions, or legal exposure.

Inadequate Quality Verification

One of the most frequent issues is assuming datasheet specifications equate to real-world performance. Counterfeit or substandard capacitors may appear genuine but fail prematurely under operating conditions. Buyers often neglect rigorous incoming inspection, such as X-ray analysis, electrical testing, or material composition verification. Using capacitors from unauthorized distributors or gray market suppliers increases the risk of receiving re-marked, recycled, or out-of-spec components, which can compromise circuit reliability and longevity.

Lack of Supply Chain Transparency

Poor visibility into the capacitor supply chain exposes buyers to quality and compliance risks. Without traceability from manufacturer to end-user, it becomes difficult to verify authenticity or respond effectively to field failures. Relying on intermediaries without documented chain-of-custody increases the likelihood of receiving non-compliant or counterfeit parts, especially for high-demand or obsolete components.

Intellectual Property Infringement Risks

Designing with capacitors—especially proprietary or patented types—can inadvertently expose companies to IP claims. Using capacitors that incorporate patented materials, structures, or manufacturing techniques without proper licensing may result in legal challenges. This is particularly relevant when sourcing from lesser-known manufacturers whose designs may infringe on established patents held by major brands like Murata, TDK, or Panasonic.

Overlooking Compliance and Certification

Capacitors used in regulated industries (e.g., medical, automotive, aerospace) must meet specific standards (e.g., AEC-Q200, ISO/TS 16949). Sourcing components without proper certifications can lead to non-compliance, product recalls, or failed audits. Assuming compliance based on vendor claims without validating documentation is a common oversight.

Insufficient Lifecycle and Obsolescence Management

Failing to assess the lifecycle status of a capacitor can disrupt production. Components nearing end-of-life (EOL) may become unavailable, forcing costly redesigns. Sourcing from manufacturers with poor lifecycle communication increases the risk of sudden supply interruptions, especially when no second-source options are qualified.

Logistics & Compliance Guide for Circuit Board Capacitors

Product Classification and HS Code

Circuit board capacitors are typically classified under the Harmonized System (HS) code 8532.20, which covers fixed capacitors for use in electronic equipment. Accurate classification is essential for determining import duties, taxes, and regulatory requirements in destination countries. Always verify the specific subcategory based on capacitor type (e.g., ceramic, electrolytic, tantalum) and capacitance value.

Export Controls and ITAR/EAR Considerations

Most standard capacitors are classified as EAR99 under the U.S. Export Administration Regulations (EAR), meaning they are low-risk and generally not subject to stringent export controls. However, capacitors designed for military, aerospace, or high-frequency telecommunications applications may fall under stricter controls or even the International Traffic in Arms Regulations (ITAR). Confirm the Export Control Classification Number (ECCN) before shipment.

Packaging and Handling Requirements

Capacitors, especially surface-mount devices (SMD), are sensitive to electrostatic discharge (ESD) and moisture. Use anti-static bags, conductive foam, or moisture barrier packaging (MBB) with desiccant and humidity indicator cards. Label packages with ESD-sensitive warnings and follow JEDEC standards (e.g., J-STD-033) for moisture sensitivity levels (MSL). Avoid mechanical stress and ensure secure packing to prevent damage during transit.

Transportation and Shipping Regulations

Capacitors are generally non-hazardous and can be shipped via air, sea, or land without special hazardous materials declarations. However, aluminum electrolytic capacitors may contain small amounts of electrolyte that could be mildly corrosive under failure conditions. Confirm with manufacturers for any restricted substances. IATA, IMDG, and ADR regulations typically do not apply unless capacitors are part of larger hazardous assemblies.

RoHS and REACH Compliance

Ensure all capacitors comply with the European Union’s RoHS (Restriction of Hazardous Substances) directive, which limits lead, mercury, cadmium, and other harmful materials. Additionally, verify REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) compliance, particularly for substances of very high concern (SVHC). Suppliers should provide a Declaration of Conformity (DoC) and material disclosure (e.g., IPC-1752 format).

Country-Specific Import Regulations

Different countries may impose additional requirements:

– China: Requires CCC (China Compulsory Certification) for certain electronic components.

– South Korea: KCC certification may be necessary for electromagnetic compatibility.

– India: BIS (Bureau of Indian Standards) registration may apply.

Always check destination-specific regulations and ensure product markings meet local labeling laws.

Traceability and Documentation

Maintain full supply chain traceability, including lot numbers, date codes, and manufacturer certifications. Required documentation includes commercial invoice, packing list, bill of lading, and compliance certificates (RoHS, REACH, ISO 9001). For high-reliability sectors (e.g., medical, automotive), additional documentation such as PPAP or AEC-Q200 qualification may be required.

End-of-Life and Environmental Disposal

Capacitors must be disposed of in accordance with WEEE (Waste Electrical and Electronic Equipment) directives in applicable regions. Electrolytic capacitors may require special handling due to electrolyte content. Partner with certified e-waste recyclers and ensure proper recycling documentation is maintained.

Conclusion for Sourcing Circuit Board Capacitors

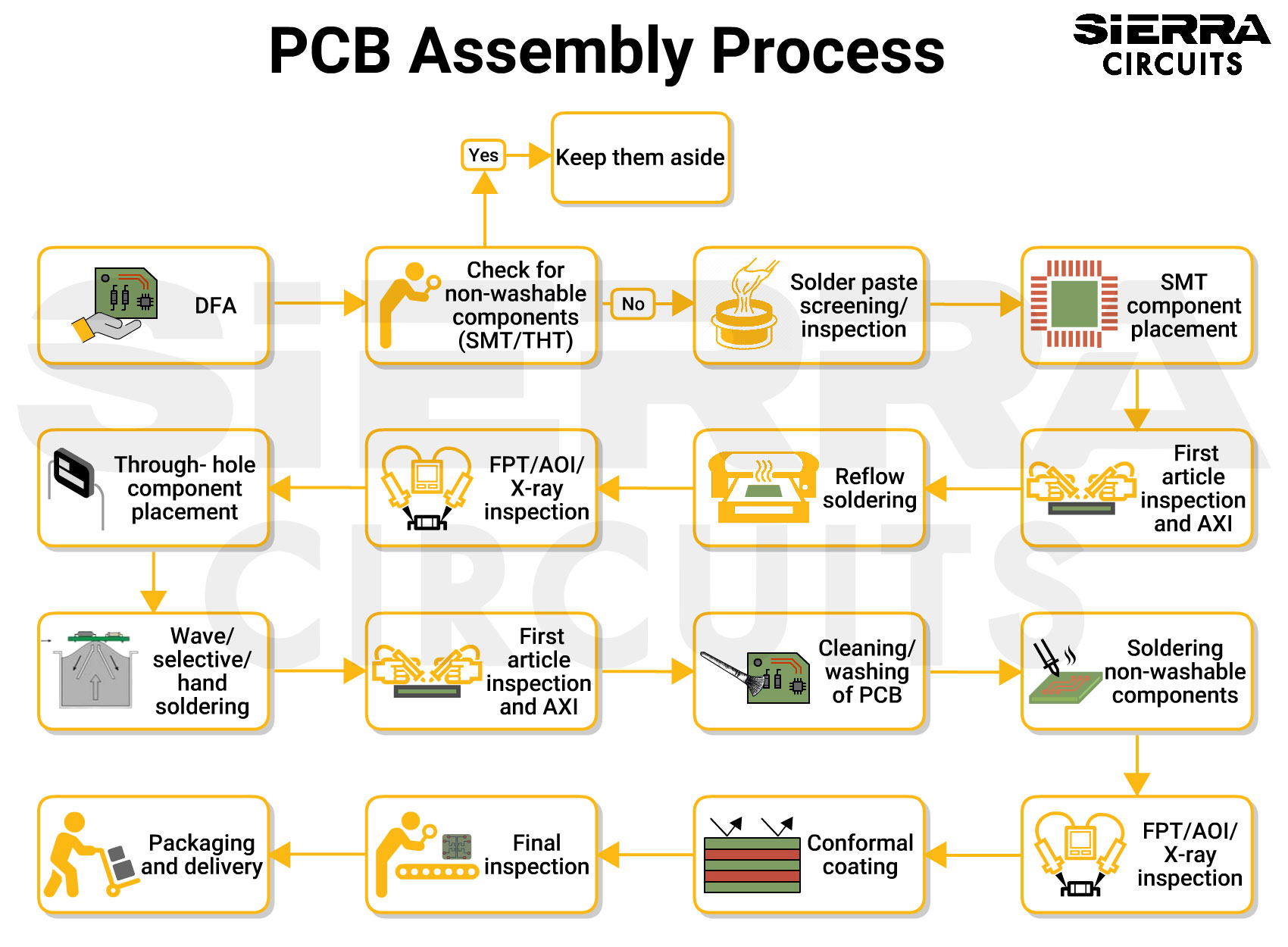

Sourcing the right capacitors for circuit boards is a critical step in ensuring the reliability, performance, and longevity of electronic devices. A successful procurement strategy involves balancing technical specifications—such as capacitance value, voltage rating, temperature stability, size, and ESR—with considerations like supplier reliability, cost, lead times, and regulatory compliance (e.g., RoHS, REACH).

Through careful evaluation of component manufacturers (such as Murata, TDK, Samsung Electro-Mechanics, and AVX), comparisons between capacitor types (ceramic, electrolytic, tantalum, film), and attention to supply chain stability, engineers and procurement teams can mitigate risks associated with obsolescence, counterfeit parts, and delivery delays. Additionally, partnering with authorized distributors and leveraging component management tools enhances traceability and quality assurance.

In summary, effective capacitor sourcing requires a collaborative approach between design, procurement, and manufacturing teams, ensuring that both technical requirements and supply chain resilience are addressed. By doing so, organizations can maintain product performance, reduce time-to-market, and achieve long-term cost efficiency in their electronic manufacturing processes.