The global chlorophyllin copper complex market is experiencing steady growth, driven by rising demand in the pharmaceutical, nutraceutical, and food & beverage industries for natural colorants and health supplements. According to a report by Mordor Intelligence, the global chlorophyll and chlorophyllin market is projected to grow at a CAGR of approximately 5.8% during the forecast period of 2024–2029. This expansion is fueled by increasing consumer preference for plant-based ingredients, growing awareness of antioxidant benefits, and the expanding use of chlorophyllin as a deodorizing and wound-healing agent in healthcare applications. With stringent regulations favoring clean-label additives, manufacturers are scaling production and investing in purification technologies to meet quality standards. As demand intensifies, a handful of key players have emerged as leading producers of high-purity chlorophyllin copper complex, dominating both regional and international supply chains.

Top 5 Chlorophyllin Copper Complex Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

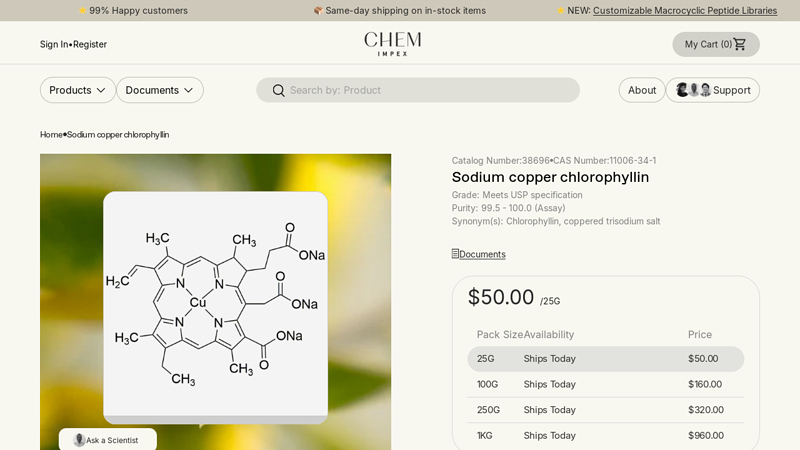

#1 Sodium copper chlorophyllin

Domain Est. 1996

Website: chemimpex.com

Key Highlights: In stock Free deliverySodium copper chlorophyllin is a versatile, water-soluble compound used as a natural colorant in food, cosmetics, and pharmaceuticals.Missing: complex manufa…

#2 Copper Chlorophyllin Extract Suppliers Exporters

Domain Est. 2013

Website: botanichealthcare.net

Key Highlights: Botanic Healthcare is one of the largest manufacturers of copper chlorophyllin extract in India, offering a wide range of herbal and organic extracts….

#3 Chlorophyllin

Domain Est. 1996

Website: parchem.com

Key Highlights: Parchem supplies Chlorophyllin-copper complex and a range of specialty chemicals worldwide, CAS# 11006-34-1….

#4 Chlorophylls & chlorophyllins, copper complexes

Domain Est. 1999

Website: iacmcolor.org

Key Highlights: Sodium copper chlorophyllin is a green to black powder prepared from chlorophyll by saponification and replacement of magnesium by copper….

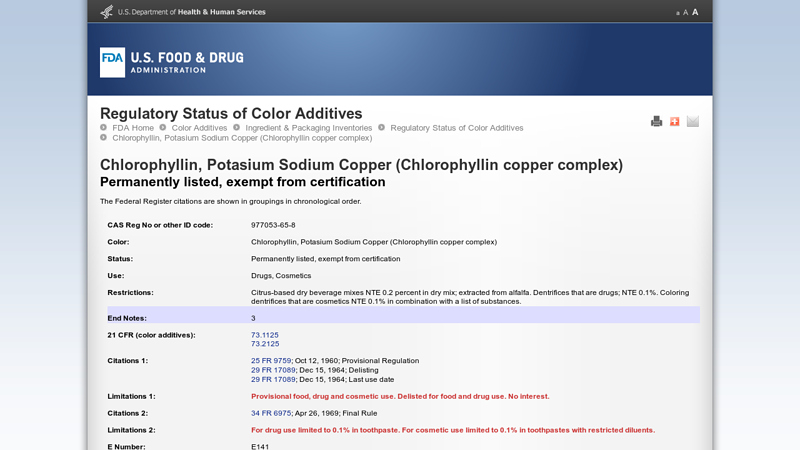

#5 Regulatory Status of Color Additives

Domain Est. 2000

Website: hfpappexternal.fda.gov

Key Highlights: 977053-65-8 · Chlorophyllin, Potasium Sodium Copper (Chlorophyllin copper complex) · Permanently listed, exempt from certification · Drugs, Cosmetics….

Expert Sourcing Insights for Chlorophyllin Copper Complex

H2: 2026 Market Trends for Chlorophyllin Copper Complex

The global market for Chlorophyllin Copper Complex (CCC) is projected to experience steady growth through 2026, driven by rising consumer demand for natural ingredients, expanding applications in nutraceuticals, cosmetics, and pharmaceuticals, and increasing awareness of its health benefits. Below is an analysis of key market trends expected to shape the Chlorophyllin Copper Complex landscape in 2026:

1. Growing Demand in the Nutraceutical and Dietary Supplement Sector

By 2026, the nutraceutical industry is anticipated to remain a primary growth driver for CCC. Chlorophyllin, known for its antioxidant, detoxifying, and anti-inflammatory properties, is increasingly incorporated into dietary supplements targeting digestive health, body odor control, and liver support. With consumers prioritizing preventive healthcare and natural wellness solutions, manufacturers are reformulating products to include plant-derived ingredients like CCC. This trend is especially strong in North America and Europe, where regulatory frameworks support the use of such ingredients in supplements.

2. Expansion in Cosmeceutical Applications

The cosmetics and personal care industry is expected to significantly contribute to CCC demand by 2026. Chlorophyllin Copper Complex is valued for its skin-soothing, anti-aging, and wound-healing attributes. It is being integrated into formulations for acne treatments, facial serums, deodorants, and after-sun products. As clean beauty and green cosmetics gain traction globally, brands are leveraging CCC’s natural origin and safety profile to appeal to eco-conscious consumers.

3. Pharmaceutical and Clinical Applications

In the pharmaceutical sector, ongoing research into Chlorophyllin’s potential chemopreventive effects—particularly in reducing aflatoxin absorption and mitigating oxidative stress—could lead to increased clinical use. By 2026, enhanced regulatory approvals and clinical validation may expand CCC’s role in therapeutic formulations, especially in regions with high rates of liver disease or exposure to dietary carcinogens.

4. Technological Advancements and Production Efficiency

Innovations in extraction and stabilization technologies are expected to improve the purity, bioavailability, and shelf life of Chlorophyllin Copper Complex. By 2026, manufacturers are likely to adopt green chemistry practices and biotechnological methods to ensure sustainable and scalable production. This will help meet rising demand while reducing environmental impact.

5. Regional Market Dynamics

Asia-Pacific is projected to emerge as a high-growth region for CCC, driven by expanding health and wellness markets in countries like China, India, and Japan. Increasing disposable incomes, urbanization, and government support for herbal and natural products are accelerating market penetration. Meanwhile, North America and Europe will maintain leadership due to established regulatory pathways and strong consumer awareness.

6. Regulatory and Safety Considerations

Regulatory scrutiny over food and supplement ingredients remains a critical factor. By 2026, continued compliance with standards set by the FDA, EFSA, and other global agencies will be essential for market access. Positive safety profiles and GRAS (Generally Recognized As Safe) status in certain applications support CCC’s widespread adoption.

7. Sustainability and Sourcing Challenges

As demand grows, sustainable sourcing of raw materials (primarily from alfalfa, nettles, and other chlorophyll-rich plants) will become a priority. Companies investing in vertically integrated supply chains and ethical sourcing practices are likely to gain competitive advantages.

Conclusion

By 2026, the Chlorophyllin Copper Complex market is expected to reflect broader trends in consumer health, clean labeling, and sustainable innovation. With expanding applications across industries and supportive scientific research, CCC is poised for robust growth, particularly in premium health and wellness segments. Strategic investments in R&D, regulatory compliance, and marketing will be key for stakeholders to capitalize on emerging opportunities.

Common Pitfalls in Sourcing Chlorophyllin Copper Complex (Quality, IP)

Sourcing Chlorophyllin Copper Complex (CCC) requires careful attention to both quality specifications and intellectual property (IP) considerations. Overlooking these aspects can lead to supply chain disruptions, product failures, regulatory issues, or legal exposure. Below are common pitfalls to avoid:

Quality-Related Pitfalls

Inadequate Specification Definition

Failing to clearly define and agree upon detailed quality specifications with the supplier is a leading cause of quality issues. Key parameters such as copper content, microbial limits, heavy metal levels (especially arsenic, lead, mercury), solvent residues, and assay purity (typically 85–95% based on dry basis) must be explicitly stated. Vague or incomplete specs can result in batch inconsistencies or non-compliance with regulatory standards (e.g., USP, FCC, or EP).

Insufficient Supplier Qualification

Choosing a supplier based solely on cost or availability without conducting thorough due diligence—such as audits, review of certifications (e.g., GMP, ISO), and batch history—can result in sourcing substandard or adulterated material. Suppliers without robust quality management systems may lack consistency in manufacturing, leading to variability in color, solubility, or stability.

Neglecting Stability and Shelf-Life Testing

Chlorophyllin Copper Complex is sensitive to light, heat, and pH. Sourcing without verifying the supplier’s stability data or failing to conduct compatibility and shelf-life testing under intended storage and formulation conditions can lead to premature degradation, color changes, or loss of efficacy in the final product.

Overlooking Raw Material Traceability

CCC is derived from natural chlorophyll, typically from alfalfa or mulberry leaves. Suppliers using inconsistently sourced plant material or without traceability controls may introduce variability in the final product’s composition. Ensuring raw material traceability and adherence to sustainable sourcing practices is essential for consistent quality and brand integrity.

Intellectual Property (IP)-Related Pitfalls

Infringing on Patented Manufacturing Processes

While CCC as a compound may be off-patent, specific synthesis methods, purification techniques, or formulations may be protected by active patents. Sourcing from manufacturers that use patented processes without licensing can expose the buyer to infringement claims. Conducting freedom-to-operate (FTO) analyses before finalizing suppliers is critical.

Unverified Claims of IP Ownership or Licensing

Some suppliers may claim their product is “patent-free” or “clear for use” without proper substantiation. Relying on such assurances without independent verification—such as reviewing patent landscapes or obtaining legal opinions—can result in unintentional IP violations and costly litigation.

Failure to Secure IP Rights in Supply Agreements

Supply contracts should clearly define IP ownership, especially if custom modifications or private labeling are involved. Ambiguities in agreements may lead to disputes over who owns process improvements, formulations, or branding elements developed during collaboration.

Ignoring Regulatory Exclusivity and Data Protection

In certain markets (e.g., pharmaceuticals or novel foods), regulatory submissions using CCC may benefit from data exclusivity. If sourcing decisions are based on third-party regulatory dossiers without proper authorization, companies risk violating data protection laws or facing marketing authorization challenges.

By proactively addressing these quality and IP pitfalls, organizations can ensure a reliable, compliant, and legally secure supply of Chlorophyllin Copper Complex for their applications.

H2: Logistics & Compliance Guide for Chlorophyllin Copper Complex

Chlorophyllin Copper Complex (also known as Sodium Copper Chlorophyllin or SCC) is a semi-synthetic, water-soluble derivative of chlorophyll used in food, dietary supplements, cosmetics, and pharmaceuticals as a colorant and antioxidant. Due to its diverse applications, proper logistics handling and regulatory compliance are essential for safe and legal distribution.

1. Regulatory Classification and Approvals

-

Food Use (FDA – USA):

Chlorophyllin Copper Complex is approved as a color additive exempt from certification under 21 CFR 73.125. It may be safely used in foods in amounts consistent with good manufacturing practice (GMP). -

EU Regulations (EFSA & EU Commission):

Approved as a food colorant (E number E141(ii)) under Regulation (EC) No 1333/2008. Specific usage levels apply depending on food category. -

Cosmetics (Global):

Permitted in cosmetics in the U.S. (FDA), EU (Annex IV of Regulation (EC) No 1223/2009), and other major markets. Must be listed as “Chlorophyllin-Copper Complex” or “CI 75810” in ingredient declarations. -

Dietary Supplements (USA):

Recognized as a safe ingredient. Must comply with labeling requirements under DSHEA, including structure/function claims and GMPs (21 CFR Part 111). -

Pharmaceutical Use (if applicable):

Subject to additional requirements under cGMP (21 CFR 210/211) if used in drug products.

2. Packaging and Labeling Requirements

- Packaging:

- Use airtight, light-resistant containers (e.g., HDPE or amber glass) to prevent degradation from UV exposure and moisture.

- Ensure packaging is food-grade or pharmaceutical-grade, depending on intended use.

-

Inner liners (e.g., polyethylene bags) recommended for powder forms.

-

Labeling (per GHS & Regulatory Standards):

- Include product name: “Chlorophyllin Copper Complex”

- Batch/lot number and date of manufacture/expiry

- Net weight

- Storage instructions (e.g., “Store in a cool, dry place, away from light”)

- Manufacturer/distributor information

- Safety Data Sheet (SDS) availability notice

Note: Although generally recognized as safe (GRAS), labeling must reflect intended use and compliance with regional regulations.

3. Storage Conditions

- Temperature: Store at 15–25°C (59–77°F); avoid excessive heat.

- Humidity: Keep below 60% RH to prevent clumping or degradation.

- Light: Protect from direct sunlight and UV radiation.

- Shelf Life: Typically 24–36 months when stored properly. Confirm with Certificate of Analysis (CoA).

4. Transportation & Shipping

- Mode of Transport:

- Road, air, and sea acceptable under general cargo conditions.

-

Not classified as hazardous under IATA, IMDG, or ADR regulations (non-hazardous for transport).

-

Documentation:

- Commercial invoice, packing list, CoA, and SDS (required under OSHA HazCom 2012 and EU REACH/CLP).

-

Import permits may be required in certain countries (e.g., China, India, Brazil) for commercial quantities.

-

Cold Chain: Not required, unless specified by the manufacturer for stability.

5. Import/Export Compliance

- HS Code (Example):

-

2933.99 (Heterocyclic compounds with nitrogen) – verify locally, as classification may vary by country and formulation.

-

Key Regulations:

- USA: FDA Prior Notice required for food and FDA-regulated products entering the U.S.

- EU: Notification under REACH may be required if imported in quantities ≥1 ton/year.

- China: Requires CFDA (now NMPA) registration for food or health product use.

-

Japan: Subject to Japan’s Positive List under the Pharmaceutical Affairs Law for cosmetics and quasi-drugs.

-

Customs Clearance:

Provide CoA, SDS, and proof of regulatory compliance (e.g., GRAS documentation, EU Novel Food status if applicable).

6. Safety & Handling (Workplace Compliance)

- Exposure Controls:

- Use local exhaust ventilation when handling powder to minimize dust inhalation.

-

Wear gloves, safety goggles, and dust mask if generating airborne particles.

-

SDS Classification (GHS):

- Typically classified as non-hazardous.

- May cause mild eye or respiratory irritation (check specific product SDS).

-

No known carcinogenicity or environmental hazards.

-

Disposal:

Dispose of in accordance with local, state, and federal regulations. Not considered hazardous waste under RCRA (USA) in most cases.

7. Quality Assurance & Documentation

- Certificates Required:

- Certificate of Analysis (CoA) – includes assay, heavy metals, microbial limits, particle size, and solubility.

- Certificate of Origin

- Free Sale Certificate (if exporting)

-

GRAS documentation (for U.S. food use)

-

Testing Parameters:

- Heavy Metals (Pb, As, Cd, Hg) – must comply with USP/EP limits

- Microbial Contamination (Total Plate Count, E. coli, Salmonella)

- Identification (UV-Vis, TLC, or HPLC)

8. Key Compliance Considerations by Region

| Region | Regulatory Body | Key Requirements |

|——–|——————|——————|

| USA | FDA, FTC | GRAS status, DSHEA compliance, accurate labeling |

| EU | EFSA, EMA | E141(ii) usage limits, REACH registration if applicable |

| Canada | Health Canada | Permitted food color under List of Permitted Coloring Agents |

| Japan | MHLW/PMDA | Approved under Food Sanitation Act; quasi-drug use requires approval |

| Australia | FSANZ, TGA | Approved in Standard 1.3.1; TGA oversight if in therapeutic goods |

9. Summary of Best Practices

- Verify end-use application (food, supplement, cosmetic, pharma) to ensure correct compliance.

- Maintain full documentation for traceability and audits.

- Use qualified suppliers with ISO, FSSC 22000, or similar certifications.

- Monitor regulatory updates (e.g., EFSA re-evaluations, FDA guidance).

- Train logistics and procurement teams on labeling and import procedures.

For continued compliance, conduct periodic audits of supply chain partners and stay informed on evolving global standards for color additives and functional ingredients.

In conclusion, sourcing chlorophyllin copper complex requires careful consideration of several key factors to ensure quality, safety, and regulatory compliance. It is essential to select reputable suppliers who adhere to Good Manufacturing Practices (GMP) and can provide proper documentation, including certificates of analysis (CoA) and proof of regulatory compliance (e.g., FDA, EFSA, or other relevant authorities). The choice between synthetic and natural sources, along with considerations of purity, solubility, and intended application—whether in food, cosmetics, dietary supplements, or pharmaceuticals—will influence the optimal sourcing strategy. Additionally, evaluating supply chain transparency, sustainability practices, and cost-effectiveness contributes to long-term reliability and brand integrity. By conducting thorough due diligence and maintaining strong supplier relationships, organizations can secure a consistent and high-quality supply of chlorophyllin copper complex to meet their specific needs.