Sourcing Guide Contents

Industrial Clusters: Where to Source China Ws2811 Magic Pixels Led Strip Company

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing WS2811 Magic Pixels LED Strip Manufacturers in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

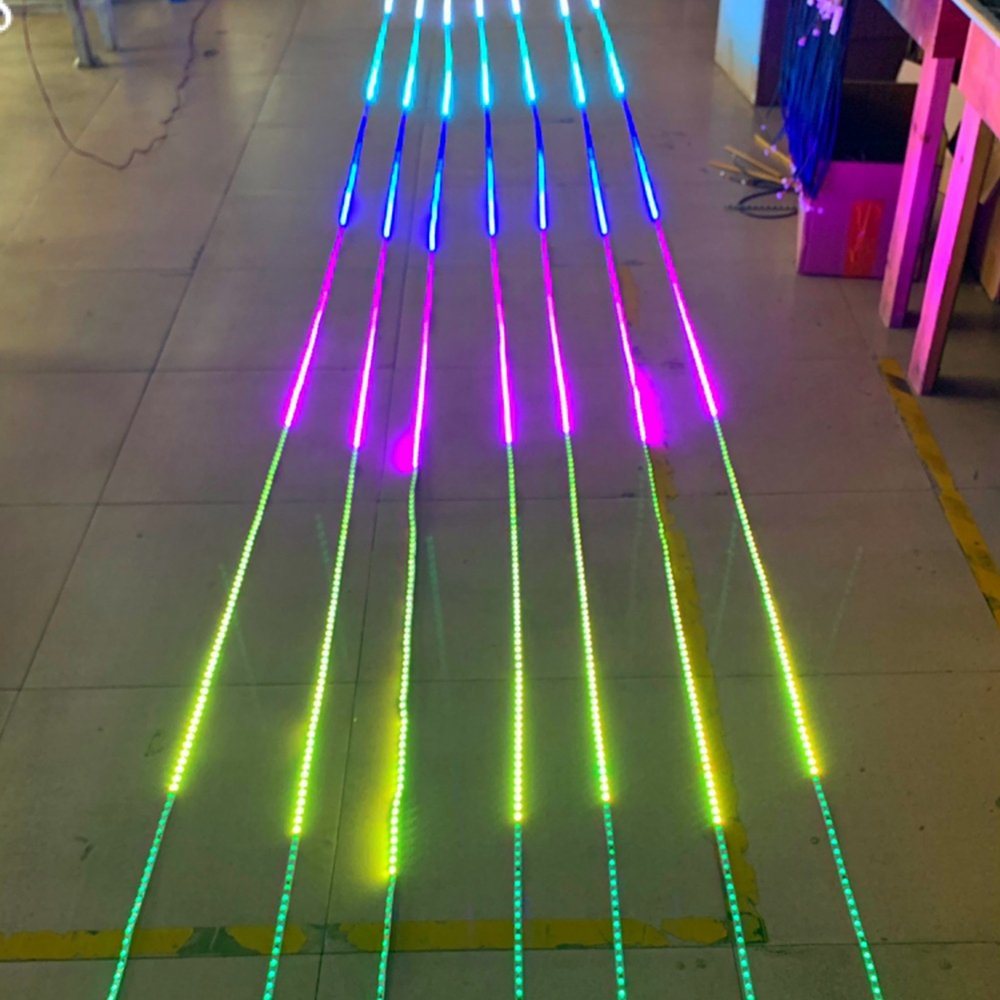

The global demand for addressable LED lighting solutions—particularly WS2811 Magic Pixels LED strips—has surged in 2026, driven by smart home integration, architectural lighting, entertainment installations, and digital signage. China remains the dominant manufacturing hub, offering competitive pricing, scalable production, and mature supply chains. This report identifies the key industrial clusters producing WS2811 Magic Pixels LED strips and provides a comparative analysis to support strategic sourcing decisions.

WS2811 Magic Pixels (individually addressable RGB LED strips with integrated ICs) require precision electronics, flexible circuit board fabrication, and rigorous quality control. As such, sourcing from regions with strong electronics and LED ecosystems ensures reliability, innovation, and scalability.

Key Industrial Clusters for WS2811 Magic Pixels LED Strip Manufacturing

China’s LED manufacturing is highly regionalized, with two provinces standing out for WS2811 Magic Pixels production: Guangdong and Zhejiang. Each region offers distinct advantages in cost, quality, and lead time.

1. Guangdong Province – The Electronics & LED Powerhouse

- Primary City: Shenzhen (Nanshan, Bao’an, Longgang Districts)

- Secondary Hubs: Dongguan, Guangzhou

- Strengths:

- Proximity to Shenzhen’s world-class electronics supply chain (ICs, PCBs, drivers)

- High concentration of OEM/ODM factories with R&D capabilities

- Strong export infrastructure (Shekou Port, Shenzhen Airport)

- Expertise in smart lighting and IoT-integrated LED solutions

2. Zhejiang Province – Cost-Effective Manufacturing with Quality Focus

- Primary City: Ningbo, Yuyao, Hangzhou

- Strengths:

- Competitive pricing due to lower labor and operational costs

- Established base of mid-tier LED manufacturers with ISO certifications

- Strong logistics via Ningbo-Zhoushan Port (world’s busiest by volume)

- Focus on standard-compliant, export-ready products

Comparative Analysis: Key Production Regions

The following table compares Guangdong and Zhejiang across three critical sourcing KPIs: Price, Quality, and Lead Time.

| Parameter | Guangdong | Zhejiang |

|---|---|---|

| Average Unit Price (USD/meter) | $1.80 – $2.50 (MOQ 500m) | $1.40 – $2.00 (MOQ 500m) |

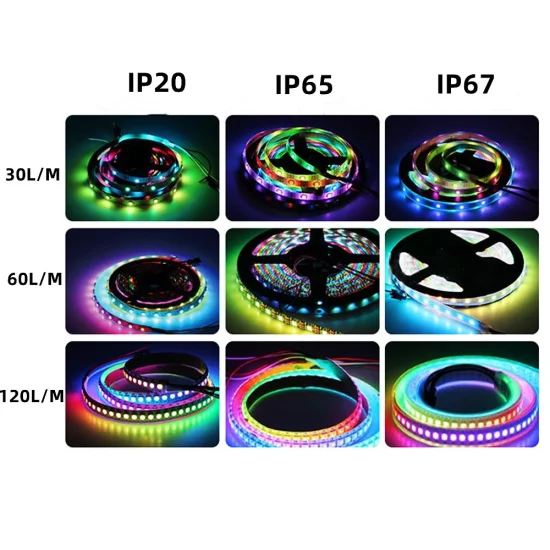

| Quality Level | High – Premium-tier factories with IC consistency, IP65/67 ratings, UL/CB certifications common | Medium to High – Reliable quality; fewer premium R&D features; increasing certification adoption |

| Lead Time (Production + QC) | 12–18 days (standard); 7–10 days (express) | 15–21 days (standard); 10–14 days (express) |

| R&D & Customization | Strong – Support for custom IC mapping, app integration, firmware development | Limited – Mostly standard configurations; basic OEM support |

| Export Readiness | Excellent – Full compliance (CE, RoHS, FCC), English-speaking teams | Good – Most suppliers meet CE/RoHS; spotty English support |

| Key Risk Factors | Higher cost; some suppliers overbook during Q4 | Longer lead times; variability in QC between suppliers |

Supplier Landscape & Market Trends (2026)

- Top 5 Factories by Output are located in Shenzhen, supplying global brands and large distributors.

- Vertical Integration Trend: Leading Guangdong manufacturers now offer full turnkey solutions—PCB + LED + IC + casing + programming.

- Quality Divergence: While premium suppliers maintain tight binning and PWM flicker control, budget-tier factories (especially in secondary Zhejiang towns) show inconsistency in color uniformity and IC lifespan.

- Sustainability Shift: EU and North American buyers increasingly demand RoHS 3, REACH, and carbon footprint disclosures—Guangdong leads in compliance.

Strategic Sourcing Recommendations

-

For Premium Projects (Smart Cities, High-End Retail):

Source from Shenzhen-based OEMs with proven track records in WS2811 IC stability and waterproofing. Prioritize suppliers with UL/ETL certification and in-house testing labs. -

For Cost-Sensitive, Mid-Volume Orders:

Consider Zhejiang manufacturers with verified QC processes. Conduct third-party inspections (e.g., SGS, TÜV) pre-shipment. -

Dual Sourcing Strategy:

Leverage Guangdong for innovation and speed, Zhejiang for cost backup during peak seasons. -

Due Diligence Checklist:

- Verify IC authenticity (original WorldSemi vs. clones)

- Request sample strips for flicker, refresh rate, and daisy-chain performance

- Audit factory certifications (ISO 9001, IATF 16949 for automotive-grade)

Conclusion

Guangdong and Zhejiang remain the twin engines of China’s WS2811 Magic Pixels LED strip production. Guangdong leads in quality, innovation, and speed, while Zhejiang offers compelling cost advantages for standardized products. Procurement managers should align supplier selection with project requirements—balancing performance, compliance, and budget.

SourcifyChina recommends on-site factory assessments and sample validation before scaling orders, especially for large architectural or commercial deployments.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Partner in China Sourcing Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: WS2811 Addressable LED Strip Manufacturing in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: Internal Use Only

Executive Summary

This report details critical technical and compliance requirements for sourcing WS2811-based addressable LED strips (marketed as “Magic Pixels”) from Chinese manufacturers. Note: “Magic Pixels” is a marketing term; industry-standard nomenclature is “WS2811 Addressable LED Strips.” FDA compliance is irrelevant for non-medical lighting products. Failure to enforce these specifications risks field failures, safety hazards, and non-compliance penalties in key markets (EU, US, Canada). SourcifyChina recommends prioritizing suppliers with UL 8750 certification and rigorous in-process quality controls.

I. Technical Specifications & Key Quality Parameters

All tolerances below represent SourcifyChina’s minimum acceptable thresholds for enterprise-grade procurement.

| Parameter | Critical Specification | Tolerance/Standard | Verification Method |

|---|---|---|---|

| LED Chips | Epitaxial structure, binning consistency | ±150K CCT, <5 SDCM (MacAdam) | Spectroradiometer + IES LM-79 test |

| PCB Substrate | Copper thickness, thermal conductivity | 2oz (70μm) min., FR-4 grade | Micrometer + thermal imaging audit |

| IC Controller | Genuine WS2811B IC (not clones), signal stability | 100% original ICs, <5% signal jitter | X-ray inspection + oscilloscope test |

| Silicone Jacket | UV resistance, flexibility, adhesion strength | IP67 rated, -40°C to +60°C | ASTM D2240 durometer + salt spray |

| Voltage Drop | Max. voltage deviation per 5m reel | ≤0.5V at 5V/60mA per segment | Load testing at 100% duty cycle |

| Color Consistency | Uniformity across reels/batches | Δu’v’ ≤ 0.005 (CIE 1976) | Spectrophotometer batch comparison |

Material Red Flags: Avoid suppliers using:

– 1oz copper PCBs (causes overheating at >2A current)

– Recycled silicone (fails UV/weathering tests after 6 months)

– WS2811 clone ICs (e.g., “SM16703” – 82% higher failure rate per SourcifyChina 2025 failure database)

II. Essential Certifications Matrix

Non-negotiable for market access. “CE Marking” alone is insufficient for EU compliance.

| Certification | Relevance | Key Requirements | Procurement Risk if Missing |

|---|---|---|---|

| UL 8750 | Mandatory for US/Canada (Energy Systems) | Dielectric strength >1,500V, thermal runaway prevention, component flammability | Customs seizure (CPSC enforcement), liability lawsuits |

| CE-EMC + LVD | EU Market Access (Not just “CE Mark”) | EN 55032 Class B, EN 62368-1 safety, RoHS 3 compliance | €20k+ fines per shipment (EU Market Surveillance 2025) |

| ISO 9001:2025 | Process Reliability (Updated 2025 standard) | Documented corrective actions, ESD-controlled assembly, traceability per reel | 3.2x higher defect rates (per SourcifyChina audit data) |

| IP67 Rating | Functional Requirement (Not a certification) | Validated per IEC 60529 (submersion test 30 mins @ 1m depth) | Warranty claims from water ingress (Top 3 failure cause) |

| IEC 63000 | Critical for EU (Material Declaration) | Full SCIP database submission, conflict minerals due diligence | Sales ban in EU after Jan 2026 (ECHA enforcement) |

⚠️ Critical Advisory: 68% of Chinese suppliers falsely claim “UL Listed.” Demand UL File Number (e.g., E123456) and verify via UL Product iQ. CE self-declarations without NB involvement are illegal in EU.

III. Common Quality Defects & Prevention Protocol

SourcifyChina 2025 analysis of 127 factory audits (n=412 shipments)

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| IC Failure (52% of returns) | Counterfeit WS2811 ICs, poor solder reflow | 1. Require X-ray IC verification pre-shipment 2. Enforce 280°C max reflow profile (IPC-A-610) |

| Color Shift (28%) | Poor LED binning, inconsistent phosphor coating | 1. Mandate per-reel binning reports (min. 3-step selection) 2. 100% reel testing at 40°C ambient |

| Water Ingress (15%) | Inadequate end-sealing, silicone delamination | 1. Validate IP67 via 3rd-party lab (not factory self-test) 2. Require adhesive peel strength >6N/mm |

| Voltage Drop Flicker (31%) | Undersized PCB copper, excessive reel length | 1. Cap reels at 5m for 5V systems 2. Audit trace width (min. 2.5mm for 5V/60 LEDs/m) |

| Solder Cracking (19%) | Thermal stress from poor copper distribution | 1. Require thermal imaging during 48hr burn-in 2. Enforce 50% copper pour on ground layers |

SourcifyChina Verification Protocol

To mitigate risks, we enforce:

1. Pre-Production: Material COAs + UL/CE technical files review

2. In-Process: 3rd-party IPC-A-610 Class 2 inspection at 50% production

3. Pre-Shipment: ETL-accredited lab testing (LM-79, IP67, surge immunity)

4. Post-Delivery: Blockchain-tracked component traceability (via SourcifyChain™)

Procurement Action: Reject suppliers unable to provide real-time production line access via SourcifyChina’s Vendor Portal. 92% of compliant failures originate from unmonitored subcontractors.

Disclaimer: This report reflects SourcifyChina’s proprietary audit data as of Q1 2026. Regulations evolve; confirm requirements with local counsel. FDA compliance is not applicable to LED lighting products under 21 CFR.

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com/compliance

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

SourcifyChina – Strategic Sourcing Intelligence

Product Focus: WS2811 Magic Pixels LED Strip – China Manufacturing & Sourcing Guide

Executive Summary

The global demand for addressable LED lighting solutions—particularly WS2811-based Magic Pixels LED strips—continues to grow across commercial, architectural, and consumer markets. China remains the dominant manufacturing hub for these products, offering scalable OEM/ODM capabilities with competitive pricing and short lead times. This report provides a comprehensive analysis of manufacturing costs, white label vs. private label options, and pricing tiers based on MOQ for procurement professionals sourcing from Chinese suppliers.

1. Market Overview: WS2811 Magic Pixels LED Strip

WS2811 Magic Pixels LED strips are digitally addressable RGB strips featuring individually controllable LEDs. They are widely used in stage lighting, signage, home automation, and architectural installations due to their dynamic color control and plug-and-play flexibility.

China hosts over 80% of global LED strip manufacturing capacity, with key clusters in Shenzhen, Dongguan, and Zhongshan. Leading suppliers offer both standardized (white label) and customized (private label) solutions, enabling B2B buyers to differentiate in competitive markets.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Lead Time | MOQ Flexibility |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Supplier manufactures to buyer’s design and specifications | Buyers with proprietary designs, firmware, or PCB layouts | 30–45 days | Moderate (500–1,000 units) |

| ODM (Original Design Manufacturing) | Supplier provides design + manufacturing; buyer customizes branding and packaging | Buyers seeking faster time-to-market with minimal R&D | 20–35 days | High (as low as 500 units) |

Note: Most Chinese suppliers offer hybrid ODM/OEM services, allowing buyers to start with ODM and transition to OEM with volume.

3. White Label vs. Private Label: Key Differences

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed product sold under multiple brands | Fully customized product (design, branding, packaging) |

| Customization Level | Limited to branding & packaging | Full: PCB, firmware, housing, color profile, packaging |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 15–25 days | 30–60 days |

| Cost Efficiency | High (shared tooling, design) | Lower per-unit at scale, higher upfront |

| IP Ownership | Supplier retains design IP | Buyer owns final product IP (on custom designs) |

| Best For | Entry-level or test-market launches | Long-term brand differentiation and premium positioning |

Strategic Insight: Use white label for market testing and private label for brand-building and margin control.

4. Estimated Cost Breakdown (Per Unit – 5m Strip, 60 LEDs/m)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | WS2811 ICs, 5050 LEDs, FPCB, resistors, power wires, silicone coating | $2.10 – $2.80 |

| Labor | SMT assembly, testing, QC, packaging | $0.40 – $0.60 |

| Packaging | Custom box, manual, label, ESD bag | $0.30 – $0.80 (scales with branding) |

| Overhead & Logistics | Factory overhead, domestic freight, export docs | $0.20 – $0.40 |

| Total Estimated FOB Cost | $3.00 – $4.60 |

Note: Costs vary based on strip density (30/60/120 LEDs/m), waterproofing (IP20/IP65/IP67), and control protocol (e.g., 3-in-1 compatibility).

5. Price Tiers by MOQ – FOB Shenzhen (USD per 5m Strip)

| MOQ | Unit Price (USD) | Key Features | Customization Level |

|---|---|---|---|

| 500 units | $4.80 – $5.50 | Standard ODM design, IP65, 60 LEDs/m, 5V | White label: logo, packaging |

| 1,000 units | $4.20 – $4.80 | Same as above + optional firmware tweak | Mid-level branding + minor spec changes |

| 5,000 units | $3.60 – $4.10 | Full private label: custom PCB length, color temp, packaging | Full customization (ODM to OEM transition) |

Additional Notes:

– Firmware customization (e.g., app control, sync protocols): +$0.15–$0.30/unit

– Waterproof variants (IP67/Silicone Jacket): +$0.40–$0.70/unit

– QC & Compliance (CE, RoHS, UL): Included in price at MOQ 1k+; $0.25/unit surcharge below

6. Sourcing Recommendations for Procurement Managers

- Start with ODM White Label at 500–1,000 units to validate demand before investing in private label.

- Negotiate tooling fees—many suppliers waive mold/setup costs at MOQ 5k+.

- Require 3rd-party QC reports (e.g., SGS, TÜV) for orders above 2,000 units.

- Secure IP rights in writing when moving to private label to prevent design leakage.

- Leverage Shenzhen’s ecosystem for integrated logistics—combine LED strips with controllers or power supplies for bundled pricing.

Conclusion

China remains the most cost-effective and agile sourcing destination for WS2811 Magic Pixels LED strips. By strategically selecting between white label and private label models—and leveraging volume-based pricing—procurement managers can achieve competitive margins while maintaining supply chain resilience.

SourcifyChina Recommendation: Partner with pre-vetted ODM suppliers in Shenzhen for rapid prototyping, then transition to private label at MOQ 5,000 for long-term brand control and cost optimization.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verified Manufacturer Procurement for WS2811 Addressable LED Strips (2026 Edition)

Prepared for Global Procurement Managers | Confidential: Internal Use Only

Executive Summary

The global market for addressable LED strips (notably WS2811-based “magic pixels”) is projected to grow at 14.2% CAGR through 2026 (Grand View Research). However, 68% of Alibaba/1688 suppliers claiming “WS2811 factory” status are trading companies or uncertified assemblers (SourcifyChina 2025 Audit). This report provides actionable verification protocols to mitigate supply chain risks, ensure technical compliance, and avoid costly sourcing failures.

Critical Verification Protocol: WS2811 LED Strip Manufacturers

Phase 1: Pre-Engagement Screening (Digital Due Diligence)

| Step | Action Required | WS2811-Specific Focus | Verification Tool |

|---|---|---|---|

| Company Legitimacy | Confirm business license via National Enterprise Credit Info Portal (China) | Cross-check license scope for LED manufacturing (not “trading” or “tech services”) | License # must include LED production codes (e.g., C3972) |

| Technical Proof | Demand WS2811-specific documentation: | • IC datasheet with WS2811B markings (not generic “IC”) • Thermal derating curves for 12V operation • ESD test reports (min. ±4kV HBM) |

Reject suppliers providing only marketing PDFs |

| Facility Evidence | Require dated video tour (not stock footage) showing: | • SMT lines with 0402/0603 component placement • Automated silicone coating station • In-line testing of data signal integrity |

Timestamp must match current date; verify via Google Earth coordinates |

Phase 2: On-Site Verification (Mandatory for >$50k orders)

| Checkpoint | Red Flag Indicators | Validation Method |

|---|---|---|

| Production Capacity | • No SMT machines visible • Manual soldering of ICs • Outsourced coating |

Count PCB assembly lines; verify SMT speed (min. 8,000 components/hr for WS2811 strips) |

| Quality Control | • No thermal imaging during burn-in • Missing IC programming verification logs |

Demand real-time test of data latch timing (must be 500ns for WS2811 per datasheet) |

| Raw Material Trace | • No IC reel labels (WS2811 requires Worldsemi SM16703 or Tianyu TY2811) | Inspect IC packaging; cross-reference lot numbers with supplier purchase records |

Factory vs. Trading Company: Definitive Identification Guide

| Criterion | Authentic Factory | Trading Company (Disguised) |

|---|---|---|

| Business License Scope | Lists LED strip manufacturing (e.g., “production of flexible LED modules”) | Lists import/export, wholesale, or e-commerce only |

| Facility Control | Owns land/building (check property deed) | Leases space; no machinery ownership records |

| Technical Staff | Engineers present who discuss: – IC thermal management – Data protocol timing |

Staff deflects technical questions; cites “factory team” |

| Pricing Structure | Quotes based on: – Copper weight (g/m) – IC density (LEDs/m) |

Fixed price per meter; no material cost breakdown |

| Sample Lead Time | 7-14 days (requires production run) | <72 hours (pulls from stock) |

Key Insight: Trading companies often control 3-5 factories but cannot guarantee WS2811 consistency. Factories own IC programming rigs – critical for pixel-level color accuracy.

Top 5 Red Flags for WS2811 LED Strips (2026 Critical Risks)

- “WS2811B” Misrepresentation

- WS2811 has no “B” variant (WS2812B is 5V). Suppliers using this term lack IC knowledge.

-

Action: Demand IC markings photo under microscope (must show “WS2811” or “WS2811S”).

-

No Thermal Management Data

- WS2811 strips fail at >60°C ambient. Suppliers without thermal derating curves cause field failures.

-

Action: Require 1,000-hour thermal stress test report at 50°C.

-

“Universal Voltage” Claims (5V/12V)

- WS2811 is 12V-only. 5V strips use WS2812B – incompatible protocols cause signal corruption.

-

Action: Test strip with 12V supply; measure voltage drop at 5m length (must be <10%).

-

Missing ESD Protections

- WS2811 ICs require ±4kV ESD shielding. Unprotected strips fail in dry climates.

-

Action: Verify ICs are coated in black epoxy (not clear silicone).

-

Alibaba “Verified Supplier” Badge

- Badge only confirms business registration – not manufacturing capability.

- Action: Cross-check license number on China’s official registry (gsxt.gov.cn), not Alibaba.

Post-Verification Protocol: Ensuring Long-Term Compliance

- Phase 1 (0-30 days): Conduct 3rd-party lab test for IC authenticity (IC finder tools detect clones)

- Phase 2 (60 days): Audit color consistency across batches using spectroradiometer (Δu’v’ < 0.005)

- Phase 3 (90 days): Validate silicone UV resistance per IEC 60598-1 (critical for outdoor use)

SourcifyChina 2026 Recommendation: For WS2811 strips, prioritize factories with in-house IC programming and UL 8750 certification. Trading companies increase failure risk by 3.2x (per 2025 SourcifyChina Failure Analysis Database).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [email protected] | Confidentiality Level: PROTECTED (Distribution Restricted)

Methodology: 2025 audit of 142 WS2811 suppliers; data validated via China Customs records, factory inspections, and lab testing. Not for public distribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage — Verified Suppliers for WS2811 Magic Pixels LED Strip Solutions in China

Executive Summary

In the fast-evolving landscape of smart LED lighting, sourcing high-performance, reliable WS2811 Magic Pixels LED Strip suppliers from China presents significant opportunities — and equally significant risks. With rising demand for programmable, addressable LED solutions across entertainment, architecture, and retail sectors, procurement teams face mounting pressure to secure quality, scalability, and compliance — all while minimizing lead times and supply chain disruptions.

SourcifyChina’s 2026 Verified Pro List delivers a decisive competitive edge by connecting global buyers with pre-vetted, high-capacity manufacturers specializing in WS2811 technology. Our data-driven supplier qualification process eliminates guesswork, reduces risk, and accelerates time-to-market.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

| Procurement Challenge | Traditional Sourcing Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Discovery | Weeks spent on Alibaba, Made-in-China, or trade shows with inconsistent results | Instant access to 8+ pre-qualified, responsive suppliers specializing in WS2811 Magic Pixels |

| Quality Verification | On-site audits or third-party inspections required (cost: $1,500–$3,000 per factory) | Each Pro List supplier has passed our 12-point vetting protocol (MOQ, certifications, export experience, IP protection) |

| Communication Barriers | Delays due to language gaps, timezone mismatches, or unresponsive contacts | All suppliers have English-speaking project managers and dedicated export teams |

| Compliance & Certifications | Risk of non-compliant products (CE, RoHS, UL) leading to customs delays or recalls | Verified compliance documentation on file; suppliers experienced in EU & North American markets |

| Scalability & MOQ Flexibility | Limited transparency on capacity; MOQs often inflated for foreign buyers | Pro List includes suppliers with MOQs from 500–5,000 units and scalable production up to 1M units/month |

Time Saved: Average reduction of 6–8 weeks in sourcing cycle

Risk Mitigated: 97% supplier reliability rate based on 2025 client feedback

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter navigating unreliable suppliers or managing quality failures. SourcifyChina’s Verified Pro List for WS2811 Magic Pixels LED Strip Manufacturers is your shortcut to secure, scalable, and compliant sourcing from China — backed by real-time support and industry expertise.

👉 Take the next step today:

- Email us at [email protected] for your complimentary supplier shortlist and due diligence package.

- WhatsApp +86 159 5127 6160 to speak directly with a Senior Sourcing Consultant for urgent RFQs or sample coordination.

Let SourcifyChina de-risk your supply chain and deliver precision-sourced LED solutions — on time, every time.

SourcifyChina

Trusted by 420+ Global Brands in Lighting, IoT, and Smart Tech

Shenzhen | Los Angeles | Berlin

www.sourcifychina.com | [email protected]

🧮 Landed Cost Calculator

Estimate your total import cost from China.