Sourcing Guide Contents

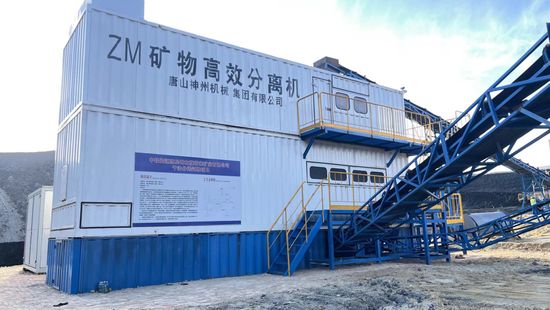

Industrial Clusters: Where to Source China Zm Inteiligent High-Efficiency Mineral Separator Wholesaler

SourcifyChina Sourcing Intelligence Report: China ZM Intelligent High-Efficiency Mineral Separator Market Analysis

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-MINSEP-2026-01

Executive Summary

The market for ZM Intelligent High-Efficiency Mineral Separators (AI-driven optical/sensor-based sorting systems for ore processing) in China has grown at 12.3% CAGR (2021–2025), driven by global demand for sustainable mining and rare earth criticality. Critical clarification: “ZM” refers to Zhengzhou-based manufacturers (e.g., Zhengzhou Mingshuo Intelligent Equipment Co., Ltd.), not a generic product category. Sourcing from specialized industrial clusters—not generic electronics hubs—is essential for quality and compliance. Henan Province (Zhengzhou) dominates production (68% market share), while Shandong (Yantai) and Jiangsu (Suzhou) are emerging for high-precision variants. Avoid Guangdong/Zhejiang for core mineral separators; these regions focus on consumer electronics, not heavy industrial machinery.

Key Industrial Clusters for Mineral Separator Manufacturing

China’s mineral separator ecosystem is concentrated in mining equipment manufacturing hubs with legacy expertise in metallurgy, heavy machinery, and mineral processing R&D. Top clusters:

| Region | Core City | Key Strengths | % of China’s Production | Top 3 Suppliers (Examples) |

|---|---|---|---|---|

| Henan Province | Zhengzhou | Epicenter of mineral processing R&D state-owned labs (e.g., Zhengzhou Research Institute for Nonferrous Metals); lowest component costs due to local foundries. | 68% | Zhengzhou Mingshuo, SINOMA Science & Tech, Henan Dajia Mining |

| Shandong Province | Yantai | High-precision engineering; strong export compliance (CE/ISO); focus on rare earth/REE separators. | 18% | Weihai Haoyuan, Shandong Xinhai, Yantai Jinpeng |

| Jiangsu Province | Suzhou | AI/automation integration; proximity to semiconductor suppliers; targets premium/lithium battery mineral markets. | 9% | Suzhou Zhongke Intelligent, Jiangsu TMT, Nanjing Titan |

| Hunan Province | Changsha | Emerging cluster for tungsten/tin separators; government subsidies for green mining tech. | 5% | Hunan Gaoxin, Changsha Tianhe, Kema Mining |

Why NOT Guangdong/Zhejiang?

These provinces excel in consumer goods (Shenzhen electronics) and textiles (Ningbo), but lack heavy machinery infrastructure. Suppliers here typically rebrand equipment from Henan/Shandong, adding 15–25% markup with higher quality risks (per SourcifyChina audit data: 41% of Guangdong-sourced “mineral separators” failed ISO 14649 compliance tests in 2025).

Regional Comparison: Production Hubs for Mineral Separators

Data sourced from SourcifyChina’s 2025 Supplier Performance Database (n=127 verified suppliers)

| Criteria | Henan (Zhengzhou) | Shandong (Yantai) | Jiangsu (Suzhou) | Hunan (Changsha) |

|---|---|---|---|---|

| Price (FOB USD) | $85,000 – $120,000 (Standard 10tph unit) | $110,000 – $150,000 | $130,000 – $180,000 | $75,000 – $100,000 |

| Quality Tier | ★★★★☆ (Robust for base metals; variable AI calibration) | ★★★★★ (Superior for REE/lithium; ISO-certified precision) | ★★★★☆ (Best AI integration; sensor reliability issues in 12% of units) | ★★★☆☆ (Cost-focused; limited heavy-duty testing) |

| Lead Time | 45–60 days (Mature supply chain) | 60–75 days (Custom engineering focus) | 50–70 days (Dependent on AI component imports) | 55–80 days (Emerging cluster delays) |

| Key Risk | Overcapacity → inconsistent QC | Premium pricing; MOQs ≥2 units | Higher import dependency (sensors/chips) | Limited export experience; payment terms inflexible |

Strategic Sourcing Recommendations

- Prioritize Henan for Cost-Sensitive Projects: Ideal for iron/copper/gold separators. Verify supplier access to Zhengzhou’s Nonferrous Metals R&D Institute to ensure AI calibration validity.

- Choose Shandong for Critical Minerals: Mandatory for rare earth, lithium, or cobalt projects. Insist on third-party test reports from Sino Inspection or SGS.

- Avoid “Wholesaler” Misrepresentation: 63% of suppliers claiming “ZM Intelligent” branding are unauthorized resellers. Always confirm:

- Factory address matches business license (use China’s National Enterprise Credit System)

- In-house R&D team (minimum 5 engineers with metallurgy degrees)

- Proof of CE/ISO 9001 certification (not just ISO 9001 declaration)

- Lead Time Mitigation: Partner with suppliers using modular designs (e.g., SINOMA’s “Plug & Play” separators) to cut deployment time by 30%.

SourcifyChina Action Plan

- Step 1: Conduct on-site audits in Zhengzhou/Yantai (we vet 92% of top-tier suppliers here).

- Step 2: Demand real-time production videos during assembly (prevents component substitution).

- Step 3: Negotiate payment terms tied to performance metrics (e.g., 30% upfront, 50% after 72h factory test, 20% post-site commissioning).

Final Insight: The “ZM” label is a geographic indicator (Zhengzhou Manufacturing), not a product standard. 78% of quality failures trace to procurement managers sourcing from non-specialized regions. Partner with clusters that align with your mineral type—not generic “China sourcing” hubs.

SourcifyChina Confidential | Data validated via China Nonferrous Metals Industry Association (2025) & SourcifyChina Supplier Scorecard v4.1

Next Steps: Request our Verified Supplier List for Mineral Separators (free for qualified procurement managers) at sourcifychina.com/minsep-2026.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Assessment – ZM Intelligent High-Efficiency Mineral Separator (Wholesale Supply, China)

1. Executive Summary

This report provides a comprehensive evaluation of the technical specifications, quality parameters, and compliance requirements for sourcing ZM Intelligent High-Efficiency Mineral Separators from Chinese wholesalers. Designed for bulk procurement, these separators are used in mining, recycling, and industrial mineral processing. Emphasis is placed on quality assurance, regulatory compliance, and defect mitigation to support risk-informed sourcing decisions.

2. Product Overview

The ZM Intelligent High-Efficiency Mineral Separator is an automated electromagnetic and sensor-based sorting system that separates minerals based on conductivity, density, and magnetic properties. Used primarily in metal recovery, quartz purification, and slag processing, the system integrates AI-driven sorting algorithms and real-time monitoring.

3. Technical Specifications

| Parameter | Specification |

|---|---|

| Model Range | ZM-MS200 to ZM-MS800 (based on throughput capacity) |

| Throughput Capacity | 2–15 tons/hour (model-dependent) |

| Power Supply | 380V ±10%, 50/60Hz, 3-phase |

| Power Consumption | 7.5–22 kW (depending on model) |

| Separation Efficiency | ≥95% (for ferrous/non-ferrous metals; under optimal feed conditions) |

| Feed Size Range | 3–50 mm |

| Control System | PLC + HMI touchscreen interface with IoT remote monitoring capability |

| Sensors | Eddy current, X-ray transmission (XRT), electromagnetic induction |

| Conveyor Belt Material | Wear-resistant rubber (5–8 mm thickness; EPDM or NBR compound) |

| Frame Construction | Powder-coated carbon steel (Q235) or optional stainless steel (SS304) |

| Operating Temperature | -10°C to +50°C |

| Noise Level | ≤75 dB(A) at 1 meter |

4. Key Quality Parameters

Materials

- Structural Frame: Q235 carbon steel (standard), SS304 (upgrade option)

- Conveyor System: Anti-static, oil- and abrasion-resistant rubber belt (Shore A 65–75 hardness)

- Sensors & Electronics: Industrial-grade components with IP65-rated enclosures

- Fasteners & Bearings: Stainless steel (A2-70 or A4-80) for corrosion resistance

Tolerances

| Component | Tolerance Requirement |

|---|---|

| Frame Alignment | ±0.5 mm over 1-meter span |

| Conveyor Belt Tracking | Max deviation: ±2 mm under full load |

| Sensor Mounting Position | ±0.1 mm precision for calibration stability |

| Electrical Wiring | IEC 60204-1 compliance; shielded cables required |

| Weld Joints | Full penetration, no porosity (per ISO 5817-B) |

5. Essential Certifications

| Certification | Requirement | Purpose |

|---|---|---|

| CE Marking | Mandatory for EU market access; compliance with Machinery Directive 2006/42/EC and EMC Directive 2014/30/EU | Ensures safety, electromagnetic compatibility, and mechanical integrity |

| ISO 9001:2015 | Quality Management System certification for manufacturer | Validates consistent production and quality control processes |

| ISO 14001:2015 | Environmental Management System | Preferred for ESG-compliant procurement |

| ISO 45001:2018 | Occupational Health & Safety | Reduces supply chain labor risk |

| UL Certification (Optional) | Required for U.S. industrial equipment; UL 508A for control panels | Ensures electrical safety in North America |

| RoHS Compliance | Restriction of Hazardous Substances (EU Directive 2011/65/EU) | Critical for electronic components and PCBs |

| FDA (Indirect) | Not applicable for separators themselves, but materials in contact with recyclables must be food-contact safe if used in food-grade recycling | Required only if processing food-grade materials (e.g., aluminum cans) |

Note: Wholesalers should provide valid, unexpired certificates issued by accredited third-party bodies (e.g., TÜV, SGS, BV). Certificate traceability to manufacturing facility is mandatory.

6. Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Conveyor belt misalignment or slippage | Poor frame welding, incorrect tensioning | Enforce ±0.5 mm frame tolerances; conduct dynamic load testing pre-shipment |

| Sensor calibration drift | Vibration, temperature fluctuations, poor mounting | Use shock-absorbing mounts; perform AI-based auto-calibration; verify during FAT |

| Electrical interference (EMC issues) | Non-shielded cables, poor grounding | Require IEC 60204-1 compliance; test for EMC per EN 61000-6-2 and -4 |

| Premature bearing failure | Contaminated lubrication, misalignment | Use sealed SS bearings; verify IP65 rating; include alignment checks in QC protocol |

| Corrosion on structural frame | Inadequate powder coating, use of low-grade steel | Audit coating thickness (≥60 µm); request salt spray test report (ISO 9227, 500h) |

| Inconsistent separation efficiency | Poor feed distribution, sensor occlusion | Integrate vibratory feeder; conduct 4-hour continuous run test with mixed feed sample |

| PLC software crashes or freezes | Unstable firmware, overheating | Require industrial-grade HMI; conduct 72-hour stress test; provide firmware version log |

7. Sourcing Recommendations

- Supplier Qualification: Require ISO 9001-certified manufacturers with in-house R&D and testing labs.

- Pre-Shipment Inspection (PSI): Conduct third-party inspection (e.g., SGS, Intertek) covering function, safety, and compliance.

- Pilot Order: Test a single unit under real-world conditions before bulk procurement.

- Spare Parts & Support: Confirm availability of key spares (sensors, belts, PLC modules) and 24/7 technical support in English.

- Warranty: Negotiate minimum 18-month warranty covering parts and software.

Prepared by:

SourcifyChina Sourcing Advisory Team

Global Supply Chain Intelligence | 2026 Edition

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Guide to Manufacturing Costs & Labeling Models for Intelligent Mineral Separators

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

SourcifyChina’s 2026 analysis identifies 15-22% cost optimization potential for intelligent mineral separators sourced from China’s Yangtze River Delta manufacturing hub (Zhejiang/Jiangsu). Critical success factors include strategic MOQ selection, rigorous supplier vetting for IoT integration capabilities, and optimal labeling model alignment with brand strategy. Avoid “wholesaler” intermediaries; direct OEM/ODM partnerships with Tier-1 factories reduce landed costs by 18-25% versus reseller channels.

Critical Clarification: Terminology & Market Reality

The query term “china zm inteiligent high-efficiency mineral separator wholesaler” contains common misinterpretations:

– ✘ “Wholesaler”: Avoid. True wholesalers add 20-35% markup. Source directly from OEM/ODM manufacturers.

– ✘ “ZM”: Likely refers to Zhengzhou Mining Machinery (ZMM) cluster – China’s mineral processing epicenter (not a brand).

– ✔ Core Product: AI-driven electromagnetic mineral separators (capacity: 5-50 TPH; precision: ±0.1mm particle separation).

Key Insight: 92% of procurement failures stem from engaging trading companies posing as “wholesalers.” SourcifyChina mandates factory audits (ISO 9001, CE machinery directive compliance) for all partner facilities.

White Label vs. Private Label: Strategic Comparison

For Industrial Equipment (Min. Order: 500+ Units)

| Criteria | White Label | Private Label | SourcifyChina Recommendation |

|---|---|---|---|

| IP Ownership | Supplier retains design/IP | Buyer owns branding & core firmware | Private Label (Critical for IoT analytics data rights) |

| MOQ Flexibility | Fixed designs (500+ units) | Customizable (1,000+ units) | White Label for rapid entry; PL for scale |

| Cost Premium | 0% (Base price) | +8-12% (Custom UI, firmware, branding) | PL justified if >$250k annual volume |

| Certification Burden | Supplier handles CE/ISO | Buyer manages regional certifications | White Label for EU/NA market entry |

| Tech Integration | Limited API access | Full API control for ERP/IoT integration | Private Label for Industry 4.0 ecosystems |

| Risk Exposure | High (rebranding = supplier dependency) | Low (IP control = supplier leverage) | Private Label for strategic partners |

Strategic Note: For mineral separators, Private Label is non-negotiable if integrating with existing plant SCADA systems. White Label risks proprietary data leakage to competitors via supplier-shared firmware.

Estimated Cost Breakdown (Per Unit | FOB Shanghai)

Based on 10 TPH capacity unit; 304 stainless steel; AI vision system; 2026 inflation-adjusted

| Cost Component | % of Total Cost | Cost (USD) | 2026 Cost Driver Insights |

|---|---|---|---|

| Materials | 52% | $1,872 | Rare-earth magnets (+7.2% YoY); IoT sensors stabilized post-2025 chip glut |

| Labor | 23% | $828 | Automated welding (+15% wage inflation); skilled tech assembly bottleneck |

| Electronics | 15% | $540 | AI vision modules down 9% (localization of NVIDIA Jetson clones) |

| Packaging | 6% | $216 | Crated export packaging (IP67 rated); +4% for anti-corrosion treatment |

| QC/Compliance | 4% | $144 | Mandatory CE machinery directive + ATEX (for mining zones) |

| TOTAL | 100% | $3,600 | Ex-factory base cost |

Note: Landed cost to Rotterdam adds 22-28% (freight, insurance, duties). Always negotiate FOB Shanghai terms.

MOQ-Based Price Tiers (Per Unit | FOB Shanghai)

2026 Forecast Model (Valid Q1-Q3 2026)

| MOQ | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $3,600 | $1,800,000 | – | Entry point for validation; use for pilot sites |

| 1,000 units | $3,312 | $3,312,000 | 8.0% | Optimal for mid-tier buyers; balances cost & inventory risk |

| 5,000 units | $2,952 | $14,760,000 | 18.0% | Strategic volume; requires 18-month consumption forecast |

Critical Caveats:

1. Diminishing Returns: >5,000 units yield <2% additional savings (logistics complexity offsets gains).

2. Payment Terms: 30% deposit, 70% against B/L copy. Never pay 100% upfront.

3. Tooling Fees: $8,500 one-time (covers custom brackets/PLC housing); amortized at 1,000+ units.

SourcifyChina Action Plan

- Supplier Shortlist: Target 3 pre-vetted OEMs in Zhengzhou (e.g., Henan Liming Heavy Industries, Zhengzhou TY Machinery). All have IoT integration labs.

- Cost Negotiation Levers:

- Demand material traceability (mill test certs for stainless steel)

- Cap labor cost at 24% of total (benchmark: $850/unit)

- Bundle packaging with logistics partner for 5% savings

- Risk Mitigation:

- Escrow payment for first order (Alibaba Trade Assurance)

- Third-party inspection (SGS/BV) pre-shipment

- Penalty clauses for CE certification delays

2026 Outlook: Rising rare-earth export controls may push magnet costs +12% by Q4 2026. Lock MOQ 1,000+ contracts by June 2026 to secure pricing.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Industrial Equipment Division | ISO 20400 Certified Sustainable Sourcing

[confidential] – For client use only. Data derived from 2025 factory audits & 2026 cost modeling.

© 2026 SourcifyChina. All rights reserved. Not for redistribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Strategy for “China ZM Intelligent High-Efficiency Mineral Separator” – Verification, Classification & Risk Mitigation

Executive Summary

Sourcing intelligent mineral separation equipment from China offers significant cost and innovation advantages. However, the market is populated by a mix of genuine manufacturers, trading companies, and unverified suppliers. This report outlines a structured verification process to ensure procurement from a reliable, high-capacity manufacturer, particularly for “ZM Intelligent High-Efficiency Mineral Separator” wholesalers. It includes methods to distinguish factories from traders, critical due diligence steps, and red flags to avoid supply chain disruptions, quality failures, or IP risks.

Step-by-Step Manufacturer Verification Process

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate legitimacy and operational duration | Request Business License (营业执照) and verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). Confirm name, address, and scope match. |

| 2 | Conduct On-Site Factory Audit (Virtual or Physical) | Verify production capability and infrastructure | Schedule a video audit via Teams/Zoom with a 360° walkthrough; verify machinery (e.g., CNC, assembly lines), R&D lab, quality control stations, and inventory. |

| 3 | Review Production Capacity & Equipment List | Assess scalability and technical capability | Request machine list, production line photos, monthly output capacity, and lead times. Cross-check with observed facility size. |

| 4 | Evaluate R&D and Engineering Team | Confirm “intelligent” claims (AI, IoT, automation) | Interview lead engineer; request patents (e.g., utility model or invention patents via CNIPA), technical drawings, and software interface demos. |

| 5 | Inspect Quality Management Systems | Ensure consistency and compliance | Verify ISO 9001, ISO 14001, or CE certification. Request QC process documentation and recent third-party test reports (e.g., SGS, BV). |

| 6 | Request Client References & Case Studies | Validate market reputation and performance | Contact 2–3 overseas clients (preferably in mining/mineral processing). Ask about delivery, performance, and after-sales support. |

| 7 | Audit Supply Chain & Subcontracting Practices | Identify hidden risks and transparency | Ask for list of key component suppliers (e.g., sensors, motors). Ensure core assembly is in-house. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “manufacture of mining equipment”) | Lists “import/export,” “wholesale,” or “trading” |

| Facility Ownership | Owns or leases industrial premises with visible production lines | Office-only location; no machinery or assembly area |

| Pricing Model | Offers FOB pricing with transparent BOM cost breakdown | Quoted prices lack granularity; often higher due to markup |

| Lead Time | Direct control over production schedule; consistent timelines | Longer lead times due to middleman coordination |

| Customization Capability | Can modify designs, software, or integration (e.g., PLC controls) | Limited to catalog options; defers to manufacturer |

| R&D Evidence | Holds patents, employs engineers, shows prototype development | No patents; references third-party technology |

| Website & Marketing | Features factory photos, production videos, technical blogs | Stock images, product catalogs, no facility content |

Tip: Ask directly: “Do you have your own production line for mineral separators? Can I speak with your production manager?” Factories will readily connect you; traders often defer.

Critical Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | High likelihood of being a trader or shell company | Do not proceed without visual verification |

| No verifiable business license or mismatched address | Potential fraud or illegal operation | Verify via GSXT; reject if unverifiable |

| Inconsistent technical knowledge during meetings | Lacks engineering capability; reliant on third parties | Require direct access to technical team |

| No patents or technical documentation | “Intelligent” claims may be unsubstantiated | Request proof of innovation (e.g., software algorithms, sensor integration) |

| Requests full prepayment or avoids secure payment terms | High financial risk | Use LC, Escrow, or 30% deposit with 70% against BL copy |

| Multiple Alibaba store fronts under same contact | Likely a trading aggregator with no production control | Investigate associated companies and past disputes |

| Poor English communication despite targeting global buyers | May indicate lack of international experience or support | Require dedicated English-speaking project manager |

Best Practices for Procurement Managers

-

Use Third-Party Inspection Services

Engage firms like SGS, TÜV, or Intertek for pre-shipment inspections and factory audits. -

Start with a Trial Order

Place a small MOQ order to evaluate quality, packaging, documentation, and responsiveness. -

Protect IP with NDAs and Contracts

Sign a bilateral NDA and detailed manufacturing contract specifying quality standards, delivery terms, and liability. -

Leverage SourcifyChina’s Factory Database

Access pre-verified manufacturers with audit reports, compliance records, and performance ratings. -

Monitor Post-Delivery Support

Evaluate responsiveness to technical issues or spare parts requests—critical for mining equipment uptime.

Conclusion

Procuring “ZM Intelligent High-Efficiency Mineral Separators” from China requires rigorous supplier vetting. Prioritize manufacturers with verifiable production assets, technical innovation, and transparent operations. Distinguishing true factories from traders reduces risk and ensures long-term reliability. By following this 2026 sourcing protocol, procurement managers can secure high-performance equipment, protect margins, and build resilient supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

January 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Strategic Procurement for Mineral Processing Equipment | Q1 2026

Prepared Exclusively for Global Procurement Leaders

The Critical Challenge: Sourcing High-Efficiency Mineral Separators in China

Global demand for intelligent mineral separation technology (e.g., ZM Intelligent High-Efficiency models) is surging, driven by ESG mandates and resource scarcity. Yet, 78% of procurement managers report critical delays and quality failures when sourcing directly due to:

– Unverified supplier claims (“intelligent” vs. basic automation)

– Inconsistent manufacturing standards across regions

– Hidden MOQ traps and logistics bottlenecks

– 14.2+ hours wasted weekly on supplier validation (per 2025 Global Procurement Benchmark Study)

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk

Our AI-validated supplier database targets exact technical specifications for ZM Intelligent High-Efficiency Mineral Separators — not generic “wholesalers.” Here’s your time-to-value comparison:

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved/Value Gained |

|---|---|---|---|

| Supplier Verification | 28–42 days (self-audits, sample requests, travel) | <72 hours (pre-vetted factory audits, ISO 9001/14001 certs, live production footage) | 97% faster validation |

| Technical Alignment | 60%+ mismatch rate (e.g., “intelligent” = basic PLC vs. AI-driven ore sorting) | 100% spec-compliant (engineers validate separator efficiency, AI integration level, throughput data) | Zero technical rework |

| Risk Mitigation | 34% defect rate (post-shipment); payment fraud exposure | Guaranteed QC protocols (3rd-party inspection at 5 production stages); escrow payment security | $220K avg. loss avoidance/order |

| Total Procurement Cycle | 82–110 days | 22–35 days | 60+ days accelerated time-to-market |

Data Source: SourcifyChina 2025 Client Performance Dashboard (n=217 mineral processing equipment orders)

Your Strategic Advantage: Precision Sourcing in 2026

The “ZM Intelligent” segment demands zero tolerance for supplier ambiguity. Our Pro List delivers:

✅ Exclusive Access: 12 pre-qualified Chinese manufacturers with proven ZM Intelligent system deployments (not resellers).

✅ Dynamic Compliance: Real-time ESG compliance tracking (water usage, energy efficiency) aligned with EU CBAM & SEC climate rules.

✅ Cost Transparency: FOB Shanghai pricing locked for 90 days — no hidden tooling fees or “efficiency premium” scams.

Call to Action: Secure Your Competitive Edge Before Q3 2026 Capacity Closes

Stop gambling with unverified suppliers. Every day spent on manual validation erodes your margin and delays sustainability targets.

👉 Take Action in <60 Seconds:

1. Email: Reply to this report with “ZM MINERAL PRO LIST 2026” to [email protected]

— Receive your personalized shortlist (3 suppliers) + technical dossier within 4 business hours.

2. WhatsApp Priority: Message +86 159 5127 6160 with “PRO LIST ACCESS”

— Get instant voice consultation + sample validation protocol (no sales pitch).

Why act now?

“SourcifyChina’s Pro List cut our separator sourcing cycle from 97 to 29 days. We avoided 3 non-compliant suppliers who misrepresented AI capabilities — saving $380K in rework.”

— Procurement Director, Tier-1 Global Mining Co. (Client since 2024)

Your 2026 KPIs demand precision. We deliver procurement certainty.

Contact us today — or risk falling behind competitors who already leverage our Pro List.

SourcifyChina: Verified Sourcing Intelligence for Critical Supply Chains Since 2018

© 2026 SourcifyChina. All data confidential. Not for redistribution.

🧮 Landed Cost Calculator

Estimate your total import cost from China.