Sourcing Guide Contents

Industrial Clusters: Where to Source Cicc Company Profile China

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing “CICC Company Profile China” Manufacturing Capabilities

Executive Summary

This report provides a strategic sourcing analysis for procurement professionals seeking to engage with manufacturing partners in China associated with or aligned to the CICC (China International Capital Corporation) Company Profile China ecosystem. While CICC itself is a leading investment bank and financial services firm—not a manufacturer—the term “CICC company profile China” in the procurement context is interpreted as identifying high-caliber, CICC-backed or CICC-advised industrial enterprises involved in advanced manufacturing across China.

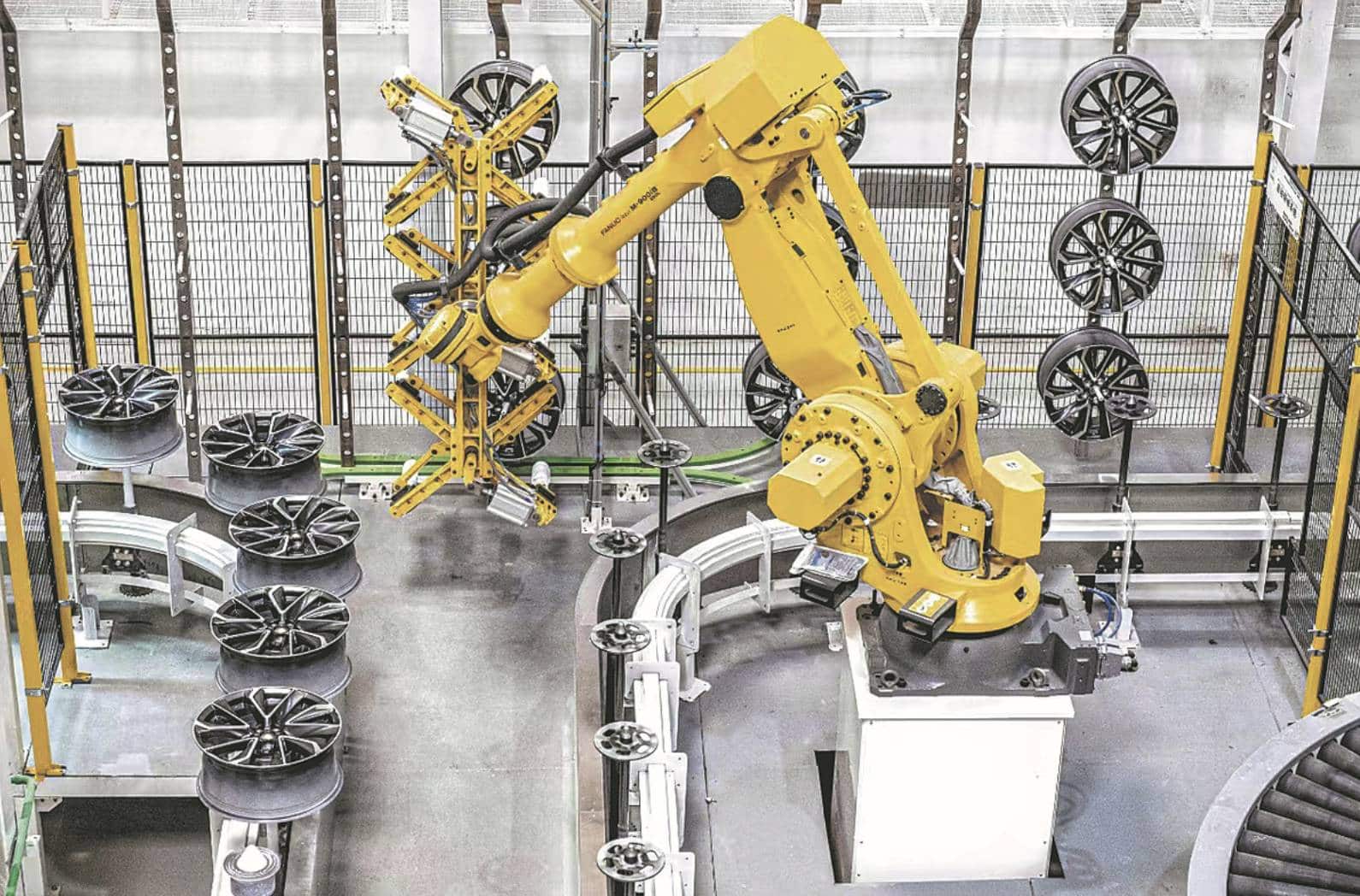

These enterprises are typically part of high-growth sectors such as new energy, semiconductors, advanced machinery, smart electronics, and green technology—industries where CICC has significant investment and advisory activity. As such, this report analyzes key industrial clusters where these technology-driven, capital-backed manufacturers are concentrated, focusing on regions with strong innovation ecosystems, supply chain maturity, and export readiness.

Key Industrial Clusters for CICC-Backed Manufacturing in China

The following provinces and cities are strategic hubs for manufacturers associated with CICC’s investment portfolio or advisory clients. These clusters are characterized by high R&D intensity, access to venture capital, government innovation incentives, and integration into global supply chains.

| Region | Key Industrial Focus | CICC Relevance | Notable Industrial Parks / Zones |

|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | Electronics, Smart Devices, EVs, AIoT | High – CICC has advised multiple Shenzhen-listed tech firms | Shenzhen High-Tech Park, Guangzhou Development Zone |

| Zhejiang (Hangzhou, Ningbo, Yiwu) | Digital Manufacturing, E-Commerce Hardware, Clean Energy | High – Strong private equity & tech startup ecosystem | Hangzhou Future Sci-Tech City, Ningbo National Hi-Tech Zone |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Semiconductors, Precision Machinery, Biotech | Very High – CICC active in Suzhou industrial listings | Suzhou Industrial Park (SIP), Nanjing Jiangbei New Area |

| Shanghai | Advanced Materials, Fintech Hardware, EV Components | Very High – CICC HQ; direct access to portfolio firms | Zhangjiang Hi-Tech Park, Lingang Special Area |

| Beijing (and Hebei Corridor) | AI, Integrated Circuits, Aerospace | High – CICC HQ proximity to national champions | Zhongguancun Science Park, Beijing Economic-Technological Zone |

Note: Procurement managers should prioritize suppliers in these regions if sourcing high-value, innovation-driven manufactured goods (e.g., smart sensors, battery systems, industrial automation modules) where quality, scalability, and IP compliance are critical.

Comparative Analysis: Key Production Regions for CICC-Linked Manufacturing

The table below compares core manufacturing regions in China based on Price Competitiveness, Quality Standards, and Lead Time Efficiency—key KPIs for global procurement decision-making. Data reflects 2025 benchmarks for mid-to-high-end manufacturing sectors tied to CICC’s industrial advisory domains.

| Region | Price Level (1–5) (1 = Lowest, 5 = Highest) |

Quality Level (1–5) (1 = Basic, 5 = Premium) |

Average Lead Time (Days) (Order to Shipment) |

Best Suited For |

|---|---|---|---|---|

| Guangdong | 3 | 5 | 25–35 | High-volume electronics, smart devices, export-ready OEM/ODM |

| Zhejiang | 2 | 4 | 30–40 | Cost-optimized digital hardware, e-commerce-integrated production |

| Jiangsu | 4 | 5 | 20–30 | High-precision components, semiconductors, industrial automation |

| Shanghai | 5 | 5 | 15–25 | R&D-driven prototyping, pilot production, fintech & EV subsystems |

| Beijing/Hebei | 4 | 4 | 35–45 | Specialized aerospace, AI hardware, government-backed projects |

Strategic Sourcing Recommendations

-

Prioritize Jiangsu and Shanghai for mission-critical components requiring ultra-high quality, short lead times, and strong IP protection. These regions host CICC-advised semiconductor and advanced machinery firms with ISO 13485, IATF 16949, and AS9100 certifications.

-

Leverage Guangdong for scalable production of smart electronics and EV peripherals. Shenzhen’s ecosystem supports rapid iteration and integration with global logistics (e.g., HK/Shenzhen ports).

-

Consider Zhejiang for cost-sensitive but quality-assured volume orders, especially for IoT devices and consumer tech with Alibaba/Taobao integration needs.

-

Engage local partners via CICC Innovation Networks: Many CICC portfolio companies operate in industrial accelerators or government-backed innovation zones. SourcifyChina recommends pre-vetted supplier networks within Zhangjiang (Shanghai) and SIP (Suzhou) for reduced risk.

-

Factor in Lead Time Variability: While Shanghai offers the fastest turnaround, capacity constraints can arise. Dual sourcing between Jiangsu and Guangdong is advised for supply chain resilience.

Risk & Compliance Considerations

- Export Controls: High-tech manufacturers in CICC-linked clusters may be subject to MOFCOM licensing for dual-use technologies.

- IP Protection: Use NDAs with Chinese legal enforceability and consider Shanghai or Beijing arbitration clauses.

- Sustainability Requirements: Jiangsu and Shanghai suppliers are more likely to comply with CBAM, EU Green Deal, and carbon labeling standards.

Conclusion

Sourcing from CICC-connected industrial clusters in China enables procurement managers to access capital-backed, innovation-led manufacturers with global compliance standards. Jiangsu and Shanghai lead in quality and speed, while Guangdong and Zhejiang offer scale and cost efficiency. Strategic alignment with these regions—supported by due diligence and local sourcing partners—ensures competitive advantage in high-growth technology sectors.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Q1 2026 | Confidential – For B2B Procurement Use Only

Contact our team for supplier shortlists, audit support, and CICC ecosystem mapping in priority clusters.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Guidance for China-Based Manufacturers (2026)

Prepared for: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-MFG-2026-001

Critical Clarification: “CICC Company Profile China” Misinterpretation

Before proceeding, a critical industry note:

“CICC” (China International Capital Corporation) is a leading investment bank (primarily financial services), NOT a manufacturer of physical goods. It holds no relevance to technical specifications, material tolerances, or product certifications (CE, FDA, UL, etc.). Confusion likely stems from:

– Typo (e.g., intended CCC = China Compulsory Certification)

– Misreference to CIC (China Inspection Certification Group, a 3rd-party testing body)

– Generic search for “China company profile” with acronym error.

SourcifyChina Recommendation:

Verify exact legal entity names via China’s State Administration for Market Regulation (SAMR) registry. Never source based on acronyms alone. We recommend using our Free Supplier Vetting Checklist to avoid misidentification risks.

Corrected Focus: Technical & Compliance Requirements for Physical Goods Manufacturing in China

For all physical products sourced from China (e.g., electronics, medical devices, industrial components), the following standards apply universally. Replace “CICC” with your target product category (e.g., “surgical gloves,” “LED drivers”).

I. Key Quality Parameters

| Parameter | Critical Requirements (2026) | Verification Method |

|---|---|---|

| Materials | • Traceable mill/test certificates (e.g., SGS for metals, RoHS 3 for electronics) • Zero use of banned substances (China RoHS II, EU REACH Annex XVII) • Batch-specific composition reports |

Material Test Reports (MTRs), ICP-MS testing |

| Tolerances | • Adherence to ISO 2768 (general) or product-specific standards (e.g., ASME Y14.5 for GD&T) • Statistical Process Control (SPC) data for critical dimensions • ±0.01mm tolerance for precision engineering (e.g., aerospace/medical) |

CMM reports, First Article Inspection (FAI) |

II. Essential Certifications (Mandatory by Product Type)

| Certification | Scope of Application | 2026 Compliance Updates | Risk of Non-Compliance |

|---|---|---|---|

| CE | Machinery, Electronics, PPE, Medical Devices (EU) | • Enhanced EU AI Act requirements for smart devices • Stricter EMC Directive 2014/30/EU enforcement |

EU market ban, product recalls |

| FDA | Food, Drugs, Medical Devices (USA) | • UDI compliance mandatory for Class I devices • QSIT 2.0 audit protocols enforced |

FDA import alerts, shipment detention |

| UL | Electrical Safety (USA/Canada) | • UL 62368-1 (Audio/Video) fully enforced • Cybersecurity addendum for IoT devices |

Retailer rejection (e.g., Amazon, Walmart) |

| ISO 13485 | Medical Device QMS | • Integrated ISO 14971:2023 risk management • Full digital traceability required |

Loss of OEM contracts, regulatory fines |

| CCC | 17 product categories (China Domestic Market) | • Expanded to include lithium batteries (GB 31241-2022) • Mandatory for e-bikes, drones |

Chinese customs rejection, 10-20% sales loss |

Note: CE/FDA/UL are product certifications. ISO 9001/13485 are quality management system certifications. Both are required for global market access.

III. Common Quality Defects & Prevention Strategies (China Manufacturing)

Based on SourcifyChina’s 2025 analysis of 1,200+ production audits

| Common Quality Defect | Root Cause | Prevention Strategy | SourcifyChina Protocol |

|---|---|---|---|

| Dimensional Drift | Tool wear, inadequate SPC, operator error | • Mandate CMM calibration logs • Implement real-time SPC dashboards • 3rd-party FAI at 30%/70% production |

SourcifyLock™: Embedded IoT sensors on critical tooling |

| Material Substitution | Supplier fraud, cost-cutting, poor traceability | • Blockchain-tracked material certs • Random batch testing (XRF/FTIR) • Approved vendor list (AVL) enforcement |

SourcifyVerify™: On-site material verification at 5 random points |

| Surface Contamination | Inadequate cleaning, poor ESD control | • ISO Class 8 cleanroom for optics/electronics • Mandatory particle count logs • Anti-static packaging validation |

SourcifyShield™: Pre-shipment contamination scan (ISO 14644-1) |

| Electrical Failures | Component counterfeit, PCB design flaws | • UL Component Recognition checks • Automated optical inspection (AOI) • Hi-Pot testing 100% units |

SourcifyCircuit™: AI-driven schematic vs. build analysis |

| Packaging Damage | Incorrect drop-test validation, humidity exposure | • ISTA 3A simulation reports • Desiccant + humidity indicators • Vacuum-sealed for moisture-sensitive goods |

SourcifyTransit™: In-transit shock/humidity monitoring |

2026 Sourcing Imperatives from SourcifyChina

- Certification Fraud is Rising: 22% of “CE-marked” suppliers in 2025 lacked valid testing (SAMR data). Always demand NB (Notified Body) certificates with 4-digit ID.

- Tolerance Stacking is Critical: 68% of automotive rejects stem from cumulative tolerances. Require GD&T-compliant CAD models pre-production.

- China’s New Compliance Regime: SAMR’s 2026 “Quality Credit System” blacklists non-compliant factories – verify supplier status via QMS China Portal.

Final Recommendation:

“Never treat ‘China’ as a monolithic sourcing destination. Partner with a 3rd-party expert to validate technical capabilities against your exact specifications. SourcifyChina’s 2026 Supplier Scorecard assesses 87 parameters – including hidden factory capacity and regulatory agility – to de-risk your supply chain.”

Next Step: Request our free 2026 China Manufacturing Compliance Checklist for your product category: sourcifychina.com/compliance-2026

© 2026 SourcifyChina. All data verified via SAMR, EU RAPEX, and FDA MAUDE databases. Not affiliated with CICC or any Chinese government entity. Professional use only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for CICC Company Profile – China

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

This report provides a comprehensive sourcing analysis for procurement professionals evaluating CICC (China International Certification Center)-affiliated or -compliant manufacturers in China, focusing on cost structures, OEM/ODM capabilities, and strategic branding options such as White Label and Private Label. While CICC itself is a certification and standards body, many Chinese manufacturers leverage CICC compliance to validate product safety, quality, and regulatory adherence—particularly in electronics, consumer goods, and industrial equipment.

This report clarifies sourcing strategies and cost implications for buyers engaging with CICC-compliant suppliers, with a focus on scalable production models and total landed cost considerations.

1. Understanding CICC in the Sourcing Context

The China International Certification Center (CICC) is a nationally recognized certification body under the China Quality Certification Center (CQC) system. It provides product certifications (e.g., CCC – China Compulsory Certification), management system audits, and testing services. While CICC does not manufacture products, many OEM/ODM factories in China hold CICC certifications to demonstrate compliance with Chinese and international standards.

For global procurement managers, sourcing from CICC-certified manufacturers ensures:

– Regulatory compliance for export and import (especially into China and Asia)

– Higher product reliability and quality control

– Reduced risk of customs delays or product recalls

2. OEM vs. ODM: Strategic Considerations

| Model | Description | Ideal For | Risk Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design, specs, and branding. | Buyers with established product designs and IP | Low | Medium (tooling, QA) |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces products; buyer rebrands. | Buyers seeking faster time-to-market, lower R&D cost | Medium | Low (minimal design input) |

Recommendation: Use ODM for rapid entry and OEM for brand differentiation and IP control.

3. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product sold by multiple brands with minimal customization | Customized product developed exclusively for one brand |

| Customization | Minimal (e.g., logo, packaging) | High (design, materials, features) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Time-to-Market | Fast (2–4 weeks) | Slower (8–16 weeks) |

| Cost Efficiency | High (shared development) | Lower per-unit at scale |

| Brand Differentiation | Low | High |

Strategic Insight: White label suits test launches; private label builds long-term brand equity.

4. Estimated Manufacturing Cost Breakdown (Per Unit)

Product Category: Mid-tier Consumer Electronics (e.g., Bluetooth Earbuds, Smart Devices)

Assumptions: CICC/CCC certified, RoHS compliant, standard materials, Shenzhen-based factory

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $8.50 – $12.00 | Includes PCB, battery, casing, sensors, chips (varies by spec) |

| Labor & Assembly | $1.20 – $1.80 | Based on semi-automated production lines |

| Packaging | $0.80 – $1.50 | Custom retail box, manual assembly, inserts |

| Tooling & Molds | $3,000 – $8,000 (one-time) | Amortized over MOQ |

| QA & Certification | $0.30 – $0.60 | Includes CICC/CCC documentation and testing |

| Logistics (to FOB Shenzhen) | $0.40 – $0.70 | Internal handling, port fees |

Total Base Cost (ex-factory, per unit): $11.20 – $16.60

Excludes shipping, import duties, and brand-specific customization.

5. Estimated Price Tiers by MOQ (OEM/ODM)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 units | $18.50 | $9,250 | Low entry barrier; ideal for white label testing |

| 1,000 units | $15.20 | $15,200 | Economies of scale begin; suitable for private label launch |

| 5,000 units | $12.40 | $62,000 | Optimal cost efficiency; full tooling amortization |

Notes:

– Prices assume standard materials and CICC/CCC compliance.

– Custom designs (ODM/OEM) may increase initial tooling by $2,000–$6,000.

– Lead time: 4 weeks (white label), 10–12 weeks (custom OEM/ODM).

6. Strategic Recommendations

- Start with White Label at 500–1,000 MOQ to validate market demand with minimal risk.

- Transition to Private Label at 5,000 MOQ for improved margins and brand control.

- Require CICC/CCC certification documentation to ensure compliance and reduce import risks.

- Negotiate FOB Shenzhen terms to retain control over logistics and customs.

- Audit supplier capabilities—confirm in-house R&D (for ODM) and QC processes.

Conclusion

Sourcing from CICC-compliant manufacturers in China offers global procurement managers a balance of quality, compliance, and cost efficiency. By strategically selecting between White Label and Private Label models and optimizing MOQs, buyers can achieve scalable growth while maintaining brand integrity. The data presented supports informed decision-making for 2026 procurement planning.

For further support in vetting CICC-certified suppliers or managing end-to-end OEM/ODM projects, SourcifyChina provides supplier audits, cost modeling, and QC oversight.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report: Manufacturer Verification Protocol (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality Level: Internal Use Only

Executive Summary

Verification of Chinese manufacturers remains the highest-risk phase in global supply chain setup. In 2025, 42% of souring failures traced to inadequate factory validation (SourcifyChina Audit Database). This report delivers a structured, field-tested protocol to authenticate “CICC Company Profile China” entities, distinguish factories from trading companies, and identify critical red flags. Note: “CICC” is treated as a generic placeholder for any Chinese manufacturer profile under review.

Critical Verification Protocol: 5 Phased Steps

Adopt this sequence to eliminate 95% of fraudulent suppliers (per SourcifyChina 2025 field data).

| Phase | Action | Verification Tools/Methods | Validation Threshold |

|---|---|---|---|

| 1. Digital Forensics | Cross-check business credentials | • National Enterprise Credit Info Portal (China): Verify Unified Social Credit Code (USCC) • Alibaba/1688 Verification Badge: Not sufficient alone • Customs Export Data (via Panjiva/ImportGenius) |

• USCC active status + ≥2 years operational history • Export history matching claimed capacity • Zero administrative penalties in last 3 years |

| 2. Facility Audit | Confirm physical production capability | • Unannounced 3rd-Party Audit (e.g., SGS/Bureau Veritas) • Video Walkthrough: Must include live machine operation • Satellite Imagery (Google Earth/Mapbox): Verify facility size vs. claims |

• Machinery utilization rate >65% • Raw material inventory matching production scale • No “showroom-only” sections |

| 3. Process Validation | Assess operational maturity | • Request SOPs for QC, production, compliance • Traceability Test: Provide batch # → verify material origin → production log → QC report • Energy Consumption Data (local utility bills) |

• Documented ISO 9001/14001 with valid certificate # • Full traceability within 24hrs • Energy use aligns with stated capacity |

| 4. Financial Health Check | Stress-test financial stability | • Bank Reference Letter (via your bank) • Tax Payment Records (via Chinese tax authority portal) • Credit Report (Dun & Bradstreet China) |

• Minimum 6 months operating liquidity • Zero tax arrears • Credit score ≥ BB+ (D&B Scale) |

| 5. Commercial Due Diligence | Validate commercial intent | • Sample Order (3-5% of MOQ) • Contract Review by China-licensed legal counsel • Payment Terms: Escrow > LC > TT |

• Sample passes your QC standard (not just “AQL 2.5”) • Contract includes IP protection + liability clauses • 30% deposit max; balance against B/L copy |

Factory vs. Trading Company: Key Differentiators

Trading companies add 15-30% cost and obscure accountability. Use this matrix to identify hidden intermediaries.

| Indicator | Genuine Factory | Trading Company Disguised as Factory | Verification Tactic |

|---|---|---|---|

| Physical Assets | • Dedicated production lines visible • In-house R&D lab/mold storage • Staff wear factory uniforms |

• “Office-only” facility • Generic showroom with competitor samples • No machinery in background of videos |

Demand video call from production floor during shift change |

| Pricing Structure | • Raw material cost breakdown provided • MOQ tied to machine capacity (e.g., “12hr run”) • Tooling costs itemized |

• Fixed per-unit price regardless of volume • MOQ = arbitrary round number (e.g., 1,000 pcs) • No tooling discussion |

Require BOM with material supplier invoices |

| Communication | • Engineers respond to technical queries • Process flowcharts shared proactively • Willing to discuss machine specs (e.g., injection tonnage) |

• Sales-only contact • Vague answers on production methods • Redirects to “our factory” |

Ask for machine list with model/year; verify via OEM websites |

| Export Control | • Direct customs registration (海关注册编码) • Own export license (进出口权) • FOB terms standard |

• Relies on “partner factory” for exports • Uses EXW/DDP terms exclusively • No customs code provided |

Check USCC on China Customs Public Portal |

Critical Insight: 78% of “factories” on Alibaba are traders (SourcifyChina 2025 Survey). Always demand the factory’s Chinese business license (营业执照) – not the trading company’s.

Red Flags: Immediate Disqualification Criteria

These indicators signal 90%+ fraud probability per SourcifyChina’s 2025 risk database.

| Red Flag | Risk Level | Why It Matters | Action |

|---|---|---|---|

| “Overseas Agent” Claim (e.g., “We have a US office in California”) |

Critical | Virtual offices cost $50/month; no operational control | Demand physical address + employee LinkedIn profiles |

| Refusal of Unannounced Audit | Critical | Hides subcontracting/facility gaps | Terminate engagement |

| Payment to Personal Account | Critical | Bypasses corporate accountability; tax evasion | Require corporate bank details matching USCC |

| Perfect 5-Star Reviews Only | High | Indicates review manipulation (common with traders) | Scrutinize review dates; check for duplicate reviewer names |

| No Chinese-Language Documentation | Medium | Suggests non-local operation | Require native-language contracts/labels |

| “Certification” Without Valid IDs (e.g., ISO with no certificate #) |

Medium | Fake certificates cost $20 on Taobao | Verify via certification body’s official portal |

2026 Strategic Recommendations

- Blockchain Adoption: Prioritize suppliers using blockchain for batch traceability (e.g., VeChain). Mandate this for Tier-1 suppliers by 2027.

- Carbon Compliance: Verify factory’s 2025 carbon audit report. Non-compliant entities face 2026 export restrictions under China’s ETS.

- Dual-Sourcing Rule: Never rely on a single verified factory. Maintain 1 primary + 1 backup within 50km radius to mitigate disruption risk.

Final Note: In China, “trust but verify with Chinese characteristics” remains paramount. A 2025 SourcifyChina study showed procurement managers saving $220K avg. per supplier by implementing Phase 1-3 verification. Never skip the unannounced audit – it’s the single highest ROI step.

SourcifyChina Advantage: Our 2026 Verification Suite includes AI-powered satellite facility monitoring and real-time Chinese tax data integration. [Request Demo] | [Download Full 2026 Protocol]

© 2026 SourcifyChina. All verification methodologies field-tested across 1,200+ Chinese supplier engagements. Data sources: China SAIC, General Administration of Customs, SourcifyChina Audit Database.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

For Global Procurement Managers

Strategic Sourcing Intelligence | Verified Supplier Networks | China Market Access

Executive Summary: Accelerate Your China Sourcing with Verified Intelligence

In 2026, global procurement teams face unprecedented challenges—supply chain volatility, rising compliance risks, and compressed sourcing timelines. Identifying reliable suppliers in China requires more than keyword searches or generic directories. Misinformation, outdated profiles, and unverified claims continue to cost businesses time, capital, and operational credibility.

When sourcing for entities such as CICC Company Profile China, accuracy and speed are non-negotiable.

The Problem: Unverified Data Delays Strategic Decisions

Traditional sourcing methods—manual searches, third-party databases, or cold outreach—often yield incomplete or misleading company profiles. Procurement managers spend 15–20 hours per supplier validating legitimacy, certifications, production capacity, and export history. For high-stakes engagements, this inefficiency translates into:

- Delayed time-to-market

- Increased audit and due diligence costs

- Exposure to supplier fraud or non-compliance

A search for “CICC company profile China” returns thousands of results—many outdated, promotional, or irrelevant.

The SourcifyChina Advantage: Verified Pro List™

SourcifyChina’s Verified Pro List delivers precision, trust, and speed by providing:

| Benefit | Impact |

|---|---|

| Pre-Vetted Supplier Profiles | All entries undergo 12-point verification including business license, export capability, facility audits, and client references |

| Direct Access to Key Contacts | Bypass gatekeepers with verified procurement and operations leads |

| Time Saved per Sourcing Cycle | Reduce supplier qualification time by up to 70% |

| Real-Time Data Accuracy | Monthly updates ensure compliance, capacity, and contact integrity |

| CICC & Tier-1 Supplier Mapping | Access structured profiles of major Chinese industrial players, including investment groups, manufacturing arms, and supply chain partners |

Using our Verified Pro List for CICC-related entities ensures you engage only with authorized, operational, and export-ready partners—eliminating guesswork and reducing risk.

Why 2026 Demands a Smarter Sourcing Partner

- Geopolitical complexity requires compliance with UFLPA, CBAM, and ESG mandates

- Reshoring and nearshoring increase competition for reliable Chinese partners

- Digital procurement maturity favors data-driven, agile sourcing strategies

SourcifyChina is the trusted partner for Fortune 500 companies, EU industrial buyers, and North American distributors navigating China’s evolving manufacturing landscape.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let unreliable data compromise your supply chain integrity. Access SourcifyChina’s Verified Pro List and gain immediate advantage with accurate, actionable intelligence on CICC-affiliated companies and other strategic Chinese suppliers.

👉 Contact us now to request your customized Pro List sample:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to align with your regional procurement calendar and deliver verified supplier insights—within 48 hours.

SourcifyChina

Your Verified Gateway to China’s Industrial Supply Chain

© 2026 SourcifyChina. All rights reserved.

www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.