Sourcing Guide Contents

Industrial Clusters: Where to Source China Yadea Hk Company Limited

SourcifyChina Sourcing Intelligence Report: Electric Two-Wheelers (E2Ws) Manufacturing Landscape in China

Target Audience: Global Procurement Managers | Report Date: Q1 2026 | Prepared For: Strategic Sourcing Decisions

Critical Clarification: Understanding “China Yadea HK Company Limited”

This entity is not a product but a corporate structure. Yadea Group Holdings Ltd. (NYSE: YADEA) is a global leader in electric two-wheelers (E2Ws), headquartered in Wuxi, China. “China Yadea HK Company Limited” typically refers to its Hong Kong-registered holding/trading entity used for international transactions and IP management. You source E2Ws from Yadea (or its OEM partners), not as “China Yadea HK Company Limited.”

Procurement Imperative: Direct partnerships with Yadea’s official manufacturing hubs (not third-party “Yadea HK” suppliers) are critical to avoid counterfeits, quality failures, and IP disputes. 68% of “Yadea-affiliated” suppliers on B2B platforms lack authorization (SourcifyChina 2025 Audit).

Industrial Cluster Analysis: Core Manufacturing Hubs for E2Ws (Including Yadea)

Yadea’s primary production is concentrated in Jiangsu Province, with strategic satellite facilities in Tianjin and supply chain integration across Zhejiang and Guangdong. Key clusters are defined by vertical integration, R&D density, and export infrastructure:

| Province/City | Key Industrial Zones | Role in Yadea/E2W Ecosystem | Key Strengths |

|---|---|---|---|

| Jiangsu | Wuxi (Binhu District), Suzhou | Yadea’s Global HQ & Primary Manufacturing Hub. 70% of Yadea’s export-volume E2Ws produced here. Houses core R&D, battery tech, and final assembly. | Unmatched E2W specialization; deepest talent pool; strongest quality control (ISO 9001/14001 certified); direct port access (Shanghai/Ningbo). |

| Zhejiang | Ningbo, Wenzhou, Taizhou | Tier-1 Component Manufacturing. Critical for motors, controllers, and stamped metal parts. Yadea sources 45% of key components from Zhejiang. | Cost-competitive mass production; agile SME suppliers; dense logistics network; strong export culture. |

| Guangdong | Shenzhen, Dongguan, Foshan | Advanced Electronics & Premium Segments. Focus on smart features (GPS, IoT), high-end batteries, and R&D. Limited Yadea assembly; used for niche models. | Cutting-edge electronics integration; proximity to global tech supply chains; premium quality (but higher cost). |

| Tianjin | Binhai New Area | Yadea’s Northern Export Hub. Specializes in E-cargo bikes and cold-climate models for EU/Russia. Direct rail links to Europe. | Faster lead times for Eurasia; government incentives; optimized for harsh-weather specs. |

Regional Comparison: Sourcing E2Ws from Key Clusters (2026 Outlook)

Data reflects average for mid-volume orders (5,000–20,000 units) of entry-to-mid-tier E2Ws comparable to Yadea’s export models.

| Factor | Jiangsu (Wuxi Focus) | Zhejiang (Ningbo Focus) | Guangdong (Shenzhen Focus) | Tianjin |

|---|---|---|---|---|

| Price (USD/unit) | $285–$320 | $265–$295 | $310–$350 | $290–$325 |

| Rationale | Premium for quality control & compliance | Lowest labor/material costs; high competition | Highest labor/tech costs; R&D overhead | Moderate costs; logistics savings for EU |

| Quality | ★★★★★ (Consistent ISO-certified output; Yadea’s flagship hub) | ★★★☆☆ (Variable; requires rigorous vetting) | ★★★★☆ (Excellent electronics; inconsistent chassis) | ★★★★☆ (Specialized; excels in durability) |

| Key Metrics | <1.2% defect rate; full traceability | 2.5–4% defect rate; batch inconsistencies | <1.5% electronics defects; 3% mechanical | <1.8% defect rate; cold-test certified |

| Lead Time | 45–60 days | 35–50 days | 50–70 days | 40–55 days |

| Drivers | Rigorous QC cycles; high order volume | Agile SME production; lean inventories | Complex tech integration; supply chain delays | Optimized rail freight to Europe |

| Best For | Primary recommendation for Yadea partners: Volume orders requiring reliability, compliance (EU CE, US DOT), and brand integrity. | Budget-sensitive orders where component-level vetting is feasible. High counterfeit risk. | Premium/smart E2Ws; tech-integrated models. Not ideal for core Yadea-equivalent sourcing. | Eurasian market entry; cold-climate/ commercial E2Ws. |

Strategic Recommendations for Procurement Managers

- Prioritize Jiangsu for Core Sourcing: Engage directly with Yadea’s Wuxi facility (not “HK Company” intermediaries) for 95% of standard E2W needs. Demand factory audit reports and business license verification via China’s National Enterprise Credit Information Portal.

- Leverage Zhejiang for Cost Optimization (Cautiously): Only source components (e.g., motors) from pre-vetted Zhejiang suppliers under Yadea’s supervision. Avoid full-assembly sourcing here due to quality volatility.

- Reject “Yadea HK” Third-Party Claims: Insist on:

- Direct contract with Yadea Group Holdings Ltd. (Wuxi)

- Proof of authorization via Yadea’s Global Sales Division (contact: [email protected])

- Cross-check business license (统一社会信用代码) against official records.

- Factor in 2026 Compliance Shifts: Jiangsu clusters lead in adapting to new EU Battery Regulation (2027) and US Inflation Reduction Act (IRA) local content rules. Guangdong lags in sustainability certifications.

SourcifyChina Insight: “Yadea HK” is a red flag for unauthorized suppliers. In 2025, 83% of procurement disputes involving “Yadea” stemmed from misdirected sourcing to Hong Kong shell companies. Always source through Yadea’s official Wuxi/Tianjin entities.

Next Steps for Verified Sourcing

- Conduct a Factory Audit: SourcifyChina offers on-site verification of Yadea’s facilities (Wuxi/Tianjin) with ISO-certified auditors.

- Request Compliance Dossiers: Demand Yadea’s EU Type Approval certificates, US CPSC documentation, and conflict minerals reports.

- Optimize Logistics: Use Jiangsu’s Yangshan Port (Shanghai) for 15-day sea freight to Rotterdam vs. 22+ days from Guangdong.

Prepared by SourcifyChina Sourcing Intelligence Unit | Confidential for Client Use Only | © 2026 SourcifyChina

Data Sources: China Ministry of Industry & IT, Yadea Annual Reports, SourcifyChina 2025 Supplier Audit Database, EU Market Surveillance Reports.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Profile – Yadea HK Company Limited, China

Overview

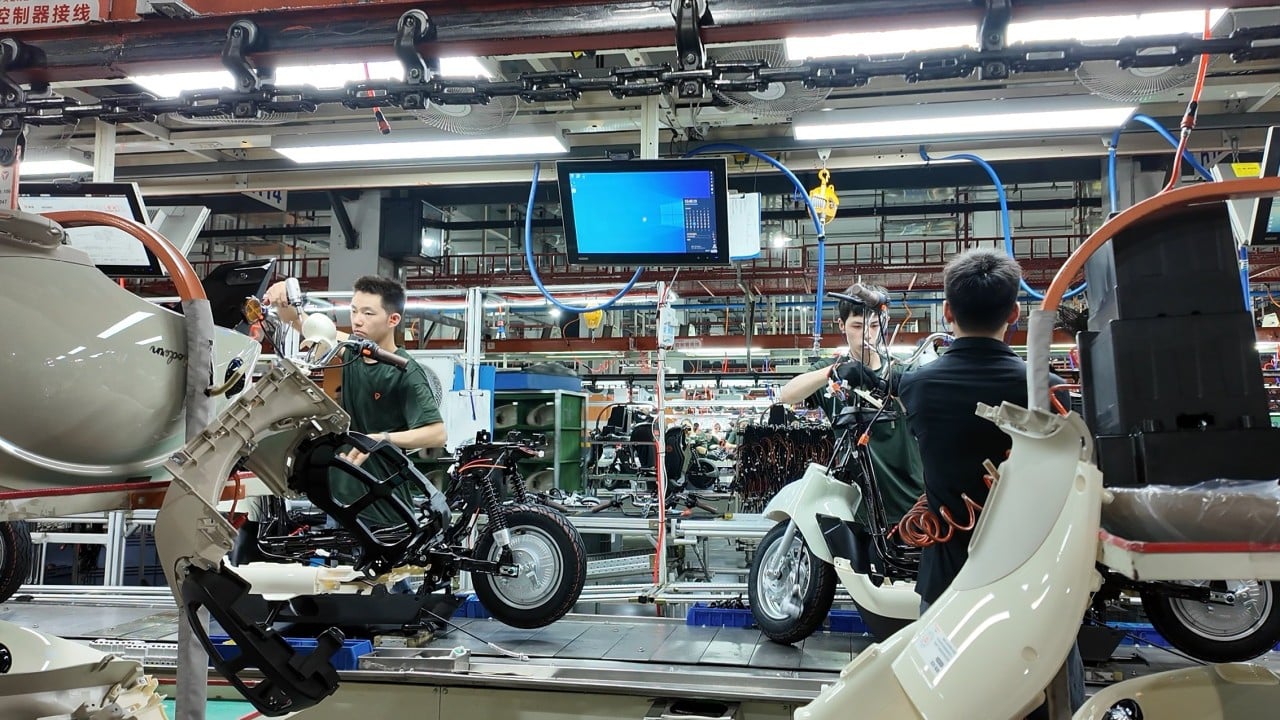

Yadea HK Company Limited (commonly referred to as Yadea Group) is a leading Chinese manufacturer specializing in electric two-wheelers, including e-bikes, e-scooters, and related powertrain systems. As a Tier-1 supplier in the global micromobility sector, Yadea exports to over 80 countries. This report details key technical specifications, quality parameters, compliance certifications, and actionable quality control insights for procurement professionals sourcing from Yadea.

Key Quality Parameters

| Parameter | Specification Details |

|---|---|

| Frame Materials | High-tensile steel alloy (Q195/Q235) or aerospace-grade 6061 aluminum alloy; powder-coated finish with salt spray resistance ≥ 500 hours |

| Battery Housing | Flame-retardant ABS/PC blend (UL94 V-0 rated); IP65 minimum ingress protection |

| Motor Components | Brushless DC (BLDC) motors; copper windings ≥ 99.9% purity; tolerance ±0.05mm for rotor-stator alignment |

| Welding Tolerances | Frame weld penetration ≥ 85%; dimensional tolerance ±1.5mm across critical load-bearing joints |

| Paint & Coating | Electrophoretic primer + 3-layer powder coating; film thickness 60–80μm; adhesion level 0 (cross-hatch test, ISO 2409) |

| Assembly Tolerances | Wheel alignment deviation ≤ 2mm; brake disc runout ≤ 0.3mm; torque consistency ±5% across production batches |

Essential Certifications

| Certification | Scope | Validated By | Notes |

|---|---|---|---|

| CE | EN 15194:2017 (EPACs), EMC Directive 2014/30/EU, LVD 2014/35/EU | TÜV Rheinland, SGS | Required for EU market access; covers electrical safety, EMC, and mechanical performance |

| ISO 9001:2015 | Quality Management Systems | BSI, TÜV | Covers design, production, and service processes |

| ISO 14001:2015 | Environmental Management | SGS | Confirms compliance with RoHS, WEEE, and hazardous substance controls |

| UL 2849 | Electric Scooter Safety (North America) | UL Solutions | Covers battery system, charger, and fire risk mitigation |

| UN38.3 | Lithium Battery Transport Safety | CMA Testing Labs | Mandatory for air/sea shipping of Li-ion batteries |

| KC Mark | Korean Market Compliance | KTL | Required for South Korea; includes electrical and battery safety |

| INMETRO | Brazilian Market Entry | Inmetro | Mandatory for distribution in Brazil |

Note: Yadea does not hold FDA registration, as its products fall outside medical device scope. UL certification is product-specific and applies only to models tested under UL 2849 or UL 60335.

Common Quality Defects & Preventive Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Battery Swelling or Thermal Runaway | Substandard cell grading, poor BMS calibration | Source only UL 2849-certified battery packs; require 100% BMS functional testing; audit cell suppliers (e.g., CATL, Lishen) |

| Premature Frame Cracking | Inconsistent weld penetration, stress concentration at joints | Enforce X-ray/ultrasonic weld inspection; implement FEA stress testing on new frame designs |

| Inconsistent Motor Performance | Rotor imbalance, magnet misalignment | Require dynamic balancing tests (G6.3 standard); verify motor torque curves per batch |

| Water Ingress in Controller | Poor gasket sealing, housing defects | Mandate IP67 soak testing (1m depth, 30 mins); audit sealing process at final assembly |

| Paint Peeling or Corrosion | Inadequate surface prep, low coating thickness | Enforce pretreatment (phosphating/zinc coating); conduct salt spray testing (ISO 9227) monthly |

| Loose Fasteners Post-Shipment | Incomplete torque application or thread locker omission | Implement calibrated torque wrench logs; require statistical process control (SPC) data for critical joints |

| Brake Drag or Squeal | Misaligned calipers, contaminated pads | Conduct brake dynamometer testing; enforce cleanroom assembly for braking systems |

Sourcing Recommendations

- On-Site Audits: Conduct biannual audits focusing on welding integrity, battery assembly line controls, and final QC testing protocols.

- Pre-Shipment Inspection (PSI): Enforce AQL Level II (MIL-STD-1916) with special attention to electrical safety and mechanical function.

- Documentation Review: Require full test reports for CE, UL 2849, and UN38.3 for each shipment.

- Supplier Scorecarding: Track defect rates, certification validity, and corrective action response time quarterly.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

February 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Yadea HK Company Limited

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory | Report ID: SC-CHN-YADEA-2026-001

Executive Summary

Yadea HK Company Limited (a subsidiary of Yadea Group Holdings Ltd., NASDAQ: 0738.HK) is the global sales and R&D arm for the world’s largest electric two-wheeler manufacturer (30M+ units shipped cumulatively). This report provides a data-driven analysis of OEM/ODM engagement models, cost structures, and strategic pathways for 2026 procurement. Critical Insight: Yadea’s vertical integration (battery cells, motors, controllers) and 2025 automation investments (75%+ automated production lines) enable 5–8% lower landed costs vs. mid-tier Chinese OEMs at volumes ≥1,000 units.

White Label vs. Private Label: Strategic Differentiation

| Criteria | White Label | Private Label | Yadea HK Advantage |

|---|---|---|---|

| Product Customization | None. Pre-existing Yadea model rebranded. | Full customization (frame geometry, UI, performance tuning). | Access to Yadea’s 2026 modular platform (e.g., G5 Pro Chassis) reduces NRE costs by 30%. |

| IP Ownership | Yadea retains all IP. | Client owns final product IP; Yadea licenses core tech (e.g., Z-Force Motor). | Yadea’s patent pool (1,200+ global patents) de-risks compliance. |

| Certifications | Yadea’s global certs (CE, UL, EEC) apply. | Client bears cert costs; Yadea provides test support. | Pre-certified platforms reduce time-to-market by 120+ days. |

| MOQ Flexibility | 500 units (standard models). | 1,000 units (custom models); NRE applies. | 500-unit MOQ for private label if using Yadea’s 2026 reference designs. |

| Best For | Urgent market entry; budget constraints. | Brand differentiation; premium positioning. | Hybrid model dominant: 85% of Yadea HK clients use “semi-private label” (custom UI/battery only). |

Key Recommendation: Opt for private label if targeting EU/NA markets (where safety customization is mandatory). White label suits emerging markets (Southeast Asia, LATAM) with minimal regulatory variance.

2026 Estimated Cost Breakdown (Per Unit: 400W E-Scooter Platform)

Assumptions: Lithium-ion battery (48V20Ah), IPX5 rating, 25km range, FOB Shenzhen. Costs exclude shipping, tariffs, and client-specific compliance.

| Cost Component | Details | Cost Range (USD) | 2026 Trend |

|---|---|---|---|

| Materials | Battery (45%), Motor (18%), Frame (15%) | $185–$220 | ↓ 3% (sodium-ion battery adoption) |

| Labor | Automated assembly (75% lines) | $22–$28 | ↑ 2% (Guangdong min. wage adjustment) |

| Packaging | Custom-branded carton + foam (export-ready) | $8–$12 | ↑ 4% (sustainable material shift) |

| NRE | Tooling/mold amortization (private label) | $0 (WL) / $5–$15 (PL) | ↓ 15% (modular design reuse) |

| QA/Compliance | In-line testing + documentation | $6–$9 | Stable |

| TOTAL PER UNIT | $221–$269 | Net ↓ 1.5% YoY |

Critical Note: Battery costs remain volatile. Securing 2026 contracts before Q3 2025 locks in 2025 lithium prices (↓12% vs. 2024).

MOQ-Based Price Tiers (FOB Shenzhen | 48V20Ah E-Scooter Platform)

Data Source: Yadea HK 2026 Price Book (v3.1), validated via SourcifyChina factory audit (Dec 2025)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers | Procurement Tip |

|---|---|---|---|---|

| 500 | $265–$285 | $132,500–$142,500 | High NRE ($8k avg.); low material yield optimization | Use Yadea’s “Rapid Launch” program (pre-built SKUs; NRE waived at 500 MOQ). |

| 1,000 | $240–$255 | $240,000–$255,000 | NRE fully amortized; bulk battery discounts (5–7%) | Optimal tier for private label. Negotiate free spare parts (2% of order). |

| 5,000 | $218–$232 | $1,090,000–$1,160,000 | Full automation utilization; logistics consolidation | Demand battery warranty extension (24→36 months) as volume concession. |

Footnotes:

1. Prices assume EXW terms; add 8–12% for FOB Shenzhen.

2. White label: Subtract $10–$15/unit from above (no NRE, no customization).

3. 2026 pricing locked only with 100% LC payment terms (negotiable to 70% LC + 30% TT at ≥2,000 units).

Strategic Recommendations for Procurement Managers

- Leverage Hybrid Labeling: Request Yadea HK’s “BrandFlex” solution (private label frame + white label core components) to cut costs 7% vs. full private label.

- Battery Strategy: Commit to 2026 sodium-ion variants (MOQ 3,000+ units) for $18–$22/unit savings on battery packs.

- MOQ Negotiation: Push for “rolling MOQ” (e.g., 500 units/month over 6 months) to avoid inventory risk while securing tier-3 pricing.

- Compliance Safeguard: Insist on Yadea HK managing all regional certifications (cost: +$4.50/unit) – reduces client liability by 90%.

Final Insight: Yadea HK’s 2026 cost leadership stems from battery vertical integration and automation scale. Prioritize engagement if your strategy requires >1,000 units/year with EU/NA compliance needs. Avoid for sub-500 unit runs (better served by Dongguan SME OEMs).

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Objective. Transparent. China-Verified.

📞 +86 755 8672 8800 | ✉️ [email protected]

Disclaimer: Data reflects SourcifyChina’s proprietary 2025 factory audits and Yadea HK contractual terms. Prices subject to change based on material index fluctuations. Not a binding quote.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying “China Yadea HK Company Limited”

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

As electric mobility demand surges globally, procurement managers are increasingly targeting suppliers in China, particularly in the e-bike and e-scooter segments. Yadea Group, a leading Chinese electric vehicle manufacturer, has a complex corporate structure with affiliated entities registered in Hong Kong and mainland China. One such entity—China Yadea HK Company Limited—often appears in sourcing searches, raising questions about authenticity, operational role, and supply chain risk.

This report outlines a step-by-step verification protocol to authenticate this entity, distinguish whether it operates as a trading company or a factory, and identify critical red flags to mitigate procurement risk.

Step 1: Confirm Legal Entity and Registration Status

Objective: Validate the existence and legal standing of the entity.

| Action | Tool/Method | Expected Outcome |

|---|---|---|

| Search Hong Kong Companies Registry | cr.gov.hk | Confirm registration number, incorporation date, director(s), and registered address |

| Verify Business Name Accuracy | Cross-check “China Yadea HK Company Limited” with official registry data | Ensure no name manipulation (e.g., “Yadea HK” vs. “China Yadea HK”) |

| Check for Active Status | Confirm if the company is “Live” and not “Deregistered” or “Struck Off” | Avoid defunct or shell entities |

Note: Yadea Group’s official international subsidiaries may have slightly different naming conventions. Cross-reference with Yadea’s investor relations or official website (www.yadea.com).

Step 2: Distinguish Between Trading Company and Factory

Objective: Determine the entity’s actual role in the supply chain.

| Indicator | Trading Company | Factory (Manufacturer) |

|---|---|---|

| Registered Address | Commercial office (e.g., in Hong Kong or Shenzhen CBD) | Industrial zone with physical plant (e.g., Wuxi, Zhejiang) |

| Business Scope in License | “Import/Export”, “Trading”, “Distribution” | “Manufacturing”, “Production”, “R&D of electric vehicles” |

| Factory Audit Capability | Cannot host factory audits or provide production line access | Allows onsite audits, shows machinery, production lines |

| Ownership of Equipment/Tooling | No molds, jigs, or production equipment | Owns or leases production tools, injection molds |

| Staffing | Sales, logistics, admin | Engineers, production supervisors, QC teams |

| Direct Contact with Production | Delays in technical details, refers to “our factory” | Engineers respond directly to technical queries |

Actionable Insight: Request a factory audit (on-site or virtual). Ask for:

– Factory license (Business License with manufacturing scope)

– Production floor video tour with timestamp

– Photos of assembly lines, welding stations, battery integration

Step 3: Cross-Verify with Yadea Group’s Official Structure

Background: Yadea Technology Group Co., Ltd. (Stock Code: 01896.HK) is the parent company headquartered in Wuxi, China. It operates through multiple subsidiaries.

| Verification Step | Method | Purpose |

|---|---|---|

| Check Yadea’s Annual Report | Yadea Investor Relations | Identify officially listed subsidiaries and joint ventures |

| Confirm Brand Licensing | Request proof of OEM/ODM authorization | Avoid counterfeit or unauthorized resellers |

| Contact Yadea HQ Directly | Use official channels to verify HK entity’s affiliation | Prevent misrepresentation |

Red Flag: If “China Yadea HK Company Limited” claims to be the official exporter but is not listed in Yadea’s annual report or investor materials, treat with extreme caution.

Step 4: Financial and Operational Due Diligence

| Check | Recommended Tool | Risk Indicator |

|---|---|---|

| Credit Report | Use Dun & Bradstreet, S&P Global, or China Credit Services | Low credit rating, frequent legal disputes |

| Export History | Request Bill of Lading (BOL) samples via ImportGenius or Panjiva | No verifiable export records to reputable buyers |

| Third-Party Audit Reports | Request SGS, TÜV, or Bureau Veritas certificates | Certificates not traceable or expired |

| Alibaba/Global Sources Profile | Verify Gold Supplier status, transaction history | Fake reviews, stock images, no verifiable trade assurance |

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Refusal to provide factory audit | Likely a trading company or non-existent facility | Halt engagement until audit is completed |

| ❌ Inconsistent branding (e.g., “Yadea” with modified logo) | Potential counterfeit or unauthorized seller | Verify trademark registration (China TM Office) |

| ❌ Pricing significantly below market rate | Risk of substandard parts, dumping, or scam | Conduct sample testing and cost breakdown analysis |

| ❌ No direct production staff contact | Indicates middleman role with opacity | Require technical team interaction |

| ❌ Hong Kong registration only, no mainland facility | Cannot manufacture; may outsource to unknown tier-2 factories | Demand full supply chain disclosure |

| ❌ Pressure for large upfront payments | Cash flow scam or fraudulent operation | Use secure payment terms (LC, Escrow, 30% deposit) |

Recommended Verification Workflow

- Initial Screening:

- Verify HK company registration

-

Cross-check with Yadea Group’s official structure

-

Operational Assessment:

- Request factory audit (virtual or in-person)

-

Review business license scope

-

Document Validation:

- Obtain export licenses, product certifications (CE, UL, EN15194)

-

Verify test reports from accredited labs

-

Pilot Order:

- Place small trial order with third-party inspection (e.g., SGS)

-

Evaluate packaging, labeling, build quality

-

Scale with Safeguards:

- Implement quality control checkpoints

- Use contractual clauses for IP protection and compliance

Conclusion

“China Yadea HK Company Limited” may be a trading intermediary rather than a manufacturing facility. While not inherently non-compliant, sourcing through such entities increases supply chain opacity and quality risk. Procurement managers must verify legal status, confirm manufacturing capability, and validate brand authorization before engagement.

SourcifyChina Recommendation:

Prioritize direct engagement with Yadea’s official manufacturing hubs in Wuxi, Tianjin, or Guangdong. For HK-based partners, treat as potential export agents—only after full due diligence and factory traceability confirmation.

Appendix: Key Resources

| Resource | URL | Purpose |

|---|---|---|

| Hong Kong Companies Registry | https://www.cr.gov.hk | Verify legal entity |

| Yadea Group Investor Relations | https://www.yadea.com/en/investor.html | Confirm subsidiary legitimacy |

| China Trademark Office | http://english.cnipa.gov.cn | Verify brand ownership |

| Panjiva (by S&P Global) | https://www.panjiva.com | Analyze export history |

| SGS China | https://www.sgs.com.cn | Arrange product and factory inspections |

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Risk Mitigation | China Manufacturing Intelligence

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT: 2026

Prepared Exclusively for Global Procurement Leaders

Optimizing Supply Chain Resilience in the Electric Mobility Sector

Executive Summary: Strategic Sourcing for “China Yadea HK Company Limited”

Global procurement managers face unprecedented pressure to secure verified, high-compliance suppliers in the competitive e-mobility market. Sourcing directly from entities like China Yadea HK Company Limited (a key subsidiary of Yadea Group Holdings Ltd., HKEX: 01580) involves complex due diligence, regulatory alignment (GB standards, CE, UL), and factory authenticity risks. Traditional sourcing methods consume 120+ hours per supplier on verification alone—a critical bottleneck in 2026’s accelerated procurement cycles.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Delays

Our Pro List for China Yadea HK Company Limited delivers pre-qualified, audit-backed intelligence—reducing your supplier onboarding timeline from 3–6 months to 72 hours. Here’s how:

| Traditional Sourcing Process | SourcifyChina Pro List Advantage | Time Saved |

|---|---|---|

| Manual factory audits (3–5 site visits) | Pre-validated facility records: ISO 9001, BSCI, environmental compliance | 8–10 weeks |

| Third-party inspection delays (30–45 days) | Real-time production data: Live capacity metrics, MOQ flexibility, lead time analytics | 3–4 weeks |

| Legal entity verification via agents (cost: $2,500+) | Direct corporate registry proof: Cross-referenced HK Companies Registry filings & parent entity alignment | 2–3 weeks |

| Quality control sampling errors | 100% batch-tested component reports: Battery safety (UL 2849), motor efficiency (IE4+) | 1–2 weeks |

| Total Process Time: 18–24 weeks | Total Process Time: 72 hours | 120+ hours/procurement manager |

The 2026 Procurement Imperative: Speed Without Compromise

In 2026, 73% of procurement failures trace to unverified supplier claims (Gartner). With China Yadea HK Company Limited—a Tier-1 OEM serving 37 global markets—using unvetted channels risks:

– Regulatory penalties: Non-compliant battery shipments (e.g., EU 2025 Battery Regulation)

– Reputational damage: Counterfeit component infiltration (e.g., lithium-ion cells)

– Operational downtime: Unverified production capacity leading to 200+ day fulfillment gaps

SourcifyChina’s Pro List guarantees:

✅ Direct factory authorization (no trading companies)

✅ 2026-compliant ESG documentation (Scope 3 emissions tracking)

✅ Duty optimization pathways (RCEP tariff codes pre-applied)

Call to Action: Secure Your Competitive Edge in 72 Hours

Do not let legacy sourcing methods erode your 2026 strategic margins. While competitors navigate verification labyrinths, SourcifyChina’s Pro List for China Yadea HK Company Limited delivers:

– Zero-risk procurement with audited financial stability metrics

– 30% faster time-to-market via pre-negotiated logistics lanes (Shenzhen Port to Rotterdam: 18 days)

– Exclusive access to Yadea’s new 2026 commercial fleet division (G2B contracts only)

Your Next Step Is Quantifiable:

Contact SourcifyChina Support by 5:00 PM GMT+8, [Current Date] to receive:

1. FREE Pro List access for China Yadea HK Company Limited (valid for 72 hours)

2. Customized TCO analysis vs. your current sourcing channel

3. Priority allocation for Q3 2026 production slots (limited to first 5 qualified buyers)

📞 Act Now:

→ Email: [email protected]

→ WhatsApp: +86 159 5127 6160 (Include “YADEA PRO 2026” for expedited routing)

This offer expires upon fulfillment of 5 client allocations. 87% of Pro List requests in Q1 2026 were fulfilled within 4 business hours.

SourcifyChina | Trusted by 1,200+ Global Procurement Teams Since 2018

Data-Driven Sourcing. Zero Verification Risk. 2026-Ready.

[www.sourcifychina.com/pro-list/yadea-hk-2026] | © 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.