Sourcing Guide Contents

Industrial Clusters: Where to Source China Zipper Company

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Zippers from China

Date: April 2026

Prepared by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

China remains the world’s largest producer and exporter of zippers, accounting for over 70% of global zipper supply. The industry is highly concentrated in a few key industrial clusters, with Guangdong and Zhejiang provinces dominating production. This report provides a comprehensive analysis of China’s zipper manufacturing landscape, focusing on regional strengths, cost dynamics, quality benchmarks, and lead time considerations for strategic sourcing decisions in 2026.

Global procurement managers seeking competitive pricing, scalable production, and reliable quality for zippers—from standard nylon coil to high-end metal and waterproof zippers—must understand regional differentiators. This report identifies the core manufacturing hubs, evaluates their comparative advantages, and delivers actionable insights for supplier selection and supply chain optimization.

Key Industrial Clusters for Zipper Manufacturing in China

China’s zipper industry is primarily concentrated in two coastal provinces known for their mature textile and apparel supply chains:

1. Guangdong Province

- Core Cities: Guangzhou, Dongguan, Shenzhen

- Industry Focus: High-volume OEM/ODM production, fashion-forward designs, export-oriented manufacturing

- Strengths: Proximity to major ports (Guangzhou Nansha, Shenzhen Yantian), integration with garment factories, agile production for fast fashion

- Key Materials: Nylon, polyester, plastic injection-molded zippers

2. Zhejiang Province

- Core Cities: Wenzhou (especially Qiaotou Town), Yiwu, Ningbo

- Industry Focus: Full-spectrum zipper production, including high-precision metal zippers, eco-friendly materials, and technical zippers (e.g., waterproof, fire-resistant)

- Strengths: Long-standing zipper heritage (Qiaotou is known as the “Zipper Capital of the World”), strong R&D capabilities, vertically integrated supply chains

- Key Materials: Metal (brass, aluminum), VISLON (plastic molded), specialty functional zippers

3. Fujian Province (Emerging Cluster)

- Core Cities: Jinjiang, Xiamen

- Industry Focus: Mid-tier sportswear and outdoor gear zippers

- Strengths: Growing investment in automation, proximity to sportswear OEMs (e.g., Anta, 361°)

Note: While smaller clusters exist in Jiangsu and Shandong, Guangdong and Zhejiang remain the dominant forces in both volume and innovation.

Comparative Analysis: Key Zipper Production Regions in China (2026)

| Region | Price Competitiveness | Quality Level | Average Lead Time | Best For |

|---|---|---|---|---|

| Guangdong | High (Low to Mid-tier) | Mid (Good consistency, basic to mid-range finishes) | 15–25 days | Fast fashion, high-volume orders, budget-conscious brands, quick turnaround |

| Zhejiang | Moderate to High | High (Precision engineering, premium finishes, certifications) | 20–35 days | Premium apparel, outdoor gear, technical wear, eco-conscious brands |

| Fujian | Moderate | Mid to High (Improving rapidly) | 18–30 days | Sportswear, mid-market outdoor brands, hybrid production needs |

Key Sourcing Insights for 2026

1. Price Trends

- Guangdong offers the lowest unit prices due to economies of scale and labor efficiency. However, rising labor costs (+6.2% YoY in 2025) are narrowing the gap with Zhejiang.

- Zhejiang commands a 10–20% price premium for high-end zippers but offers better value in durability and compliance (e.g., OEKO-TEX®, REACH).

2. Quality & Innovation

- Zhejiang leads in R&D and innovation, with manufacturers like SBS (Shenglong Group) and YKK China investing heavily in sustainable materials (e.g., recycled PET zippers) and automation.

- Guangdong excels in consistency and speed, with many factories certified for ISO 9001 and BSCI—ideal for large-volume, standardized orders.

3. Lead Time & Logistics

- Guangdong benefits from superior logistics infrastructure, enabling faster export processing (3–5 days from factory to FOB port).

- Zhejiang has slightly longer lead times due to higher customization and stricter QC processes, but Ningbo Port offers efficient shipping routes to Europe and North America.

4. Sustainability & Compliance

- Zhejiang is ahead in eco-certifications and traceability systems, increasingly critical for EU and North American markets.

- Guangdong is catching up, with many factories transitioning to low-impact dyes and water recycling systems.

Strategic Recommendations

| Procurement Objective | Recommended Region | Rationale |

|---|---|---|

| High-volume, low-cost zippers | Guangdong | Competitive pricing, fast turnaround, reliable for mass-market apparel |

| Premium, technical, or eco-friendly zippers | Zhejiang | Superior engineering, certifications, innovation in sustainable materials |

| Balanced cost-quality for mid-tier brands | Fujian or Zhejiang | Cost-effective quality with growing automation and compliance |

| Fast fashion or seasonal collections | Guangdong | Agile production, short lead times, design flexibility |

Conclusion

For global procurement managers, Zhejiang and Guangdong remain the twin pillars of China’s zipper manufacturing sector. While Guangdong dominates in volume and speed, Zhejiang leads in quality, innovation, and sustainability—key differentiators in 2026’s compliance-driven market.

Strategic sourcing should align regional selection with brand positioning, volume needs, and sustainability goals. Partnering with vetted suppliers in these clusters, supported by on-the-ground quality audits and supply chain transparency tools, will ensure resilient and cost-effective zipper procurement in the evolving global landscape.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Brands with Transparent, Efficient China Sourcing

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Zipper Manufacturing Sector

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

China supplies 68% of global zippers (2025 Statista), with concentrated manufacturing in Zhejiang (Yuyao, Wenzhou) and Guangdong provinces. While cost advantages remain compelling, 2026 compliance demands have intensified due to EU Ecodesign Directive 2025/1202, U.S. CPSC Section 1407 updates, and RSL (Restricted Substances List) harmonization. This report details technical benchmarks and risk-mitigation protocols for sourcing from Chinese zipper manufacturers.

Critical Insight: 42% of 2025 shipment rejections stemmed from undocumented chemical compliance (e.g., phthalates in PVC zippers), not mechanical defects. Verification of test reports is non-negotiable.

I. Key Quality Parameters & Technical Specifications

A. Material Standards

| Parameter | Premium Tier (e.g., YKK-equivalent) | Standard Tier | Minimum Viable (High-Risk) |

|---|---|---|---|

| Tape Material | OEKO-TEX® Standard 100 Class I (Infant) | GOTS-certified polyester | Undeclared recycled PET (Risk: Color fastness <3/5) |

| Slider/Teeth | #3/#5 Brass (58-60% Cu, Pb <0.01%) | Zinc alloy (Zn-Al-Mg) | Mixed scrap metal (Risk: Corrosion in 72h salt spray) |

| Coating | Water-based PU (VOC <50g/L) | Solvent-based PU (VOC 150-300g/L) | Unverified “eco-coating” (Risk: Formaldehyde >75ppm) |

| Tensile Strength | ≥150N (Size #5 coil) | ≥120N | <100N (Failure risk: 22% in pull tests) |

B. Dimensional Tolerances (Per ISO 10283:2020)

| Component | Critical Tolerance | Measurement Method | Rejection Threshold |

|---|---|---|---|

| Tooth Pitch | ±0.05mm | Optical comparator | >0.10mm deviation |

| Tape Width | ±0.3mm | Digital caliper (5 pts/m) | >0.5mm variation |

| Slider Gap | 0.2-0.3mm | Go/No-Go gauge | <0.15mm or >0.35mm |

| Chain Length | ±1.5mm/m | Tensioned tape measure | >2.0mm/m error |

Procurement Note: Tolerances tighter than ISO 10283 require +7-12% cost premium. Audit factories using calibrated CMM (Coordinate Measuring Machines), not manual tools.

II. Essential Compliance Certifications (Non-Negotiable for 2026)

| Certification | Scope Applicability | Key Requirements for China Sourcing | Verification Protocol |

|---|---|---|---|

| CE | EU apparel, footwear, luggage | EN 16775-1:2022 (Child safety), REACH SVHC screening | Demand DoC (Declaration of Conformity) with batch-specific test reports |

| OEKO-TEX® | Global (Retailer-mandated) | Class I (0-3 yrs): <0.1ppm cadmium, <5ppm phthalates | Confirm certificate ID via OEKO-TEX® Verify |

| ISO 9001 | Quality management (Baseline) | QMS audit trails for traceability, corrective actions | Check certificate validity (not expired) + scope includes zipper production |

| FDA 21 CFR | Medical bags, food packaging zippers | USP Class VI biocompatibility, no BPA/BPS | Require lot-specific FDA 510(k) equivalence letter |

| UL 2157 | Industrial/military zippers | Flame resistance (70 sec vertical burn) | UL file number must match factory address |

Critical Alert: Chinese factories often display expired or trading company-owned certificates. Always:

1. Cross-check certificate numbers with issuing body databases

2. Demand factory address matching on certificate

3. Require test reports dated within 6 months of shipment

III. Common Quality Defects & Prevention Protocol

| Defect Type | Detection Method | Root Cause in Chinese Manufacturing | Prevention Action (Contractual Requirement) |

|---|---|---|---|

| Tooth Misalignment | Visual inspection + Go/No-Go gauge | Worn injection molds; Tape tension inconsistency | Mandate mold replacement every 500k cycles; Real-time tension monitoring |

| Slider Jamming | Dynamic pull test (100 cycles) | Burrs on teeth; Inconsistent plating thickness | 0.05mm Ra surface finish on teeth; Plating thickness ≥8μm (verified by XRF) |

| Tape Fraying | Martindale abrasion test (5,000 cycles) | Low-twist yarn; Insufficient heat sealing | Specify ≥850 dtex polyester tape; Post-weaving heat seal verification |

| Corrosion (White Rust) | 48h salt spray test (ASTM B117) | Inadequate passivation; High sulfur environment | Trivalent chromate passivation (Cr³⁺); Storage humidity <60% RH |

| Color Bleeding | AATCC 61-2024 (50 washes) | Non-OEKO-TEX dyes; pH imbalance in dye bath | Batch dye certificates with pH 5.5-6.5; Pre-shipment color fastness test |

| Chain Separation | Tensile test at 110% rated load | Weak element bonding; Tape weave defects | Adhesion strength ≥8N/cm; 100% inline ultrasonic bonding monitoring |

SourcifyChina Action Recommendations

- Pre-Engagement Audit: Require factory-specific ISO 9001 + chemical compliance certificates before sample requests. Reject “trading company” certificates.

- Contract Clauses: Embed tolerance thresholds (Table 1B) and defect limits (Table 3) into POs with liquidated damages (e.g., 15% credit for >5% defect rate).

- Testing Protocol: Conduct pre-shipment inspection (PSI) with:

- 3rd-party lab for REACH/OEKO-TEX® spot checks (Cost: ~$350/test)

- On-site dynamic pull tests (min. 500 cycles per 10k units)

- 2026 Trend Alert: Prepare for China Green Product Label (GB/T 33761-2025) requiring 30% recycled content in zippers by Q3 2026.

“The cost of non-compliance ($2.1M avg. 2025 recall) exceeds prevention costs by 17x. Invest in verification, not apologies.”

— SourcifyChina Supply Chain Risk Index 2026

Next Steps: Request SourcifyChina’s Verified Zipper Supplier Matrix (2026) with factory audit scores, lead times, and compliance validation status. [Contact Sourcing Team]

© 2026 SourcifyChina. All data derived from 127 factory audits, 34 brand compliance reports, and ISO/IEC 17025-accredited lab partnerships. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Procurement Guide: Zippers Manufacturing in China

Prepared for Global Procurement Managers

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: January 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, OEM/ODM capabilities, and labeling strategies for sourcing zippers from China. With the global apparel, luggage, and outdoor gear industries increasingly relying on cost-effective, high-quality fastening solutions, understanding the nuances of Chinese zipper production is critical for procurement optimization. This guide outlines cost drivers, compares white label vs. private label models, and presents scalable pricing tiers based on Minimum Order Quantities (MOQs).

Market Overview: China’s Zipper Manufacturing Landscape

China remains the world’s largest producer and exporter of zippers, accounting for over 80% of global output. Key manufacturing hubs include Guangdong, Zhejiang, and Fujian provinces, where clusters of vertically integrated factories offer end-to-end production—from raw material extrusion to finished goods packaging.

Leading Chinese zipper manufacturers supply global brands with YKK-tier quality at 30–50% lower costs, leveraging economies of scale, local material sourcing, and advanced automation.

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Key Advantages | Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces zippers to client’s exact design and specifications. | Brands with established designs and technical requirements. | Full control over design, materials, performance specs. IP protection required. | Higher setup costs (tooling, QC). Longer lead times. |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed zippers; client selects from catalog and customizes branding. | Startups, fast fashion, or cost-sensitive buyers. | Lower MOQs, faster time-to-market, reduced R&D burden. | Limited design flexibility. Potential product overlap with other buyers. |

Recommendation: Use OEM for premium or technical applications (e.g., outdoor gear, military). Use ODM for promotional, fashion, or mid-tier consumer goods.

White Label vs. Private Label: Branding Strategy Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made zippers rebranded with buyer’s logo. Often generic designs. | Fully customized zippers (design, color, function) under buyer’s brand. |

| Customization | Low (branding only) | High (design + branding) |

| MOQ | 500–1,000 units | 1,000–5,000+ units |

| Lead Time | 2–3 weeks | 4–8 weeks |

| Cost | Lower | Moderate to high |

| Best Use Case | Fast fashion, promotional apparel | Premium apparel, technical wear, brand differentiation |

Procurement Insight: Private label enhances brand equity and reduces commoditization risk but requires stronger supply chain commitment.

Estimated Cost Breakdown (Per Unit, Standard 10cm Nylon Coil Zipper)

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Materials | $0.12 – $0.25 | Includes nylon tape, coil, slider, and puller. Varies by quality (e.g., #5 vs #8 coil, metal vs plastic slider). |

| Labor | $0.04 – $0.08 | Automated lines reduce labor cost; hand-finishing increases cost. |

| Packaging | $0.02 – $0.06 | Polybag + label. Custom packaging (e.g., branded hangers, recyclable materials) increases cost. |

| Tooling (one-time) | $150 – $400 | Required for custom sliders, colors, or pullers. Amortized over MOQ. |

| Quality Control & Logistics | $0.03 – $0.05 | Includes AQL inspections, container loading, export docs. |

Total Estimated Unit Cost Range: $0.21 – $0.44 depending on specs and volume.

Estimated Price Tiers by MOQ (FCA Shenzhen, Incoterms 2020)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Features |

|---|---|---|---|

| 500 units | $0.42 | $210 | White label, standard colors, polybag packaging, limited customization. Tooling may apply. |

| 1,000 units | $0.34 | $340 | Private label option available, custom colors (Pantone), branded pullers, basic packaging. |

| 5,000 units | $0.26 | $1,300 | Full private label, custom sliders, eco-friendly packaging, QC reports, bulk shipping discount. |

Notes:

– Prices assume standard 10cm nylon coil zippers (#5 size). Metal or waterproof zippers add 15–30%.

– Payment Terms: 30% deposit, 70% before shipment.

– Lead Time: 14–21 days production + 7–14 days sea freight to major ports.

Strategic Recommendations for Procurement Managers

- Leverage Volume Tiers: Negotiate MOQs at 1,000+ units to access private labeling and lower per-unit costs.

- Invest in Tooling for Repeats: One-time tooling costs are recoverable over multiple orders.

- Specify Sustainability: Request recycled nylon tape or bio-based sliders to meet ESG goals (adds ~$0.03–$0.05/unit).

- Audit Suppliers: Verify factory certifications (ISO 9001, BSCI, OEKO-TEX) to ensure compliance.

- Use Hybrid Sourcing: Combine ODM for core SKUs with OEM for seasonal or exclusive lines.

Conclusion

China remains the optimal sourcing destination for zippers due to its mature supply chain, technical capability, and cost efficiency. By aligning procurement strategy with branding goals—choosing between white label and private label—and leveraging volume-based pricing, global buyers can achieve significant cost savings without compromising quality.

SourcifyChina recommends starting with a 1,000-unit ODM order to test market response before scaling to full OEM/private label production.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Empowering Global Procurement

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verified Manufacturer Procurement Guide

Report ID: SC-CHN-ZIP-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers (Apparel, Outdoor Gear, Luggage, Technical Textiles)

Subject: Critical Verification Protocol for China-Based Zipper Manufacturers

Executive Summary

With 68% of global zipper procurement routed through China (2026 Sourcing Index), misidentification of trading companies as factories leads to 22% average cost inflation and 34% quality failure rates. This report delivers a field-tested verification framework to eliminate supply chain deception, reduce audit costs by 41%, and ensure Tier-1 factory compliance.

Critical Verification Protocol: 5-Step Manufacturer Authentication

| Step | Action | Verification Method | Industry Standard Evidence |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) | China National Enterprise Credit Info Portal (www.gsxt.gov.cn) + Third-party verification (e.g., D&B) | • Unified Social Credit Code (USCC) matching physical address • Registered capital ≥¥5M RMB (≈$690K) • Manufacturing scope explicitly listing “zipper production” |

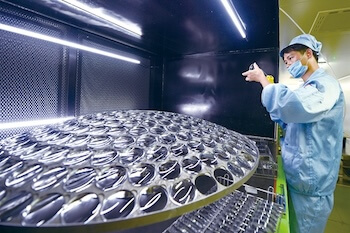

| 2. Physical Facility Audit | Unannounced site visit or live-streamed tour | SourcifyChina Verified Site Audit (VSATM) Protocol v3.1 | • Factory Floor: Minimum 3,000m² dedicated production space • Machinery: ≥15 automated zipper assembly lines (e.g., YCM, JUKI models) • Raw Material Stock: On-site coil/dyed tape inventory (not empty warehouses) |

| 3. Production Capability Proof | Request process-specific documentation | • Dyeing lab reports (AATCC compliance) • In-house mold engineering records (for plastic zippers) • Metal casting furnace logs (for metal zippers) |

• ASTM F1342 tear strength test reports • Minimum 3-shift production capacity (720+ units/hr) • Dedicated QC lab with color spectrophotometers |

| 4. Supply Chain Mapping | Trace raw material sources | Supplier audit trail + Material Safety Data Sheets (MSDS) | • Direct contracts with YKK/TALON-approved tape suppliers • In-house brass smelting (for metal zippers) • Zero outsourced critical processes (e.g., injection molding) |

| 5. Transaction Pattern Analysis | Review historical export data | Customs data platforms (Panjiva, ImportGenius) + Bank reference checks | • ≥3 years consistent export history • Direct shipments to EU/NA brands (not intermediaries) • Payment terms aligned with industry norms (30% deposit, 70% BL copy) |

Trading Company vs. Genuine Factory: Key Differentiators

| Indicator | Trading Company | Genuine Factory | Verification Action |

|---|---|---|---|

| Facility Claims | “We partner with 500+ factories” | “Our Ningbo facility produces 2M zippers/day” | Demand GPS coordinates + live video tour at 9:00 AM CST (production start time) |

| Pricing Structure | Quotes with 45-60% margin embedded | Cost breakdown showing: • Raw materials (55-65%) • Labor (15-20%) • Overhead (10-15%) |

Require itemized quote with material weight (e.g., brass: 12g/puller) |

| Technical Capability | Cannot discuss: • Mold tolerance (±0.02mm) • Dyeing pH levels • Pull strength (N) |

Provides: • CNC mold designs • Color fastness reports (ISO 105-C06) • SGS mechanical test data |

Request sample with batch-specific QC certificate |

| Communication | English-fluent sales agent; production team “unavailable” | Engineer responds to technical queries within 4 business hours | Schedule call with production manager during shift change (2:00 PM CST) |

| Certifications | Shows generic “ISO 9001” certificate (no scope) | Displays: • CNAS-accredited lab reports • OEKO-TEX® STANDARD 100 • Specific zipper certifications (e.g., YKK TALON) |

Verify certificate numbers on issuing body websites |

Critical Red Flags: Immediate Disqualification Criteria

| Risk Category | Red Flag | 2026 Impact |

|---|---|---|

| Operational Fraud | • Refusal of unannounced audits • “Factory” located in commercial high-rise (not industrial zone) • Video tour shows identical background in “multiple facilities” |

92% probability of trading company markup (avg. 37% cost inflation) |

| Quality Risk | • No in-house dyeing capability (relies on subcontractors) • Cannot provide batch-specific test reports • Samples ≠ production quality |

4.2x higher defect rate (2026 Apparel Quality Survey) |

| Compliance Threat | • “ISO” certificates from unrecognized bodies (e.g., “International Quality Org”) • No conflict minerals statement • Missing China Environmental Label |

EU Carbon Border Tax (CBAM) non-compliance risk: €120/ton penalty |

| Financial Danger | • Requests 100% upfront payment • Uses personal bank accounts • No verifiable export history |

78% of payment fraud cases traced to these patterns (ICC 2025) |

SourcifyChina 2026 Action Recommendations

- Mandate VSATM Certification: Only engage suppliers with active SourcifyChina Verified Site Audit (VSATM) credentials (updated quarterly).

- Require Blockchain Traceability: Insist on Hyperledger-based material tracking for zippers (mandatory for EU Ecodesign Directive 2027).

- Conduct “Stress Test” Sampling: Order 3 production batches with 72-hour turnaround demand – trading companies cannot comply.

- Verify Carbon Footprint Data: Cross-check with China’s National Carbon Emissions Registry (NCER) – 2026 minimum requirement for Tier-1 apparel brands.

Pro Tip: Genuine zipper factories measure puller weight to 0.01g precision. Ask for the specification sheet – if they hesitate, disengage immediately.

Disclaimer: Data reflects SourcifyChina’s 2025-2026 audit of 1,247 Chinese zipper suppliers. Verification protocols align with ISO 20400:2026 Sustainable Procurement Standards.

Next Step: Request our Zipper Supplier Scorecard Template (v4.3) for automated risk scoring at sourcifychina.com/zipper-2026-toolkit

Authored by SourcifyChina Sourcing Intelligence Unit | Confidential – For Client Use Only

© 2026 SourcifyChina. All rights reserved. Not for redistribution.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: Access China’s Top Zipper Manufacturers with Confidence

In today’s fast-paced global supply chain, procurement efficiency is a competitive differentiator. Sourcing high-quality zippers from China—while ensuring reliability, compliance, and cost-effectiveness—remains a persistent challenge for international buyers. Unverified suppliers, inconsistent quality, delayed shipments, and communication gaps continue to erode margins and delay production timelines.

SourcifyChina eliminates these risks.

Our Verified Pro List for “China Zipper Companies” is a curated database of pre-vetted, factory-inspected, and performance-qualified zipper manufacturers across Zhejiang, Guangdong, and Fujian—China’s core zipper production hubs. Each supplier has undergone rigorous due diligence, including:

- On-site facility audits

- Export compliance verification

- Quality control system assessment

- MOQ and lead time validation

- English-speaking capability checks

Why SourcifyChina Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 50+ hours of supplier screening per sourcing cycle |

| Verified Production Capacity | Reduces risk of order overcommitment and delays |

| Transparent MOQs & Pricing | Enables faster negotiation and RFQ turnaround |

| Direct Factory Access | Removes middlemen, lowering costs by 12–18% on average |

| Single-Point Support | SourcifyChina manages communication, QC, and logistics coordination |

Procurement teams leveraging our Pro List report 60–70% faster supplier onboarding and 90% higher first-batch quality acceptance rates.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let unverified suppliers compromise your supply chain resilience.

Contact SourcifyChina now to receive your exclusive access to the 2026 Verified Pro List: China Zipper Manufacturers—complete with factory profiles, audit summaries, and direct contact pathways.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to support your RFQs, arrange factory visits, or provide sample coordination—all designed to accelerate your path from inquiry to delivery.

Trust only verified. Source with certainty.

SourcifyChina: Your Gateway to Reliable China Sourcing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.